Created in 2017, Cardano (ADA) shocked the cryptocurrency market by climbing 7th place among the top coins by market capitalization. Fast forward to 2023, and while ADA has made sufficient headways in the crypto space with its projects, the larger bearish sentiment has hit the Cardano price negatively. But the recent interest is further pumping its price and getting it closer to a bull ride.

This how-to-buy Cardano guide explains everything you need to learn about this project and the platforms to purchase ADA.

On this Page:

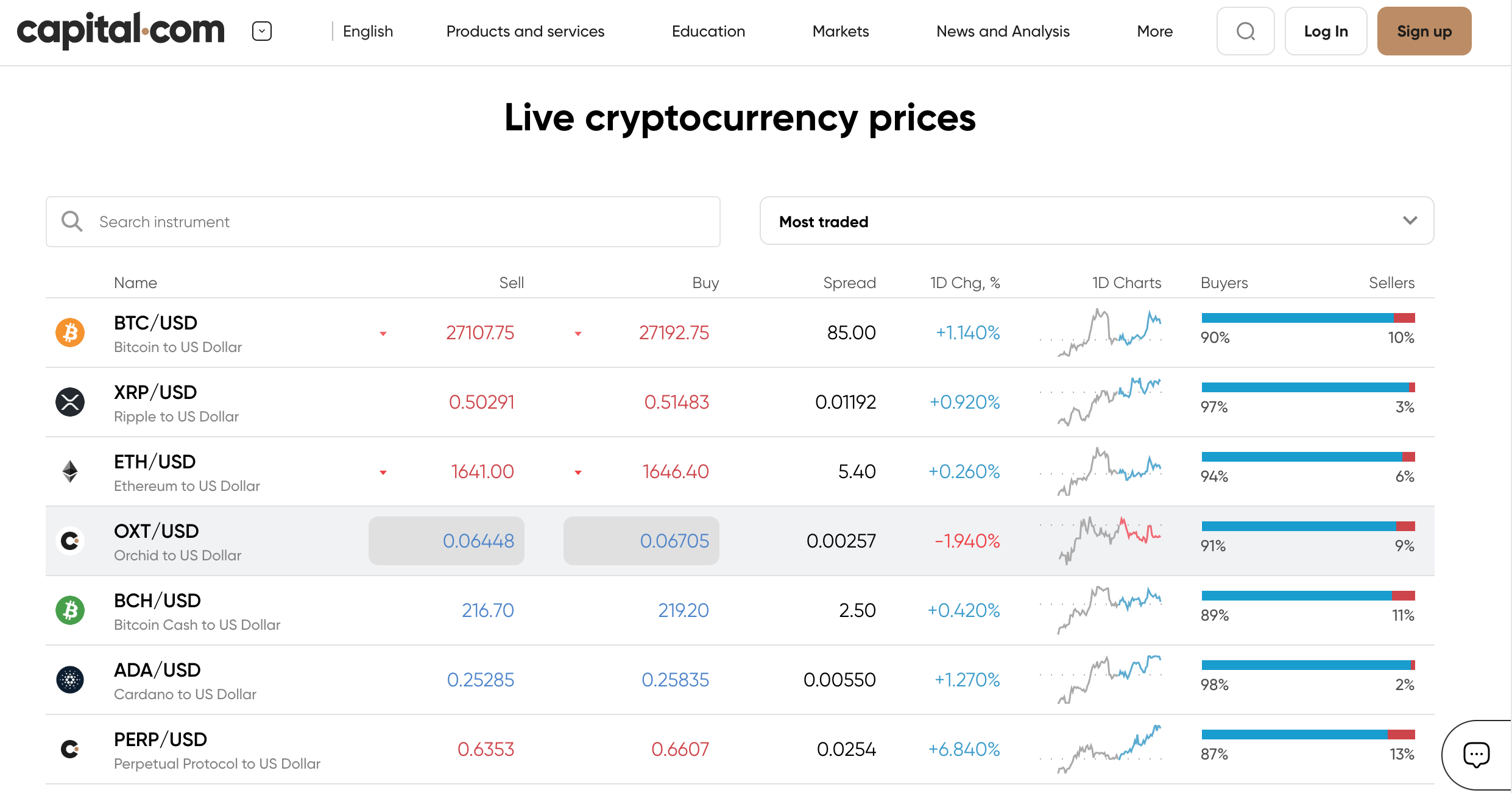

Where to Buy ADA – Quick Guide

- Choose a Cardano exchange – we recommend Capital.com

- Create an account

- Deposit funds into your account

- Search ‘Cardano’ in the drop-down menu

- Click ‘Open Trade’ and select an amount of ADA to buy

Compare Platforms to Buy Crypto

Since Cardano is a popular altcoin, you can also trade Cardano CFDs on derivatives platforms such as Libertex, MEXC, KuCoin, Capital, Plus500, and CryptoRocket.

