With a staggering cumulative market cap exceeding $80 billion, the DeFi sector has immensely benefitted from the growing attention on crypto. The DeFi sector, used as an umbrella term for all decentralized finance projects in the rapidly evolving crypto world, is making strong waves as one of the hottest segments of Web3.

In this guide we’ll attempt to predict some DeFi price forecasts and list the largest DeFi coins and some undervalued low market cap DeFi coins.

Top DeFi Coins by Market Cap

DeFi coins are the governance tokens of DeFi protocols, and some of the most well-established are:

- Avalanche (AVAX) – $10.6 billion

- Uniswap (UNI) – $4.2 billion

- Chainlink (LINK) – $6.8 billion

- Tezos (XTZ) – $658 million

- Maker (MKR) – $1.2 billion

- Theta Network (THETA) – $1.2 billion

- Aave (AAVE) – $2.1 billion

- Fantom (FTM) – $1.8 billion

- The Graph (GRT) – $1.5 billion

- Terra Luna Classic (LUNC) – $488 million

The list above can vary depending on the site, e.g. Coinmarketcap.com and Defimarketcap.io, depending if Wrapped Bitcoin (wBTC) and stablecoin Dai (DAI) are included in the top list.

The top 10 DeFi coins by market cap above are all listed to buy on crypto platform eToro.

[fin_table id=”14091″]DeFi Price – Charts of the Top DeFi Coins by Market Cap

One investing strategy is to buy high marketcap DeFi coins that are well established but still undervalued compared to BTC and ETH. Another is to invest in low market cap DeFi coins that could be competitors to the more ‘blue chip’ DeFi projects and are undervalued compared to the rest of the DeFi ecosystem.

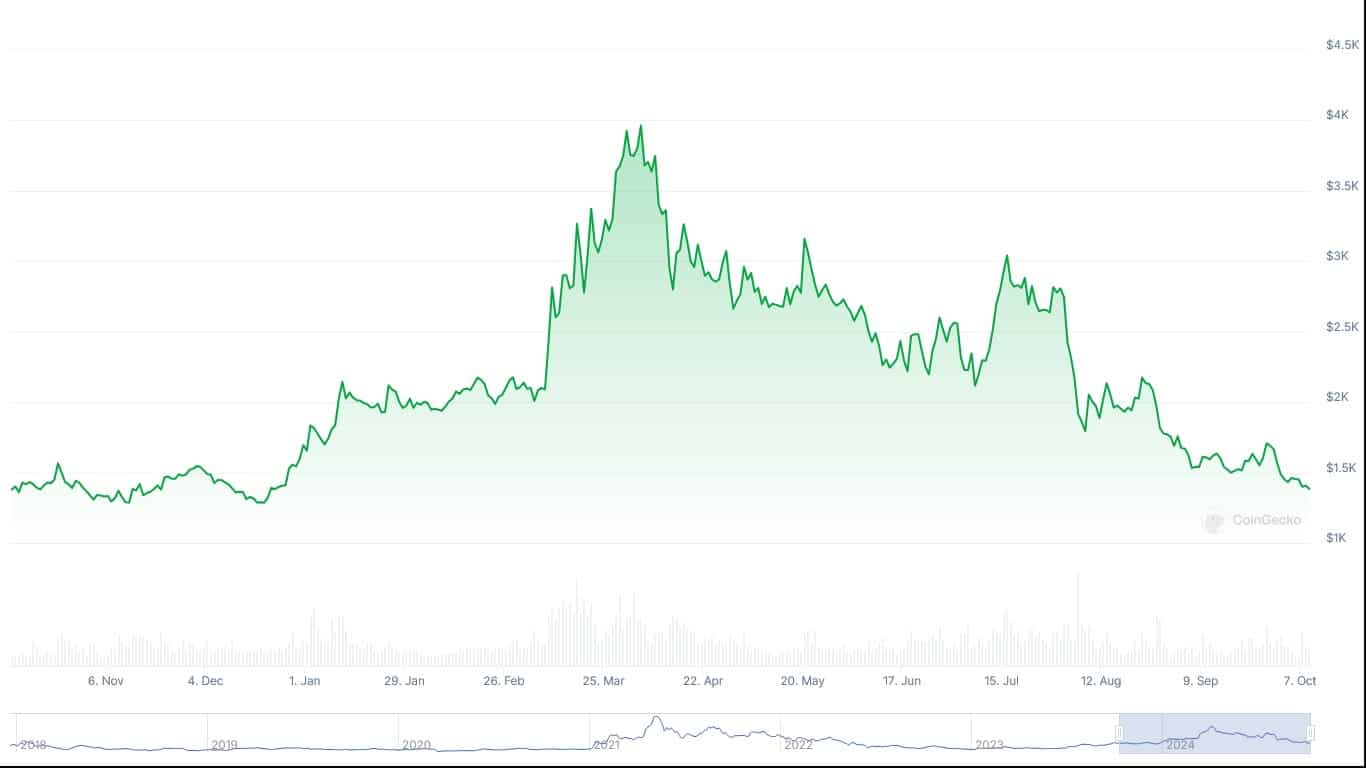

Below are some DeFi price charts for each of the top 10 DeFi coins by market capitalization.

