Gemini is one of the first cryptocurrency exchanges that allowed users to buy and sell cryptocurrencies.

It was founded in 2014 by the brothers Cameron and Tyler Winklevoss and has grown to become among the largest cryptocurrency exchanges in terms of trading volume and supported countries. However, there are a number of flaws with this exchange.

In this guide, we will suggest 5 alternatives to Gemini that provide lower fees and more security.

On this Page:

What are some disadvantages of Gemini?

Gemini has gained popularity since its launch and now has a market cap of over $26 million, counting with a large user base around the word.

Gemini was specifically designed as a web-based platform that enables users to buy and sell digital assets and, if necessary, to store these cryptocurrencies on its own built-in electronic wallet.

And yet, with all the benefits that the exchange has to offer, there are some Gemini alternatives that enable traders a much more effective way to trade cryptocurrencies.

However, the truth must be said, the Gemini platform (including the Gemini ActiveTrader) is not really a trading dashboard where you can execute a large number of trades.

Gemini has based its product on the needs of clients who want to find a secure cryptocurrency platform. This exchange is suitable for those who are interested in exchanging large amounts of fiat currency and but one of the top five cryptocurrencies offered by Gemini. Gemini is regulated by the New York State Department of Financial Services (NYSDFS) and is the first-ever licensed ether and Zcash exchange.

There are some notable flaws in the Gemini exchange. The US-Based crypto exchange has mixed reviews for a reason (the exchange has poor reviews on TrustPilot). We have listed some of the main disadvantages of Gemini:

- A limited selection of five cryptocurrencies – Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and ZCASH.

- Gemini trading services are available in only five countries – The United States, Australia, Canada, Hong Kong, and Singapore.

- Gemini does not offer margin trading

- Long and complicated verification process

- Gemini holds users’ private keys

- High trading and financing fees

- Limited support channels

But if you are the average Joe, you will likely want to find a better choice before you start trading. We have collected four Gemini alternatives with lower fees, leveraged trading, and a wider selection of currencies. These online platforms are based on the principle of Contract for Difference (CFDs), meaning they allow you to speculate on a security price without owning it. Let’s find out more about Gemini alternatives.

Best Gemini Alternative in December 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Gemini Alternatives

Etoro-BTC-6

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Huobi

Visit SiteAs prices of digital assets are highly volatile, users could lose all or a substantial portion of the value of any digital asset they purchase....

Regulation: CySEC, FCA, and ASIC

Payment methods: Visa, MasterCard, Diners, Visa Electron, Maestro, PayPal, Neteller, Skrill, Rapid Transfer, Wire Transfer, Sofort, and China Union Pay. ” image0=”” pros1=”Unlike Gemini, eToro offers more than 15 cryptocurrency pairs” pros2=”While Gemini to fund their account with cryptocurrencies, wire transfer and bank transfer (US only) eToro has a wide selection of payment methods ” pros3=”eToro provide a demo account” cons1=”Gemini offer the the Cryptoverse, which is weighted mix of every listed cryptocurrency ” cons2=”Unlike eToro, Gemini is more suitable for large institutions” cons3=”” cta-label=”Visit eToro” cta-url=”https://insidebitcoins.com/visit/etoro-bitcoin” disclaimer-text=”68% of retail investor accounts lose money when trading CFDs with this provider. Crypto assets are highly volatile unregulated investment products. No EU investor protection.” paragraphCount=”1″]

