June Update – it’s now possible to buy LUNA under its new name Terra Classic (LUNC), the buying guide below is still accurate although you will see the new ticker symbol LUNC in eToro. To buy LUNA 2.0, that new asset created after the Terra hard fork has been listed on Crypto.com.

$100 can now buy you 5 million LUNA crypto tokens, when in April 2022 it wouldn’t buy one LUNA token, so many investors are keen to know where to buy Terra LUNA – and should you buy LUNA?

Terra is (or was) a popular proof-of-stake blockchain designed to maximize cryptocurrency’s potential benefits for the financial sector. It focused on the mass payment processing infrastructure and the production of a usable, stable coin. The TerraUSD (UST) stablecoin could be exchanged for the network’s native token, Terra (LUNA). UST could be transmitted anywhere with minimal costs and without consideration of bank limits, allowing people worldwide to swap cryptocurrency instantly over the Terra blockchain with no hidden costs.

If you’re interested in Luna and want to study it more, in this guide we cover what Luna is, who created it, how LUNA works, the LUNA token use case and where can you buy Terra LUNA on the dip. Is it worth buying in 2024? What will its price reach in the future? How can you manage taxes on LUNA earnings given the LUNA crash?

How to Buy Terra LUNA Crypto

- Choose an exchange that listed LUNA – we recommend eToro as it’s FCA, ASIC and CySEC regulated

- Sign up and verify your free trading account

- Deposit with a bank transfer, a credit card, PayPal, or another supported method

- Search ‘LUNA’ in the drop-down menu to open the LUNA price chart and trading platform

- Click ‘Trade’ and select an amount of LUNA to buy

Best Exchange to Buy Terra in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How to Sign Up at eToro

Note – Some crypto exchanges are yet to relist LUNA, eToro also was one of the platforms that delisted it – eToro will relist LUNA at a safe time to invest in LUNA, once the issues with the inflation of the LUNA supply are solved.

It is simple to open a free eToro account and the platform is user-friendly, especially for beginners.

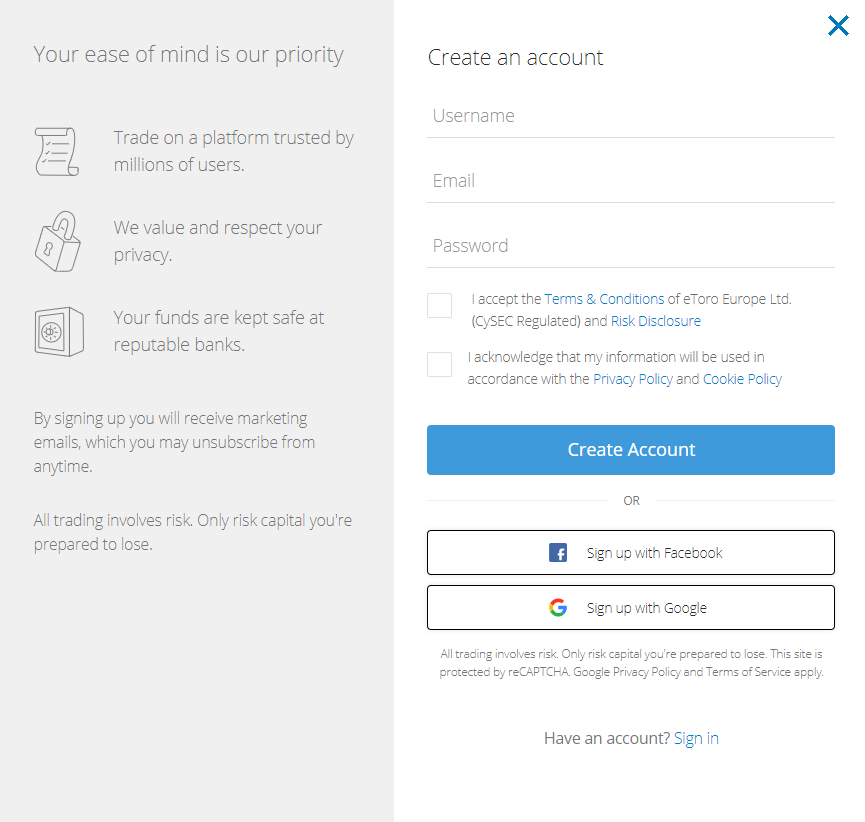

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, complete the quick account creation process.

