Flare is the native token of Flare, a distributed blockchain network and innovative contract platform built on the Avalanche consensus system and following the Federated Byzantine Agreement (FBA). Rather than economic mechanisms, the network is secured using FBA consensus methods. Flare apps are also built using the Spark Dependent Application concept. Furthermore, the Flare Network provides a Turing-complete smart contract platform in an FBA context, based on the Avalanche protocol, to enable a scalable, safe, and decentralized network free of the constraints and safety conflicts associated with using economic means to prevent Sybil attacks.

The primary goal of Flare (FLR) is to provide smart contract functionality to other blockchain networks. Ripple and Litecoin (LTC) are two blockchain networks (XRP). In addition to these two, the flare token is compatible with the Ethereum Virtual Machine (EVM). Although the Flare coin has not yet been widely adopted, experts such as Guy from Coin Bureau believe the FLR price has potential.

If you’re interested in FLR and want to study it more, we cover FLR, who created it, how FLR works, the FLR token use case, and where you can buy FLR on the dip. Is it worth buying in 2024? What will its price reach in the future?

How to Buy Flare Crypto

- Choose an exchange that lists FLR – we recommend eToro as it’s FCA, ASIC, and CySEC regulated

- Sign up for and validate your free trading account.

- Make a deposit using a bank transfer, a credit card, PayPal, or another supported method.

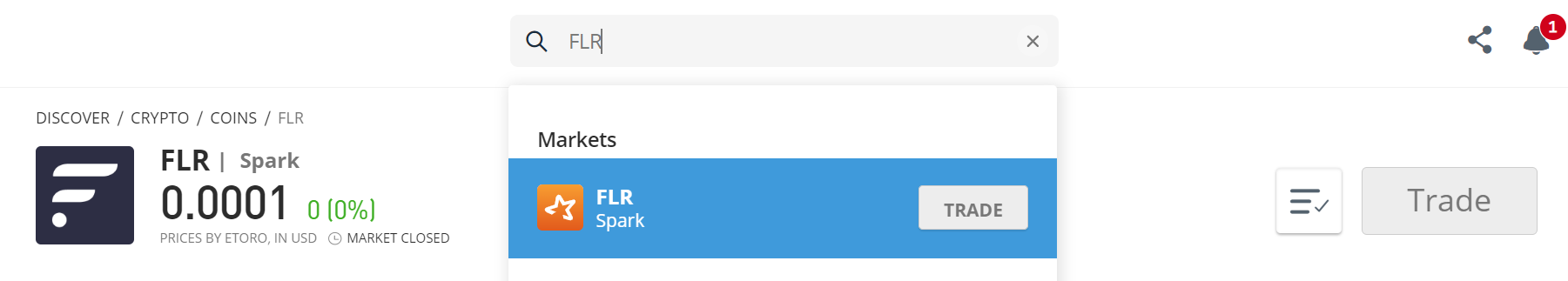

- Open the FLR price chart and trading platform by searching ‘FLR’ in the drop-down menu.

- Click ‘Trade,’ then enter the amount of FLR you want to buy.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Best Exchange to Buy Flare in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

How to Sign Up at eToro

Creating a free eToro account is easy, and the site is particularly user-friendly for newbies.

