Choosing the right stock broker is one of the first and most important steps for any investor or trader. However, with the increasing number of options available today, it can be difficult to sort through the variety and find the right fit.

To help ease this concern, our analysts have scoured various options to identify some of the best stock brokers in the market. We will review each of them individually and provide some additional information toward the end, so make sure to read until the conclusion to learn about picking the right stock broker this year.

Best Stock Broker 2024 – Top List

Here are the top stock brokers we identified during our research, which will be discussed further in the individual reviews:

- eToro: An innovative stock broker offering commission-free trading with social features, enabling users to follow and replicate the strategies of experienced traders seamlessly.

- Admiral Markets: A popular stock broker providing access to thousands of global stocks, with advanced tools and MetaTrader integration for a seamless trading experience.

- Trade Nation: Simplifies the trading process with fixed spreads and a transparent fee structure, making it appealing to those seeking clarity in their investments.

- XTB: Provides access to diverse markets and instruments, featuring proprietary xStation platforms that enhance trading precision and analysis for investors.

- Pepperstone: Focused on efficient stock trading, delivering ultra-fast order execution alongside tight spreads, catering to those who value speed and reliability.

- AvaTrade: Bridges education and trading, offering a wide variety of assets alongside resources designed to guide beginners and support seasoned investors alike.

- IG Markets: Boasting decades of experience, IG combines an extensive range of stocks with cutting-edge tools for an unmatched investment experience.

- Fidelity: A robust platform for stock investors, with additional offerings for long-term savings, retirement accounts, and in-depth market research.

- Interactive Brokers: Globally acclaimed for low-cost trading and expansive market access, it supports a range of assets with customizable tools for professionals.

- Merrill Edge: An accessible platform with strong ties to Bank of America, providing seamless integration of banking and investment features for users.

Best Stock Brokers in 2024 – Complete Review

Here is a more in-depth analysis of the stock brokers to help you choose the one that suits you best:

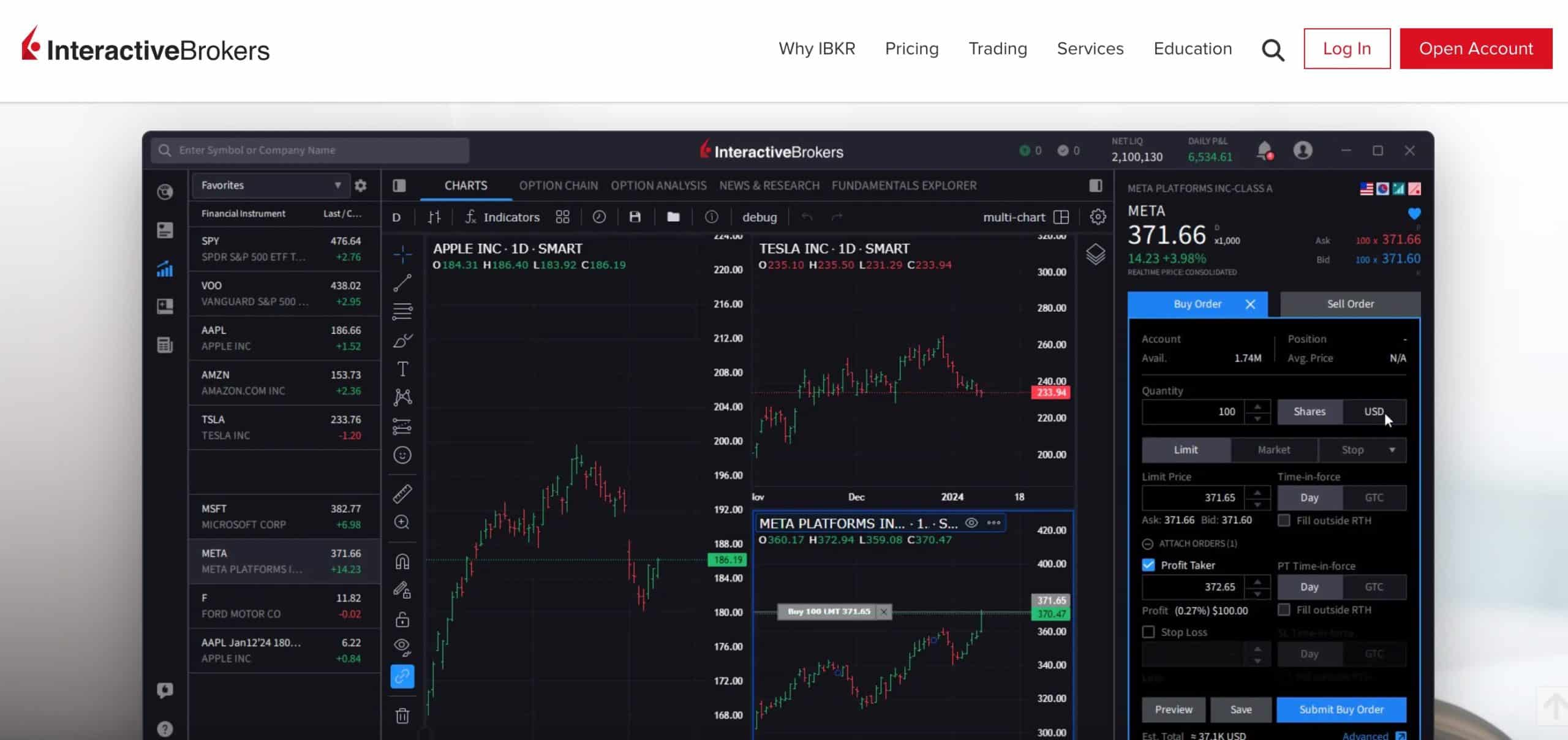

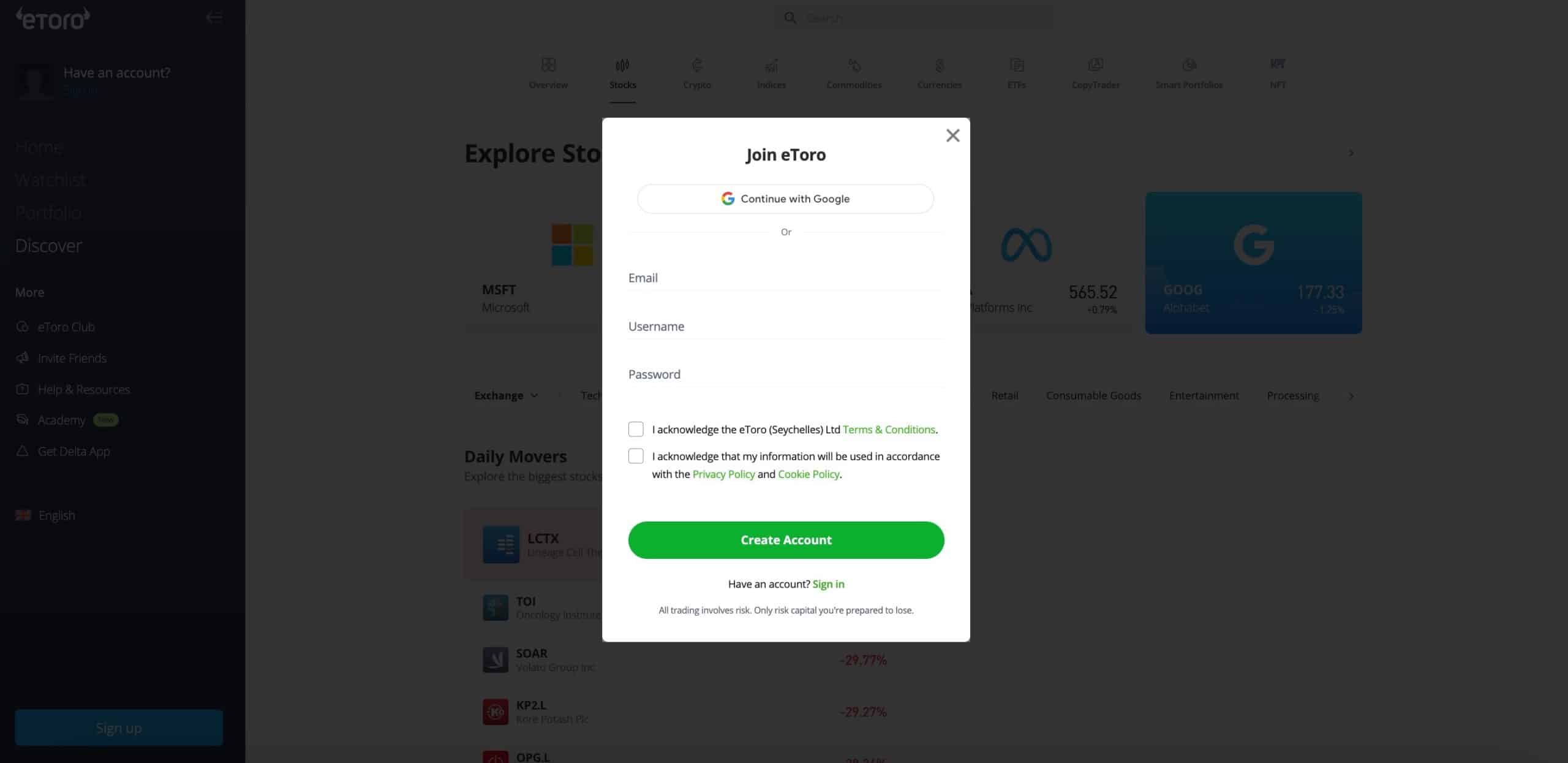

eToro – Best Stock Broker for Social Trading and Commission-Free Investing

eToro is a tech-centric stock broker that combines commission-free investing with innovative social trading features, making it a preferred choice for a wide range of investors. The platform’s hallmark feature, CopyTrader, enables users to mirror the strategies of successful traders in real time, offering a practical way for beginners to learn and experienced investors to diversify their strategies. With millions of users worldwide, eToro has built a vibrant and collaborative trading community.

Investors can access a broad selection of stocks, ETFs, and other assets, catering to diverse trading goals. The user-friendly interface ensures smooth navigation, while the platform’s design supports traders of all experience levels. For those who prefer passive investing, eToro’s Smart Portfolios offer pre-structured investment options focused on specific themes or sectors.

eToro also emphasizes education through its virtual portfolios and detailed resources. This makes it easier for beginners to gain confidence and refine their strategies before committing actual funds. The mobile app mirrors the desktop version in terms of efficiency and usability, allowing users to trade on the move without missing opportunities.

