Update – Maker pumped when Terra (LUNA) crashed to under $1 – investors might be moving into MKR as it has a similar use case (and DAI has similar utility to UST).

MKR is a decentralized ERC-20 token and the utility and governance token for the decentralized lending platform Maker. MKR was one of the first tradeable tokens on the Ethereum network. Now MKR is one of the most popular ETH-based platforms on the market. There are 2.1 million ETH locked up in Maker contracts.

Maker corrects issues with the traditional financial sector. It is a critical part of the DeFi community – the growing sector of decentralized financial institutions. DeFi aims to provide viable solutions to the modern centralized financial services the public uses.

An Ethereum-based decentralized autonomous organization (DAO) enables users to lend and borrow cryptocurrency without credit checks. The network combines advanced smart contracts with a uniquely secured stablecoin to accomplish this task. Let’s review where to buy Maker tokens.

On this Page:

How to Buy Maker

- Choose a cryptocurrency exchange – we recommend Binance

- Create an account and verify your identity

- Search for ‘Maker’ in the platform

- Select your payment method

- Enter how much MKR you want to buy

- Confirm your trade

Compare Cryptocurrency Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Best Exchange to Buy MKR in the UK

Here we look at the pros and cons of the best exchanges and brokers to buy Maker right now in November, 2024, and rank them.

1 – Binance

Binance is the world’s largest cryptocurrency exchange by daily transaction volume, with over $20 billion in deals per day. It gives you access to hundreds of assets and a smooth trading service that makes it simple to make money.

The advantages of Binance are pretty astounding. The trading commission is a flat 0.1 percent, which is low. Expert traders can use sophisticated tools, including futures and margin trading, and the exchange offers a variety of deposit and withdrawal methods. Combining this with Binance’s high liquidity makes it easy to see why it’s so popular.

Binance, on the other hand, is a crypto-only exchange. The exchange also charges high credit card transaction fees.

The Binance interface is not particularly user-friendly for newcomers. The charts and menu options may be bewildering for first-time Maker token (MKR) buyers. Bitcoin and Ethereum are the most convenient cryptocurrencies, but many altcoins can be deposited.

Binance listed Maker (MKR) & Dai (DAI) on July 23, 2021. It has these trading pairs for the Maker coin – MKR/BNB, MKR/BTC, MKR/BUSD, MKR/USDT.

Pros & Cons of the Binance platform:

- Excellent liquidity

- Outstanding security features

- Professional traders have access to a wide range of sophisticated items

- More altcoins than Coinbase

- High fees for credit card deposits

- Copytrading isn’t available

Your Capital is at Risk

2 – Coinbase

Coinbase is among the most well-known cryptocurrency exchanges in the United States and one of the world’s largest. Nevertheless, keep in mind the hazards of trading these speculative currencies. Coinbase, the largest cryptocurrency trading platform in the United States, was founded in 2012 in San Francisco.

CoinMarketCap.com, a market research website, is also among the top crypto exchanges globally in terms of traffic, liquidity, and trading volumes. Coinbase is a cryptocurrency brokerage that provides custodial services for institutional cryptocurrency storage and a cryptocurrency payments network for businesses.

Furthermore, USD Coin (USDC) is a stable cryptocurrency pegged to the US dollar. Coinbase became the first crypto trading company in the United States to be listed on a US exchange in April, with an IPO valued at roughly $86 billion.

While bitcoin brokerages are not covered by the Securities Investor Protection Corporation or SIPC, Coinbase covers its site for any losses incurred due to theft or hacking.

Back on June 11th, 2020, Coinbase listed Maker (MKR). Maker (MKR) is supported on Coinbase.com and in the Coinbase mobile apps for Android and iOS. Customers of Coinbase will now be able to purchase, sell, convert, transmit, receive, or store MKR via the exchange’s new services. Except for New York State, MKR will be accessible in all Coinbase-supported locations.

Pros & Cons of the Coinbase platform:

- It offers access to more than 60 cryptocurrencies.