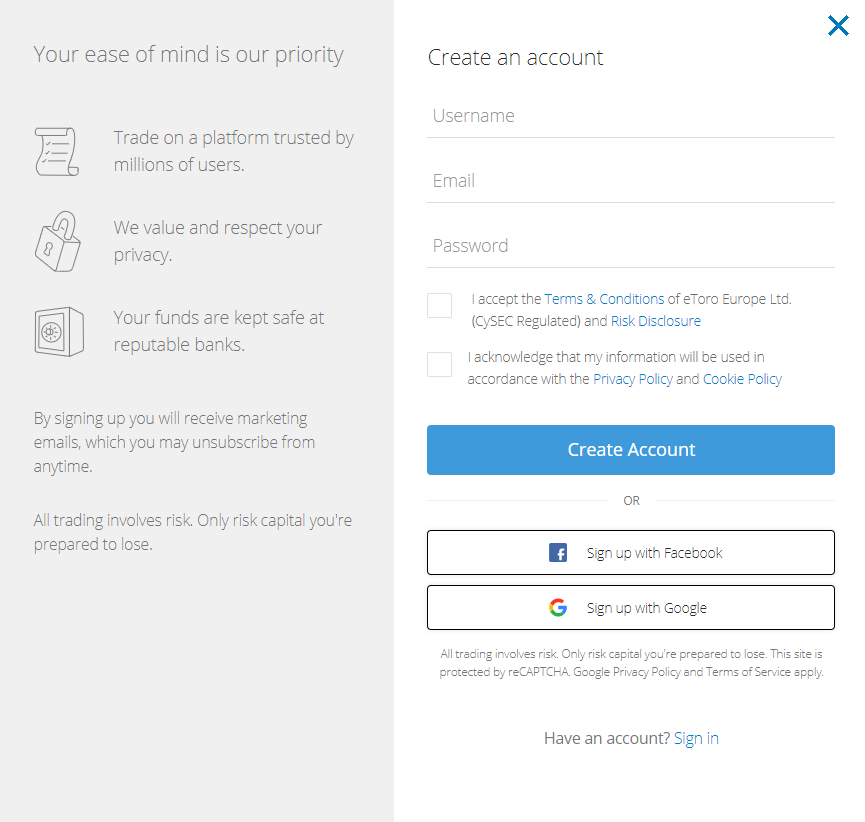

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- Complete the quick account creation process on the eToro website.

- There will be an electronic form where you can enter all your personal information required to open a new trading account.

- eToro also allows you to log in using Facebook or Gmail.

- While submitting your information, please read eToro’s Terms & Conditions and privacy policy.

- Select the “sign-up” option.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Your capital is at risk.

Step 2: Upload ID

To begin, you must create an account with eToro by providing some basic personal information, an email address, and a cell phone number. To complete the verification process, you must also provide identification.

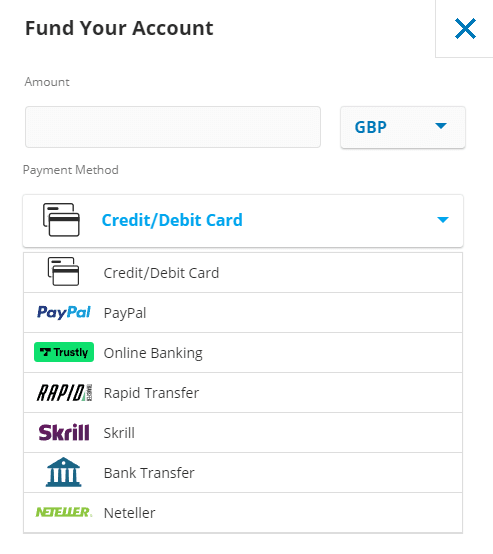

Step 3: Make a Deposit

When you’re ready to deposit, go to the ‘Deposit Funds’ section and enter the amount you want to deposit. A minimum deposit of $10 is required to open an account with eToro, which can be made in various ways. Payment methods accepted include debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller.

Depositing eToro is free of charge. After selecting a payment method, click the ‘Deposit’ button to finish the transaction.

Deposit methods on eToro

Step 4: Buy Flare (FLR)

Begin typing ‘FLR’ into the top-of-the-screen search bar. Click the ‘Trade’ button when you see the cryptocurrency asset.

Searching FLR on eToro

Step 5: Review Flare (FLR) Price

This step will get you to an order page where you can enter the number of FLR coins you want to buy. Then, click ‘Open Trade’ to add FLR to your portfolio. Finally, we suggest storing your digital assets in a third-party wallet in addition to the trading platform. The eToro Crypto Wallet, which now supports over 120 different cryptocurrencies and FLR, is one viable option.

FLR price chart on eToro – before the Terra crash

The good thing is, there’s no maker/taker fee on eToro as they solely charge buy/sell spread.

