With uncertain times ahead for the financial markets space,

To help you along your way, we are going to discuss some of the best investments for 2024 and beyond.

Before we get started, let’s take a look at what makes a good investment.

What makes a good investment?

In its most basic form, the overarching aim of making an investment is to increase the value of your wealth. At an absolute minimum, this would need to grow at a faster rate than that of inflation.

With the interest rates offered by banks now at record lows, keeping your funds in a basic savings account is no longer viable. In fact, the real-world value of your money will decline.

For example, if you held $10,000 in a basic savings account that paid an annual interest rate of 1%, then your original $10,000 would be worth $10,100 at the end of the year.

However, what if inflation grew by 3% in the same period? Essentially, although your $10,000 would be worth 1% more, when you factor in the 3% inflation rate, you’re effectively 2% worse off!

As such, when asking yourself what is the best investment, it needs to be a financial instrument that not only protects your wealth, but helps it to grow.

On top of this, the best investments also ensure that risk levels are kept to an absolute minimum, with respect to the amount of growth that is expected.

In the financial world this is known the ‘Risk vs Reward’ model, and essentially means that the more risk an investor takes, the more profits they should be rewarded with.

Otherwise, there would be no point in increasing the underlying risk.

As such, the best investments are those that cater directly to your appetite for risk. While some individuals view the best investments as those that offer super low-risk levels that yield low returns, others opt for high risk levels that will potentially yield really high returns.

So now that you know what makes a good investment, in the next part of our guide we are going to discuss 15 of the best investments for 2024 and beyond.

New forms of investment in 2024 – investing in NFTs

The buzz around NFTs can be understood from the fact that even Collins dictionary has declared it as the word of the year for 2021. In case you don’t know much about NFTs, you can understand it in form of the unique and non-interchangeable data units, which are kept on a digital ledger.

The NFTs are linked to objects such as films, audios, photographs, and other media. Anyone who purchases NFTs gain public proof of ownership through the application of blockchain technology.

Any form of a digital file, such as images, audio, movies, GIFs, tweets, art, and even memes, can be made an NFT. Therefore, if you have any item that has value, you can earn the value for your creation by making its NFT on the blockchain.

The thing which makes NFTs special is the alternative model of ownership that allows content creators to have complete control over their art. They can share and utilize their NFTs across many platforms, and still remain the owner of art until they are sold.

Further, as an artist, you can connect with buyers easily through the use of NFTs. Creators can get the payment from the buyers in a transparent and trustless manner, eliminating the need for intermediaries and middlemen.

NFT is supported by Blockchain

Moreover, considering the fact that NFTs provide the artists to make good money out of their art, its popularity will continue to soar in the years to come.

Though there are concerns about the negative effect of NFTs on our environment, with the shift of Ethereum from the proof-of-work (PoW) consensus model to the proof-of-stake (PoS) mechanism, this concern will get sorted due to the decreased energy consumption of an NFT transaction.

Overall, NFTs are a potentially a good investment for all crypto lovers and those who are interested in movies, sports, and art in general. Given the fact that the value of this industry will increase in the upcoming times, it is advisable to buy NFTs of your favorite art, and then send it at a profit later on.

What are the best investments for 2024? Top 15 asset classes

In order to point you in the right direction, we are going to explore 15 of the best investments in terms of the underlying asset class. This will give you the opportunity to explore the financial product in more detail, and subsequently allow you to make an informed decision at to the best investments for your individual needs. Take note, these are in no particular order.

1. Cryptocurrencies

-

- What are cryptocurrencies?

Cryptocurrencies are digital currencies allow people to send and receive funds without using a third party. Although there are more than 2,000 different cryptocurrencies in existence, Bitcoin is the most well-known, and carries the largest value. - How do cryptocurrencies work?

As cryptocurrencies are available to trade on multiple exchanges as you can see in out eToro review, their value goes up and down just like in the real-world stock market. As such, you want to make an investment with the hope that your chosen cryptocurrency increases in value. - What returns can I expect?

Cryptocurrencies are highly volatile, meaning that prices can go up or down by more than 10% in a single day. Bitcoin rose from $1,000 to $20,000 in 2017, which amounting to an increase of 2,000% in for the year. However, its since gone down to $4,000. - Which cryptocurrencies should I invest in?

In order to mitigate your risk, it might be best to mix established digital currencies such as Bitcoin and Ethereum, which some small alt-coins. - How much should I invest?

If you want to buy cryptocurrencies, just remember they are a high-risk asset class, so you’re best keeping your investment amounts low. You might also consider investing smaller amounts on a regular basis.

- What are cryptocurrencies?

