A financial derivative is a contract in which two parties agree to exchange their underlying assets. The parties are not required to exchange physical assets but cash or other assets—the agreement’s value between the parties increases as the value of the underlying assets. Financial derivatives enable users to reduce market risks, making market participation more convenient. Financial markets began to expand in the twentieth century.

Moreover, this expansion necessitated using derivatives to address the new risks in the financial markets. This resulted in the growth of the OTC (over-the-counter) derivatives market. The OTC derivative agreement lets two parties make a legal agreement about who will pay who when the value of an underlying asset changes.

However, not all financial markets were open to the public for trading. As a result, they were granted access to markets supported by their local government. Because of these regulations, people find engaging in digital business and cryptocurrency trading difficult. Many brokers have tools to help them overcome this barrier, but they only apply to that specific platform, not the entire market.

UMA is the platform that enables all participants to gain access to the market and trade any asset they desire. UMA has allowed people to enter crypto by removing international trade and financial market infrastructure barriers. This article will go over the essential aspects of UMA, such as the project’s goal, potential future investment, and whether you should invest in 2024.

How to Buy UMA Token – Quick Guide

Here’s a quick guide to buying the UMA token in just a few simple steps:

- Choose a UMA exchange – We recommend eToro, which is ASIC, CySEC, and FCA-regulated

- Create an account and verify it with your ID

- Make a deposit into your account via bank transfer, Paypal, credit card, or other payment methods

- Search ‘UMA’ in the drop-down menu to see the UMA price chart

- Click ‘Trade’ and select an amount of UMA to buy

Best Places to Buy UMA in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Cryptocurrency Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

The initial step is to open an account with a broker. Since UMA (UMA) is listed on the Blockchain network, finding a broker with blockchain access is critical. We recommend eToro as the most user-friendly fiat on-ramp, as it accepts the most deposit methods, including Paypal, credit cards, Sofort, Giropay, and others.

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, click the “Join Now” or “Trade Now” button.

- On this page, you’ll find an electronic form where you can enter all your personal information needed to open a new trading account.

- Please fill out this form with all of the necessary information.

- Users can log in to eToro using Facebook or Gmail.

- Please read eToro’s Terms & Conditions and privacy policy before submitting your information for consideration.

- Please indicate your agreement by checking the appropriate box after reviewing the terms.

- To submit your information, click the “sign-up” button.

eToro website homepage

Your capital is at risk.

Step 2: Upload ID

To comply with government regulations, eToro will require you to provide a copy of your driver’s license or passport to verify your identity.

A copy of the utility bill or bank account statement will be required to verify the provided address. Once the documents are uploaded, the verification will take place automatically.

Step 3: Make a Deposit

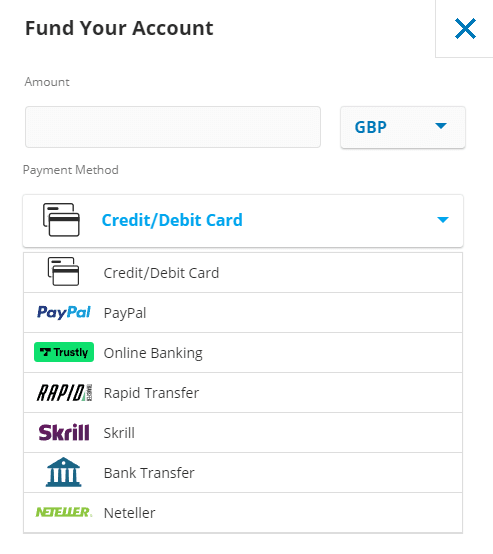

The minimum requirement for opening an account with eToro is $10, which can be deposited through various methods, including:

- Debit cards

- Credit cards

- Bank transfer

- Skrill

- PayPal

- Neteller

eToro charges no deposit fees regardless of payment method. This is less expensive than some of its key competitors, such as Coinbase, which charges 3.99 percent to buy Bitcoin with a debit card. They do also have an exchange Coinbase Pro however where UMA can be bought for a 0.5% or lower fee with a limit order.