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

The brokers below were selected and carefully reviewed as the best platforms to buy or margin trade Cardano on leverage. They all have a good combination of instant-buying options, low fees, and broad payment options.

How to Buy Cardano – Quick Guide to the Best Brokers for Buying Cardano in November 2024

Do you plan to buy Cardano right now? If yes, follow the four quickfire steps outlined below to get started.

- Open an account: You’ll first need to open an account with a trusted cryptocurrency broker. We recommend Capital.com.

- Upload ID: As a regulated brokerage site, Capital.com requires investors to upload a copy of their government-issued ID.

- Deposit: You can now deposit funds with a debit/credit card, Paypal, Neteller, Skrill, or a bank wire.

- Buy Cardano: Search for ‘ADA’ and click the ‘Trade’ button. Enter the amount of Bitcoin you wish to buy and confirm the order.

You will now have Cardano in your portfolio. You can keep your Cardano funds in your physical crypto wallet or leave it on the platform until you’re ready to cash out.

Where to Buy ADA

As the price of Cardano rises, so does the number of options where you can buy ADA. This is in contrast with what was applicable years back. With so many options, it might be difficult to choose. To save you from the headaches, we’ve profiled some of the best platforms where you can buy Cardano.

1. Capital.com – Trade Cardano CFDs Commission-Free

Capital.com is one of the most notable platforms for global trading contracts for difference (CFDs). A CFD is an agreement to pay the difference between the current price of an asset and its value when the contract expires. It doesn’t offer direct exposure to ADA, but it allows you to trade on its price nonetheless.

Capital.com is regulated by the FCA and the Cyprus Securities and Exchange Commission (CySEC). You can use the platform to trade ADA CFDs, speculating on the asset’s price in the medium or long term.

The exchange has a minimum deposit of $20. But note that you must pay at least $250 for bank transfers. The service has no inactivity fees or hidden fees, and its platform is relatively easy to use. Account opening on Capital.com is pretty efficient – you can get set up in just a few minutes if you have all your details.

Pros

- Various payment and deposit options are available

- Quick account opening process

- Impressive customer support

Cons

- Only offers CFD products

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

2. KuCoin – Secure Crypto Exchange With Over 30 Million Users

Amidst numerous crypto exchanges, a select few not only excel in size but also in pioneering innovations integrated into their platforms. KuCoin stands out by blending centralized and decentralized features, establishing itself as an optimal exchange for purchasing cryptocurrencies like Cardano in recent years. Founded by finance professionals in 2017, this exchange currently extends its services to over 200 countries, boasting a user base exceeding 30 million globally.

As of the present, KuCoin has ascended to a top 5 position among crypto exchanges based on traded volume. The exchange hosts one of the most extensive arrays of cryptocurrencies, encompassing popular options such as ADA and DOT, alongside lesser-known tokens from recent launches.

Consistently delivering remarkably useful products for traders and investors, KuCoin operates its headquarters in Seychelles and has adeptly steered clear of major regulatory issues or legal conflicts, attributed to its robust compliance policies. For investors seeking an exchange offering a seamless interface, intuitive navigation, educational resources, and robust security measures, KuCoin undoubtedly emerges as a viable consideration.

Pros

- Highly advanced features

- Strong customer support

- Low fees compared to other exchanges

- Supports multiple cryptocurrencies

- Fluid user interface

Cons

- Limited fiat options

Your Capital is at risk.

3. MEXC – Highly Popular Broker Facilitating Mega Transactions

MEXC

The platform has integrated sought-after and essential features while continually introducing upgrades, ensuring a smooth and straightforward investment or trading experience for users. It prides itself on a high-performance trading engine, offering users lightning-fast and impeccable trading encounters. Capable of processing up to 1.4 million transactions per second, it stands as one of the fastest platforms in the crypto space.

With a portfolio boasting over 1700 listed coins, robust customer support, and more, the platform has witnessed a consistent surge in adoption since the last bull market. These combined elements position MEXC as an outstanding choice for those considering investments in Cardano or similar altcoins.

Pros

- Good customer support

- Massive selection of cryptocurrencies

- High liquidity

- Wide variety of advanced trading features

- High-security elements

Cons

- No support for fiat

Your Capital is at risk.

4. Libertex – Industry-Leader Broker for Stocks and CFDs

Libertex is another service that offers exposure to cryptocurrencies via CFDs. The only difference here is that, unlike Capital.com, Libertex offers exposure to other financial instruments. Libertex has a long operating history, with the platform launching in 1997. The CySEC regulates and allows the platform to trade assets like bonds, ETFs, and cryptocurrencies.

Margin traders especially love Libertex as it offers up to 1:600 leverage for their trading activities, increasing their profitability chances significantly. However, it also puts them at higher risk.

