The Ethereum Name Service (ENS) is similar to the Domain Name System (DNS) (DNS). However, it offers a secure and decentralized method of managing website domains and sending ETH and ERC20 tokens. The Ethereum Name Service (ENS) is a service that provides names for machine-readable identifiers such as wallet addresses and hashes. Reading data strings into easily readable addresses becomes difficult. It’s similar to how a website’s Domain Name System (DNS) works.

ENS used the Vickrey auction structure to first sell popular six, five, four, and three-letter domain names to interested consumers. Each name ends in. eth and can be linked to cryptocurrency addresses, hashes, and other information.

This article will explain how ENS works and why it is essential. Our primary focus will be on the ENS registry and resolvers. We’ll also review the protocol’s governance tokens and the ENS DAO quickly (decentralized autonomous organization).

On this Page:

How to Buy Ethereum Name Service

- Choose an exchange that supports the ENS token. eToro is highly recommended because FCA, ASIC, and CySEC regulate it.

- Create and validate your eToro trading account.

- Deposit into your account.

- Type ‘ENS’ into the search bar to open charts and trades.

- Enter the amount to be traded in ENS and press the “Trade Now” button.

Best Exchange to Buy ENS in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

For first-time buyers of ENS tokens, here is an overview of the investment process with FCA-regulated broker eToro.

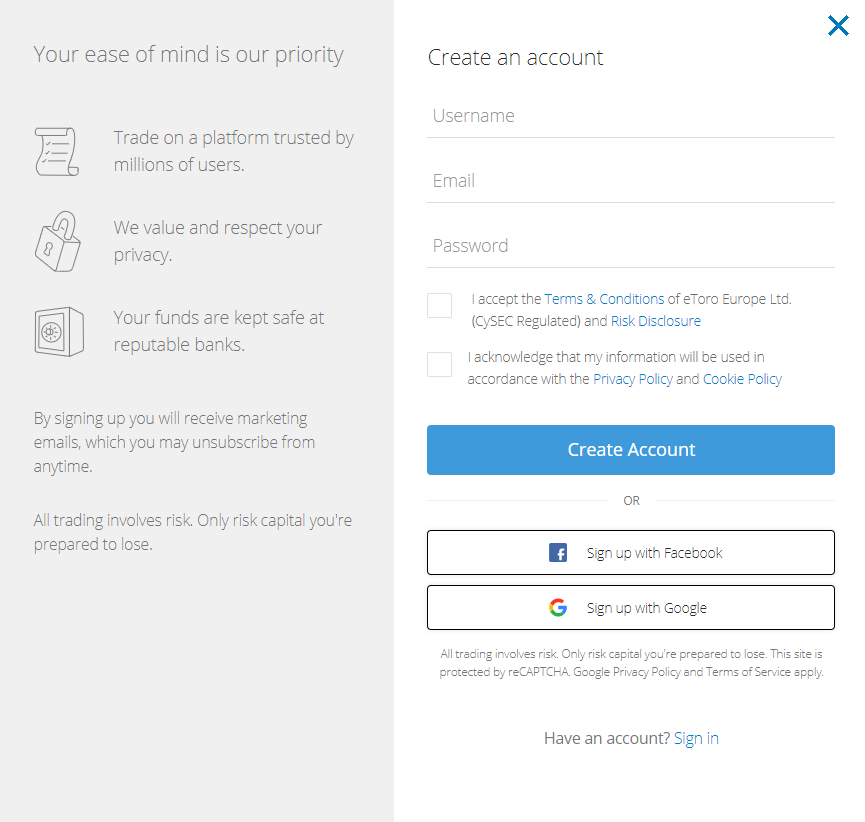

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- Press the “Join Now” or Trade Now option on the eToro website.

- You’ll find an electronic form where you can enter all your personal information needed to open a new trading account.

- Users need to fill out this form with all of the necessary information.

- Users can access eToro through Facebook or Gmail.

- Please read eToro’s Terms & Conditions and privacy policy before submitting your information for consideration.

- After reviewing the terms, please indicate your agreement by checking the appropriate box.

- Click the “sign-up” button to submit your information.

eToro website homepage

Your capital is at risk.

Step 2: Upload ID

Users must upload proof of ID and address after filling out an e-form with all their information. eToro requires it to comply with regulatory standards and to confirm that the person is who he claims to be. Therefore, users can upload a government ID, a driving license, or a passport as proof of ID, whereas the most recent utility bill or bank statement can be used as proof of address.

