We all enjoy watching and streaming live videos, but everyone does not have easy access to it. Users in many developing and under-developing countries could not enjoy content like video streaming because connecting remote and distant data centers to the end users was expensive. Fortunately, a platform known as the Theta Network was developed to deal with this issue. It was made in 2018, and the team’s goal was to give more people worldwide access to live video streaming while keeping costs and equipment to a minimum.

Theta is a ground-breaking blockchain-based platform for decentralized video content distribution. Its goal is to improve video streaming efficiency and benefit people who contribute their computing capabilities and resources through improved video data transmissions.

The network and protocol are open-source, allowing anyone to build on the Theta blockchain. Content creators can build decentralized apps tailored to their target audience. Decentralized applications on the Theta network can provide movies, songs, sports, online coverage, virtual shows, and online classes. Some of the video providers already available on the Theta Network include Samsung VR, Cinedigm, Factory, and THETA.tv.

Keep reading if you’re interested in THETA and want to learn more about it. We have discussed the THETA. Who created it? How does it work? What is its token THETA use case? Where can you buy it? Is it worth buying in 2024? Where will it reach its peak in the future? How can you manage taxes on their earnings and more?

On this Page:

How to Buy Theta

- Choose an exchange that offers Theta (THETA) – we recommend eToro as it’s FCA, ASIC, and CySEC regulated.

- Sign up and verify your trading account with eToro.

- Fund your account with a bank transfer, a credit card, PayPal, or another method.

- Search ‘THETA’ in the drop-down menu to open charts and trades.

- Click ‘Trade’ and select an amount of THETA to buy

Best Exchange to Buy Theta in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Etoro-BTC-6

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Huobi

Visit SiteAs prices of digital assets are highly volatile, users could lose all or a substantial portion of the value of any digital asset they purchase....

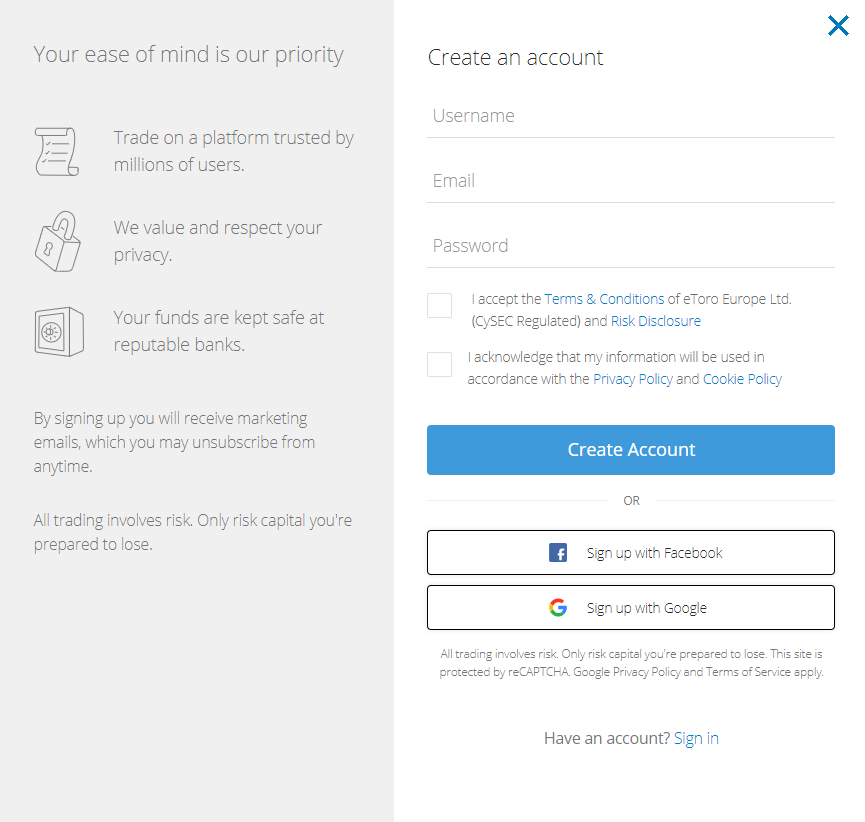

How to Sign Up at eToro

Opening a free eToro account is simple because the platform is user-friendly, especially for beginners.