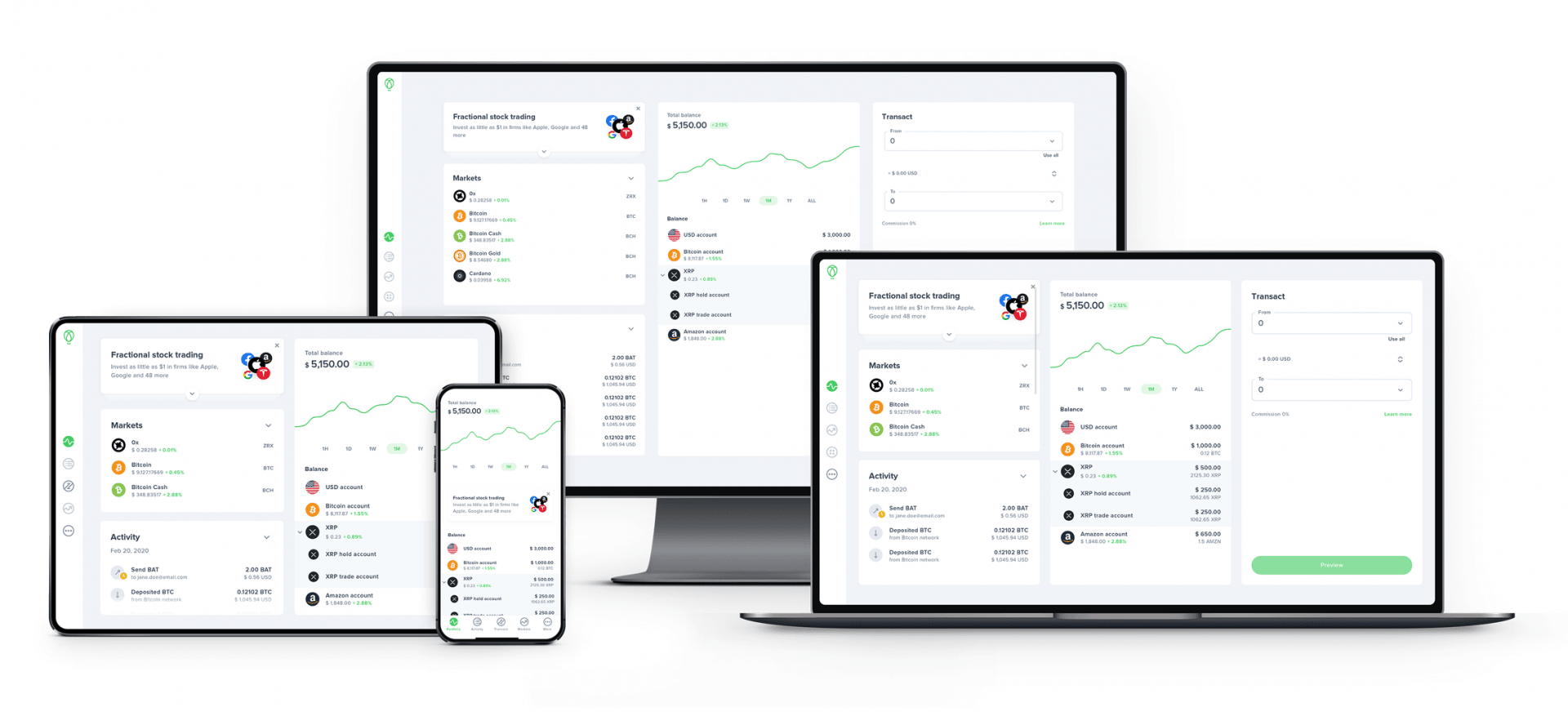

Uphold Exchange Platform & App

How we analyzed the best Gemini alternatives

Overall, Gemini has developed a cryptocurrency trading platform suitable for large institutions and investor that execute high volume positions. Having said that, the Gemini web-based platform is not a good match for day traders nor for swing traders. The verification process is long and complicated and if you are not located in one of Gemini’s supported countries, you’ll have to find an alternative platform. Our conclusion is based on the following factors:

- Safety and regulation: There’s no doubt that Gemini is among the most regulated and secure exchanges in the industry. Yet, the exchange is mainly regulated in the United States and has no additional licenses in other jurisdictions. Being regulated by CySEC, FCA, and ASIC, and registered with FinCEN, eToro can offer its services for residents in the US as well as in more than 60 countries around the world.

- Usability: Reviews online indicate that Gemini’s trading dashboard is complex and its ActiveTrader trading platform which was designed for day traders is not as effective as another platform. A social trading platform is the great advantage of eToro, allowing users of the community to connect and even copy trades of other successful traders using the CopyTrader feature.

- Supported countries: Gemini only supports the trading of cryptocurrencies in the United States, Canada, Hong Kong, and Singapore while eToro offers cryptocurrency trading in more than 60 countries.

- Fees: Gemini fees are considerably higher than other exchanges and CFD brokers. The trading fees range from %0.5 to %1.49 which is above the industry average.

Gemini alternatives – Final Thoughts

The bottom line, Gemini might be a good choice for institutions and high-volume investors since it offers users such high-security features and its strict regulatory framework. But for all the traders who seek high trading activity, the Gemini alternatives above can do the work for you. You’ll get a professional trading platform, leverage positions, lower fees, and a greater selection of supported cryptocurrencies.

Our main recommendation for 2024 is eToro, which has also recently launched staking rewards for holders of Ethereum, Cardano or Tron.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Are there any sites like Gemini?

Yes. At the time of writing, there are more than 200 cryptocurrency exchanges that support cryptocurrency trading through a web-based trading platform. Some of the most well-known cryptocurrency exchange sites include Coinbase, Kraken, CEX.io, Poloniex and many more.

Why is Gemini so expensive?

Similar to other exchanges in the market such as Coinbase, Kraken, and CEX.io, Gemini's fees remain expensive. In fact, Gemini has the highest trading fees for retail clients, which is not surprising as the Winklevoss brothers have been marketing the exchange for large institutions. If anything, CFD brokers’ zero-fee crypto trading is the exception. These brokers often charge no trading fees rather than a small buy and sell spread.

Is Gemini unsafe?

Gemini is one of the few cryptocurrency exchanges that has never been hacked and is considered by many as a top-secured exchange.

Why should I trade cryptocurrencies via a CFD broker?

Cryptocurrency exchanges allow you to buy and sell cryptocurrencies and often store the coins on a built-in electronic wallet. These exchanges usually charge high fees and have a complicated user interface that is similar to banks and investment firms. As another option, CFD brokers offer you to s speculate on the price of a financial asset (like cryptocurrencies) but without owning the asset. This happens through a secondary derivative market where the broker connects you with other participants.

Bitcoin

Bitcoin