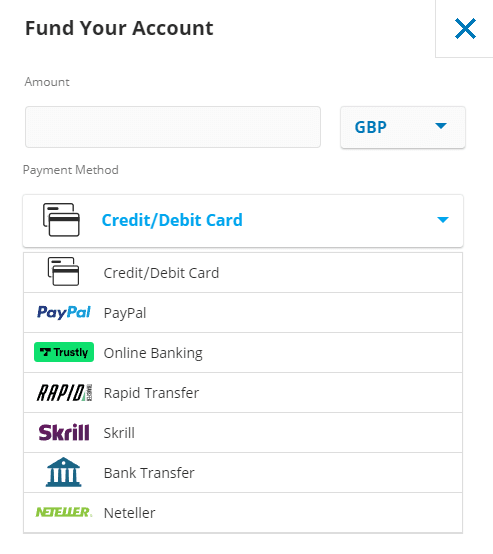

Step 3: Make a Deposit

The next step is to fund the account and begin investing. The minimum eToro account deposit is $10, and it can be made with Visa Debit or Credit Cards, bank transfers, PayPal, Skrill, or other payment methods. After selecting a payment method, click the “Deposit” button to complete the transaction. eToro does not charge any deposit fees.

Deposit methods on eToro

Step 4: Buy Ethereum Name Service

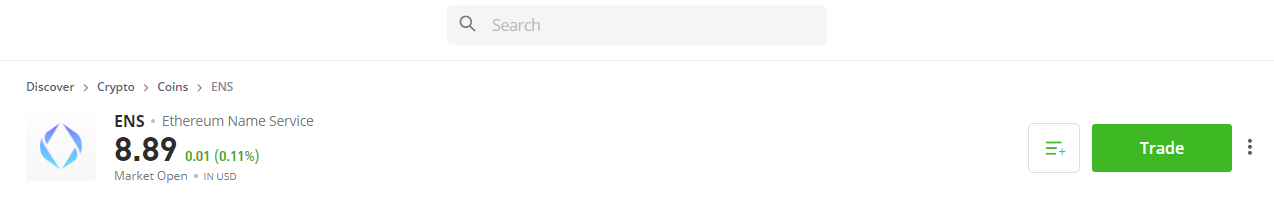

To buy Ethereum Name Service, enter ENS into the search box and select the relevant token from the list.