- You’ll find an electronic form where you can enter all of your personal information needed to open a new trading account.

- eToro also offers the option of logging in through Facebook or Gmail.

- Make sure to read eToro’s Terms & Conditions and privacy policy while submitting your information.

- Click the “sign-up” button.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Step 2: Upload ID

To begin, you must register with eToro by providing some basic personal information, as well as an email address and cell phone number. Additionally, you will be required to provide identification to complete the verification process.

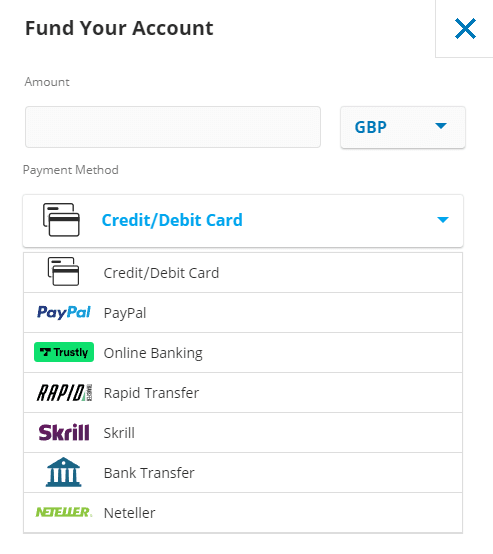

Step 3: Make a Deposit

When you’re ready to make a deposit, navigate to the ‘Deposit Funds’ section and enter the desired amount. To open an account with eToro, a minimum deposit of $10 is required, which can be made in a variety of ways. Debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller are all accepted forms of payment.

eToro does not charge a fee for making a deposit. After selecting a method of payment, click the ‘Deposit’ button to complete the transaction.

Deposit methods on eToro

Back on April 19, 2022, eToro listed the Terra (LUNA) coin.

Step 4: Buy Terra (LUNA)

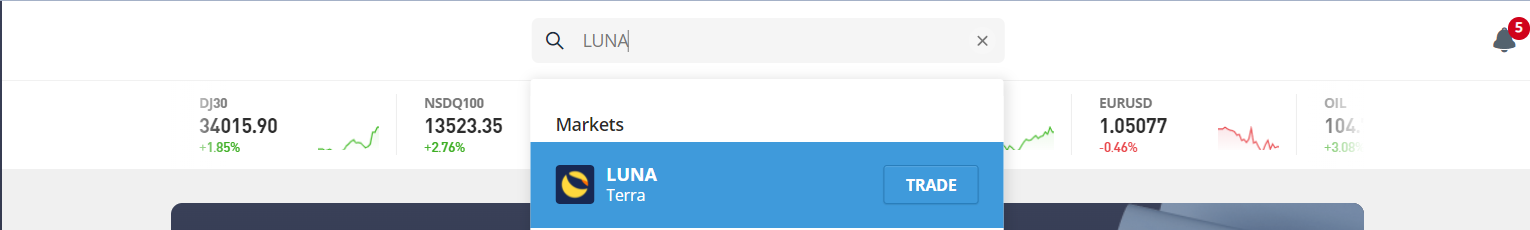

Begin typing ‘Terra’ into the top-of-the-screen search bar. Click the ‘Trade’ button when you see the cryptocurrency asset.

