This year, there has been a major shift in the market since Donald Trump was elected as the 47th president of the United States of America. Profit seekers are now on the lookout for the best stocks, but which ones should you choose? With effective stock picking services, investors can identify which stocks to buy and which to sell.

To simplify this process, we’ve compiled a list of this year’s best stock picking services. Our experts have thoroughly evaluated each service and explained why they deserve a place on our list.

Best Stock Picking Websites – Top 10 List

Here is a complete list of the best stock picking sites for this year.

- Benzinga Pro – Overall Best Stock Picking Service Provider of 2024

- AltIndex – Offers AI-enabled Stock Picking Service

- eToro – Stock Picking Services Through CopyTrader and Other Unique Tools

- Seeking Alpha – Offers Two Stocks Every Month Using Data-Driven Insights

- Mindful Trader – US-Based Stock Picking Service Provider Offering Real-Time Data on Stock and Options

- Danelfin – Popular Stock Picking Platform Backed by Explainable Artificial Intelligence

- Morning Star – Free Stock Picking Service Featuring Undervalued Stocks

- The Street Premium – Offers Daily Stock Picks by Experts

Visit the Best Stock Picking Service Provider

Review of the Best Stock Picking Services

There are many stock picking services available, but they vary in quality and focus. Some cover small “pink sheet” stocks, while others focus on expensive securities. In our list, we’ve reviewed services that provide insights into both undervalued and well-performing assets.

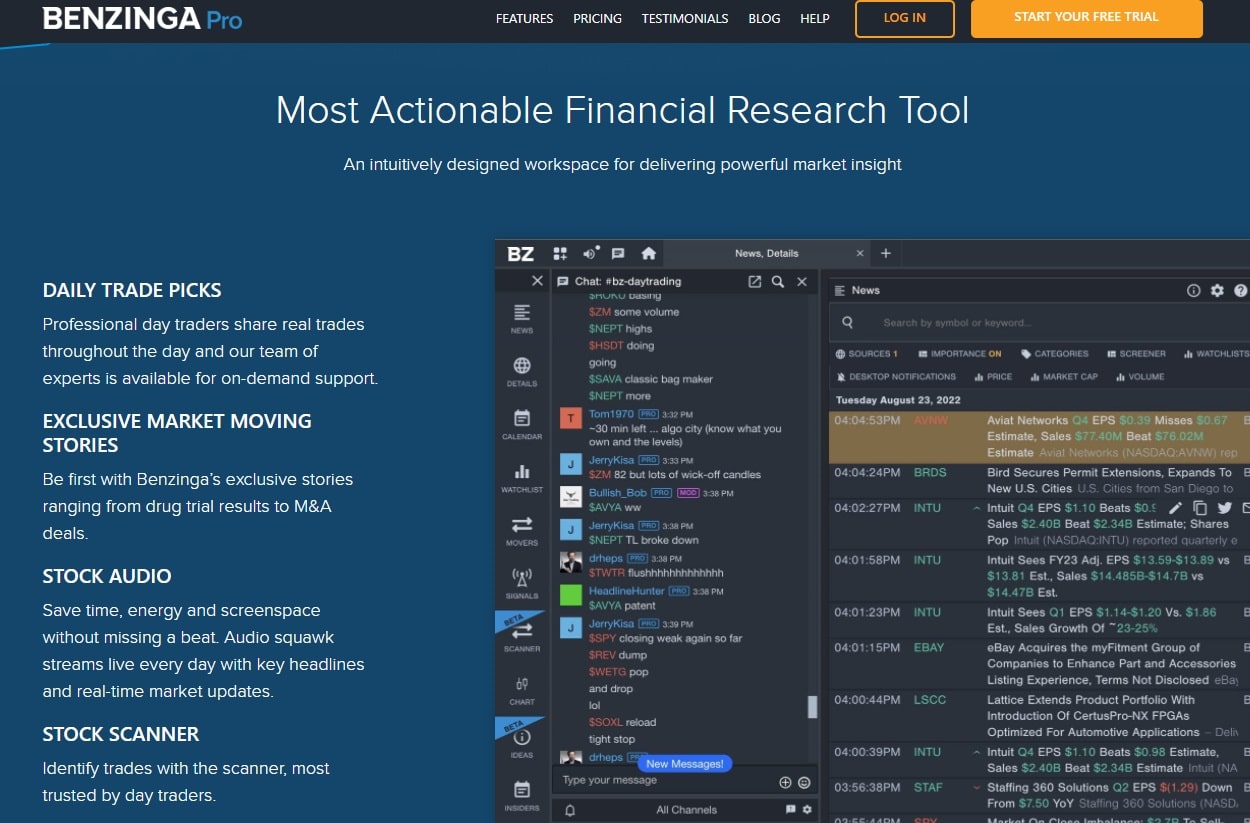

Benzinga Pro – Overall Best Stock Picking Service Provider of 2024

With its research software and access to breaking stock market news, Benzinga Pro is one of the best stock picking services on the market. It features a simplified UI and offers a free trial, which makes it more suitable for those wanting to go the extra mile but are yet to decide whether to choose it or not.