Searching ENS on eToro

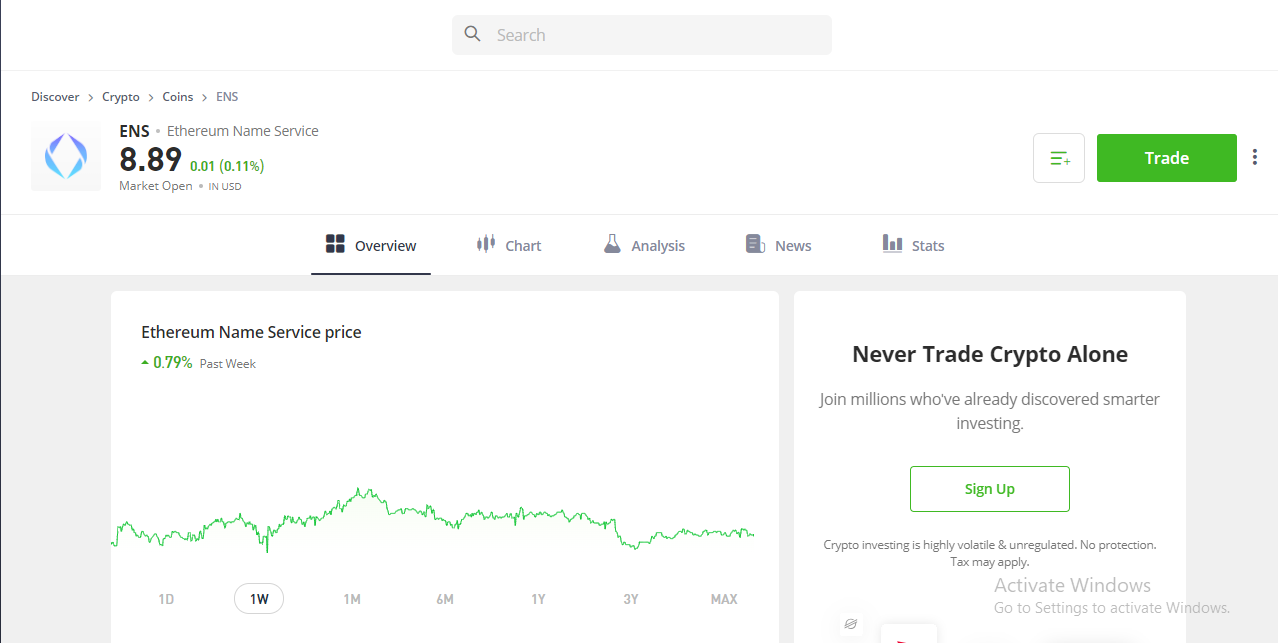

Step 5: Review Ethereum Name Service Price

Begins with the selection of the cryptocurrency, an order page will be displayed, on which the trader will enter the desired Ethereum Name Service (ENS) token amount. When you’ve decided, click the “Open Trade” button to include ENS in your portfolio.

We recommend storing your digital assets in a third-party wallet separate from the trading platform. One option is the eToro Crypto Wallet, which supports over 120 digital assets and ENS.

ENS Price Chart on eToro

The good news is that eToro does not charge a maker/taker fee; instead, they charge a buy/sell spread.

Step 6: Buy Ethereum Name Service

Then click on the “Trade” button. Enter the amount you want to contribute to the ENS. Following that, you will be given two options.

Pending Order: When the price of ENS reaches a certain level, a buy limit will be placed to execute an order.

Instant Buy: This option is for those that want to buy Ethereum Name Service as soon as possible at the current market price. The underlying asset, ENS, will be acquired in the trader’s eToro account by clicking ‘Open Trade.’ A trader can exit the trade at any time. ENS/USD was listed on eToro on April 19, 2022, and traders can trade it on eToro with several other coins.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Ethereum Name Service (ENS)- Best Platforms

After extensive research, the best platforms to buy Ethereum Name Service have been narrowed down for your convenience. Their benefits, fees, and reasons for being different are all listed.

eToro is the most highly recommended platform for purchasing ENS tokens as it is secure, offers reasonable prices, and, most importantly, is the easiest to use.

Best Brokers to Buy Ethereum Name Service

1 – eToro

eToro rose to prominence with its social investing platform, a novel tool that allows users to mimic other investors’ trades. eToro, founded in 2007, now has over 20 million users in 140 countries, including the United States.

Customers in the United States will be able to purchase stocks and ETFs from the company beginning in 2022. Previously, customers in the United States could only trade cryptocurrencies on the platform, whereas eToro operated multi-asset brokerages in other countries (offering stocks, commodities, and forex trading).

Additionally, you can now stake prizes for buying Ethereum and storing it in your wallet and Cardano and Tron.

Learn more about cryptocurrency staking.

Trading and transaction fees: To buy or sell crypto assets on the eToro platform, a 1% fee is charged. There is no commission on stock and ETF trades; the broker pays the regulatory transaction fees when you sell a stock. There is also a $75 account transfer fee for partial and complete transfers.

Cryptocurrency trading pairs: Users in the United States cannot access direct crypto-to-crypto trading. However, unlike Coinbase, there is a cryptocurrency-to-crypto conversion option for Bitcoin, Litecoin, Bitcoin Cash, Ethereum, and Stellar.

Bitcoin, the most popular digital asset, as well as popular altcoins such as Ethereum, Aave, XRP, Graph, and others, are accepted by eToro.

Deposit Fee: eToro charges its customers a reasonable fee structure. Depositing eToro is entirely free. Deposit methods include bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller. The minimum deposit amount varies according to the user’s location.

If you use a debit card or connect a bank account, the minimum deposit amount is $10. You can also purchase fractional shares of stock, which means you can buy a small portion of a share for any amount greater than $10.

eToro allows you to buy and sell online and through their mobile app. In comparison, registering for an eToro account is simple and takes only a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp, founded in 2011, is a well-known cryptocurrency exchange platform supporting more than 56 cryptocurrencies. While this is a smaller selection than some exchanges, it is more than enough for most beginners, and the simplified fee structure makes it an easier (albeit slightly more expensive) entry point for newcomers; however, more advanced users may prefer more coins or lower trading fees.