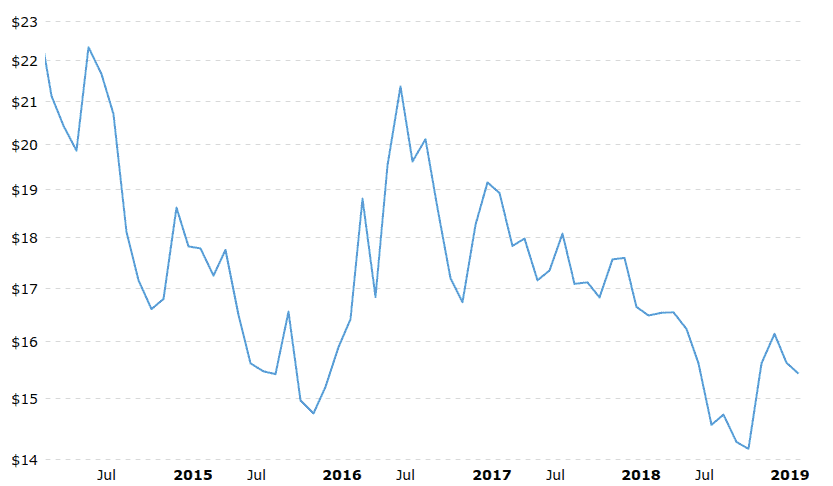

The rise and fall of Bitcoin between April 2016 and March 2019 – it did recover to make new highs

Pros and cons of investing in cryptocurrencies

Pros:

- More than 2,000+ cryptocurrencies to choose from

- High growth potential

- Lots of platforms to buy and sell your cryptocurrencies

Cons:

- Very high-risk asset class

How do I invest in cryptocurrencies?

Here’s how you can invest in cryptocurrencies CFDs via Huobi.

- Open an account with Huobi and confirm your identity

- Deposit a minimum of $100 in to your account

- Head over to the ‘Crypto’ section

- Choose one of 14 cryptocurrencies to investing

- Decide whether you want to buy or sell and place your trade

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing your money.

2. Blue-chip stocks

-

- What are blue-chip stocks?

Blue-chip stocks is a term used to reference large corporations that are publicly listed on major stock exchanges such as the New York Stock Exchange (NYSE), NASDAQ or London Stock Exchange (LSE). - How do blue-chip stocks work?

if the value of the stocks that you hold go up in value in the open marketplace and you decide to sell them, you would have made profit in the form of capital gains. The second revenue stream that some blue-chip stocks offer is in the form of periodic dividends. - What returns can I expect?

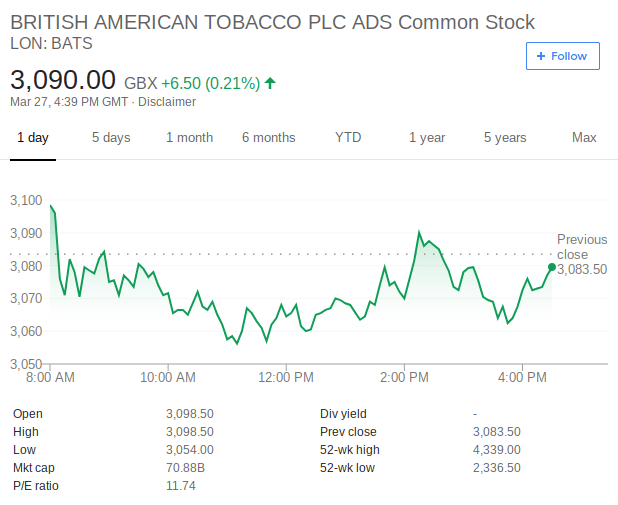

Blue chips stocks that pay dividends can pay anywhere between 1-5% per year. The value of the shares on the open marketplace can go or down, although you’d hope to get at least 5% in gains per year. - What are the best blue-chip stocks to invest in?

Technology stocks such as Apple and Microsoft are good investments because they good growth levels and they pay regular dividends. You can read more about how to buy Apple stock or how to buy Microsoft stocks in our comprehensive guides. It might be worth considering tobacco stocks too such as British American Tobacco, as they can currently be purchased on the cheap, and they pay dividends. - How much should I invest?

There’s no limit to the amount you can invest in blue-chip stocks, especially if you’re backing low-risk companies. Just make sure you diversify by holding multiple stocks from different industries.

- What are blue-chip stocks?

Pros and cons of investing in blue-chip stocks

Pros:

- Low-risk investments – opportunity for long-term growth

- Most pay regular dividends – earn regular income

- Thousands of companies to choose from across multiple industries

Cons:

- Most stocks suffer when the financial markets are weak

How do I invest in blue-chip stocks?

Here’s how you can invest in blue-chip stocks via Webull

- Open an account with Webull and confirm your identity

- Head over to the ‘Trade’ section

- Choose from thousands of companies to invest in

- Decide whether you want to buy or sell, and then place your trade

80.5% of retail investor accounts lose money when trading CFDs with this provider.

