Alternative data is revolutionizing how industries access timely, actionable insights. From satellite imagery to social sentiment analysis, these top 10 providers deliver cutting-edge solutions. Explore how they empower smarter strategies across finance, real estate, and beyond.

Top 10 Alternative Data Providers

Here’s a quick overview of the best alternative data providers and what makes them stand out.

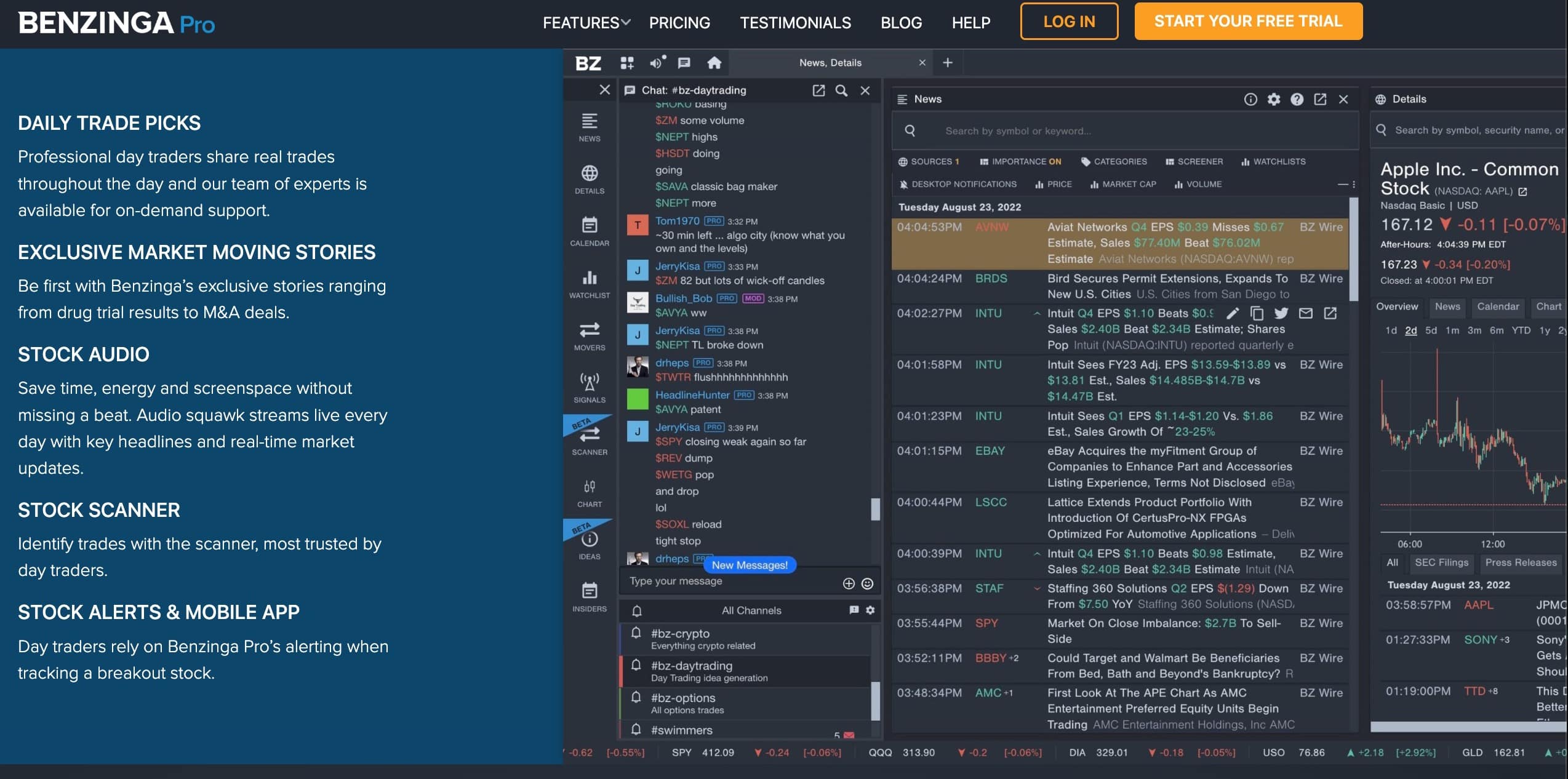

- Benzinga Pro: Benzinga Pro offers real-time market news, sentiment analysis, and tools like a squawk box for breaking updates. It’s ideal for active traders looking to capitalize on actionable insights in stocks, options, and financial markets.

- AltIndex: AltIndex provides alternative data for stocks and cryptocurrencies, including social sentiment metrics, job postings, and patents. With an AI-backed ranking system and beginner-friendly pricing, it’s perfect for new investors seeking insightful metrics.