Searching LUNA on eToro

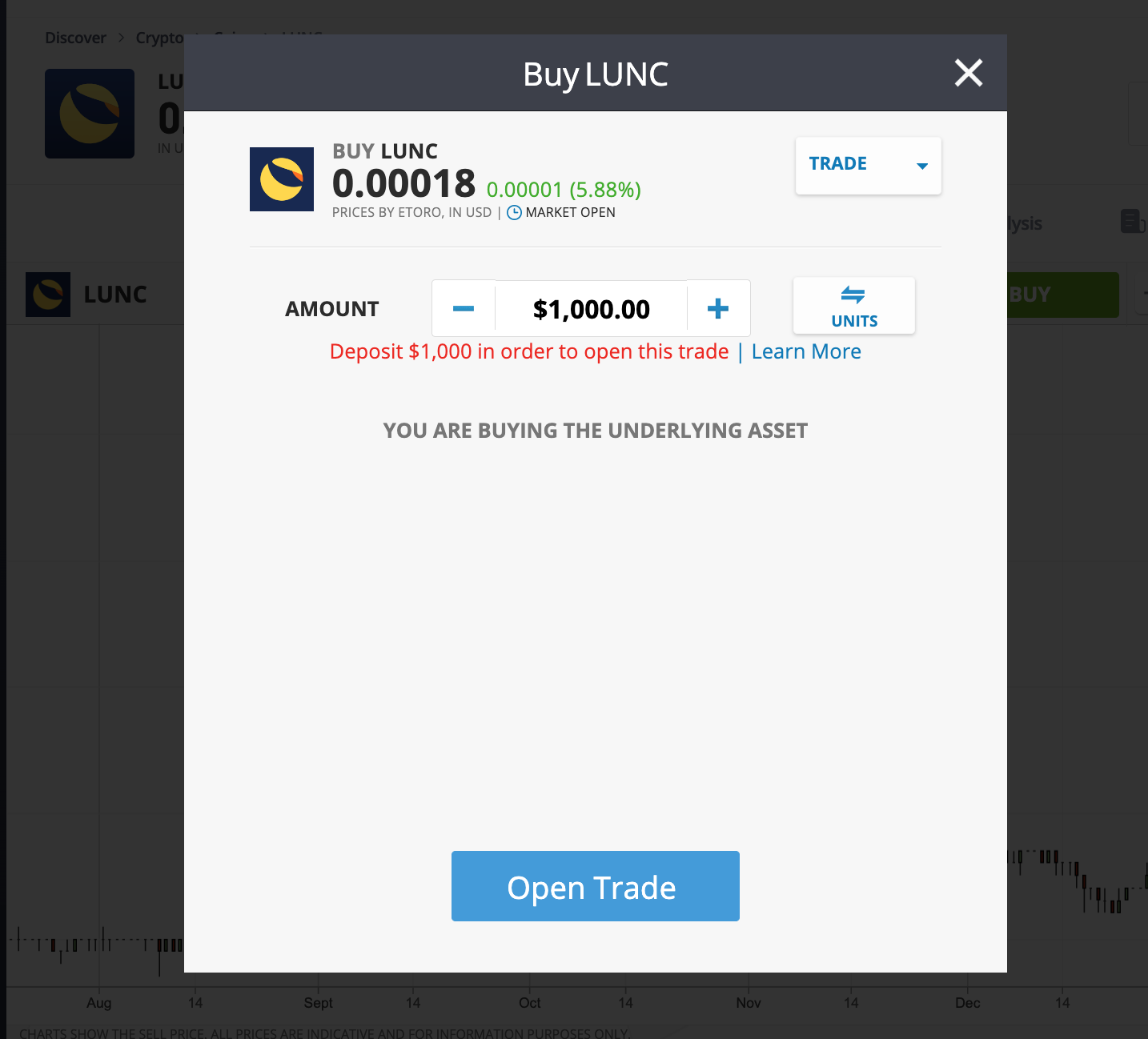

Step 5: Review Terra (LUNA) Price

This step will take you to an order page where you can enter the quantity of Terra coins you wish to purchase. Following that, click open Trade’ to add the LUNA to your portfolio. Apart from the trading platform, we support storing your digital assets in a third-party wallet. One viable option is to utilize the eToro Crypto Wallet, which now supports over 120 different cryptocurrencies in addition to LUNA.

LUNA price chart on eToro

The good thing is, there’s no maker/taker fee on eToro as they solely charge buy/sell spread.

Step 6: Buy Terra

At this stage, you can confirm eToro how much money you want to invest in Terra in the ‘Amount’ box – starting with $10. Click the ‘Open Trade’ button to complete your purchase.

How to buy LUNA on eToro

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Terra LUNA Tokens – Best Platforms

Terra Luna was a top 10 cryptocurrency asset and promising blockchain. It allowed users to stake LUNA to earn interest, made it simple to create new stablecoins, and rapidly gained traction, driving up the price of the LUNA token before the LUNA crash. It may still recover as a LUNA and UST recovery plan has beeen announced. This guide will cover how to buy Terra Luna step by step on the dip.

We review the best place to buy Terra right now below. Our list of sites to buy LUNA in 2024 covers their fees, features and more. eToro has established itself as the top site for buying LUNA cryptocurrency, and saved investors from a large part of the LUNA drop by delisting it temporarily.

