Since its inception, the industry has created thousands of additional coins. Every coin has a unique use case to address issues with previous coins. Regardless of how much progress has been made, there are still several issues in the new blockchain industry. Linking different blockchains with one another is one of the most difficult issues in the industry.

Even though numerous projects on the market claim to have solved this problem, no single platform can say that it can provide interaction between all kinds of blockchains. One reason is that each blockchain operates differently, and it is very complex to develop an operating system that can allow interoperability between them. For instance, thousands of blockchains have hundreds of mechanisms, but no single platform can deliver a bridge between these networks.

Some blockchains have come up with a solution to provide a bridge-like service between two or three blockchains, but not more. Therefore, Quant Network has developed a blockchain operating system (OS), allowing all blockchains using their OS to interact with one another simultaneously. Thus, solving the interoperability issue between blockchains through their OS, Quant’s main aim is to become like Windows or macOS of blockchains in the future.

This guide will show you how to buy Quant with low fees in less than five minutes.

On this Page:

How to Buy Quant

- Choose an exchange that offers Quant (QNT) – we recommend eToro as it’s FCA, ASIC, and CySEC regulated.

- Sign up and verify your trading account with eToro.

- Fund your account with a bank transfer, a credit card, PayPal, or another method.

- Search ‘QNT’ in the drop-down menu to open charts and trades.

- Click ‘Trade’ and select an amount of QNT to buy

Best Exchange to Buy Quant in December 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

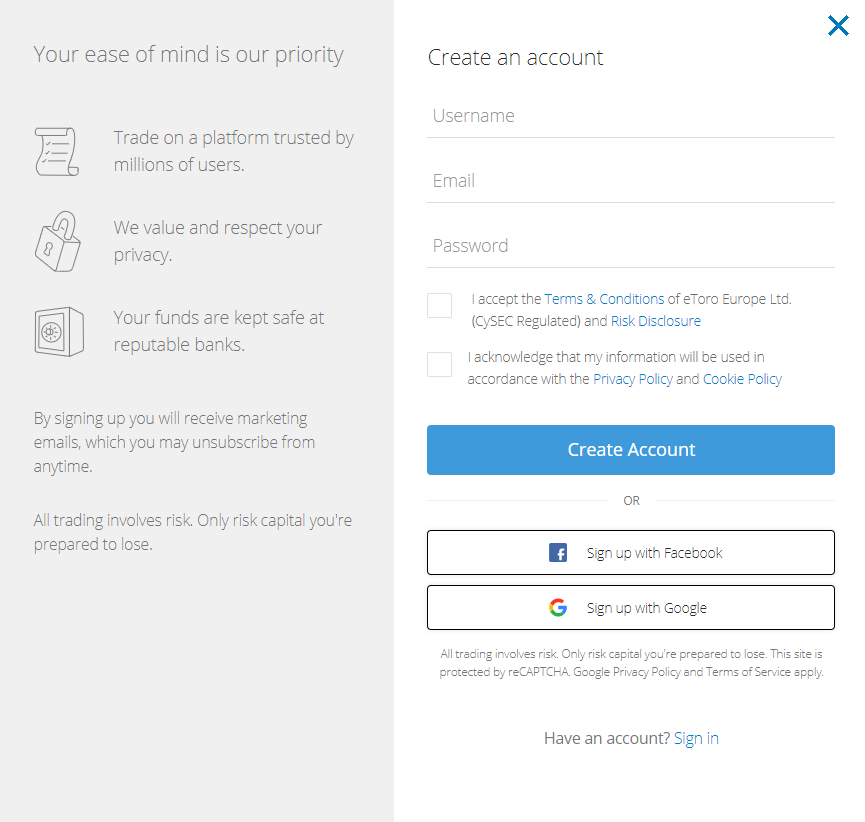

How to Sign Up at eToro

It is simple to open a free eToro account because it is very user-friendly, especially for beginners.

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, click the “Join Now” or “Trade Now” button.

- You’ll find an electronic form on this page where you can enter all your personal information required to open a new trading account.

- Please complete this form with all the required information.

- eToro allows users to log in using Facebook or Gmail.

- Before submitting your information for consideration, please read eToro’s Terms & Conditions and privacy policy.