With Libertex, users get access to a proprietary, web-based trading platform that is quite sleek. Its user-friendliness is impressive, and it operates completely online without downloading. Of course, you could always choose from MetaTrader 4 or MetaTrader 5 if you want to go with the old but gold.

Libertex has eliminated all deposit and withdrawal fees. There are no hidden costs, although the minimum deposit of $100 seems a bit high. You can make deposits and withdrawals through several channels, so feel free to explore your options. Just keep in mind that many of these channels have their own fees.

Pros

- Offers high leverage

- Regulated broker service

- Withdrawals are processed in about 24 hours

Cons

- Relatively clunky interface

Your Capital is at risk.

5. Plus500 – Regulated Platform Offering Different Asset Classes

Plus500 is a CFD broker that has been operating since 2008. The platform has grown, with licenses from agencies like the FCA and the Australian Securities and Investments Commission (ASIC). Plus500 is even listed on the London Stock Exchange. Like Capital.com, Plus500 allows you to trade cryptocurrency CFDs and has an expansive range. There are over 2,000 financial instruments here, including a broad range of cryptocurrency CFDs for you to trade with.

Plus500 offers features like an intuitive user interface, no fees for deposits or trading, and even negative balance protection for your account. The platform also has some of any brokerage platform’s most extensive research and educational tools.

Minimum deposits on Plus500 stand at $100, which is a bit high. The exchange charges an inactivity fee of $10 after three months of no usage. You should also note that Plus500 doesn’t serve users in every U.S. state.

Pros

- Impressive regulatory credentials

- Intuitive user interface

- Negative balance protection

Cons

- Charges an inactivity fee

Your Capital is at risk.

6. Coinbase – Top US Crypto Exchange

Coinbase is the most popular cryptocurrency exchange in North America. Starting in 2012, the company has grown to be the second most widely used globally, with billions in daily trading volumes per CoinMarketCap. Its operations span most of the developed world; the company is listed on the NASDAQ exchange.

As a top crypto exchange, Coinbase supports trading over 100 digital assets – including ADA. You can trade ADA against several fiat and digital currencies on the platform, taking advantage of its impressive layout and user interface. Besides trading, Coinbase also offers several remarkable benefits. You can stake your coins to earn more over time, and a Coinbase Card allows you to spend your cryptocurrency at retail outlets.

Coinbase offers a low minimum account balance of just $2. Compared with many crypto exchanges, this is very competitive. The exchange is available to new and sophisticated traders, and you get a broad range of deposit and withdrawal methods.

However, the platform has a complex fee structure, with transaction costs between 1.5% and 4.5% based on several factors – including your desired platform, the currency type, and others.

Pros

- Broad currency portfolio

- An impressive suite of services

- User-friendly interface

Cons

- Complex fee structure

Your Capital is at risk.

6. Binance – World’s Largest Crypto Exchange

Binance is the world’s largest cryptocurrency exchange by daily trading volumes. It is also the most popular worldwide, offering services in over 150 countries.

While it doesn’t offer exposure to other asset classes, Binance is impressive regarding crypto. The exchange offers a minimum balance of $1, and trading commissions are charged at a flat rate of 0.1% on your gains. So, Binance doesn’t make money until you do. You can also access cryptocurrency futures and options on Binance if you’re a professional trader.

Deposit and withdrawal options are very broad on Binance, as expected. You don’t pay any deposit fees, although withdrawal fees can be high – especially for card-based transactions. Binance is also not regulated in the United States, and while it has a U.S.-facing arm, even that isn’t available in all states.

Pros

- High liquidity

- Broad transaction channels

- Advanced trading options available

Cons

- Not available across the U.S.

- Pretty clunky interface

Your Capital is at risk.

7. AvaTrade – Legacy Crypto Trading Platform for Investors

AvaTrade is a forex and CFD broker. The service has operated since 2006 and is part of the Australia-based financial conglomerate Ava Group. AvaTrade is incorporated in the Republic of Ireland. But it also has outlets in Japan, Australia, South Africa, Canada, and the British Virgin Islands.

While it isn’t the most popular for crypto, AvaTrade offers several benefits. You get a broad collection of cousins and outstanding education and research tools. The platform offers a quick and fully digital account opening process that shouldn’t take longer than a few minutes. Plus, you get a top-notch user experience and compatibility with different platforms.

AvaOptions – a proprietary retail forex and CFD options trading platform. Options are getting more popular in the crypto market, and AvaTrade offers a simple way to get into these instruments.

But it’s not all good. AvaTrade offers a minimum deposit of $100, which is quite high. The platform’s fee structure is also quite complex, especially if you want to trade cryptocurrency CFDs. The platform also charges a high inactivity fee of $50 quarterly after your first three months of no usage. After a year of non-use, AvaTrade will charge an annual administration fee of $100.

