Due to the 2008 economic meltdown, the first cryptocurrency was created. At the time, the creators and investors focused on decentralizing currency. The main objective was to create a financial and commerce system that central banks or the government did not control.

Cryptocurrencies are the first alternative to the current banking system, and they have many advantages over previous asset classes and payment systems. Crypto.com is ideal for those who want to do more with their cryptocurrencies than buy and store them. So it’s an excellent place for active investors and anyone who wants to use cryptocurrency as real money instead of just an investment.

If you want to understand more about the underlying technology of CRO and its potential role as a financial system in the future, continue reading this article. We’ve discussed what CRO is. Where can you buy it, and what are the risks of buying a CRO token? Furthermore, we have also enlisted exchanges offering CRO trading. You can also find the taxation rules on CRO earnings and the strategies you might adopt to reduce the risks in CRO trading. Finally, we have also elaborated on how to use an automated trading robot to invest in CRO CFDs.

On this Page:

How to Buy Cronos

- Choose an exchange that supports the Cronos token. eToro is highly recommended because FCA, ASIC, and CySEC regulate it.

- Create and validate your eToro trading account.

- Deposit into your account.

- Type ‘Cronos’ into the search bar to open charts and trades.

- Enter the amount to be traded in Cronos and press the “Trade Now” button.

Best Exchange to Buy CRO in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

For first-time buyers of CRO tokens, here is an overview of the investment process with FCA-regulated broker eToro.

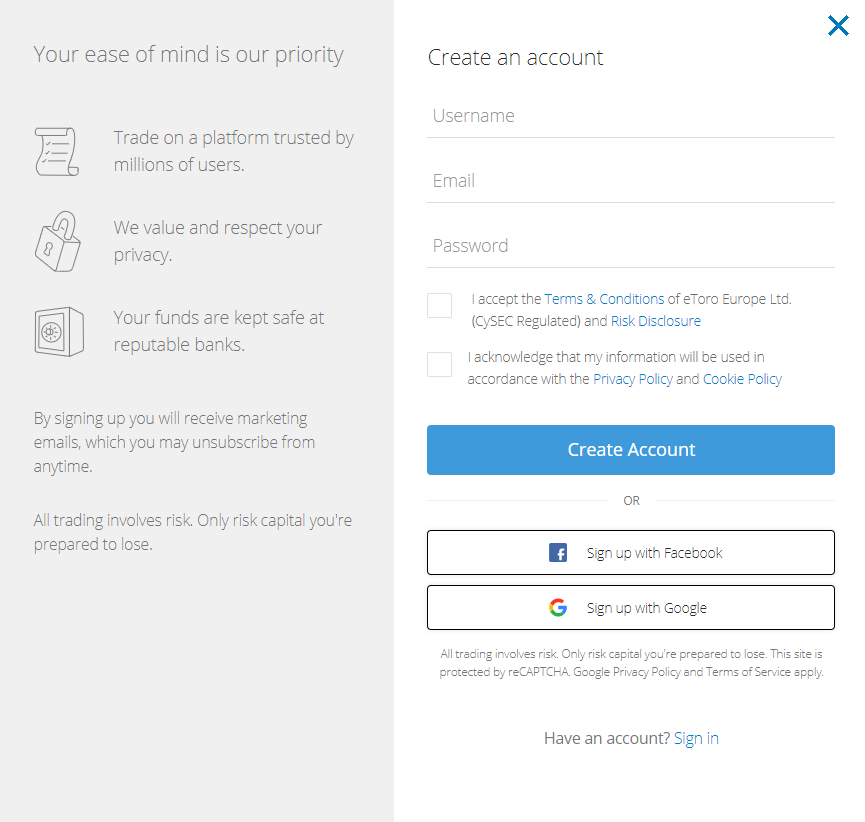

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, click the “Join Now” or “Trade Now” button.

- On this page, you’ll find an electronic form where you can enter all your personal information needed to open a new trading account.

- Please fill out this form with all of the necessary information.

- Users can access eToro through Facebook or Gmail.

- Please read eToro’s Terms & Conditions and privacy policy before submitting your information for consideration.

- After reviewing the terms, please indicate your agreement by checking the appropriate box.

- Click the “sign-up” button to submit your information.

eToro website homepage

Your capital is at risk.

Step 2: Upload ID

To ensure compliance with regulatory standards, eToro requires a copy of a driver’s license or a passport when opening an account. It will also require a copy of the most recent utility bill or bank statement to verify the address. Following the submission of the documents, the verification process will begin automatically.

