In the area of blockchain tech, decentralized finance and non-fungible tokens are now two prominent use cases. NFTs enable asset tokenization, and DeFi provides decentralised access to financial services.

Increasingly industries are considering the possibility of using an NFT-DeFi combo to benefit businesses. To all those confused about the terms NFTs and DeFi, this guide will clarify what these terms mean and how they exist together in the same ecosystem.

Though they may seem complicated at first, both of these terms are now growing elements of the crypto universe and certainly something our readers should know more about.

What are NFTs and DeFi?

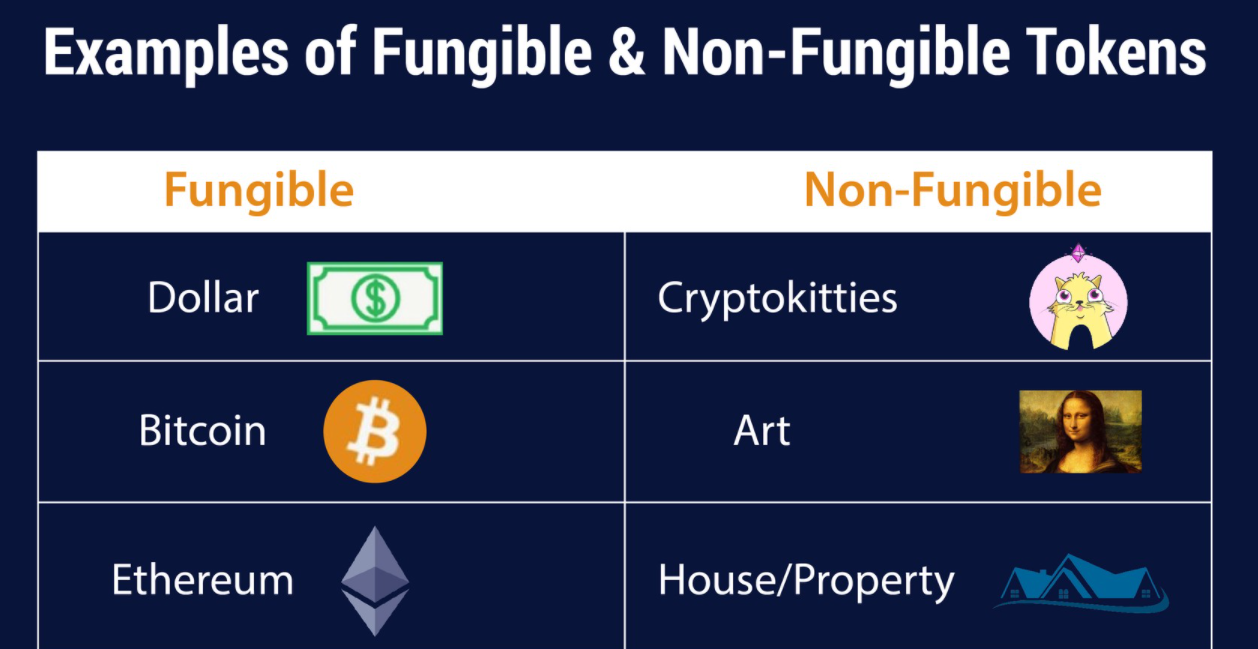

Coming to the first question, what are NFTs exactly? An NFT or a non-fungible token is a digital asset representing real-world objects like art, music, in-game items and videos.

Fungible vs non-fungible assets

They are bought and sold online at NFT marketplaces, frequently with cryptocurrency such as ETH and SOL, and they are generally encoded with the same underlying software as many cryptos. Their actual value is their trait of being a unique owned piece of digital art.

Your capital is at risk

What is DeFi?