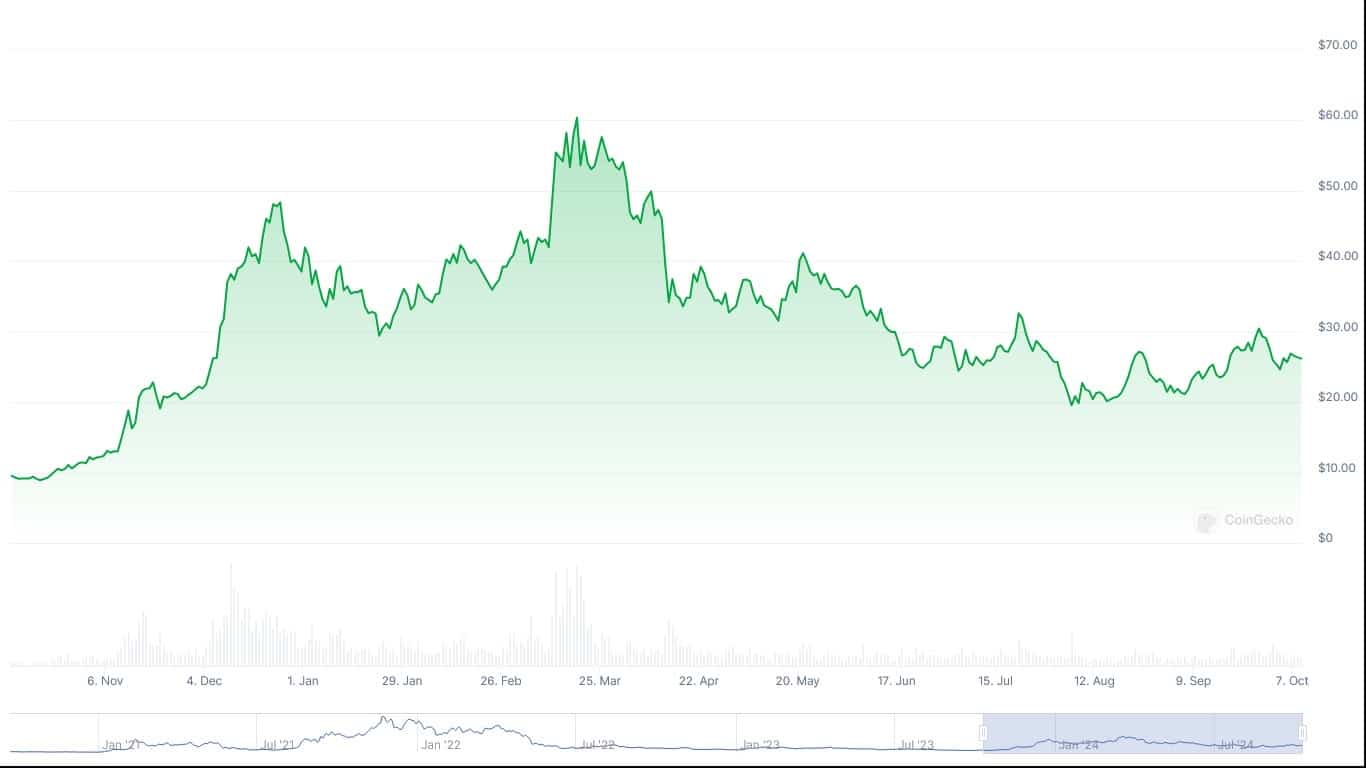

Avalanche

eToro describes Avalanche as a smart contracts platform that uses a mechanism for securing blockchain networks.