Different deposit methods on eToro

Step 4: Search for UMA

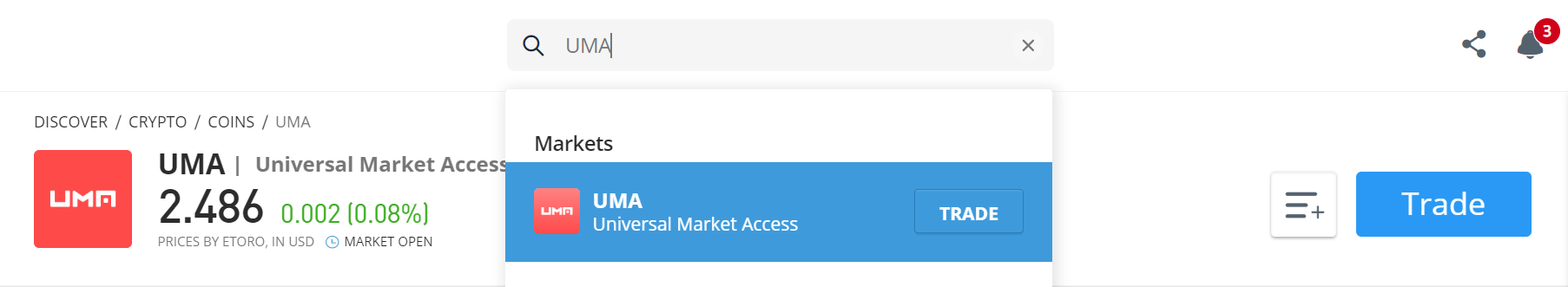

You should have a funded eToro account at this point in our step-by-step guide. It is now time to buy UMA. The quickest way to do this is to type ‘UMA’ into the search box at the top of the page.

- The process starts with entering the account’s username and password.

- Enter UMA in the search box.

- The search results will show a list, and investors must click on the desired cryptocurrency to select it.

UMA on eToro

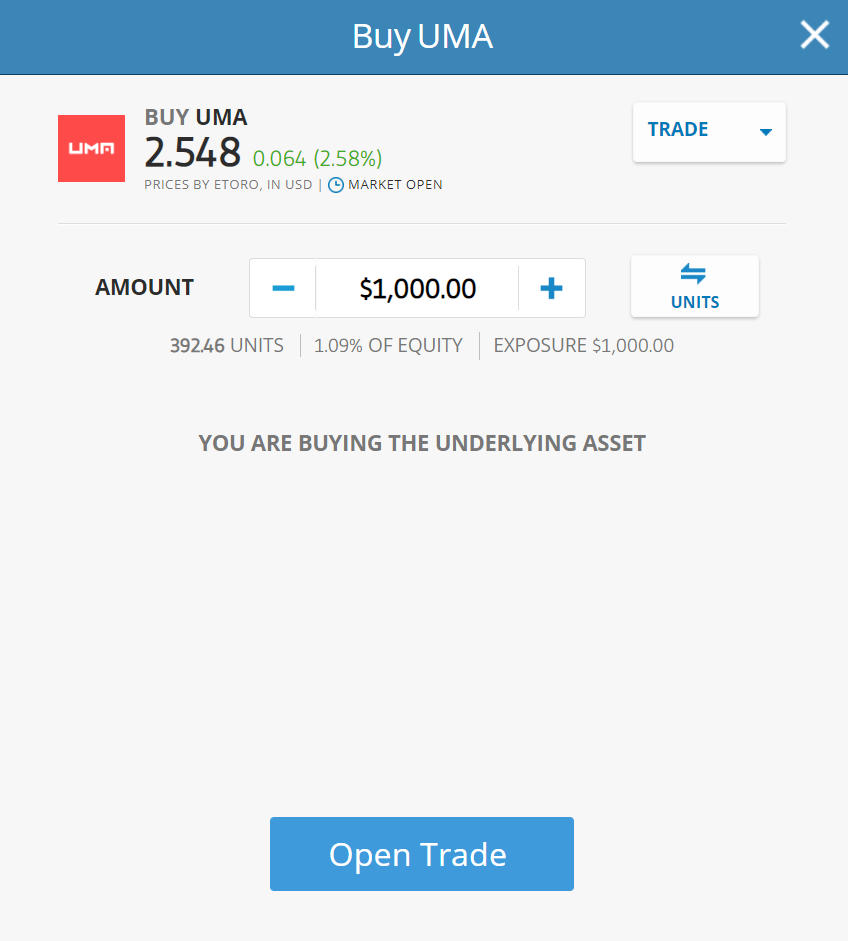

Step 5: Review UMA Price

This will take you to an order page where you can specify how many UMA coins you want. Then, click’ Open Trade’ to include the UMA in your portfolio.’ Finally, we support storing your digital assets in a third-party wallet in addition to the trading platform.