When it comes to features, the list is large. The first one to stand out is Alerts, which will deliver customizable real-time market news alerts to desktop or email. It comes with browser notifications as well. Investors looking for more streamlined information will like the stock calendar about specific stock events. For social traders, there is a chat room community, real-time biggest gainers and losers offer quick market insights, and with rapid stock market news, investors will get the best market news delivered quickly to their feeds.

Other special features include stock scanner help users scan stocks, get real-time updates, and filter based on market cap, volume, float, and others. Other features include trading mentorship programs and even watchlists to keep an eye on the current stocks being traded. With the screener feature, users can get a stock list based on their specific attributes.

The pricing structure of this particular stock picking service is also inclusive, giving users a 14-day free trial before letting them choose. There are three pricing models. Basic is just $37 per month, Essential is a whopping $197 per month, and those looking for a streamlined service can pick Streamlined for $174 per month.

Overall, this stock picking service is unique due to how rich it is when it comes to features and how simple it is when it comes to usage. Considering the current market, it could be one of the best options to pick this year.

- Offers a stock calendar and unusual activity signals

- Affordable price structure

- Delivers trade mentorship programs

- The design is a bit old-school

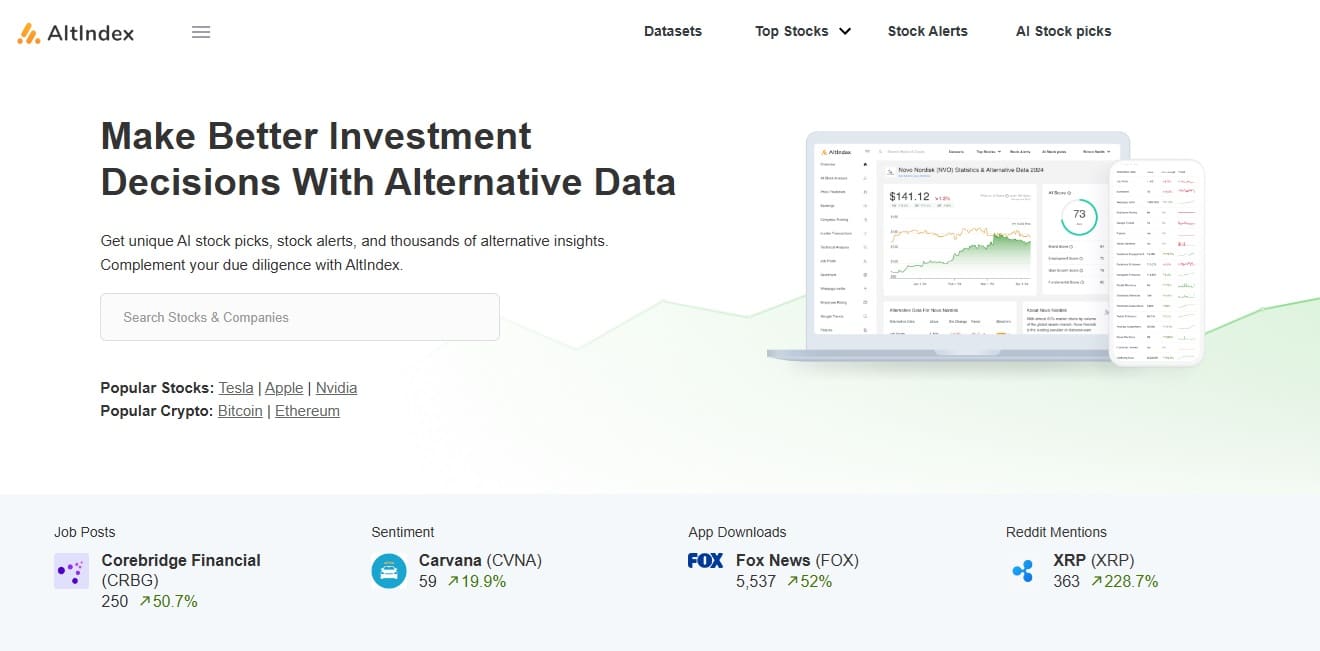

AltIndex – Offers AI-enabled Stock Picking Service

Those looking to make “better investment decisions with alternative data” should give AltIndex a try. This particular stock picking service is also very inclusive, coming with a free 14-day trial. It offers insights into the most popular stocks and delivers stock alerts and thousands of alternative insights with the help of artificial intelligence.