- AVAX market cap – $10.6 billion

- AVAX Coinmarket rank – #12

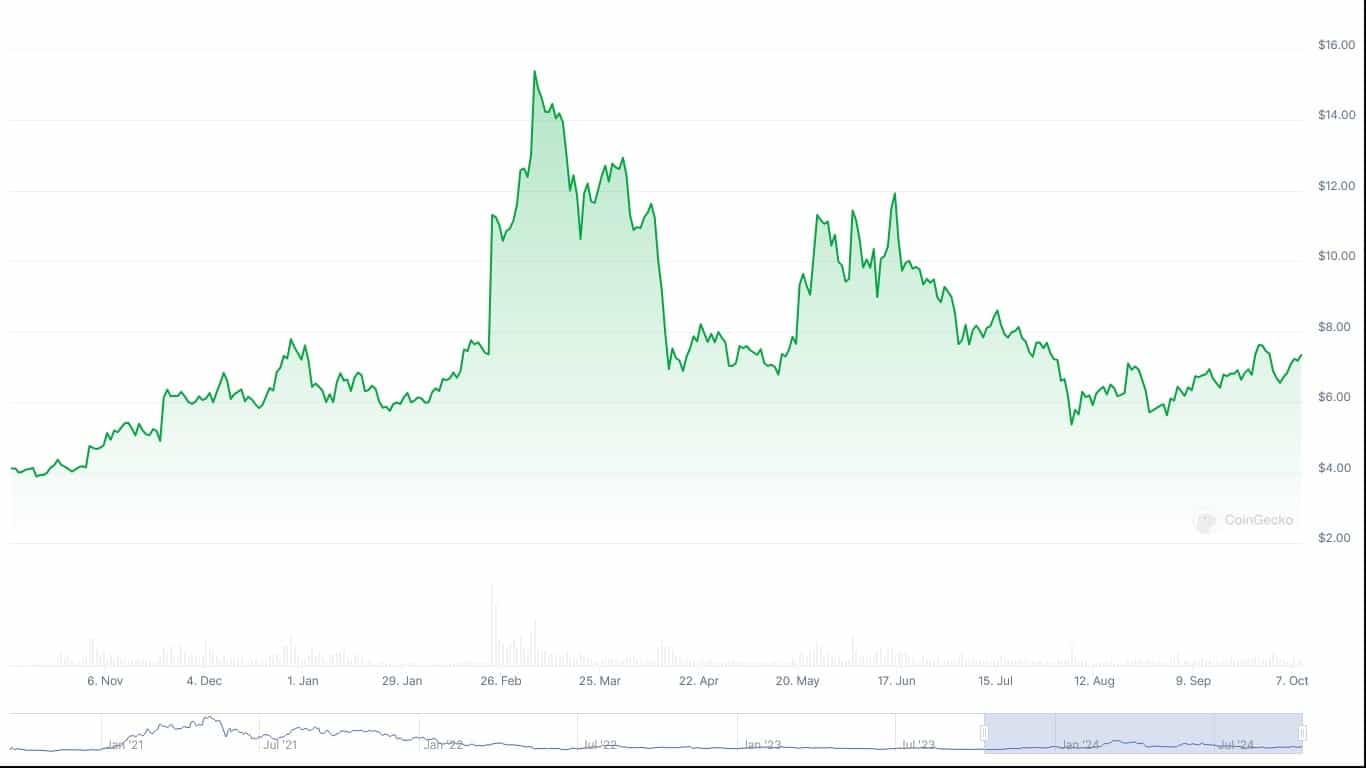

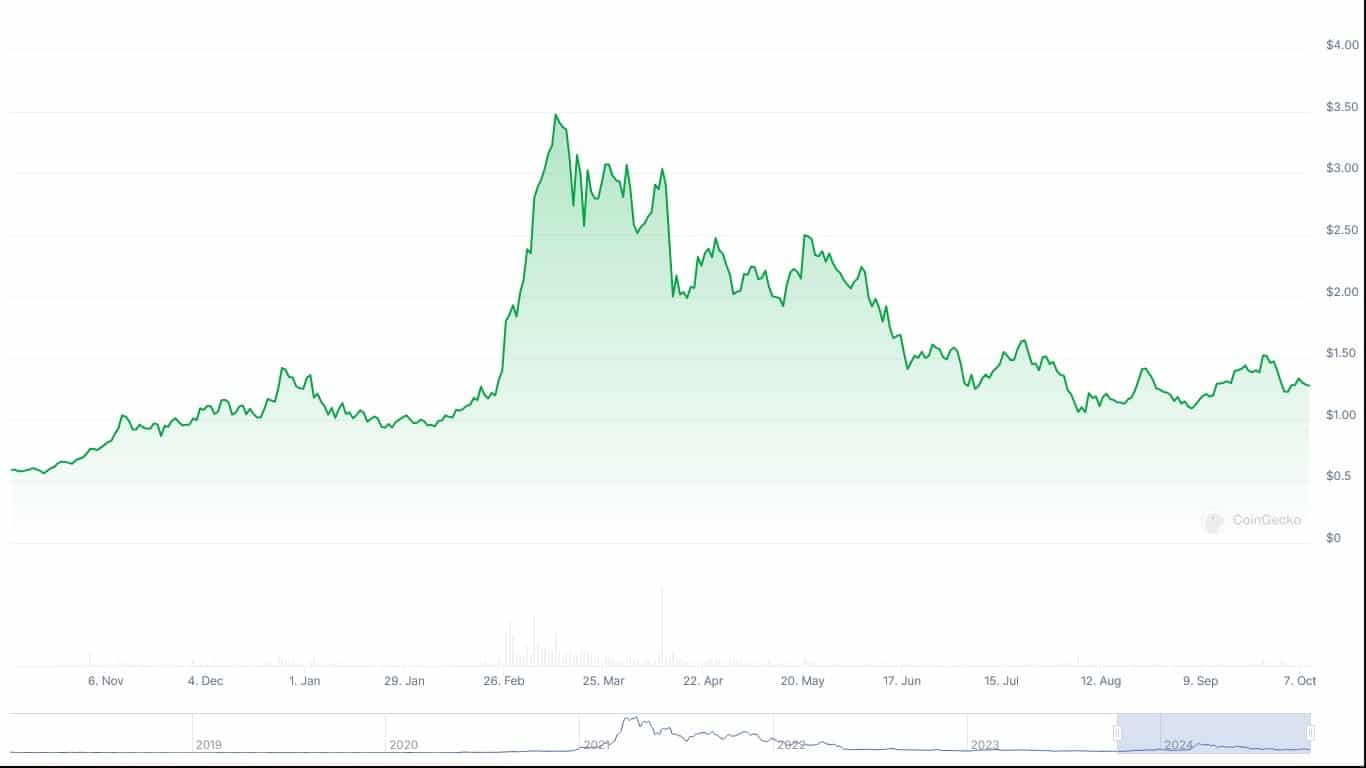

Uniswap

eToro describes Uniswap as an Ethereum-based exchange that allows decentralised token swaps.

