In the second era of blockchain technology, developers attempted to resolve the most challenging issues. The issues were lack of trust, fear of cyber-attacks, increased transaction costs, and limited democratization. This era has arrived, bringing innovative financial resources and new networks, one of which is Fantom. This system provides important advantages to the digital currency, like scalability and speed. It solves this problem by implementing asynchronous Byzantine Fault Tolerance.

Fantom attains decentralization and security by implementing a permissionless and leaderless consensus framework. Every user can join and leave the network, as all nodes are similar. Compared to synchronous BFT ledgers like Ethereum and Bitcoin, Fantom’s aBFT consensus allows transactions to be processed asynchronously, boosting transaction speed and efficiency.

If you want to learn more about Fantom, keep reading this article. It will cover everything you should know before purchasing Fantom. You can easily compare the services offered by different exchanges that provide FTM trading on their platform.

How to Buy Fantom Crypto

- Choose an exchange that lists FTM- we recommend eToro as its FCA, ASIC, and CySEC regulated

- Sign up and verify your free trading account

- Deposit with a bank transfer, a credit card, PayPal, or another supported method

- Search ‘FTM’ in the drop-down menu to open the FTM price chart and trading platform

- Click ‘Trade’ and select an amount of FTM to buy

Best Exchange to Buy Fantom in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

How to Sign Up at eToro

Opening a free eToro account is simple, and the platform is user-friendly, especially for beginners.

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, complete the quick account creation process.

- You’ll find an electronic form where you can enter all your personal information needed to open a new trading account.

- eToro also offers the option of logging in through Facebook or Gmail.

- Read eToro’s Terms & Conditions and privacy policy while submitting your information.

- Click the “sign-up” button.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

Step 2: Upload ID

To begin, you must register with eToro by providing some basic personal information and an email address and cell phone number. Additionally, you will be required to provide identification to complete the verification process.

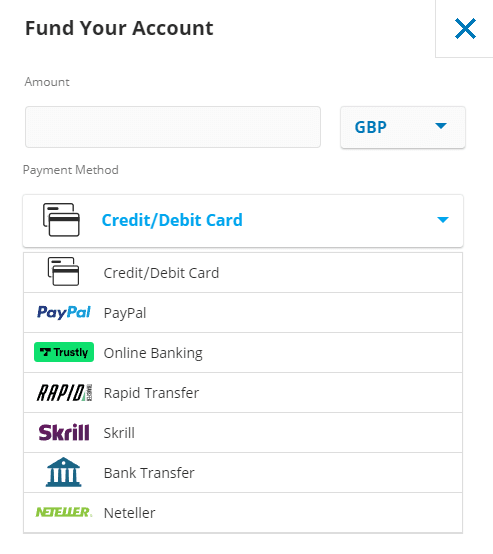

Step 3: Make a Deposit

When you’re ready to deposit, go to the ‘Deposit Funds’ section and enter the amount you want to deposit. A minimum deposit of $10 is required to open an account with eToro, which can be made in various ways. Payment methods accepted include debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller.

Depositing eToro is free of charge. After selecting a payment method, click the ‘Deposit’ button to finish the transaction.

Deposit methods on eToro

On March 15, 2022, eToro listed the Fantom (FTM) coin.

Step 4: Buy Fantom (FTM)

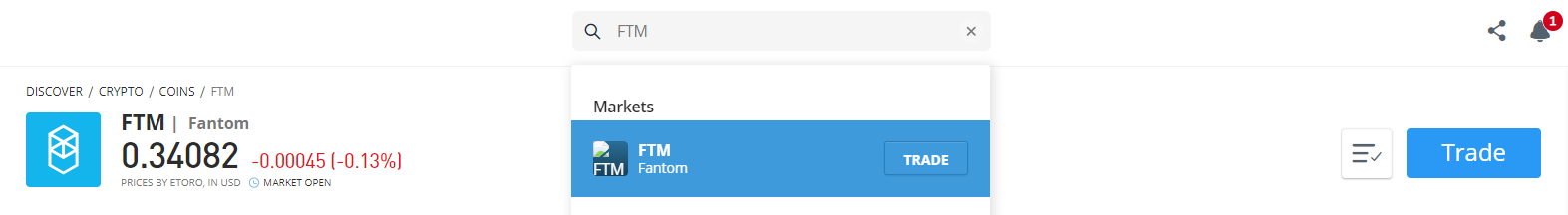

Begin typing ‘Terra’ into the top-of-the-screen search bar. Click the ‘Trade’ button when you see the cryptocurrency asset.