Pros and cons of investing in stock market index funds Pros: Cons: How do I invest in stock market index funds? Here’s how you can invest in stock market index funds via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Pros and cons of investing in Gold Pros: Cons: How do I invest in Gold? Here’s how you can invest in Gold via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Pros and cons of investing in Oil Pros: Cons: How do I invest in oil? Here’s how you can invest in oil via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Pros and cons of investing in real estate Pros: Cons: How do I invest in real estate? Here’s how you can invest in real estate via Ally Invest Pros and cons of investing in penny stocks Pros: Cons: How do I invest in penny stocks? Here’s how you can invest in penny stocks via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Pros and cons of investing in bonds Pros: Cons: How do I invest in bonds? Here’s how you can buy U.S. bonds direct from the government (U.S only) Pros and cons of investing in futures Pros: Cons: How do I invest in futures? Here’s how you can invest in futures via Ally Invest (U.S. only) Pros and cons of investing in mutual funds Pros: Cons: How do I invest in mutual funds ? Here’s how you can invest in mutual funds via Ally Invest (U.S. only) Pros and cons of investing in forex Pros: Cons: How do I trade forex? Here’s how you can trade forex via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Pros and cons of investing in small-to-medium company stocks Pros: Cons: How do I invest in small-to-medium company stocks? Here’s how you can invest in small-to-medium company stocks via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Pros and cons of investing in dividend paying stocks Pros: Cons: How do I invest in dividend-paying stocks? Here’s how you can invest in dividend-paying stocks via Ally Invest (U.S. only) Pros and cons of investing in Silver Pros: Cons: How do I invest in Silver? Here’s how you can invest in Silver via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Pros and cons of investing in the Dow Jones Pros: Cons: How do I invest in the Dow Jones? Here’s how you can invest in the Dow Jones via Webull. 80.5% of retail investor accounts lose money when trading CFDs with this provider. Getting your investment strategies right is fundamental if you are to make money in both the short and long-term. In order to point you in the right direction, we’ve listed 5 useful tips to get you thinking in the right mindset. Before you even think about parting with your own money, it is crucial that you perform significant amounts of independent research. This needs to cover the asset itself, the industry that it operates in, and the overall health of the markets.Ultimately, this is one of the most important investment strategies that you can take if you want to ensure that your wealth is protected in the long-run. Successful traders have a full understand of pricing charts. These are charts that detail the historical pricing movements of a particular asset. It is absolutely fundamental that you take some time to read pricing charts, as it could be the difference between entering the market at the right time, or the wrong time. Most importantly, you want to ensure that you are not purchasing an asset when it is close to peaking. Although this is often overlooked, when selecting the best investments for your portfolio you need to set some underlying targets. This is to ensure that you do not miss your opportunity to exit the market. If you are keen to hold on to your best investments long-term, this is fine, but you should have a rough idea as to what you are looking to achieve. Markets can change very quickly in the investment space, so always have a plan. Diversifying your best investments means that you avoid putting all of your eggs in to one basket. Not only does this mean multiple assets, but you ideally want to cover multiple industries across multiple markets. This way, should one of your investments perform poorly, your exposure won’t be felt nearly as much. An example of a diversified investments basket would be to blend traditional stocks with precious metals, real estate and currencies, If you do have an appetite for higher-risk assets in your list of best investments, then it crucial that you balance this out with lower-risk assets. Most successful traders will utilize a weighting system. For example, traders might opt for 70% in low-risk assets, 20% in medium-risk assets and 10% in high-risk assets. This is a similar approach to diversifying your best investments, as the overarching aim is to mitigate your risk. If you’ve chosen the best investments for your individual needs and you’re ready to start trading, then you’ll need to find a suitable investment platform. Here’s 4 that are worth considering. Webull is a hugely popular broker. The company is listed on the Hong Kong Stock Exchange. You’ll be able to access a full selection of the best investments we have listed in our guide, including forex, shares, stock indices, and ETFs. Pros: Cons: 80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing your money. Launched in 2005, Ally Invest have risen to fame in recent years. The mobile-based investment platform is backed by U.S. bank Ally Financial, so it has some serious clout behind it. You’ll be able to trade stocks, mutual funds, ETFs and more at Ally, all at really competitive prices. Pros: Cons: Hargreaves Lansdown are a UK-based award winning broker that specializes in a plethora of investment products. This covers shares, ETFs, ISAs, CFDs and a full selection of commodities. Their investment research and analysis coverage is industry leading, and they’ll fully regulated by the UK’s FCA. Pros: Cons: Markets.com is a platform that is fully catered for first-time investors. On top of having a really slick layout, the platform is jam-packed with educational tools and useful guides. With no commission fees, Markets.com offer great value. Pros: Cons:3. Stock market index funds

If you like the sounds of investing in blue-chip stocks, but either can’t decide which companies to back, or you want to diversify your risk, you should consider investing in stock market index funds. This allows you to invest in lots of companies, rather than just one or two.