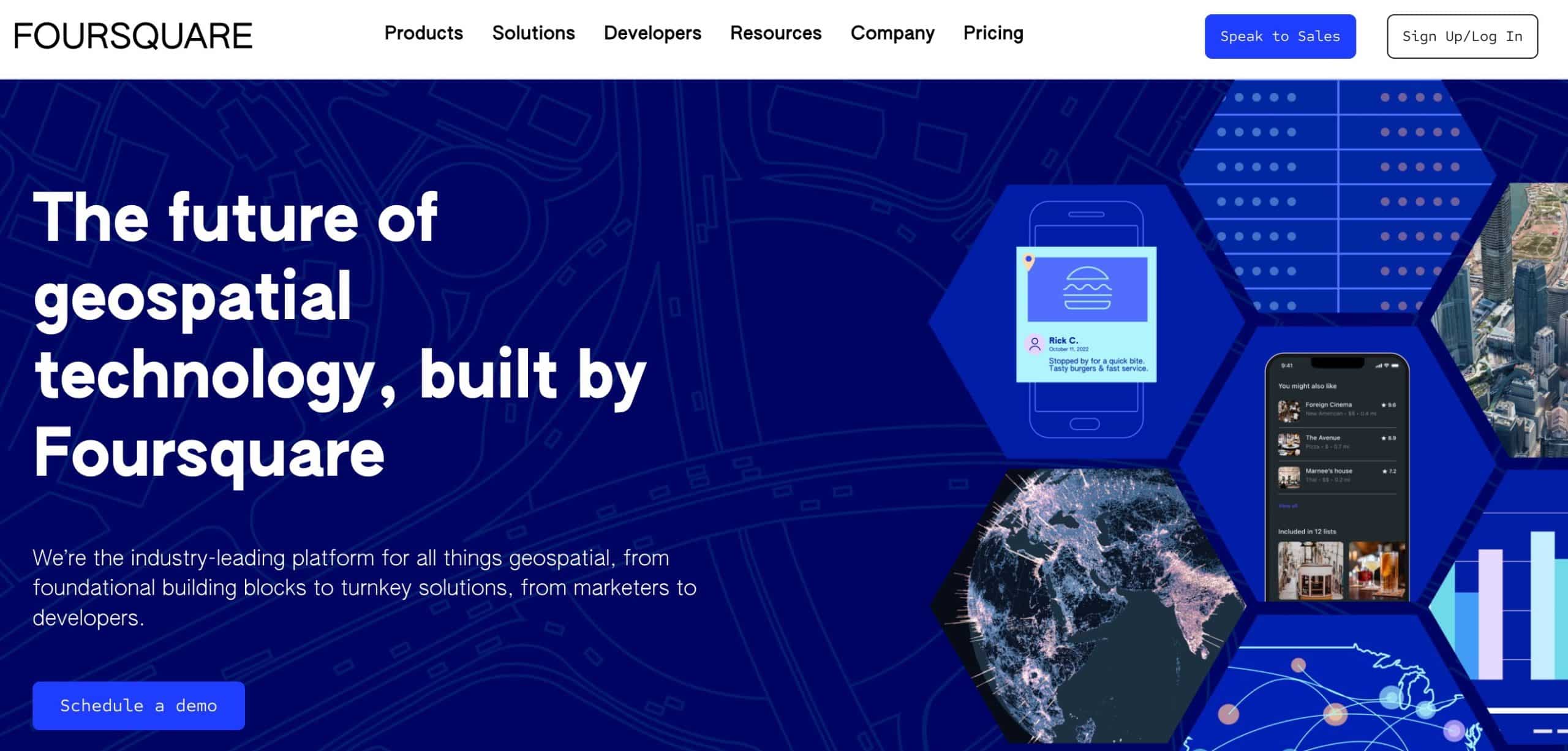

- Foursquare: Foursquare specializes in geolocation data, offering insights into foot traffic and customer behavior. It’s an excellent choice for retail businesses and real estate investors analyzing trends and competitor performance.

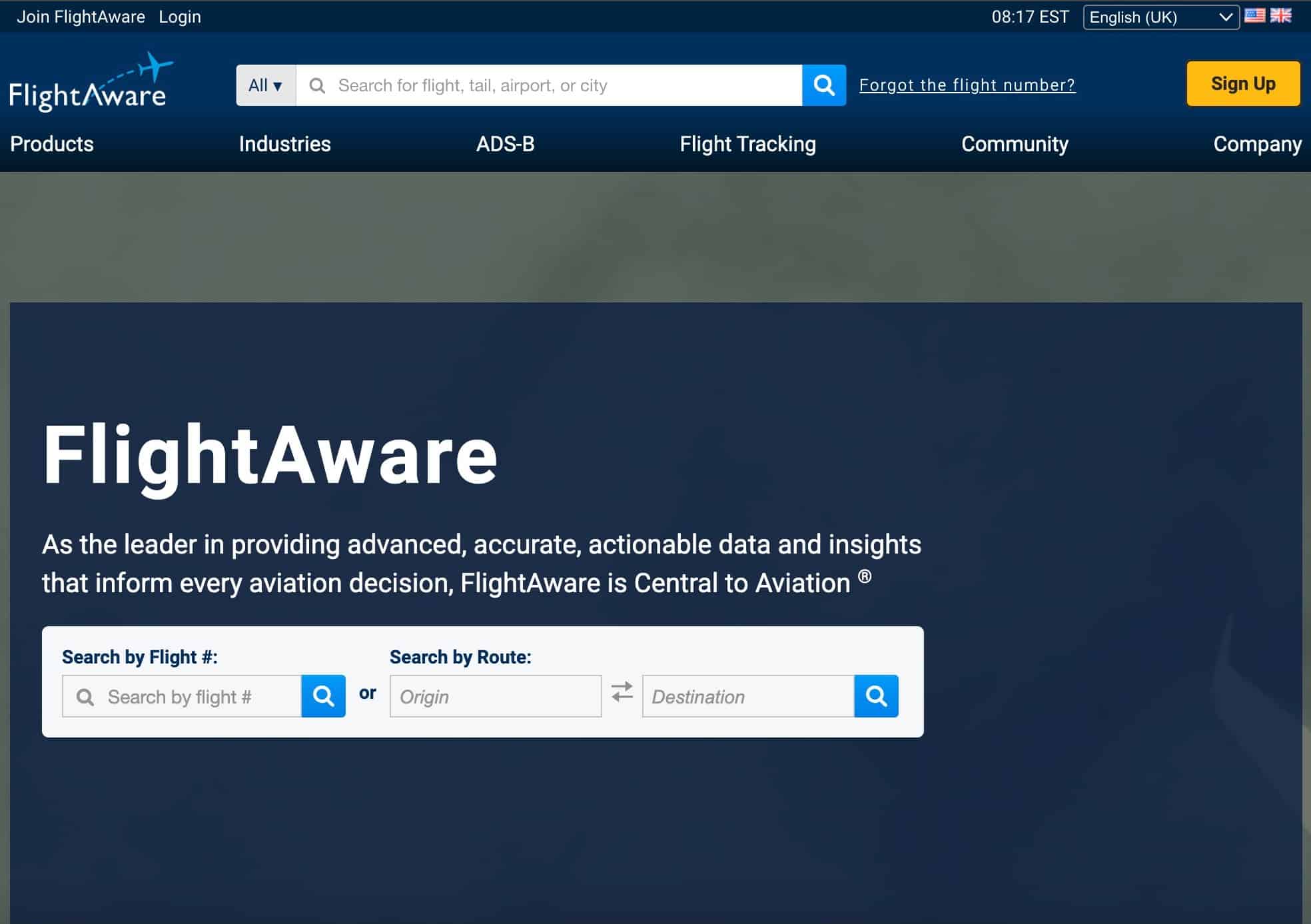

- FlightAware: FlightAware tracks global aviation traffic with real-time updates on flights, delays, and routes. Its predictive analytics and interactive maps make it invaluable for logistics, aviation, and supply chain industries.

- Plaid: Plaid bridges fintech apps with financial institutions, offering secure transaction data and spending insights. It’s a trusted tool for fintech startups and investors exploring consumer spending trends.