With over 30k registered users and over 100 unique daily stock alerts, it is one of the better versions of stock picking services out there.

All the data provided by this stock picking service focuses most on comprehension. Users are presented with a graph and alternative data points that let them get a complete view of what the stock is about. The insights covered are also unconventional, focusing on things like customer satisfaction, job postings, website traffic, app downloads, social media trends, as much as on traditional prices.

This multi-faceted approach to stock analysis is akin to how cryptocurrencies are analyzed.

Those who prefer to get quick updates about the market will also receive stock alerts, which are delivered when one particular company’s stock experiences popularity on social media platforms or gets additional traffic, or experiences a surge in customer satisfaction level. This approach leverages advanced algorithms and data analysis tools, which is only better for people looking for a more holistic view of the market before they make a decision about an asset.

There is also Unique AI Stock picks which reportedly has an 80% win rate. The platform’s advanced algorithms sift through thousands of stocks daily for this, and the goal is to harness the power of traditional and alternative data, and then provide signals so that users can act on them to generate profit.

The platform has a simplified pricing model. One is $199 per year, which will provide users 10 AI stock picks and 10 stocks in portfolio and stock alerts along with unlimited insight pages, unlimited stock screener, newsletter and email support. However, those who go higher and pick the $400 a year model will also get 50 AI stock picks, and 100 stocks in portfolio.

Overall, AltIndex is best for those looking for a holistic view of an asset, essentially an approach that does not focus solely on the prices, but also other sentimental factors.

- Beginner-friendly stock picking service

- Focuses on sentimental indicators as well

- Leverages AI to provide stock tips

- Offers a high win rate

- Features a limited free plan

eToro – Stock Picking Services Through CopyTrader and Other Unique Tools

For those looking for a more robust stock picking service that blends research as well as providing strategies to invest in stocks as well as cryptocurrencies should look at eToro. Named the “Best Trading Platform” by Forbes in 2024, eToro is a trading platform offering analysis tools as well as direct interfaces to buy and sell cryptos, stocks, and other types of assets.

Among the many tools that the site offers through its services, one of the most notable ones is Copy Trader, which allows users to copy the top-performing traders. This user-friendly tool is automatic and, most importantly, does not incur any additional charges.

The second reason we have added it to our stock picking services is the addition of smart portfolios. With smart portfolios, users get access to an innovative long-term investment portfolio which has been curated by eToro analysts. These strategic portfolios allow investors to diversify their investments without having to do a lot of research on their own.

Those looking for more insights can look at eToro’s Earnings reports calendar, which offers a list of earning reports released by publicly traded companies. These entries are ordered according to the market capitalization, and they detail the financial investment instrument, sector and expected release date.

IPO calendar does the same thing, offering users a chance to find the next IPOs and invest ahead of schedule.

Better analysis services by eToro is offered using Delta Investment Tracker, tracking performance in real time. The assets tracked this way include cryptos, stocks, NFTs, forex, indices, and more.