Pros

- A regulated broker service

- Great for beginner traders

- Dedicated options trading platform

Cons

- Complex fee structure

- High inactivity fee

Your Capital is at risk.

8. Revolut – Personal Financial Banker with Crypto Support

Revolut is one of the most popular financial services providers globally, offering top-notch transactions and currency services. You don’t get the usual trading services with Revolut. Regarding crypto, the service gives you the basics – transactions, and payments. The company has a history dating back to 2015, and FCA now registers it.

Revolut’s primary benefit is its impressive interface, which lets you get used to it quickly. The service has exposure to several currency pairs and offers a debit card enabling users to spend cryptocurrencies at merchants worldwide. There’s even a savings vault that allows you to save your money and earn interest on it. When it comes to banking, only a few FinTechs match Revolut.

As for its drawbacks, the lack of trading services is the most striking. Revolut also imposes many fees – transaction fees, card maintenance fees, SWIFT transfer fees, etc. The fee structure is as complex as you’d imagine with different pricing tiers available.

But note that withdrawals are free for up to €200/£200 a month. From there, the service charges a 2% fee for every withdrawal.

Pros

- Supports different currencies

- Impressive banking features

- Offers a debit card for payments

Cons

- Too many fees to deal with

Your Capital is at risk.

9. CryptoRocket – New Crypto Trading Platform and Exchange

Launched in 2018, CryptoRocket is quite an interesting service. As the name suggests, it started with a focus on cryptocurrencies alone. But, it has since expanded and now supports trading in different asset classes – from stocks to ETFs and bonds. CryptoRocket is based in St. Vincent and the Grenadines.

As you would expect, the service offers the basic benefits – broad asset exposure, no fees on deposits and withdrawals, and even commission-free trading when you use its LiveTrader feature.

Margin trading is also available for sophisticated traders on CrytoRocket. The service offers up to 1:1,500 leverage for margin traders, improving their profitability and risk exposure. There are no minimum deposits on CryptoRocket, although the service has a minimum withdrawal of 0.01 BTC – or its equivalent.

Trading commissions on the standard interface start from $6 per lot, which seems a bit high. Also, many investors have issues with CryptoRocket’s limited regulatory information.

Pros

- Impressive educational tools

- Commission-free trading available

- High leverage for margin traders

Cons

- Not available in the U.S.

- Not registered with any tier-1 jurisdiction

Your Capital is at risk.

10. Changelly – Nifty Exchange for Instant Cardano Purchases

Based in Hong Kong, Changelly has become popular for being an instant cryptocurrency exchange. It has operated since 2013, although any tier-1 jurisdiction doesn’t regulate it. With Changelly, you can access over 170 cryptocurrencies and trading pairs. The platform is simple to use, and you also get support for some minor currencies. So, regardless of where you are, you can try it.

The primary benefit of Changelly is its instant exchange service, which lets you move from one coin to another in seconds. The platform also offers fantastic educational and research tools, and you can make deposits and withdrawals using different channels.

As for fees, you’ll find Changelly’s offering quite competitive. Crypto swaps on the exchange go for a flat rate of 0.25%, while crypto-to-fiat conversions carry a 5% charge. Trading fees vary between assets, but Changelly doesn’t charge deposit fees. As for withdrawal fees, everyone pays a flat rate of 0.0004 BTC or its equivalent.

Pros

- A non-custodial exchange

- Impressive user interface

- Quick transactions

Cons

- No margin trading

- Non-regulated exchange

Your Capital is at risk.

What is Cardano?

Cardano is a high-performance blockchain platform that has become incredibly popular in 2021. The blockchain has positioned itself as one of the most prominent “Ethereum killers” – essentially, blockchains that look to steal Ethereum’s market share and become bigger than the blockchain behemoth.

Cardano is a decentralized proof of stake (PoS) blockchain offering higher processing and app development efficiency. The platform looks to improve the interoperability, scalability, and sustainability of proof of work (PoW) blockchains like Bitcoin and – for now – Ethereum.

The Cardano blockchain was developed by Input Output Hong Kong (IOHK) – a Hong Kong-based blockchain firm founded by Ethereum co-founder Charles Hoskinson.

During his time at Ethereum, Hoskinson had gotten a proper grasp of the challenges facing blockchain platforms all over the industry. He started developing Cardano and its ADA cryptocurrency in 2015; the platform and token were launched in 2017.

Since its launch, Cardano has positioned itself as a much better alternative to Ethereum. Both platforms are very similar and look to build an interconnected, decentralized system. But, as IOKH puts it, Cardano is more advanced than its predecessor.

Amongst other things, Cardano’s primary function is identity management and traceability. The former function allows Cardano to streamline and simplify the processes that require multi-source data collection.

As for the latter, Cardano allows users to track and audit product movements across supply chains. This way, the blockchain helps reduce the use of counterfeit products worldwide.