Best Brokers to Buy Terra (LUNA)

1- eToro

eToro is an online trading and investment company that offers social trading and investment platform. Founded in 2006, this company is headquartered in Tel Aviv, Israel. eToro provides a range of services to retail investors and traders, including trade execution through its proprietary web platform. Additionally, the company offers social trading and copy-trading capabilities.

The site and company provide a platform available in over 25 languages and approved by the Cyprus Financial Markets Authority. Additionally, the site features an advanced analytics tool that enables users to identify trading opportunities, monitor performance, analyze their investment strategy, and identify areas for improvement.

Additionally, you can now earn rewards for purchasing and buying Ethereum, Cardano, and Tron in your wallet.

Read more about how to stake crypto.

eToro is governed by some of the world’s most reputable regulatory authorities, including the Financial Conduct Authority of the United Kingdom (FCA). Additionally, the Australian Securities and Investment Commission, and the Cyprus Securities and Exchange Commission. User funds are kept separate from the platform’s operating capital in compliance with CySEC regulations for all CySEC-registered brokers. This is the way the platform operates.

eToro charges a nominal trading fee like other companies, including 0.75 percent for purchasing or selling bitcoin. On eToro, the cost of converting bitcoins is only 0.1 percent on top of the existing margins. As a result, eToro has established itself as a market leader in cryptocurrency trading. eToro USA LLC does not offer CFDs, only real Crypto assets available.

eToro charges its consumers a reasonable fee structure. eToro does not charge a fee for making a deposit. Deposits can be made using bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller, among others. The minimum deposit amount varies by user region. Individuals in the United Kingdom and the rest of Europe, for example, must make a minimum deposit of $200 before trading. In the United States, users must make a $10 deposit.

eToro accepts Bitcoin, the leading cryptocurrency, as well as major altcoins such as Ethereum, Aave, XRP, Graph, and other popular cryptocurrencies.

Buying and selling on eToro can be done online as well as on handheld devices through their mobile app. The opening process of an eToro account is straightforward and takes about a couple of minutes.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy / sell spread large on altcoins

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2 – Bitstamp

Bitstamp is a Luxembourg-based cryptocurrency exchange founded in 2011 by Nejc Kodri and Damijan Merlak. This well-established cryptocurrency exchange offers a low-fee cryptocurrency marketplace geared toward professional investors and large financial institutions.

Bitstamp was one of the first bitcoin exchanges in the cryptocurrency market, having been founded less than two years after the invention of bitcoin.

Bitsamp is best suited for seasoned investors in search of a top-notch cryptocurrency trading platform. However, it is an excellent platform for users looking to make a single purchase of digital assets and store them on Bitsamp’s web-based cold storage wallet.

Payment Fees: In comparison to the majority of digital asset exchanges, Bitstamp charges relatively low transaction fees. The UK offers two deposit options. The first option is to use an international wire transfer, which charges only 0.05 percent of the amount transferred (very low compared to other crypto platforms). The second option is to make use of the complimentary Faster Payments service.

Additionally, the withdrawal fee is lower than the industry average – 0.1 percent for international wire transfers and 2 GBP for Faster Payment. Bitstamp’s only shortcoming is the high fee they charge on credit card cryptocurrency purchases – 5% on any amount.

Unlike the majority of online trading platforms, Bitstamp does not have a minimum deposit requirement. However, similar to Bittrex, it requires a minimum order of 50 USD/EUR/GBP, whereas some other exchanges may require a much higher minimum order.

Trading fees on Bitstamp: Bitstamp is widely regarded as a low-fee exchange, especially for highly active investors. The maximum trading fee you can pay is 0.5 percent if your daily volume is less than $10,000. (above the average in the industry, which is around o.25 percent ). However, as the investor’s total volume of transactions increases, the fees decrease significantly. As a result, if your volume exceeds $20,000,000, you may pay as little as 0% in fees. Individual investors should anticipate paying a fee of approximately 0.1 percent at Bitstamp.

Security: All investors performing critical account functions are now required to use two-factor authentication, and Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured. However, according to crypto exchange security evaluator CER, it ranked near the bottom of our review of crypto exchanges in terms of security, indicating that it may still have room to grow into a category leader.