- Low minimum to fund an account.

- Cryptocurrency is insured in the event a website is hacked.

- Higher fees than other cryptocurrency exchanges.

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

Your Capital is at Risk

3 – Bitfinex

Bitfinex, launched in 2012, is one of the older cryptocurrency exchanges. Since its inception, the exchange has remained a market leader in cryptocurrency trading, now ranking eighth among the world’s major cryptocurrency exchanges by volume, according to CoinMarketCap.

Bitfinex has relatively cheap trading costs, with most trades costing less than 0.20 percent.

Bitfinex’s active trading platform offers 150 cryptocurrencies, including Bitcoin, Ethereum, Terra, Tether, Solana, Litecoin, Ripple, etc. There are too many to list here, but Bitfinex performs a fantastic job of supporting popular currencies on its platform in general.

Fees

Another notable aspect of Bitfinex is the absence of trading fees. The majority trades either a 0.10 percent maker fee or a 0.20 percent taker fee. This rate applies to crypto, stablecoin, and fiat transactions.

However, Fees can be avoided if you keep the LEO currency in your account. For example, you can save 15% on taker costs for crypto-to-crypto and crypto-to-stablecoin trades if you have the equivalent of $1 in LEO in your account.

With at least $5,000 in LEO, you’ll receive a 25% discount on taker costs for crypto and stablecoin trades and a 10% discount on fiat trades. And, if you have $10,000 or more in LEO, you may be eligible for a bigger percentage discount, depending on your amount.

Bitfinex listed Maker (MKR) back on November 9, 2021. MKR can be traded with USD (MKR/USD) and USDt (MKR/USDt). Trading will only be available in certain jurisdictions and is exclusive to verified users.

Pros & Cons of the Coinbase platform:

- Established since 2012

- Suited for advanced traders

- Over 100 supported coins.

- Accepts bank wire deposits and withdrawals

- U.S. citizens not accepted

- Not regulated

- High trading fees

- Hacked on more than one occasion

Your Capital is at Risk

4 – KuCoin

KuCoin is a Singapore-based exchange founded in Hong Kong in 2017. It’s a genuinely global corporation, having offices in Hong Kong, Singapore, and Seychelles, which is why it bills itself as “The People’s Exchange.” Their goal was to provide consumers worldwide with an easy and secure platform for buying and selling a variety of digital currencies. They have undoubtedly made an impression on the global crypto community, increasing their user base to over 8 million in just four years and serving one in every four crypto holders globally.

KuCoin is a relatively new cryptocurrency exchange that has swiftly gained a devoted following due to its user-friendly design and high degree of security. The exchange is well-known for having various cryptocurrency pairs, allowing customers to buy a wide range of cryptocurrencies. On the negative, Kucoin is a crypto-only exchange, so if you want to buy coins with fiat currency like HKD, USD, or CAD, you’ll need to use another exchange.

It provides bank-level security, a slick interface, a user-friendly UX, and a wide range of crypto services, including Margin and futures trading, built-in P2P exchange, the ability to buy crypto with a credit or debit card, Instant-exchange services, the ability to earn crypto by lending or staking via its Pool-X and opportunity to participate in new initial exchange offerings (IEOs) via KuCoin Spotlight.

Besides, KuCoin has some of the lowest fees because it lists small-cap cryptocurrencies with significant upside potential, has a vast range of coins, lesser-known cryptos, and solid profit-sharing incentives. For example, up to 90% of trading fees are returned to the KuCoin community via KuCoin Shares (KCS) tokens.

Trading Fees – Kucoin’s trading fee structure is pretty straightforward. The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. If you own the platform’s native Kucoin Shares tokens, you can further minimize your fees.

Pros & Cons of the Coinbase platform:

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- User-friendly exchange

- Low trading and withdrawal fees

- KuCoin Shares allow users to invest in the success of KuCoin.

- Users can trade using Arwen without transferring funds into a third-party wallet.