Bitstamp can be an excellent option for those new to crypto who want to trade the leading crypto coins or even more popular altcoins due to its simple fee structure and the ability to buy crypto with fiat currency directly from a bank account, credit card, or debit card.

Bitstamp offers 24-hour customer service, including a phone support line for urgent inquiries. This type of support is hard to come by in the crypto exchange space, so if speaking with a support agent over the phone is essential to you, Bitstamp is worth a second look.

Bitstamp charges a flat fee percentage whether your order is a maker (creates liquidity on the exchange), a taker (reduces liquidity), or made using the trading or instant buy platforms.

Trading fees will be 0.5 percent for traders with less than $10,000 monthly trade volume. Fees are reduced to 0.25 percent for $10,000 to $20,000 transactions and continue to fall as trading volume increases.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Around-the-clock phone support.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Leon Li established Huobi Global in 2013 and was initially based in China. In 2017, Huobi Global’s headquarters were resettled to Singapore and the Republic of Seychelles amid China’s crackdown on cryptocurrency exchanges. Huobi Global is available in most countries worldwide, but it excludes a few, such as the United States and Japan (though users in Japan can use Huobi Japan instead).

Huobi Global provides crypto-to-crypto trading with diverse assets and low trading fees. Limit, stop, and trigger orders, as well as margin and futures trading, are supported by the platform aimed at active traders and institutional investors. OTC trade desks, derivatives, and custom trading tools are also available to institutional traders.

Deposit: A $100 deposit is required, and additional fees such as deposit fees, transaction fees, and withdrawal fees vary depending on the currency.

Fees: Huobi Global charges reasonable fees for cryptocurrency trading but higher fees for cryptocurrency purchases made with a credit or debit card. Although deposits in fiat currency (such as US dollars) are free, trading fees must be paid. Fees are charged at a flat rate of 0.2 percent for both makers and takers. Depending on the scale volume, it can be as low as 0.1 percent.

Huobi Global Trading Fees: Maker-taker fees are charged by Huobi Global, with discounts available for high-volume traders who own HT tokens. You will pay different fees depending on whether you are a maker or a taker in the transaction. Professional accounts have a higher trading volume requirement (more than 1,000 BTC every 30 days) and a higher HT holdings requirement (at least 2,000 total).

Houbi Global provides customer service via email, phone, online chat, ticket system, and social media platforms. Security features include two-factor authentication, cold storage, account freezing, and Bitcoin reserves.

Pros & Cons of the Houbi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

4 – Crypto.com

Crypto.com, a global cryptocurrency exchange based in Hong Kong, was founded in 2016 and currently serves over ten million traders from over 90 countries, allowing you to trade over 250 cryptocurrencies for a low trading fee. Crypto.com has a more extensive selection of cryptocurrencies on its exchange than any other service we reviewed, with approximately 180 available.

Deposit: This platform’s minimum account balance is $1. The maker/taker commission ranges from 0.04 percent to 0.40 percent. Credit/debit card purchases are charged at 0% or no fee for the first 30 days after opening the account.

Low cash fees: Crypto.com has no trading or transaction fees if you pay with money transferred from your bank account via ACH or an automated clearinghouse.

Users of the Crypto.com App can now purchase ENS at face value in USD, EUR, GBP, and 20+ other fiat currencies and use the Crypto.com Visa Card to spend it at nearly 70 million merchants worldwide.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

The exchange allows traders worldwide to trade with up to 100x leverage in a limited number of crypto products, including BTC, ETH, EOS, and XRP.

Bybit, based in Singapore, is a crypto-to-crypto exchange that does not require users to go through stringent KYC verification and generates close to $1 billion in daily trading.

Co-Founders of ByBit

After seven years as XM’s China District General Manager, Ben Zhou founded Bybit in March 2018. Bybit’s core team has experience in investment banking and the Forex industry, and they were among the first to adopt blockchain technology, whereas XM is a leading brokering service provider.

Trading with leverage: Bybit Exchange primarily offers perpetual futures products with 100:1 leverage. This implies they will try to connect with established exchanges such as Binance and Phemex, which offer similar non-expiry futures contracts.

Market takers pay a fee of 0.075 percent, while market makers pay a fee of -0.025 percent. As a result, when a transaction is initiated, market makers will be compensated. Because of the low fee, market makers are likelier to be active and fill the order book.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is a cryptocurrency exchange that provides seasoned investors with low fees, access to hundreds of digital currencies, and enhanced tools. Binance is famous for its lightning-fast trade execution.