Customer Service: Customer service is available 24 hours a day, seven days a week, and includes an emergency phone support line.

Pros & Cons of the Bitstamp platform:

- Allows for the purchase of cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Leon Li founded Huobi Global in 2013 and was originally based in China. Following China’s crackdown on cryptocurrency exchanges in 2017, Huobi Global’s headquarters were relocated to Singapore, and then to the Republic of Seychelles. Huobi Global is available in the majority of countries worldwide, but it does not support a few, including the United States and Japan (though users in Japan can use Huobi Japan instead).

Huobi Global provides crypto-to-crypto trading with a wide range of supported assets and reasonable trading fees. Limit, stop, and trigger orders, as well as margin and futures trading, are available on the platform, which is intended for active traders and institutional investors. OTC trade desks, derivatives, and custom trading tools are available to institutional traders.

For margin trading, the platform offers up to 5% leverage. Houbi Global’s fee structure is very reasonable and low in comparison.

Deposit: The minimum deposit fee is $100 USD, and other fees, such as deposit fees, transaction fees, and withdrawal fees, differ depending on the currency.

Fee: Those who want to buy cryptocurrency with a credit or debit card must pay a higher fee to Houbi. Both the maker and the taker fees are set at 0.2 percent. Depending on the scale volume, it can be as low as 0.1 percent.

Huobi Global offers customer service via email, phone, online chat, ticket system, and social media platforms. It offers a variety of security features, such as 2-factor authentication, cold storage, account freezes, and bitcoin reserves.

Huobi listed LUNA on July 19, 2020. The trading pair available for trading include LUNA/USDT, LUNA/BTC, and LUNA/HT.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- Complex account registration process

4 – Crypto.com

In 2016, Crypto.com, a global cryptocurrency exchange, was founded. It is headquartered in Hong Kong and currently serves over 10 million traders in more than 90 countries and enables you to buy and sell over 250 cryptocurrencies with low trading fees.

The unique selling point of the Crypto.com platform is that it allows users to stake their cryptocurrency.

By staking or holding them in a crypto.com wallet, users can earn up to 14.5 percent p.a. interest. Aside from trading, the exchange provides a number of other services, including staking rewards, Visa card benefits, NFT trading, DeFi products, and more.

Security: Crypto.com employs a variety of security measures, including MFA (multi-factor authentication). It also uses whitelisting to safeguard customer accounts. The platform employs compliance monitoring and stores customer deposits offline in cold storage to prevent hacks and losses.

Deposit: On this platform, the minimum account balance is set at $1. Maker/Taker fees range from 0.04 to 0.40 percent. During the first 30 days after opening an account, credit/debit card purchases are charged at 0% or no fee. Users can also earn up to $2000 for each friend they refer.

Coinbase LUNA Listing: April 23, 2021

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a cryptocurrency trading platform that offers spot trading, derivatives trading, and margin trading with up to 100x leverage on BTC/USD and ETH/USD trading pairs.

Bybit was founded in March 2018 in Singapore by professionals from investment banks, technology firms, the forex industry, and early blockchain adopters. It is a British Virgin Islands-registered trading exchange with over 2 million users.

Bybit is a cryptocurrency-to-cryptocurrency exchange that does not require customers to go through onerous KYC verification and today has a daily trading volume of up to $1 billion.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the most active cryptocurrency exchanges in terms of daily transaction volume, with more than $20 billion transacted each day. It provides access to hundreds of assets as well as a welcoming trading environment that makes profiting simple.

Minimal fees, a robust charting interface, and support for hundreds of coins are among Binance’s most distinguishing features. Binance, in contrast to eToro, is a cryptocurrency-focused exchange that does not provide copy trading, FX, commodities, or other financial services.

Binance uses two-factor authentication (2FA) and deposits in US dollars (USD) that are FDIC-insured. Binance also uses device management in the United States, address whitelisting, and cold storage to protect its customers.

Fees range from 0.015 to 0.10 percent for buying and trading, 3.5 percent or $10 for debit card purchases, whichever is greater, and $15 for US wire transfers.