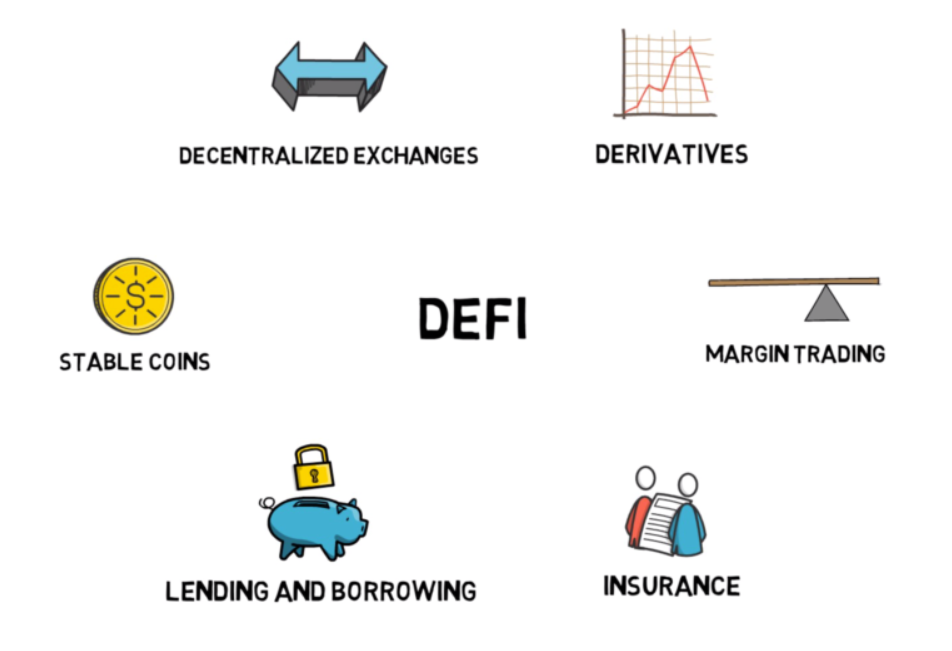

DeFi Decentralized finance (abbreviated as DeFi) is an umbrella word that refers to peer-to-peer financial services provided on public blockchains, most notably Ethereum.

It is a catch-all word for financial services provided over public blockchains, primarily on the Ethereum platform. Most of the things that banks allow you to do — earn interest, borrow, and lend; buy insurance; trade derivatives; trade assets; and more — are available to you through DeFi.

It is far faster and does not necessitate the involvement of a third party.

DeFi meaning – how it replaces the traditional banking system

As is true of the crypto industry in general, DeFi is global, peer-to-peer (meaning that it is sent directly between two people rather than being routed through a centralized system), pseudonymous, and accessible to anybody.

DeFi utilizes the fundamental qualities of Bitcoin – digital money — and builds upon it, resulting in an entirely digital alternative to Wall Street that is free of the expenses associated with traditional financial institutions (think office towers, trading floors, banker salaries).

A more open, free, and fair financial market that is accessible to anybody with an internet connection is possible due to this development. But it comes with its own challenges.

Fluctuating transaction rates on the Ethereum blockchain means that active trading can get expensive. Also, you have to maintain your own records for tax purposes and those regulations can vary from region to region.

Your capital is at risk

How are DeFi and NFTs Linked?

It is necessary to understand the types of assets that can be tokenized to comprehend the possible NFT-DeFi connection.

Real estate tokens, for example, are one of the earliest examples of NFTs since they offer a true value proposition. Real estate investments were extremely illiquid and necessitated a significant amount of documentation.

Putting such assets on the blockchain in virtual tokens can make it easier to indicate ownership and transfer them. It can also increase the flexibility of the system.

NFTs can also help unlock and mobilize value in situations where it is difficult to mobilise value on a consistent basis. For example, music performers may give out NFTs as a thank you for participating in one-on-one sessions with them during their performances.

When determining the value of an offering, the value of the offering is a crucial component to consider. Because NFTs provide a compelling value proposition, it is necessary to establish a price for them.

NFT’s entry into the DeFi ecosystem

Design patterns in decentralized finance, often known as DeFi, are slowly but steadily intermingling with those in the world of NFTs and NFT markets.

Rarible, like many other DeFi projects, provides a non-financial-transaction (NFT) marketplace that is solely focused on creators.

It has also built the required procedures for regulation under the aegis of a Decentralized Autonomous Organization (DAO), which is represented by the governance token known as RARI (DAO).

The combined power of NFT and DeFi

The holders of RARI tokens, which include producers and collectors, were able to vote on platform enhancements while also actively participating in the moderating of the marketplace itself.

RARI has also included a non-profit trust index, which serves as a portfolio for non-profit trusts to assist all collectors in seeing the artworks and selecting the most appropriate one for investment.

