The crypto sector is introducing new technologies that promise to effectively and sustainably replace existing ones. SKALE Network SKL is one of these crypto market initiatives. The technology has a promising future and a solid foundation for solution development. Previous blockchains required a scaling solution due to the rapidly expanding market for new decentralized applications and e-commerce.

When the Skale founders saw a potential market opportunity, they created a unique, high-throughput layer that would work with Ethereum and assist new DApps in overcoming scaling issues. SKALE was created at the time. The SKALE Project was announced publicly by Jack and Stand, with assistance and funding from Signia Ventures and Floodgate. Later, SKALE received funding from several other cryptocurrency and blockchain investors, including Winkelvoss Ventures, Hashed, Hashkey, and many more.

SKALE launched its phased mainnet implementation after 2.5 years of experimentation and development. This strategy included holding a public SKL token sale on ConsenSys Codefi’s Activate platform. SCALE is the first project to use Activate’s new utility token Proof-of-Usage framework. The Ethereum network is congested because many developers use it to build decentralized apps, but the SKALE Network provides a solution.

SKALE Network provides a Layer-2 scaling solution, allowing Ethereum to provide developers and ETH consumers with a super-scalable environment. By combining with Ethereum, SKALE Network hopes to enable Web3 apps to compete with traditional apps in terms of price and performance. Users may use side chains to create DApps and avoid network traffic congestion because SKALE fully integrates into the Ethereum network and uses elastic side chains.

In this article, we will look at the pricing of the SKALE Network and its current and future state to help you as a crypto investor. It also provides SKALE Network and SKL price prediction to help you trade the crypto markets and decide whether to buy or sell SKALE Network SKL. Finally, consider the SCALE Network’s price prediction and whether you should invest in 2024.

How to Buy SKALE Network – Quick Guide

Following are a few simple steps to buy the SKALE Network in just a few simple steps:

- Choose an exchange that offers SKL Protocol – we recommend eToro, which is ASIC, CySEC, and FCA-regulated

- Sign up with eToro and verify your account with your government ID or driving license.

- Fund your account via bank transfer, PayPal, credit card, or other payment methods

- Type ‘SKL’ in the search bar and select SKALE network from the drop-down menu to see the price chart

- Click the ‘Trade’ button and select a quantity of SKL coins you would like to buy

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Compare Cryptocurrency Exchanges to Buy SKALE Network

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Where to Buy SKALE Network – Best Crypto Platforms

In the broker’s review section below, you will find the top crypto platform to buy SKALE Network in 2024. eToro is the most popular platform for purchasing SKL cryptocurrency, as it is secure, affordable, and simple to use.

1. eToro: Overall Best Platform to Buy SKL Coin in 2022

On our list of the best platforms for purchasing SKL coins, eToro comes in first place. Because of its simple copy-trading platform, which allows traders to replicate the trades of experienced investors – or receive exclusive benefits for sharing their trading strategies – eToro is a leading crypto platform. With over 3,000 tradeable symbols, including CFDs, forex, and exchange-traded securities, eToro offers a comprehensive trading experience.

eToro was founded in 2007 and is regulated in two tier-1 and one tier-2 jurisdiction, making it a safe (low-risk) broker for trading forex and CFDs.

eToro offers a comprehensive online brokerage platform in other countries. It is new to the US market and currently only offers cryptocurrency trading. The eToro platform provides 27 cryptocurrencies, a transparent fee structure, and a vibrant user community. eToro, as a multi-asset broker, goes above and beyond to ensure traders have a positive experience. For example, eToro allows you to trade CFDs and underlying assets directly from the trade-ticket window—a subtle but beneficial feature.

eToro offers cryptocurrency trading through CFDs and trading the underlying security (e.g., buying Bitcoin). Cryptocurrency CFDs are unavailable to retail traders in the United Kingdom through any broker. Neither entity, UK residents, nor even the Dutch. Furthermore, cryptocurrency trading is unavailable on eToro in Russia, the Netherlands, or France (including French Territories). Lastly, you can earn rewards in your wallet for buying and selling Ethereum, Cardano, and Tron.

eToro accepts Wire transfers, credit cards, debit cards, PayPal, Skrill, Sofort, and Netteller payment methods. It is free to deposit funds into an eToro trading account. The minimum deposit amount varies depending on the user’s location. Before trading, individual investors in the United Kingdom and the rest of Europe must make a minimum deposit of $200. Users from the United States must also deposit $10.