Step 6: Buy Flare

You can tell eToro how much money you want to invest in FLR by entering it into the ‘Amount’ box, which starts at $10. To complete your purchase, click the ‘Open Trade’ button.

How to buy FLR on eToro – the FLR price is a lot cheaper now

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Flare FLR Tokens – Best Platforms

The Flare Token (FLR) is unavailable on some popular cryptocurrency exchanges. FLR is available on eToro, one of the few platforms. Because the coin is still in its early stages, the Flare team will only accept listings on top broker exchanges. The registration process on eToro is simple, and the trading experience is pleasant. The website contains instructions for purchasing digital assets.

The best place to buy Flare right now is reviewed below. Our list of sites to buy FLR in 2024 includes fees, features, and more information. eToro has established itself as the best place to buy FLR cryptocurrency, and by temporarily delisting it, it has saved investors from a large portion of the FLR drop.

Best Brokers to Buy Flare (FLR)

1- eToro

eToro is an investment and social trading platform that provides an online trading and investment platform. This company was founded in 2006 and is headquartered in Tel Aviv, Israel. eToro offers retail investors and traders various services, including trade execution via its proprietary web platform. Furthermore, the company provides social trading and copy-trading capabilities.

The site and company offer a platform available in more than 25 languages and approved by the Cyprus Financial Markets Authority. The site also includes an advanced analytics tool that allows users to pinpoint trading opportunities, monitor performance, analyze their investment strategy, and spot areas for improvement.

You can also earn rewards for buying and selling Ethereum, Cardano, and Tron in your wallet.

Learn more about how to stake cryptocurrency.

eToro is overseen by some of the world’s most reputed regulatory bodies, including the United Kingdom’s Financial Conduct Authority (FCA). The Australian Securities and Investment Commission, the Cyprus Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA) are also in charge. Per CySEC regulations, user funds are kept separate from the platform’s operating capital for all CySEC-registered brokers. This is how the platform works.

eToro, like other companies, charges a small trading fee, including 0.75 percent, when buying or selling bitcoin. The cost of converting bitcoins on eToro is only 0.1 percent on top of the existing margins. As a result, in 2022, eToro will be the market leader in cryptocurrency trading, with a strong preference for crypto-assets and CFDs.

eToro charges reasonable fees to its customers. Depositing eToro is free of charge. Deposits are accepted via bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller, among other methods. The minimum deposit amount varies depending on the user region. Before trading, individuals in the United Kingdom and the rest of Europe, for example, must make a minimum deposit of $200. Users in the United States must make a $10 deposit.

eToro accepts Bitcoin, the leading cryptocurrency, and popular altcoins like Ethereum, Aave, XRP, and Graph.

Buying and selling on eToro can be done online and on mobile devices via their mobile app. Opening an eToro account is simple and takes only a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA, or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a Luxembourg-based cryptocurrency exchange founded in 2011 by Nejc Kodri and Damijan Merlak. This well-established cryptocurrency exchange offers a low-fee cryptocurrency marketplace for professional investors and large financial institutions.

Bitstamp was one of the first Bitcoin exchanges in the cryptocurrency market, having been founded less than two years after the invention of Bitcoin.

Bitsamp best suits seasoned investors searching for a top-notch cryptocurrency trading platform. However, it is an excellent platform for users looking to make a single purchase of digital assets and store them on Bitsamp’s web-based cold storage wallet.

Payment Fees: Compared to most digital asset exchanges, Bitstamp charges relatively low transaction fees. The UK offers two deposit options. The first option is an international wire transfer, which charges only 0.05 percent of the amount transferred (very low compared to other crypto platforms). The second option is to make use of the complimentary Faster Payments service.

The withdrawal fee is also lower than the industry average – 0.1 percent for international wire transfers and 2 GBP for Faster Payment. Bitstamp’s only shortcoming is the high fee on credit card cryptocurrency purchases – 5% on any amount.

Unlike most online trading platforms, Bitstamp does not have a minimum deposit requirement. However, similar to Bittrex, it requires a minimum order of 50 USD/EUR/GBP, whereas some other exchanges may require a much higher minimum order.