- Due to KuCoin’s commitment to rapidly launching new, innovative crypto assets, customers can access various trading pairs.

- Users can choose from a vast number of trade pairs.

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilize.

- Lacks the trading volumes found on some of the more established platforms.

- No fiat trading pairs

Your Capital is at Risk

5 – Bybit

Bybit is a cryptocurrency derivatives platform founded in March 2018 and has since grown to become one of the world’s most popular exchanges, with over 3 million users worldwide. The program focuses on leverage trading

Bybit allows you to trade several markets, including spot, inverse perpetual, USDT perpetual, and inverse Futures.

Market takers pay 0.075 percent, while market makers pay -0.025 percent. As a result, they will be compensated when a market maker opens a transaction. This low cost encourages market makers to stay active and fill the order book.

Where is Bybit regulated?

Bybit is a legal cryptocurrency trading platform run by Bybit Fintech Limited. The corporation is registered in the British Virgin Islands and headquartered in Singapore. Because the cryptocurrency exchange is not yet regulated in any nation, users do not need to provide KYC to trade on Bybit.

- USDT everlasting BTC, ETH, EOS, and LTC pairs

- Trading costs range from 0.025 to 0.075 percent for leverage up to 100 times.

- Order books with high liquidity and low spreads

- Bybit is a mobile trading app.

- 4.9 out of 5 stars based on over 50,000 reviews

- Affiliate and referral program (30% commission)

Pros & Cons of the Coinbase platform:

- Trustworthy and reputable trading platform

- 4th largest derivatives exchange in the world by volume

- Variety of markets, including spot, perpetual, and Futures

- Advanced and feature-rich trading platform

- Intuitive and responsive mobile app

- Difficult for beginners to navigate

- A limited number of spot trading pairs against BTC

Your Capital is at Risk

What is Maker?

Maker was launched in 2014 by California native Rune Christensen. Maker is described as a decentralized autonomous organization (DAO) on the ETH blockchain and the framework for both the DAI stablecoin and the MKR token.

The MKR cryptocurrency is an ERC-20 utility token constructed using Ethereum’s protocols. Holders of Maker tokens have a say in the future and operation of the Dai Credit System.

The Maker coin did not have an initial coin offering (ICO). Instead, MakerDAO decided to gradually move the token onto the market through private sales before launching the Maker market.

Transparency Issues:

Transparency is one of the primary issues that Maker attempts to correct. Smart contracts are used on the network to eliminate the need to trust anyone. Major stable currencies, such as Tether USD, need you to trust the network’s reserves. You’ll often have to rely on third-party auditors to verify the company’s assets.

Volatility

MKR’s primary job is to ensure that DAI remains tied to the dollar. This dual crypto method reduces volatility and gives users more confidence in the project’s long-term viability.

Is it Worth Buying Maker in 2024?

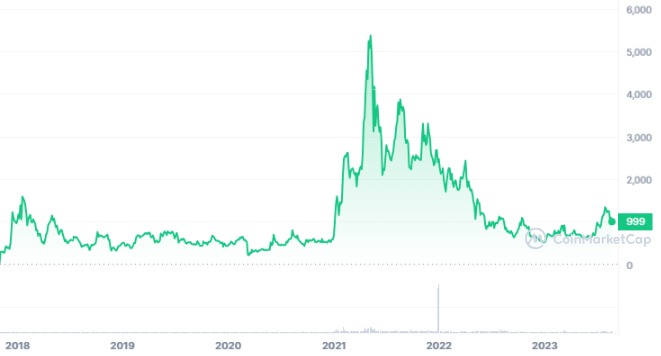

The year 2023 has seen its share of market fluctuations, raising whether it’s wise to invest in Maker (MKR). With its intricate dynamics, the coin demands a grasp of crypto gaming intricacies. A pivotal point of interest is the projected surge of Maker’s future price, speculated to surpass the $6070 mark, potentially making it an appealing prospect. The question arises: Does Maker present a justified risk-reward ratio for potential investors?