Resolving the problem of Collateralization

When it comes to the NFT DeFi combo, the capacity to unlock value is one of the essential elements to consider. At the same time, it isn’t easy to develop particular techniques for assuring that the value of NFTs is determined.

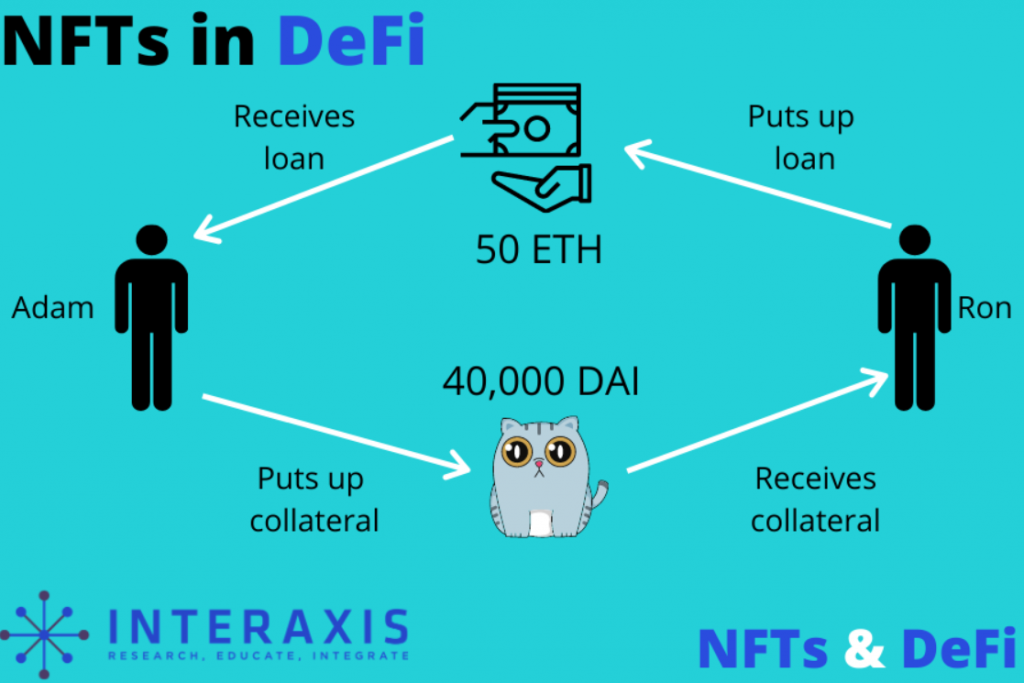

The usage of NFTs could assist the lender in determining the quantity of collateral to be used in DeFi – the borrower would submit a loan amount request to the NFT, acting as collateral for the loan. When evaluating the loan amount in conjunction with the collateralized NFT, the lender would take into account a variety of elements such as the owner’s price tag and secondary market value.

The usage of NFT and DeFi in conjunction with one another may make it possible to solve the problem of collateralization more quickly. The importance of recognizing problems resulting from concerns with market liquidity cannot be overstated.

When it comes to liquidity, the world of artwork and collectibles is very speculative and vulnerable to market fluctuations. Consider the case of a painting that has a price tag of about 1 million dollars.

It is only when someone is interested in paying for the painting that the price of the painting has any value, to begin with. The NFT decentralized finance organization could easily handle the difficulties of collateralization for artwork that have been brought to their attention.

In this situation, a logical solution could be to use non-traditional art and collectibles as collateral in DeFi loans. In the offline world, traditional art has traditionally been utilized as collateral in a typical manner. The move from NFTs to DeFi appears to be a proper step towards the future, as demonstrated by the following results: Because of their ability to enable tokenization, NFTs have the potential to help the DeFi sector by resolving liquidity difficulties.

Tokenization may make it easier and more flexible to prepare an illiquid asset in a shorter amount of time than is now achievable.

The impact of NFT ownership on DeFi

The use of of DeFi platforms in conjunction with NFTs in the music industry indicates that the world of art is about to undergo a dramatic shift. In the same way, NFT creators have discovered a critical role in granting ownership rights and income to the actual producers.