Changpeng Zhao, the company’s founder, devised a new system for corresponding orders for high-speed traders before the launch of Binance in China in 2017. Binance offers nearly 60 cryptocurrencies and continues outperforming many other US exchanges despite having fewer digital currencies and crypto-to-crypto trading pairs than its parent company.

Minimum Deposit: In the United States, the minimum trade is $10.

Binance.US charges a flat 0.1 percent spot trading fee, which is lower than the fees charged by many other US exchanges, including eToro (0.5 percent trading fees plus a flat fee of up to $2.99 per trade, depending on trade amount). For traders who need to transact quickly, Binance.US also charges a 0.5 percent Instant Buy/Sell fee.

Binance, unlike its global brokerage, charges a 4.5 percent fee for debit card transfers. In the United States, credit card purchases are not permitted).

ACH bank transfers are free for cash deposits and withdrawals, whereas bank wire transfers cost $15 per transaction. With a minimum withdrawal amount of 0.001 bitcoin, bitcoin withdrawals cost 0.0005% of the amount withdrawn.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is limited.

- High fees for credit card deposits

- No copy trading

7 – Coinbase

With nearly 100 cryptocurrencies available for trading, Coinbase is the largest cryptocurrency exchange in the United States. However, Coinbase fees can be perplexing and significantly higher than some competitors. While Coinbase provides appealing security features, cryptocurrency trading is highly volatile, so weigh the risks.

Trading platforms: Coinbase users can trade on the original Coinbase platform, which allows users to purchase cryptocurrency with US dollars and Coinbase Pro.

Coinbase Pro, formerly known as GDAX, offers advanced charting and allows users to conduct crypto-to-crypto transactions and place market, limit, and stop orders.

Coinbase Earn is a fresh take on “earning while you learn.”

Coinbase offers video classes and exams to educate users about cryptocurrency trading and some available cryptocurrencies. In addition, users can earn specific cryptocurrencies by taking classes.

Fees: Coinbase’s fees are higher than those of other cryptocurrency exchanges (and have a more complicated fee structure at times). Coinbase is ideal for cryptocurrency traders looking for a simple way to trade. Traders must quickly convert one cryptocurrency to another.

Minimum Deposit: A minimum trade amount of $2 is required to purchase cryptocurrency on Coinbase.

Fees for trading and transactions: The Coinbase fee structure is a perplexing jumble of elements determined by two factors:

Coinbase charges a 0.5 percent spread on cryptocurrency sales and purchases; rates may vary depending on market fluctuations. Coinbase also charges a flat or variable fee, depending on the amount purchased and the method of payment used.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, a well-known name in the cryptocurrency industry, has established itself as a prominent one-stop shop for all cryptocurrency transactions. It was founded in 2017 and currently offers over 200 cryptocurrencies in over 400 markets worldwide.

With approximately 750 currency pairs, Kucoin offers a diverse range of cryptocurrencies. It can give you experience with less popular coins that are hard to find on popular cryptocurrency exchanges. This platform provides the KuCoin Earn service, which pays interest on cryptocurrencies staked or lent. Its mobile app also provides its customers with margin trading and trading bots.

Kucoin has some of the lowest trading fees because it does not charge monthly or withdrawal fees. The deposit fee is instead determined by the method of transfer you select. It claims that one in every four cryptocurrency holders uses its services due to its large customer base.

The Kucoin fee can be reduced by holding at least 1000 KCS.

The maker/taker fee starts at 0.1 percent and gradually decreases as you progress through the levels. Withdrawal fees vary according to the cryptocurrency. Fees for US citizens who cannot deposit directly into their Kucoin account range from 3.5 percent to 5 percent.

The fees for withdrawals and transfers vary depending on the coin. Kucoin is one of the few cryptocurrency exchanges that allows you to trade on margin. Users can also lend their crypto assets to others. Users can also hire trading bots on this platform for a small fee.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex, established in 2012, is one of the oldest cryptocurrency exchanges. This exchange, aimed at professional and institutional traders, has some of the industry’s highest BTC/USDT volumes, thanks partly to the 100x leverage it provides traders.

Bitfinex provides various order types, margin trading, and over-the-counter (OTC) trading, making it an ideal platform for experienced traders seeking advanced options and low fees. It is, however, not available in the United States.