- After reviewing the terms, please indicate your agreement by checking the appropriate box.

- Click the “sign-up” button to submit your information.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

Step 2: Upload ID

To begin, you must first register with eToro by providing some basic personal information, email address, and cell phone number. You will also be required to provide identification as part of the verification process.

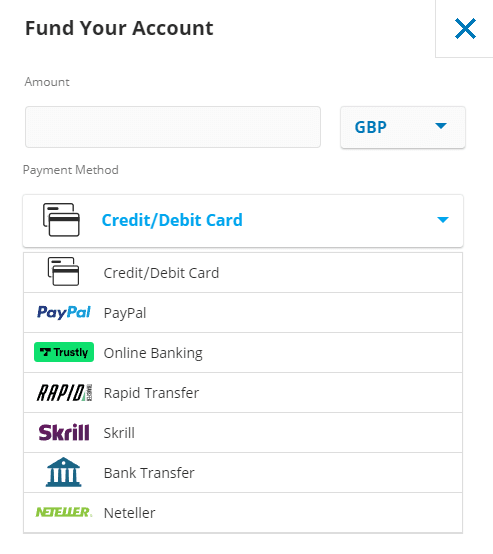

Step 3: Make a Deposit

When ready, enter the ‘Deposit Funds’ section and enter the amount you want to deposit. To open an account with eToro, a minimum deposit of $10 is required, which can be done in various ways. Debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller are all accepted payment methods.

There are no deposit fees at eToro. When you decide on a payment method, click the ‘Deposit’ button to finish the transaction.

Deposit methods on eToro

On November 09, 2021, eToro listed the Quant (QNT) coin. Quant is narrowing the gap and making running applications across multiple servers and blockchains easier. QNT assists investors in utilizing specialized programs that run on the Quant network, irrespective of server location. Investors should remember that this is a hard-capped cryptocurrency, so there is only a limited supply of QNT.

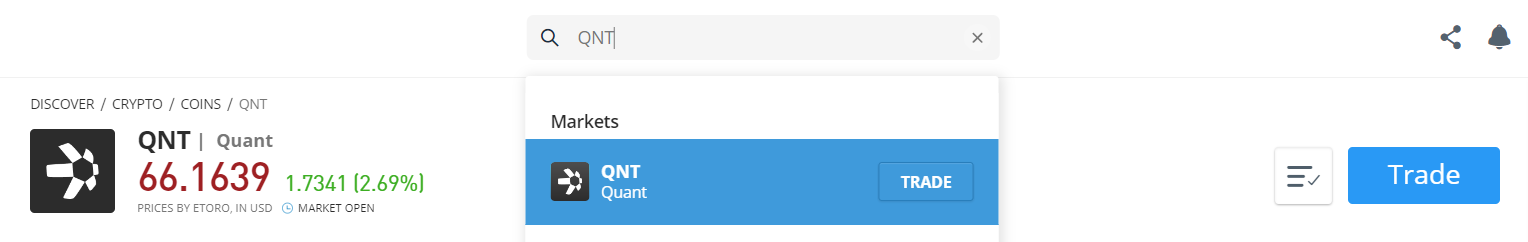

Step 4: Buy Quant

Proceed by typing ‘Quant’ into the top-of-the-screen search bar. Click the ‘Trade’ button when you see the cryptocurrency asset.