If their works are successful in the marketplace, NFT owners can earn a predictable percentage of the streaming revenue or resale value of their creations. The preservation of verifiable profits through non-financial institutions (NFTs) also provides an effective alternative to collateral.

It can also make it easier to obtain under-collateralized loans, which would otherwise be impossible without using NFT in DeFi. Crypto.com is one platform that offers crypto loans, interest on DeFi protocols, and a DeFi wallet.

The commercialization of art and artifacts through non-financial transactions (NFTs) has become a vital component of the overall narrative surrounding the NFT boom.

NFTs, on the other hand, have the potential to become more effective tools for tackling issues such as royalty sharing, licencing, and copyright ownership.

Another key consideration when using NFT DeFi in conjunction with each other is the concept of fractional ownership. NFTs also provide the ability to create shares of the NFT with greater flexibility.

As a result, investors and fans of NFT producers may have the option to own NFT without having to purchase the entire NFT. The applications of fractional ownership of NFTs in the DeFi domain, on the other hand, are still in the early phases of development.

Your capital is at risk

NFT Defi Crypto Projects

1. Mintbase

Mintbase was founded by Nate Geier and Calorine Wend and launched in 2018.

In 2020, Mintbase raised $1 million in a seed funding round. The round was led by Sino Global and included other VCs such as Block Oracle Capital, D1 Ventures, and angel investors. It’s a platform that makes minting non-fungible tokens simple. Sino Global recently led an investment round in the company.

It allows users to mint Ethereum coins, but the NEAR blockchain has gone to great lengths to ensure that it is compatible with the original smart-contract chain. Mintbase is currently launching a feature on NEAR that allows royalty payments to be shared with up to 1,000 people.

Mintbase allows anyone with an internet connection to create an NFT and sell it on their NEAR NFR marketplace or on other NFT marketplaces like OpenSea.

Miners can use a smart contract to limit the transferability of tokens minted, preventing fraud and illegally transferring valuable items.

Mintbase is dedicated to providing a one-of-a-kind NFT creation experience, which is why, as previously stated, it supports a variety of digital assets.

2. Zora Project

Zora is a platform-independent cryptographically enforced registry of media. It’s a marketplace with two main components but a single philosophy: creators’ long-term economic viability.

All too often, producers are only rewarded once for their efforts, while the secondary economy continues to generate value beyond their reach. Consider an artist who develops a piece and then sells it for a fair price.

That’s terrific, but every ounce of effort the artist puts into future work, into establishing a name, a brand, and a community for themselves adds to the piece’s value. The artist never sees a penny from it, instead relying on the value of future releases to pay off the debt.

The main Zora product is a market that allows creators or artists to launch things and subsequently participate in their secondary market value. According to the project description, Zora’s NFT minting and market protocol is open, making it a “original protocol that can be merged and constructed.”

Builders can install more encrypted media infrastructure on or near Zora at any time, and you can utilise it to directly cast and operate your own NFT storefront.

3. Polyient Network

This group is focused on NFT financialization, from investing in the industry to developing tools to strengthen it. It maintains a decentralised NFT exchange, has its own method to fractional ownership, and provides NFT security solutions.

Polyient Games is a fund that invests in blockchain gaming infrastructure firms. Polyient, the industry-leading investment firm behind Polyient Games, has launched the Polyient Network, a decentralised data network for non-fungible token (NFT) pricing that will enable a new generation of synthetic assets based on the NFT asset class.

The Polyient Network is being developed as a cross-chain protocol that encompasses the leading layer 1 and layer 2 networks in order to accommodate the bigger NFT market. The NFT asset class will benefit from standardisation and interoperability as a result of this approach.

The Polyient Network is being developed as a cross-chain protocol that encompasses the leading layer 1 and layer 2 networks in order to accommodate the bigger NFT market. The NFT asset class will benefit from standardisation and interoperability as a result of this approach.

NFT Market Cap, the first system meant to feed into the Polyient Network, will soon be available in beta. NFT Market Cap is the first decentralised analytics platform for the NFT asset class, with industry-first techniques to token valuation data gathering, filtering, and analysis.

4. Ark Gallery

Larva Labs’ pioneering NFTs became more fungible because to this company’s creation of a DAO that produced wrapped CryptoPunks.