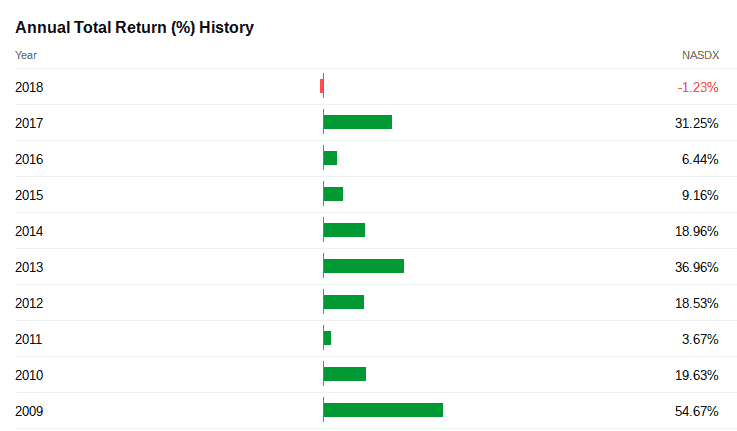

Lots of financial institutions are able to track the movement of major stock exchanges such as the NASDAQ. For example, the NASDAQ 100 index fund tracks the 100 largest companies trading on the NASDAQ exchange. Your investment is based on the average share price movements of all the companies that make up the index.

Although you won’t receive any company dividends by investing in a stock market index, growth is usually very good. For example, the NASDAQ index increased in value by 31% in 2017, 6.4% in 2016 and 9% in 2015. Also, in the 10 year period from 2007-2017, the FTSE 100 (LSE) made total gains of 74%.

You can invest in multiple stock market indexes if you want to diversify your risk. Consider putting some funds into the Dow Jones (NYSE), NASDAQ 100 (NASDAQ) and the FTSE 100 (LSE).

As stock market indexes usually perform very well, there is generally no limit to the amounts that you should invest. As noted above, just make sure you spread your risk by investing your money into lots of different stock markets.

4. Gold

When you invest in Gold, you are speculating on its price going up or down in the open marketplace. Prices are linked to real-world demand and supply.

If you want to invest in Gold, you don’t need to physically hold the asset. Instead, you can purchase a CFD that tracks its price. If you think that its value will go up, and it does, then you simply the sell the Gold CFD with a profit.

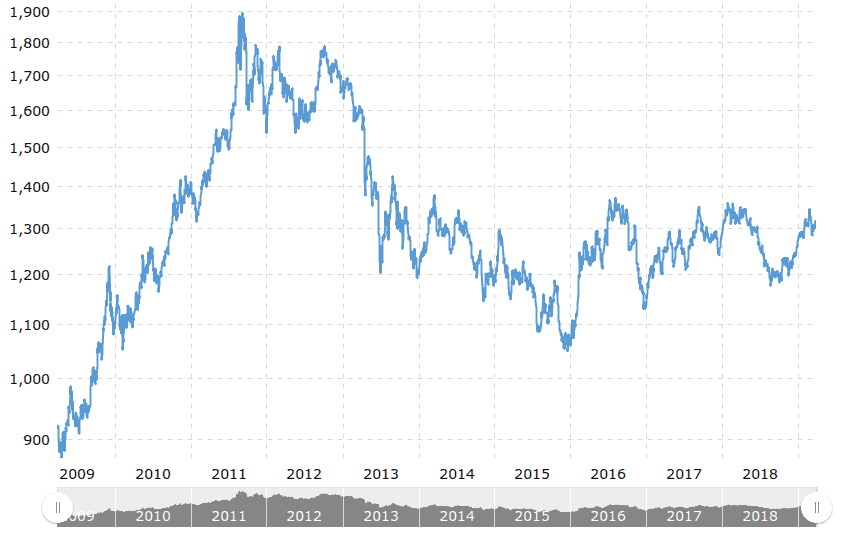

As is often the case with most commodities, Gold is quite volatile. For example, at the start if 2009, Gold was valued at $881/oz. Less than three years later in September 2011, its value soared to around $1,826/oz. However, in March 2019, its value has retreated to $1,284/oz.

In the financial markets, there are a number of Gold ETFs that track global prices. However, the movement of each ETF is usually similar. Nevertheless, if you want to invest in Gold yourself, the easiest way to do this is via CFD on Plus500.

As Gold is a volatile asset, you should only invest a small percentage of your portfolio. Limit your stakes and make sure you keep an eye out for any major developments in the market.

5. Oil

The value of oil is ultimately determined by global demand and supply levels. In other words, as demand for oil increases, in theory the price should follow suit.

When you invest in oil, you don’t physically own the oil. Instead, you invest in an asset that tracks the movement of global oil prices. This is usually done via an ETF (Exchange Traded Fund) or a CFD broker like Plus500.