Cardano has also increased its efficiency thanks to the launch of smart contracts. The blockchain launched its Alonzo hard fork in September 2021, bringing smart contracts to its features; this means that developers can now build decentralized applications (dApps) on Cardano – much like they do on Ethereum and other chains.

Why Buy Cardano? ADA Analysis

ADA was one of the most popular cryptocurrencies in 2021 but has since largely corrected due to 2022’s crypto winter. The token’s price bearish turn led to the emergence of many skeptics who believed that Cardano may not be a worthy investment.

Moreover, since 2020, the approach of the SEC towards the crypto sector has been characterized as heavy-handed. The regulatory body asserts that most tokens and activities fall under its jurisdiction as securities offerings. This pressure on cryptocurrencies resulted in some negative events in the crypto market, including the crush of such popular tokens as LUNA and FTX.

The culmination was the significant price loss of many major cryptocurrencies and the crypto winter. Cardano started 2022 with a price of $1.3, which was already 2.3 times lower compared to its all-time high. The prices continued to drop during the whole of 2022, and by the end of the year, ADA experienced its lowest price since 2021, dropping to $0.24.

The coin seemed to be recovering at the start of 2023. In April, it even made an attempt to reach $0.5. However, the SEC filed another case, this time against Binance and Coinbase targeting SOL, ADA, and MATIC coins and naming them as securities. This was followed by the announcement of delisting those coins by such popular platforms as Robinhood.

Cardano’s price dropped back to $0.26 again in June; however, some positive events in the crypto market regarding the SEC vs. Ripple lawsuit pushed it back to $0.357. Cardano started to lose value shortly, and in August, it again dropped below $3. Currently, the coin is trading at a price of $2.5. This gives ADA only a 4% YTD return rate making it quite a risky investment.

Still, many people believe in the valuable features Cardano offers the crypto industry. It’s one of the most popular crypto projects and the 7th largest coin by market capitalization. However risky it may seem to invest in Cardano, things can change if the general crypto market takes a bullish direction.

Is it Worth Buying Cardano in 2024?

2022 wasn’t the best year for Cardano, and most of it wasn’t due to its fault. The token followed the bearish trends of Bitcoin and other major altcoins, which dropped ADA from one of the top 5 cryptos to the top 10 by market capitalization.

The token’s performance in early 2023 gave cryptocurrency investors hope. Cardano managed to increase its opening price of 2023, which was $0.24 up to $0.45, but this lasted only for a short period. Even the recent news about Ripple’s lawsuit filed by the SEC did not bring Cardano too much value, while the rest of the market benefited from it.

However, ADA managed to recover some of its market capitalization and moved to being the 7th largest token from the 10th place. ADA is currently trading at a price of $0.25, which is quite close to its opening price of the year. The moving averages for the coin are completely bearish, and the technical indicators are mostly bearish too.

Still, we need to admit that Cardano’s value also depends on the performance of the general crypto market. Cardano will probably follow the uptrend if the prices of other cryptocurrencies increase again. The volatility is far from over, and better days can come for Cardano as this token is the native coin of one of the most well-established blockchain projects.

One of the reasons we consider Cardano a worthy cryptocurrency investment is because of its utility. This smart-contract-enabled blockchain was one of the first utility tokens to exist. And since 2023 will focus most on cryptocurrencies with use cases, Cardano can potentially have significant upsides for those who invest now.

Ways of Buying Cardano

If you want to buy Cardano, there are several methods to do this:

Buy Cardano with PayPal

With over 30 million customers worldwide, PayPal is a top payment processing company. The US company has recently added support for cryptocurrencies on its platform. You can buy Bitcoin and Ripple with PayPal, for instance.

Buy Cardano with Credit Card

Another means to buy Cardano is through your credit card. However, you must speak with your credit card issuer to know how much in fees you will have to pay.

Some credit card companies define crypto transactions as a “cash advance” and charge 3 to 5% of your transaction.

Another thing to consider is if the exchange supports credit card purchases. Some regions or locations are supported for credit card transactions.

Buy Cardano with Debit Card

Buying Cardano with a debit card is one of the most convenient and cost-effective payment options. Meanwhile, you must take your broker’s processing fee into cognizance if you intend to use this method.

Crypto exchanges have different payment processors and charge differently as well. Some may bill 4% of the total debit card payments, while others may be much lower.

What to Remember Before Buying Cardano

While ADA appears to be a unique asset to add to your portfolio, it’s important to consider some caveats. Keep the following in mind as you step into the market:

Markets are volatile

The most important thing to remember as a prospective investor is that the crypto market is very volatile. Prices jump and drop occasionally, so losses on your investments are possible. You want to do your research and ensure that you’re investing in a solid project. Thankfully for you, ADA is as solid as any crypto project is. The coin has real value, and its associated blockchain is also very impressive.