Despite this optimistic projection, the specter of price volatility looms, prompting a closer examination of MKR’s recent trends. Over the past year, the prevailing trajectory for MKR’s price has been bearish, marked by a consistent downward movement. This descent reflects skepticism among investors, as evidenced by sustained selling pressures.

Notably, the price has encountered a robust support level at $664, undergoing three tests to validate its resilience. This support juncture has become a pivotal foundation, staving off further downward slides.

Over the year, notable resistance thresholds emerged at $787 and $1138, with the latter standing firm since August 2022 as a staunch impediment to substantial price escalations. Another noteworthy resistance point at $957 became apparent through three rigorous tests within the analyzed period.

The price’s consistent pattern of lower highs and lower lows has been mirrored by a relatively lackluster trading volume, hinting at a lack of robust buying interest. A fleeting volume surge was witnessed in February 2023, coinciding with a momentary breach above the 20-week moving average (MA) and a corresponding surge in the Relative Strength Index (RSI) beyond the 50-line. However, the overall subdued volume underscores tepid market engagement and a prevailing uncertainty among potential buyers.

A technical analysis reveals the gradual contraction of Bollinger Bands since October 2022, indicative of diminishing volatility. The price, for the most part, has remained below the 20-week MA. Exceptions to this norm occurred in October 2022 and February 2023 when the price briefly climbed above the 20 MA, aligning with transitory upward movements.

As of the latest market data, Maker’s current trading price is $1,037.13, accompanied by a 24-hour trading volume of $241.27 million. The coin’s market capitalization holds steady at $1.01 billion, with a market dominance of 0.10%. Over the past 24 hours, the MKR price has exhibited a 1.73% decline.

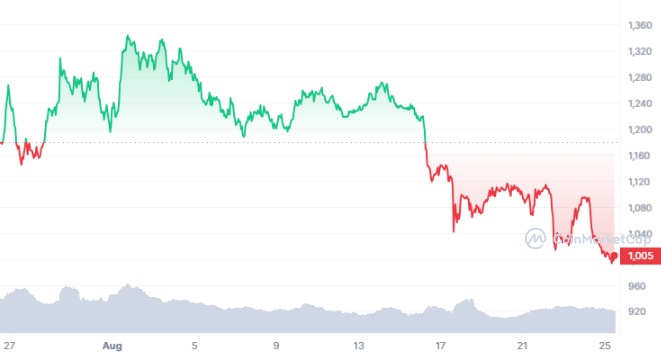

Retrospectively, Maker attained its highest historical price of $6,244.44 on May 3, 2021, while its nadir of $171.27 was recorded on March 16, 2020. Notably, the lowest price after its all-time high was $503.28, signaling a significant drop in value. The highest MKR price following this bearish phase reached $1,356.40.

As for the current market sentiment, the prevailing outlook for Maker’s price prediction leans bearish. This sentiment is mirrored by a Fear & Greed Index reading 41, indicative of an environment dominated by caution rather than exuberance.

Regarding supply dynamics, Maker’s circulating supply presently encompasses 977,631 MKR tokens out of a maximum supply of 1.01 million MKR. Within the broader landscape of decentralized finance (DeFi) coins, Maker ranks as the fifth-largest, and within the Ethereum (ERC20) Tokens sector, it holds the thirteenth position.

Will the Price of MKR Go Up in 2024?

The Maker Ecosystem, powered by the innovative MakerDAO protocol, has gained traction for its promise of streamlined transactions and enhanced efficiency within the decentralized landscape. MakerDAO aims to usher in a new era of seamless transactions by minimizing the complexities associated with decentralized systems.

At its core, MakerDAO’s decentralized autonomous organization (DAO) is designed to facilitate quicker and more cost-effective transactions. It is achieved by integrating MKR into various decentralized applications (dapps), allowing swift and seamless payment settlements.