- Offers robust trading services

- Delivers copy trading services

- Offers users a smart portfolio

- Features an IPO calendar

- The pricing model is a hard to understand

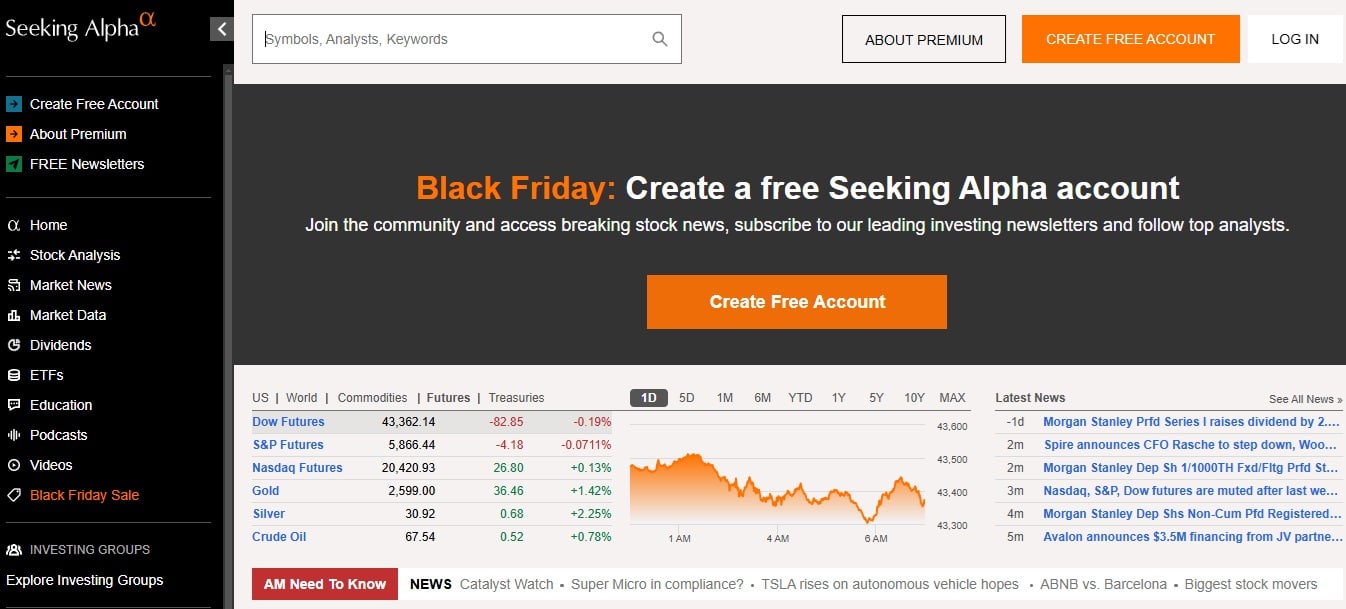

Seeking Alpha – Offers Two Stocks Every Month Using Data-Driven Insights

Seeking Alpha invites investors to join hands with an investor community by way of not only price charts but also premium articles and comprehensive analysis. Offering two stocks every month, Seeking Alpha is evolving into one of the best stock picking services for those who are seeking profits in today’s volatile market.

The platform gives users full access to premium articles, as well as analysis that covers global time zones. Top analysts give their own ideas about over 1,300 stocks, which Wall Street often overlooks. There is also a “Listen to Article” feature for those who want to stay updated with the market without losing sight of their daily tasks.

Helping with its services is artificial intelligence. AI essentially offers Quant ratings, which is done after analyzing hundreds of metrics from “Strong Buy” to “Strong Sell”. This approach is also suitable for those looking for assets deemed undervalued or overvalued by Wall Street.

Another cool addition is the advanced comparison tool, which lets users evaluate stocks through multiple screeners. The screeners are customizable according to an investor’s strategy, with preset screeners focusing on the Top-Rated stocks.

Like most, this platform also offers a free trial, accessible only after creating an account. After that, users are required to engage with a special offer and pay $209 for the first year, after which the yearly fee will increase to $299.

Seeking Alpha is simple, stylish, and offers a lot of insights. The fact that it also focuses on articles makes it a good choice for those who want their analysis reports to be more robust than a few charts and graphs.

- Has a great track record

- Offers two stocks per month

- Focuses on macro stocks

- Fundamentals are the main focus

- Only the annual plan is available

Mindful Trader – US-Based Stock Picking Service Provider Offering Real-Time Data on Stock and Options

Mindful Trader is a stock picking service started by Eric. He not only designed and coded the website, but also tested the trading strategies available on the platform. As such, this particular stock picking service has a human touch to it, as Eric lets users follow his trades and learn from them.

And people don’t have to blindly follow each strategy, Eric claims, as each one has gone through a rigorous amount of back testing. This approach of testing the strategy inside a controlled environment has been favored by many who aim to only use proven techniques to trade.

The entire Mindful Trader website won’t provide users with any tools; instead, it focuses on the research he has done to explore each asset. Eric has also offered a 20-Year Back Test page for those who want to confirm whether strategies work or not. There are also lessons about how to pick penny stocks and his options strategy.

Under the My Statistical Approach section, Mindful Trader offers his Swing Trade Stock picks. That said, the trader does not believe in focusing on the news, stating that he is squarely in the swing trading camp that relies on price movement.

When it comes to the pricing model, it is just $47 a month, which is suitable for those looking to take a more frugal route towards their investment strategies.

