In a rapidly evolving stock market where things happen at a very fast pace, investors need immediate access to real-time updates and notifications that could help them put accurate trades during the best moments and leave positions whenever appropriate.

This is where stock alert services come in, providing timely stock news and potential trading opportunities that could position investors for big gains. While many platforms claim to offer stock alert services, only a few of them have a proven track record and deliver a positive user experience.

In this comprehensive guide, we will take you through the top 10 stock alert services that are worth considering in 2024. Read on to know more.

Best Stock Alert Services in 2024 – Quick List

Here is a quick list of some of the top stock alert services that traders should consider this year:

- Benzinga Pro – Overall Stock Alert Service For All Trading Levels

- eToro – Instant Stock Alerts & Notifications

- AltIndex – Broader Stock Market Insights

- AvaTrade – Expert-Recommended Buy Or Sell Alerts

- MorningStar – Valuable Stock Trading Alerts

- The Trading Analyst – Real-Time SMS Alerts

- Sharesight – Efficient Portfolio Tracking

- Stock Alarm – Price Movement Notifications

- Finimize – Exclusive Access To 24/7 Stock & Market Updates

- Danelfin – AI-Driven Stock Data

Visit The Best Stock Alert Service

10 Best Stock Alert Services in 2024 – Full Review

In this segment of our guide, we present a complete insight into the best stock alert services that made the quick list.

Benzinga Pro – Overall Stock Alert Service For All Trading Levels

Benzinga Pro leads the way when it comes to providing real-time data, market-moving news, historical price insights, extensive analysis tools, and a host of educational resources that can help investors level up their trading game. Alerts provided by this platform are based on deep research and careful market considerations, highlighting specific strategies that investors can try out to amplify their returns.

Thanks to its high success rate, Benzinga Pro gives subscribers an edge over other traders, ensuring that they do not miss out on any potential opportunities in the highly volatile stock market. Investors can customize Benzinga Pro’s alerts in a way that suits their investment goals, with options ranging from newsfeed and calendar to signals and watchlists.

Those who want to get ultra-fast updates on all the available categories will be able to pick customized notifications for each, helping them to know and differentiate the kind of alerts they have received. They can choose whether they want the alert to come in through a background sound, a desktop notification on the screen, or through their emails. Regardless of the options used, users can rest assured that they will receive alerts that will be beneficial to their trading.

Another standout attribute of Benzinga Pro is its intuitive and easy-to-use UI, making it a compelling pick for all categories of traders. Likewise, the platform has a dedicated chat room, with members consisting of well-established traders, making it possible for them to share quick market insights and trading suggestions.

Above all, Benzinga Pro caters to newcomers looking to make profitable trades right from the beginning and experienced traders who have other important commitments outside of trading. Beyond stock alerts, it also offers mentorship programs for those looking to take their stock trading journey to the next level. There is also a stock scanner that accurately scans stocks based on market cap, volume, and daily price performance.

For those interested, Benzinga Pro has three subscription models – Basic, Essential, and Streamlined. However, there is a 14-day free trial for users to explore all the features before deciding the subscription model to pick.

eToro – Instant Stock Alerts & Notifications

There’s probably no stock trader who has never heard of eToro. The platform is renowned for its robust architecture and advanced functionalities which provide an enabling pathway for investors to safely dive into the world of stocks and crypto. In recognition of its excellent service delivery, eToro was recently named as the “Best Trading Platform of 2024” by Forbes, demonstrating its strong market position.

However, beyond offering a direct interface for users to buy, sell, and trade a host of promising stocks, eToro, through the aid of TipRanks, also offers prompt and detailed market alert information, earning it a place on this list. TipRanks is one of the most reliable stock data platforms around.

All investors need to do is to identify any of the stocks, use the one-click access widget on the asset page, and set up an alert for a specific price movement. Once the asset hits the milestone, users will be notified immediately through their mobile phones or desktops. This particular strategy helps investors to realize the best time to enter a particular stock market or exit.