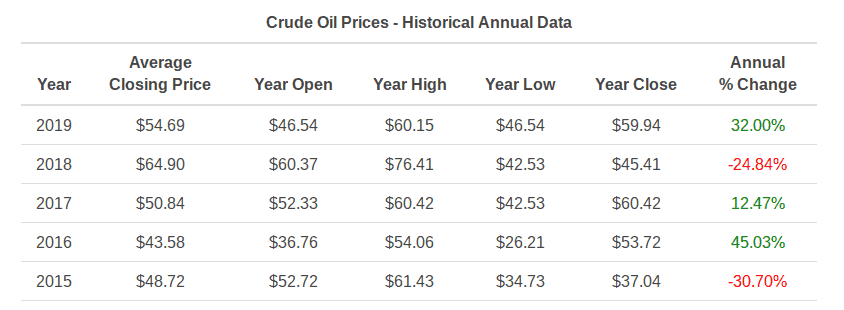

In March 2019, prices stand at around the $67/barrel mark, potentially indicating that it might be slightly under-valued. However, oil prices can be quite volatile and usually go up or down in value by at least 10% every year. As you’ll see from the chart below, oil has increased in value by more than 32% already in 2019. However, in 2018 it lost 24%.

As you won’t be buying oil in the physical sense, you’re probably best off using a CFD that tracks global oil prices. Plus500 allows you to do this via a CFD.

You should limit your stakes when investing in oil, as prices are very volatile. It might be best to treat oil as a short-term investment so that you can make gains when the market is up. Don’t forget, you can also make money when the prices go down if you decide to ‘Go Short’.

6. Real estate

When you invest in real estate, you are investing in the growth of the housing market. This is broken down in to specific locations, such as the U.S. housing market.

If you have a large amount of cash, then the best way to invest in real estate is to purchase properties yourself. You can then rent the property out, and sell the house at a later date when the value of the property is worth more. Alternatively, you can invest in real estate via an ETF.

Real estate offers one of the safest long-term investments. Depending on the housing market you are invested in, you can between 5-10% in annual rental payments. In terms of the property growing in value on the open marketplace, this will vary depending on the location. In the U.S., house prices rise by an average of 5% per year.

If you can’t afford to buy a property yourself, you’re best off investing in an ETF. One of the best real estate investments is the Vanguard Real Estate ETF, which tracks the U.S. housing market.

As real estate investing is such a secure long-term investment choice, there is no limit to the amount you can invest. It’s also a good idea to re-invest your profits back in to further real estate investments.

7. Penny stocks

Penny stocks are shares in small companies. The share price must be $5 or less for it to be classed as a penny stock.

When you buy stocks, you are speculating that the value of the shares will increase on the open marketplace. Most penny stocks are traded OTC (Over-the-Counter), although some are listed on Plus500 as a CFD.

As penny stocks are so volatile, prices can go up or down by more than 10% in just 24 hours. If you pick a penny stock that makes it big, its value can grow by more than 1000%. However, you could equally the majority of your investment too.

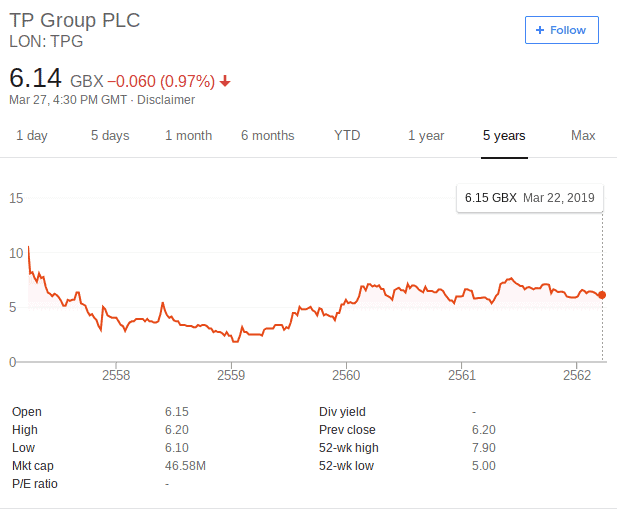

Technology services company Arcimoto, Inc. are currently experiencing good revenue growth, so they might be worth a small punt. TP Group raised an impressive £20.8 million in their 2017 IPO and still have much of this sitting on their balance sheet. Just keep your stakes small.

Keep your penny stocks investment ultra-small, as they are one of the highest-risk asset classes.

8. Bonds

Bonds are loans issued to governments or large corporations.

Bonds pay annual interest payments to their investors. At the end of the fixed term (for example 5 years), you’ll then receive your total investment back as one lump sum.

Bond returns will depend on whether you are buying government or corporate bonds, and how risky the underlying institution is. On average, you can expect to make between 1-5% per year in interest payments.