Searching QNT on eToro

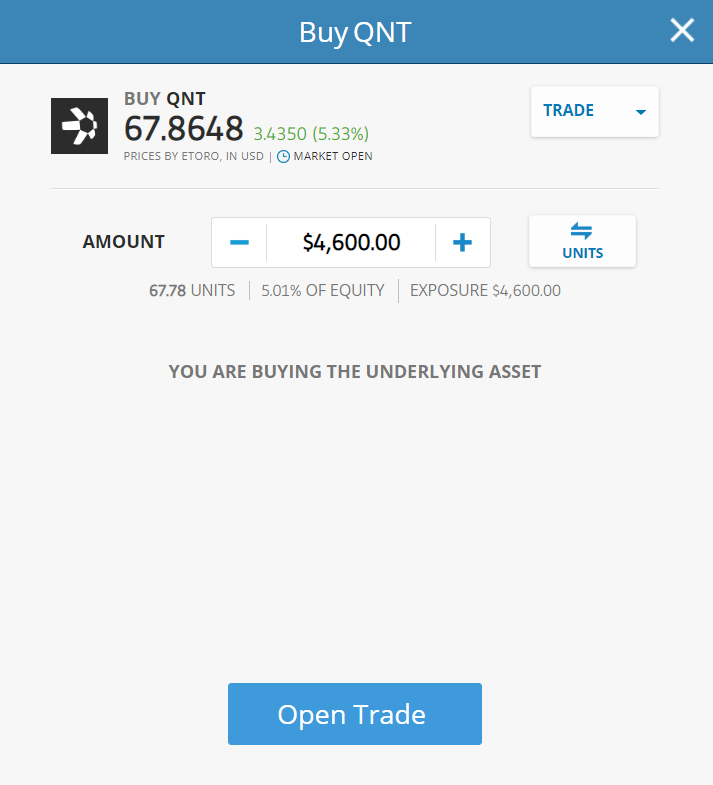

Step 5: Review Quant Price

This step will take you to an order page where you can enter the number of Quant coins you wish to purchase. Following that, click Open Trade’ to add the QNT to your portfolio. Apart from the trading platform, we support storing your digital assets in a third-party wallet. One viable option is to utilize the eToro Crypto Wallet, which now supports over 120 cryptocurrencies and QNT.

QNT Price Chart on eToro

The good thing is, there’s no maker/taker fee on eToro as they solely charge a buy/sell spread.

Step 6: Buy Quant

Tell eToro how much money you want to invest in Quant (QNT) in the ‘Amount’ box, starting with $10. Then, click the ‘Open Trade’ button to complete your purchase.

Buy QNT on eToro

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Quant (QNT) – Best Platforms

Gilbert Verdian founded Quant Network in 2015, and its native token, Quant, was released shortly after. The Quant protocol arose from a strong desire to improve the efficiency of global information exchange and had a vast potential to grow.

Therefore, we have prepared reviews of the best places to buy the Quant coin. Our list of brokers/exchanges to buy QNT in 2024 contains their characteristics, fees, and the reasons for their uniqueness. eToro has established itself as the top site for buying QNT cryptocurrency. The platform is secure, offers competitive pricing, and is simple.

Best Brokers to Buy Quant

1- eToro

eToro is a social trading and investment platform that provides an online trading and investment platform. This company was founded in 2006 and is headquartered in Tel Aviv, Israel. eToro offers retail investors and traders various services, including trade execution via its proprietary web platform. Furthermore, the company provides social trading and copy-trading capabilities.

Users can trade while on the go with eToro’s mobile app, which includes news, research, charts, and technical analysis tools. eToro is well-known for its social trading features and copy trading platform. Furthermore, the company provides a variety of accounts for individuals with one to nine years of experience. With a single click, eToro users can copy the trades of experienced traders and investors worldwide with little to no risk.

The site and company offer a platform available in over 25 languages and approved by the Cyprus Financial Markets Authority. The site also includes an advanced analytics tool that allows users to identify trading opportunities, monitor performance, analyze their investment strategy, and identify areas for improvement.

Furthermore, you can now earn rewards for buying and selling Ethereum, Cardano, and Tron in your wallet.

Learn more about how to stake crypto.

eToro is governed by some of the world’s most reputable regulatory bodies, including the United Kingdom’s Financial Conduct Authority (FCA). Furthermore, the Australian Securities and Investment Commission, the Cyprus Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA) are in charge of this (FINRA). Following CySEC regulations, user funds are kept separate from the platform’s operating capital for all CySEC-registered brokers. This is how the platform works.

eToro, like other companies, charges a small trading fee, including 0.75 percent, when buying or selling bitcoin. The cost of converting bitcoins on eToro is only 0.1 percent on top of the existing margins. As a result, in 2022, eToro will be the market leader in cryptocurrency trading, with a strong preference for crypto-assets and CFDs.

eToro has a reasonable fee structure for its customers. Depositing eToro is free of charge. Deposit methods include bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller. The minimum deposit amount varies depending on the user region. Before trading, individuals in the United Kingdom and the rest of Europe, for example, must make a minimum deposit of $200. Users in the United States must make a $10 deposit.

eToro accepts Bitcoin, the leading cryptocurrency, and major altcoins such as Ethereum, Aave, XRP, Graph, and other popular cryptocurrencies.