- UNI market cap – $4.2 billion

- UNI Coinmarket rank – #24

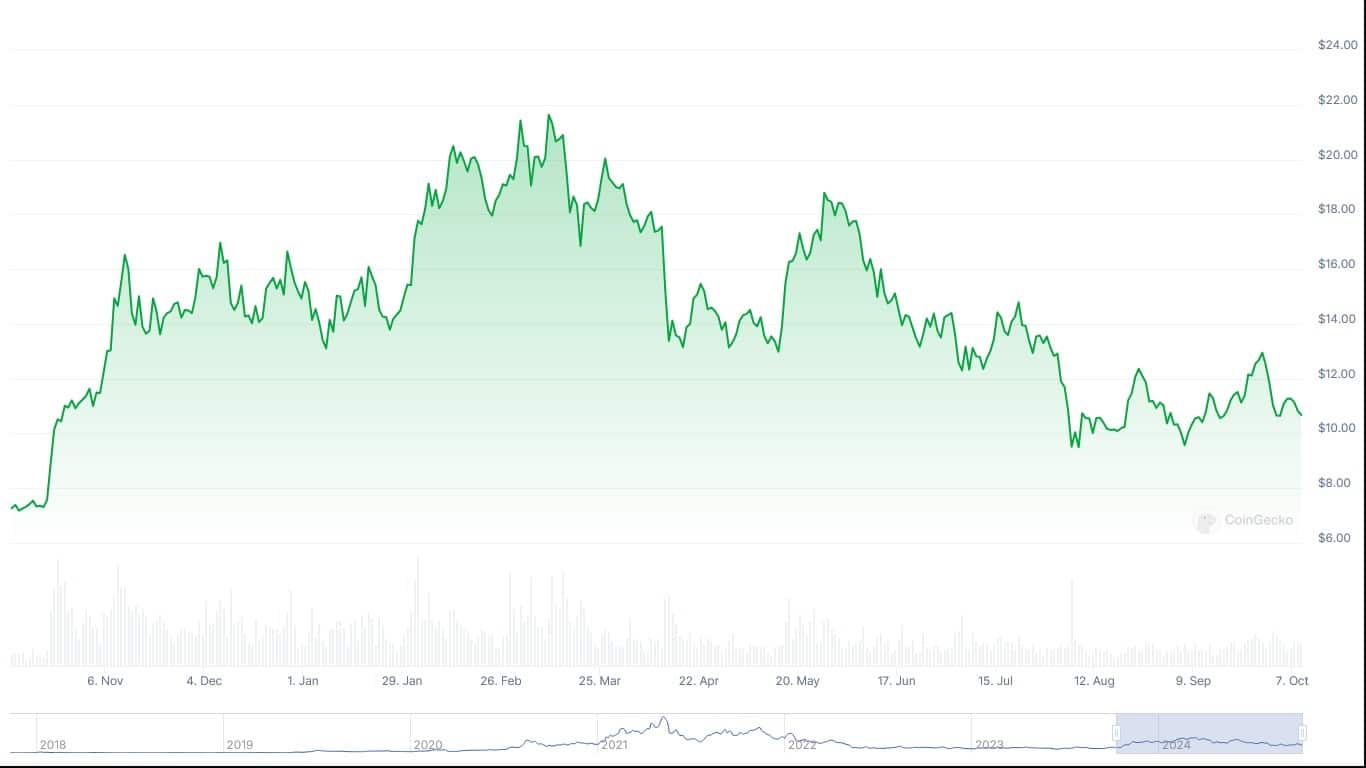

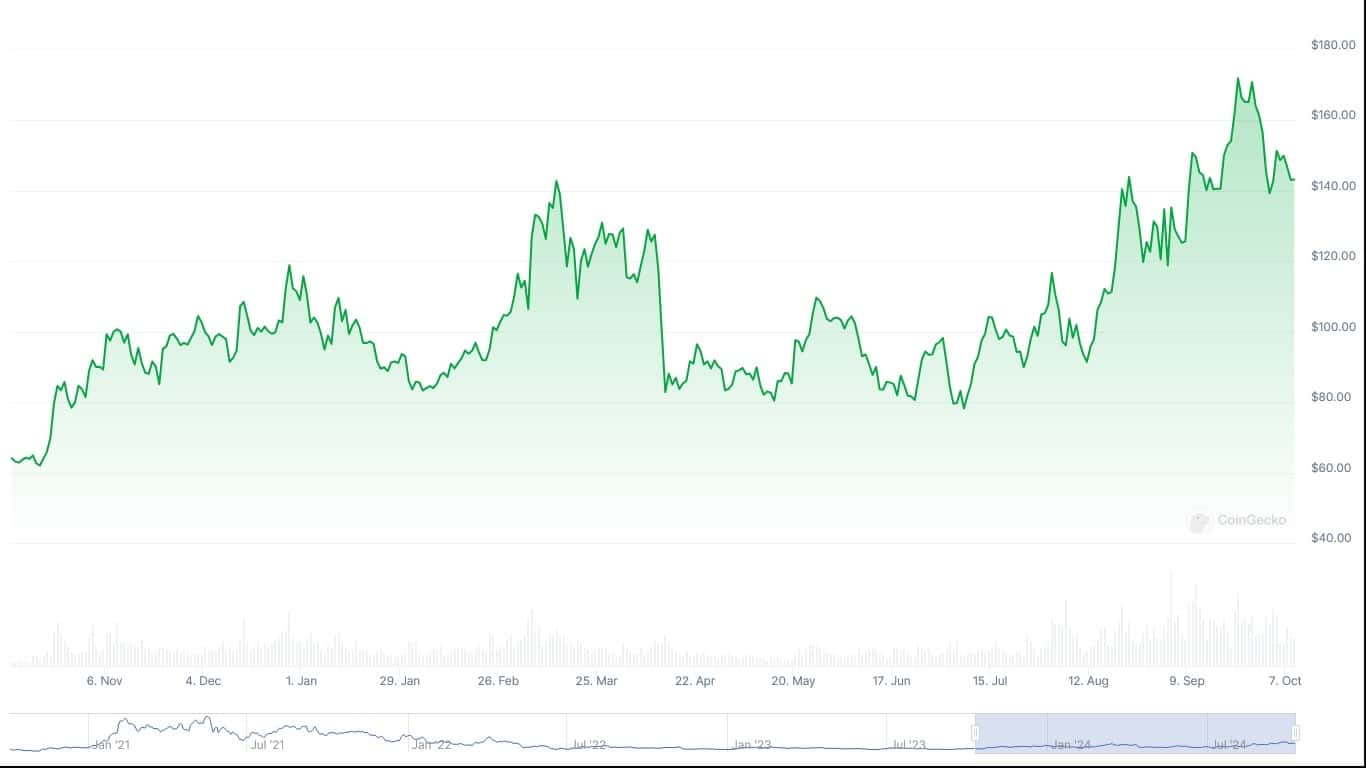

Chainlink

eToro describes the DeFi use case of Chainlink as providing a communication platform for messaging and digital services in international finance, healthcare, retail, and logistics industries.