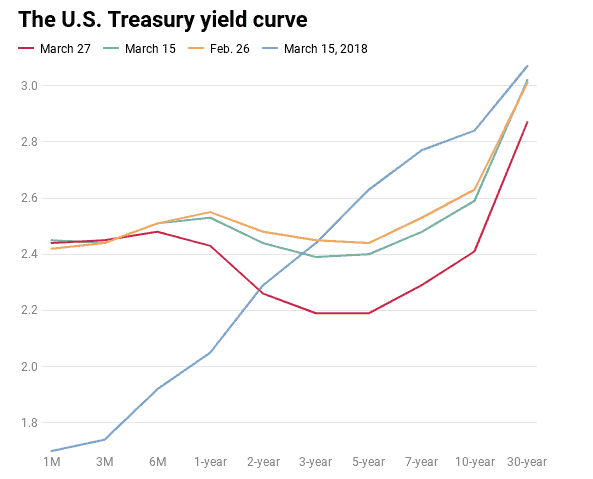

If you’re looking for a super low-risk bond investment, then stick with U.S. treasury bonds. Holding these bonds for 10 years will get you around 3% in annual interest payments.

If you’re looking to invest in low-risk U.S. government bonds then you can allocate a large proportion of your funds to this asset class. The chances of the U.S. government defaulting are close to 0.

9. Futures

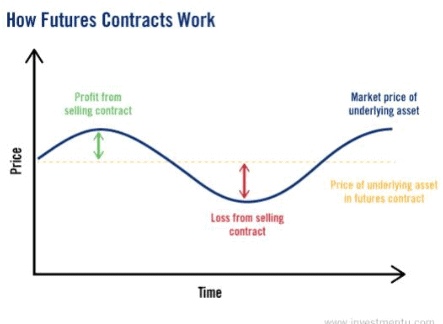

Futures are financial instruments that allow you speculate on the future value of an asset, or a group of assets. They make our best investments for 2024 list because essentially, they allow you to invest in virtually any asset class.

Futures always have an expiry date, which is usually every three months. Once you’ve decided what asset you want to speculate on, you need to decide whether the price will increase or decrease at the end of the expiry date. You’ll make profit if your prediction was correct.

Returns from futures are dependent on how well you predicted the future movement of the asset. For example, if the original price of the contract was $100 and you bought 10 contracts, if the contract expired at a price of $150, you’d make $500 (10 contracts x $50 growth).

You might want to consider buying futures in the NASDAQ 100, as growth levels in 2019 have been really promising so far. If the trend continues in the Q2 and Q3, it might be worth buying some futures contract. Alternatively, oil is also experiencing good gains in 2019, and it might still be undervalued at current prices.

Investment amounts should depend on the underlying asset. As futures are best for short-term investments, you’ll be best limiting your stakes.

10. Mutual funds

Mutual funds come in a range of shapes and sizes, however the main concept is that you pay a fund manager to find the best investments on your behalf. In most cases this will be with a major financial institution, although stock brokers can also arrange this for you.

You invest an amount into the mutual fund, and the fund will buy and sell stocks on your behalf. You’ll pay an annual fee for this.

This will depend on the mutual fund that you decide to invest in, as well as risk-level you choose. You’ll likely make at least 5% per year, however this is often more than 10%. Don’t forget, you’ll have to pay fees too.

Your best bet is to stick with funds that invest in large companies. Fidelity Advisor Growth Opportunities is a top performing fund that made 26% last year, with an expense ratio of 1.05%. Sparrow Growth is also a notable fund that made 21.4% last year.

Established mutual funds are led by some of the best performing investors in the financial industry. As such, if going for a fund that invests in large stocks, then this could be one of your biggest investments for 2024 and beyond.

11. Forex

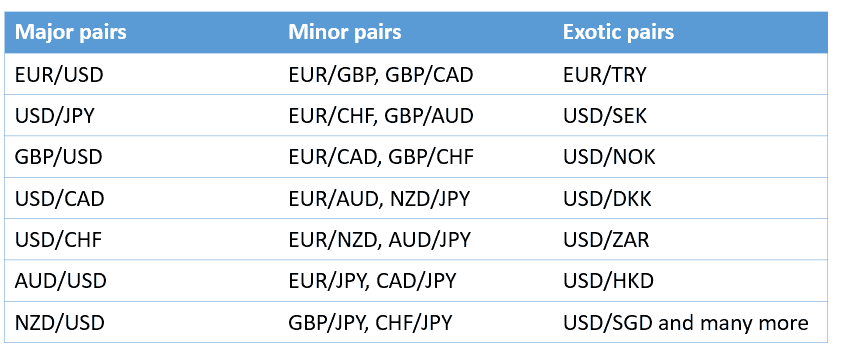

The foreign exchange markets, or simply ‘Forex’, is a multi-trillion dollar industry that involves trading currencies. Much like any asset class that can be traded on the open market place, currencies rise and fall in value on almost a second-by-second basis.

Rather than speculating on a single currency, you actually need to speculate on how a currency will perform against another currency. For example, if you felt that GBP was massively undervalued, then you would need to invest in a forex pairing, such as GBP/USD. As such, if you felt that one of the best investments for 2024 was that GBP would rise against the USD, then you would simply buy the pairing.