While the platform is accessible and user-friendly, it does have a few limitations. Withdrawal fees and currency conversion costs can be drawbacks, particularly for small-scale investors or those trading across multiple currencies. However, overall, the platform succeeds in positioning itself as one of the best stock brokers in 2024.

Pros

- Commission-free trades on stocks and ETFs

- CopyTrader enables strategy replication for beginners

- Easy-to-navigate interface suitable for all skill levels

Cons

- Withdrawal and conversion fees may impact smaller portfolios

Admiral Markets – Advanced Platform for Diversified Global Trading

Admiral Markets, rebranded as Admirals, is a well-established brokerage offering a comprehensive suite of trading options, including stocks, forex, commodities, indices, and ETFs. It provides traders access to global markets with tools tailored for precision and efficiency. The platform’s integration with the MetaTrader suite, particularly MetaTrader 4 and 5, makes it a go-to choice for those seeking detailed charting and technical analysis capabilities.

A noteworthy addition to its offerings is the MetaTrader Supreme Edition, an enhanced version of the software that incorporates custom tools and add-ons, helping users make better-informed decisions. Admirals also supports a flexible account structure, catering to varying experience levels and trading styles. Commission-free trading is available on select accounts, making it appealing for cost-conscious investors.

The platform includes an extensive array of educational resources, including webinars, tutorials, and in-depth market analysis. These features ensure traders, especially newcomers, have access to knowledge that helps them understand market trends and strategies.

Admiral Markets is regulated by trusted authorities such as the FCA and ASIC, lending credibility and ensuring compliance with high-security standards. Customer support is available via live chat, phone, and email, ensuring assistance is readily accessible. However, some users may find its inactivity fee a disadvantage, particularly those who trade infrequently.

- Wide selection of tradable instruments across global markets

- Integration with MetaTrader platforms, including the Supreme Edition

- Educational tools and market analysis accessible to all users

- Competitive fee structure with options for commission-free trading

- Regulated by leading financial authorities

- Inactivity fees could affect casual traders

- Support is not available 24/7

Trade Nation – Transparent Trading with Fixed Spreads

Trade Nation is a globally recognized stock broker that focuses on simplicity and transparency in trading. Established in 2014, it offers access to a variety of financial instruments, including forex, indices, commodities, and shares. One of its distinguishing features is its provision of fixed spreads, allowing traders to know their trading costs upfront, which is particularly beneficial in volatile markets.

The broker provides a proprietary trading platform known as Made to Trade, designed with user-friendliness in mind. This platform offers flexible charting tools and an intuitive interface, catering to both novice and experienced traders. Additionally, Trade Nation supports the popular MetaTrader 4 (MT4) platform, known for its advanced charting capabilities and automated trading options.

Trade Nation operates under the regulation of several reputable authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Securities Commission of The Bahamas (SCB). This multi-jurisdictional regulation enhances the broker’s credibility and provides clients with a sense of security.

The broker offers a loyalty program where traders earn points for their trading activity, which can be redeemed for cash rebates. This program incentivizes active trading and adds value for clients. Trade Nation also provides educational resources, including webinars and tutorials, to assist traders in making informed decisions.

Customer support is available through multiple channels, including live chat, email, and phone, ensuring that assistance is readily accessible when needed. The broker’s commitment to transparency is evident in its clear communication of fees and trading conditions, fostering trust among its clientele.

- Fixed spreads provide cost certainty

- User-friendly proprietary platform alongside MT4 support

- Regulated by multiple reputable authorities

- Loyalty program offers cash rebates

- Comprehensive educational resources

- Limited range of tradable instruments compared to some competitors

- Advanced traders may find the proprietary platform lacks certain features

XTB – Diverse Market Access with Advanced Trading Platforms

XTB is among the most popular brokerage firms, providing traders access to a wide array of financial instruments, including forex, commodities, indices, stocks, and ETFs. Established in 2002, XTB has built a reputation for reliability and innovation in the trading industry.

Top features of XTB include its proprietary trading platform, xStation 5, which offers an intuitive interface equipped with advanced charting tools, technical indicators, and real-time market data. This platform caters to both novice and experienced traders, providing a seamless trading experience across desktop and mobile devices. The mobile application ensures that traders can monitor and execute trades on the go without compromising functionality.

XTB offers a diverse range of tradable instruments, with over 5,800 CFD assets available, including real shares, cryptocurrencies, and ETFs. This extensive selection allows traders to diversify their portfolios and explore various markets. The broker also provides educational resources, such as webinars, tutorials, and market analysis, to support traders in making informed decisions.

In terms of fees, XTB maintains a competitive structure. The broker does not charge deposit or withdrawal fees for bank transfers above a certain threshold, and there is no minimum deposit requirement, making it accessible to traders with varying capital levels.

However, it’s important to note that there is an inactivity fee of £10 per month after 12 months of inactivity, which could be a drawback for less active traders.

XTB is regulated by several reputable authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the International Financial Services Commission (IFSC) of Belize. This multi-jurisdictional regulation enhances the broker’s credibility and provides clients with a sense of security.