More so, those seeking to diversify their investments without going through much research or spending time on market analyses can try out eToro’s “smart portfolios” feature, offering an expert-recommended long-term investment portfolio that can deliver tangible returns. Users will also have a holistic view of the quarterly financial performance of publicly traded companies through the platform’s Earnings report calendar.

Trusted by more than 10 million users across 150 countries worldwide, eToro stands out as one of the most comprehensive stock alert platforms to use this year. Its all-around features help investors stay up-to-date with the latest market movements, keep tabs with what other traders are buying and selling, and emulate trading strategies of successful investors – all with a single click.

AltIndex – Broader Stock Market Insights

Known for its AI-driven infrastructure, AltIndex has established itself as an ideal spot to get a diverse array of stock trading insights. Stock alerts provided by AltIndex are usually sent directly to users’ email, containing a summarized list of top trending stocks and some trading suggestions that can help strengthen their portfolios.

The platform, through the aid of machine learning and artificial intelligence, studies the general sentiment around a stock, taking into consideration some important metrics like trends, social media followers, likes, expansion efforts, layoffs, Reddit mentions, employee ratings, and many more.

For instance, if the general discussion and opinions about a trending stock is positive on social media, especially Reddit, AltIndex will rate it highly, probably between 60 to 70. If negative, perhaps due to some factors like layoffs, AltIndex will rate it low. Meanwhile, beyond social media sentiment analysis, the platform also explores alternative data points to provide users with accurate recommendations.

Guided by the broad data derived from all the supported sources, AltIndex will rate the potential of the stock, giving investors a direct clue about which investment decision to take.

Those looking for information about stocks that are somehow related to their portfolios can try out AltIndex’s screener feature. This powerful feature is primarily put in place to help investors maintain a strong position while regularly updating their portfolios to mitigate risks and optimize their profits.

Like Benzinga Pro, AltIndex features a plethora of plans that suit the pockets of all users. One is $199 per year, offering 10 AI stock picks alongside unlimited insight pages and stock screener, email support, and newsletter. There is also a $400 yearly plan, which will see the number of the AI stock picks rise to 50.

AvaTrade – Expert-Recommended Buy Or Sell Alerts

AvaTrade is yet another top-tier broker that offers a combination of stock trading and alert services in a single platform. First, when it comes to trading, the Dublin-based online broker features a broad range of advanced tools and instruments that can help users maximize all the opportunities embedded in the global stock market.

Named as the best stock CFD broker in Europe, AvaTrade provides multiple market access points to complement the varied trading preferences and needs of its users. From AvaTrade mobile app to WebTrader and MetaTrader 4 & 5, AvaTrade positions itself as a versatile option for all categories of traders.

The broker also excels when it comes to providing beneficial alerts and in-depth market analysis that can help both novice and experienced traders identify and act upon potentially profitable trading opportunities. Stock alerts on AvaTrade are offered through its trading signals service, providing expert-recommended buy/sell recommendations and parameters for trading.

Each recommendation provided through this service is accompanied by a detailed explanation behind the suggestion. With this outstanding model, users are able to make investment decisions based on a solid consideration and understanding of the market dynamics.

For those who do not want to miss out on happenings within the stock market, even while on the go, the AvaTrade app platforms come highly recommended. The WebTrader, on the other hand, has also been fully optimized to help desktop uses access the same insightful data and elevate their trading performance.

MorningStar – Valuable Stock Trading Alerts

MorningStar is a household name in the investment research field, providing everything that investors need to navigate the ups and downs in the stock market. From regular penny stock alerts to investment thesis, stock screener, X-Ray tool, and many more, MorningStar leaves no stone unturned to help traders find their next best investments.

Three different stock alerts are provided by MorningStar. One is the price alert, notifying investors of any dramatic price swings in the stock market. The second one, known as MorningStar alerts, updates users whenever there is a change in MorningStar’s stock ratings and classifications. The last one, dubbed filing alert, keeps users abreast of any new stocks or fund reports showing the financial performance of publicly listed firms.