ADA isn’t so private

Transactions using ADA aren’t private. So, don’t buy the coin believing you’d get any privacy benefits. Several other assets, such as Monero (XMR) and ZCash (ZEC), will suit you better.

Choosing the Right Cardano Broker

To buy ADA, you must have a broker or an exchange platform. So many options are available, so choosing one can be a bit of a chore. But, consider these factors when selecting.

Compatibility

As expected, your ADA broker must be compatible with the coin, and the platform should support the currency and offer seamless transactions.

Fees

You want a brokerage service that doesn’t charge so much. Check out their fee structure – for withdrawals, deposits, trading, etc. You should also look into whether there are any hidden fees – account maintenance, inactivity fees, etc.

Ease of use

User-friendliness is an important part of choosing a cryptocurrency brokerage service or exchange. Dealing with cryptocurrencies can be challenging, and you need a platform that makes the process so much easier for you.

Security

Your chosen broker should be as secure as possible. They’re handling your funds; you don’t want to lose money. So, check out features like fund storage, encryption, etc. All of these will come in handy when you make your purchase.

Customer Support

Customer support should be available at all times. Look into their channels and how quickly they respond to complaints and Emails. No one anticipates any problems, but it helps to know someone is available to help you.

Payment Channels

Look into the broker’s payment channels and how to find your account – or receive funds when you withdraw. Can you use them? What are the fees? This will help you to choose wisely.

Transaction Speed

Your preferred broker should be able to make transactions quickly enough. This way, you don’t risk delays when buying or selling.

Investing in Cardano vs. Trading Cardano

People looking for crypto exposure tend to either invest or trade an asset. Both strategies have their merits and demerits, of course.

When you invest in ADA, you purchase the coin and hold it for a long time – usually months or years. This means that you expect its price to jump in the long term, and you’re willing to ignore short-term price movements and hold your position.

Investing is advantageous because you don’t get to bother much about the market. While you need to keep an eye on the coin occasionally, you’ve got the long game in mind and are not worried about small swings. Also, with ADA being backed by a substantial project in Cardano, you have a higher chance of netting those long-term gains you’re looking for. Just consider the coin’s year-to-date performance in 2021, and you can see.

As for trading, you make speculative decisions based on the coin’s short and medium-term projections. Trading allows you to benefit from ADA’s price volatility, which could be a massive earning opportunity. But you also have to constantly monitor the market and make moves based on its direction. This way, you know when to enter and exit the market to maximize your gains.

Buying Cardano as a CFD Product

Contract for differences (CFD) is a financial contract that has become increasingly popular due to its merits. Cardano can also be traded as a CFD product like several other crypto assets. A CFD is essentially a contract agreement between an investor and a broker to trade the difference in the value of a financial product (most times securities or derivatives). Advanced traders mostly use cFDs given the absence of storing the asset, ease of execution, and the intrinsic ability to go long or short in a particular trade.

Employing a CFD trading strategy ensures that you profit from the price swings of Cardano while not directly holding the asset – numerous brokers offer it.

Taxation on Cardano Earnings

Taxation is a key part of any financial transaction, and investors must pay a fraction of their gains. The crypto space has gained a sizable relevance, and government agencies like the US Securities and Exchange Commission (SEC) are exploring ways to regulate the nascent industry. Aside from the SEC, the Internal Revenue Service (IRS) is also working on a crypto tax framework.

According to the tax agency, cryptocurrencies are considered properties and can be treated under the capital gains bracket. Meanwhile, there are particular circumstances in which crypto trades are taxed under the income. This section will explore some occasions requiring you to fulfill your tax obligations while participating in the crypto market.

Taxable events that qualify for capital gains tax:

- Paying for goods and services with crypto

- Exchanging one digital asset for another on an exchange or peer-to-peer (P2P)

- Swapping crypto for USD

Taxable situations that fall under the income tax bracket:

- Earning block rewards from mining crypto

- Receiving payment for services rendered with crypto

- Receiving a crypto airdrop

- Interests earned from lending to decentralized finance (DeFi) protocols

- Newly minted crypto assets earned from liquidity pools (LPs) or staking

Despite the strict crypto tax structure, you can still write off up to $3,000 as losses from trading cryptocurrencies. This will save you some money and also keep the agency away.

Calculating Capital Gains Tax

Crypto taxes, especially in the US, largely depend on two principal factors: the duration of owning a digital asset and your income tax bracket. With these two criteria, you should have a rough idea of how much you will need to pay in:

Short-term Capital Gains Tax

Short-term capital gains tax would come into force if you purchased crypto-assets for less than a year. This will see your crypto transactions treated under the income tax bracket by the IRS. You could pay between 15% to 37% depending on your income. Meanwhile, you can still minimize some of your potential taxes through losses.