- Transparent about its track record

- Focuses on fundamentals and price swings

- Only focused on proven techniques

- Let users see his massive investment history

- Features an affordable subscription model

- Do not focus on the news when making investment decisions

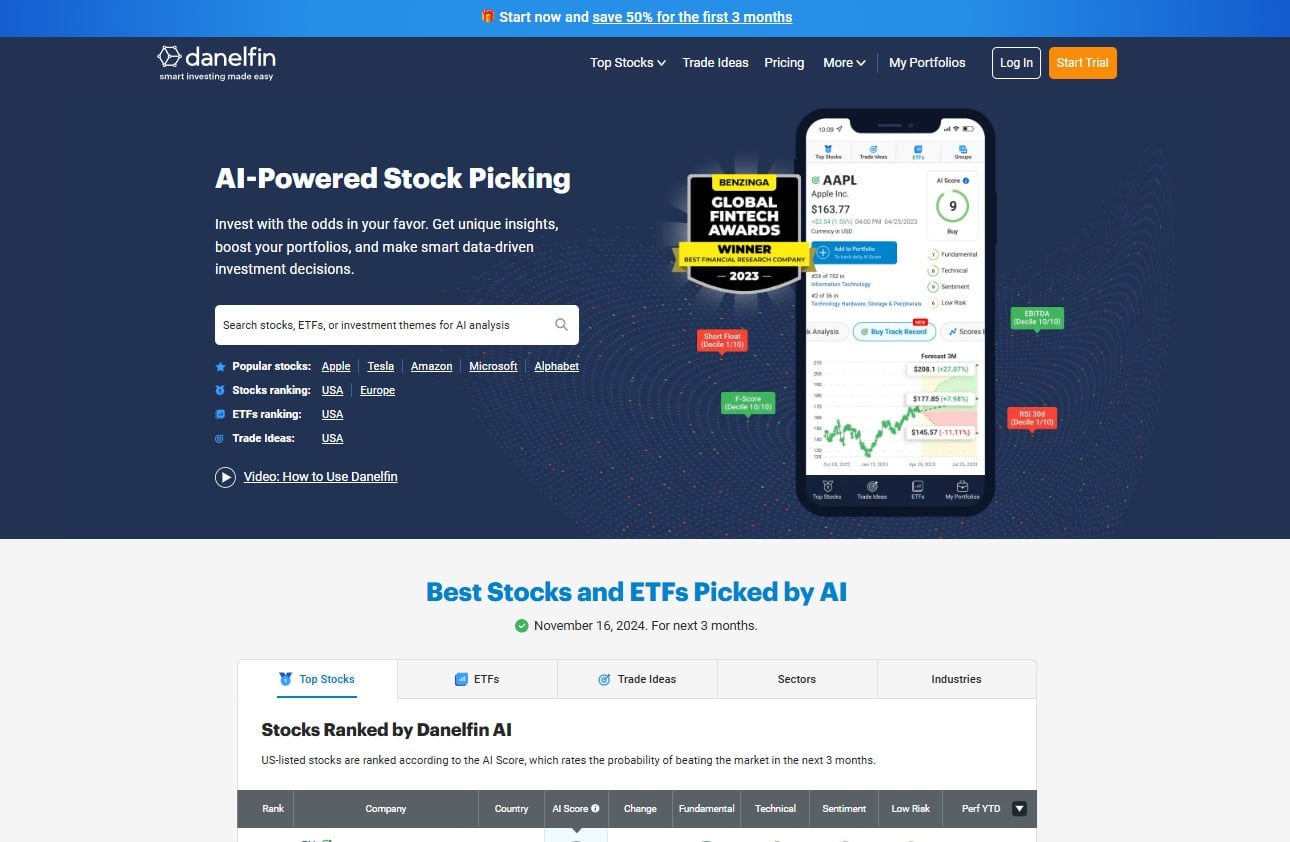

Danelfin – Popular Stock Picking Platform Backed by Explainable Artificial Intelligence

Danelfin is another stock-picking platform that also focuses on AI-driven intelligence. The smart approach reportedly leverages artificial intelligence in picking the blue chip stocks and ETFs.

The UI is simple, with regular reports provided to users. However, the aspect that stands out the most about this platform is the AI score given to each asset. Every stock is analyzed using more than 900 indicators that use 600 technical, 150 fundamental, and 150 sentiment indicators per stock, which lets the AI use over 10,000 daily features to learn how a price might move on the market.

The entire stock analysis has also been covered by a diagram, which, at the time of writing, has given the current market a score of 7. This visual style is great for those looking to get a quick analysis of any stock they want to buy.

The platform also lets users create a portfolio and keep it diversified.

The platform also gives users trade ideas, which provides a list of stocks and their AI score. However, the only limitation is that the site only covers two markets – USA and Europe. Considering how diversified Asia has become in terms of financial opportunities, the lack of an Asian market section may worry some.

The ideas also focus on how the assets have performed after their market cap has grown past $3 million. They also cover a risk score, which underlines how much reward an asset can generate depending on the score.

Danelfin has three pricing models. There is a free model that offers a newsletter with 10 daily stocks to buy and ranking for the top 10 ETFs, Top 10 stocks, and top 3 sectors to invest in. Users can also create a portfolio for 5 stocks or ETFs. The Plus plan is the most popular. Costing only $12 a month for the first three months, it offers unlimited stock and ETF rankings, lets users create 5 portfolios, and receives top alpha signals.

Those who are serious and looking for more alpha signals can get the pro service, which costs $25 a month for the first three months. It also offers historical details of its AI scores and trading parameters of stocks and ETFs.