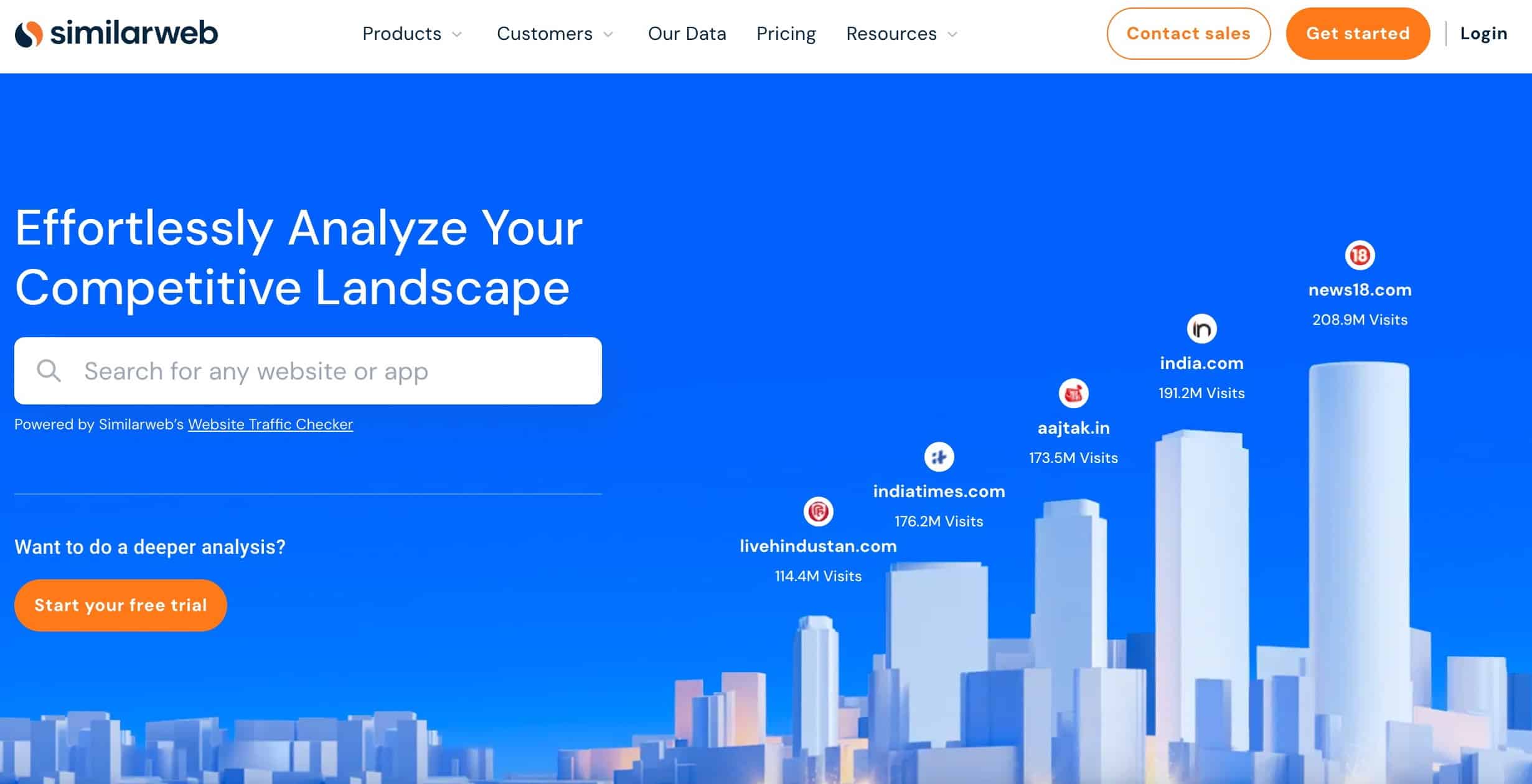

- Similarweb: Similarweb excels in digital performance analytics, providing data on web traffic, market share, and competitive benchmarks. Marketers and investors can leverage its insights for SEO strategies and trend forecasting.

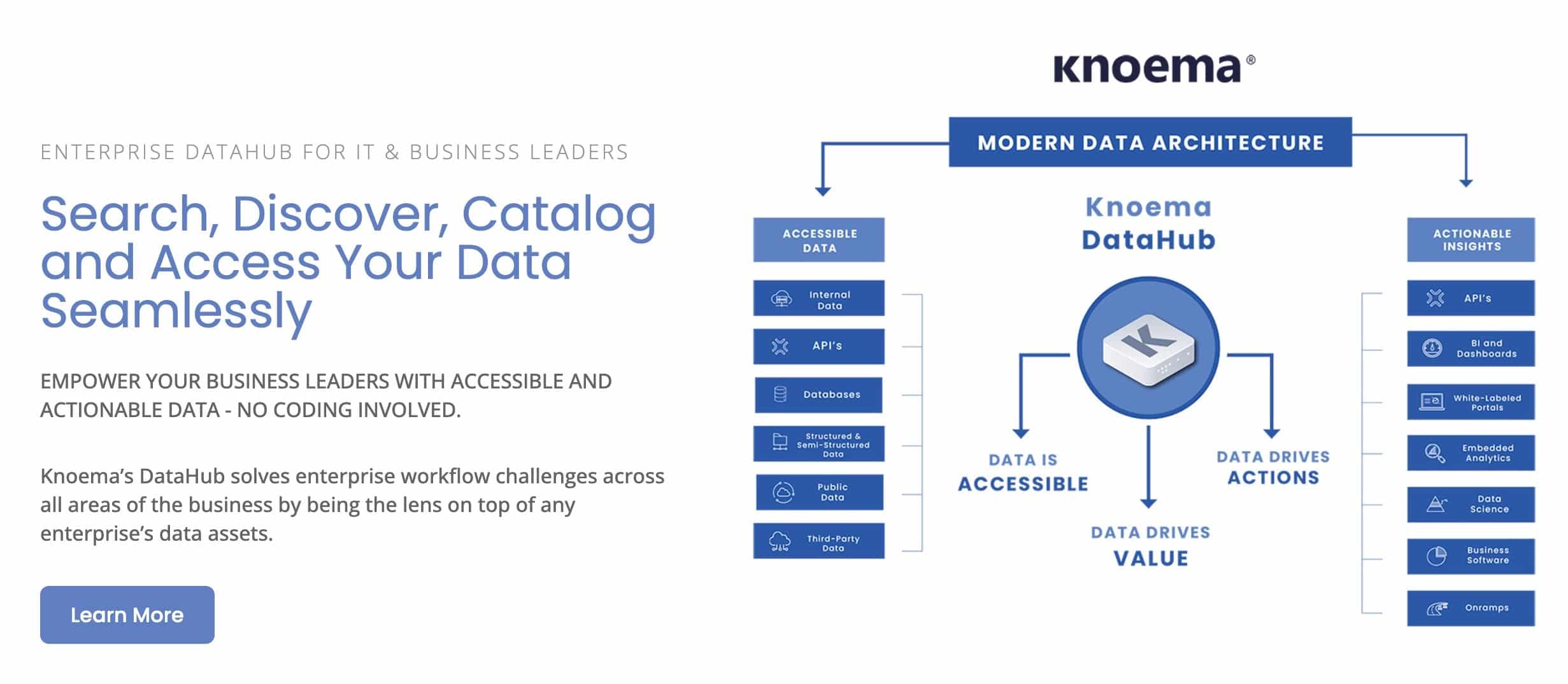

- Knoema: Knoema aggregates global datasets on economics, demographics, and industries. Its visualization tools and vast database make it a go-to platform for policymakers, researchers, and market analysts.