One viable option is the eToro Crypto Wallet, which now supports over 120 cryptocurrencies in addition to UMA.

UMA Price Chart

Step 5: Buy UMA

Begin typing ‘UMA’ into the search bar at the top of the screen. Then, when you see the cryptocurrency asset, click the ‘Trade’ button.

Trade UMA on eToro

Read more about how to buy cryptocurrency in 2024 here.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

Where to Buy UMA Token – Best Crypto Platforms

Even though UMA is a new digital currency, some of the industry’s largest crypto exchanges decided to list it as soon as it became available. Our most recent update contains reviews of the best places to buy UMA right now.

The characteristics, fees, and reasons for their uniqueness are included in the list of UMA buying sites in 2024. eToro has established itself as the most popular platform for buying UMA cryptocurrency. The platform is secure, affordable, and simple to use.

Best Brokers to Buy UMA

1. eToro to List UMA in 2022

eToro is a social trading and investment platform that allows you to trade stocks, commodities, indices, and foreign exchange online. It also gives you a social trading experience by allowing you to copy other traders’ trades and share your investments with others. Furthermore, eToro charges low fees, has no minimum deposit requirements, and has a high level of liquidity.

In other countries, eToro provides a comprehensive online brokerage platform. It is new to the US market and currently only provides cryptocurrency trading in the US. The eToro platform offers 27 cryptocurrencies, a transparent fee structure, and a vibrant user community.

If you’re looking for a low-cost cryptocurrency exchange, remember that eToro has relatively high trading fees. You can now earn rewards for buying and selling Ethereum, Cardano, and Tron in your wallet.

Find out more about cryptocurrency staking.

The deposit process on eToro is completely free. Deposit methods include wire transfer, credit card, debit card, PayPal, Skrill, Sofort, and Netteller, among others. The minimum deposit amount varies depending on the user’s location.

Before trading, individuals in the United Kingdom and the rest of Europe must make a minimum deposit of $200. Users in the United States must also deposit $10.

2. Binance: Trade UMA with Leading Crypto Exchange

Binance, a decentralized cryptocurrency exchange based in China, was founded in 2017 by software developer Changpeng Zhao. While Binance is currently the world’s largest cryptocurrency exchange by trading volume, it also faces regulatory challenges in several countries. For instance, authorities in the United States are looking into allegations of money laundering and tax evasion.

Several countries have also prohibited the platform’s use.

Binance gives users all over the world access to hundreds of cryptocurrencies. However, the global Binance platform differs from its US counterpart, Binance.us, which only supports 65+ cryptocurrencies. Binance offers much more to its clients than just cryptocurrency trading, proposing cryptocurrency-to-crypto, cryptocurrency-to-fiat, and fiat-to-crypto trading. They also provide margin trading, futures trading, and ICO listing.

Binance utilizes two-factor authentication (2FA) and FDIC-insured USD deposits. Additionally, Binance protects its US customers with device control, whitelisting addresses, and cold storage.

Purchase and sale fees range between 0.015 and 0.10 percent, with debit card purchases costing 3.5% or $10, whichever is greater, and US wire transfers costing $15.

3. Crypto.com: Leveraged Trading on UMA

With over 9 million global users, Crypto.com is one of the most popular cryptocurrency wallets, enabling you to buy and sell more than 250 cryptocurrencies with low trading fees. Daily, Crypto.com processes more than $2 billion in transactions.

In addition, the company provides:

- Crypto-to-crypto and fiat-to-crypto services, as well as credit cards

- Wire transfers

- Cash deposits at any ATM around the world.

In addition to wallets, Crypto Capital Corp., a subsidiary of Crypto, offers trading services for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP).

The company maintains offices in the United States, Japan, Singapore, and South Korea, and its headquarters in Hong Kong. Samuel Leach and Matt Mickiewicz founded Crypto in Zug, Switzerland, on February 22, 2014.

This platform requires a $1 minimum account balance for deposits. Maker/taker fees range between 0.04% and 0.40%. Purchases made with a credit or debit card are free for the first thirty days after an account is opened. Additionally, users can earn up to $2,000 per referral.

The ability to stake cryptocurrencies is the primary selling point of the platform. Customers who stake or store their cryptocurrency in a crypto.com wallet are eligible to earn annual interest rates of up to 14.5%.