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- Click the “Join Now” or “Trade Now” button on the eToro website.

- You’ll find an electronic form on this page where you can enter all your personal information required to open a new trading account.

- Please complete this form with all the required information.

- eToro allows users to log in using Facebook or Gmail.

- While submitting your information, please read eToro’s Terms & Conditions and privacy policy.

- After reviewing the terms, please confirm your agreement by checking the appropriate box.

- Click the “sign-up” button to submit your information.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Your capital is at risk.

Step 2: Upload ID

To begin, you must create an account with eToro by providing some basic personal information, an email address, and a cell phone number. To complete the verification process, you must also provide identification.

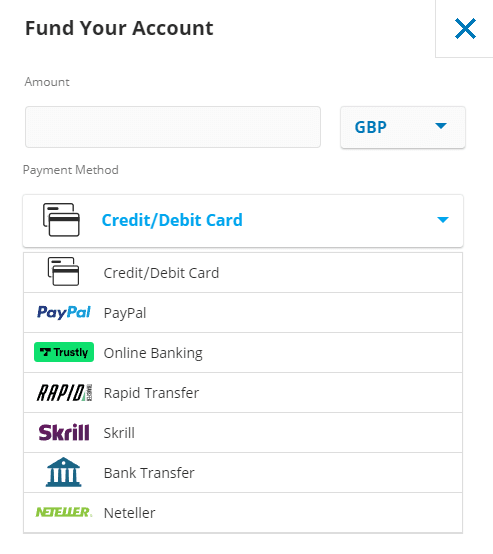

Step 3: Make a Deposit

When you’re ready to deposit, navigate to the ‘Deposit Funds’ section and enter the desired amount. To open an account with eToro, a minimum deposit of $10 is required, which can be made in various ways. Debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller are all accepted forms of payment.

eToro does not charge a fee for making a deposit. After selecting a payment method, click the ‘Deposit’ button to complete the transaction.

Deposit methods on eToro

Back on April 19, 2022, eToro listed the THETA coin.

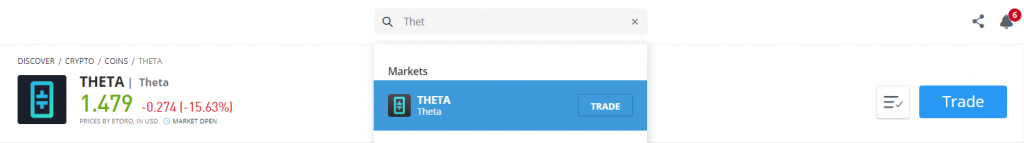

Step 4: Buy Theta (THETA)

Begin typing ‘Theta’ into the top-of-the-screen search bar. Click the ‘Trade’ button when you see the cryptocurrency asset.