The LUNA token was listed on Binance on August 19, 2022, and is now available for trading. Furthermore, Binance has launched trading pairs for LUNA/BTC, LUNA/BUSD, and LUNA/BNB.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- Wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copytrading

7 – Coinbase

When people ask how to get started investing in cryptocurrency, Coinbase is frequently mentioned as a good place to start. Coinbase was founded in 2012, just three years after Bitcoin was created, and has since grown to become the largest cryptocurrency exchange in the United States by trading volume, with over 73 million verified users in over 100 countries.

While the company provides a variety of valuable products for retail and institutional investors, businesses, and developers, the ability to buy, sell, and trade more than 100 different cryptocurrencies and crypto tokens is its defining feature. After going public through a direct listing on the Nasdaq exchange in April 2021, its quarterly trading volume is now $327 billion, with $255 billion in assets on the platform.

While Coinbase’s transaction and trading fees are higher than those of some of its competitors, it remains one of the most popular cryptocurrencies investing apps available.

Limit and market orders for Terra can be placed on the Coinbase Pro exchange. The maker/taker fee is 0.5 percent for the first $10,000 in volume traded in 30 days, after which it drops to 0.35 percent. You can trade cryptocurrency for free without paying a maker fee if your 30-day volume exceeds $300 million.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to / from bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker / taker fee than Binance unless your trading volume is very high

- Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that provides a variety of trading options to its eight million customers. Spot, futures, margin, peer-to-peer (P2P), and staking and lending are all available.

Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the world’s most well-known cryptocurrency exchanges. KuCoin has grown to become one of the most well-known cryptocurrency exchanges. It has more than 8 million registered users from 207 countries and territories around the world.

Deposit and Withdrawal: KuCoin does allow for the purchase of bitcoin with fiat currency, but only through a third-party application. Payments can be made with a credit or debit card, Apple Pay, or Google Pay, but not by bank transfer. However, the fees could be exorbitant.

KuCoin Transaction Fees: Kucoin’s trading fee structure is straightforward. The platform charges 0.1 percent for both makers and takers, making it one of the most affordable bitcoin exchanges online. If you own the platform’s native Kucoin tokens, you can further reduce your fees.

Terra (LUNA) was listed on KuCoin on August 28, 2019, and supported LUNA/BTC, and LUNA/USDT trading pairs.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange that allows users to buy, sell, and trade a wide range of digital coins. In 2012, the Hong Kong-based portal was established. Because Bitfinex’s trading area includes a robust set of chart analysis tools, intermediate and professional traders are more likely to use it.

Aside from cryptocurrency, the only way to deposit and withdraw funds is via wire transfer. Bitfinex, like Coinbase, is one of the few platforms that allows you to short cryptocurrencies and use leveraged trading strategies.

Founders – Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange, offering digital asset trading services to customers all over the world.

Bitfinex Securities Ltd., a blockchain-based investment product provider, has established a regulated investment exchange (Bitfinex Securities) in the AIFC to improve members’ access to a diverse range of financial products. Bitfinex, as a result, is completely unregulated. While the corporation’s headquarters are in Hong Kong, it is registered in the British Virgin Islands.

Fees and deposit limits: Bitfinex charges a 0.1 percent fee for bank transfer deposits. If you deposit $10,000, for example, you will be charged a fee of $10.

Withdrawal fees: Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. You can pay a 1% expedited fee if you need funds within 24 hours.

Terra (LUNA) was listed on Bitfinex on April 14, 2021. LUNA is available to trade with US Dollars (LUNA/USD) and Tether tokens (LUNA/USDt).

Pros & Cons of the Bitfinex platform:

- Established since 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- US citizens are not accepted.

-

Expensive trading fees

- Support team only available via email

What is Terra (LUNA)?

In the financial ecosystem, customers of different organizations and countries buy and sell goods and services, utilize, save, or invest money, and do anything related to finance. However, local people use different currencies to buy goods and services in other countries, such as the won in Korea and the dollar in the United States. It was very challenging for them to run a business in a foreign country using their local currency. The same is the case with cryptocurrencies, whose prices continuously fluctuate with local currencies. But there are cryptocurrencies with stable values, known as stable coins. However, most stable coins are pegged to the US dollar, ignoring the rest of the world’s currencies.

The terra protocol provided stable coins pegged to a particular country’s currency to resolve this issue. For example, UST was pegged to the US dollar, and KRT to the Korean won. Anybody could propose minting new stable currencies at any time, even if it be a stable coin pegged to the US dollar, Indian rupee, or Korean won. Terra’s ecosystem was built on two assets: the native network coin known as Luna and the stable coin known as UST. Luna ran on the Terra blockchain platform, which was also developed by Terraform. It primarily targeted payment processing systems in a few Asian countries, such as South Korea and Taiwan, and was successful.