The exchange also provides staking incentives, Visa card benefits, NFT trading, and DeFi products, among other services.

4. Coinbase: One of the Best Crypto Platforms to Trade Crypto

Coinbase Global, Inc., also known as Coinbase, is a United States-based cryptocurrency exchange platform. Coinbase is a decentralized organization with no physical headquarters; all employees work remotely, and it is the largest cryptocurrency exchange in the United States by trading volume.

The company provides various high-value products for individual and institutional investors, corporations, and developers, but its defining characteristic is the ability to buy, sell, and trade over 100 distinct cryptocurrencies and crypto tokens.

In April 2021, the company went public through a direct listing on the Nasdaq exchange. The quarterly trading volume of the platform is currently $327 billion, and its assets are currently $255 billion.

The listing of UMA on Coinbase on April 28, 2022, which has 98 million verified users and 150 crypto assets, caused the price of UMA to be nearly $2.45 on Coinbase alone. Coinbase supports the vast majority of cryptocurrencies, such as Ethereum, Bitcoin, LUNA, Uniswap, and Cardano, and meme currencies, such as Dogecoin and Shiba Inu.

When using a debit or credit card, Coinbase charges a 3.99% fee; this fee is reduced to 1.49 % when ACH transfers are used, or you can use Coinbase Pro to make free bank transfer deposits.

What is UMA?

UMA, also known as Universal Market Access, is a decentralized protocol designed to enable every individual to create decentralized financial products that give them economic freedom. The platform facilitates the creation of synthetic assets for all individuals worldwide, regardless of their status or capabilities.

In the digital world, synthetic assets are the currencies that represent and track the value of their holders’ physical assets. These assets, known as priceless financial contracts, provide participants with universal access by eliminating all economic barriers. These contracts are governed by smart contracts, granting users access to the platform without requiring them to interact with the irreplaceable financial contracts.

The Ecosystem of the UMA Token

The UMA ecosystem consists of a decentralized protocol that enables the creation, purchase, and settlement of financial contracts for underlying assets. It develops innovative systems to facilitate its participants’ risk-free trading. The protocol uses Ethereum smart contracts to provide its users with self-policing margin accounts.

UMA’s ecosystem includes a Data Verification Machine (DVM) and smart contracts secured by it. The smart contract on the UMA protocol consists of the five components listed below.

Public addresses: The UMA protocol is a mutual understanding between the two parties. This section of the platform inserts the addresses of both parties, including the person who created the assets and the person who received them, into the smart contract when an agreement is reached.

Margin subaccounts: Each counterparty is assigned a margin account, and each UMA contract has two margin accounts: margin taker and margin maker. These accounts are listed as sub-accounts in the contract. The accounts, however, are not open to the public.

The accounts are only accessible to the maker and the taker. They can withdraw and add funds to their margin accounts, but they must maintain a balance.

NPV: NPV is the net present value. This feature provides the platform with the logic to calculate the economic terms of the agreement on the smart contract.

Oracle: The economic terms are recorded on the smart contract under a certain code. These codes refer to one or more price-feed oracles. These oracles return the current price of the underlying reference asset.

Contract Functions:

The contract functions of the agreement include:

- calcNPV

- Termination functions

- Withdrawal Functions

- Deposit Functions

- Remargin Functions

Fundamentals of UMA

When was it introduced?

UMA was founded in 2018.

Management Team:

Hart Lambur and Allison Lu founded UMA. The software development firm employs 11–50 people. Mhairi McAlpine is the Community Manager at UMA, and Clayton Roche is the Head of Community and communications. UMA, led by Melissa Quinn, specializes in finance, blockchain, crypto, Ethereum, DeFi, Open Source Software, and other fields.

Native Token: UMA

What is its aim?

UMA’s mission is economic liberty. It is working to make global financial markets accessible for fair trade. UMA claims to value people’s economic rights and is working to make Decentralized Finance product creation simple and feasible.

How does it work?

UMA’s protocol generates smart contracts. They are synthetic assets, also known as priceless financial contracts, that require an on-chain price feed to determine the asset’s underlying value. Furthermore, the platform uses DVM to solve data disparity issues (Data Verification Mechanism).

UMA Use Case: UMA tokens power the UMA platform and can be used by their holders for various reasons, including representing and tracking the real-life asset’s price. It also allows users to vote on token-related proposals through decentralized governance and earn rewards.