Searching THETA on eToro

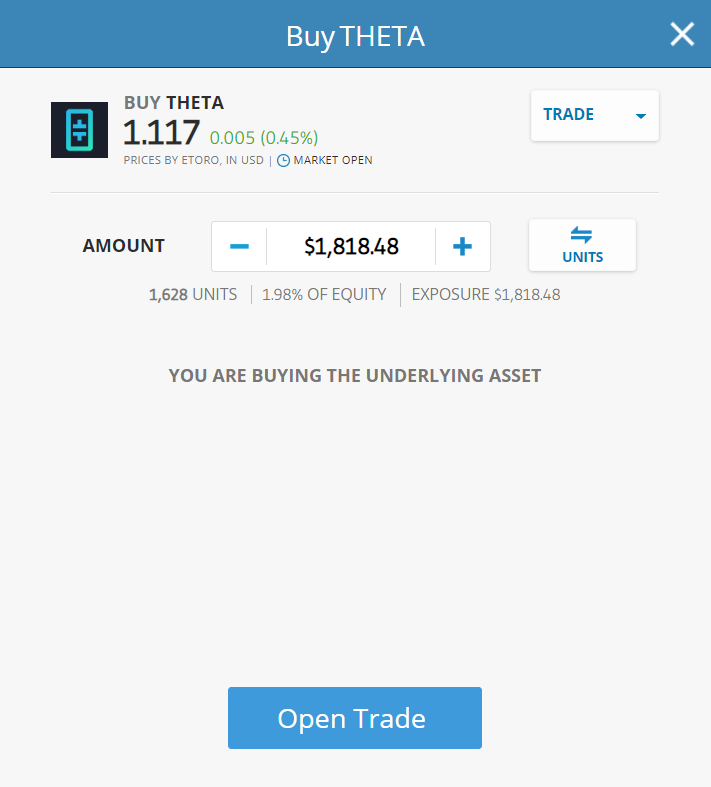

Step 5: Review Theta (THETA) Price

This step will take you to an order page where you can enter the quantity of Theta coins you wish to purchase. Following that, click Open Trade’ to add the Theta to your portfolio. Apart from the trading platform, we support storing your digital assets in a third-party wallet. One viable option is to utilize the eToro Crypto Wallet, which now supports over 120 cryptocurrencies and Theta.

Theta Price Chart on eToro

The good thing is, there’s no maker/taker fee on eToro as they solely charge buy/sell spread.

Step 6: Buy Theta

At this stage, you can confirm eToro how much money you want to invest in Theta in the ‘Amount’ box – starting with $10. Click the ‘Open Trade’ button to complete your purchase.

Buy Theta on eToro

Read more about how to buy cryptocurrency in 2024 here.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

Where to Buy Theta (THETA) – Best Platforms

Theta is a decentralized video-streaming platform that is primarily used to stream eSports. Theta Labs of Seoul launched in 2018 as an Ethereum-based network, with THETA initially being an ERC-20 token. However, it launched its own mainnet in March 2019, converting its ERC-20 tokens into its own native THETA and TFUEL tokens (with the latter being used to pay for transactions).

Nonetheless, reviews of the best places to buy Theta can now be found in our update. Our list of sites to buy Theta in 2024 contains their characteristics, fees, and the reasons for their uniqueness. eToro has established itself as the top site for buying Theta cryptocurrency. The platform is secure, offers competitive pricing, and is simple.

Best Brokers to Buy Theta (THETA)

1- eToro

eToro is a social trading and investment platform that provides an online trading and investment platform. This company was founded in 2006 and is headquartered in Tel Aviv, Israel. eToro offers retail investors and traders various services, including trade execution via its proprietary web platform. Furthermore, the company provides social trading and copy-trading capabilities.

The site and company provide a platform available in over 25 languages and approved by the Cyprus Financial Markets Authority. The site also includes an advanced analytics tool that allows users to identify trading opportunities, monitor performance, analyze their investment strategy, and identify areas for improvement.

Additionally, you can now earn rewards for purchasing and buying Ethereum, Cardano, and Tron in your wallet.

Read more about how to stake crypto.

eToro is governed by some of the world’s most reputable regulatory authorities, including the Financial Conduct Authority of the United Kingdom (FCA). The Australian Securities and Investment Commission, the Cyprus Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA) are also responsible (FINRA). User funds are kept separate from the platform’s operating capital in compliance with CySEC regulations for all CySEC-registered brokers. This is the way the platform operates.

eToro charges a nominal trading fee like other companies, including 0.75 percent for purchasing or selling bitcoin. On eToro, the cost of converting bitcoins is only 0.1 percent on top of the existing margins. As a result, eToro has established itself as a market leader in cryptocurrency trading, with a strong preference for crypto-assets and CFDs in 2022.

eToro charges its consumers a reasonable fee structure. eToro does not charge a fee for making a deposit. Deposits can be made using bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller, among others. The minimum deposit amount varies by user region. For example, individuals in the United Kingdom and the rest of Europe must make a minimum deposit of $200 before trading. In the United States, users must make a $10 deposit.

eToro accepts Bitcoin, the leading cryptocurrency, and major altcoins such as Ethereum, Aave, XRP, Graph, and other popular cryptocurrencies.