Buying and selling on eToro can be done online and on handheld devices through their mobile app. The opening process of an eToro account is straightforward and takes a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA, or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a Luxembourg-based cryptocurrency exchange founded in 2011 by Nejc Kodri and Damijan Merlak. This seasoned cryptocurrency exchange offers a low-fee cryptocurrency marketplace for professional investors and large financial institutions.

Bitstamp was founded just two years after Bitcoin’s inception, making it one of the first Bitcoin exchanges in the crypto market.

Bitsamp is best suited for experienced investors seeking a high-quality cryptocurrency trading platform. It is, however, an excellent platform for users who want to buy digital assets once and store them on Bitsamp’s web cold storage wallet.

Payment Fee: Bitstamp’s payment fees are relatively low compared to most digital asset exchanges. When it comes to deposits, the United Kingdom offers two options. The first option is an international wire transfer with a 0.05 percent fee (meager compared to other crypto platforms). The free Faster Payments option is the second option.

The withdrawal fee is also lower than the industry average – 0.1 percent for international wire transfers and 2 GBP for Faster Payment. The only drawback to Bitstamp is the high fee they charge on credit card cryptocurrency purchases – 5% on any amount.

Unlike most online trading platforms, bitstamp does not require a minimum deposit to open an account. However, like Bittrex, it has a minimum order amount of $50 USD/EUR/GBP, whereas other exchanges may have a much higher minimum order amount.

Trading fees at Bitstamp: Bitstamp is widely regarded as a low-fee exchange, particularly for highly active investors. The highest trading fee you can pay for a daily volume of less than $10,000 is 0.5 percent (above the average in the industry, which is around o.25 percent ). However, as the investor’s total volume of transactions increases, the fees decrease dramatically. As a result, if your revenue exceeds $20,000,000, your fees may be as low as 0%. Individual investors should expect to pay a fee of around 0.1 percent when using Bitstamp.

Security: All investors performing essential account functions must now use two-factor authentication. Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured. However, according to crypto exchange security evaluator CER, it ranked near the bottom of our review of crypto exchanges in terms of security, indicating that it may still have room to grow to become a leader in this category.

Customer service is available 24 hours a day, seven days a week, and includes a phone support line for urgent inquiries.

Pros & Cons of the Bitstamp platform:

- Allows for purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Huobi Global, headquartered in Singapore, was founded in 2013. The company was initially based in China, but after China banned cryptocurrency, it relocated to Singapore.

The exchange is a digital asset rather than a cryptocurrency exchange. It accepts ICO tokens and trades over 350 different cryptocurrencies.

According to the company, the future development of the blockchain economy will result in the creation of new categories of digital assets. Houbi Global is divided into three platforms: global, Houbi Japan, and Houbi Korea. This exchange’s services are not available to US traders. With features like margin and futures trading, interactive charts, and limit and stop orders, it provides a sophisticated trading experience.

The platform provides up to 5% leverage for margin trading. In comparison, Huobi Global’s fee structure is very reasonable and low.

The minimum deposit fee is $100 USD, and other fees, such as deposit, transaction, and withdrawal, vary by currency.

Fee: Those who want to buy cryptocurrency with a credit or debit card must pay a higher fee to Houbi. Both the maker and the taker fees are set at 0.2 percent. Depending on the scale volume, it can be as low as 0.1 percent.

Houbi Global offers customer service via email, phone, online chat, ticket system, and social media platforms. It offers a variety of security features, such as 2-factor authentication, cold storage, account freezes, and Bitcoin reserves.

Quant was listed on Huobi on September 23rd, 2021. The trading pair available for trading include QNT/USDT.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

In 2016, Crypto.com, a global cryptocurrency exchange, was founded. It is headquartered in Hong Kong and serves over 10 million traders in over 90 countries. It lets you buy and sell over 250 cryptocurrencies with low trading fees.