Trading fees on Bitstamp: Bitstamp is widely regarded as a low-fee exchange, especially for highly active investors. The maximum trading fee is 0.5 percent if your daily volume is less than $10,000. (above the average in the industry, which is around o.25 percent ). However, as the investor’s total volume of transactions increases, the fees decrease significantly. As a result, if your volume exceeds $20,000,000, you may pay as little as 0% in fees. Individual investors should anticipate paying a fee of approximately 0.1 percent at Bitstamp.

Security: All investors performing critical account functions must now use two-factor authentication. Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured. However, according to crypto exchange security evaluator CER, it ranked near the bottom of our review of crypto exchanges in terms of security, indicating that it may still have room to grow into a category leader.

Customer Service: Customer service is available 24 hours a day, seven days a week, and includes an emergency phone support line.

Pros & Cons of the Bitstamp platform:

- Allows for purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Leon Li launched Huobi Global in 2013 and was located in China then. In the wake of China’s 2017 crackdown on cryptocurrency exchanges, Huobi Global shifted its headquarters to Singapore and later to the Republic of Seychelles. Huobi Global is accessible across most of the world’s nations, except for the United States and Japan (though users in Japan can use Huobi Japan instead).

Huobi Global offers crypto-to-crypto trading with diverse supported assets and competitive trading fees. On the platform, designed for active traders and institutional investors, limit, stop, trigger orders, and margin and futures trading are available. Institutional traders can utilize OTC trade desks, derivatives, and customized trading instruments.

The platform offers up to 5 percent leverage for margin trading. The fee structure of Houbi Global is quite affordable and competitively low.

Other fees vary by currency, including deposit, transaction, and withdrawal. The minimum deposit fee is $100 USD.

Those wishing to purchase cryptocurrencies with a credit or debit card must pay Houbi a higher fee. The maker and taker fees are both fixed at 0.2 percent. Depending on the volume of the scale, it can be as low as 0.1%.

Huobi Global provides customer support via email, telephone, online chat, a ticketing system, and social media platforms. It provides multiple security measures, including two-factor authentication, cold storage, account freezes, and Bitcoin reserves.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

In 2016, Crypto.com was created as a global cryptocurrency exchange headquartered in Hong Kong; it services more than 10 million traders in over 90 countries and allows you to buy and sell more than 250 cryptocurrencies with cheap trading fees.

The key selling proposition of the Crypto.com platform is the ability to stake cryptocurrencies. By staking or storing them in a crypto.com wallet, customers can earn up to 14.5% annual interest rates. In addition to trading, the exchange offers various services, such as staking incentives, Visa card advantages, NFT trading, DeFi products, and more.

Crypto.com implements several security methods, including multi-factor authentication (multi-factor authentication). Whitelisting is sometimes used to protect consumer accounts. The platform employs compliance monitoring to prevent hackers and losses and saves customer deposits offline in cold storage.

This platform requires a $1 minimum account balance for deposits. Maker/Taker fees range between 0.04% and 0.40%. During the first 30 days after account opening, purchases made with a credit or debit card incur no fee or a fee of zero percent. Additionally, users can earn up to $2,000 for each referral.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a cryptocurrency trading platform that provides spot trading, derivatives trading, and margin trading on BTC/USD and ETH/USD trading pairings with up to 100x leverage.

Bybit was formed in Singapore in March 2018 by specialists from investment banks, technological organizations, the forex sector, and early users of blockchain technology. It is a trading exchange registered in the British Virgin Islands with approximately 2 million customers.

Bybit is a cryptocurrency-to-cryptocurrency exchange that does not need consumers to undergo burdensome KYC verification and has a trading volume of up to $1 billion daily.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the most active cryptocurrency exchanges in daily transaction volume, with over $20 billion in daily transactions. It provides access to hundreds of assets and a trading environment facilitating easy earning.

Low costs, a comprehensive charting interface, and support for hundreds of cryptocurrencies distinguish Binance. Unlike eToro, Binance is a cryptocurrency-centric exchange that does not offer copy trading, FX, commodities, or other financial services.