Searching FTM on eToro

Step 5: Review Fantom (FTM) Price

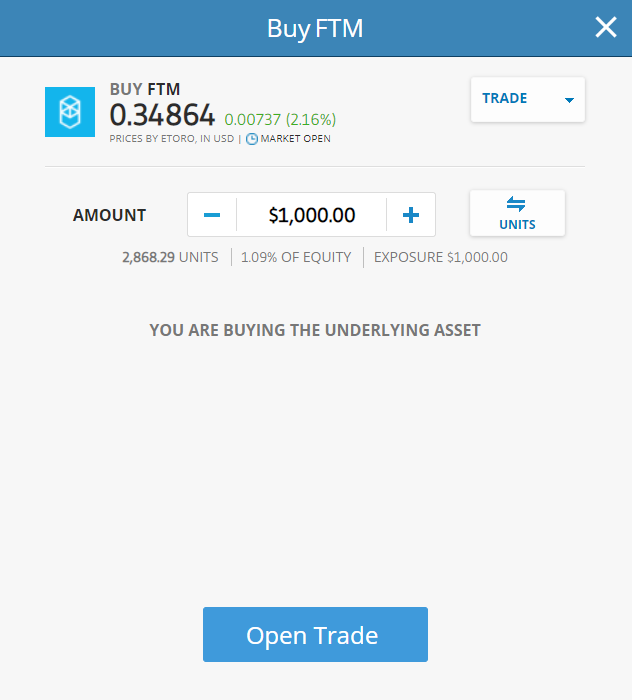

This will bring you to an order page where you can enter the number of Terra coins you want to buy. Then, click “Open Trade” to add the FTM to your portfolio. We support storing your digital assets in a third-party wallet in addition to the trading platform. The eToro Crypto Wallet, which now supports over 120 different cryptocurrencies besides FTM, is one viable option.

FTM price chart on eToro

The good thing is, there’s no maker/taker fee on eToro as they solely charge buy/sell spread.

Step 6: Buy Fantom

You can tell eToro how much money you want to invest in Terra by entering it into the ‘Amount’ box, which starts at $10. To complete your purchase, click the ‘Open Trade’ button.

How to buy FTM on eToro – the FTM price is a lot cheaper now

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Fantom FTM Tokens – Best Platforms

Fantom is on a downward trend as Terra Luna continues to fall. Before the invention of Fantom, initial cryptocurrencies like Bitcoin and Ethereum used the Proof-of-Work consensus protocol. This process required a lot of energy and was harmful to the environment. The introduction of Fantom ends the use of the energy-sucking P-o-W consensus protocol. The Lachesis consensus mechanism is used to validate operations with Fantom, which saves energy. This option makes Fantom a more eco-friendly and durable network.

Despite a drop in FTM price, price forecasts point to a possible bullish reversal in the near future. This guide will cover how to buy Fantom step by step on the dip.

We are reviewing the best place to buy Fantom right now below. Our list of sites to buy FTM in 2024 covers their fees, features, and more. eToro has established itself as the top site for buying FTM cryptocurrency and saved investors from a large part of the FTM drop by delisting it temporarily.

Best Brokers to Buy Fantom (FTM)

1- eToro

eToro is an online trading and investment company that offers social trading and investment platform. Founded in 2006, this company is headquartered in Tel Aviv, Israel. eToro provides retail investors and traders various services, including trade execution through its proprietary web platform. Additionally, the company offers social trading and copy-trading capabilities.

Additionally, you can now earn rewards for purchasing and buying Ethereum, Cardano, and Tron in your wallet.

Read more about how to stake crypto.

eToro is governed by some of the world’s most reputable regulatory bodies, including the United Kingdom’s Financial Conduct Authority (FCA). The Australian Securities and Investment Commission, Cyprus Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA) are also in charge (FINRA). CySEC regulations keep user funds separate from the platform’s operating capital for all CySEC-registered brokers. This is how the platform works.

eToro charges a nominal trading fee like other companies, including 0.75 percent for purchasing or selling bitcoin. On eToro, the cost of converting bitcoins is only 0.1 percent on top of the existing margins. As a result, eToro has established itself as a market leader in cryptocurrency trading, with a strong preference for crypto-assets and CFDs in 2022.

eToro charges reasonable fees to its customers. Depositing eToro is free of charge. Deposits are accepted via bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller, among other methods. The minimum deposit amount varies depending on the user region. Before trading, individuals in the United Kingdom and the rest of Europe, for example, must make a minimum deposit of $200. Users in the United States must make a $10 deposit.

eToro accepts Bitcoin, the leading cryptocurrency, and popular altcoins like Ethereum, Aave, XRP, and Graph.

Buying and selling on eToro can be done online and on handheld devices through their mobile app. The opening process of an eToro account is straightforward and takes a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a cryptocurrency exchange established in Luxembourg and founded in 2011 by Nejc Kodri and Damijan Merlak. This well-known cryptocurrency exchange provides a free marketplace for professional investors and large financial institutions.

Bitstamp was founded less than two years after the invention of Bitcoin and was one of the first cryptocurrency exchanges in the market.

Bitsamp is best suited for experienced investors looking for a top-tier cryptocurrency trading platform. Nevertheless, it is an excellent platform for investors who want to buy digital assets in bulk and store them on Bitsamp’s web-based cold storage wallet.