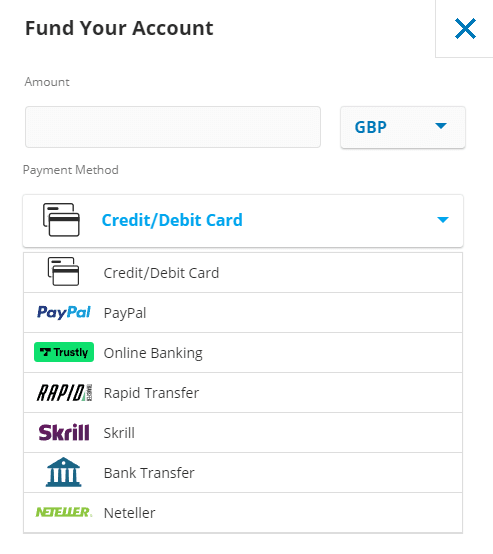

Step 3: Make a Deposit

The next step is to deposit funds into the account to begin investing. The minimum eToro account deposit is $10, which can be made using Visa Debit or Credit Cards, bank transfers, PayPal, Skrill, and other payment methods. After choosing a payment method, click the “Deposit” button to finish the process. There are no deposit fees at eToro.

Deposit methods on eToro

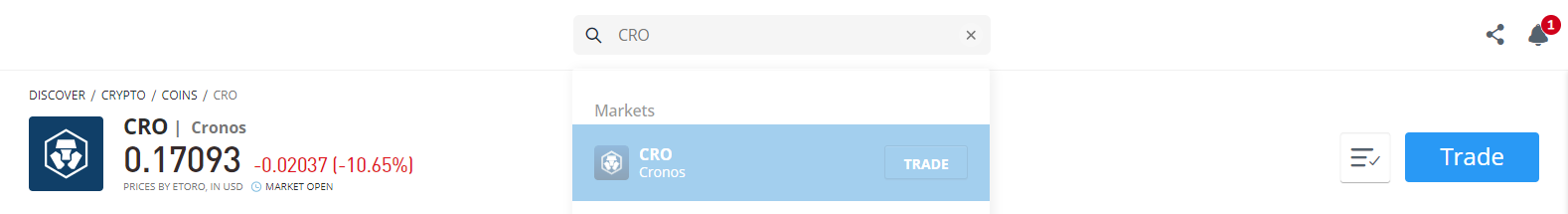

Step 4: Buy Cronos

To buy Cronos, enter CRO into the search box and select the relevant token from the search list.

Searching CRO on eToro

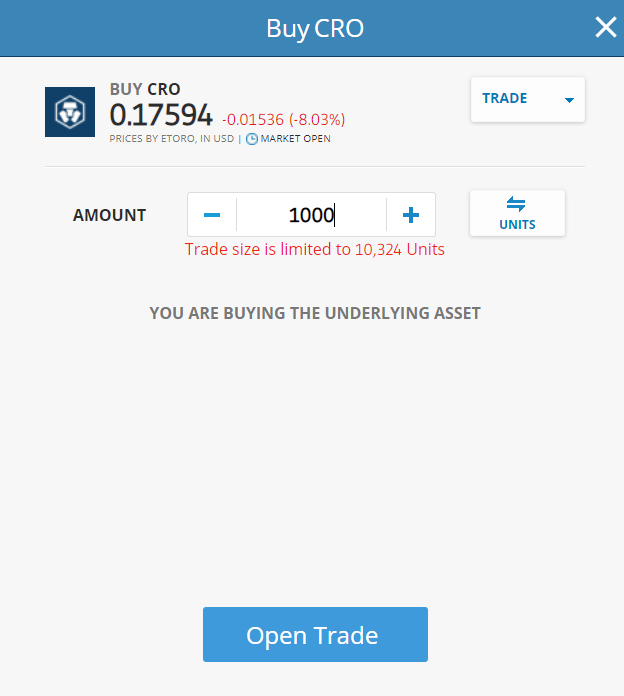

Step 5: Review Cronos Price

Following the selection of the cryptocurrency, an order page will be opened, where the trader will enter the amount of the desired Cronos token. When you’ve decided, click the “Open Trade” button to add Cronos to your portfolio.

We recommend storing your digital assets in a third-party wallet separate from the trading platform. One option is the eToro Crypto Wallet, which supports over 120 digital assets and CRO. The good news is that eToro does not charge a maker/taker fee; instead, they charge a buy/sell spread.