The inherent nature of the system ensures that transactions are verified within seconds, made possible by faster block generation times and minimal fees. The appeal of Maker extends to its provision of APIs/SDKs, enabling dapps, merchants, and consumers to transact using a variety of crypto assets, including ERC20 tokens and ETH. Furthermore, Maker’s integration empowers decentralized exchanges to offer their users efficient and economical trading options, bolstering trust and security.

The maker has demonstrated impressive growth recently, boasting a substantial 53.5% increase over the last month. Notably, between July 15 and July 22, the cryptocurrency experienced a remarkable surge of 28.1%, achieving its highest daily closing price in nearly a year. The critical question that looms is whether Maker can maintain its current trajectory.

Analysts scrutinize the situation to discern whether the recent price surge is sustainable or if short-term factors drive it. A key development that could influence Maker’s future is the unveiling of the “Endgame” roadmap by MakerDAO. This comprehensive five-phase upgrade plan encompasses a range of strategic moves, including introducing two tokens with updated functionalities, rebranding, and implementing a new blockchain.

The heart of this upgrade involves the creation of incentive programs that promote interaction and governance participation via a new chain bridged to the Ethereum network. This revolutionary step empowers users to initiate hard forks in response to potential threats, enhancing security and resilience.

While the recent price surge could be linked to these promising changes, attributing the entirety of the rally to these developments may oversimplify the situation. Notably, Maker’s price remained stable for a substantial period following announcing the “Endgame” roadmap. Investors must dig deeper into the dynamics of MKR’s movement to grasp the precise catalysts behind the price surge.

Several factors bolster the notion that Maker could sustain its upward momentum. Integrating a buyback mechanism, a noteworthy 343% surge in revenue, and reduced risk following venture capital exit strategies all contribute to Maker’s favorable position. Additionally, the co-founder’s strategic adjustment of holdings favoring MKR signals a strong commitment to its potential.

Amidst the broader landscape of cryptocurrency losses, particularly for holders of altcoins, Maker stands out for its resilience. According to the analysis of Intotheblock, a prominent analyst firm, Maker has demonstrated a more favorable profit/loss profile than its peers. Unlike most other altcoins, Maker has showcased an encouraging trend, with fewer holders experiencing losses than the previous year. This pattern, coupled with Maker’s consistent profitability for holders, further cements its unique position.

While many altcoins are experiencing unprecedented losses, with over 90% of holders incurring losses, principal DeFi tokens are showing some resilience.

An examination of the profit and loss profiles of holders over the past year reveals that most are in a similar position… pic.twitter.com/miXAX5YdLX

— IntoTheBlock (@intotheblock) August 24, 2023

Considering these recent developments and trends, it is anticipated that the price of MKR will continue to gather momentum in the coming months and years. According to projections, the average price of MKR is expected to reach $593 by October 2023. As the cryptocurrency market continues to evolve, all eyes remain on Maker and its potential to redefine decentralized transactions and secure a robust position within the crypto landscape.

How to Choose the Right Crypto Broker

Given the abundance of brokers from which to purchase Maker (MKR), you must make the best decision possible. As you look for the best broker for you, consider the following factors:

1. Fees

Finding a low-cost broker is crucial when trading cryptocurrencies like Maker (MKR). What’s the significance? Because fees can quickly accumulate. Get a breakdown of the broker’s fee structure before deciding on a trading platform. Fees for withdrawals, deposits, transactions, and trading should be included.

2 – Safety

The correct broker should have appropriate safety and security standards to avoid illegal access to your assets.

3. Support

A reputable broker will also have a strong customer service department to assist you with your every requirement.

4. Deposit Options

You want to be able to make as many deposits as feasible. There are always a lot of choices, from bank transfers to credit cards to payment processors. Just keep in mind that each one comes with its own set of expenses.