Binance utilizes two-factor authentication (2FA) and FDIC-insured US dollar (USD) deposits. Additionally, Binance protects its customers with device control in the United States, address whitelisting, and cold storage.

Fees range from 0.015 to 0.10 percent for purchasing and selling, 3.5 percent or $10, whichever is greater, for debit card purchases, and $15 for US wire transfers.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

7 – Coinbase

When consumers inquire about how to begin investing in cryptocurrencies, Coinbase is commonly recommended. Coinbase was established in 2012, barely three years after the creation of Bitcoin, and has since grown to become the largest cryptocurrency exchange in the United States by trading volume, with over 73 million verified users in over 100 countries.

While the company offers a range of valuable products for individual and institutional investors, corporations, and developers, its defining characteristic is the ability to buy, sell, and trade over 100 distinct cryptocurrencies and crypto tokens. In April 2021, the company went public through a direct listing on the Nasdaq exchange. Its quarterly trading volume is now $327 billion, and the platform’s assets are $255 billion.

Even though Coinbase’s transaction and trading costs are greater than its competitors, it remains one of the most popular apps for investing in cryptocurrencies.

FLR limit and market orders are supported on the Coinbase Pro exchange. The maker/taker charge is 0.5 percent for the first $10,000 in volume traded within a 30-day period and 0.35 percent after that. If your 30-day volume surpasses $300 million, you can trade cryptocurrencies without any maker fees.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, created in 2017, is a global cryptocurrency exchange that offers eight million customers various trading alternatives. Spot, futures, margin, peer-to-peer (P2P), staking, and lending options exist.

Johnny Lyu is the Co-Founder and Chief Executive Officer of KuCoin, one of the most well-known cryptocurrency exchanges in the world. KuCoin has developed into one of the most popular cryptocurrency exchanges. It has over 8 million registered users from more than 207 nations and territories.

KuCoin permits the purchase of bitcoins with fiat currency, but only via a third-party application. It is possible to pay with a credit or debit card, Apple Pay, or Google Pay, but not with a bank transfer. However, the fees may be prohibitive.

KuCoin Transaction Fees: The structure of Kucoin’s trading fees is basic. The platform charges 0.1 percent for both makers and takers, making it one of the cheapest online Bitcoin exchanges. If you hold the native Kucoin tokens of the platform, you can further lower your fees.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange where users may buy, sell, and trade various digital coins. The Hong Kong-based portal was created in 2012. Since Bitfinex’s trading area contains a robust set of chart analysis tools, intermediate and expert traders are more likely to utilize it.

Aside from cryptocurrencies, wire transfers are the only method for depositing and withdrawing monies. Bitfinex, like Coinbase, is one of the few platforms permitting shorting and leveraging trading tactics with cryptocurrencies. Bitfinex was created in December 2012 as a peer-to-peer Bitcoin exchange offering digital asset trading services to clients worldwide.

Bitfinex Securities Ltd., a supplier of blockchain-based investment products, has created a regulated investment exchange (Bitfinex Securities) in the AIFC to increase member access to a wide variety of financial products. Consequently, Bitfinex is fully unregulated. Despite having its headquarters in Hong Kong, the corporation is registered in the British Virgin Islands.

Fees and deposit limits: For bank transfer deposits, Bitfinex charges a 0.1% fee. For example, if you deposit $10,000, you will be charged $10.

Bitfinex imposes a 0.1 percent withdrawal fee for bank wire withdrawals. If you require funds within 24 hours, you can pay a 1 percent expedited fee.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- US citizens are not accepted.

-

Expensive trading fees

- The support team only available via email

What is Flare (FLR)?

Flare is the native token for Flare, a distributed blockchain network and innovative contract platform based on the Avalanche consensus algorithm and the Federated Byzantine Agreement (FBA). FBA consensus techniques do not use economic mechanisms to secure the network. Instead, the Spark Dependent Application model is a Flare app creation template.

The Flare Network provides a Turing complete innovative contract platform in an FBA context, based on the Avalanche protocol, to enable a scalable, safe, and decentralized network free of the constraints and safety conflicts associated with using economic mechanisms to prevent Sybil attack.