Payment Fees: Bitstamp charges relatively low transaction fees compared to most digital asset exchanges. The United Kingdom provides two deposit options. The first option is to use an international wire transfer, which costs only 0.05 percent of the transferred amount (very low compared to other crypto platforms). The second option is to take advantage of the free Faster Payments service.

Furthermore, the withdrawal fee is less than the industry standard – 0.1 percent for international wire transfers and 2 GBP for Faster Payment. The only drawback to Bitstamp is the high fee they charge on credit card cryptocurrency purchases – 5% on any amount.

Bitstamp unlike most online trading platforms, does not require a minimum deposit; however, it, like Bittrex, has a minimum order of 50 USD/EUR/GBP, whereas other exchanges may have a much higher minimum order.

Bitstamp trading fees: Bitstamp is widely regarded as a low-fee exchange, particularly for highly active investors. If your daily volume is less than $10,000, the maximum trading fee you can pay is 0.5 percent. (This is higher than the industry average of around o.25 percent). However, as the investor’s total volume of transactions increases, so do the fees. As a result, if your volume exceeds $20,000,000, you may pay no fees at all. Individual investors should expect to pay a fee of about 0.1 percent at Bitstamp.

Security: All investors performing critical account functions must now use two-factor authentication. Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured. However, according to crypto exchange security evaluator CER, it ranked near the bottom of our review of crypto exchanges in terms of security, indicating that it may still have room to grow into a category leader.

Customer service is available 24 hours a day, seven days a week, and an emergency phone support line is available.

Pros & Cons of the Bitstamp platform:

- Allows for purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Leon Li founded Huobi Global in 2013 and was initially based in China. Following China’s crackdown on cryptocurrency exchanges in 2017, Huobi Global’s headquarters were relocated to Singapore and then to the Republic of Seychelles. Huobi Global is available in most countries worldwide but does not support a few, including the United States and Japan (though users in Japan can use Huobi Japan instead).

Huobi Global provides crypto-to-crypto trading with a wide range of supported assets and reasonable trading fees. Limit, stop, and trigger orders, as well as margin and futures trading, are available on the platform, which is intended for active traders and institutional investors. OTC trade desks, derivatives, and custom trading tools are available to institutional traders.

For margin trading, the platform offers up to 5% leverage. Huobi Global’s fee structure is very reasonable and low in comparison.

Deposit: The minimum deposit fee is $100 USD, and other fees, such as deposit fees, transaction fees, and withdrawal fees, differ depending on the currency.

Fee: Those who want to buy cryptocurrency with a credit or debit card must pay a higher fee to Houbi. Both the maker and the taker fees are set at 0.2 percent. Depending on the scale volume, it can be as low as 0.1 percent.

Huobi Global offers customer service via email, phone, online chat, ticket system, and social media platforms. It offers a variety of security features, such as 2-factor authentication, cold storage, account freezes, and Bitcoin reserves.

Huobi listed FTM on November 17, 2021. The trading pair available for trading include FTM/USDT, FTM/BTC, and FTM/ETH.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

Crypto.com is a global cryptocurrency exchange established in 2016 and is based in Hong Kong and presently serves over 10 million traders in over 90 countries, allowing you to buy and sell over 250 cryptocurrencies with low trading fees. The Crypto.com platform differentiates itself by letting users stake their cryptocurrency.

Users can make up to 14.5 percent p.a. interest by staking or keeping them in a crypto.com wallet. Aside from trading, the exchange presents staking rewards, Visa card benefits, NFT trading, DeFi products, and other services.

Crypto.com utilizes several security standards to defend customer accounts, including MFA (multi-factor authentication) and whitelisting. The platform employs compliance monitoring to prevent hacks and losses and stores customer deposits offline in cold storage.

Deposit: This platform’s minimum account balance is $1. Fees for Makers and Takers range from 0.04 to 0.40 percent. Credit/debit card purchases are charged at 0% or no fee for the first 30 days after opening an account. Additionally, users can earn up to $2000 for each friend they refer.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a cryptocurrency trading platform that provides spot trading, derivatives trading, and margin trading on BTC/USD and ETH/USD trading pairs with up to 100x leverage.

Bybit was founded in March 2018 in Singapore by investment bankers, technology firms, forex traders, and early blockchain adopters. It is a trading exchange registered in the British Virgin Islands with over 2 million users.

Bybit is a cryptocurrency-to-cryptocurrency exchange with a daily trading volume of up to $1 billion.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Regarding daily transactions, Binance is one of the most active cryptocurrency exchanges/platforms. Binance has more than $20 billion transacted daily, nourishing access to hundreds of assets and welcoming trading conditions that make profiting easy.

Minimal fees, a powerful charting interface, and support for hundreds of coins are Binance’s most distinctive characteristics. In contrast to eToro, Binance is a cryptocurrency-focused exchange that does not offer copy trading, forex, commodities, or other financial services.