When you’re considering an investment, follow these things:

Every cryptocurrency carries some level of risk, but in the case of Maker, the risks are very high (MKR). As a result, it’s critical to avoid getting sucked into the fear of missing out when investing. Before investing in any digital asset, do your study in addition to following the advice of others.

1 – Research, research, research: Before investing your money, a good and comprehensive research about the product must be done to avoid associated risks.

Here are the different methods we looked into:

- Investigating various forms of social media.

- Speculating on what’s to come.

- Learn the essentials by doing some research.

- Find out what’s hot right now.

- Make use of the strength of specialized forums.

- Attend crypto gatherings.

- Keep an eye on the number of transactions.

Monitor the market – Monitoring the market is a second step in knowing more about your selected product or digital asset. The market could move in a different direction from your expectations, and keeping your calm when the market is moving in another direction is also an essential factor. The best way to monitor the market is to go through the review sites and make recommendations on them.

Buying Maker as a CFD Product

Contracts for differences (CFDs) are derivatives that allow you to speculate on multiple financial markets without owning the underlying asset. It is widely used in established markets such as foreign exchange currency pairings, stocks, bonds, indices, and commodities.

Trading CFDs entails more than simply buying and selling; it also entails agreeing to swap the difference in an asset’s price when the contract is opened and expires.

CFD trading has entered the cryptocurrency industry, and Maker (MKR) is now available as a CFD product. If you’re having trouble understanding bitcoin trading and where to keep your crypto funds, you may use CFDs to profit from Maker (MKR).

We recommend trading Maker CFDs on the Binance platform since they are regulated and allow you to choose from various analytical tools. MKR CFD isn’t available yet on CryptoRocket, but hopefully, it will be listed very soon.

Your Capital is at Risk

Taxation on Maker Earnings:

Because the cryptocurrency market is still in its early stages, regulatory bodies like the SEC are attempting to control it. Furthermore, the Internal Revenue Service has attempted to establish a cryptocurrency tax structure. Cryptocurrencies and digital assets are classified as real estate and subject to capital gains tax. However, some cryptocurrency revenues are considered income in certain circumstances and fall within the income tax category. The taxable events that qualify for capital gains and income taxes when exchanging digital assets are as follows.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21 and IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals who own bitcoin as a capital asset but are not in the trade or business of selling cryptocurrencies may find answers to their questions in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

In the tax sector, profit is referred to as gain. It is the difference between your tax basis (usually the amount you paid for the shares + transaction costs) and the amount you receive when you sell or exchange them.

Taxable events that are considered property gains tax in the US:

- Exchanging your cryptocurrency for fiat money

- Making purchases with crypto.

- Swapping one cryptocurrency for another – through an exchange or a peer-to-peer (P2P) channel – is common.

Taxable events that are considered income taxes:

- Mining rewards for blocks of cryptocurrency

- Liquidity pools (LPs) and staking are two methods for acquiring crypto assets.

- Receiving cryptocurrency in exchange for services rendered

- Obtaining cryptocurrency via an airdrop

- Making money by lending to decentralized finance (DeFi) services.

Be aware that you can write off your capital gains tax through losses incurred from trading.

Calculating Your Capital Gains Tax

The crypto market has seen exponential growth in the past year, and government agencies are trying to take knowledge of it. Given the recent spike in the non-fungible token (NFT) sub-sector, the IRS is also looking to get a piece of the crypto pie. Two things essentially decide the number of capital gains tax rates for cryptocurrencies: your income tax bracket and how long you have held on to your crypto asset. This will help you calculate your:

a.) Capital Gains on Short-Term Investments

The short-term capital gains tax largely depends on how long you have been trading or holding cryptocurrencies. You will be taxed under your normal tax bracket if you have made gains or losses from trading or holding crypto for less than a year. Losses you incur for that trading year can prove useful. Leveraging a tax-loss harvesting strategy, you can write off up to $3,000 of your taxes. You also enjoy the privilege of post-dating your taxes to the following year.

b.) Capital Gains on Long-Term Investments

Long-term capital gains apply if you have been trading cryptocurrencies for over a year. You will pay taxes between 0 to 20% depending on your income. We have itemized the income tax brackets on this link.

