Join Our Telegram channel to stay up to date on breaking news coverage

After a hellish few days of stomach-churning bitcoin price swings, market participants are hoping the leading cryptocurrency is now entering a period of consolidation, with a recovery taking hold before the next upswing.

Bitcoin briefly broke through $12,000 at one stage, but is priced at $11,739 at the time of writing, after trading as low as $9,664 on 2 July. That represents an 21% price bounce.

Bulls are now eyeing $12,000 which could bring a retest of the near-term high at $13,800 back into view.

Upper most in the minds of traders and investors is an answer to the question: is the parabola still in play?

At first sight you might think that after a drop of 30% the answer might be no, but this is bitcoin and we’ve seen this all before.

“Fourth Parabola” still intact

First off, just as quickly as the price retreated, it has almost as quickly made up for a chunk of recent losses in the space of 24 hours.

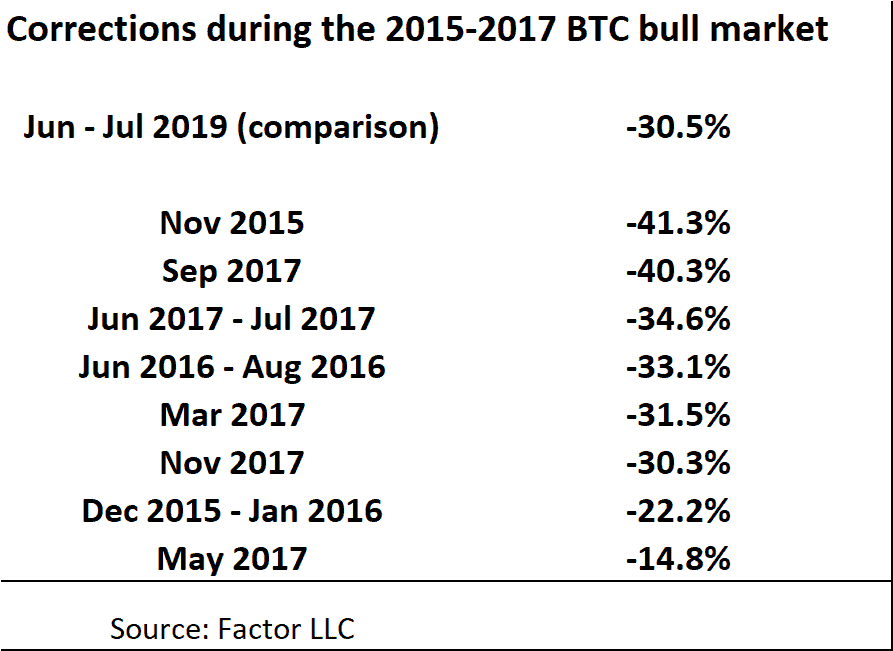

Trader Peter Brandt has been taking a close look at the charts and finds that in the last parabola from 2015 to 2017 there were several reversals on the way to the all-time high that were as large, if not larger, than the one we have just witnessed.

He shows that there were five corrections bigger than the 30.5% of recent days.

“The recent 30.5% correction in BTC is mild compared to the many corrections in the 2015-2017 parabolic advance,” notes Brandt in a tweet yesterday.

Here’s the table, with the corrections listed in order of magnitude:

By way of a reminder, Brandt has described the current price lift as “the fourth parabola” and said, if previous three parabolic movements are a guide, the bitcoin could be at $100,000 by May next year.

If you are looking to buy the dip, you can buy bitcoin with PayPal by clicking through to this page.

Pompliano reiterates bitcoin at $100,000… with some bumps along the way

Anthony Pompliano, aka the Pomp, the co-founder of Morgan Creek Digital Asset, has reiterated his $100,000 forecast previously reported by Inside Bitcoins in an interview with Bloxlive.tv, putting a late 2021 date on it. He also sees sizeable downward corrections on the way up. He assigns a 75% chance of the bitcoin price hitting that lofty level.

“In August of last year, I predicted bitcoin would go down to $3,000 before returning to $10,000. It essentially did that. Now I think it’s going to $100,000, but there will be more volatility: there will be parabolic runs like we saw in June and then there will be 20-30% drawdowns from that.”

And also in unison with other market watchers, he is thanking Facebook Libra with delivering the booster for bitcoin.