Buying and selling on eToro can be done online and on mobile devices via their mobile app. Opening an eToro account is simple and takes only a few minutes.

eToro Theta Listing: March 15, 2022

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA, or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a cryptocurrency exchange based in Luxembourg founded in 2011 by Nejc Kodri and Damijan Merlak. This well-known cryptocurrency exchange provides a free marketplace for professional investors and large financial institutions.

Bitstamp was founded less than two years after the invention of Bitcoin and was one of the first Bitcoin exchanges in the cryptocurrency market.

Bitsamp is best suited for experienced investors looking for a top-tier cryptocurrency trading platform. However, it is an excellent platform for buying digital assets in bulk and storing them on Bitsamp’s web-based cold storage wallet.

Payment Fees: Bitstamp charges relatively low transaction fees compared to most digital asset exchanges. The United Kingdom provides two deposit options. The first option is to use an international wire transfer, which costs only 0.05 percent of the transferred amount (very low compared to other crypto platforms). The second option is to take advantage of the free Faster Payments service.

Furthermore, the withdrawal fee is less than the industry standard – 0.1 percent for international wire transfers and 2 GBP for Faster Payment. The only drawback to Bitstamp is the high fee they charge on credit card cryptocurrency purchases – 5% on any amount.

Bitstamp, unlike most online trading platforms, does not require a minimum deposit. However, like Bittrex, it has a minimum order of 50 USD/EUR/GBP, whereas other exchanges may have a much higher minimum order.

Security: Two-factor authentication is now required for all investors performing critical account functions. Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured. However, according to crypto exchange security evaluator CER, it ranked near the bottom of our review of crypto exchanges in terms of security, indicating that it may still have room to grow into a category leader.

Bitstamp trading fees: Bitstamp is widely regarded as a low-fee exchange, particularly for highly active investors. If your daily volume is less than $10,000, the maximum trading fee you can pay is 0.5 percent. (This is higher than the industry average of around o.25 percent). However, as the investor’s total volume of transactions increases, so do the fees. As a result, if your volume exceeds $20,000,000, you may pay no fees at all. Individual investors should expect to pay a fee of about 0.1 percent at Bitstamp.

Customer service is available 24 hours a day, seven days a week, and an emergency phone support line is available.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Huobi Global is a cryptocurrency exchange that provides professional trading tools; however, it is not available in the United States or Japan. This exchange allows you to buy, sell, and trade nearly 350 cryptocurrencies, access margin and futures trading, trading bots, over-the-counter (OTC) trading, and staking crypto assets to earn rewards. It also provides loans secured by your crypto holdings. Huobi Global, one of the largest global exchanges with reasonable trading fees, is an excellent choice for intermediate and advanced traders and institutional investors.

For margin trading, the platform offers up to 5% leverage. Huobi Global’s fee structure is very reasonable and low in comparison.

Deposit: The minimum deposit fee is $100, and other fees, such as deposit fees, transaction fees, and withdrawal fees, vary by currency.

Fee: Those who wish to purchase cryptocurrency using a credit or debit card must pay an additional fee to Houbi. The maker and taker fees are both set at 0.2 percent. Depending on the scale volume, it can be as low as 0.1 percent.

Huobi Global provides customer service via email, phone, online chat, ticket system, and social media platforms. It provides many security features, including 2-factor authentication, cold storage, account freezes, and Bitcoin reserves.