The unique selling point of the Crypto.com platform is that it allows users to stake their cryptocurrency.

By staking or holding them in a crypto.com wallet, users can earn up to 14.5 percent p.a. interest. Aside from trading, the exchange provides other services, including staking rewards, Visa card benefits, NFT trading, DeFi products, and more.

Security: Crypto.com employs various security measures, including MFA (multi-factor authentication). It also uses whitelisting to safeguard customer accounts. The platform employs compliance monitoring and stores customer deposits offline in cold storage to prevent hacks and losses.

Deposit: On this platform, the minimum account balance is set at $1. Maker/Taker fees range from 0.04 to 0.40 percent. During the first 30 days after opening an account, credit/debit card purchases are charged at 0% or no fee. Users can also earn up to $2000 for each friend they refer.

Coinbase QNT Listing: July 14, 2021

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a new peer-to-peer (P2P) cryptocurrency derivatives exchange attempting to establish itself in the nascent cryptocurrency margin/leverage trading market. Despite its March 2018 launch, Bybit quickly gained traction in the Bitcoin trading community and started accepting customers.

The exchange enables traders worldwide to engage in leveraged margin trading on a select set of cryptocurrency assets, including BTC, ETH, EOS, and XRP, which can be traded at up to 100x leverage.

Bybit, based in Singapore, is a cryptocurrency-to-cryptocurrency exchange that does not require demanding KYC verification and currently has a daily trading volume of up to $1 billion.

Ben Zhou founded the company in March 2018. Before becoming CEO of the exchange, he was the general manager of XM, a forex brokerage firm.

Leveraged trading: Bybit exchange’s primary product offering is perpetual futures with a leverage ratio of 100:1. This implies that they intend to compete with existing exchanges such as Binance and Phemex, which provide comparable non-expiry futures contracts.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the most active cryptocurrency exchanges in daily transaction volume, with more than $20 billion transacted daily. It provides access to hundreds of assets and a welcoming trading environment that simplifies profiting.

Minimal fees, a robust charting interface, and support for hundreds of coins are among Binance’s most distinguishing features. Binance, in contrast to eToro, is a cryptocurrency-focused exchange that does not provide copy trading, FX, commodities, or other financial services.

Binance uses two-factor authentication (2FA) and FDIC-insured deposits in US dollars (USD). Binance also uses device management in the United States, address whitelisting, and cold storage to protect its customers.

Fees range from 0.015 to 0.10 percent for buying and trading, 3.5 percent or $10 for debit card purchases, whichever is greater, and $15 for US wire transfers.

The QNT token was listed on Binance on July 21, 2021, and is now available for trading. Furthermore, Binance has launched trading pairs for QNT/BTC, QNT/BUSD, QNT/BNB, and QNT/USDT.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase, founded in San Francisco, is widely regarded as one of the most popular Bitcoin trading platforms in terms of user base. Coinbase was the first major cryptocurrency exchange to go public in the United States, listing on the Nasdaq in April at $381, valuing the exchange at $99.6 billion fully diluted.

Coinbase lets you buy and sell cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more than 50 others. It can also be used to convert cryptocurrencies and send and receive cryptocurrency. Coinbase, like stock trading apps, displays the current cryptocurrency price and trend, as well as your portfolio and industry news. To trade, go to the Coinbase Pro exchange, which has lower fees than the Coinbase main site. Coinbase Pro functions more like a broker.

Quant limit and market orders can be placed on the Coinbase Pro exchange. For the first $10,000 in volume traded in 30 days, the maker/taker fee is 0.5 percent; after that, it is 0.35 percent. If your 30-day volume exceeds $300 million, you can trade cryptocurrency for free without paying a maker fee.

Quant (QNT) has been available on Coinbase.com and in the Coinbase Android and iOS apps since June 24, 2021.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that offers its eight million customers various trading options. There are spot, futures, margin, peer-to-peer (P2P), staking, and lending options.

Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the most well-known cryptocurrency exchanges in the world. KuCoin has evolved into one of the most well-known cryptocurrency exchanges. It has over 8 million registered users from 207 countries and territories worldwide.