Flare (FLR), Flare’s native token, is a cryptocurrency. Its primary goal is to assist other blockchain networks in implementing smart contracts. Ripple (XRP) and Litecoin (LTC) are two blockchain networks (XRP). In addition to these two, the flare coin is compatible with the Ethereum Virtual Machine (EVM).

What is Flare?

Flare is a distributed chain that enables two-way communication between blockchain networks. Flare serves as a link between Ethereum and the Ripple network in most circumstances. Flare is simple to use. Flare can address Ripple’s minor utility issue. Ripple coins (XRP) can use its network to access Ethereum’s innovative contract capability. This capacity is unique to crypto projects. So, how does the Flare network accomplish these goals? Let us investigate.

The Flare Network

The Flare network is a blockchain-based distributed network that scales other smart contract networks (EVM) using the Ethereum Virtual Machine. The Flare network may now provide a suitable environment for Decentralized Applications thanks to this powerful functionality (DApps). Flare’s network, interestingly, does not rely on Proof-of-Stake (PoS) to provide scalability, interoperability, and token security. The network employs the Avalanche consensus protocol to provide security and transaction validation. Flare’s team also wants to use their Turing-scalable networks and low transaction fees to help people get access to DApp tokens. So, who is behind these extraordinary abilities?

The Team Behind Flare

A strong team supports the Flare network. Hugo Philion, Sean Rowan, and Dr. Nairi Usher, who also serves as Chief Scientist, are among the company’s founders. Flare features an advisory board of eight (8) people who are significant guns in some of the world’s most prestigious institutions and its fantastic founders and technical staff.

What is So Special About Flare (FLR)?

We’re used to seeing cryptocurrency used mostly for staking reasons while working with blockchain networks. This statement applies to all Proof-of-Stake platforms. Users with many crypto coins can stake them there to participate in the chain’s validation process.

Flare’s developers claim that PoS is defective by design. The staked native currencies, which may not be safe enough in the long run, are the only thing that protects PoS networks.

By not putting all the security burdens on Flare, Flare gets around this problem. Instead, it employs its currency to prevent spam transactions, enables smart contracts previously inaccessible on other platforms such as Ripple, and serves as collateral in transactions.

Flare is a distributed chain that enables two-way communication between blockchain networks. Flare serves as a link between Ethereum and the Ripple network in most circumstances. Flare is simple to use. Flare can address Ripple’s minor utility issue. Ripple coins (XRP) can use its network to access Ethereum’s innovative contract capability. This capacity is unique to crypto projects. So, how does the Flare network accomplish these goals? Let us investigate.

The Flare Network

The Flare network is a blockchain-based distributed network that scales other smart contract networks (EVM) using the Ethereum Virtual Machine. The Flare network may now provide a suitable environment for Decentralized Applications thanks to this powerful functionality (DApps). Flare’s network, interestingly, does not rely on Proof-of-Stake (PoS) to provide scalability, interoperability, and token security. The network employs the Avalanche consensus protocol to provide security and transaction validation. Flare’s team also wants to use their Turing-scalable networks and low transaction fees to help people get access to DApp tokens. So, who is behind these extraordinary abilities?

The Team Behind Flare

A strong team supports the Flare network. Hugo Philion, Sean Rowan, and Dr. Nairi Usher, who also serves as Chief Scientist, are among the company’s founders. Flare features an advisory board of eight (8) people who are significant guns in some of the world’s most prestigious institutions and its fantastic founders and technical staff.

Fundamentals of FLR

When it originated: December 12, 2020

Management Team: Founders include Hugo Philion, Sean Rowan, and Dr. Nairi Usher.

Native token: Flare

What it does: Flare (FLR), Flare’s native coin, Flare (FLR), is a cryptocurrency. Its primary goal is to assist other blockchain networks with implementing smart contracts. Ripple (XRP) and Litecoin (LTC) are two blockchain networks (XRP). The flare currency is compatible with the Ethereum Virtual Machine and these two (EVM).