Step 6: Buy Cronos

Then, press the “Trade” button. Enter the amount of money you want to put towards the CRO. Following that, two options will be presented.

Pending Order: When the price of Cronos reaches a certain level, it will place a buy limit to execute an order.

Instant Buy: This option is for those who want to purchase Cronos at the current market price as soon as possible. By clicking ‘Open Trade,’ the underlying asset, CRO, will be purchased in the trader’s eToro account. A trader has the option to close the trade at any time.

Buy CRO on eToro.

CRO/USD was listed on eToro on April 20, 2022, and traders can trade it on eToro along with several other coins.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Cronos- Best Platforms

For your convenience, the best platforms to buy CRO have been narrowed down after extensive research. Their features, fees, and reasons for being unique are all listed.

eToro is the most highly recommended platform for purchasing CRO tokens because it is secure, offers reasonable prices, and, most importantly, is easy to use.

Best Brokers to Buy Cronos

1 – eToro

eToro became prominent with its social investing platform, a novel tool allowing users to mimic other investors’ trades. Founded in 2007, eToro now has over 20 million users in 140 countries, including the United States.

Beginning in 2022, customers in the United States will be able to purchase stocks and ETFs from the company. Customers in the US could previously only trade cryptocurrencies on the platform, while eToro operated multi-asset brokerages in other countries (offering stocks, commodities, and forex trading).

Furthermore, you can now stake prizes for buying Ethereum and storing it in your wallet and Cardano and Tron.

Learn more about how to stake cryptocurrency.

Trading and transaction fees: On the eToro platform 1% fee is charged to buy or sell crypto assets. There is no commission on stock and ETF trades, and when you sell a stock, the broker pays the regulatory transaction fees. In addition, there is a $75 account transfer fee for partial and full transfers.

Trading pairs for cryptocurrencies: Users in the United States cannot access direct crypto-to-crypto trading. Unlike Coinbase, however, there is a crypto-to-crypto conversion option for Bitcoin, Litecoin, Bitcoin Cash, Ethereum, and Stellar.

eToro accepts Bitcoin, the most popular digital asset, and altcoins like Ethereum, Aave, XRP, and Graph.

Deposit Fee:eToro charges a reasonable fee structure to its customers. It is entirely free to deposit eToro. Deposit options include bank wire transfer, credit or debit card, and PayPal, Skrill, Sofort, and Netteller. The minimum deposit amount varies depending on where the user is located.

Minimum Deposit: The minimum deposit amount is $10 if you use a debit card or connect a bank account. Furthermore, you can buy fractional shares of stock, which means you can buy a small portion of a share for any amount greater than $10.

You can buy and sell on eToro online and through their mobile app. In comparison, creating an eToro account is straightforward and takes only a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp, founded in 2011, is a well-established cryptocurrency exchange platform offering over 56 cryptocurrencies. While this is a smaller selection than some exchanges, it is more than enough to satisfy most beginners, and its simplified fee structure makes it an easier (albeit slightly more expensive) entry point for newcomers; however, more advanced users may prefer more coins or lower trading fees.

With its simple fee structure and the ability to buy crypto with fiat currency directly from a bank account, credit card, or debit card, Bitstamp can be a good option for those new to crypto who want to stick to the major coins or even more popular altcoins.

Customer Service: Bitstamp provides 24-hour customer service, including a phone support line for urgent inquiries. This type of assistance is difficult to find in the crypto exchange space, so if speaking with a support agent over the phone is essential, you should give Bitstamp a second look.

Fees for Bitstamp: Bitstamp charges a single flat fee percentage regardless of whether your order is a maker (creates liquidity on the exchange), a taker (reduces liquidity), or made using the trading or instant buy platforms.

For traders with less than $10,000 in monthly trade volume, trading fees will be 0.5 percent. Fees are reduced to 0.25 percent for transactions of $10,000 to $20,000, and they continue to fall as trading volume increases.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Around-the-clock phone support.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Huobi Global was founded in 2013 by Leon Li and was initially based in China. Huobi Global’s headquarters were relocated to Singapore and the Republic of Seychelles following China’s crackdown on cryptocurrency exchanges in 2017. Huobi Global is available in most countries worldwide but does not support a few, including the United States and Japan (though users in Japan can use Huobi Japan instead).

Huobi Global offers crypto-to-crypto trading with diverse supported assets and low trading fees. The platform, aimed at active traders and institutional investors, supports limit, stop, and trigger orders and margin and futures trading. Institutional traders can also access OTC trade desks, derivatives, and custom trading tools.