Deposit and Withdrawal: KuCoin allows you to buy Bitcoin with fiat currency, but only through a third-party application. Payments are accepted via credit or debit card, Apple Pay, or Google Pay, but not via bank transfer. The fees, on the other hand, could be exorbitant.

You will also be required to purchase a certain amount of one currency immediately. For example, you could spend $200 on Tether (USDT), a stablecoin linked to the US dollar. Tether can then be used to buy other currencies. You couldn’t just put down $200 and wait for the right moment to invest it. Other exchanges let you deposit funds and decide how and when to spend them.

KuCoin Transaction Fees: The KuCoin trading fee structure is simple. The platform charges 0.1 percent for both makers and takers, making it one of the most cost-effective Bitcoin exchanges available online. You can further reduce your fees if you own the platform’s native Kucoin tokens.

Quant (QNT) was listed on KuCoin on February 07, 2021, with trading pairs of QNT/BTC and QNT/ETH.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange where users can buy, sell, and trade various digital coins. The Hong Kong-based portal was established in 2012. Intermediate and professional traders are more likely to use Bitfinex’s trading area because it includes a robust set of chart analysis tools.

Aside from cryptocurrency, wire transfers are the only way to deposit and withdraw funds. Bitfinex, like Coinbase, is one of the few platforms that allows you to short cryptocurrencies and trade them using leveraged trading strategies.

Founders – Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange, providing customers worldwide with digital asset trading services.

Bitfinex Securities Ltd., a blockchain-based investment product provider, has opened a regulated investment exchange (Bitfinex Securities) in the AIFC to provide members greater access to a diverse range of financial products. As a result, Bitfinex is completely unregulated. Despite having its headquarters in Hong Kong, the corporation is registered in the British Virgin Islands.

Fees and deposit limits: For bank transfer deposits, Bitfinex charges a 0.1 percent fee. For example, if you deposit $10,000, you will be charged a fee of $10.

Withdrawal fees: Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. If you require funds within 24 hours, you can pay a 1% expedited fee.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- US citizens are not accepted.

-

Expensive trading fees

- The support team is only available via email

What is Quant (QNT)?

Blockchain interoperability is one of the significant hurdles in the adoption of cryptocurrencies. Traders want a network to easily share information and data between blockchains without wasting much time, energy, and other resources. To address this issue, the Quant Protocol came into existence in 2015 by Gilbert Verdian. He created the Quant Protocol as a standard approach for all blockchains. He wanted to make the global exchange of information systems more efficient and learned that DLT could solve such a problem efficiently. So, he used Distributed Ledger Technologies (DLT) to develop an Operating System (OS) named Overledger Network. It is the first OS built for blockchains and aims to connect different blockchain networks. The primary function of the Overledger Network is to combine all of the valuable aspects of different blockchains.

Some people might be confused between Quant and Overledger Network because of the names of the operating systems. So, the CEO of Quant Protocol, Gilbert Verdian, said, “Overledger OS lives on top of the blockchains but is not a blockchain itself.” According to the website of Quant Network, they have provided “the world’s first DLT gateway for the enterprise that delivers interoperability across different systems, networks, and DLTs.” They are now working to make the platform so huge that it could help enterprises, governments, and individuals across the globe get the most out of the true potential of an incredible, powerful technology like blockchain.

Developers can use Overledger to build decentralized multi-chain applications (MApps). For instance, they can start building MApps only after they prove that they hold a specific number of QNT tokens. The vision of Quant Protocol is to build an ecosystem surrounding its Overledger Network where enterprises, developers, and innovators can build MApps for their customers and users. The whole idea is to build a platform similar to the App Store, like the Apple App Store and Google Play Store. However, multi-chain applications built on different blockchains will be available to use and subscribe to.

What is a QNT token?

The QNT token is a native token for the Quant Network. It is an ERC-20 token because it was built on the Ethereum blockchain. For this reason, the Ethereum blockchain was chosen. It has the highest utility rate and better and more efficient integration for wallets and exchanges.

The QNT token is a utility token, which means all the developers, enterprises, and users of the Quant Network will have to pay to use the services of the protocol. Overledger networks can only be accessed if you hold several QNT tokens. Without the QNT tokens, neither developers nor users can access Overledger, MApps, or Quant services.