Is it Worth Buying Flare FLR in 2024?

The cryptocurrency market has always been known for its extreme volatility, and Flare (FLR) is no exception. As of today’s date, Flare is priced at $0.013851, a mere fraction of its all-time high (ATH) of $0.702240 on August 13, 2022. Conversely, the cryptocurrency experienced its lowest point on August 18, 2023, plummeting to an all-time low of $0.012260. These drastic fluctuations have left investors and analysts alike wondering about the factors driving these wild price swings.

Flare’s price journey has been one of extreme highs and lows. Its ATH of $0.702240 was reached on August 13, 2022, a moment of triumph for Flare enthusiasts. However, this celebration was short-lived as the cryptocurrency embarked on a downward spiral, culminating in its all-time low of $0.012260 on August 18, 2023. This sharp decline of over 98% from its ATH highlights the unpredictability of the cryptocurrency market and the potential risks associated with investing in such assets.

Interestingly, Flare experienced a minor recovery from its cycle low, reaching a high of $0.014026. While this rebound offered a glimmer of hope, it was clear that Flare was still grappling with significant challenges in maintaining a stable price trajectory.

As of the latest data, the cryptocurrency holds a market capitalization of $204.30 million, which contributes to its marginal market dominance of 0.02%. In the past 24 hours, Flare’s price has increased by 0.52%. These numbers reflect the ongoing volatility in the market, where minor shifts can lead to notable percentage changes in cryptocurrency prices.

Investor sentiment plays a crucial role in influencing the direction of cryptocurrency prices. Currently, the Flare price prediction sentiment leans towards a bearish outlook, indicating prevailing concerns among investors. Adding to this sentiment, the Fear & Greed Index stands at 39, categorizing the market sentiment as one of “Fear.” This apprehensive sentiment reflects the cautious approach of investors due to the recent price turbulence.

Analyzing Flare’s performance over the past year, it becomes evident that the cryptocurrency has faced significant challenges. The price drop of -97% over the last year showcases the immense volatility that investors have had to endure. Moreover, Flare has lagged behind when compared to the top 100 crypto assets, as it was outperformed by all of them in the past year.

Even in comparison to flagship cryptocurrencies like Bitcoin and Ethereum, Flare has struggled to keep pace. Trading below the 200-day simple moving average further reinforces the difficulties in maintaining a stable price trend. The current price of Flare, at a staggering -98% from its ATH, serves as a reminder of the potential losses that can occur in the volatile world of cryptocurrencies.

Flare’s liquidity, determined by its market capitalization, remains at a medium level. With a circulating supply of 14.75 billion FLR, the cryptocurrency has a market cap of $204.30 million. This level of liquidity implies that while there is an active trading environment, there is also a risk of sudden price movements due to the potential impact of larger buy or sell orders.

Flare’s journey from its ATH to its current price has been a roller coaster ride, filled with extreme highs and lows. The cryptocurrency market’s inherent volatility has been amplified in the case of Flare, leaving investors cautiously optimistic at best.

Your capital is at risk.

Flare Price Now – Will FLR Go Up in 2024?

The world of cryptocurrency investing is an intricate web of speculation and anticipation. Attempting to predict the exact price movement of a token over a given period is akin to peering into a crystal ball, often clouded by the volatile nature of the market. Flare Token’s (FLR) relatively short existence in the crypto space adds an additional layer of unpredictability. While historical data may be scarce, expert forecasts and technical analyses offer insights into its potential trajectory.

Historically, Flare Token has been seen as a short-term investment by most investors due to its recent introduction to the market. With limited data available, making accurate predictions can be challenging. However, the token’s recent integration into the market highlights the necessity of forecasting its performance, even in the absence of comprehensive data.

One key factor contributing to this optimistic outlook is the network’s increasing adoption across various applications. As Flare’s utility grows, the demand for FLR tokens is expected to rise, potentially boosting their value over time.