Regarding security, Binance employs two-factor authentication (2FA) and FDIC-insured deposits in US dollars (USD). Binance also uses device management in the US, cold storage, and address whitelisting to safeguard its customers.

Fees range from 0.015 to 0.10% for buying and trading, 3.5% or $10 for debit card purchases or higher, and $15 for US wire transfers.

The FTM token was listed on Binance on December 16, 2022, and is now available for trading. Furthermore, Binance has launched trading pairs for FTM/USD and FTM/USDT.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase was established in 2012, just three years after Bitcoin was created, and has grown to evolve into the biggest cryptocurrency exchange by trading volume in the United States, with over 73 million verified users in over 100 countries.

While the company offers a variety of valuable products for retail and institutional investors, businesses, and developers, its defining feature is the ability to buy, sell, and trade over 100 different cryptocurrencies and crypto tokens. Following its initial public offering on the Nasdaq exchange in April 2021, its quarterly trading volume has increased to $327 billion, with $255 billion in assets on the platform.

Even though Coinbase’s transaction and trading fees are higher than some of its competitors, it remains one of the most popular cryptocurrency investing apps.

On the Coinbase Pro exchange, limit, and market orders for Terra can be placed. The maker/taker fee is 0.5 percent for the first $10,000 volume traded in 30 days, then drops to 0.35 percent. If your 30-day volume exceeds $300 million, you can trade cryptocurrency for free without paying a maker fee.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, established in 2017, is a global cryptocurrency exchange that offers its eight million customers various trading options. There are spot, futures, margin, peer-to-peer (P2P), staking, and lending options.

Johnny Lyu is the Co-Founder and CEO of KuCoin, a well-known cryptocurrency exchange globally. KuCoin has become a well-known cryptocurrency exchange with over 8 million registered users from 207 countries and territories worldwide.

Deposit and withdrawal: KuCoin does allow fiat currency purchases of bitcoin, but only through a third-party application. Deposits are accepted via credit or debit card, Apple Pay, or Google Pay, but not via bank transfer. The fees, however, could be exorbitant.

KuCoin Transaction Fees: The KuCoin trading fee structure is simple. The platform charges 0.1 percent for both makers and takers, making it one of the most cost-effective online bitcoin exchanges. You can further reduce your fees if you own the platform’s native Kucoin tokens.

Fantom (FTM) was listed on KuCoin on November 06, 2018, and supported FTM/BTC and FTM/ETH trading pairs.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is one of the popular cryptocurrency exchanges where users can buy, sell, and trade various digital coins. The Hong Kong-based portal was established in 2012. Professional and intermediate traders are more likely to use Bitfinex’s trading area because it includes a robust set of chart analysis tools.

Aside from cryptocurrency, wire transfers are the only way to deposit and withdraw funds. Bitfinex, like Coinbase, is one of the few exchanges that enable you to use leveraged trading strategies and short cryptocurrencies.

Founders: Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange, providing customers worldwide with digital asset trading services.

Bitfinex Securities Ltd., a blockchain-based investment product provider, has opened a regulated investment exchange (Bitfinex Securities) in the AIFC to provide members with greater access to various financial products. As a result, Bitfinex is entirely unregulated. Despite having its headquarters in Hong Kong, the corporation is registered in the British Virgin Islands.

Fees and deposit limits: For bank transfer deposits, Bitfinex charges a 0.1 percent fee. For example, if you deposit $10,000, you will be charged a fee of $10.

Withdrawal fees: Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. If you require funds within 24 hours, you can pay a 1% expedited fee.

Fantom (FTM) was listed on Bitfinex on June 17, 2021. FTM can trade with US Dollars (FTM/USD) and Tether tokens (FTM/USDt).

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- US citizens are not accepted.

-

Expensive trading fees

- Support team only available via email

What is Fantom (FTM)?

Fantom is a blockchain network that offers ledger services to companies and applications. This network addresses the scalability issues of actual public distributed ledger technologies. Lachesis, an enhanced directed acyclic graph (DAG)-based aBFT consensus algorithm, operates the Fantom network3S. Fantom-based blockchains are rapid, safe, and highly scalable.

Fantom’s native token, FTM, aims to solve the problems associated with smart contract systems. This issue is the speed of transactions, which the creator of Fantom says has been sped up to less than two seconds.

Fantom provides multiple solutions to the existing crypto network. First, it provides services at lower transaction costs. Moreover, the network lowers the climatic risks caused by other cryptos due to excessive power consumption. It is aligned with decentralized apps and smart contracts. This participation has helped investors in many ways, so the Fantom network is so well-known.

Fantom ecosystem

The Fantom ecosystem has grown in popularity to become one of the most popular blockchain projects. The Fantom ecosystem is made up of five major projects: SpookySwap (BOO), Scream (SCREAM), SpiritSwap (SPIRIT), Tarot (TAROT), and Tomb Finance (TOMB).

SpookySwap (BOO): SpookySwap is a decentralized exchange (DEX) with the maximum total value locked (TVL) of any Fantom project. Users can trade one token for another using Fantom’s speed for a very small cost.