Automated Trading With Robots

A trading robot is a computer program that, on a computerized basis, executes all of the activities of a professional trader on an exchange. The computer software is a fully automated version of tried-and-true trading techniques. Regardless of the direction in which asset values move, robots outperform humans during periods of substantial market volatility. This is because they rely on trading strategies to generate profits even when the market is down.

Furthermore, the world’s most successful trading bots are known for their lightning-fast research and execution. As a result, they can conduct many transactions each day, allowing them to capitalize on any emerging trading chances.

Trading Maker (MKR) is a challenging career for anybody to pursue, and there is no guarantee that your market analysis will result in a profit. To overcome this obstacle, there are other surefire ways to build your capital with little to no effort. Ideally, the bots benefit, and that profit is greater in risk-adjusted terms than if you had simply purchased and held the same coins throughout.

Maker (MKR) Mining: Can You Mine Maker (MKR)?

Yes, it’s possible to mine Maker. The Maker block is mined for every ASIC (Application-Specific Integrated Circuit). However, this block is then shared among all miners. The time it takes to mine one block of Maker for yourself is determined by your hash rate, which is essentially how powerful your mining system is. You will get the best results for Mining Maker using an ASIC.

Proof-of-Capacity (PoC)

Maker’s proof-of-capacity methodology is the most recent, launched in 2013. Coins are dispersed among miners over a long period of time in this process. To mine, all that is required is hard disc space.

Decreasing Risk in MKR Investment

Every investor needs to find ways to protect themselves from any significant loss. If you want to cap your risks, then follow these rules:

Hedge your risks: You should always have a well-balanced portfolio of investments. Use financial instruments strategically to mitigate the risk of adverse price movements. On the other hand, the investors hedge one investment by making a trade-in another.

Use a stop loss: A stop-loss order restricts an investor’s loss on an adverse move in a security position. You don’t have to monitor your holdings daily if you use a stop-loss order. An investor’s ally is a stop loss. Be a note of it, and make sure you stick to it. When things don’t go as planned when investing, you’ll want to know when to take your money out.

Set a target: Short-term traders who want to manage risk should employ take-profit orders. This is because they can exit a transaction as soon as their predetermined profit target is met, avoiding the risk of a market decline. Traders who follow a long-term strategy dislike such orders since they reduce profits.

Use multiple exchanges: To reduce risk in crypto trading, I use a variety of exchanges, employ hardware wallets, and invest in various narratives (Oracles, Defi, or insurance). To reduce risk when trading, trade only when truly strong patterns form or when a coin has reached its bottom.

Fundamental & Technical Analysis: I prefer to focus on coins with strong fundamentals. I only invest on rare occasions in response to news or other events. If I decide to invest, I will also do a technical analysis. I consider things like where the currency is in its life cycle.

Are there any trading patterns? The coin has support and resistance, recent price history, news, and forthcoming events. If I invest in fundamentally sound coins, I can stay calm even if the price changes a lot because I know the price will eventually rise.

Maker (MKR) vs. Other Cryptocurrencies

Maker (MKR) vs. Ethereum (ETH)

Maker is an Ethereum-based innovative contract platform that backs and stabilizes the value of the stablecoin DAI via a complex system of Collateralized Debt Positions (CDP), independent feedback mechanisms, and appropriately compensated external actors.

The Ethereum network’s programs and services all require computational power to function (and that computing power is not free). Besides, Ether is a payment method network users use to pay for the services they want from the network.

Maker (MKR) vs. Bitcoin (BTC)

Bitcoin uses peer-to-peer technology to manage transactions and issue new bitcoins without a central authority or banks. The network as a whole is in charge of these tasks. Anyone can participate in Bitcoin because it’s open-source, and nobody owns or controls it. Several of Bitcoin’s unique qualities enable it to be used in ways no other payment system has been able to. Whereas Maker is an Ethereum-based innovative contract platform that backs and stabilizes the value of the stablecoin DAI via a complex system of Collateralized Debt Positions (CDP), independent feedback mechanisms, and appropriately compensated external actors.