Is It Worth Buying UMA (UMA) in 2024?

In 2023, the question on investors’ minds is whether UMA (UMA), the brainchild of Risk Labs founded in 2018, is a worthy investment. The journey of UMA began in 2020 when its token debuted, marked by an array of partnerships that have propelled its growth since its inception.

Risk Labs, the trademark holders of the UMA project, are making waves once again with their latest announcement: the introduction of ETH tokens representing the top 500 US equity assets. Notable collaborations include industry giants like Blockchain Capital, Coinbase, Box Group, and Two Sigma, among others.

The bedrock fundamentals underpinning the UMA protocol are robust, contributing to its impressive development. However, UMA’s trajectory has been influenced by various news events in recent times. Noteworthy highlights include the May 2021 partnership with Yam Finance and crypto.com, aimed at expanding user bases and offering an array of product suites.

UMA’s journey is studded with key milestones. The launch of the Range Token in July 2021 allowed market participants to utilize it as collateral, diversifying their treasury and mitigating liquidation risks. The collaboration with Hats Finance in January 2022 aimed to bolster network security through hacker incentives. The integration of UMA’s optimistic oracle by Polymarkets in February 2022 offered efficient data solutions for information markets.

2023 has ushered in fresh developments, with UMA rolling out token staking as part of its UMA 2.0 roadmap. This innovative approach closely resembles Ethereum’s Proof-of-Stake model, actively engaging network participants in dispute resolution and enhancing security.

UMA’s pricing potential is undeniable, having attracted prominent players in the industry. Despite a downward trend since early 2022, the coin is poised for a rebound, given its progressive developments. With its solid fundamentals, diverse partnerships, and technological innovations like token staking, UMA is positioned to reclaim its value and maintain its relevance in the ever-evolving cryptocurrency landscape.

However, UMA’s journey so far has been marked by strategic partnerships, groundbreaking features, and transformative developments. While market trends have posed challenges, the future looks promising for UMA, making it a cryptocurrency to watch closely in 2023.

Will UMA (UMA) Price Go Up in 2024?

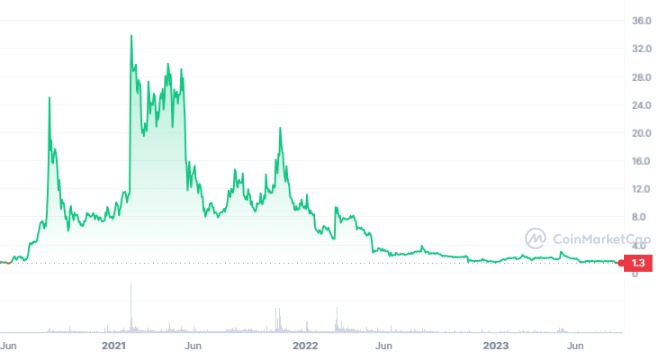

UMA (UMA) has captured the attention of investors with its swift ascent. Debuting in the public domain in May 2020 at an initial price of $1.16, UMA’s trajectory has been marked by noteworthy fluctuations. Following a steady climb, the coin’s value surged from $1.82 to $4.33 in July, a remarkable 140 percent leap. Demonstrating resilience, UMA displayed an encouraging performance throughout 2021, escalating from $7.64 to $10.35 by January 4.

A pinnacle was reached on February 4, 2021, when UMA scaled an all-time high of $33.37. Notably, a significant update titled “across protocol” was released in November 2021, fueling a 36 percent value surge, propelling the price to $24.38. However, by year-end, the value receded to $14, possibly influenced by the emergence of the Omicron variant of COVID-19 and its associated economic repercussions.

The cryptocurrency market experienced a substantial dip in the previous year. By mid-2022, UMA’s valuation had dwindled to approximately $2.65, descending further to $1.58 in November 2022. Despite these setbacks, UMA displayed a resurgence, registering positive spikes on its price charts.

The year 2023 began promisingly for UMA, commencing at $1.5 and recovering to over $2 in May. Regrettably, this rally was short-lived, as the coin struggled to maintain its position, subsequently plummeting. At present, UMA is valued at $1.34, with a 24-hour trading volume of $3,231,214. This reflects a 1.13 percent decline within the last 24 hours.