- Access to a wide range of financial instruments

- Advanced proprietary trading platform with mobile compatibility

- Comprehensive educational resources and market analysis

- Competitive fee structure with no minimum deposit requirement

- Regulated by multiple reputable authorities

- Limited support for third-party platforms like MetaTrader

- Customer support availability may vary depending on location

Pepperstone – High-Speed Trading with Competitive Costs

Pepperstone is a broker that prioritizes efficiency, offering ultra-fast order execution and competitive trading conditions. Founded in 2010, the platform has become a go-to choice for those who value precision and speed, particularly in volatile markets. With a focus on forex and CFD trading, Pepperstone also provides access to other markets, including stocks, commodities, and cryptocurrencies.

The broker is well-regarded for its support of multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform caters to different trading preferences, providing flexibility for users. Whether it’s algorithmic trading, detailed technical analysis, or intuitive navigation, Pepperstone ensures its clients have the tools needed for successful trading.

Pepperstone’s fee structure is another highlight, with tight spreads and commission-based accounts designed to suit active traders. The Razor account, for example, offers spreads starting from 0.0 pips, paired with low commissions. This setup is particularly attractive for high-frequency traders who seek minimal costs per trade.

The broker is regulated by several leading authorities, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and Germany’s BaFin, providing assurance of security and compliance. Traders also benefit from negative balance protection, ensuring that market volatility doesn’t result in significant losses beyond deposited funds.

Pepperstone provides a range of educational materials, including market analysis and webinars, to support informed decision-making. However, some traders might find the limited variety of non-CFD instruments a drawback.

- Ultra-fast execution with tight spreads

- Support for multiple platforms, including MT4, MT5, and cTrader

- Razor account tailored for high-frequency trading

- Regulated by trusted financial authorities with negative balance protection

- Educational resources to assist traders

- Limited offerings outside of CFDs and forex

- Does not provide proprietary trading platforms

AvaTrade – Perfect for Learning and Trading Across Multiple Markets

AvaTrade has been serving traders since 2006, offering a well-rounded trading environment that combines intuitive platforms with access to various financial markets. Catering to both beginners and seasoned traders, it provides tools and features designed to simplify trading while offering room for growth and skill development.

One of AvaTrade’s most valuable aspects is its educational resources. From detailed webinars and tutorials to up-to-date market insights, the broker ensures traders are equipped with the knowledge they need to navigate the markets effectively. These resources make it particularly appealing to those new to trading, who may appreciate structured guidance as they learn.

Traders can choose from multiple platforms, including AvaTrade’s own WebTrader, the user-friendly AvaTradeGO mobile app, or the widely popular MetaTrader 4 and 5. These platforms cover a range of trading styles, offering flexibility whether you’re looking to trade from your desktop or on the go. AvaTradeGO stands out for its clean interface and streamlined mobile experience, making it ideal for quick trades and market tracking.

AvaTrade also boasts competitive fees, with commission-free trading and tight spreads, allowing for cost-effective transactions. However, inactivity fees after three months of no trading and annual charges for prolonged inactivity could be a downside for less frequent users.

The broker operates under strict regulations in multiple jurisdictions, including Ireland, Australia, and South Africa, ensuring a safe trading environment for its clients. This commitment to security and transparency enhances the overall reliability of the platform.

- Broad selection of trading platforms, including mobile options

- Commission-free trading with competitive spreads

- Extensive educational materials for beginner traders

- Regulated in multiple regions, ensuring security and reliability

- User-friendly interface across platforms

- Inactivity fees may impact casual traders

- Advanced features might not satisfy professional traders

IG Markets – Extensive Market Access and Advanced Tools

IG Markets, founded in 1974, is a veteran in the brokerage space and a trusted platform for trading a vast range of financial instruments. With access to over 17,000 markets, including stocks, forex, commodities, indices, and cryptocurrencies, it caters to traders looking for diverse opportunities across global markets. Its long-standing reputation and global presence make it a popular choice for both new and experienced traders.

The platform’s proprietary trading software offers an intuitive design, combined with advanced charting tools and market analysis features. For traders who prefer flexibility, IG also integrates with MetaTrader 4 (MT4), one of the most widely used platforms globally. This combination of in-house and third-party options ensures a seamless trading experience tailored to individual preferences.

IG Markets also provides a wealth of educational resources, making it easier for beginners to get started. From interactive tutorials and webinars to in-depth market analysis and signals, users can enhance their skills and stay informed about market trends. For those who want to practice their strategies, the demo account is a useful feature that allows risk-free learning.

The broker maintains competitive fees, offering tight spreads across most instruments. However, inactivity fees may affect traders who do not use their accounts regularly. IG is regulated by reputable authorities, including the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC), ensuring security and transparency for users.

- Wide range of markets and financial instruments

- Intuitive proprietary platform with MT4 integration

- Rich educational content, including webinars and tutorials

- Demo account for risk-free practice

- Regulated by top-tier financial authorities

- Limited support for some niche instruments

- Features may seem overwhelming for beginners

Fidelity – Comprehensive Investment Services with Robust Research Tools

Fidelity Investments, established in 1946, is a leading financial services firm offering a wide array of investment options, including stocks, bonds, mutual funds, ETFs, and retirement accounts. Its extensive range of services caters to both novice and seasoned investors, providing tools and resources to support informed decision-making.