The process is similar to the license key method, where keys are necessary to access the features of products, just like for Office 365 and iOS apps. Developers and enterprises are required to buy the license key from the platform. For this purpose, they pay in fiat currency to the Quant Treasury, which converts them into QNT tokens according to the prevailing market rate. These QNT tokens are then locked in for 12 months. After that, developers are assigned a BPI key, which is used to access the Overledger Ecosystem to read or write operations or run the gateways.

Another important thing is that the license key expires every 12 months, and the fee is then charged as QNT tokens. In addition, when the license key expires, access to Quant Network services is cut off. The service can be used once again when the annual fee is paid.

Is it Worth Buying Quant (QNT) in 2024?

Delving into its price history while considering that the past doesn’t inexorably dictate the future can furnish valuable insights for interpreting potential trends.

Since its inception in 2018, the QNT price chart exhibited a relatively placid course until 2021, a turning point ignited by a burgeoning market sentiment. Commencing the year at $11.23, QNT’s value surged to an all-time pinnacle of $393.54 on September 10, 2021. However, subsequent retreat saw QNT conclude the year at $178.82.

The year 2022 wrought trials for the crypto landscape as a sequence of crashes vaporized over a trillion dollars from the cumulative crypto value, with QNT among the casualties. Data from CoinMarketCap illustrates a descent from a $2.18 trillion total crypto market cap on January 1 to $1.01 trillion by June 18, 2022.

QNT’s trajectory mirrored this descent, plummeting from $179.16 on January 1, 2022, to a nadir of $42.95 on June 18. Yet, the cryptocurrency undertook a resurgent journey after that. Its valuation more than doubled, cresting at $130 on August 15 and sustaining an upward momentum.

An impressive ascent transpired during the initial half of October, breaching the $150 threshold and surging to a 90-day zenith of $226.09 on October 17, 2022. However, QNT’s fortunes waned after the FTX (FTT) exchange suffered a collapse, causing the token to tumble to $100.52 on November 22. Notably, QNT demonstrated resilience, rebounding to $132.61 on December 3.

The year’s end, however, saw a downturn as QNT’s value slipped to approximately $105.50 on December 21, 2022. With slightly over 12 million QNT in circulation from a total supply of 14,612,493, its market capitalization hovered at about $1.275 billion. This ranking placed QNT as the 32nd largest cryptocurrency by this metric.

Presently, QNT’s price is grappling to regain its erstwhile momentum at $104.12. Over the last 24 hours, the token has recorded a trading volume of $17,042,136, marking a 3.75% surge. In the current CoinMarketCap ranking, QNT occupies the 37th position, boasting a market cap of $1,256,963,639. The circulating supply entails 12,072,738 QNT coins out of a maximum supply of 14,881,364 QNT coins.

As the crypto verse navigates 2023, the outlook for QNT entails a gradual recovery. While challenges persist, the token’s performance exhibits a potential for cautious optimism.

Will the Price of Quant (QNT) Go Up in 2024?

Quant (QNT) stands out as a potential candidate for upward price movement in 2023, backed by its innovative solutions to blockchain challenges and a series of significant accomplishments.

Addressing the inherent shortcomings of blockchain technology, Quant has emerged as a solution to pivotal gaps. Notably, the accessibility of data and the trade-off between transaction speed and cost have remained persistent challenges. Quant tackles these obstacles head-on, offering faster transactions without the burden of elevated costs, making it a notable contender in the blockchain realm.

One of the standout strengths of Quant is its ability to ensure seamless data transfer across networks, eliminating additional expenses. Moreover, it excels in expediting transactions, distinguishing itself from its counterparts. Its advantages over similar networks accentuate its potential for broader adoption and sustained growth.

Despite the bearish trend experienced in 2022, Quant Network achieved remarkable milestones. Notably, the year witnessed an impressive 74% expansion of the team, consistent updates to the Overledger platform, a pioneering blockchain course in partnership with King’s College London, and crucial collaborations with entities such as LACChain to provide cross-border solutions. The adoption of Quant’s solutions by banks, exchanges, and major corporations indicated its increasing relevance.