Huobi listed Theta on January 16, 2018. The trading pairs available for trading include THETA/BTC and THETA/ETH.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

Crypto.com, a global cryptocurrency exchange, was founded in 2016. It is based in Hong Kong and serves over 10 million traders in over 90 countries, allowing you to buy and sell over 250 cryptocurrencies with low trading fees.

The Crypto.com platform distinguishes itself by allowing users to stake their cryptocurrency.

Users can earn up to 14.5 percent p.a. interest by staking or holding them in a crypto.com wallet. Aside from trading, the exchange offers staking rewards, Visa card benefits, NFT trading, DeFi products, and other services.

Crypto.com employs several security measures, including MFA (multi-factor authentication). It also employs whitelisting to protect customer accounts. The platform employs compliance monitoring to prevent hacks and losses and stores customer deposits offline in cold storage.

Deposit: This platform’s minimum account balance is $1. Fees for Makers and Takers range from 0.04 to 0.40 percent. Credit/debit card purchases are charged at 0% or no fee for the first 30 days after opening an account. Additionally, users can earn up to $2000 for each friend they refer.

Crypto.com Theta Listing: April 23, 2021

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a cryptocurrency platform offering spot, derivatives, and margin trading with up to 100x leverage on BTC/USD and ETH/USD trading pairs.

Bybit was founded in March 2018 in Singapore by professionals from investment banks, technology firms, the forex industry, and early blockchain adopters. It is a British Virgin Islands-registered trading exchange with over 2 million users.

Bybit is a cryptocurrency-to-cryptocurrency exchange that does not require customers to go through onerous KYC verification and currently has a daily trading volume of up to $1 billion.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Regarding daily transaction volume, Binance is one of the most active cryptocurrency exchanges, with more than $20 billion transacted daily. It gives you access to hundreds of assets and a friendly trading environment that makes profiting easy.

Binance’s most distinguishing features include low fees, a robust charting interface, and support for hundreds of coins. Unlike eToro, Binance is a cryptocurrency-focused exchange that does not offer copy trading, FX, commodities, or other financial services.

Binance employs two-factor authentication (2FA) and FDIC-insured deposits in US dollars (USD). Binance also protects its customers through device management in the United States, address whitelisting, and cold storage.

Fees for buying and trading range from 0.015 to 0.10 percent, 3.5 percent or $10 for debit card purchases, whichever is greater, and $15 for US wire transfers.

On May 19, 2018, the Theta token was listed on Binance and is now available for trading. Binance has also launched trading pairs, including THETA/BTC, THETA/ETH, and THETA/BNB.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase is frequently mentioned as a good place to start when people ask how to invest in cryptocurrency. Coinbase was founded in 2012, just three years after Bitcoin was created, and has grown to become the largest cryptocurrency exchange by trading volume in the United States, with over 73 million verified users in over 100 countries.

While the company offers a variety of valuable products for retail and institutional investors, businesses, and developers, its defining feature is the ability to buy, sell, and trade over 100 different cryptocurrencies and crypto tokens. Its quarterly trading volume is currently $327 billion, with $255 billion in assets on the platform, after going public through a direct listing on the Nasdaq exchange in April 2021.

Even though Coinbase’s transaction and trading fees are higher than some of its competitors, it remains one of the most popular cryptocurrency investing apps.

On the Coinbase Pro exchange, limit and market orders for Theta can be placed. The maker/taker fee is 0.5 percent for the first $10,000 volume traded in 30 days, then drops to 0.35 percent. If your 30-day volume exceeds $300 million, you can trade cryptocurrency for free without paying a maker fee.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that offers its eight million customers various trading options. Spot, futures, margin, peer-to-peer (P2P), staking, and lending options exist.

Johnny Lyu is the Co-Founder and CEO of KuCoin, a well-known cryptocurrency exchange worldwide. KuCoin has grown to become a well-known cryptocurrency exchange. It has over 8 million registered users from 207 countries and territories worldwide.