Scream (SCREAM): Scream is a loan protocol developed by TVL, and it is the second-largest project under Fantom. It is influenced by a similar Ethereum-based system called CREAM Finance and Compound. Scream offers decentralized loans using cryptocurrency as collateral.

SpiritSwap (SPIRIT): SpiritSwap is another well-known Fantom decentralized exchange (DEX). Users may exchange tokens at regulated prices, and features such as lending/borrowing, bond purchases, and the simplified leverage trading option Ape Mode identify this project.

Tarot (TAROT): Tarot is a decentralized Fantom initiative offering peer-to-peer financial marketplaces. Lenders may earn interest without experiencing temporary losses, while borrowers can utilize LP tokens as security by making extra money via leveraged yield farming. Users can also use automated ways to stake tokens and earn returns across several lending pools.

Tomb Finance (TOMB): TOMB is Fantom’s first algorithmic stablecoin, with a price of 1 FTM. The protocol’s main logic dynamically adjusts TOMB supply to maintain cost competitiveness with FTM. Tomb Finance’s trust in Fantom’s potential and FTM’s future expansion.

Fundamentals of Fantom

Management Team

A South Korean computer scientist, Dr. Ahn Byung Ik founded the Fantom Foundation. Michael Kong is the platform’s current CEO.

Native Token: FTM

What does it do?

Fantom is a layer-1 blockchain that aims to provide an alternative to Ethereum users’ frequent complaints about excessive rates and slow performance. Fantom is built on a blockchain that uses directed acyclic graphs, similar to Hedera Hashgraph.

How does it work?

Fantom employs the Asynchronous Byzantine Fault Tolerance (aBFT) consensus mechanism to ensure that transactions are fast, secure, and long-lasting.

Fantom’s four core design principles are scalability, security, modularity, and open source. The design protects data while also allowing for scalability and decentralization. Implementing a permissionless and leaderless consensus framework achieves decentralization and security.

Use Case of Fantom (FTM)

The network uses FTM coins for staking, governance, transactions, and fees.

FTM Tokenomics

It is currently ranked #57 and has a market capitalization of $604,778,641. There are currently 2,545,006,273 FTM coins in circulation, with a total supply of $3,175,000,000 FTM coins available. Fantom is a blockchain network that provides companies and applications with ledger services. This network addresses the scalability issues associated with existing public distributed ledger technologies.

Lachesis, an enhanced directed acyclic graph (DAG)-based aBFT consensus algorithm, runs the Fantom network. Fantom-based blockchains are fast, secure, and scalable. FTM, Fantom’s native token, aims to address the issues associated with smart contract systems. The speed of transactions has been sped up to less than two seconds, according to the creator of Fantom.

Fantom offers a variety of solutions to the existing crypto network. For starters, it offers services at lower transaction costs. Furthermore, the network mitigates the climatic risks caused by other cryptos’ excessive power consumption. It is compatible with decentralized applications and smart contracts. This involvement has benefited investors in various ways, which is why the Fantom network is so well-known.

Is it Worth Buying Fantom in 2024?

Amidst the aftermath of the Terra LUNA and FTX crash, Fantom, a blockchain platform, is showing signs of potential growth. Despite a sluggish development pace in 2023 and limited engagement on Twitter, year-to-date trends suggest a largely upward trajectory for Fantom, positioning it as a prospective investment option for the year.

The latest update reveals that Fantom (FTM) currently holds a price of $0.200074. Moreover, it has witnessed a 24-hour trading volume of $127.23 million, making it an influential player in the market with a market capitalization of $672.17 million and a dominant presence of 0.06%. In the past 24 hours, FTM has experienced a slight decline of -1.18%.

Fantom currently has 2.80 billion FTM tokens in circulation out of a maximum supply of 3.18 billion FTM. The annual supply inflation rate stands at 10.01%, resulting in the creation of 254.82 million FTM tokens in the past year alone. Fantom ranks #8 among DeFi Coins and holds the #32 position within the Layer 1 sector for market capitalization.

Fantom’s price history has undergone significant fluctuations. On October 28, 2021, the platform achieved its highest price, soaring to an all-time high of $3.47 per token. In contrast, on March 13, 2020, it plunged to an all-time low of $0.001762.

In the current market cycle, the price of Fantom has displayed significant fluctuations. The lowest point reached $0.164761 (cycle low), contrasting with its all-time high. On the other hand, the highest price since the last cycle low peaked at $0.654477 (cycle high). These price movements highlight the volatile nature of the Fantom market and its potential for profitability.

Despite recent crashes in the crypto market, Fantom remains resilient and shows promising upward trends throughout 2023. This makes it an attractive choice for investors seeking growth opportunities. The platform’s ability to rebound and display favorable price movements even in challenging circumstances underscores its potential for a successful investment year.