2. Binance: Trade SKL with Leading Crypto Exchange

Binance is a cryptocurrency exchange that offers low fees, exposure to hundreds of digital currencies, and additional features for sophisticated investors. Nevertheless, Binance is not accessible to customers in the United States; if you live there, you must use Binance.US, which has less functionality. In 2017, Chinese software developer Changpeng Zhao founded the decentralized cryptocurrency exchange Binance, the world’s largest cryptocurrency exchange by trading volume.

Binance provides global users with access to hundreds of cryptocurrencies. On the other hand, the global Binance platform is distinct from its US counterpart, Binance.us, which only supports over 65 cryptocurrencies. In addition to cryptocurrency trading, Binance offers cryptocurrency-to-crypto, cryptocurrency-to-fiat, and fiat-to-crypto currency trading. In addition, they offer margin trading, futures trading, and listing for ICOs.

Binance does not provide no-fee trading. However, their fees are lower than even the best cryptocurrency exchanges that charge fees and commissions. The highest commission for spot trading is 0.1%. Since some crypto platforms charge over 5 percent to deposit funds and then buy crypto, the low fees are one of the reasons why traders use Binance for a significant portion of their crypto investments. The fee ranges between 0.015 and 0.10 percent, with debit card purchases costing 3.5% or $10, whichever is greater, and US wire transfers costing $15.

Binance utilizes two-factor authentication (2FA) and FDIC-insured USD deposits. In addition to device control, cold storage, and address whitelisting, the leading cryptocurrency exchange protects its US customers with device control.

3. Crypto.com: Leveraged Trading on SKL

Crypto.com offers a vast selection of digital assets for reasonable prices. Even though it does not support traditional crypto-to-cryptocurrency trading, sophisticated traders may be interested in its DeFi offerings. Crypto.com is a cryptocurrency platform that enables trading, investing, staking, wallets, and non-fungible tokens, among other things. This platform provides over 250 crypto assets, reasonable fees, and discounts for large Crypto.com Coin (CRO) holdings.

In addition, its ecosystem of crypto-related products may make it an excellent option for those who wish to do a great deal with their cryptocurrency. With over 9 million global users, Crypto.com is one of the most popular cryptocurrency wallets, allowing you to buy and sell more than 250 cryptocurrencies with low trading fees. Daily, Crypto.com processes more than $2 billion in transactions.

Crypto.com offers:

- Credit cards, as well as crypto-to-crypto and fiat-to-crypto services

- Wire transfers

- Cash deposits at any ATM worldwide

Crypto Capital Corp., a subsidiary of Crypto, also provides trading services for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). The company maintains offices in the United States, Japan, Singapore, and South Korea, and its headquarters in Hong Kong. On February 22, 2014, Samuel Leach and Matt Mickiewicz founded Crypto in Zug, Switzerland.

To make a deposit, a minimum account balance must be $1. Fees for both issuers and acceptors range between 0.04 and 0.40 percent. The first thirty days of credit and debit card purchases are free after opening an account. Additionally, users can earn up to $2,000 per referral. The ability to stake cryptocurrencies is the primary selling point of the platform. Customers who stake or store cryptocurrency in a crypto.com wallet can earn up to 14.5 percent annual interest.

The exchange provides staking bonuses, Visa card perks, NFT trading, and DeFi products. Crypto.com provides 180 cryptocurrencies to US customers, more than any other exchange we reviewed. In contrast to some competing exchanges, Crypto.com only accepts fiat currencies such as US dollars.

4. Coinbase: One of the Best Crypto Platforms to Trade Crypto

Coinbase is a reputable platform for buying, selling, and exchanging cryptocurrencies. Coinbase makes purchasing Bitcoin as easy as purchasing stocks via an online brokerage. It was founded in 2012 as a platform for sending and receiving Bitcoin, but it now supports dozens of other cryptocurrencies and employs more than 4,900 people globally. Coinbase is a decentralized company without a central office.

Coinbase Global, Inc., also known as Coinbase, is a cryptocurrency exchange platform in the United States. It is the largest cryptocurrency exchange in the United States regarding trading volume and is a decentralized organization with no physical headquarters. The company offers a variety of high-value products to individual and institutional investors, corporations, and developers. Still, its defining characteristic is the ability to buy, sell, and trade more than 100 distinct cryptocurrencies and crypto tokens.