Luna differed from other cryptos in that it was utilized to keep the value of Terra stable. The Luna token kept the price of Terra fixed at one dollar, and was also used to pay network fees. For instance, when the value of UST was misaligned with the value of a real US dollar, they used Luna to incentivize certain customers to do specific activities to stabilize the price, such as burning their UST or generating more of it, to control the value. Profits were incentivized for those customers who actively assisted the network in being stable.

Will LUNA recover? It would require the Terra Labs team restoring their reputation and burning a large part of the hyper inflated Terra supply.

Terra LUNA in the Financial Ecosystem

Luna tokens serve as the foundation of the whole Terra ecosystem. Terra Luna is able to keep its stable currencies stably pegged to an exact price due to Luna. Terra (LUNA) provides several advantages to the financial ecosystem. It is perfect for the digital economy because of its decentralized and stateless nature. The system provides inexpensive programmable payments, logistical support, and a framework intended to facilitate the creation of decentralized applications and stable coins.

The price of Luna rises as more people purchase UST, though it appears that a tiny percentage of this profit goes to those who help maintain UST stability. However, when individuals withdraw their money from the ecosystem, the value of the Luna token is taken away from those who hold it. They hold Luna for two main reasons: first, if they are bullish on the Terra ecosystem and believe that more people will join it, and second, if they want to make transactions through the Terra network, they must hold Luna because Luna is the native coin that allows them to do business. In addition, anyone can stake their Luna tokens to secure the network through proof of stay. Terra Luna is constructing an entire financial decentralized ecosystem, and payments are simply one component of it.

There can be three different statuses of Luna: bonded, unbonded, and bonding. Bonded Luna can be claimed or allocated to a stake account. These are locked up in order to earn incentives and can not be easily traced. Unbonded coins are those that may be traded easily and are not connected to a stake pool. Bonding refers to coins that have been removed from staking or authority, and it takes 21 days to complete and cannot be withdrawn while waiting.

LUNA Price Now – Will LUNA Go Up in 2024?

In May 2022, the cryptocurrency market experienced a defining moment in its history when the Terra Protocol and its ecosystem attracted huge attention but not for a good reason. An unexpected event happened with the ecosystem’s native token – LUNA (currently Terra Luna Classic – LUNC), which crashed in 48 hours, dropping from as high as $120 to as low as $0.02. While many speculations have sprung up about the drastic decline of the LUNA cryptocurrency, one of the largest theories suggests that it is associated with its stablecoin – UST.

According to the theory, the massive sales of the stablecoin led to its price dropping below $1. It could be the reason why many UST holders panicked and started to sell their tokens, which made the situation even worse. As the algorithm works, when the price of the UST drops, more LUNA tokens are issued to keep the stablecoin’s value stable. However, the massive minting of the LUNA token affected the LUNA price itself. In the long run, both tokens suffered, and the LUNA investors lost their faith in Terraform Labs – the founder of the Terra Luna ecosystem.

After that, Do Kwon – the co-founder of the project – came up with a new recovery plan which was accepted by the validators. The plan suggested building a new Terr Luna ecosystem without a pegged stablecoin. The new LUNA tokens would be distributed among the old LUNA and UST holders for their loss. Both coins are currently functional, with the previous LUNA being renamed Terra Luna Classic.

The current value of the LUNC token is $0.00017, but can it ever recover and hit $100 again? Crypto experts still find it difficult to answer this question. However, LUNA recovery may be possible if a LUNA crypto recovery plan that includes burning most of the LUNA supply is successfully implemented.

Taking into account its circulating supply, we can compare the LUNC token with another coin with more circulating supply but a higher market cap – Shiba Inu. Its native token, SHIB has a circulating supply of 540 trillion tokens with a market cap of $7.2 billion. So, it is still possible for the token to pump even with such a high supply. But it mostly depends on the further development of the Terra Luna ecosystem and whether the team can win back the investors’ trust.

Meanwhile, in the short-term perspective, Terra Luna Classic is quite volatile, so you can use its daily price fluctuations to earn rewards from short-term trading.