- LINK market cap – $6.8 billion

- LINK Coinmarket rank – #14

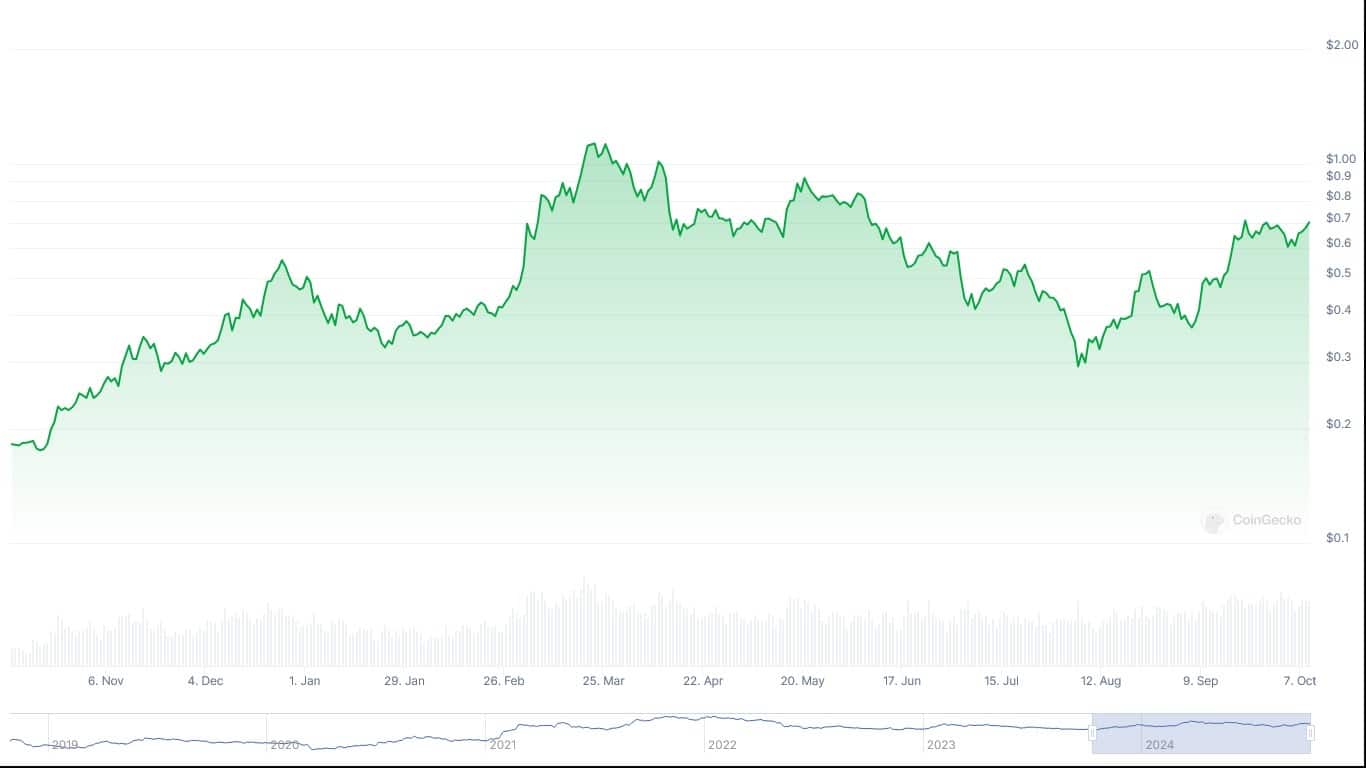

Tezos

eToro describes Tezos as a crypto asset similar to BTC and ETH in its use of smart contracts and blockchain tech but without the need for hard forks which have been an issue for many crypto coins.

- XTZ market cap – $658 million

- XTZ Coinmarketcap rank – #99

Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Maker

eToro describes the Maker platform as a decentralised autonomous organisation (DAO) on the Ethereum blockchain, and the framework for the DAI stablecoin. The Maker (MKR) token helps stabilise the price of the DAI token at $1 and enable management of the Dai Credit System.

- MKR market cap – $1.2 billion

- MKR Coinmarketcap rank – #57

Theta Network

eToro describes Theta as a decentralised blockchain powered network purpose built for video streaming.

- THETA market cap – $1.2 billion

- THETA Coinmarketcap rank – #56

Aave

eToro describes AAVE as one of the largest emerging decentralized finance coins by market cap, an Ethereum-based currency that enables the creation of lending pools, allowing users to lend or borrow up to 17 different cryptocurrencies.

- AAVE market cap – $2.1 billion

- AAVE Coinmarketcap rank – #39

Fantom

eToro describes Fantom as a smart contract platform that aims to progress the scalability and transaction speed of blockchain and maintain cheap operating costs.