UMA is ranked at #181 on CoinMarketCap, boasting a live market capitalization of $98,696,737. With a circulating supply of 73,598,344 UMA coins and a maximum supply of 101,172,570 UMA coins, the cryptocurrency holds prospects for wider adoption across various sectors by 2031. As UMA navigates the volatile landscape of the cryptocurrency market, its future trajectory remains subject to the dynamics of the evolving economic and technological landscape.

UMA (UMA) Price Prediction: Where does UMA go from here?

Predicting the future price of any cryptocurrency, including UMA (UMA), is a complex and speculative endeavor that involves a multitude of factors. Market trends, technological developments, regulatory changes, macroeconomic influences, and investor sentiment all play pivotal roles in shaping the trajectory of a cryptocurrency’s value.

UMA’s price history has been marked by notable fluctuations, showcasing the inherent volatility of the cryptocurrency market. Its past performance, including instances of rapid appreciation and subsequent declines, demonstrates the difficulty in accurately forecasting its future price movements.

Several analysts and experts offer their perspectives on UMA’s potential price trajectory in 2023 and beyond. Some argue that the coin’s recent struggles to maintain higher price levels might be indicative of short-term challenges. Others, however, remain optimistic, pointing to the potential impact of technological advancements, upgrades, and broader adoption of decentralized finance (DeFi) protocols that UMA is a part of.

Let us now look at our technical analysis based on UMA price predictions:

UMA Price Prediction 2023

The average price of UMA in 2023 is expected to be around $2.72. Crypto is predicted to reach as high as $3.14 on its price charts.

UMA Price Prediction 2024

With more partnerships and adoptions of major blockchain networks, UMA may gain in the upcoming years. In 2024, UMA is anticipated to cost an average of $3.96. According to the cryptocurrency’s price charts, it might increase as high as $4.51.

UMA Price Prediction 2025

UMA has a lot of investors interested in it, but with more collaborations, the number of users and investors may grow. If the market sentiment to invest in UMA is achieved, the trading value of UMA is expected to remain stable for the foreseeable future. As per the price predictions, the average price of UMA would be $5.86, and the crypto is expected to surpass the mark of $7 in 2025.

Summary

UMA is the first platform to focus on making the digital market accessible to everyone. It has given people the opportunity to create synthetic products in decentralized finance. The COVID-19 pandemic, which disrupted the global economy, caused massive drops in the price of UMA. However, the price appears to be on the mend.

Market trends and volatility may cause prices to fall, but our forecasts do not show any sudden drops. Furthermore, long-term forecasts indicate that the price will rise. UMA’s potential growth is growing and being discovered with all of its upgrades and collaborations with major blockchains in the crypto space.

This token is expected to be a worthwhile long-term investment for investors looking for a coin to diversify their portfolio. However, given the market’s volatility, we recommend conducting thorough research on your behalf before taking any drastic steps.

As we discussed above, the coin has the potential to grow exponentially. Therefore, if you want to buy it, our suggested regulated broker, eToro, can help you get started. The platform is, of course, licensed and regulated by the FCA and has one of the best reputations in the industry. Furthermore, eToro provides a wealth of educational resources to help those new to the market learn the ropes.

Other Undervalued DeFi Projects

We recently updated our list of the best altcoins to include DeFi coin, an underappreciated DeFi project (DEFC). Despite the May cryptocurrency crash, it increased in value by 350-400 percent that month after completing portions of its roadmap.

It has also retraced 98.75% of its all-time high, as has Terra LUNA, albeit after over a year. It’s now at a low price but still more than the presale price. It has more upside potential than downside risk and has room to grow as the DeFi market cap recovers in 2024.

FAQ

Any risk in buying UMA now?

Technical analysis suggests that UMA is an excellent option for traders with a long-term investment strategy. The price is rising, so you could make a lot of money. However, it may be a bad investment for those looking for high returns in a short period. Because of market trends and volatility, the value of your investment may decline in the coming years.

Is UMA a secure network?

Yes! The UMA network platform is very secure, and one of the reasons it is being adopted globally is the security provided to its participants' assets. The platform is protected by a proof-of-word consensus mechanism that runs on the ETH blockchain.

How much will UMA be worth in 2030?

By 2030, we have predicted the UMA token to cross its all-time high value. It might reach the average trading value of $78.01 with a minimum trading value of $74.09. The maximum value might go up to $92.18 with bullish trends being followed.

Will UMA ever hit $100?

Yes! According to technical analysis and UMA price predictions, the UMA price could reach $100 by 2031.

Bitcoin

Bitcoin