Despite the blow from the Terra LUNA crash, Fantom has upside potential. Blockpour, a data gathering and analytics platform, published a public beta version of their app with Fantom compatibility in April 2022. It provides traders with DeFi data and analytical tools to help them optimize their trading and identify investment possibilities. One of the numerous benefits of Blockpour is that it manages node infrastructure for supported chains.

Fantom has been incorporated into the industry-leading liquidity broker Orion Protocol. The Orion Protocol platform addresses the issues of fragmentation, centralization, and liquidity in the number of decentralized and centralized crypto exchanges. These concerns can result in instability, high exchange costs, and price variances.

However, the project’s development in 2023 has been a bit slower. Besides a couple of retweets discussing the Fantom Foundation, Fantom has not been that active on Twitter, which doesn’t provide us much insight into where this project might go. That said, the Fantom Hackathon and Bitcoin’s revival have fueled people’s hope for this crypto. The YTD trends show that Fantom is on the rise, with only a minimum downturn in between. That, combined with many positive movements for this crypto that might happen this year, makes us and other experts believe that Fantom may be a worthy investment in 2024.

Your capital is at risk.

Fantom Price Now – Will FTM Go Up in 2024?

Fantom emerges as a significant player in the field, revolutionizing DeFi transactions through its focus on speed and security. Consequently, it paves the way for a decentralized future. As Fantom’s ecosystem expands noticeably, a question naturally arises: What does the future hold for Fantom’s price trajectory in 2023?