Terra Classic LUNC Weekly Chart

LUNA Price Prediction – What’s Next for Terra?

Update – with a circulating supply now of 6.5 trillion, the LUNA market cap would flip Bitcoin in market cap ($584 billion) if it reached nine cents again ($0.09). A large part of the LUNA supply will need to be burnt. It would reach its former market cap of about $40 billion at a LUNA token price of $0.006.

As mentioned in the previous section, Terraform Labs CEO Do Kwon came up with a new plan for the recovery called “Terra Ecosystem Revival Plan 2.” Do Kwon posted the short-term timeline on his Twitter account, which was accepted by the Terra community. As a result, the team used the well-known DAO hack that the Ethereum network encountered in 2016, that split blockchain networks into two tokens, Ethereum (ETH) and Ethereum Classic (ETC).

Hence, the new token – LUNA was born, which was distributed among the holders, stakeholders, and developers of LUNC will be rewarded with brand new LUNA tokens with a limit of one billion. And the old LUNA token was converted to LUNC tokens which are currently traded at $0.00017. So what is next for the LUNC price? Obviously, there are a lot of fundamental factors about the Terra Luna project development to consider that can affect its price. However, let’s take a look at Luna Classic price predictions according to the technical indicators.

Terra Classic All-Time Chart

Though it’s tough to predict LUNC’s price, if it manages to experience a trend reversal, the next bullish target is set between $0.000277, which is predicted to be LUNC’s maximum price for 2023. LUNC’s average price for 2023 is expected to be $0.000252. The price predictions for 2024 indicate that LUNC has a maximum price of $0.00042 and will be traded at $0.00037 as its average price. According to the technical indicators, LUNC will have an average price of $0.0005, while its maximum price can hit $0.00064.

The Verdict – Should You Buy LUNA?

In conclusion, the Terra Luna cryptocurrency project was once one of the more valuable cryptocurrencies in the market. It was among the 10 largest cryptocurrencies, with its market capitalization hitting a $40 billion valuation and an all-time high LUNA price of $119.55. However, the unsuccessful events related to the Terra Luna have proved that cryptocurrencies in any form are highly volatile, even when it comes to stablecoins.

So, should you buy LUNA? Can the token recover its high of over $100? While these questions are still hard to answer, it is still possible for LUNA to gain value if the recovery plan of Do Kwon works properly. While Terra Luna’s being a good investment in the long term is still under question, you can consider it an excellent asset for short-term trading and speculate on its price fluctuations.

If you’re wondering where to buy LUNA in 2024, it’s listed at eToro, which briefly delisted it and suspended LUNA trading but has resumed it shortly. The platform is licensed and regulated by the FCA and has one of the best reputations in the industry, also providing a wealth of educational resources to help those new to the market learn the ropes.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

FAQs

Any risks in buying LUNA now?

Terra's current price is $0.00017, and LUNA is ranked #52 in the cryptocurrency ecosystem. Luna has experienced a massive sell-off although it has since put in a 200x bounce when Terra halted the blockchain and stopped the hyper inflation of the circulating supply. If further efforts in the LUNA recovery plan succeed, it could rise in value. However, the reputation of the project has taken a hit. Proceed with caution.

Is it safe to buy LUNA?

A small investment could pay off with 20x returns if LUNA recovers its market cap from the current LUNA price today. Now that the supply inflation has been curbed it is not as high risk as it was during the drop. However all crypto investment comes with risk.

How much will LUNA be worth in 2030?

Assuming the Terraform Labs team burn and reduce the circulating supply from 6.5 trillion back to its former levels of 380 million, and completely restore their reputation, LUNA could recover its former all time high of $119.55 or set new highs. At that point it was already a top 10 crypto asset so may not reach much higher than that - it's unlikely to ever flip Bitcoin or Ethereum in market capitalization.

Will LUNA ever hit $100 again?

At this point investors are waiting to see if Terra Labs do burn the circulating supply and reduce it to its former levels as mentioned above. They will also need to recover the peg of TerraUSD (UST) back to $1, a 1:1 peg to the US dollar. At that point it may reach triple digits again. It's difficult to make a Terra price prediction at this point as this was a black swan event and the largest crypto crash of one single asset in history, only comparable to ponzi schemes like Bitconnect and Plus Token.

Bitcoin

Bitcoin