Flare’s journey toward price growth is underscored by its strategic partnerships and developments. The network’s commitment to collaborations has not gone unnoticed, and these partnerships hold the potential to catalyze substantial growth. Recent announcements in July 2023 have further bolstered the network’s credibility:

- Partnership with Ankr: The collaboration with Ankr aims to provide robust RPC infrastructure for developers, enhancing the network’s performance and usability.

- Punk Domains Alliance: Flare’s partnership with Digital Identity Venture Punk Domains signifies the network’s expansion into the realm of digital identity, presenting new avenues for utility and growth.

- Transparency Initiative: Flare’s association with the Community Transparency Initiative FlareDashboard reflects its dedication to transparency and community engagement, factors that can solidify investor confidence.

One pivotal shift in Flare’s strategy is its transition to a staking model. This move introduces FIP.05, a proposal outlining staking infrastructure, limits, and rewards. This transition not only aligns with broader industry trends but also offers FLR holders an opportunity to actively participate in securing the network while potentially earning rewards.

This evolution in governance can contribute to a more engaged and committed community, which often correlates with positive price movements. As Flare Token continues to expand its utility, foster partnerships, and transition to new models, its potential for growth remains promising.

Flare (FLR) Price Prediction: Where Does FLR Go From Here?

While the recent price increase of 0.52% in the last 24 hours might offer a temporary respite, it’s clear that Flare’s path to recovery is riddled with challenges. The bearish sentiment and the Fear & Greed Index’s indication of “Fear” underscore the uncertainty that currently surrounds Flare’s future price movements.

Let us now look at our technical analysis based on FLR price predictions:

FLR Price Prediction 2023

While the token price will continue to be volatile during such events throughout the year, we believe the token will reach a minimum level of $0.050 by the end of the year while maintaining an average price of $0.030.

FLR Price Prediction 2024

The Flare Token is expected to reach $0.088 by mid-2024 after starting the year at around $0.059. FLR could reach a high of $0.099 by the end of the year, just a little away from being counted as a penny currency.

With that being said, the token could reach these targets much earlier than projected if it becomes a part of the crypto-wide bull run, expected to occur in 2024. If it does, investors could be looking at double these numbers easily.

FLR Price Prediction 2025

FLR could very well begin 2025 for $0.01, and this price will be sustained throughout the year as future developments and token adoption make FLR an active e-trading asset. Once the token reaches the $0.01 level, it could be set for a promising future, potentially making exponential gains before 2030.

Market analysts predict the token to stay between $0.015 – $0.020 during 2025 after consolidations that mitigate the effects of any corrections post the bull run.

Now that you’ve decided to purchase the token and are wondering where to buy FLR in 2023, you can find it listed on eToro. The platform is licensed and regulated by the FCA. It has one of the best reputations in the industry, providing a wealth of educational resources to help those new to the market learn the ropes.

Other Undervalued DeFi Projects

We recently updated our best altcoins list to include DeFi coin, an undervalued DeFi project (DEFC). Despite the May crypto crash, it rose in price by 350-400 percent that month after completing portions of its roadmap.

It has also already retraced 98.75 percent of its all-time high, as has Terra LUNA, albeit over a year. It’s now at a low price but still higher than presale. It has more upside potential than downside risk and has room to grow in 2024 as the DeFi market cap recovers.

FAQs

What is Spark?

Spark (FLR) is the Flare network's governance token, which can also be used as collateral in various decentralized applications.

Is it a good idea to invest in Spark?

Spark is still a new digital asset, so predicting where it will go is premature. This is why you should only invest a small amount in this crypto token.

Where can I keep my Spark tokens?

Spark, as a cryptocurrency, must be kept in a secure wallet. You can also use a regulated broker like eToro and leave your FLR coins on the platform after purchasing. This also simplifies the process of selling your Spark tokens when the time comes.

How can I sell my Spark investment?

On eToro, you can sell Spark by selecting it from your portfolio and cashing out directly from the platform.

Any risk in buying Spark now?

When it comes to improving the capabilities and scalability of existing blockchains, the Flare network appears to be very promising. If it is successful on all fronts, it will transform the DeFi sector and gain traction in the cryptocurrency market.

Bitcoin

Bitcoin