One of Fidelity’s standout features is its commitment to low-cost investing. The firm offers zero-expense-ratio index funds and commission-free trading for online U.S. stocks, ETFs, and options, making it an attractive option for cost-conscious investors.

Fidelity’s trading platforms are designed to accommodate various investor needs. The web-based platform is user-friendly, offering intuitive navigation and comprehensive research tools. For active traders, the Active Trader Pro platform provides advanced charting capabilities, real-time alerts, and customizable dashboards, enhancing the trading experience.

The firm places a strong emphasis on research and education, providing investors with access to a wealth of resources, including market analysis, webinars, and investment tutorials. These tools empower investors to make informed decisions and develop effective investment strategies.

Customer service is another area where Fidelity excels. With 24/7 support via phone, live chat, and a network of physical branches, investors have multiple avenues to seek assistance. This comprehensive support system ensures that help is readily available when needed.

While Fidelity offers a broad spectrum of services, some investors may find the platform’s extensive features overwhelming. Additionally, certain advanced trading tools may require a learning curve for those new to investing.

- Zero-expense-ratio index funds and commission-free trading

- Advanced trading platforms catering to various investor needs

- Extensive research and educational resources

- 24/7 customer support with access to physical branches

- Comprehensive range of investment options

- Extensive features may be overwhelming for beginners

- Advanced trading tools may require a learning curve

Interactive Brokers – Ideal for Sophisticated Traders with Global Reach

Interactive Brokers, also known as IBKR, is a top-tier brokerage catering to both casual investors and professional traders, offering access to over 150 markets worldwide. With its global reach, IBKR enables clients to trade a wide range of assets, including stocks, forex, commodities, bonds, ETFs, and more, across multiple regions, making it a prime choice for those seeking diversified opportunities.

The broker provides two account types: IBKR Lite, tailored for casual investors with commission-free trading on U.S. stocks and ETFs, and IBKR Pro, which appeals to active and institutional traders with tiered pricing and lower costs for high-volume trading. Its low margin rates add another layer of appeal for those who use leverage to enhance their positions.

Interactive Brokers’ flagship Trader Workstation (TWS) is an advanced platform designed to meet the needs of professional traders, offering detailed charting tools, algorithmic trading capabilities, and extensive customization options. For those seeking simpler interfaces, the Client Portal and IBKR Mobile provide streamlined, intuitive access to account management and trading features on the go.

In addition to its trading platforms, IBKR offers robust research tools, including access to analyst reports, market insights, and live news feeds. Its educational resources, available through the IBKR Campus, include tutorials, webinars, and guides, making the platform suitable even for those still learning the ropes.

However, with its vast array of tools and features, Interactive Brokers can feel overwhelming for beginners. The steep learning curve might discourage less experienced users, and while the broker offers extensive support, some traders may find customer service less accessible compared to others in the industry.

- Access to over 150 global markets and diverse asset classes

- Competitive pricing, including low-margin rates and commission-free trading for U.S. stocks

- Advanced trading tools via Trader Workstation, with mobile and web-friendly alternatives