Founders: Giancarlo Devasini and Raphael Nicolle founded Bitfinex, one of the first cryptocurrency exchanges to offer peer-to-peer margin trading. Even though this feature helped Bitfinex stand out among increasing competitors, the company has been the victim of multiple hacks and was recently fined by US regulators.

Fees: Bitfinex’s fees are reasonable, though not the lowest in the industry. While most traders will pay between 0.1 and 0.2 percent per trade, those who trade frequently may have their fees reduced to zero. Users who trade over $7.5 million monthly are eligible for free maker trades. Customers with USDt LEO in their accounts are also suitable for discounts.

Security: Following several major breaches in the past, Bitfinex has increased its security. It supports two-factor authentication (2FA) and whitelisting of wallet addresses, and 99.5 percent of user funds are kept in multi-signature cold storage.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

Lack of Regulation

-

US citizens are not accepted.

-

Expensive trading fees

What is the Ethereum Name Service (ENS)?

ENS is a distributed, expandable, and open naming service built on Ethereum. The primary goal of ENS is to convert human-readable names, such as “john. eth,” into machine-readable IDs, such as MetaMask wallet addresses, Ethereum addresses, or any other cryptocurrency address.

Most identifiers are long, laborious combinations of letters and numbers. As a result, ENS links crypto addresses like “0xb76F25…” to more human-readable names or websites. In addition, ENS has a feature known as reverse resolution. For example, interface descriptions and canonical names can now be linked to an Ethereum address.

ENS, like DNS, aims to provide a more consistent user experience. In other words, ENS serves the same function in Web3 as DNS. As a result, ENS enhances Web3 usability and makes blockchain technology more viable for widespread adoption.

Despite having the same goal, their structure, and architecture are vastly different. This disparity is explained by the Ethereum blockchain’s unique capabilities and constraints. ENS is decentralized. There is no single point of failure, increasing its security and resistance to censorship.

Now that you know Ethereum Name Service read on to learn how the Web3 protocol works. Let’s continue reading to learn more about Ethereum Name Service.

Who Manages ENS?

ENS was previously a component of the Ethereum Foundation, but it became a separate entity in 2018. The project’s Lead Developer is Nick Johnson, a New Zealand-born software engineer who has previously worked at Google and the Ethereum Foundation. The ENS team comprises nine people, and a 4-to-7 multi-signature root oversees its treasury.

How does Ethereum Name Service work?

ERC-721 Non-Fungible Tokens (NFTs) represent a unique address in ENS domain names. A domain can be transferred or sold to another person or entity. Each token has a wallet address and other data the owner can manage. A registrar is a smart contract that contains the creation of subdomains and holds a top-level domain, such as. Eth. You must contact the. Eth registrar to start BinanceAcademy.eth.

You can see if an Ethereum domain name is available and buy it yearly. Popular names, on the other hand, were auctioned off first. After obtaining the name, the highest bidder can add addresses, create subdomains, and loan or sell them. For instance, if you own BinanceAcademy.eth, you may freely create and learn.BinanceAcademy.eth.

What Makes it So Unique?

The ENS is based on Ethereum’s smart contracts, making it more secure, private, and censorship-resistant than the Internet’s Domain Name Service (DNS). The ENS team considers internet-naming infrastructure a critical component that should be open, decentralized, community-driven, and non-profit.

On a technical level, the ENS can use Ethereum’s existing ecosystem, making it very flexible and able to do more than just naming other smart contracts.

Fundamentals of the Ethereum Name Service

When it originated: May 4, 2017

Management Team: CEO – Alex Van de Sande and Nick Johnson

Native token: ENS

What it does: As we discussed in the previous section, there are some similarities between ENS and DNS. For starters, they serve the same purpose in two separate areas. They work on the same structure of “dot-separated” hierarchical names known as “domains.”

ENS Tokenomics: The current market ranking is #130, with a live market cap of $369,399,133. There are 20,244,862 ENS coins in circulation, with 100,000,000 ENS coins in circulation.

Is it Worth Buying Ethereum Name Service (ENS) in 2024?

The ENS token recently went through a turbulent journey. It faced significant market pressures, causing its value to drop to all-time lows. This downturn started in June when major exchanges such as Binance and Coinbase faced legal action from the United States Securities and Exchange Commission (SEC).