- FTM market cap – $1.8 billion

- FTM Coinmarketcap rank – #47

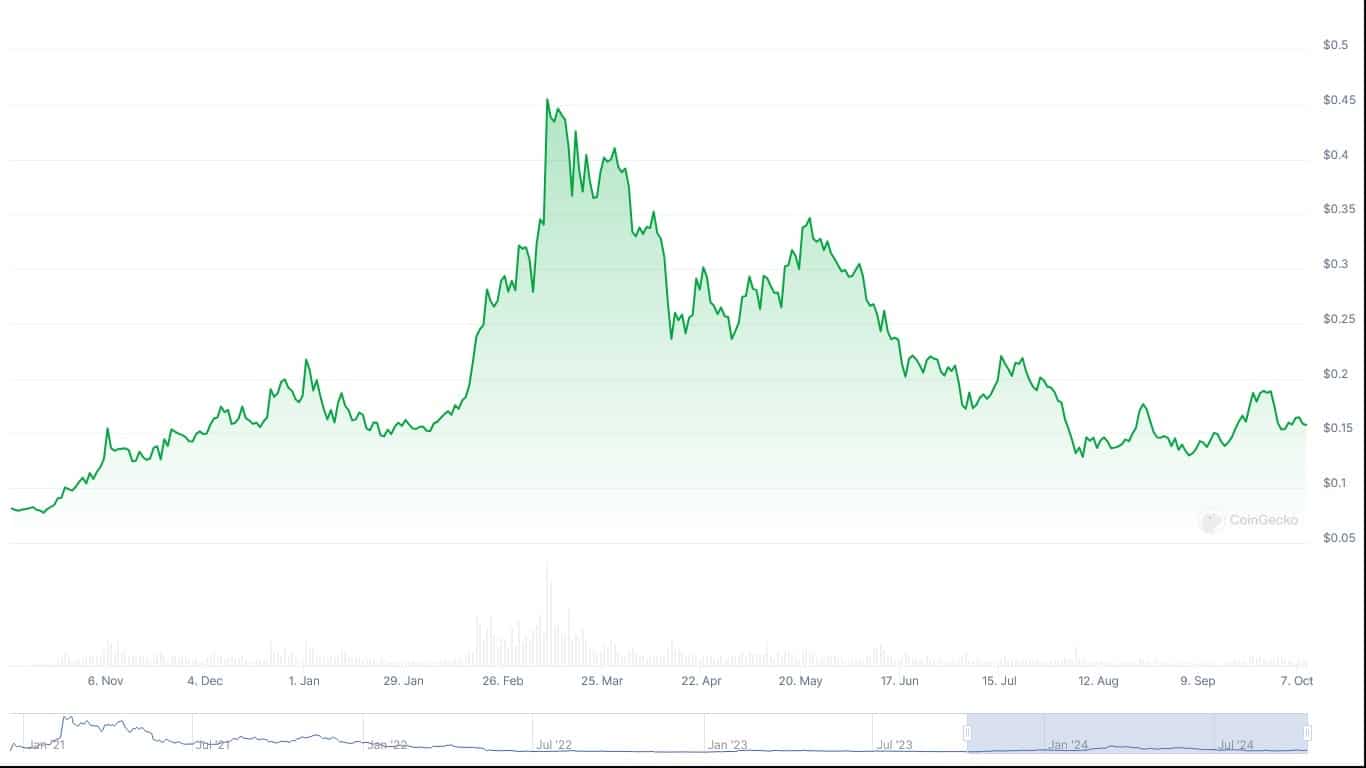

The Graph

eToro describes The Graph as a decentralised indexing protocol powering various applications in decentralised finance and throughout the Web3 ecosystem.