- Comprehensive research tools and educational materials

- Strong regulatory oversight ensuring a secure trading environment

- Complex interface may not be beginner-friendly

- Some users may find customer support availability limited

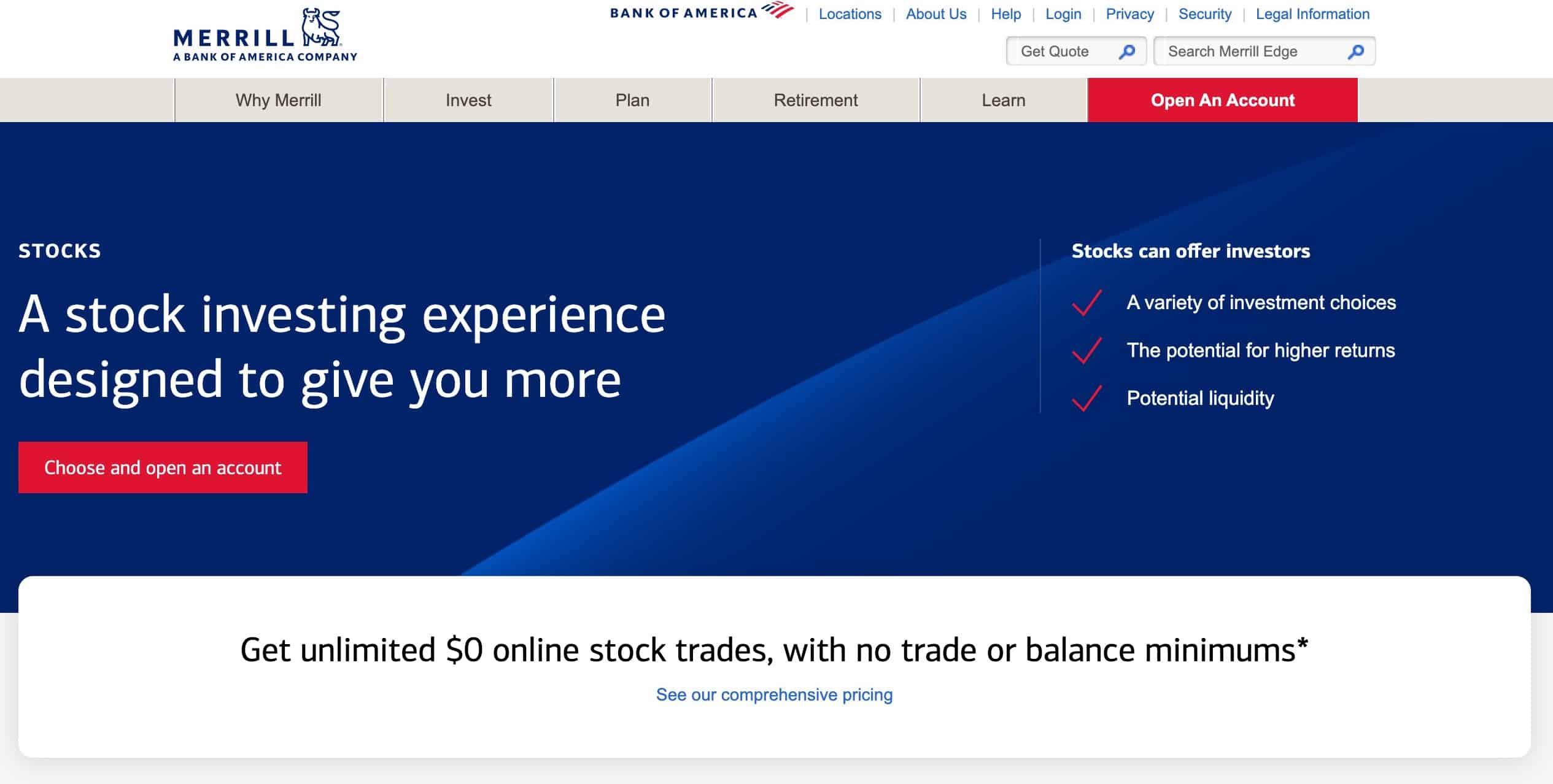

Merrill Edge – Offers Integrated Banking and Investment Services

Merrill Edge, a subsidiary of Bank of America, offers a seamless integration of banking and investment services, providing a unified platform for managing finances. This integration allows clients to effortlessly transition between their banking and investment accounts, streamlining financial management.

The platform caters to a wide range of investors, from beginners to seasoned traders. It offers commission-free trading for stocks and ETFs, making it an attractive option for cost-conscious investors. Additionally, Merrill Edge provides access to a variety of investment products, including mutual funds, bonds, and options, allowing for diversified portfolio building.

Merrill Edge’s research tools are robust, offering insights from Bank of America’s Global Research team, as well as third-party providers like Morningstar. These resources assist investors in making informed decisions by providing comprehensive market analyses and reports.

The platform’s user interface is intuitive, featuring customizable dashboards and real-time data feeds. For active traders, Merrill Edge offers the MarketPro platform, which includes advanced charting tools and streaming market data, enhancing the trading experience.

Customer support is a strong point for Merrill Edge, with 24/7 access to financial advisors via phone, chat, or in-person consultations at Bank of America branches. This accessibility ensures that clients receive timely assistance and personalized advice when needed.

However, Merrill Edge does have some limitations. The platform does not support fractional share trading, which may be a drawback for investors looking to purchase partial shares of high-priced stocks. Additionally, while the platform offers a range of investment options, it lacks access to certain alternative investments, such as cryptocurrencies and futures.

- Seamless integration with Bank of America accounts

- Commission-free trading for stocks and ETFs

- Access to comprehensive research tools and reports

- User-friendly interface with advanced trading features

- 24/7 customer support with in-person consultation options

- No support for fractional share trading

- Limited access to alternative investments like cryptocurrencies and futures

How Does a Stock Broker Work?

A stock broker acts as a middleman between you and the stock market, enabling you to buy and sell shares of publicly traded companies. Think of a stock broker as a bridge connecting investors to the stock exchange, where all the trading happens.

Without a broker, accessing the stock market directly would be nearly impossible for individual investors due to the technical and regulatory requirements involved.

Imagine you want to buy a piece of a company, say “Google,” because you believe its value will increase over time. Instead of calling the company directly to purchase shares, you turn to a stock broker. You tell the broker, “I want to buy 10 shares of Google,” and the broker makes this transaction happen for you.

They find a seller willing to sell 10 shares at the current market price and complete the trade on your behalf.

Behind the scenes, a stock broker operates through advanced trading systems connected to stock exchanges like the NYSE, NASDAQ, or other global markets. These systems execute orders almost instantly. Modern brokers often rely on electronic trading platforms that use sophisticated algorithms to match buy and sell orders efficiently.

There are two primary types of brokers:

- Full-Service Brokers: Offer personalized advice, portfolio management, and research but usually charge higher fees.

- Discount Brokers: Focus on executing trades at lower costs but provide limited advisory services.

Most brokers today also provide online platforms or mobile apps, making trading accessible to anyone with an internet connection. These platforms have stock alerts, display live stock prices, charts, and analytics, helping investors make informed decisions.

When you place a trade through an online broker, your order is sent to the stock exchange electronically. The exchange matches your buy or sell order with someone willing to sell or buy at the price you’ve specified. Once matched, the transaction is confirmed, and the shares are transferred to your account, while the payment is deducted or credited accordingly.