Although ENS was not directly implicated as an unregistered security, it struggled due to the negative market response, resulting in a substantial decline. On November 9th, 2021, ENS debuted in the public market with a valuation of $33.66. This sparked immediate interest among investors. Within two days, it skyrocketed to an unprecedented high of $85.69, only to experience a subsequent decline and end the year at $39.01.

The year 2022 presented a striking contrast to the promising beginnings of ENS. The value of the token underwent a relentless decline, reflecting the overall downturn in the market. The FTX exchange experienced a significant setback in November, resulting in a closing value of only $10.76 by the end of the year. This represented a substantial loss of over 70% throughout 2022.

In 2023, the year brought a glimmer of hope for ENS. It started positively, with a peak of $17.96 on February 20th. However, the token’s momentum gradually declined in the following months. The situation worsened in June when news surfaced about Crypto.com suspending its American institutional arm. Consequently, ENS plummeted to an unprecedented low of $6.93.

ENS, despite reaching a low point, showed resilience by bouncing back. Its performance improved after announcing its layer 2 plans on June 28th. By July 5th, its value had risen to approximately $9.15.

As of the latest update, Ethereum Name Service is priced at $9.02, boasting a 24-hour trading volume of $24.00 million, a market capitalization of $259.43 million, and a market dominance of 0.02%. The ENS price slightly declined in the past 24 hours -1.13%.

Market observers and crypto enthusiasts closely follow Ethereum Name Service, monitoring its market behavior and the unfolding dynamics. This creates an intriguing narrative within the ever-evolving cryptocurrency landscape.

Will the Price of Ethereum Name Service (ENS) Go Up in 2024?

In the world of cryptocurrency, experts and enthusiasts are analyzing the Ethereum Name Service (ENS) token price for the remainder of 2023 amidst its volatile market. Understanding historical and current trends is crucial for making accurate projections.

Furthermore, analyzing the unique advantages of the ENS token compared to its counterparts can provide insights into its potential price movements. The ENS native token offers several key benefits. One of these is its ability to facilitate cost-effective transactions, provide logistical solutions, and offer storage alternatives.

This advantageous position becomes even more evident as the crypto landscape witnesses a surge in decentralized applications (DApps) and stablecoins. These emerging trends are expected to fuel the utility and demand for the ENS token.

Observers have recently become curious due to some notable developments. Particularly, attention was drawn to a significant decline in .eth domain registrations on the Ethereum Name Service (ENS) during the previous month.

In an intriguing turn of events, an anonymous crypto user is known as “dark market.eth” managed to reclaim a staggering 39,712 Ether (ETH), equivalent to approximately $74.17 million as of July 31st. This astonishing discovery was brought to light by the blockchain investigator Lookonchain. Soon after, this individual transferred over $119 million in ETH to a new wallet, causing quite a stir within the cryptocurrency community.

The Ethereum Name Service (ENS) partnered with MoonPay, a Web3 payments entity in April. This alliance aimed to simplify the process of purchasing .eth domain names by introducing a fiat on-ramp through MoonPay’s services.

This initiative aimed to simplify the process for users who may find cryptocurrency wallet setup overwhelming. The collaboration focused on allowing users to purchase and register .eth domains using fiat currency directly, thereby reducing entry barriers for individuals with limited technical expertise.

The Ethereum Name Service (ENS) has showcased its adaptability in response to the changing crypto landscape. Recently, it unveiled plans to expand into Layer 2 technology. As Ethereum’s popularity surges, so do gas prices, prompting users to seek more cost-effective alternatives.

ENS positioned itself as an alternative solution, striving for Layer 2 interoperability. The project has been working on incorporating features like Wildcard Resolution and Secure Offchain Data Retrieval to demonstrate its dedication to enhancing scalability and efficiency.

The Ethereum Name Service (ENS) and Unstoppable Domains are interconnected on the horizon of decentralized domain platforms. Recently, Unstoppable Domains expressed its support for .eth domain names from ENS, merging two leading players in the Web3 ecosystem. This collaboration enables users to create easily understandable domain names and cryptocurrency wallet addresses within Web3, enhancing their profiles and unlocking various functionalities.

The evolving and adapting Ethereum Name Service (ENS) ecosystem holds the key to shaping its future growth trajectory. The convergence of utility-driven advancements, strategic collaborations, and broader trends in the crypto domain will undoubtedly impact the price dynamics of ENS in the coming months. Only time will reveal whether this promising digital asset will experience a surge in value by 2023.