Deposit and withdrawal: KuCoin does allow fiat currency purchases of bitcoin, but only through a third-party application. Payments are accepted via credit or debit card, Apple Pay, or Google Pay, but not via bank transfer. The fees, however, could be exorbitant.

KuCoin Transaction Fees: The KuCoin trading fee structure is simple. The platform charges 0.1 percent for both makers and takers, making it one of the most cost-effective online Bitcoin exchanges. You can further reduce your fees if you own the platform’s native Kucoin tokens.

Theta (THETA) was added to KuCoin on February 05, 2021, with trading pairs of THETA/USDT.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange that allows users to buy, sell, and trade a wide range of digital coins. In 2012, the Hong Kong-based portal was established. Because Bitfinex’s trading area includes a robust set of chart analysis tools, intermediate and professional traders are likelier to use it.

Aside from cryptocurrency, the only way to deposit and withdraw funds is via wire transfer. Bitfinex, like Coinbase, is one of the few platforms that allows you to short cryptocurrencies and use leveraged trading strategies.

Founders – Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange offering digital asset trading services to customers worldwide.

Bitfinex Securities Ltd., a blockchain-based investment product provider, has established a regulated investment exchange (Bitfinex Securities) in the AIFC to improve members’ access to a diverse range of financial products. Bitfinex, as a result, is completely unregulated. While the corporation’s headquarters are in Hong Kong, it is registered in the British Virgin Islands.

Fees and deposit limits: Bitfinex charges a 0.1 percent fee for bank transfer deposits. If you deposit $10,000, for example, you will be charged a fee of $10.

Withdrawal fees: Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. You can pay a 1% expedited fee if you need funds within 24 hours.

Theta (THETA) was listed on Bitfinex on December 14, 2021. THETA is available to trade with US Dollars (THETA/USD) and Tether tokens (THETA/USDt).

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- US citizens are not accepted.

-

Expensive trading fees

- The support team only available via email

What is Theta Network (THETA)?

Theta is a cryptocurrency built on the blockchain that runs the Theta network, and Theta Labs designed it. The platform is simply a blockchain-based decentralized video distribution and video streaming network. Theta was intended to address the numerous problems with existing worldwide streaming networks such as Twitch and YouTube.

And being a decentralized network has several benefits over these streaming platforms. Viewers can also stream videos without a centralized mediator platform because Theta is made to send traffic to the videos that need the most bandwidth and do the best in terms of popularity and viewers.

The Theta coin was originally introduced as an Erc20 token to show the potential of the Theta network and assets. However, following Theta Mainnet 2.0’s debut on May 27, 2020, the original coins were exchanged for new coins with transactional value.

Is it possible to mine Theta Token?

The Theta token cannot be mined but can be acquired using Bitcoin or Ethereum on several major exchanges. The theta token aims to incentivize users and network node producers to work collaboratively and contribute to the platform’s current performance. For instance, viewers on the Theta platform can use tokens to reward video content creators without any middlemen, making it easier for content creators to be recognized for their work and not rely on advertisements or hosting sites. Companies need to buy theta tokens to use the blockchain protocol’s services. A separate currency called gas is used to pay for the network’s services. Its blockchain, just like Ethereum, also facilitates smart transactions. A few have described Theta as the upcoming Ethereum.

Despite having an operational ecosystem with many customers, Theta is still far from reaching Ethereum. In terms of price and market capitalization, the network is many projects short, and the Theta token has yet to reach the top of Ethereum. Theta is also highly complex, more similar to Ethereum in that it runs an entire ecosystem rather than just a token with few applications but excellent value, the same as Bitcoin. It is up to the market to decide whether Theta deserves this position, and the value and market cap will be the final arbiters on whether it can maintain its position among the top ten coins. Theta must compete with Bitcoin, Ethereum, Litecoin, and many other important coins to sustain itself in the market.