Now, let’s say you want to sell these shares after a year because their value has gone up. Again, you inform the broker, and they handle the process of finding a buyer and executing the sale. In both cases, the broker facilitates the trade, ensuring you can seamlessly invest in or divest from the stock.

How Did We Choose the Best Stock Brokers?

Selecting the best stock brokers requires evaluating critical factors that impact the overall trading and investing experience. Here’s how we chose the brokers featured in this list:

Access to Markets

The brokers we selected are international platforms with access to multiple markets. While some may not be available in every region, they allow investors to trade across various global markets from a single account.

This enables users to diversify their investments beyond local markets, exploring opportunities in regions such as the U.S., Europe, Asia, and more. The ability to access multiple markets through one avenue empowers investors to broaden their portfolios and capitalize on global economic trends seamlessly.

Security and Trust

All brokers on this list have established a reputation for trustworthiness over the years. They are well-known in the industry for maintaining high standards of safety and reliability. Unlike platforms that may face legal trouble for mismanagement or fraudulent activities, these brokers have avoided such controversies.

Even in cases of minor disputes or lawsuits, they were resolved without compromising the security or funds of investors. This level of trust ensures peace of mind, making them reliable choices for both new and experienced traders.

Regulatory Compliance

Regulation is a key indicator of a broker’s legitimacy, and all the brokers included here adhere to strict regulatory standards in the regions where they operate. Compliance with reputable legal authorities ensures that they meet industry standards for safety, transparency, and fairness.

Platforms lacking strong regulatory oversight are at higher risk of operational issues, potentially leaving investors vulnerable. With these brokers, users can trade confidently, knowing that their funds and personal information are safeguarded.

Fees and Commissions

While fees and commissions vary across brokers, all platforms in our list are competitively priced. Some may charge slightly higher fees than others, but these costs are often justified by the robust security, innovative features, and additional services provided.

Many of these brokers offer loyalty benefits or account tiers that further reduce costs for regular users. Investors can enjoy a good balance between affordability and premium features, making these brokers suitable for a wide range of trading budgets.

Innovative Features

Each broker on our list offers a blend of innovative and trending features designed to enhance the trading experience of users. From advanced charting tools and real-time analytics to social trading and automated investment options, these platforms keep users at the forefront of modern trading.

These features simplify complex strategies and help investors make informed decisions, staying competitive in the ever-evolving financial markets.

Types of Stock Broker Platforms

Stock broker platforms come in various forms, catering to the diverse needs and preferences of investors. Below are the main types of stock broker platforms and the range of assets they typically support.

Full-Service Platforms

Full-service platforms offer a comprehensive range of investment services, including personalized financial advice, portfolio management, and research tools. These platforms are ideal for investors who prefer a hands-off approach or need professional guidance.

Assets Supported: Stocks, ETFs, mutual funds, bonds, commodities, real estate investment trusts (REITs), and sometimes options.

Discount Platforms

Discount platforms focus primarily on executing trades at low costs, without the additional services provided by full-service brokers. They are favored by self-directed investors who prefer managing their investments independently.

Assets Supported: Stocks, ETFs, options, and occasionally forex or cryptocurrencies, depending on the broker.

Proprietary Platforms

These are platforms built and maintained by the broker itself, offering a tailored user experience with features specifically designed for their clients. Proprietary platforms often come with unique tools or innovations to enhance trading.

Assets Supported: Varies by broker but typically includes stocks, ETFs, mutual funds, and options, with some supporting forex, commodities, or crypto.

Third-Party Platforms

Third-party platforms like MetaTrader or TradingView are used by brokers who don’t develop their own software. These platforms provide advanced tools for technical analysis and automated trading, appealing to professional or experienced traders.

Assets Supported: Forex, commodities, CFDs, indices, and sometimes stocks or ETFs, depending on the broker’s offerings.

Mobile-First Platforms

Mobile-first platforms are designed for users who prefer to trade or invest via smartphones or tablets. They offer simplified interfaces and easy access to key features while retaining core functionalities.

Assets Supported: Stocks, ETFs, and mutual funds, with some including crypto and forex.

Range of Assets Supported

Modern stock broker platforms support a wide variety of asset classes, depending on their target audience and focus. Here’s a general overview of the types of assets typically available across different platforms:

- Equities: Stocks and ETFs form the backbone of most platforms, providing access to company shares and market-tracking funds.

- Fixed Income: Bonds, including corporate, government, and municipal, are supported on many full-service and proprietary platforms.

- Commodities: Gold, silver, oil, and other commodities are often available, particularly on platforms supporting futures or CFDs.

- Forex: Currency pairs are accessible on platforms geared toward forex traders.

- Options and Derivatives: Platforms targeting active or experienced traders frequently include options and derivatives.

- Cryptocurrencies: Increasingly popular, crypto is supported on some discount and proprietary platforms.

- Mutual Funds: Common on full-service and discount platforms for long-term investors.

Most platforms support at least 3–5 types of assets, but advanced platforms, particularly those with multi-market access, can offer 7–10 asset classes, ensuring diversification opportunities for all types of investors.