The company went public through a direct listing on the Nasdaq exchange in April 2021. The platform’s current quarterly trading volume is $327 billion, and its current assets are $255 billion.

Coinbase supports the trading of most cryptocurrencies, including Bitcoin, Ethereum, LUNA, Uniswap, and Cardano, as well as meme currencies such as Dogecoin and Shiba Inu. Coinbase charges a 3.99 percent fee when using a debit or credit card; this fee is reduced to 1.499 percent when ACH transfers are used, and Coinbase Pro enables free bank transfer deposits.

Following the standard maker/taker model, Coinbase Pro’s trading fees are significantly reduced and simplified. When you execute a trade that is immediately filled, the taker fee is applied, reducing the total liquidity on the exchange. The maker fee is charged for orders that are not instantly filled, resulting in liquidity and potentially a lower fee.

What is SKALE (SKL)?

The SKALE Network is an ETH ecosystem-compatible, elastic blockchain with maximum bandwidth and customizable byzantine fault tolerance. In plainer terms, it is a flexible network that can give Ethereum scalability. Its first application was as an adjustable side chain for the ETH blockchain. A class of virtualized sub-nodes selected from a subset of nodes adopts side chains in the SKL Network.

They utilize the entire available storage and processing power on each node or only a portion. Users may select their primary blockchain, consensus protocol, chain size, virtual machine, and other security measures on each side chain, which is very flexible. The company’s technology focuses on running smart contracts in a secure, decentralized, and fast way. Users may be able to run them 1000 times faster, the company says.

The network uses a Delegated Proof-of-Stake (DPoS) consensus method, allowing for asynchronous transactions and functions as quickly as Elrond or Binance Smart Chain. With the help of the SKALE Network, developers can quickly and easily create native Ethereum chains that are decentralized and programmable. In addition to on-chain file storage and artificial intelligence in EVM, SKALE chains can execute complete smart contracts and perform block timings in under a second.

SKALE Ecosystem

SKALE ecosystem provides a comprehensive collection of integrations with significant wallets and auths providers, validators, data storage solutions, data explorers, oracles, and blockchain API connectors.

Following are the major SKALE Ecosystem Partners.

Blockdaemon: The Skale Blockdaemon offers complete end-to-end node administration and support for SKALE, an Ethereum blockchain that empowers developers.

Ankr: After the initial time of required staking, users can spin up their validator using Ankr and delegating SKL. In addition, they may maximize benefits while maintaining safety by using a non-custodial approach.

Chainlink: Chainlink helps the SKALE Network by enabling its developers to create more complex Smart contract applications utilizing real-world information and API applications given access via Chainlink oracles.

Truffle: The Truffle Developer Tool makes it easier for developers to instantiate, build, and deploy applications on the SKALE Network. Additionally, you may create and migrate your current Smart Contracts to the SKALE Network using Truffle.

The Fundamentals of SKALE Network

When it originated: Jan. 1, 2018

Management Team: Jack O’Holleran and Stan Kladko, who have extensive software sector backgrounds, established SKALE Network. The current CEO of SKALE is Jack O`Holleran.

Native Token: SKL

What it does: The SKALE Network is a Layer-2 scaling approach for the Ethereum network. It allows developers to get around mainnet congestion by moving their activities off the main chain and onto nearby, SKALE-managed side chains.

How does it work: The SKALE Network effectively separates network nodes using what it refers to as an elastic capacity method. For instance, each SKALE Node may operate numerous side chains simultaneously thanks to virtualized sub-nodes.

Due to SKALE’s powerful encryption and pooled security model, speed and decentralization are made possible without compromising security, enabling developers to provide end users with an excellent experience free of delay and gas costs.

SKL Use Case: The SKL token powers the SKALE Network and is mainly used for Staking, Payment, Rewards, and Governance. Owners of SKL tokens can stake them to take part in consensus. To pay for membership access to utilize the elastic blockchain for their apps, developers must require SKL tokens. Additionally, SKL is a governance token, and holders will have voting rights through their tokens.

Is It Worth Buying SKALE (SKL) in 2024?

On June 30, 2020, SKALE launched the first phase of its mainnet, a limited version that didn’t allow for any staking or token transfers. The ConsenSys Activate token sale occurred in September 2020, with approximately 4,000 people from 90 countries participating. In October 2020, Mainnet Phase 2 allowed delegation and staking with more than 46 validator groups. The final stage of the mainnet launch, Mainnet Phase 3, happened in December 2020, at the end of the Proof-of-Use period for the tokens.