- GRT market cap – $1.5 billion

- GRT Coinmarketcap rank – #51

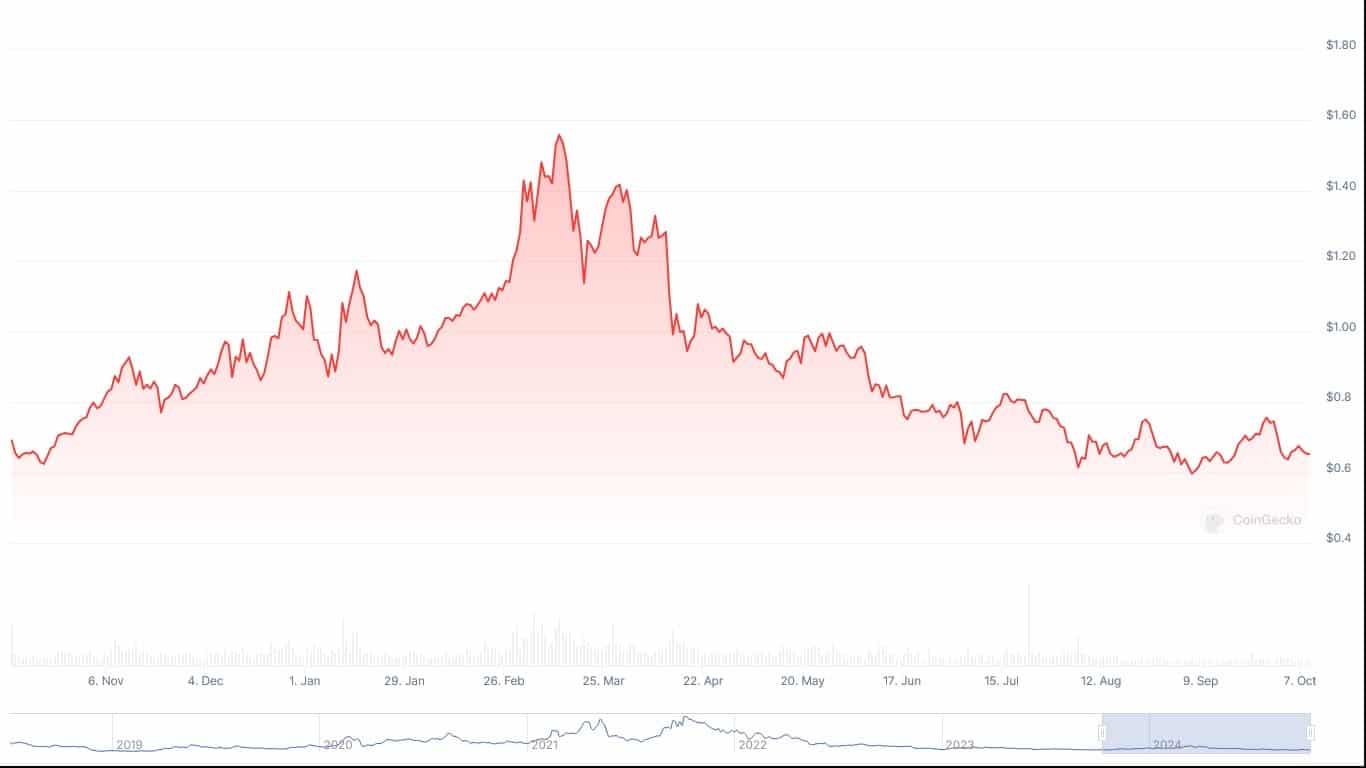

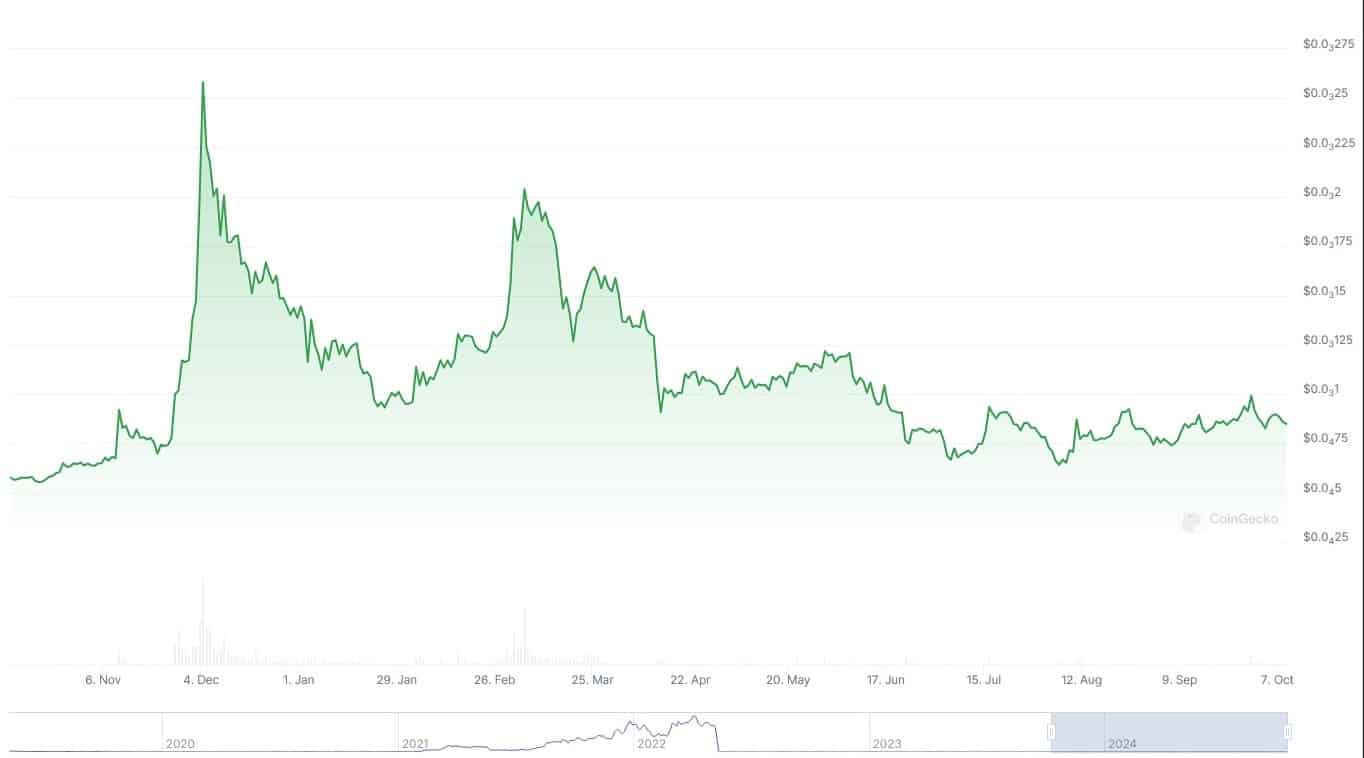

Terra Luna Classic (LUNC)

Founded by Terraform Labs in 2018, eToro describes Terra as a layer 1 blockchain built on the Cosmos SDK and Tendermint Consensus that operates a suite of stablecoins.

The May 2022 Luna crash from $90 to $0.83 barely registers on the LUNA price chart. Following the collapse, the original Terra was rebranded to Terra Classic.

- LUNA market cap – $488 million

- LUNA Coinmarket rank – #121

What is the DeFi Market Cap?

The live market capitalization of each individual DeFi project can be calculated by multiplying its native DeFi token price by the number of tokens in the circulating supply. For fully diluted market cap the max supply is used, which includes coins still locked and not yet released into circulation.

For example Avalanche (AVAX), the top DeFi coin by market cap (if wBTC isn’t counted) has a live market cap of $10.6 billion currently, even after the recent correction, ranked #12 in terms of all crypto coins on Coinmarketcap, and #1 within the list of DeFi coins. Its fully diluted market cap is $18.9 billion as not all AVAX coins are yet in circulation.