Forex traders aim to make small profits on a frequent basis. Successful forex traders will aim to make between 1-10% per month.

Although there are more than a 100 forex pairs to trade, start off with major pairs such as GBP/USD. These will have the largest trading volumes, smallest spreads and are generally less volatile.

This will depend on how much you want to risk. If you’re just starting out, it’s best to keep stakes low. If you use an established Forex CFD platform such as Plus500, you’ll need to deposit at least $100.

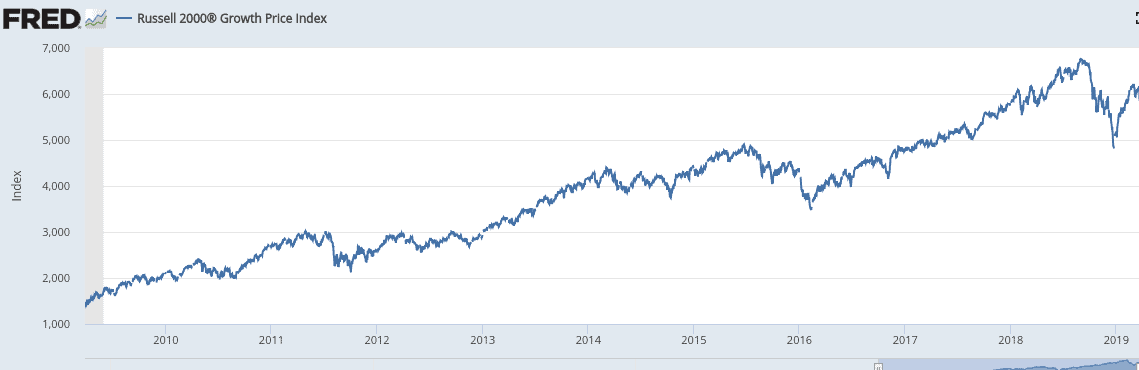

12. Small-to-medium company stocks

These companies are usually long-established, have an excellent trading history and offer good levels of transparency. The key difference between this particular investment class and blue-chip stocks is that the underlying companies have smaller market capitalizations

This works in the same way as a blue-chips stock investment, as you’re buying shares that are listed on a stock exchange.

As you are investing in smaller companies, returns are often higher than investing in larger blue-chip stocks. Returns can amount to between 5-15% per year if the company performs well. However, losses are also possible. The Russell 2000 index, which tracks 2,000 small-to-medium companies in the U.S., has grown by more than 600% in the past 10 years.

Shoe Carnival, Inc. is one of the largest family owned shoe companies in the U.S. The stock outperformed a disappointing 2018 for the Russell 2000, subsequently making more than 32% in gains. The stock has had a slow start to 2019, so you might be able to buy the stock on the cheap. Alternatively, you can simply buy an ETF that tracks the 2,000 companies that make up the Russell index.

You might want to invest slightly less in to small-to-medium stocks, in comparison to blue-chip stocks, This is because risk levels are slightly higher.

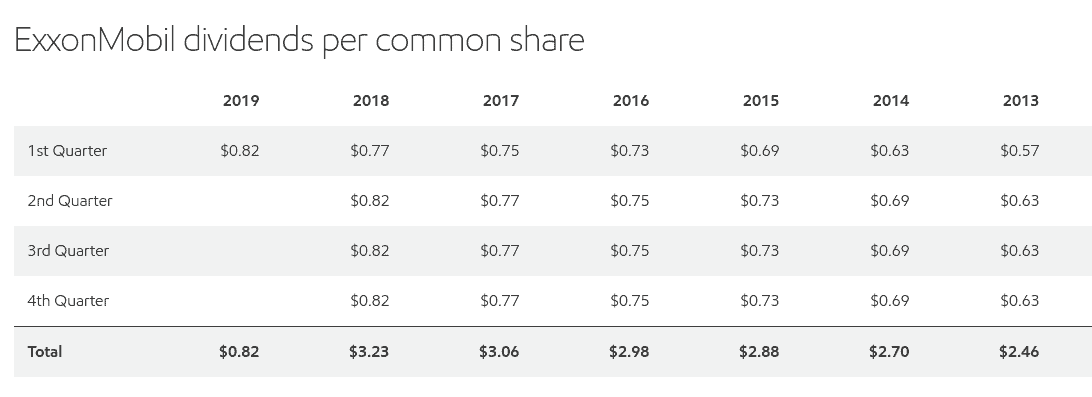

13. Dividend paying stocks

Dividend paying stocks are essentially publicly listed companies that have a strong preference for issuing dividends.

You invest in stocks in the usually manner, however you’ll receive regular dividend payments. This will usually occur every 3 months, or once a year.

On top of making gains when the value of your shares increase, dividends can pay between 1-5% per year.