SKALE’s historical price has been volatile since its launch in March 2021. According to CoinMarketCap, SKL started trading at around $0.4 on March 11, 2021 and reached its all-time high of $0.88 on March 12, 2021. However, SKL soon entered a downtrend and fell below $0.1 by May 2021. SKL then recovered slightly and traded between $0.1 and $0.2 for most of the second half of 2021.

In 2022, SKALE’s price was influenced by several factors, such as the platform’s development, the adoption of decentralized applications, the competition from other scaling solutions, the market sentiment, and the overall performance of the crypto industry. SKL started 2022 at around $0.21 and reached a peak of $0.30 in April 2022, following the launch of several new features and partnerships on the SKALE network. However, SKL faced a correction in May 2022 and dropped to $0.08. Things became more severe, and SKL dropped to $0.04 in June.

SKL then regained some momentum and climbed to $0.07 by July 2022. SKL benefited from the increased demand for scalability and interoperability in the decentralized space as more users and developers migrated to SKALE’s sidechains.

However, SKL faced a downturn in mid-July 2022, as the crypto market experienced a major crash due to regulatory uncertainty and environmental concerns. SKL fell to $0.04 by August 2022; by the end of the year, the situation became much worse as SKL dropped to $0.02 and remained below $0.1 for the rest of the year.

In 2023, SKALE’s price showed some signs of recovery as the crypto market entered a new bull cycle and the adoption of decentralized applications increased. SKL started 2023 at around $0.01 and reached $0.06 by February 2023.

SKL then dropped and reached $0.02 by June 2023. However, SKL faced some resistance at $0.05 and fluctuated between $0.03 and $0.02 for the next few months. SKL was affected by the competition from other scaling solutions, such as Polygon, Optimism, and Arbitrum, which also offered fast and cheap transactions on Ethereum.

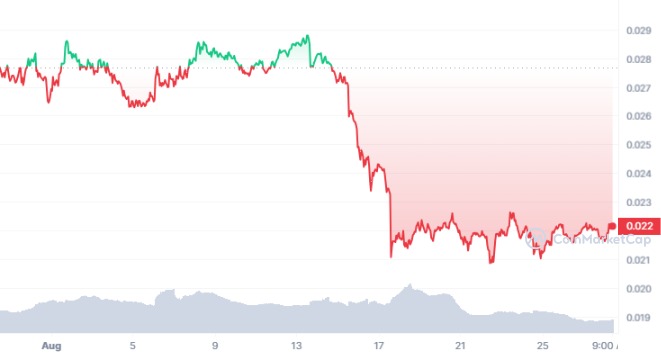

As of today (August 28, 2023), SKL is trading at around $0.02, with a market cap of $103 million and a daily volume of $3 million. SKL has a circulating supply of 5.7 billion tokens out of a total supply of 7 billion tokens.

Will the SKALE (SKL) price Go Up in 2024?

SKALE experienced significant ecosystem growth in recent years; however, in 2023, it also saw notable events, like, the Q2 performance report revealing significant developments in its blockchain scalability platform. The Metaport Bridge, a crucial addition, facilitates navigation through SKALE’s multi-chain ecosystem by offering secure token transfers with zero gas fees. This bridge supports distinct App-Specific Chains and three Community Hubs: Europa for Liquidity, Nebula for Gaming, and Calypso for NFTs.

Noteworthy Q2 engineering updates encompass improved SKALE contract distribution. Simplified distribution of SKALE addresses and APIs streamlines contract integration for developers. Anticipating the upcoming 2.2 update, SKALE has undertaken substantial enhancements. These include swifter transaction processing via an optimized IMA bridge, enhanced state operations, heightened stability under load, and improved node rotation mechanisms.

DappRadar’s integration posed challenges due to SKALE’s multi-chain nature, yet it successfully indexed six out of twenty SKALE Chains on its platform. SKALE remains dedicated to innovation, solving blockchain scalability limits, and empowering developers. Its user-centric Ethereum scaling, zero gas fees, on-chain storage, interchain messaging, and AI smart contracts underscore its commitment to speed, security, and enhanced capabilities.