Ethereum isn’t part of the DeFi market cap chart. Most DeFi coins do run on the Ethereum blockchain, but ETH is thought of as a Layer-1 coin, whereas the DeFi market cap is a measure of all Layer-2 coins in the DeFi ecosystem, separate to other cryptos. As of October 2024, Bitcoin, also not included in DeFi market cap charts, has a market cap of approximately $1.2 trillion and ETH has a market capitalization of $294 bn.

Sites like DappRadar, DeFi Pulse and DeFi Llama also calculate the size of the DeFi ecosystem using TVL, total value locked. That includes all assets locked up in some way, e.g. for staking, farming yield, liquidity pools, and within smart contracts. DappRadar estimates the DeFi TVL to still be $100 billion in their DeFi overview section. Estimates vary though across different DeFi ecosystem tracking websites.

DeFi Market Cap History

The total DeFi market cap rose over 100x, or 10,000% since its 2020 open. Based on the Tradingview ‘TOTALDEFI’ chart above, and the open of each monthly candle, some notable metrics are:

- 2019 open – $1.15 billion

- 2020 open – $1.96 billion

- 2021 open – $21.6 billion

- All time high DeFi market cap (Nov 8th 2021) – $199.5 billion

- 2022 open – $161.6 billion

- 2023 open – $38.5 billion

- 2024 open – $80 billion

Invest in DeFi Tokens on eToro

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

DeFi Market Cap Prediction

The DeFi sector is gradually bouncing back after suffering a significant blow in the late 2022 crypto bloodbath. This noticeable meltdown coincides with the insolvency crisis that rocked one-time world’s second-largest cryptocurrency exchange, FTX.

According to the Financial Times, the FTX crisis wiped out more than $8 billion from the cryptocurrency landscape. Amid the crisis, the crypto market lost a noticeable portion of its market cap, dropping to around $1.5 trillion in 2023.

The market-wide turbulence extended to the DeFi niche, causing it to lose a huge portion of its market cap, dropping from $161.6 billion to $38.53 billion towards the start of last year. During this period, the price of BTC dropped significantly to $17k while Ethereum dipped to $1,2011.

Despite suffering heavy downturn in between late 2022 to early 2023, the DeFi market and the broader crypto industry staged a comeback in late 2023 and early 2024. The growing interest in the cryptocurrency landscape and the positive attention the industry is gaining in the run-up to the US presidential election has revived the hope of investors.

DeFi Institutional Interest

One of the major drivers of the recent growth of the DeFi and crypto landscape is the increasing interest in digital assets by institutional investors. While BTC and ETH ETFs have been the major entry point for traditional investors, some asset managers are already recommending that their private clients should consider investing in decentralized finance.

In a DeFi report, Goldman Sachs stated decentralized applications (dApps) and other innovations “have potential for adoption” in TradFi (traditional finance) which has been valued at over $500 trillion in size. DeFi is yet to capture even 1% of that market share, so there is still room for growth.

Is DeFi a Good Investment?

Interest in DeFi cryptocurrencies has reduced drastically following the collapse of Luna and FTX. The interest in DeFi tokens weakened further as users opted for more reliable yield innovations.

Without a doubt, the decentralized finance sphere has been on a great revival in 2024 championed by the introduction of new solutions and growing regulatory clarity. With that, the DeFi space is looking to further solidify its position as a crucial sector in the blockchain space.

Despite suffering a strong falloff, the DeFi market is still in a bull cycle up over 2,000% since the 2020 open. The present DeFi market structure would maintain its bullish run towards the start of 2025 and beyond due to the increased attention on the cryptocurrency landscape.

Low Market Cap DeFi Coin To Watch Closely – Crypto All-Stars

Crypto All-Stars is one of the latest DeFi projects that has taken the broader crypto market by storm. Developed on Ethereum, Crypto All-Stars brings a fresh and innovative approach to staking meme coins and earning rewards.

Central to its appeal is its fully audited MemeVault solution, an industry-standard staking platform that has been developed to help degen investors maximize their meme coin holdings. The Crypto All-Stars’ staking ecosystem will support all the world’s most celebrated meme coins, including Dogecoin, Shiba Inu, Floki Inu, Mog Coin, Brett, Bonk, Dogecoin, empowering their holders to earn passive rewards under one roof.

Crypto All-Stars has a native token – $STARS. For staking any of the aforementioned meme coins, investors will earn rewards in STARS. However, staking $STARS guarantees 3x rewards. This lucrative reward potential not only boosts investors’ interest in the token but also lays the groundwork for its future success.

More so, keeping up with other top crypto projects, Crypto All-Stars has been fully audited by famous blockchain security firms, SolidProof and Coinsult. Being an audited project adds an extra layer of credibility to Crypto All-Stars, making it a legitimate investment option for all investors.

Given its multiple upsides, well-known crypto analysts like ClayBro have backed Crypto All-Stars to bring 10x gains to early birds in the coming months.

At press time, the Crypto All-Stars presale has raised upwards of $2 million, demonstrating investors’ belief in its potential. Ahead of its eagerly-anticipated debut, those interested in getting in on the ground floor can visit the project website to join the presale.

FAQs

What are DeFi projects?

DeFi projects are applications and platforms that leverage the powers of blockchain technologies to deliver unparalleled financial services to users.

Which low-cap DeFi coin should I invest in right now?

One of the best low-cap DeFi tokens to invest in right now is Crypto All-Stars. This meme coin is currently available on presale at a discounted rate of $0.0014.