Your best bet is to back an established company that has a good track record of paying dividends. Johnson & Johnson’s usually pay around 2.4%, and Wells Fargo & Co pay a bit more at 3.6%. An even better choice for 2024 might be Exxon Moil Corporation, who recently paid a dividend yield of 4.16%.

If you’re looking to back a low-risk company that pays regular dividends, then there are no limits to the amount you choose to invest. When you receive your dividends, you should also consider re-investing them back into additional stocks.

14. Silver

By investing in silver, you are speculating on the price going up or down in the open marketplace. There is no need to actually own the silver, as you can invest via CFD.

The returns you make on silver will depend on how long you hold the asset for. 2018 saw a loss of 9.4%, while 2017 saw a gain of 7.12%. 2016 was a good year for silver at it increased in value by more than 15%.

It’s best to limit your stakes when investing in silver as the asset is quite volatile.

15. Dow Jones Industrial Average

The Dow Jones Industrial Average, or simply the ‘Dow Jones’, is one the most notable indexes that tracks the U.S. equities space. In its most basic form, the Dow Jones is an index that tracks 30 of the largest U.S. stocks.

The Dow Jones allows you to invest in the 30 largest U.S. companies, via a single investment.

When the U.S. stock market performs well, as will the Dow Jones. The Dow is up 9.85% so far this year. In 2016 and 2017 it made gains of 13.4% and 25.08% respectively. Last year the Dow lost about 5%, which was unusual.

If you’re prepared to hold on to your Dow Jones investment long term, it is well considering making it one of the main investments.

Top investment strategies

1. Do your own research on your chosen investment

2. Learn how to read pricing charts

3. Set targets

4. Diversify

5. Hold a mixture of risk-levels

Best investment platforms

Webull

Ally Invest

Hargreaves Lansdown

Markets.com

Best property investments

UK housing market ETF

If property is at the very top of your best investments list for 2024, then it might be worth considering an ETF. Real estate ETFs are available across multiple housing markets, however one of the most established is the iShares UK Property UCITS (IUKP), which tracks the UK market.

In order to get a good indication of the UK property space, the ETF incorporates a range of constituents. This includes Land Securities, Segro, British Land and Hammerson.

Fees will cost in the region of 0.4%.

Pros:

- Great for gaining exposure to the UK real estate market

- Competitively priced

Best stocks and shares investments

NASDAQ 100

If you are looking for the best investments in the stocks and shares space, but you can’t quite decide which companies to back, then it’s probably best to invest in an index. One such example of this is the NASDAQ 100 index fund. The fund tracks the 100 largest companies listed on the NASDAQ stock exchange, meaning you’ll get sensible exposure to the wider marketplace.

Pros:

- Invest in 100 leading U.S. stocks via a single trade

- Excellent way to diversify

Best investment apps

Ally Invest

Fully in-line with the age of digitization, it is now possible to access the very best investments via a mobile app. One of the most popular mobile investment platforms available is that of Ally Invest.

Pros:

- Very low trading fees – $4.95 base fee

- Mutual funds just $9.95 per buy/sell

- Good range of investment products to choose from

Conclusion

If you’ve read our Best Investments guide from start to finish, then you should now have a full understanding of the different types of investment products to consider in 2024 and beyond.

Each of the 15 investments that we discussed offers their own underlying risk-levels. As such, it is potentially a good idea to invest in multiple asset classes, with the view of mitigating your risk.

Whether its real estate, cryptocurrencies, stocks, ETFs, futures or mutual funds, there’s an investment product out there for everyone.

FAQs

What is the easiest way to start investing?

If you are at the very start of your investment journey, then it's probably best to use a CFD broker. You'll still have access to more than a thousand assets, and fees are much lower than traditional stock brokers. This means that you'll be able to start investing with smaller amounts.

What are the best investments of 2022?

If you're looking for the best investments in 2022, then your best bet is to diversify across a range of different assets. This will mitigate your risk and ensure that you are not too exposed to a single marketplace. Think about combining stocks with ETFs, index funds and commodities.

Which investments are low-risk?

While every asset class will always attract an element of risk, some are considered to be at the very bottom of the risk vs reward model. Such examples are bonds, real estate and debt mutual funds.

Should I invest in higher-risk assets?

There is nothing wrong with higher-risk assets, as long as you keep your investment to an absolute minimum. Moreover, you need to have a firm understanding of the underlying risks before you part with your money.Some investors will allocate a small amount of their portfolio to higher-risk assets, however just make sure you combine this with other assets that are less risky.

Am I Best suited for short or long term investments?

There is no one-size-fits-all with investment strategies. Short term investments will generally require more of your time, as you'll need to be fairly active to accumulate frequent profits. This also depends on the asset you intend on investing in. For example, if you'll looking to invest in bonds or real estate, these are generally best suited for long-term investing.

Is investing in CFDs safe?

As long as you are using a regulated broker that is fully authorized to sell CFDs, they are completely safe. As with all brokers, you should still conduct your own research to ensure that they are the right platform for you.