SKALE offers a faster, more efficient, and highly scalable blockchain infrastructure, reinforcing its status as a pioneering force in the blockchain landscape. Developers can rapidly deploy EVM blockchains without compromising on performance, security, or decentralization within the SKALEverse.

SKALE’s price prediction for the end of 2023 is based on various factors, such as the technical analysis, the fundamental analysis, the market trends, and expert opinions. Based on these factors, some possible scenarios for SKL’s price by December 31, 2023, are:

- Bullish scenario: If SKALE continues to develop its platform, attract more users and developers, integrate with more blockchains and protocols, and benefit from the growth of the crypto industry, SKL could break above $0.35 and reach new highs by the end of 2023. A possible target for this scenario is $0.5.

- Neutral scenario: If SKALE maintains its current performance, delivers its roadmap milestones, faces moderate competition from other scaling solutions, and follows the market movements, SKL could trade sideways or slightly increase by the end of 2023. A possible range for this scenario is $0.25-$0.35.

- Bearish scenario: If SKALE faces technical issues, security breaches, regulatory challenges, user attrition, strong competition from other scaling solutions, and a market downturn, SKL could fall below $0.25 and reach new lows by the end of 2023. A possible bottom for this scenario is $0.1.

These scenarios are not financial advice and are based on assumptions and estimates. SKALE’s price is subject to change due to various factors and uncertainties. Therefore, investors and traders should do their own research and analysis before making any decisions regarding SKL.

SKL Price Prediction: Where does SKALE go from here?

Let’s have a look at our technical outlook and SKL’s long-term price prediction.

SKALE Network Price Prediction 2024

The fan base of SKALE Network may grow due to future partnerships and integration with other sports organizations. If the pace at which developers have been working continues, then the utility and popularity of the SKL network are sure to rise in 2024. According to our estimates, the maximum price of an SKL token will be about $0.25 in 2024. The expected average cost for the same token is $0.22.

SKALE Network Price Prediction 2025

The lowest amount of the SKALE Network SKL coin price estimate will be $0.25. According to our forecasts for the SKALE Network SKL coin, the highest price will be $0.33, with an average price of about $0.29 in 2025.

SKALE Network Price Prediction 2026

Our long-term forecasting indicates that the SKALE Network SKL currency has a promising future. In terms of price and market capitalization, it may reach new highs. Our analysts say the minimum SKALE Network SKL price prediction is $0.35, and the maximum price level is $0.42. Based on what we think the price of SKL will be, the average price of a token will be about $0.37 in 2025.

Summary

To summarize this article, SKALE enhances the fundamental concepts of Ethereum while providing significant functionalities. For example, no fees will change how consumers interact with Eth 2.0. In the long run, SKALE could provide more features for interacting with other Ethereum smart contracts. However, during the cryptocurrency winter, the network lost roughly 80% of its value, and experts agree that predicting when the price will bottom out is difficult. SKALE shows promise, and the token will gradually recover from its losses.

With only a few minor variations in value, price forecasts for the SKALE network closely resemble predictions of a long-term increasing trend. Price forecasts can range from optimistic to pessimistic. SKL has grown due to strong investor interest and the introduction of significant validators into the SKALE network ecosystem.

If you want a token to add to your portfolio, the SKALE network could be a good long-term investment. However, you must research and interpret the analysis before investing in any cryptocurrency futures market.

Lastly, our recommended broker is eToro, as this platform is licensed and regulated by the FCA and has the best reputation in the industry. Moreover, eToro offers educational resources to guide newcomers to the market in learning the ropes.

FAQ

Any risk in buying SKL now?

Trading cryptocurrencies have a significant amount of risk because of their level of volatility. However, the SKL token is now trading at a relatively low level compared to its all-time high, which implies there is less chance of decline and more possibility for growth. Additionally, the integrations show that the SKL coin has a promising future.

Is it safe to buy SKL?

SKL was built on the Ethereum blockchain, which means it has the same security levels as ERC-20 tokens. Furthermore, your cryptocurrency is safe in your wallet since the SKALE network is non-custodial. To participate, you must instead share a secure delegation key.

How much will SKL be worth in 2030?

If everything works well, the SKL token might increase to $1 or more in 2030; however, according to DigitalCoinPrice, SKL will be worth $0.21 in 2030.

Will SKL ever hit $1?

Yes! In the long run, it's feasible for SKL to surpass the $1 threshold. However, given its price history, SKL may reach this level in 2030.