Ark Gallery has since developed new techniques to improve liquidity for the initial non-fungible coin, and deserves credit for the current CryptoPunks market’s frenzied activity. Blank.Art is currently being worked on.

ARK Gallery is an Ethereum-based application that allows you to buy and trade Cryptopunks with the help of other users. By establishing digital community ownership, Ark Gallery gives a new way to gather NFTs.

Anyone can start their own ARK or join one that already exists. An Ark is a crowdsourcing project with the purpose of collecting a Cryptopunk. It can alternatively be described as a trustless, decentralised system for Punk’s collectors, enabled by a smart contract and DAO (Decentralised Autonomous Organization).

When the Punk is sold, the ARK smart contract ensures that the monies pooled by the Collectors are always safe, allowing each Collector to cash out the sale proceeds. ARKs are more than just a kind of fractional ownership.

ARKS are live communities of collectors who share the experience of co-owning a Punk. With an ARK, the Punk is never hidden away and is always available for anybody to collect on the market. Only ARKS collectors have the power to set or adjust the price.

ARK stands for genuine democracy and inclusion: 100 or more collectors can own an Alien Punk together, or if you own a Zombie Punk, you can share a portion of it with other collectors who might not otherwise have access to it.

ARK Gallery is an experimental platform for non-financial tokens (NFTs) that enables decentralised community ownership.

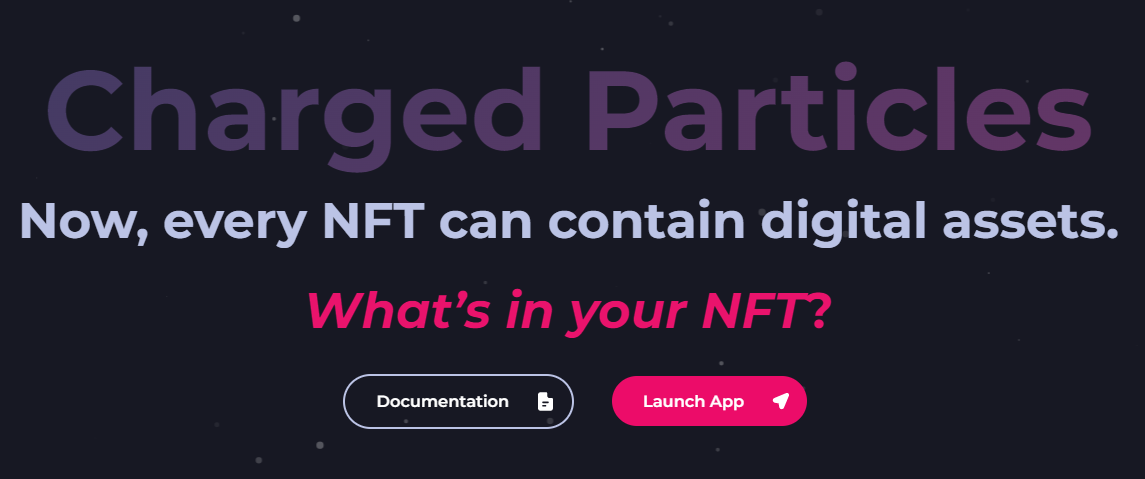

5. Charged Particles

Charged Particles is a revolutionary new technology that allows you to store digital assets in your NFTs. It allows you to convert your NFT into a basket that can carry ANY token (including more NFTs). In February of 2021, the Charged Particles Protocol and its initial DApp were released.

A “Charged Particle” is an interest-bearing Non-Fungible Tokens (DeFi NFTs) that is minted with an Asset Token (e.g. DAI, USDT, etc.) and earns interest through a Liquidity Provider (e.g. Aave, yEarn, etc.) giving the Token a “Charge.”

The “Charge” that the token (Particle) has amassed is the amount of interest it has earned. Both the principal (mass) and the interest (charge) can be fully customised. The principal can be locked in time, ensuring royalties for future generations.

Particles with Charge NFTs are yours to keep – They’re regular, non-custodial NFTs that you keep in your DeFi wallet and can “discharge” at any moment to collect any earned interest. It includes a novel token mechanism that allows Smart Contracts and/or DApps to determine how to treat a certain token based on its “Charge” level.