Deposit: The minimum deposit is $100, and additional fees such as deposit fees, transaction fees, and withdrawal fees vary depending on the currency.

Fees: Huobi Global charges reasonable fees for cryptocurrency trading but higher fees for purchasing cryptocurrency with a credit or debit card. Although deposits in fiat currency (such as US dollars) are free, users must pay trading fees. Fees for both makers and takers are charged at a flat rate of 0.2 percent. Depending on the scale volume, it can be as low as 0.1 percent.

Huobi Global Trading Fees: Huobi Global charges maker-taker fees, with discounts available for high-volume traders who own HT tokens. You will pay different fees depending on whether you are a maker or a taker in the transaction. Professional accounts require a high trading volume (more than 1,000 BTC every 30 days) and a higher HT holdings requirement (at least 2,000 total).

Houbi Global offers customer service via email, phone, online chat, ticket system, and social media platforms. It includes two-factor authentication, cold storage, account freezing, and Bitcoin reserves, among other security features.

Pros & Cons of the Houbi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

4 – Crypto.com

In 2016, Crypto.com, a global cryptocurrency exchange, was founded in Hong Kong and served over ten million traders from over 90 countries, allowing you to trade over 250 cryptocurrencies for a low trading fee. With approximately 180 cryptocurrencies available, Crypto.com has a more extensive selection of cryptocurrencies on its exchange than any other service reviewed by

Low fees with cash: If you pay with money transferred from your bank account via ACH or an automated clearinghouse, Crypto.com has no trading or transaction fees.

Deposit: The minimum account balance on this platform is $1. The maker/taker commission ranges between 0.04 and 0.40 percent. For the first 30 days after the account is opened, credit/debit card purchases are charged at 0% or no fee.

Users of the Crypto.com App can now buy CRO at face value in USD, EUR, GBP, and 20+ other fiat currencies and spend it at nearly 70 million merchants worldwide with the Crypto.com Visa Card.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a new peer-to-peer (P2P) cryptocurrency derivatives exchange looking to establish itself in the burgeoning cryptocurrency margin/leverage trading market. Although founded in March 2018, Bybit quickly gained traction and onboarding customers in the cryptocurrency trading community.

The exchange allows traders worldwide to engage in leveraged margin trading in a limited number of crypto products, including BTC, ETH, EOS, and XRP, which can be traded with up to 100x leverage.

Bybit, based in Singapore, is a crypto-to-crypto exchange that does not require users to go through stringent KYC verification and currently generates close to $1 billion in daily trading.

Co-Founders of ByBit

Ben Zhou founded Bybit in March 2018 after seven years as XM’s China District General Manager. Bybit’s core team has experience in investment banking and the Forex industry, and they were early blockchain adopters, while XM is a leading brokering service provider.

Leveraged trading: Bybit Exchange primarily provides perpetual futures products with 100:1 leverage. This suggests they attempt to connect with established exchanges like Binance and Phemex, which offer similar non-expiry futures contracts.

Fee – Market takers pay a 0.075 percent fee, while market makers pay a -0.025 percent fee. As a result, market makers will be compensated when a transaction is initiated. Market makers are more likely to be active and fill the order book because of the low fee.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is a cryptocurrency exchange that offers low fees, access to hundreds of digital currencies, and enhanced tools for seasoned investors. Binance is well-known for its lightning-quick trade execution.

Before the launch of Binance in China in 2017, the company’s founder, Changpeng Zhao, devised a new system for corresponding orders for high-speed traders. Despite having fewer digital currencies and crypto-to-crypto trading pairs than its parent company, Binance offers nearly 60 cryptocurrencies and outperforms many other US exchanges.

Minimum Deposit: The minimum trade in the United States is $10.

Trading and transaction fees: Binance.US charges a flat 0.1 percent spot trading fee, which is lower than the fees charged by many other US exchanges, including eToro (0.5 percent for trading fees plus a flat fee of up to $2.99 per trade, depending on trade amount). Binance.US also charges a 0.5 percent Instant Buy/Sell fee for traders who need to transact quickly.

In contrast to its global brokerage, Binance charges a 4.5 percent fee for debit card transfers.

Credit card purchases are not permitted in the United States). ACH bank transfers are free for cash deposits and withdrawals, whereas bank wire transfers cost $15 per transaction. Bitcoin withdrawals cost 0.0005 percent, with a minimum withdrawal of 0.001 bitcoin.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited.