- AI-driven stock picking service

- Leverages explainable artificial intelligence for its services

- Offers multiple US-listed stocks

- Features a free plan

- Only AI-driven stock ranking

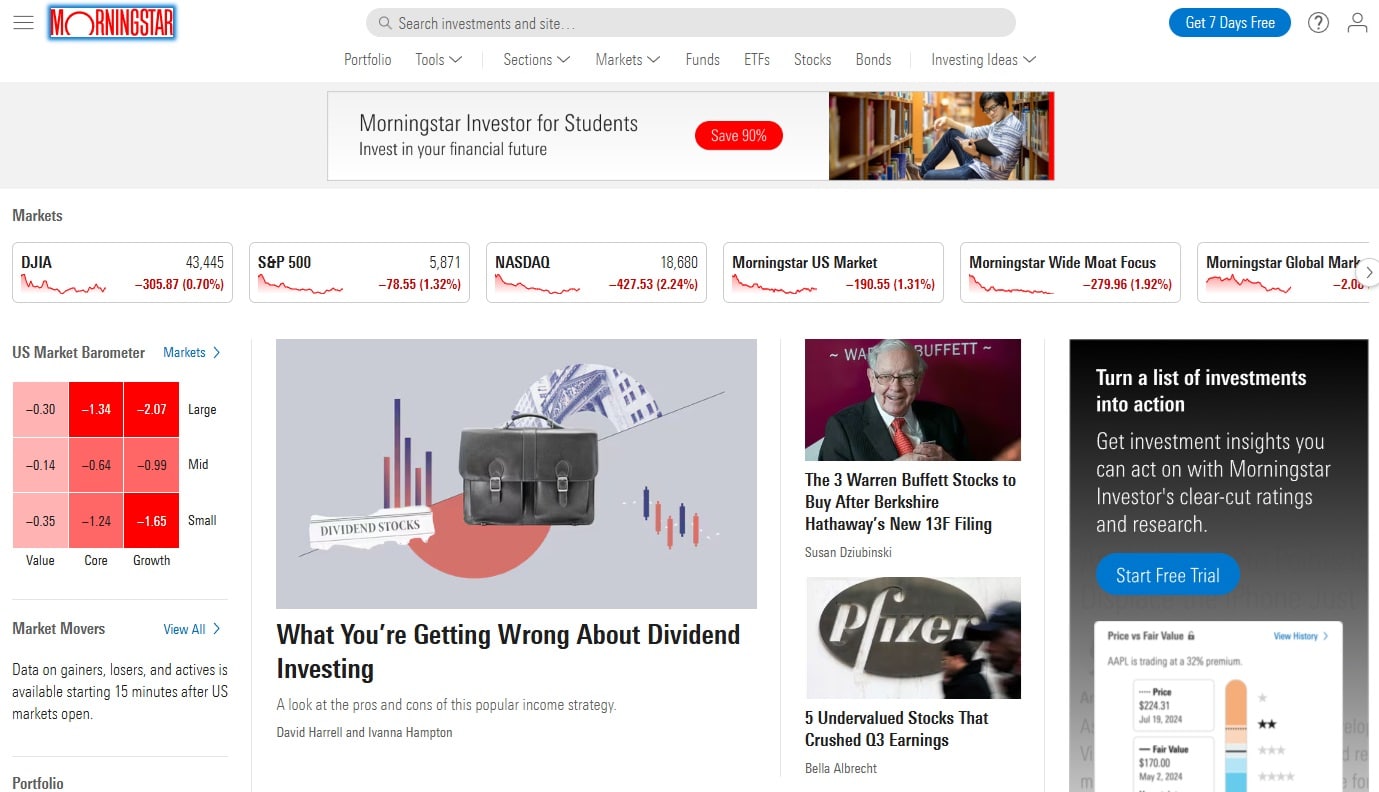

Morning Star – Free Stock Picking Service Featuring Undervalued Stocks

Another high-grade stock research platform that has gained traction over many years is MorningStar. MorningStar is a robust stock picking service provider that keeps news about the latest market developments at the forefront, offering everything from opinion pieces to tips about the current market.

At the top of its home page, MorningStar shows the price action of the most recent stocks. Users can also take a look at the market movers, which is essentially the complete data of the biggest losers, gainers and actives available 15 minutes after the US markets open.

The Markets section is also unique, offering a barometer about their overall performance, which involves giving scores about their core, growth, and overall value. Analysis does not stop there as users get both the performance view and the valuation view of the market, perfect for those who want to buy stocks and strategize long-term investments.

Inside the tools section, MorningStar offers portfolio, watchlist, screener, chart and rating changes. However, all of them are locked until an account is created. While there was a time when this website used to be free, now it has a robust pricing model. That said, those who sign up do get a 7-day free trial.

Those who want to dive deep into more research can look at investing ideas, which offer articles like Best Investments, Christine Benz’s Portfolios, Asset management companies, and also the Best 529 savings plans.