Called Tax-loss Harvesting, this strategy allows you to write as much as $3,000 from your tax payments without incurring any penalty. This is used mostly in short-term capital gains situations, as the tax rates for short-term gains are much higher than long-term tax rates.

Long-term Capital Gains Tax

Long-term capital taxes usually occur if you have been trading cryptocurrencies for over a year. It is more tax-efficient than its short-term counterpart, and you will be taxed between 0 to 20% depending on your income bracket.

The Importance of Responsible Cardano Investment

The crypto market sees many investors investing in digital assets to make quick money. Even though this sometimes happens, they are always far and in between. The best strategy is to build for the long term and resist the urge to follow the hottest and trending coins. Given the intrinsic risk of volatility cryptocurrencies hold, we itemize a few things to consider while you are surfing the industry:

Have an investment plan

The risks of trading cryptocurrencies are mainly related to their volatility. They are speculative, and you must understand the risks involved. We advise that you create an investment or trading plan and stick to it. Your trading plan should cover critical issues such as the kind of investment you are interested in, the conditions behind the decision, and your investment objectives. You should also factor in your risk appetite and work according to this.

This will help you depersonalize and detach yourself from the trade. Your trading plan should comprise the leverage you are comfortable with, your preferred entry and exit prices for the trade, and the maximum amount you are willing to invest in a particular asset. Also, crucial issues like how diversified your portfolio reduces the impact of a potential loss and when you want to liquidate your position should feature in your plan.

DYOR

The crypto market is one of the most saturated financial markets in the world at the moment. Misinformation and fraudulent schemes are being repackaged to appeal to naïve investors. To forestall potential capital loss, we recommend you do your research (DYOR) by validating and double-checking any information you come across to save you needless losses. No matter how appealing an investment may seem, do due diligence before financially committing.

Don’t Put Your Eggs In One Basket

The crypto market is full of great assets with good value propositions but also fraught with potential bad eggs. To ensure you do not lose your entire capital, do not hold only one or two assets because this exposes you to more risks. Try as much as possible to incorporate cryptocurrencies aside from investing in Cardano. This will require you to reassess your crypto asset allocation structure. You can also stake some of your assets and provide liquidity in DeFi pools.

Take Five

Take a break from trading. This will afford you time to reassess your goals and decisions. Taking time off also enables you to see the market more clearly.

Would You Try Cardano Mining?

Cryptocurrencies require validator nodes or miners to solve sophisticated mathematical equations to earn block rewards. Although this system ensures security against malicious attacks, they are slower, costlier, and more energy-intensive.

This spurred the development of proof-of-stake (PoS) consensus algorithms which require validating nodes to hold a certain amount of a digital token before being selected to verify transactions on the network. The Cardano network uses a PoS mining protocol called Ouroboros, and it does not require mining as all the ADA tokens have been pre-mined.

Minimizing your Risk With Crypto Investment

Given the inherent risks associated with cryptocurrency trading, we have itemized some safety tips for you as you trade Cardano:

Understand What Crypto Is

Start from the bottom and spend time knowing the details about what cryptocurrencies are. This will acquaint you with the fundamentals of investing in digital currencies. We recommend starting from this stage to avoid losing fortunes from making wrong investment decisions.

Use Reputable Exchanges only

One of the most important steps in cryptocurrency investment is ensuring that your trading account and wallet are safe. A regulated exchange or broker offers protection from fraud. Some safety features you should look out for include two-factor authentication (2FA), a whitelist address feature, and a strong password structure. Also, look for a broker that separates traders’ funds from the company’s finances. This will ensure your capital is not affected in the event of bankruptcy.

Keep FOMO at Arm’s Length

One of the issues you will deal with in the crypto space is the fear of missing out (FOMO). FOMO is an anxious feeling that you may have missed out on a profitable trade elsewhere. However, entering any market position without proper knowledge leads to major losses. Investing decisions should be based on facts, not emotions.

To make steady gains from your crypto investments, you will need to address the FOMO effect. This will require you to consider a few factors, including social media crypto gimmicks, inflated gains, potential losses from emotion-backed decisions, gossip and rumors, and how volatile the market is.

Cardano Against Other Cryptocurrencies

Although Cardano ranks in the top five most valuable crypto assets by market cap, it is not the only popular digital asset.

Cardano vs. Bitcoin

Bitcoin is the most recognized cryptocurrency in the market and the precursor to the Cardano network. Bitcoin’s hard-cap limit of only 21 million tokens has seen several investors term it as digital gold. It also controls the largest crypto market share, with almost 50% of the market cap attributed to the benchmark crypto.

Cardano vs. Ethereum

Like Bitcoin, the Ethereum blockchain is viewed as a frontrunner for the rapidly expanding DeFi ecosystem. The decentralized applications (dApp) facilitator is home to over 3,000 top-performing dApp protocols and has a 20% stake in the crypto market. Its eventual switch to a PoS consensus model is expected to boost the value of the ETH token.