Various mainstream factors, including project announcements and development information, market attitude, the circulation of cryptocurrencies on exchanges, and the overall state of the economy drive THETA’s value. The value of THETA is also influenced by the desire for governance rights over the project and the demand for TFUEL from Validator and Guardian nodes, which demand THETA for staking. THETA is the network’s main crypto asset. As a cryptocurrency seller or investor, users must purchase this digital asset. It is valuable but risky, like other cryptocurrencies. Because the price fluctuates, brokers can profit or lose by investing in it. Theta is the governance token and the primary crypto asset of the Theta network. It gives users many options and can be set as either a manuscript to be published or a Guardian endpoint.

The Theta network aims to increase enterprise development control above video services, such as Disney, Verizon, and others, and to keep customer prices low by lowering provider operational expenses. Lowering streaming costs and increasing bandwidth benefits both the brand and the end user.

Is it worth Buying Theta (THETA) in 2024?

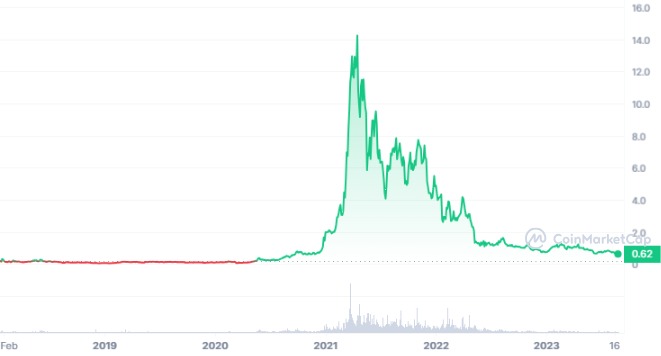

THETA has been one of the most successful cryptocurrencies in terms of price performance in the past few years. In 2021, it surged from around $0.2 at the beginning of the year to an all-time high of $15.72 in April. That was a staggering increase of nearly 8,000% in just four months.

The price spike was driven by several factors, such as the launch of the Theta Mainnet 3.0, which introduced new features like edge computing and elite edge nodes; the announcement of partnerships with major media companies like Sony and MGM; and the growing popularity of video streaming platforms like Theta.tv and World Poker Tour.

However, after reaching its peak, THETA entered a correction phase that lasted for the rest of 2021 and most of 2022. The price dropped below $5 in May 2021. In 2022, THETA started to recover from its slump, as the Mainnet 3.0 finally went live and brought more stability and scalability to the network. The price bounced back above above $5 in March 2022.

It also benefited from the increasing adoption of THETA by various content creators and viewers and the support from influential figures like Katy Perry and Steve Aoki, who launched their own NFTs on Theta Network. By June 2022, THETA had lost most of its ground, reaching $1.

In 2023, THETA maintained its upward momentum. It also expanded its ecosystem by integrating with other blockchains like Ethereum, Binance Smart Chain, and Solana. The price has been in tight range trading since the new year started at $1 to $0.60. As of August 28, 2023, THETA is trading at around $0.6197 with a 44.81% yearly low, with a market capitalization of over $619,691,380.

Will the Price of Theta (THETA) Go Up in 2024?

According to various sources, THETA token price prediction for the end of 2023 is bullish, with most analysts expecting the coin to reach new highs. Some of the reasons for this optimism are:

In 2023, several notable events unfolded within the Theta Network, showcasing significant advancements and collaborations. On August 21st, Lavita introduced AI Training Jobs for Medical Q&A Tasks on the Theta Edge Network. This move aimed to leverage the network’s capabilities for medical query processing.

Earlier, on July 24th, FedML and Theta jointly launched a Decentralized AI Supercluster focusing on Generative AI and Content Recommendation. This partnership held the potential for groundbreaking innovations in the AI landscape.

The preceding months saw continuous progress, with the Theta Video API incorporating a Billing Dashboard on June 13th, a pivotal step towards offering decentralized cloud services. Notably, on May 1st, the collaboration between Theta Network and The Squad led to the announcement of MetaCannes Film3.