6. Unifty

Unifty launched The Gallery, a novel exhibition venue inspired by the platform’s goal to improve upon the traditional gallery-creator connection, in December 2021, combining decentralised finance (DeFi) and non-fungible tokens (NFT).

Because of the Gallery’s unique approach to the NFT economy, all participants are rewarded for engaging on the platform, including creators, collectors, curators, and fans.

The Gallery reimagines how artists present their work to the public in the past, as well as the NFT platform experience.

Unifty is bringing DeFi into the digital art exhibition and watching the process through The Gallery by rewarding and involving all community members, including makers, collectors, and art fans, as well as organizations.

Unifty uses its dual-token framework to benefit all ecosystem players. The platform’s governance token is Unifty’s NIF token.

Holders can vote on which creators or collectors are chosen to display in The Gallery, as well as the platform’s overall direction.

NIF holders can also use their tokens to participate in the exhibitions of their choice. Members of the community who stake NIF participate in the earnings earned by the show.

Several factors influence the yield, including the agreed market value of the NFTs on display, the creator’s reputation, the quantity of NIF tokens staked, and the number of individual stakers.

Unifty’s reward token, UNT, is used to pay out rewards. The exhibitor, whether a collector or a creator, and the fans who staked NIF on it receive the UNT that is farmed from a particular display in The Gallery.

Unifty intends to improve the world of NFTs in this way by using instruments more often found in DeFi. Not only are creators appropriately compensated for their work through sales and/or just presenting it, but people who believe in and enjoy it may also receive a return by staking their commitment to it with NIF tokens.

How to invest in NFTs?

Although maintaining an NFT marketplace is not as simple as running an Amazon or other e-commerce site, it is not impossible. Everyone wants their own NFTs, but the question is how to go about investing in them. Following are 5 easy steps to invest in NFTs:

1. Buy Ethereum on eToro

The majority of NFTs may be purchased with Ethereum, which is easiest to purchase on FCA regulated platform eToro.com. Sign up for an eToro account, verify your identity, and deposit funds.

After your account has been validated and funded, search Ethereum in the menu and choose how much you wish to buy.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

You’ll need to transfer the Ethereum to your eToro Wallet once you’ve acquired it. To do so, go to your eToro account’s Portfolio button, choose Ethereum, and then click Transfer to Wallet.

Your capital is at risk

2. Download Metamask

MetaMask is a cryptocurrency wallet that serves as a portal to the Ethereum-based decentralised finance (DeFi) and network finance (NFT) ecosystems. It’s accessible as a mobile app for iOS and Android, as well as a browser-based add-on for Firefox and Google Chrome.

You’ll need to download the program from MetaMask.io, create a wallet, set a password, and save the recovery phrase whether you use the mobile or desktop version.

3. Send Ethereum to Metamask

You’re ready to transmit your Ethereum to your MetaMask wallet now that you’ve purchased your first Ethereum and downloaded the MetaMask. To do so, access your eToro Wallet and select Ethereum from the “Send” menu.

Copy the address of your wallet from MetaMask and paste it into the address field on your eToro app. Simply enter the amount of Ethereum you wish to transfer and click “Send” to complete the process.

The transaction time is determined by the pace of the Ethereum network, which can get quite busy at times. This shouldn’t take more than a few minutes to an hour.

4. Connect to an NFT Marketplace

You can now link your MetaMask Wallet to an NFT platform because Ethereum is already stored in your MetaMask Wallet. Many investors favour OpenSea, which is said to be the largest NFT platform in the world today.

Locate the “Wallet” icon on the OpenSea home page and select “MetaMask.” You’ll then be connected to your wallet, and you’ll have access to a variety of NFTs.

Explore the OpenSea website to see the seemingly limitless collections of digital goods ranging in price from a few tens of dollars to hundreds of thousands of dollars, including artwork, avatars, the first tweet, and even popular memes.

There are many additional NFT platforms that are well-liked by NFT purchasers. SuperRare, Rarible, Foundation, Nifty Gateway, Larva Labs, and even an NBA Top Shot Marketplace are just a few of them.