Another essential tool offered by MorningStar is the portfolio monitor, providing important updates about the performance of their portfolios. There is also a free-to-use basic screener, crafted to help investors identify trading opportunities that align with their goals.

Similarly, those who want to determine the true allocation of their assets can use MorningStar’s X-Ray tool. The solution will screen the quarterly report of their individual stock ownership to arrive at their true allocation.

Adding a feather to MorningStar’s cap is its simple layout design, fostering easy access to all the features on the platform. In fact, just at the top of the home page, users will be able to find the price action of some of the top trending stocks and market movers, containing vital information about big gainers and losers.

Finally, when it comes to pricing, MorningStar offers both monthly and yearly plans, costing $34.95 and $249 respectively. That being said, those who create an account right now will get a 7-day free trial.

The Trading Analyst – Real-Time SMS Alerts

The Trading Analyst is a research-oriented platform operated by a team of passionate traders, with decades of experience in the stock market. Known for providing real-time SMS alerts, this platform signals investors on potential entry and exit points, empowering them to optimize their returns and reduce their losses.

The Trading Analyst focuses more on how investors can effectively manage risks, track their portfolio performance in real time, and act on data-backed trading strategies to enhance their portfolios.

In fact, the platform, according to its website, has leveraged its swing trading strategy to help over 11,000 traders refine their investment tactics, strengthening its position among other stock alert service providers.

In addition to this, The Trading Analyst also furnishes users with exclusive weekly reports, giving them insight into new market outlooks and updates on their investment holdings.

In the same vein, it delivers diverse educational materials for subscribers, supporting them to become better and profit-making traders. On the platform, traders can access quality educational content like articles, videos, and webinars.

Subscription fees on The Trading Analyst range between $147 monthly to $787 annually, opening up an exclusive pathway for users to explore the world of stock investing.

Sharesight – Efficient Portfolio Tracking

Sharesight is a leading asset portfolio tracker that allows users to effectively monitor the performance of their investment holdings. It has full compatibility with a host of American brokerages including Robinhood, Vanguard, and Fidelity, empowering users to automatically import their trading data into their Sharesight portfolio.

Similarly, investors can as well import trades using CSV/Excel files or manually while using Sharesight. This strategic approach goes a long way in helping them track their investment performance across different brokers, asset classes, and markets for the purpose of making firmer decisions.

Moreover, Sharesight automatically monitors users’ domestic and foreign dividend income and presents the data in an easily digestible format. Similarly, as one of the best stock signal services, Sharesight tracks investors’ dividend yield, supporting them to know how the yield has been performing within a given period of time.

Also, setting itself apart from competitors, the stock alert service provider has a direct accounting communication system that assigns a personal account manager. This exclusive feature has tremendously contributed to the positive user experience on the platform.