“People may not like Zuckerberg, but no one thinks he’s dumb. Bitcoin will benefit from Libra being a “gateway drug” for cryptocurrencies.”

Fib retrace suggest $14,000 re-test ?

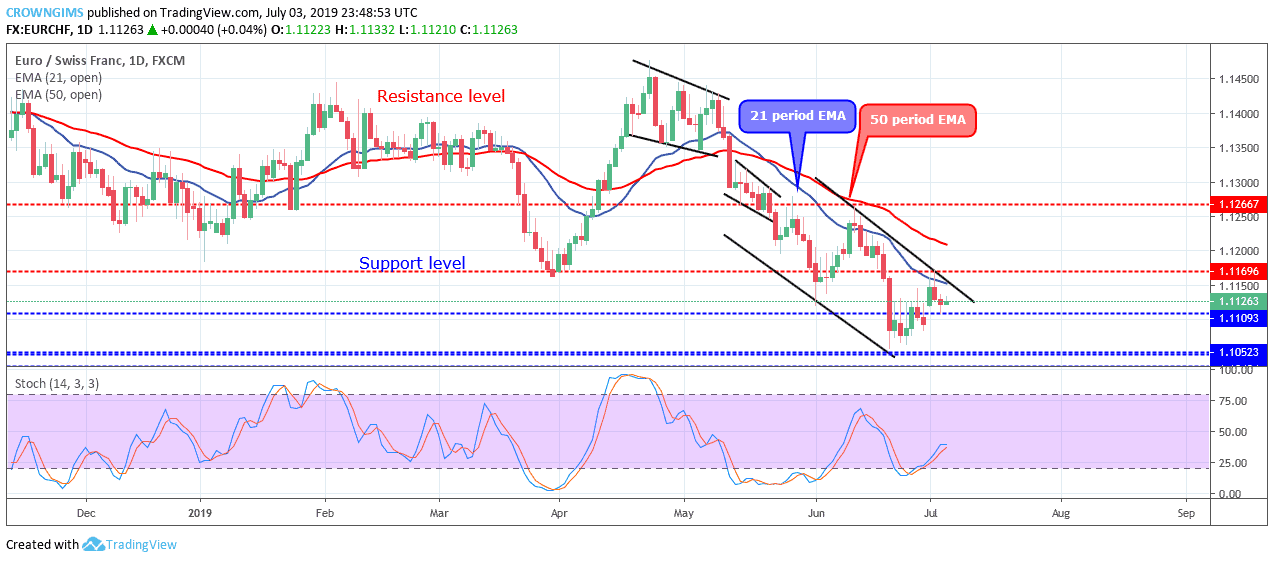

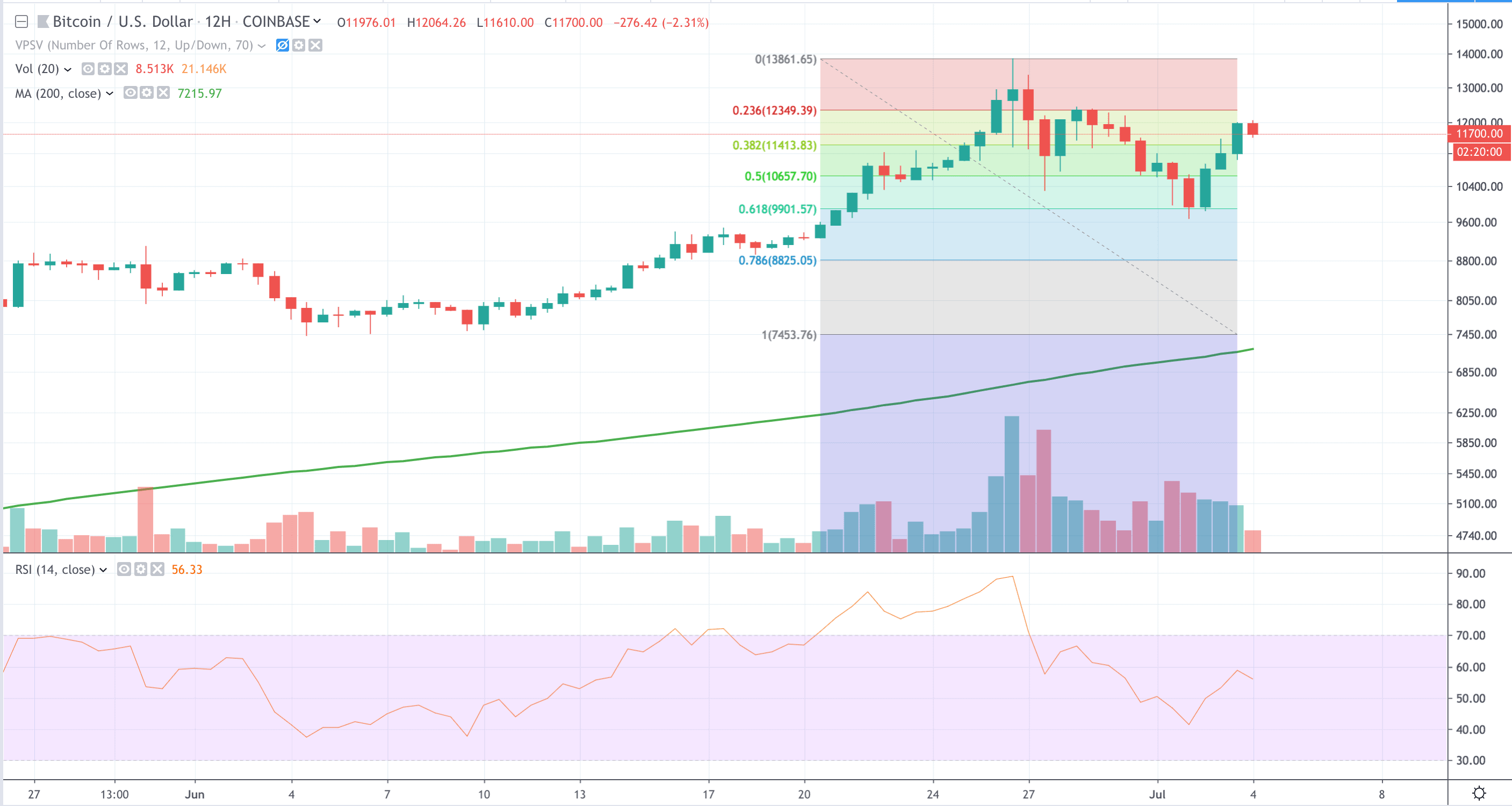

Analyst Simon Peters makes a similar observation, in addition to drawing attention to how the most recent correction lines up with the 38.2% Fib retracement:

“In addition, the drop to $10,000 corresponds with the 38.2% Fibonacci retracement, a ‘gap’ close on CME Bitcoin Futures, and looking back historically at the parabolic bull run of 2017, when the price did correct in that bull run, we typically saw corrections of between 30%-40%. We could be witnessing history repeat itself.”

We’ve drawn the chart so you can see what he’s talking about:

Looking at the recent bitcoin trading, Peters sees short positions being closed around the key $10,000 level helping fuel the recovery rally. “Elsewhere, traders shorting bitcoin from earlier highs who targeted the $10,000 zone as an area to take profit have been closing their positions and switching their bias, creating an uptick in open buy positions over the course of this week.”

Tuesday night’s rally was the largest one-day percentage gain since 19 May.

On the Tether controversy that has seen Bitfinex and Tether accused by some of manipulating the market following the issuance of 600 million fresh tokens, Peters draws no such conclusion, merely noting the latest tranche:

“New amounts of Tether in particular – with another 100 million USDT minted at the start of this week – is correlating with the price rally. Of the money flow recorded over the last 24 hours, 18-20% has been between bitcoin and Tether alone.”

Tether-Bitfinex manipuation?

On those manipulation suspicions, Kraken chief executive Jesse Powell doubts that Tether issuance drove the rally.

In an interview with TDAmeritrade Network he said: “I don’t have inside knowledge of what’s happening at Tether, but I can tell you that, historically, when you’ve seen growth in the supply of Tether, we’ve seen growth in the supply of U.S. dollars coming onto Kraken. And other exchanges would report the same.”

If you are considering buying bitcoin then make sure you store it safely by using a non-custodial Bitcoin wallets where you will have full control over your cryptoasset’s private keys.

Gary McFarlane is the cryptocurrency analyst at UK investment platform interactive investor and writes here in a personal capacity. None of his commentary should be considered investment advice.

Join Our Telegram channel to stay up to date on breaking news coverage