Things to Remember Before Investing or Trading With a Stock Broker

Choosing the right stock broker is a critical step, but there are several factors to keep in mind before you start investing or trading. Here are key points to consider:

Understand the Risks

Buying stocks inherently involve risks, including the possibility of losing your capital. Before diving in, assess your risk tolerance and understand the nature of the markets you’re entering. Markets can be volatile, and even with the best broker, you may face losses if trades don’t go as planned. Ensure you have a clear strategy in place and avoid risking money you cannot afford to lose.

Educate Yourself

While brokers often provide tools and resources, having a foundational understanding of trading and investing is essential. Take time to research and learn basic concepts like market orders, portfolio diversification, and risk management.

Look for brokers that offer educational resources, such as tutorials, webinars, and demo accounts, which can help you gain hands-on experience without risking real money.

Find the Right Fit

Not all brokers suit every investor or trader. Evaluate your needs—do you require personalized advice or prefer a self-directed approach? Are you looking for advanced trading tools or simple, cost-effective platforms?

The right broker for an active day trader may differ significantly from one suitable for a long-term investor. Assess the broker’s features and services to ensure they align with your investment goals.

Be Mindful of Fees

Fees can significantly impact your profits, especially for frequent traders. Research the broker’s fee structure, including commissions, spreads, account maintenance fees, and hidden charges like inactivity fees.

While some brokers offer commission-free trading, others may justify higher fees with premium features or enhanced security. Choose a broker whose pricing is transparent and aligns with your budget.

Evaluate the Broker’s Features

Look at the platform’s tools and capabilities. Does it offer alternative data services, advanced charting, or research tools? For beginners, features like educational materials and simple interfaces are crucial, while advanced traders may prioritize automation and technical analysis tools. Consider whether the broker provides access to the markets or asset classes you want to trade.

Start Small

When beginning with a new broker, it’s wise to start with a small deposit or a limited number of trades. This allows you to familiarize yourself with the platform and its processes without committing too much capital upfront. As you gain confidence, you can gradually increase your investments.

How To Get Started With a Stock Broker?

Most stock brokers have a similar process to follow for buying stocks or trading. To help you understand, we shall take eToro, our recommended stock broker, and walk you through the entire process of registering to buying a stock:

Step 1: Register an Account

To get started, visit eToro’s official website and click the “Join Now” button. This will open the registration form where you’ll need to provide basic details like your full name, email address, username, and password. If you prefer, you can use Google or Facebook to sign up quickly. Once you’ve completed this, agree to eToro’s terms and conditions to proceed.

Step 2: Verify Your Identity

After registering, eToro will ask you to verify your account. This involves completing your profile with details like your date of birth, address, and phone number. You’ll need to upload a government-issued ID, such as a passport or driver’s license, along with proof of address, like a utility bill or bank statement.

Additionally, you’ll answer a short questionnaire about your trading experience and investment goals. This step is essential to comply with regulatory requirements and tailor the platform’s offerings to your needs.

Step 3: Fund Your Account

Once your account is verified, the next step is to add funds. eToro supports various deposit methods, including credit/debit cards, bank transfers, and popular e-wallets like PayPal. Select your preferred payment method, specify the amount you wish to deposit, and follow the instructions to complete the process.

Step 4: Explore the Platform

Before diving into trading, take some time to familiarize yourself with eToro’s features. The dashboard includes a watchlist, live news feed, and market overview. If you’re new to investing, use the demo account that comes with $100,000 in virtual funds to practice trading without any financial risk.

Step 5: Purchase Your First Stock

To buy your first stock, search for the company you’re interested in using the search bar at the top of the platform. For instance, typing “Tesla” will take you to Tesla Inc.’s stock page. Here, you’ll find detailed information, including real-time prices, charts, and relevant news. Click the “Trade” button to open the trading window.

In the trading window, specify the amount you want to invest. With eToro, you can also invest in fractional shares, meaning you don’t have to buy a full share. For example, you could invest $50 in Amazon even if the stock price is much higher.

Set your leverage to “X1” to invest in the actual stock rather than trading it as a CFD. If you want, you can also set stop-loss or take-profit limits to manage your position automatically. Once everything is ready, click “Open Trade” to finalize your purchase.

Step 6: Monitor Your Investment

After buying your stock, you can track its performance in the “Portfolio” section. Here, you’ll see your open positions, gains or losses, and other details in real-time. If needed, you can adjust stop-loss and take-profit settings or close your position at any time.

Conclusion

A huge number of investors or traders may find it difficult to find the right fit for them when it comes to choosing a stock broker. Some may be more suited for advanced investors, while others may be for beginners.

Knowing what fits best and choosing such a platform is important to be able to have a seamless investing and trading experience. Our list consists of a variety of options that any investor may be able to navigate and use easily.

Our most recommended option, however, is eToro, with its mix of social trading features and a user-friendly interface, making it a perfect fit for traders and investors of all experience levels.

FAQs

What are the main types of stock broker platforms?

The main types include full-service, discount, proprietary, third-party, and mobile-first platforms.

What assets do stock brokers typically support?

Stock brokers typically support stocks, ETFs, mutual funds, bonds, commodities, forex, options, and cryptocurrencies.

What are the risks of investing in stocks?

The risks include potential capital loss due to market volatility and unexpected economic changes.

Are brokers like eToro regulated?

Yes, eToro is regulated by authorities such as the FCA and CySEC to ensure security and compliance.