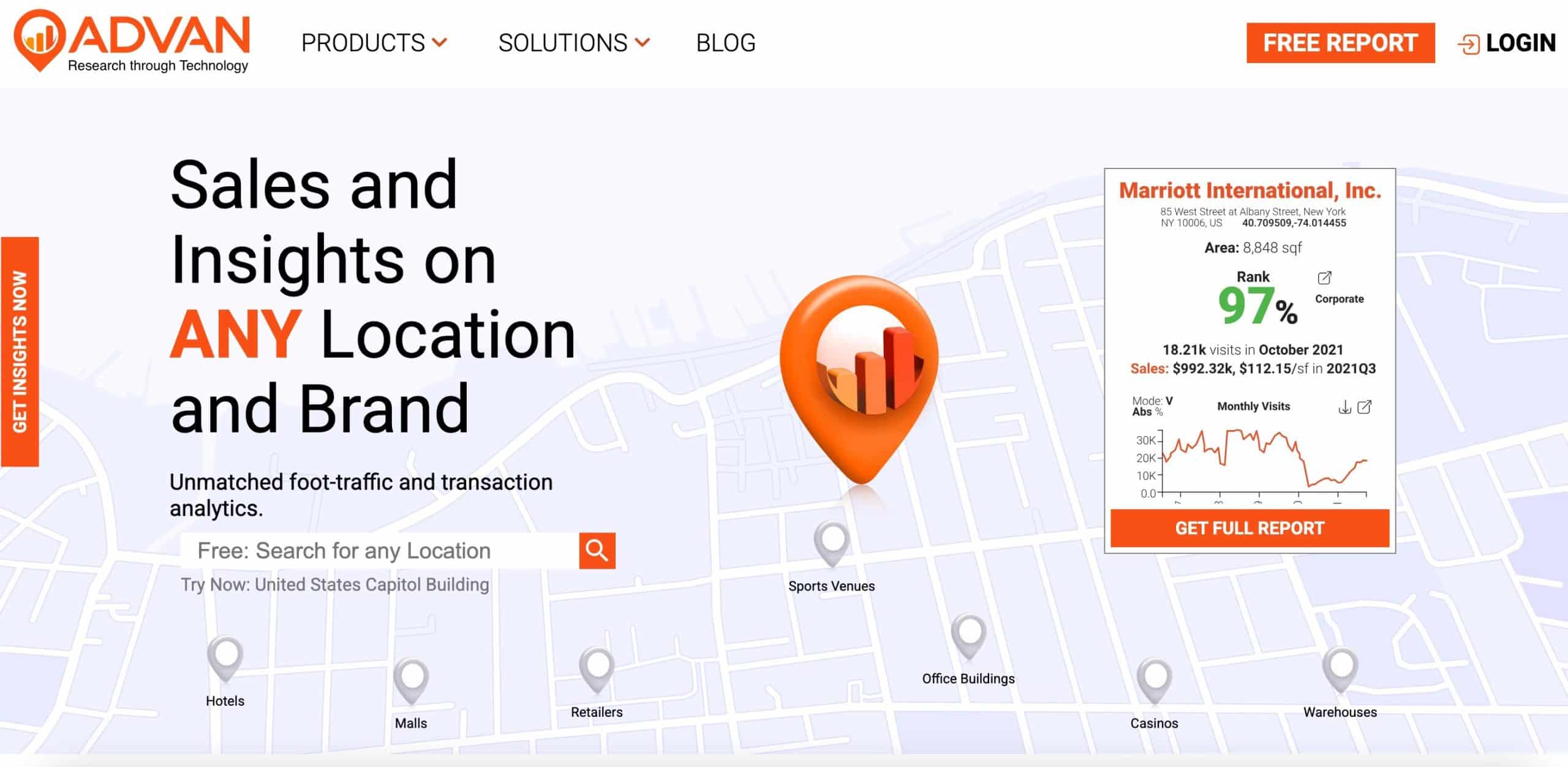

- Advan: Advan focuses on foot traffic analytics, delivering insights into consumer behavior and location trends. It’s a powerful tool for retail and real estate professionals to optimize site selection and performance.

- Descartes Labs: Descartes Labs uses satellite imagery and machine learning to analyze agriculture, energy, and commodities. Its environmental monitoring and predictive models are essential for ESG investments and supply chain forecasting.