5. Buying an NFT

You can either buy an NFT right away or place a bid when you’ve discovered one you like. When you select the “Buy Now” option, you’ll be prompted to review the NFT before moving on to the “Checkout” section to look over the gas prices. After clicking “Confirm,” you will be the new owner of an NFT.

When you click the “Make Offer” button, you’ll be asked to submit a bid. You must first convert your Ethereum to WETH (Wrapped ETH) before proceeding with the bidding transaction. A “Gas Cost” is a fee that all Ethereum users must pay before they can complete any transaction on the blockchain.

Conclusion

The verifiability of ownership is one of the most important factors associated with the use of NFTs and DeFi together. The ease with which NFT owners can prove ownership opens up the DeFi space for them to obtain loans using NFTs as collateral.

Most importantly, it’s critical to understand that NFT is capable of assigning value to almost anything. DeFi, on the other hand, aids in the unlocking of a specific asset’s value.

NFT-backed loans are slowly gaining traction, and the expansion of NFT DeFi as a whole portends more innovation. DeFi and NFTs could change the way we think about financial services as the number and depth of users grow.

FAQs

What are NFTs?

A non-fungible token is a non-transferable interchangeable unit of data that may be sold and traded and is held on a blockchain, a type of digital ledger. Digital media such as photographs, videos, and audio may be connected with several types of NFT data units.

What is the meaning of Defi?

Decentralized finance (DeFi) is a new financial technology based on distributed ledgers that are similar to those used in cryptocurrencies. The system decentralises control over money, financial products, and financial services from banks and institutions. DeFi can entail lending, sending, or investing in cryptocurrency.

What are some examples of Defi?

Some of the important Defi platforms and applications are MetaMask, Stablecoin, Uniswap, Aave etc.

What is the difference between NFT and Defi?

The fundamental distinction between NFT and DeFi is that NFT refers to unique digital assets, whilst DeFi refers to the internet's financial system. DeFi runs on smart contracts on block chain on its platform and eliminates intermediaries, whereas NFT holds a unit of data that is unique and non-interchangeable. NFT facilitates tokenization of assets. Typically, the tokens are reasonable value propositions. The asset's value is locked. NFT's worth varies depending on who you ask and how much you pay. The value of the offering is a big factor in determining its worth. DeFi, on the other hand, allows for financial transactions and services. Decentralized applications are used to run the platform. Smart contract programmes allow transactions to be made directly between participants.

What is collateralization in Defi?

Collateralization is when a borrower pledges an asset as collateral, the lender is able to recover their capital if the borrower defaults on the loan. The backbone of open lending protocols in decentralised finance is collateralized loans. As a result, most DeFi lending applications, like mortgages, will need borrowers to put up collateral as a means of holding them accountable for repaying their debt.

What is Ethereum?

Ethereum is a decentralised, open-source blockchain that allows users to create smart contracts. The platform's native cryptocurrency is Ether. Ether is the second most valuable cryptocurrency after Bitcoin in terms of market capitalization.

What is the meaning of ‘NFT Marketplace’?

Artists can sell their NFT artworks through specialised marketplaces. Buyers could search the marketplace for NFTs and then place a bid on the item they wanted. As a result, any NFT developer or enthusiast should review the NFT marketplace list to ensure that they are getting good bargains on artwork, collectibles, and other digital assets.

What is eToro?

eToro is a social trading and multi-asset brokerage firm based that specialises in financial and copy trading services such as FX and cryptocurrency. Cyprus, the United Kingdom, the United States, and Australia are among its registered offices.

What is Opensea?

OpenSea is a decentralised marketplace for buying and selling NFTs that is changing the game. NFTs stand for Non-Fungible Tokens, which are unique, collectible digital items such as in-game assets, avatars, trading cards, and art.

What are the alternatives to eToro?

Though eToro is considered as quite an efficient brokerage company, there are many alternatives to it such as XTB, IG, Trading 212, Markets.com, Naga Markets etc.

How do NFTs store value?

One of the first examples of NFTs are tokens having realistic value propositions, such as real estate. Real estate investments were notoriously illiquid and necessitated a great deal of paperwork. Putting assets on the blockchain in the form of virtual tokens can make it easier to represent ownership and transfer them. Furthermore, NFTs could aid in the unlocking and mobilisation of value in situations where it is difficult to do so.