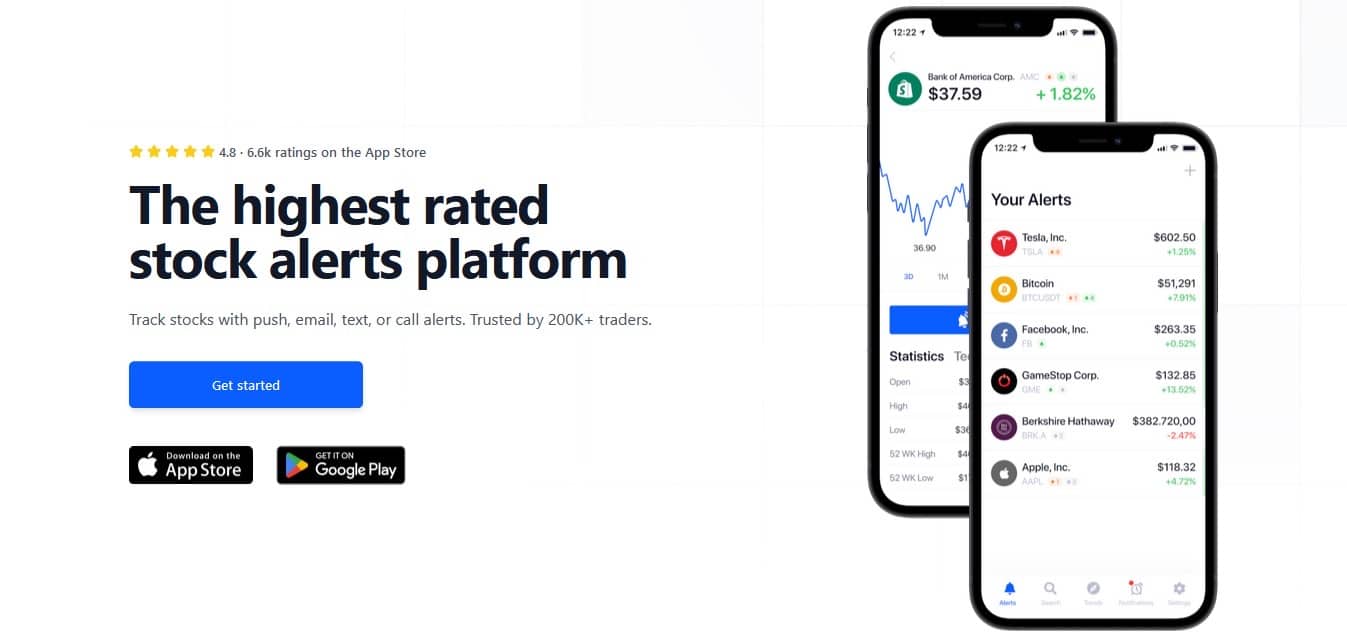

Stock Alarm – Price Movement Notifications

Stock Alarm is recognized among the investing community as a platform that efficiently tracks financial assets like blue chip stocks, ETFs, and cryptocurrencies. Featuring a huge array of tools and instruments, Stock Alarm allows users to customize their alerts against a host of real-time exchange feeds.

At its core, Stock Alarm provides users with more than 50 alert and picking services ranging from various market signals, price changes, upcoming earning reports, technical indicators alerts, and initial public offerings (IPOs). Built on the principles of simplicity, Stock Alarm has a responsive and easy-to-navigate interface, making it an appealing spot for newcomers still finding their feet in the stock industry.

More so, with Stock Alarm, users can easily customize and select the kinds of trading alerts to suit their investment portfolio. This particular attribute adds an extra layer of flexibility to the platform.

All in all, Stock Alarm comes highly recommended for traders who are usually occupied during trading hours but remain keen on controlling their trading activity. In terms of accessibility, Stock Alarm can be used through its mobile and web versions, with the latter having an intuitive interface that encourages swift alerting.

The platform ticks all the right boxes when it comes to security, ensuring that all connections to third-party services are completed without sacrificing users’ data. To further strengthen users’ security and prevent unauthorized access to their accounts, Stock Alarm mandates multi-factor authentication for all logins.

Finimize – Exclusive Access To 24/7 Stock & Market Updates

Finimize is a financial education platform that provides investors with up-to-date market information, educational content, and timely news in the investing world.

Those who subscribe to this platform are offered various guides relating to ETFs, investment tips, real estate, stock market fundamentals, alternative assets, and more, highlighting why they should consider buying an asset.

The platform also has a special analysis segment where market data from various sources are consistently evaluated to identify the potential direction of market prices and help investors execute smart day trades.

In addition, Finimize has a vast community where traders come together to discuss emerging market opportunities. The community serves as an avenue for newbies to interact with seasoned traders who can mentor them to become smarter investors.

However, unlike others on this list, Finimize does not provide direct guidance on a particular trade or stock, a downside that has significantly affected its visibility among traders. Instead, the platform focuses on broader market trends, leaving investors with voluminous information and commentaries at their disposal.

That said, Finimize has a free version that comes with limited access to some top content. To unlock premium features, investors must pay an annual fee of $79.99. The price varies in most cases as the platform sometimes offers users a subscription discount.