Cardanovs. Solana

Like Cardano, Solana is a popular ‘Ethereum killer’ and seeks to enable widespread DeFi services. It’s PoS and PoH timing mechanisms make Solana one of the fastest dApp facilitators in the blockchain ecosystem. Solana is also cost-effective and energy-efficient, attracting several dApp protocols last year.

Cardano vs. Dogecoin

Dogecoin was created in 2013 to react to the sudden spike in crypto projects. Meant to be a joke currency for tipping users, Dogecoin has since outgrown its original vision. It is now touted as a more decentralized and viable virtual currency than Bitcoin by the likes of Tesla boss Elon Musk. This past year, Dogecoin has seen exponential growth in its protocol, with more investors adding DOGE to their portfolios.

Cardano vs. XRP

Unlike several crypto protocols, XRP is a digital token focused on the cross-border payment niche. Created by Ripple Labs, XRP is used by top financial institutions to settle trades trustless. XRP has been among the best performers this year despite facing a legal suit with the SEC. The digital asset is gradually pivoting to the central bank digital currency (CBDC). The Royal Monetary Authority of Bhutan was the first to adopt the XRP Ledger for building a digital version of their fiat.

Where Does Cardano Go From Here?

It can be difficult to envisage a good ending for a particular asset in the highly competitive crypto space. This is even more peculiar given that the Cardano network faces top rivals like Ethereum, Solana, Polkadot, Avalanche, and Fantom.

However, the Cardano network’s scientific approach to addressing the blockchain trilemma of scalability, security, and interoperability has been highly applauded. The peer-reviewed protocol has also been consistent with its deployment of functionalities, which is hard to say about the Ethereum protocol. Given the extensive knowledge and expertise of the development team, the Cardano network is expected to become one of the DeFi stars in the evolving space.

That being said, Cardano has been affected by the bearish narrative of the cryptocurrency space. ADA hit new lows in 2022 in response to the LUNA and FTX crash. Also, the drops aggravated once it came to light that Cardano had not successfully delivered more apps on the platform. But the year has changed now, and more developments are happening.

However, it should be mentioned that while many other cryptocurrencies somehow have recovered their prices, Cardano is still traded quite close to its price at the start of the year. The token had a quick bullish run for a short period in April and in July, but the prices dropped again. With a new uptrend in the crypto space in 2023, better days may be coming soon for this cryptocurrency too.

Meanwhile, you should be reminded of the following safety tips:

- Diversifying your portfolio helps mitigate risks

- Cryptocurrencies are risky but also profitable

- Always follow a trading plan

- Keep FOMO at bay while trading

- Only trade on regulated exchanges or brokers

- Use review websites and online experts to know how cryptocurrencies

For more information, read our latest Cardano price prediction here.

FAQs

How do you buy Cardano?

There are several options you can explore in buying Cardano. However, the safest is with a broker.

Should I Buy Cardano?

Buying Cardano largely depends on you. However, the digital asset has proven itself over time as a top crypto asset.

What is the best way to buy Cardano?

The best way to buy Cardano is through a crypto exchange or broker. Those reviewed on this list are all strong choices.

How does Cardano work?

The Cardano network uses a PoS protocol called Ouroboros, which divides transactions into epochs or timeframes. Validator nodes are chosen randomly to verify transactions and add them to the blockchain.

Is it safe to buy Cardano?

Even though Cardano is a crypto asset, the digital currency is a relatively safe investment.

How do I make money with Cardano?

The two popular option is to invest or trade Cardano. However, you can also earn passive income through staking your Cardano asset.

What are the benefits of buying Cardano?

Cardano is billed as one of the principal characters in the rapidly-growing DeFi and NFT sub-sectors. With the platform seeing growing adoption, its governance token ADA has surged more than 11,000% in the past year.

What are the best payment methods to buy Cardano with?

We recommend using your debit card. However, e-wallet options like PayPal, Skrill, and others are also recommended.

What are the best Cardano brokers?

We have covered several platforms that support Cardano trading.

How can I buy Cardano instantly?

The first step is to open an account with a regulated broker and follow the KYC protocol. Once this is done, you can make a deposit and buy Cardano on the spot.

How can I buy Cardano with USD?

The best means is to use a reputable exchange or broker like those reviewed here.

What are the taxes on trading Cardano?

Crypto taxes are largely dependent on the region where you reside. However, for US residents, we have highlighted a few criteria for crypto taxes in this guide.

How much is Cardano worth?

At the moment of writing, 1 ADA trades at $0.35.

How do you mine Cardano?

As we stated earlier, Cardano token ADA cannot be mined as the network uses a newer version of the consensus algorithm named PoS.