Ethereum Name Service (ENS) Price Prediction: Where does ENS go from here?

On November 11th, 2021, Ethereum Name Service (ENS) achieved its peak value, hitting an all-time high of $83.40 in trading. Conversely, its most diminished value was documented on June 10th, 2023, when it dropped to an all-time low of $6.88.

Notably, since its record high, the bottom stood at $6.88, marking a point of minimal value in its trading cycle. Conversely, the zenith following the previous cycle low reached $10.43, representing a peak value within the cycle context.

As of the current sentiment analysis, Ethereum Name Service’s price forecast leans towards a bearish outlook. Concurrently, the Fear & Greed Index registers at 54, indicating a neutral market stance.

Ethereum Name Service Price Prediction 2023

The token was last seen at $14.5, with a market capitalization of $370,673,610. Its trading volume current is at $41,223,000. ENS’s long-term price forecast will entail a detailed study of its future scope against its price and the market trend.

The year 2023 looks favorable for the ENS token. ENS is currently trading at $9.0. According to the experts, ENS’s price could be around $25.1 to $31.12. Even if we consider the most bearish scenario, its price is $11.46.

Ethereum Name Service Price Prediction 2024

We are looking at an upward goth graph for the ENS since its performance in 2023. The Ethereum Name Service (ENS) is looking at a rise of up to $28.78 by the end of 2024. The average trading price is predicted to be around $23.45. If the market turns volatile, there could be a drop in price to $18.34, which is still more than its current price of 2023. This means in the year 2024. ENS could still be a good option.

Ethereum Name Service Price Prediction 2025- 2006

Ethereum Name service’s price for 2025 should be $25.17 to $36.43, per our expert studies. For 2025, the trading price of ENS should be around $31.27.

Considering ENS’s large community, its price has the potential to surpass its value in 2025. Price swings are challenging to predict, especially when the market is more bullish or bearish than ever.

Ethereum Name Service can cost around $33.46 in 2026. However, we can only get a maximum of $49.985. Ethereum Name Service is expected to cost about $40.52 on average by 2026. A significant price shift is likely within the cryptocurrency market’s defined range.

Although the price trend of ENS looks promising, it is advised that investors take these predictions with a grain of salt, as the tides may turn anytime.

Summary

The Ethereum Name Service (ENS) is a blockchain-based distributed, open, and extensible naming system. Improving blockchain’s usability and accessibility is one of the most difficult challenges. For instance, when it comes to Ethereum (ETH) or Bitcoin (BTC) payments, beginners and even experienced users may find long wallet addresses inconvenient and perplexing. Hexadecimal numerals are easy for computers to read but less natural for humans.

The Ethereum Name Service (ENS) solves this problem by allowing anyone to create easy-to-remember website-style addresses. If you are interested in the ENS token, you should use the eToro platform to buy it. It is a well-established and highly regulated platform. However, cryptocurrency investments are dangerous, so do your homework before diving in. Opening an account with eToro is simple and takes only 2 minutes.

Furthermore, automated trading bots can help you with your trading. Remember that any cryptocurrency trading profits will be taxed, so plan accordingly. ENS Token has a bright future, and you should consider investing in it immediately.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Is Ethereum Name Service a Good Investment?

Ethereum Name Service has proven to be a good investment on occasion. In addition to the technology, it is one of the most promising blockchain initiatives in terms of application cases. Furthermore, the Blockchain is being used in a variety of real-world applications, which increases its value.

Any risk in buying Ethereum Name Service now?

Recently, Intense buying of non-fungible tokens (NFTs) for three- and four-digit Ethereum Name Service (ENS) domains has ended up causing daily trade volume on NFT marketplace OpenSea to surpass that of the Bored Ape Yacht Club (BAYC). Therefore, Ethereum Name Service is a good option to invest in. However, given the ongoing optimism and potential upside in its price movements, ENS is a better asset to trade.

How much will ENS be worth in 2030?

Many platforms and analysts believe that the price of Ethereum Name Service will continue to rise over the next five to ten years, eventually surpassing $76 by the end of 2025 and $450 by the end of 2030. Even if the price appears to be excessive, you never know. ENS and other Cryptocurrencies are incredibly volatile and can rapidly change direction.

Bitcoin

Bitcoin