The pricing model is also simple, consisting of a monthly model of $34.95 a month. Those who choose an annual plan will get a 41% discount as they can grab it at just $249, which equates to $20.75 a month.

While the free plan does not offer much, there is still a lot of articles people can check out when they come to this stock picking service provider, which makes it suitable for most investors.

- Offers free stock picking services, too

- Delivers quarterly updates about undervalued stocks

- Offers a wide array of investing ideas

- Features an affordable plan

- Full functionality requires access to the premium plan

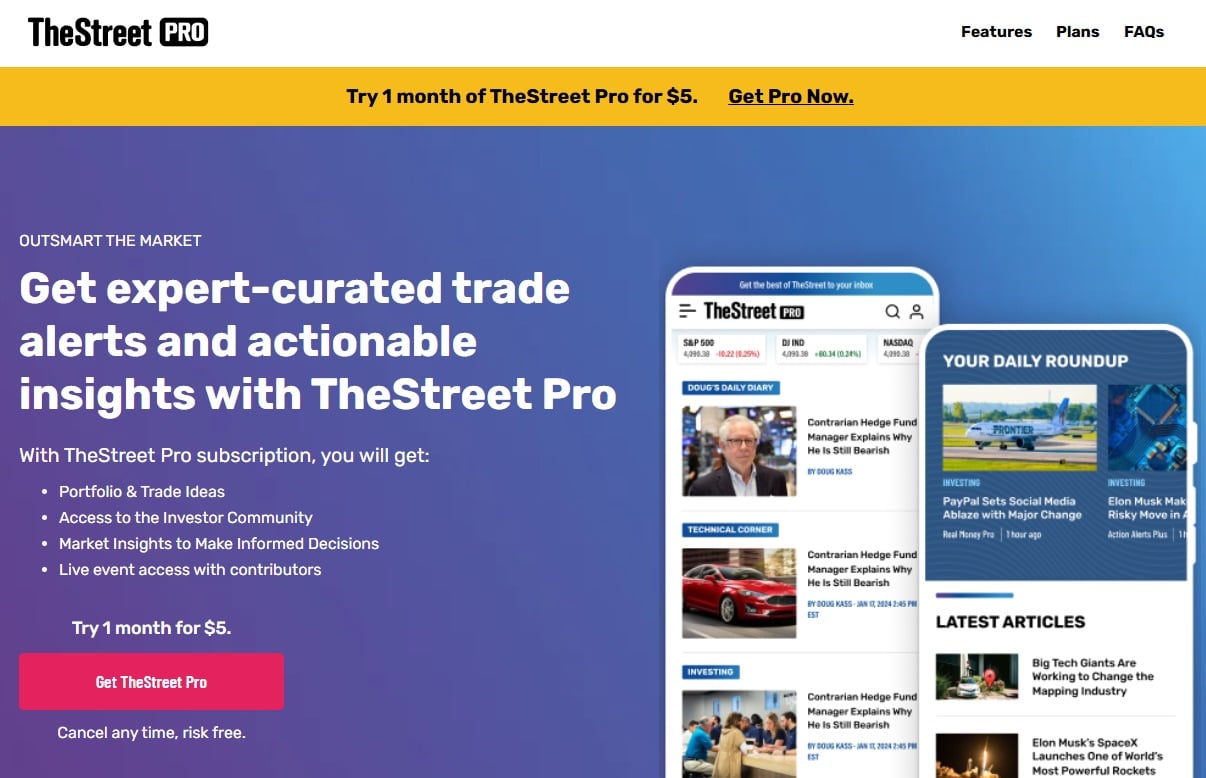

The Street Premium – Offers Daily Stock Picks by Experts

The Street Premium is a stock picking service that leverages financial news and technical analysis to deliver stock trading advice. Its high-level stock service is more suitable for long-term investors depending on the chosen plan. With The Street Premium, users will get access to a Street Portfolio, which covers open and closed positions.

Highlights of this platform are the expert-curated trade alerts and actionable insights services, which become accessible by getting TheStreet Pro account. To get it, users can get a subscription for the first month by depositing only $5.

With the “all-inclusive market analysis,” users will get over 200 trade ideas per month, and over 125 articles per day written by over 20 authors.

With the Pro feature, users will gain access to things like trade ideas, which revolve around expert’s overview and recommendations. Investor Community allows users to exchange ideas and insights with like-minded investors, which will work to enhance the portfolio strategy. There are also live video events on trades, and market commentary.

Another major factor that makes The Street Premium stand out is access to expertise from the top fund managers on Wall Street, which has become one of the core reasons why many have grown fond of what it has to offer. The “Cancel Anytime” style of subscription further adds to its trust factor.

When it comes to usability, the platform is simple. The updates it offers are comprehensive, and the insights people get are easy to understand, which makes The Street Premium perfect for those wanting to make quick decisions.