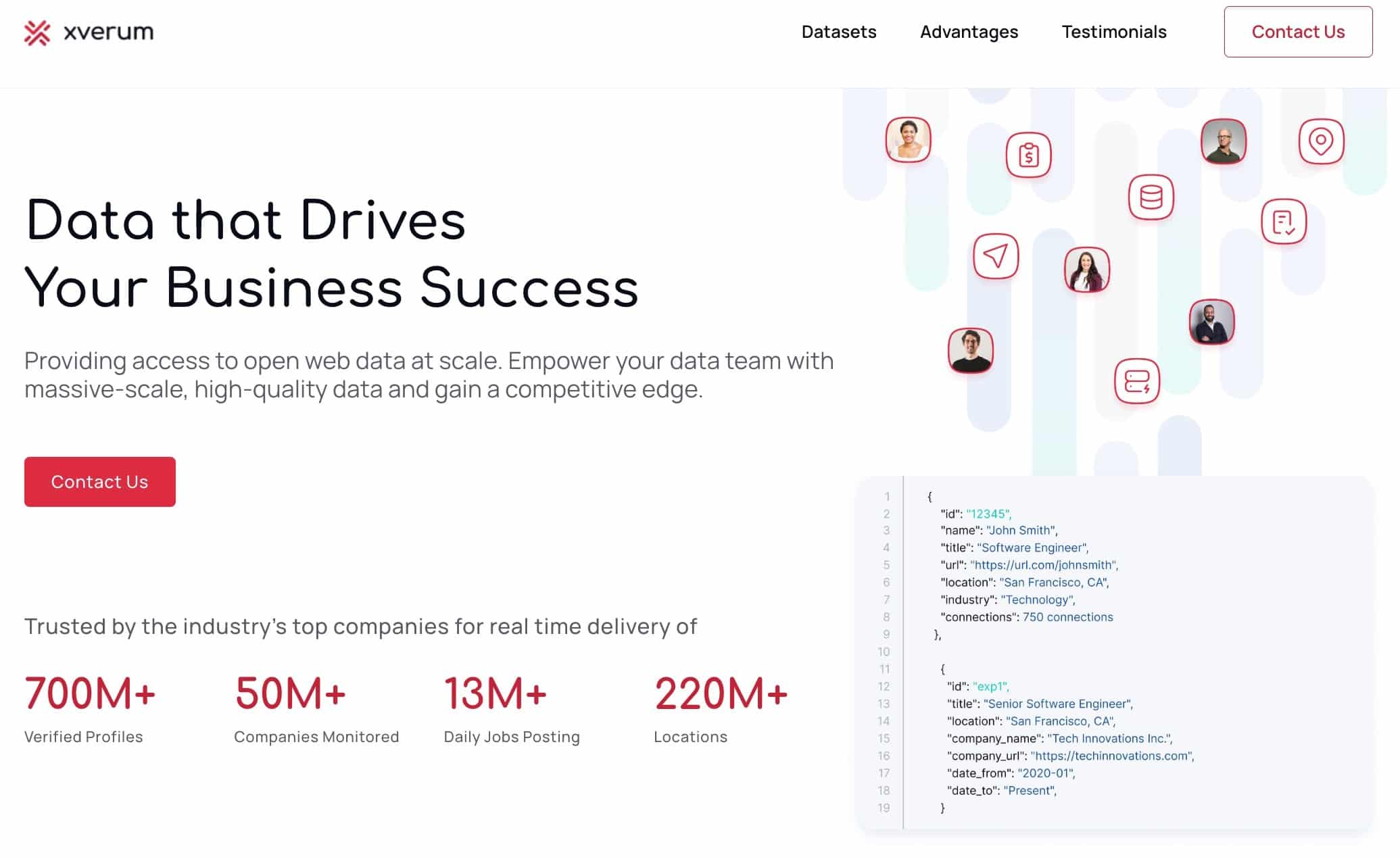

- Xverum: Xverum provides detailed B2B and demographic data, helping businesses analyze market trends and consumer profiles. Its segmentation and visualization tools ensures strategic decision-making across various industries.

Top Alternative Data Providers Unveiled

The platforms reviewed here excel in delivering diverse alternative data, ranging from satellite imagery and aviation metrics to web traffic insights and financial transaction trends.

Explore how these providers can transform decision-making across industries like finance, real estate, and retail.

1. Benzinga Pro – Best for Real-Time Market News and Insights

Benzinga Pro is an excellent choice for traders who prioritize speed and actionable insights. It provides real-time market news, making it a go-to platform for active traders seeking alternative datasets. Benzinga Pro’s platform caters to investors by offering data-driven insights on stocks, options, and the broader financial markets.

This includes insider trades, unusual options activity, and analyst ratings. These features help traders identify trends and opportunities before they become widely recognized. The platform is particularly effective for spotting news catalysts that drive significant market movements, giving users a competitive edge in timing their trades.

A standout feature of Benzinga Pro is its real-time squawk box. This audio stream ensures users never miss breaking news that could impact their trades. Additionally, the platform offers a range of filters and customization tools to refine search results, ensuring users can focus on the data that matters most to them. For example, traders can filter news by sector, market cap, or specific ticker symbols.

Benzinga Pro also includes tools like sentiment analysis, which provides a quick view of whether a news story is likely to positively or negatively impact a stock. This makes it easier for traders to act decisively in volatile markets. Another key feature is the platform’s unusual options activity feed, which highlights significant trades and potential market anomalies.

The platform offers a tiered pricing structure. The Basic plan starts at $37 per month, providing essential news alerts and access to the squawk box. The Essential plan, at $197 per month, adds advanced features like sentiment analysis, unusual options activity, and insider trade alerts. For power users, the Streamlined plan offers API access and enterprise-level data for a customized experience.

While Benzinga Pro is highly comprehensive, the cost may be prohibitive for casual investors. However, for active traders who require real-time data and insights, the platform offers exceptional value.

Pros

- Best for real-time news and actionable insights

- Unique features like squawk box and unusual options activity feed

- Customizable filters for tailored data analysis

- Sentiment analysis tools for quick decision-making

- API access available for advanced users

Cons

- Higher cost compared to some competitors

- Advanced features locked behind premium plans

2. AltIndex – Best Alternative Data Platform for Beginners

AltIndex provides a user-friendly introduction to alternative data, making it an excellent choice for beginners. Unlike many competitors, AltIndex offers a free plan that includes access to essential metrics for stocks and cryptocurrencies. This positions it as one of the best AI-powered stock-picking platforms for those new to investing.

AltIndex aggregates thousands of data points to help users make informed decisions. For instance, investors can analyze social metrics such as website traffic, Google search trends, and social media mentions. This data offers valuable insights into the sentiment surrounding specific stocks or cryptocurrencies.

A key feature of AltIndex is its focus on social metrics. The platform tracks mentions across platforms like Reddit, Facebook, and Twitter, giving users real-time insights into trending assets. For example, a stock with a surge in Reddit mentions may indicate growing investor interest, which AltIndex conveniently visualizes for easy comparison across industries.

Another standout feature is AltIndex’s job postings tracker, which highlights companies actively hiring—often a sign of growth or innovation. The platform also includes patent information, enabling users to discover firms developing new technologies or products.

AltIndex’s AI-backed ranking system further simplifies data interpretation. It compiles all available metrics into a single score, highlighting trending assets at a glance. While the free plan has limitations, such as a maximum of two stock alerts per day, the paid tiers unlock significantly more functionality.

AltIndex’s pricing is beginner-friendly, with the free plan offering basic access to its dashboard. The Starter plan costs $29 per month and includes more stock alerts, while the Pro plan at $99 per month offers comprehensive data. An enterprise plan is available for those requiring API access.

Despite its accessible design, the sheer amount of data can be overwhelming for some users. However, AltIndex’s intuitive interface helps mitigate this, making it an ideal starting point for new investors.

Pros

- Affordable and beginner-friendly

- Comprehensive social sentiment metrics

- Tracks job postings and patents for growth insights

- AI-backed ranking score simplifies data interpretation

Cons

- Free plan has limited functionality

- Volume of data may overwhelm first-time users

3. Foursquare – Best for Geolocation Data Insights

Foursquare excels in providing geolocation data, making it an essential tool for understanding consumer behavior through foot traffic analytics. The platform aggregates data from GPS, WiFi, and Bluetooth signals, delivering actionable insights to businesses and investors alike. For example, it helps retailers analyze traffic patterns and identify trends in store visits.

A core feature of Foursquare is its ability to analyze customer loyalty. This involves tracking repeat visits and the duration of those visits, offering deep insights into customer engagement. Additionally, the platform provides data on competitor foot traffic, enabling businesses to benchmark their performance and adjust strategies accordingly.

For investors, Foursquare data can be used to assess retail trends, identify growth markets, and evaluate the performance of individual stores or chains. For example, investors could track foot traffic at a popular retail chain to gauge sales potential before earnings announcements.