Maker Price Predictions: Where Does MKR Go From Here?

As the cryptocurrency landscape evolves, projections for the future price of Maker (MKR) remain a subject of keen interest. Analyzing the potential trajectory of MKR requires a comprehensive assessment of various factors that could influence its value. While it’s important to note that predicting cryptocurrency prices with absolute certainty is challenging due to the volatile and dynamic nature of the market, experts and analysts offer insights based on current trends, technological developments, and market sentiment.

Maker (MKR) Price Prediction 2023

Maker is expected to run steadily in the crypto market this year. According to experts, the crypto will maintain its current price range this year. Many experts think it would close between the $650-750 range this year. Some are even hopeful that it will exceed $850 on its price charts in the middle of this year.

Maker (MKR) Price Prediction 2024

Going by the current growth rate of this cryptocurrency, it is expected that Maker will go beyond the value of $1,000 in the year 2024. Experts believe that Maker will maintain the average price of $800-900 in the next year.

Maker (MKR) Price Prediction 2025

2025 is expected to be the golden year for this cryptocurrency as its price is predicted to double by the end of that year. Maker is expected to close 2025 at $1605 while maintaining the average price of $1250 throughout the year.

Summary

Maker is an Ethereum-based innovative contract platform that backs and stabilizes the value of the stablecoin DAI via a complex system of Collateralized Debt Positions (CDP), independent feedback mechanisms, and appropriately compensated external actors.

The MKR token had a great run last year and looks to have a promising future and roadmap heading into 2023 and beyond. The gains from investing in Maker could potentially outperform other assets. Its value should also increase with Bitcoin and the rising crypto market cap.

If you’re ready to take the plunge to get in on the action, you can complete your crypto journey using our recommended broker, Binance. It only takes three minutes to set up your account and ready-to-purchase Maker (MKR) using USD, GBP, EUR, or Bitcoin.

You should also remember the following:

- Investing in and trading Maker (MKR) involves substantial research and work.

- Maker (MKR) is a very risky investment.

- Invest just what you can afford to lose.

- Only use registered brokers and exchanges when trading or investing.

- You should also seek the opinions of review sites and online gurus on Maker.

Your Capital is at Risk

FAQs

Any risks in buying MAKER now?

There are always risks in buying digital assets. The major risk is in the possibility of MAKER (MKR) price falling off the cliff or the asset becoming worthless.

Should I buy MAKER?

Maker's most significant victory is that its future price will cross $6070. Betting on Maker with the least price change will be worth it. However, given the lower risk of a price drop, we believe Maker (MKR) is an intelligent short-term investment. The short-term Maker price projections indicate that Maker is a good long-term and short-term investment.

Where can I spend MKR?

MAKER (MKR) is still not as widely used as Bitcoin. However, an increasing number of stores are now accepting it. In any case, you can always convert MAKER tokens (MKR) into other cryptocurrencies like Bitcoin, Ethereum, or Tether to make payments online.

Is it safe to buy MKR?

MKR is a decentralized ERC-20 token that represents an investment in the Maker Project. The Maker network has long been seen as a pioneer in the market. For instance, the platform was one of the 1st-ever tradeable tokens on the Ethereum network. Now, Makeris is understood as one of the most popular ETH-based platforms available in the market. There are about 2.1 million ETH locked up in Maker CDP contracts. Therefore, Maker is a safe buy; however, we recommend not to put all your investment in one basket.

Will MAKER (MKR) ever hit $16500?

Maker would be spotlighted due to new partnerships, making it a magnet for investment and a socially respected cryptocurrency. More transactions will be completed with each passing second, posing a difficult challenge for other cryptocurrencies as Maker's price rises above $16500.