Based on these factors, here are some of the THETA token price predictions for the end of 2023 from different sources:

- CoinCodex predicts that THETA token will reach a maximum price of $1.88 and a minimum price of $0.64 in 2023, with an average price of $1.20.

- CryptoNewsZ forecasts that the THETA token will reach a maximum price of $3.20 and a minimum price of $0.72 in 2023, with an average price of $1.85.

- CoinGape estimates that the THETA token will reach a maximum price of $3.46 and a minimum price of $1.74 in 2023 after crossing the $2.27 mark earlier in the year.

- Trading Education projects that THETA token will reach a maximum price of $4.24 and a minimum price of $2.88 in 2023, with an average price of $3.39.

As we can see, there is a wide range of THETA token price predictions for the end of 2023, but most are optimistic. However, it is important to note that these predictions are based on current trends and assumptions and are subject to change depending on various factors such as market conditions, regulatory developments, technological innovations, and unforeseen events.

Theta (THETA) Price Prediction: Where does Theta (THETA) go from here?

The year 2023 has started on a good note for Theta coins. They demonstrated huge green spikes on their price charts in the initial quarter of the year 2023. The coin has witnessed a growth of more than 24% in the initial two months of this year. Theta price forecasts for the coming years are as follows:

THETA Price Prediction 2023

According to experts, Theta Network is expected to trade at an average price of $1.67 in 2023. Theta coin’s price would range from $1.1 to $1.92, with $1.92 being the highest price it might ever reach.

THETA Price Prediction 2024

The coin is expected to profit from the upcoming enhancements and integrations in the Theta network. The network upgrades will certainly boost the coin’s price in the upcoming years. In 2024, it is anticipated that the coin will cost an average of $2.43, with a minimum and highest price of $2.34 and $2.85, respectively.

THETA Price Prediction 2025

The long-term forecast for THETA price is extremely bullish as experts believe that the coin will show good growth in its value due to its strong utility and fundamentals. According to the forecasts, the average price would be $3.36 in 2025, while the highest would be $4.08.

Summary

Theta (THETA) is a blockchain-powered network designed specifically for video streaming. Theta mainnet, launched in March 2019, is a decentralized network where users share bandwidth and computing resources on a peer-to-peer (P2P) basis. Steve Chen, co-founder of YouTube, and Justin Kan, co-founder of Twitch, are advising the project.

Theta has its own native cryptocurrency token, THETA, which performs various governance tasks within the network. Enterprise validators include Google, Binance, Blockchain Ventures, Gumi, and Samsung, and a Guardian network of thousands of community-run guardian nodes.

Theta is a comprehensive blockchain solution for video streaming that provides content creators and users with technological and commercial advantages. By providing decentralized peer-to-peer video distribution for video streaming, this project intends to use blockchain information systems. Theta also enables creators to share their content, data, and computer resources globally.

The coin has the potential for exponential growth. As a result, if you want to buy it, our recommended regulated broker, eToro, can assist you. Of course, the platform is licensed and regulated by the FCA and has one of the best reputations in the industry. Furthermore, eToro offers a wealth of educational resources to assist newcomers to the market learn the ropes.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risk in buying THETA now?

The THETA token has a higher and significant potential due to its strong technical background as well as the services provided by its network. Because of its strong fundamentals, the token has a higher growth potential than other cryptocurrencies, making it a less risky investment right now.

Is it safe to buy THETA?

Buying THETA through a trusted and regulated broker or exchange reduces the risks related to the security and safety of the investor and his money. As for the Theta Network, it uses a financial incentive scheme and a proof-of-stake mechanism to provide security to its users.

How much will THETA be worth in 2030?

If the network receives the attention it claims to receive through its next upgrade, the THETA token could reach $250 by 2030.

Wil THETA ever hit $500?

Yes! The Theta network holds the potential to reach the top 10 in the near future due to its dynamic services and significant utilities. The network holds a huge growth potential in the entertainment industry and video streaming, which can push the coin towards $500 in the coming decade.

Bitcoin

Bitcoin