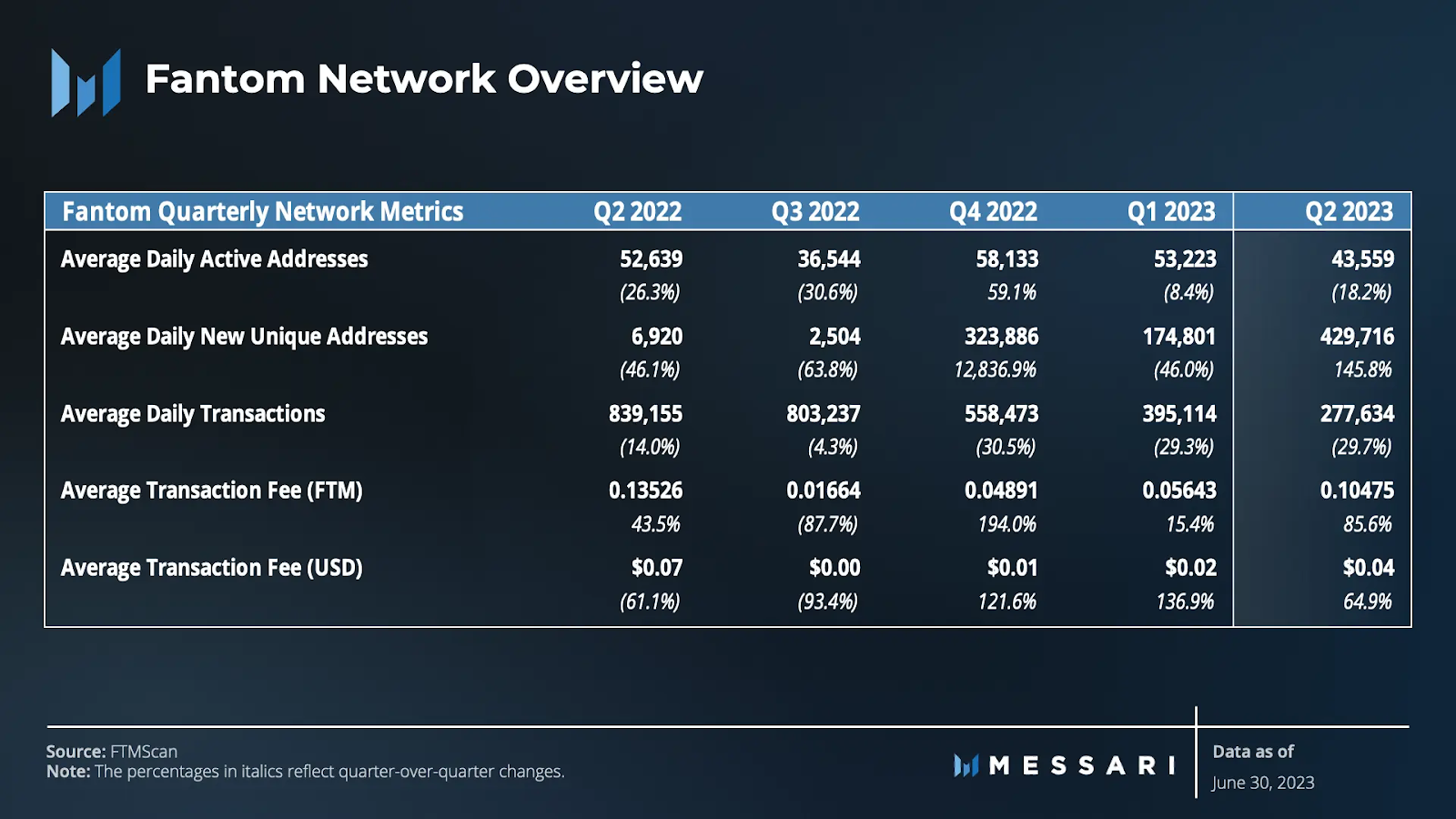

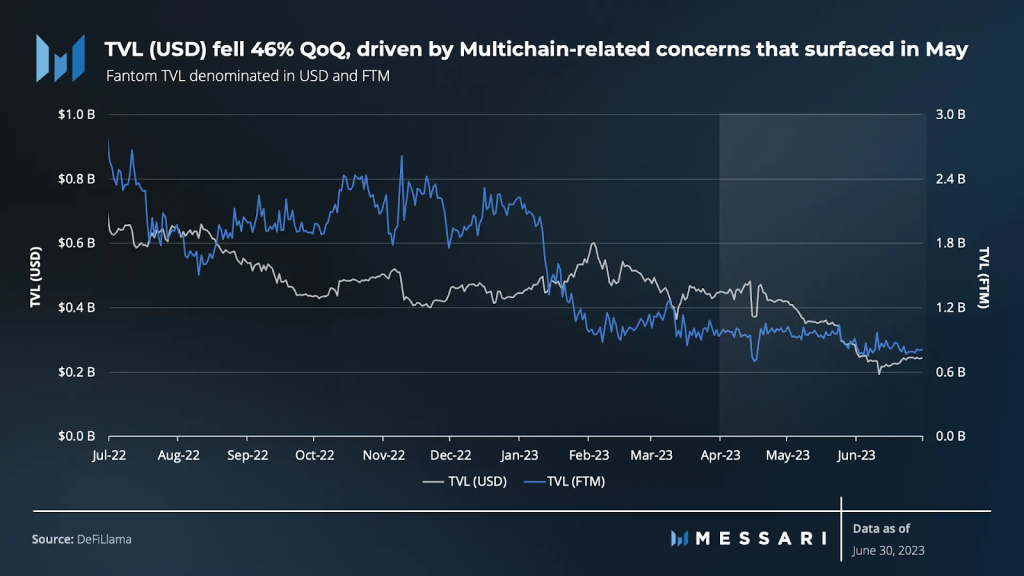

Insights gleaned from Fantom’s Q2 2023 report shed light on current developments. Specifically, the platform experienced an 18% decrease in average daily active addresses. However, this decline was offset by a remarkable 146% surge in new unique addresses during the same period. Notably, LayerZero and Galxe witnessed a significant growth in new addresses, indicating heightened activity within these segments.

However, the report also points out a diminishing trend in Fantom’s average daily transactions, showcasing a decline of 24.4% over the past year, with a further decrease of the same percentage in the second quarter of 2023.

In line with the broader crypto market, Fantom witnessed a significant 36% decline in its market capitalization over the last quarter. This drop can be attributed to regulatory measures taken by the U.S. Securities and Exchange Commission (SEC) against leading platforms Coinbase and Binance.US. However, it is worth noting that Fantom’s native token, FTM, was not deemed a security despite the regulatory crackdown.

Fantom made strategic shifts evident through the successful passing of Proposal 34. The main objective of this proposal was to reduce the minimum staking requirement for validation from 500,000 FTM to 50,000 FTM. This deliberate decision aimed at increasing staking participation, expanding the validator set, and promoting a more decentralized network.

Fantom implemented various ecosystem initiatives to drive its growth, including the introduction of the Ecosystem Vault and Gas Monetization program. These endeavors gained significant momentum during Q2 2023, signifying a noteworthy milestone in the platform’s development.

However, Fantom’s Total Value Locked (TVL) faced challenges as its USD-denominated value experienced a significant 46% decrease in the last quarter. This decline was particularly visible towards the end of May due to concerns surrounding the Multichain cross-chain router protocol.

Undeterred by these fluctuations, Fantom is gearing up for a competitive remainder of 2023. Ambitious plans include introducing a new StateDB storage system, the Fantom Virtual Machine (FVM), and account abstraction. These innovative steps are expected to play a role in shaping the platform’s future and, potentially, influencing its price trajectory.

Fantom’s growth initiatives and strategic innovations have captivated the cryptocurrency community, sparking anticipation about their potential impact on the platform’s value in the coming months. With expanding adoption, technological advancements, and market dynamics in play, a captivating journey awaits Fantom along with an intriguing outlook for its price.

Fantom Price Prediction – What’s Next for FTM?

In 2023, a new development unfolds in the world of cryptocurrency. The dynamics of the crypto space undergo transformation, shining a spotlight on practical-focused crypto assets. One such transformative asset is Fantom, renowned for its ability to provide fast and reliable services for businesses, fostering their growth.

However, the current outlook for Fantom’s price prediction appears pessimistic as indicated by a Fear & Greed Index reading of 54, which suggests a neutral sentiment.