2023 has sustained this momentum, marked by notable achievements that further solidify Quant’s position in the blockchain landscape. Quant enhanced Distributed Ledger Technology (DLT) security and interoperability in February through the Secure Asset Transfer Protocol. March saw the integration of Quant with Avalanche, enhancing its ecosystem.

In a significant development, June witnessed a collaboration with BIS and the Bank of England on Project Rosalind, paralleled by the launch of the Overledger Platform. July contributed to the narrative with Quant’s expertise in Central Bank Digital Currencies (CBDCs) featured in Finextra’s Future of Payments report. Most recently, August brought news of Quant being granted a patent for chronologically ordering blockchain transactions.

These achievements underscore Quant’s dedication to innovation and its commitment to addressing critical challenges in the crypto space. The path toward a positive price trajectory becomes increasingly likely as the ecosystem expands and garners more attention from established financial players. The advancements in the Quant ecosystem bolster its overall viability and lend credence to the notion that its value could see an upward trend in the near future.

Quant (QNT) Price Prediction: Where does Quant (QNT) go from here?

The competition between platforms and tokens in the cryptocurrency market is exceptionally high. In such a scenario, evolving its technical advancements continuously is crucial. The more useful features a platform gives, the more audience and space it gets in this market.

Thus, Quant keeps up-to-date relentlessly to keep up with its popularity and value. Its current price of around $140 shows great potential for growth in the future. There is likely to be a bullish market in the future for Quant.

However, investors should be cautious. Investments are advised only if they have the time to hold on to it and the funds to afford it. Before deciding, it is always better to read into the currency’s current and future price trends.

The following are our analysts’ QNT price predictions for the upcoming years.

Quant (QNT) Price Prediction 2023

If Quant continues to garner strength and the upward pattern continues until the next month, it may reach a resistance level of $150. However, if it takes a U-turn, it would mean that its price may crash down to below $100.

Quant (QNT) Price Prediction 2024

By 2024, analysts anticipate a spike. They see the price of QNT setting new benchmarks. With increased partnerships and further developments on the network, Quant may surpass the $187 level in 2024. The lowest level for 2024 is anticipated at around $163, and the average price is predicted from $140 to $145.

Quant (QNT) Price Prediction 2025

Based on Quant’s past price trends and market movement, the technical outlook suggests that QNT will move from $180 to $269. It could go down to a low of around $180, with an average trading price of about $233.

Quant (QNT) Price Prediction 2026

Crypto analysts suspect that Quant will continue to grow well in 2026. The price of one Quant is predicted to be about $342. For 2026, the expected lower base value is around $220, and an average trading price of $279 to $280.

Summary

Although QNT represents an excellent investment opportunity, it is essential to note that its future depends on several factors, including new technological solutions for Quant projects, the crypto market environment, legal positions, and more. As a result, it’s critical to do your homework before buying and selling Quant.

As governments create digital fiat currencies such as digital dollars and euros, there will be more use cases for network patches linked to various blockchains. During this time, Quant will be essential.

Trading in cryptocurrencies is a relatively new phenomenon, and investing in QNT is similar to investing in a crypto ETF. The difference is that instead of buying on an exchange, you navigate multiple blockchains built on an interdependent infrastructure. A high degree of risk is involved, but the payoff could be well worth it.

Therefore, if you want to buy it, our suggested regulated broker, eToro, can help you get started. The platform is, of course, licensed and regulated by the FCA and has one of the best reputations in the industry. Furthermore, eToro provides a wealth of educational resources to help those new to the market learn the ropes.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risk in buying QNT now?

If we look at the monthly price chart, we can see that QNT has been continuously declining since September 2021. Only the past two months have been in favor of the token. Some might suggest that it is a price correction, while others might say it is a trend reversal. However, in both cases, buying is the ultimate option to benefit the traders. So, I would say that there are minimum risks in buying QNT right now.

Is it safe to buy QNT?

QNT was established on the Ethereum blockchain, and it has the same security measures that ERC-20 tokens have.

How much will QNT be worth in 2030?

Yes! The QNT token will likely reach $500 in the near future. It is because the protocol's offered services and dedicated team are truly remarkable. The growing number of integrations and partnerships will soon push its prices above the 500 mark.

Bitcoin

Bitcoin