Foursquare offers customized pricing based on business needs. Small businesses can start with basic plans offering limited data points, while enterprise clients can access comprehensive datasets and API integrations.

While Foursquare’s insights are invaluable, its reliance on location data raises privacy concerns for some users. Additionally, the platform is best suited for businesses and investors with a specific focus on retail or real estate sectors.

Pros

- Industry-leading geolocation data analytics

- Insights into customer loyalty and competitor performance

- Valuable for retail and real estate investors

- Customizable data access and API integration

Cons

- Privacy concerns over location data usage

- Limited appeal outside retail and real estate sectors

4. FlightAware – Best for Aviation Data Insights

FlightAware specializes in aviation data, offering unparalleled insights into global air traffic patterns. This platform is invaluable for sectors like logistics, supply chain, and airline investment. FlightAware provides real-time data on commercial flights, private jets, and cargo movement, enabling businesses and investors to make data-driven decisions.

One of the platform’s most impressive features is its ability to monitor delays, cancellations, and route changes in real-time. This data proves crucial for evaluating the operational efficiency of airlines or identifying bottlenecks in supply chains. For instance, logistics companies can optimize delivery schedules by tracking cargo flights, while investors can use the data to anticipate financial performance in the aviation industry.

FlightAware’s visual interface stands out, providing interactive maps that display live flight paths and historical trends. Users can filter flights by airline, region, or aircraft type, making it easy to hone in on relevant data. Another unique feature is predictive analytics, which uses machine learning to forecast trends like airport congestion or seasonal flight demands.

Additionally, FlightAware integrates seamlessly with business intelligence tools through API access. This allows enterprises to integrate aviation data into their proprietary systems for deeper analysis. For smaller investors or casual users, the platform offers dashboards summarizing key metrics without requiring technical expertise.

FlightAware offers a free version with limited features, making it accessible to hobbyists and casual users. For professional-grade data, paid plans start at $89 per month. Enterprise solutions, which include predictive analytics and API access, are priced based on usage and customization needs.

While FlightAware provides comprehensive aviation insights, its niche focus may not appeal to those outside the logistics or aviation sectors. However, for users in these industries, its data is unmatched.

Pros

- Real-time data on global aviation traffic

- Predictive analytics powered by machine learning

- Interactive maps and user-friendly dashboards

- API access for seamless integration with business systems

Cons

- Limited use cases outside aviation and logistics

- Enterprise plans may be costly for small businesses

5. Plaid – Best for Financial Transaction Data

Plaid is a leading provider of financial transaction data, bridging the gap between consumers, banks, and fintech applications. The platform aggregates financial data from millions of transactions, providing insights into consumer spending habits. It’s a top choice for fintech companies looking to enhance user experiences or for investors analyzing consumer trends.

Plaid’s core functionality lies in its ability to securely connect with banks and retrieve user-authorized data. For instance, fintech apps can use Plaid to allow customers to link their accounts for budgeting, investing, or loan management. This makes Plaid not only a data provider but also a critical enabler for the fintech ecosystem.

Plaid excels in delivering actionable insights. For example, by analyzing spending trends, businesses can identify market opportunities or develop targeted marketing strategies. Investors can leverage Plaid’s data to predict sector growth, such as increased spending in e-commerce or decreased activity in discretionary sectors during economic downturns.

The platform also emphasizes security, using advanced encryption to ensure the safety of sensitive data. This has made it a trusted partner for major financial institutions and fintech startups alike. Additionally, Plaid offers robust documentation for developers, simplifying the integration process into apps and services.

Plaid operates on a pay-as-you-go model, with pricing based on API usage. This flexibility appeals to startups and enterprises alike. While larger companies may benefit from custom pricing, smaller businesses can start with basic plans to scale their usage over time.

Despite its strengths, Plaid’s offerings may not be ideal for users outside the fintech and banking sectors. However, for those in need of secure and comprehensive financial data, Plaid delivers exceptional value.

- Industry leader in financial transaction data

- Enables secure bank connections for fintech apps

- Actionable insights into consumer spending habits

- Flexible pricing models for businesses of all sizes

- Primarily focused on fintech and banking applications

- API costs can add up with extensive usage

6. Similarweb – Best for Digital Performance Analytics

Similarweb is a powerhouse for digital performance data, helping businesses and investors track web traffic, market share, and competitive positioning. Its comprehensive datasets make it invaluable for marketers, e-commerce platforms, and investment analysts looking to stay ahead in the digital age.

One of Similarweb’s key strengths is its ability to provide a detailed breakdown of website traffic. Users can analyze metrics like visitor demographics, engagement rates, and referral sources. This allows businesses to fine-tune their strategies or assess the effectiveness of digital campaigns. Investors can use Similarweb to evaluate the online performance of companies, gaining an edge in decision-making.

Similarweb’s competitive analysis feature is particularly noteworthy. It enables users to benchmark their performance against industry leaders, identify market trends, and uncover emerging competitors. For example, e-commerce platforms can use the data to optimize product listings or tailor promotions to specific customer segments.

Another standout feature is its keyword analysis tool, which helps businesses understand what drives traffic to competitor websites. This is especially useful for SEO and paid advertising campaigns. Additionally, Similarweb offers historical data, allowing users to track long-term trends and predict future performance.

Similarweb offers a free version with basic insights, while its premium plans start at $200 per month for small businesses. Enterprise users can access deeper analytics and custom reporting at a higher price point. API access is also available for seamless integration with internal systems.

While Similarweb excels in digital performance analytics, its cost may be a barrier for smaller businesses. However, the depth and accuracy of its data make it a worthwhile investment for those who prioritize digital intelligence.

- Comprehensive digital performance data

- Benchmarking tools for competitive analysis

- Keyword insights for SEO and paid campaigns

- Historical data for trend analysis and forecasting

- Premium plans may be expensive for small businesses

- Limited utility for non-digital industries

7. Knoema – Best for Global Dataset Aggregation

Knoema is a one-stop platform for accessing and visualizing global datasets. It aggregates data from a wide range of sources, including government reports, economic research, and industry studies. Its extensive repository makes it a go-to tool for researchers, policymakers, and investors who need structured data to inform their decisions.

The platform stands out for its versatility, offering users the ability to access datasets spanning economics, demographics, energy, and more. Knoema also includes tools for creating custom visualizations, making complex data easier to interpret and present. This capability is particularly useful for businesses and institutions preparing reports or conducting in-depth analyses.

Knoema simplifies data exploration by categorizing its datasets and allowing users to search by region, topic, or keyword. For instance, an investor might use Knoema to compare GDP growth across countries or track energy consumption trends. Businesses can analyze market opportunities by studying demographic shifts or trade data.

The platform also supports integration with third-party tools, enabling users to incorporate Knoema’s datasets into their workflows. For academics and professionals, Knoema provides access to proprietary datasets that are often unavailable on free platforms, ensuring deeper insights.