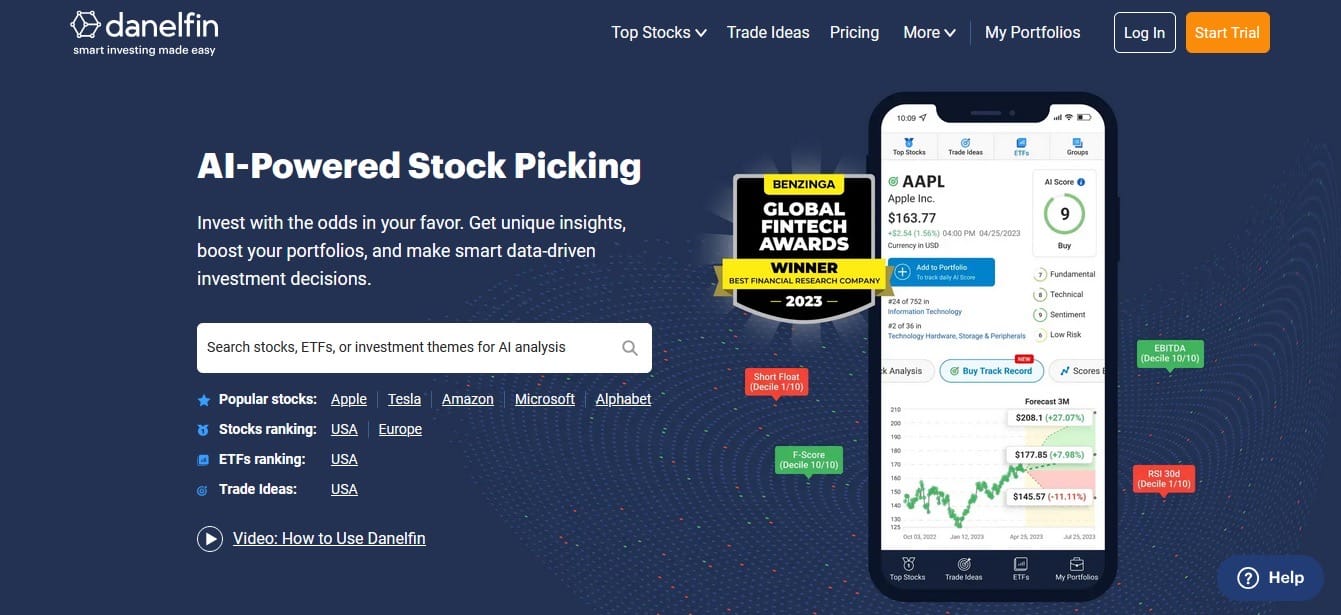

Danelfin – AI-Driven Stock Data

Danelfin is a reliable stock and ETF analytics platform that leverages artificial intelligence to scout for the best market opportunity. Following its market debut in 2018, Danelfin has swiftly won the heart of many investors as a stock research company that provides data-driven information about the stock market and positions users for noticeable gain.

More so, Danelfin helps users to stay updated with prices of stock through its data-powered platform that represents complex financial information with AI scores. Thanks to its AI-powered predictive functionality, Danelfin can review all US stocks, European equities, and US-listed ETFs, interpreting various indicators into simple information.

Additionally, the platform uses more than 600 technical indicators, 150 sentiment indicators, and 150 daily fundamental indicators to rate the price performance probability of a stock. With the AI rating, users can easily gain insight into the possible return a particular asset can provide.

Simply, Danelfin stands out among its counterparts due to its unique functionality that helps investors to navigate the complexities of the stock market. Assets rated above 60% by Danelfin indicate a buying signal while the ones rated below indicate a negative market sentiment.

Furthering its appeal is its intuitive user interface that permits easy navigation and ensures that all information, filters and indicators are well presented. Generally, Danelfin offers portfolio management, trade ideas, stock alerts, and investment groups.

What Do Stock Alert Service Offer?