- Delivers real-time market commentary about the stock market

- Offers over 125 articles per day

- Features a “Cancel Anytime” subscription model

- Historical trading results not available

What is a Stock Picker?

A stock picker is an individual or professional investor who selects specific stocks with the goal of outperforming broader market indices. The platforms offering these services conduct thorough analysis and research before making recommendations.

Stock pickers share several key characteristics. They practice active management through detailed investment analysis. Their research focuses on financial statements, market trends, and economic indicators. Modern stock pickers also incorporate sentiment analysis tools, social media engagement metrics, and customer satisfaction data to evaluate potential asset performance.

How do Stock Pickers Work?

Stock picking services employ a research-oriented approach to identify the best market investments. Their methodology can be broken down in the following ways:

Research and Analysis

This is generally the first and the most obvious phase of stock picking services. There are four types of analysis used to pick a stock.

- Fundamental Analysis – With fundamental analysis, the goal is to evaluate a company’s financial health, including earnings, debt levels, and future growth prospects. These aspects help users gauge how worthy these stocks are fundamentally.

- Technical Analysis – Technical analysis refers to analyzing the price performance of assets, focusing on finding market trends and recognizing patterns to develop short-term and long-term stock trading strategies.

- Sector Analysis – Stock picking services also focus on identifying sectors that are poised to grow economically. For instance, at the time of writing, the AI sector has high growth potential. Furthermore, Tesla’s stock has shown promise.

- Economic Indicators – This method involves looking at the market as a whole and examining trends, geopolitical events, and financial forecasts. One of the best examples of this has been the recent Israel-Palestine conflict, at the height of which many assets suffered in Q4 of 2023.

Recommendation

Other than research and analysis, stock picking services also focus on recommendations. They recommend when to buy or sell specific stock assets through alerts. For portfolio construction guidance, they offer ways to create a diverse portfolio.

Many of the options we have listed offer a stock list, highlighting the biggest gainers and losers. They also provide ratings and price targets.

Delivering the Recommendations

Once recommendations are made, they are delivered using multiple methods. Here are some of the crucial ones that most stock advisory services deliver recommendations through:

- Reports: Detailed stock analysis gets to people through either weekly or monthly reports

- Newsletter: Regular market updates are sent to users through newsletters

- Alerts: Push notifications via the app or real-time email and SMS alerts are how alerts go to users

- Web Platforms or Apps: Another way is through web applications, which offer stock screeners that provide a customizable way to examine the available information

How Did We Pick the Best Stock Picking Services on Our List?

For our selection of the best stock picking services, we focused on the following factors:

Track Record

The first aspect we analyzed was the track record of the company providing the services. A company’s historical success shows insight into how well thought-out its research is and how often it has met its price targets. Transparency is another crucial factor these companies check, including wins and losses.

However, it is also important to look at how transparent the company has been in the past, which means getting information about both wins and losses.

Expertise and Reputation

The second crucial aspect is reputation and expertise. Interested parties should analyze user reviews, testimonials, and expert opinions to understand what the community says about them. Going to TrustPilot is recommended more than looking at on-site reviews.

Users should also look at the “About Us” section and check out the teams running the platform. There are many service providers that aren’t transparent about this. It is especially important when looking at stock picking services that also feature trading robots.

Customizability

Investors should choose a service provider that matches their investment style. Assessing risk is especially important. Furthermore, the stock picking service should offer a customizable screener that lets users filter what they see on the platform.

Educational Resources

We also kept a close watch on the educational resources available on the platform. This was crucial for us, as it represented the site’s transparency and expertise in making things simple for users to understand.

If a site offers enough information about the market that could help users even without using specialized tools, we consider it a win.

User-Experience

Finally, we analyzed the website’s usability. If it is too complex, many will be deterred from using the website, and if it is too simple, the signals and alerts provided may be less believable. We looked at platforms that strike the perfect balance between the two. Alerts arrived properly, and all of the stock analysis service providers we listed offered proper mobile compatibility.

Conclusion

In this comprehensive guide, we analyzed the best stock picking services available on the market. We looked at their features, usability, and pricing structure before making our decision.

Among the ones listed, the best one by far is Benzinga Pro. Simple, sleek, and packed with a lot of information about the markets, this tool offers actionable trade ideas and market insights that elevate it above the other offerings.

We also like its 14-day free trial, which gives investors enough time to make a choice.

FAQs

What is a stock picking service?

A stock picking service consists of recommending suitable stocks to investors based on comprehensive fundamental, technical, sentimental and economical research.

Which company offers the best stock picking service?

The best stock picking service is provided by Benzinga Pro. It offers a complete view of why a particular asset was selected, and it leverages AI for precise analysis.