Knoema offers a free plan with limited datasets and visualization tools, ideal for casual users or small-scale projects. Professional plans start at $49 per month, offering access to advanced tools and premium datasets. Enterprise solutions with API access and custom datasets are available for larger organizations.

While Knoema’s offerings are robust, its vast database can be overwhelming for first-time users. However, its intuitive interface and support resources help reduce the learning curve.

- Access to a wide array of global datasets

- Custom visualization tools for presenting data

- Useful for economic, demographic, and industry analysis

- Seamless integration with third-party tools

- The sheer volume of data may be overwhelming

- Premium datasets locked behind higher-tier plans

8. Advan – Best for Foot-Traffic Analytics

Advan is a leading platform for foot-traffic analytics, offering insights that are critical for real estate investors, retailers, and urban planners. It uses anonymized GPS data to track movement patterns, providing valuable metrics on population density, consumer behavior, and business performance.

One of Advan’s key advantages is its ability to identify emerging retail hotspots. By analyzing foot traffic trends, investors can pinpoint areas with high consumer activity, aiding in site selection or portfolio management. For example, real estate developers can evaluate the potential of a new shopping center based on nearby foot-traffic volumes.

Advan goes beyond simple location tracking, offering tools to analyze consumer behavior. It provides data on visit frequency, dwell times, and peak activity hours, giving businesses a detailed view of customer engagement. Additionally, the platform allows users to compare foot traffic across different locations, enabling data-driven decisions for expansion or optimization.

The platform’s industry-specific insights make it a valuable asset for retail businesses. For instance, brands can monitor traffic patterns to assess the effectiveness of in-store promotions or adjust inventory levels based on expected demand.

Advan offers custom pricing based on the scope of data and analytics required. While the platform’s insights are invaluable for retail and real estate sectors, its niche focus may limit its appeal to users outside these industries.

Despite its specialization, Advan’s user-friendly tools and actionable insights make it a must-have solution for those seeking a competitive edge in location-based decision-making.

- Comprehensive foot-traffic analytics for retail and real estate

- Advanced tools for tracking consumer behavior

- Insights into location-based performance trends

- Customizable reports for tailored data analysis

- Limited appeal for industries outside retail and real estate

- Custom pricing may deter smaller businesses

9. Descartes Labs – Best for Satellite Imagery Analytics

Descartes Labs leverages satellite imagery and machine learning to provide insights for industries such as agriculture, energy, and commodities trading. Its cutting-edge technology allows businesses to monitor land use, crop health, and environmental changes, delivering actionable data in near real-time.

One of Descartes Labs’ standout features is its ability to forecast commodity prices. By analyzing crop yield data and weather patterns, the platform offers insights that are invaluable for traders and investors. For example, agricultural businesses can predict supply shortages and adjust their operations accordingly.

The platform’s machine learning models enhance the accuracy of its predictions, making it a trusted resource for forecasting market trends. Descartes Labs also provides historical data, enabling users to identify long-term patterns and evaluate investment opportunities. Its satellite imagery is updated frequently, ensuring users have access to the latest insights.

Another noteworthy aspect of Descartes Labs is its environmental monitoring capabilities. Businesses can use this data to assess the impact of climate change on their operations or explore opportunities in renewable energy sectors. For investors, this data can inform decisions related to ESG (Environmental, Social, and Governance) investments.

Descartes Labs offers enterprise-level solutions with pricing based on usage and customization. While the platform’s specialized data is invaluable for certain industries, its high cost may limit accessibility for smaller businesses or individual users.

Despite this, Descartes Labs remains a leader in satellite analytics, offering unparalleled insights for industries reliant on environmental and geographical data.

- Advanced satellite imagery and analytics

- Predictive models for commodities and agriculture

- Comprehensive historical and real-time data

- Valuable for ESG investment decisions

- High costs may deter smaller users

- Primarily focused on agriculture, energy, and commodities

10. Xverum – Best for B2B and Demographic Data

Xverum specializes in providing granular B2B and demographic data, offering insights that support decision-making for businesses, governments, and investors. The platform boasts a vast database covering millions of companies and individual profiles worldwide, making it a valuable resource for understanding market trends and consumer behavior.

What sets Xverum apart is its ability to segment data across various criteria, including industry, geography, income levels, and more. For example, businesses can use Xverum to identify untapped markets or evaluate the spending potential of specific demographics. This makes it a versatile tool for everything from marketing strategy to urban planning.

Xverum shines in its ability to connect data points for deeper insights. For instance, a business planning to expand into a new market can analyze consumer demographics, purchasing power, and competitive presence simultaneously. Investors can use similar datasets to evaluate the growth potential of specific regions or industries.

The platform also provides powerful visualization tools, making complex data accessible to users of all skill levels. Another notable feature is Xverum’s real-time updates, ensuring that users have access to the latest data for informed decision-making. Additionally, its API allows seamless integration with internal systems, making it easy to embed Xverum’s data into existing workflows.

Xverum offers flexible pricing plans, starting with basic options for small businesses and scaling up to enterprise-level solutions with extensive datasets and advanced analytics. Custom pricing is also available for users requiring specialized reports or API access.

While Xverum provides incredible value, its advanced features may overwhelm first-time users or those without a data analytics background. However, the platform offers tutorials and support to help users make the most of its capabilities.

- Comprehensive B2B and demographic datasets

- Advanced segmentation and visualization tools

- Real-time updates for accurate decision-making

- API integration for seamless workflows

- Advanced features may overwhelm new users

- Custom pricing could be expensive for small businesses

Understanding Alternative Data: What Sets It Apart?

Alternative data refers to information derived from non-traditional sources, offering unique insights that mainstream data often overlooks. Unlike traditional data, which includes earnings reports, financial statements, and government statistics, alternative data encompasses unconventional sources such as satellite imagery, geo-location tracking, credit card transactions, and social media sentiment.

The key difference lies in accessibility and timeliness. Traditional data is widely available and reported periodically, creating a level playing field for investors. In contrast, alternative data provides a competitive edge by offering real-time, actionable insights. For instance, satellite images of shipping ports can reveal supply chain bottlenecks before they are officially reported.

This innovative data type empowers investors, businesses, and analysts to make proactive decisions based on current, granular insights. As technology evolves, alternative data has emerged as an indispensable tool for those seeking to outperform markets and capitalize on opportunities ahead of the curve.

Real-Life Applications of Alternative Data

Alternative data is revolutionizing how businesses and investors gain insights into market trends. Below are examples of its application across industries:

Travel Industry

Flight tracking platforms like FlightAware offer real-time data on airline performance. Investors can monitor flight delays, cancellations, and route changes to gauge the operational health of airlines. For instance, significant flight cancellations could indicate staffing shortages, signaling potential challenges in upcoming quarterly earnings. Similarly, geo-location data can analyze foot traffic in airports, offering insights into broader travel industry trends.