Stock alert providers are platforms that leverage the powers of advanced technologies to consistently study the market, analyzing various factors such as technical conditions, market trends, financial performance, investors’ sentiment, and economic indicators to determine the potential of a given asset. Having come up with a data-driven market report, the stock provider will send a notification to all its subscribers, giving them the edge they need.

In essence, stock alert providers enriches the overall trading experience of traders, allowing them to focus more on other important commitments and worry less about how to make profitable trades. Whether as a newbie eager to make gains right from the start or a professional trader seeking to build a versatile portfolio, stock alerts enhance trading efficiency, providing you with all the resources to act quickly.

Overall, stock alerts have completely redefined how investors approach the financial market. In most cases, the service is integrated into a broker, making it possible for traders to act immediately after receiving the alerts.

There are also platforms such as Benzinga Pro and AltIndex that are deeply rooted in vast market research and investment insights alone without offering any interface for users to trade.

With this in mind, it might be a good idea to try any of the platforms to discover the one that best suits your investment objective.

How Do Stock Alert Service Work?

Most stock alert services work similarly, and they mostly send users notifications if a preset trigger has been achieved. Basically, these predefined conditions include price changes, percentage improvement, and fundamental updates.

Once these conditions have been met, the alert system of the platform will send notifications to subscribers through various channels such as emails, SMS, push notifications, or in-app messages. Most stock alert services permit users to set the alert system based on their personal preference and investment objective.

However, some platforms come with advanced features to help users make trades directly from the alert interface. To enable this functionality, some stock alert platforms are integrated with third party trading systems, ensuring that users react swiftly to sudden market changes and make the most of any prevailing condition.

How To Choose A Stock Alert Service?

In this section of our guide, we will discuss all the criteria a trader must consider before choosing a stock alert platform.

Success Rates

While considering which stock alert service to trust, it is crucial for investors to consider a platform with a good success rate as it reflects the effectiveness of the trading ideas generated from the site. Most leading stock alert service providers often avail access to their historical data, assisting investors to make informed decisions.

By accessing their historical data, investors can easily understand the previous performance of the stock alert provider. High success rate, in most cases, serves as a testament to the reliability and credibility of the market signals and alerts provided by the platforms.

Online Reviews

Before subscribing to a stock alert provider, it is important for investors to also check reviews about the company and its signals to understand what users are saying about them. One such way to get this information is through review sites like Trustpilot which ranks businesses and projects based on the overall testimonies of their real users.

Subscription

When considering the best stock alert provider to use, investors must also pay good attention to the numerous pricing models offered. Top alert services like Benzinga Pro and AltIndex, for instance, come with multiple subscription packages that cater to the financial capability of all categories of investors.

While they charge less for basic features, users looking to access premium functionalities might need to pay more. As such, consider your budget to determine which of the subscription packages you can afford to pay.

Number of Daily/Weekly Signals

Another important metric to check while selecting a stock alert service provider is the number of signals they provide weekly/daily. Some platforms may offer you more cost-effective plans with more daily/weekly signals.

Therefore, investors must take into consideration their trading strategy and goal to determine the number of signals they want and which platform best suits the criteria.

Our Verdict

In this comprehensive guide, we fully reviewed the top 10 stock alert services that investors can use to stay ahead of the curve, exploring their features and pricing structure. Additionally, we also highlighted some of the key metrics that must be considered before picking a stock alert service provider.

With that being said, our top pick for the best stock alert service is Benzinga Pro. The platform is home to a host of advanced features, tailored to meet the modern needs of all traders. With its instantaneous market updates, Benzinga Pro helps users make decisions quickly.

FAQs

What is a stock alert service?

A stock alert service caters to the information needs of traders, equipping them with insights on current market realities so that they can make better decisions.

Which provider offers the best stock alert services?

Benzingo Pro has carved a unique spot for itself as one of the most reliable stock alert services for all categories, including newbies and existing traders. It offers real-time data, market-moving news, historical price insights, extensive analysis tools, and other educational resources that can help investors optimize their trading strategies.