Fantom Price Prediction 2023

Fantom Network has now revealed many integrations, but it may happen as the year unfolds. And since the market is now looking for utility-centric cryptos, Fantom can possibly move upwards.

From the technical side, the current market sentiment surrounding this crypto is neutral, which is not necessarily bad as it leaves room for developments to impact how people feel about this asset. The current 200-SMA gives it a “Buy” signal.

Experts predict that the 200-SMA will rise next month, which will have a long-term impact on the price of this asset. The current RSI – relative strength index – also puts this token in neutral zones.

But does Fantom have in it to cross its all-time high? Not really. Fibonacci Retracement indicates that to test its all-time high, and Fantom must break through 0.236 fibs, which lies at $2.6. For that to happen, Fantom must witness a parabolic increase of more than 5x. And since the market is neutral, we can’t see that happening.

Bullish predictions say that Fantom may reach $1.7 by the end of 2023, and bearish prediction puts its value at $0.3073.

Fantom Price Prediction 2024

Once the Fantom Price peaks by the beginning of 2024, we expect a drop for the next seven days, which can be close to 67%. That will put the FTM price slightly above the bearish prediction of 2023. As such, we expect that FTM will drop in price in early 2024. But a bull cycle for the larger crypto space is predicted for 2024, which may pump the FTM price to $1.5.

Fantom Price Prediction 2025

2025 will see the cryptocurrency space getting more regulated and sought after, even by traditional investors. That new influx of traders would be looking to invest in assets that offer more utility – Fantom is one of them. Our analysis predicts that the Fantom price might reach $2 by the end of 2025.

Fantom Price Prediction 2026 and Beyond

As cryptocurrency will be normalized in the coming years, we may not see parabolic gains in the price charts. The added element of linearity in the price growth may push the Fantom price to $2.5 by the end of 2026.

Beyond that, the Fantom price may follow the course of blockchain’s development. As more integrations will have been launched by then, we predict the Fantom price may pass its all-time high by 2030.

The Verdict – Should You Buy FTM?

Even though Fantom is still in its early stages, it has several advantages over other prominent platforms like Ethereum and the Binance Smart Chain. Fantom’s DAG-based Lachesis aBFT consensus mechanism ensures tremendous scalability while remaining decentralized and secure.

If Fantom continues on its current path, it has the potential to become a major player in the Defi industry. Because of its aBFT consensus, transactions can be processed asynchronously, increasing transaction speed and efficiency. With the introduction of Fantom, the energy-sucking Proof of Work consensus protocol is no longer used. This network mitigates the climate risks of other cryptos’ excessive power consumption.

It can run decentralized applications and smart contracts. This collaboration has resulted in several benefits for investors, so the Fantom network has grown in popularity. As more partnerships and developments are planned, the FTM token price will undoubtedly arise in the future.

Should you buy FTM?

Given the optimistic fundamentals and the technical side, Fantom clearly has nice upside potential. The FTM token has entered the oversold zone, and bulls may enter the market to capture an entry into a cheaper coin. Hence, the increased demand may trigger a bullish trend in FTM/USD.

If you’re wondering where to buy FTM in 2024, it’s listed at eToro with good trading conditions. The platform is licensed and regulated by the FCA and has one of the industry’s best reputations and a wealth of educational resources to help newcomers learn the ropes.

Other Undervalued DeFi Projects

We recently updated our best altcoins list to include an undervalued DeFi project, DeFi coin (DEFC). Despite the May crypto crash, it increased its price by approximately 350 – 400% that month after completing parts of its roadmap.

It has also already retraced 98.75% from its all-time high, similar to Terra LUNA, although over the course of a year. It’s now at a low price point and still above presale. It has more upside potential than downside and room to grow in 2024 in the long term as the DeFi market cap recovers.

FAQs

Any risk in buying FTM now

Fantom's value is expected to rise further as scarcity drives up prices. Please keep in mind that each investment carries some level of risk. Simply invest in what you can afford before making any assumptions, and conduct as much research as you can.

Is it safe to buy FTM?

Transactions on the FTM platform are extremely secure thanks to Proof-of-Stake technology. Fantom tokens are ERC-20 tokens that can be traded on three major networks: the ERC20 platform of the Ethereum network, the BEP2 platform of the Binance Chain, and Fantom's mainnet Opera chain.

Where to buy FTM

FTM can be found on nearly every major centralized exchange, including Binance, Coinbase, FTX, Gemini, and others. It is available on decentralized cryptocurrency exchanges such as SushiSwap, Curve, etc. The FTM token can also be found in popular cryptocurrency wallets like Trust Wallet and MetaMask.

How much will FTM be worth in 2030

In terms of pricing, Fantom has enormous potential to rise to new heights rapidly. The value of FTM is expected to increase. According to our experts and analysts, Fantom could hit $1.97 by the end of 2030.

Will FTM ever hit $1?

Yes! In the long run, FTM has the potential to reach $1.

Bitcoin

Bitcoin