Real Estate

Platforms such as Advan leverage geo-location and migration data to assist real estate investors. For example, foot traffic and population growth in a specific region can indicate rising property demand.

Additionally, income band trends help assess whether an area is suitable for high-value developments. By providing these metrics two years ahead of official census reports, alternative data offers a significant head start for investors looking to secure profitable deals.

Commodity Trading

Alternative data like satellite imagery has become indispensable for commodity traders. For instance, Descartes Labs tracks weather patterns in agricultural regions, providing forecasts on crop yields.

In the energy sector, satellite imagery of oil fields can reveal operational disruptions, such as production halts due to equipment failure or geopolitical unrest. Traders use this data to predict supply fluctuations and adjust their positions accordingly.

Social Media Sentiment

Social media platforms provide real-time insights into consumer sentiment. For example, AltIndex tracks trending mentions and engagement for stocks and cryptocurrencies. During the 2021 meme stock rally, monitoring Reddit’s WallStreetBets forum helped investors predict the surge in GameStop and AMC shares before it hit mainstream media.

Retail and E-Commerce

Website analytics tools like SimilarWeb reveal trends in online traffic and app downloads. For instance, declining visits to a retail website may indicate weakened consumer interest, prompting investors to adjust their portfolios before quarterly earnings announcements.

By uncovering patterns that traditional data misses, alternative data empowers stakeholders across industries to act on actionable insights before the broader market catches on.

How to Stay Ahead with Alternative Data?

Staying ahead in the market with alternative data hinges on its ability to deliver real-time, actionable insights. Unlike traditional data, which is often retrospective and widely accessible, alternative data provides a first-mover advantage by unveiling trends before they hit mainstream sources.

For instance, satellite imagery of port congestion can signal supply chain issues weeks before they are publicly reported. Similarly, tracking social media sentiment helps investors predict consumer reactions to product launches or corporate announcements.

The predictive capabilities of alternative data are another key factor. Weather data, for example, allows commodity traders to forecast agricultural yields, while geo-location data identifies shifting consumer patterns in real estate markets.

By leveraging such insights, investors and businesses can make informed decisions, minimize risks, and seize opportunities early. Alternative data ensures you’re not just reacting to trends—you’re anticipating them.

Why Alternative Data is Transforming the Census Model

Alternative data is reshaping the census model by offering faster, more precise insights through advanced technology. Traditional census methods rely on manual surveys conducted periodically, resulting in significant delays and outdated information. In contrast, alternative data providers like Advan utilize geo-location tracking, satellite imagery, and app-based data to deliver real-time population metrics.

For instance, Advan’s data reveals migration patterns and income bands up to two years ahead of official census reports. This immediacy enables policymakers, businesses, and investors to act proactively rather than waiting for official updates. Moreover, the automated collection methods reduce human error and improve data granularity, offering hyper-local insights often missed by broader surveys.

As technology advances, alternative data will likely complement or even replace traditional census models, ensuring decision-makers have access to timely, actionable information in an increasingly fast-paced world.

Key Benefits of Using Alternative Data

Alternative data offers several distinct advantages that set it apart from traditional methods.

- Timeliness: Alternative data provides real-time insights that offer investors a competitive edge. For instance, satellite imagery can highlight supply chain disruptions before they hit traditional media, enabling swift action.

- Independent Analysis: It empowers investors to base decisions on raw, unbiased data rather than mainstream sources or pre-filtered reports. This autonomy promotes better judgment and innovative strategies.

- Enhanced Trading Opportunities: Alternative data uncovers unique patterns that others might miss, such as consumer sentiment on social media or geolocation trends. These insights open the door to lucrative investments and help traders capitalize on emerging opportunities.

By integrating these benefits, alternative data equips investors with the tools to navigate competitive markets effectively, ensuring they stay ahead of the curve with actionable, timely, and independent information.

How to Select the Right Data Provider

Choosing the right alternative data provider involves evaluating key factors to align with your investment goals.

Relevance is crucial—ensure the provider specializes in data that matches your industry. For example, satellite imagery might be ideal for commodity traders, while social media metrics benefit those investing in consumer-facing businesses.

Privacy compliance is non-negotiable. Verify that the provider adheres to regulations like GDPR or CCPA, especially if the data involves geo-location or consumer behavior.

Pricing is another critical consideration. Some providers, like AltIndex, offer affordable or even free plans, while others cater to institutional clients with custom pricing. Evaluate whether the expected return on investment (ROI) justifies the cost.

Lastly, assess user-friendliness. Platforms like SimilarWeb offer intuitive dashboards, while others may require expertise to interpret large datasets. Beginners should look for simplified scoring systems or aggregated metrics.

By carefully weighing these factors, you can choose a provider that delivers actionable insights tailored to your needs.

What’s the Cost of Alternative Data?

The cost of alternative data varies widely based on the provider and the type of insights offered. Entry-level platforms like AltIndex provide free or low-cost options for beginners, with basic access to metrics like social media mentions or website traffic. Paid plans, such as those from SimilarWeb, start at $149 per month, offering enhanced functionality and detailed analytics.

Institutional-grade providers like Descartes Labs or Advan cater to enterprises, often requiring custom quotes that can run into thousands of dollars annually. These services include advanced data sets like satellite imagery or migration patterns.

Investors must assess their return on investment (ROI) when choosing a provider. The cost should align with the potential financial benefits gained from acting on timely, accurate data. For most retail clients, balancing affordability with actionable insights is key to maximizing value from alternative data.

Conclusion

Alternative data is reshaping the way investors approach markets, offering unprecedented access to actionable insights and first-mover advantages. By leveraging unconventional sources, traders can anticipate trends, refine strategies, and navigate complex financial landscapes with confidence.

Whether you’re a seasoned professional or just starting out, alternative data holds the key to staying ahead in a rapidly evolving world of investing.

FAQs

What is alternative data?

Alternative data refers to non-traditional information sources, such as satellite imagery, social media sentiment, or credit card transactions, that provide unique insights for investment decisions.

How is alternative data different from traditional data?

Unlike traditional data, which includes earnings reports or official announcements, alternative data is often real-time and sourced from unconventional platforms, giving investors a first-mover advantage.

What industries benefit most from alternative data?

Industries like real estate, commodities, retail, and technology often benefit, as alternative data can reveal market trends, consumer behavior, and supply chain insights.

Is alternative data legal and ethical?

Yes, alternative data is legal as it uses publicly accessible or ethically obtained information. Compliance with data protection regulations like GDPR ensures its ethical use.

How can I choose the best alternative data provider?

Evaluate providers based on relevance to your strategy, privacy compliance, pricing, and user-friendliness. Start with platforms offering free trials to explore their capabilities.