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase is the largest cryptocurrency exchange in the United States, with nearly 100 cryptocurrencies available for trading. Coinbase fees, conversely, can be perplexing and significantly higher than some competitors. While Coinbase offers appealing security features, cryptocurrency trading is highly volatile, so consider the risks.

Platforms for trading: Coinbase users can trade on the original Coinbase platform, which allows users to buy cryptocurrency with US dollars and Coinbase Pro.

Coinbase Pro, formerly GDAX, features advanced charting capabilities, allowing users to conduct crypto-to-crypto transactions and place market, limit, and stop orders.

Coinbase Earn is a novel approach to “earning while you learn.”

Coinbase provides video classes and exams to educate users about cryptocurrency trading and some available cryptocurrencies. By taking the classes, users can also earn specific cryptocurrencies.

Fees: Coinbase charges higher fees than other cryptocurrency exchanges (and sometimes has a more complicated fee structure). Coinbase is ideal for cryptocurrency traders who want to trade with ease. Traders need to convert one cryptocurrency to another quickly.

Minimum Deposit: To purchase cryptocurrency on Coinbase, a minimum trade amount of $2 is required.

Trading and transaction fees: The Coinbase fee structure is a befuddling jumble of elements determined by two factors:

On cryptocurrency sales and purchases, Coinbase charges a 0.5 percent spread; rates may vary depending on market fluctuations. Coinbase also charges a flat or variable fee, depending on the amount purchased and the payment method used.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from the bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, a well-known cryptocurrency industry name, has established itself as a prominent one-stop shop for all cryptocurrency transactions. It was founded in 2017 and offered over 200 cryptocurrencies in over 400 markets worldwide.

Kucoin provides a diverse range of cryptocurrencies, with approximately 750 currency pairs. It can provide you with experience with less popular coins that are difficult to locate on popular cryptocurrency exchanges. This platform offers the KuCoin Earn service, which pays interest on staked or lent cryptocurrencies. Its mobile app also offers its customer’s margin trading and trading bots.

Kucoin’s trading fees are among the lowest because it does not charge monthly or withdrawal fees. Instead, the deposit fee is determined by the method of transfer you choose. Due to its large customer base, it claims that one in every four cryptocurrency holders uses its services.

By holding at least 1000 KCS, the Kucoin fee can be reduced.

The maker/taker fee begins at 0.1 percent and decreases gradually as you progress through the levels. Withdrawal fees differ depending on the cryptocurrency. Fees range from 3.5 percent to 5 percent for US citizens who cannot deposit directly into their Kucoin account.

Withdrawal and transfer fees vary depending on the coin. Kucoin is one of the few cryptocurrency exchanges that accept margin trades. Users can also lend their cryptocurrency holdings to others. Users can also hire trading bots for a small fee on this platform.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is one of the oldest cryptocurrency exchanges, founded in 2012. This exchange, intended for professional and institutional traders, has some of the industry’s highest BTC/USDT volumes, thanks partly to the 100x leverage it offers traders.

Bitfinex offers a diverse range of order types, margin trading, and over-the-counter (OTC) trading, making it an ideal platform for experienced traders looking for advanced options and low fees. However, it is not available in the United States.

Founders: Bitfinex was one of the first cryptocurrency exchanges to offer peer-to-peer margin trading, founded by Giancarlo Devasini and Raphael Nicolle. Even though this feature helped Bitfinex stand out among a growing number of competitors, Bitfinex has been the victim of multiple hacks and was recently fined by US regulators.

Fees: Bitfinex has reasonable fees, though they are not the lowest in the industry. While most traders will pay between 0.1 and 0.2 percent per trade, those with high trading volumes may see their fees reduced to zero. Users who trade more than $7.5 million monthly qualify for free maker trades. Discounts are also available for customers who have USDt LEO in their accounts.

Security: Bitfinex has increased its security following several major breaches in the past. It supports two-factor authentication (2FA) and wallet address whitelisting, and 99.5 percent of user funds are kept in multi-signature cold storage.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

Lack of Regulation

-

US citizens are not accepted.

-

Expensive trading fees

What is Cronos (CRO)?

Cronos (CRO) is an Ethereum token that powers the Crypto.com Chain platform, allowing users to pay for goods and services with cryptocurrency while earning cashback.

Cronos is a vital component and the backbone of the crypto.com ecosystem, and it is quickly becoming one of the most potent forces in the cryptocurrency space. The primary function of the CRO token is to allow its users to use cryptocurrency to pay for real-world items by converting it to fiat money (such as British pounds and US dollars).

Crypto.com works with other companies to ensure that payments are accepted as widely as possible, notably Visa. It was initially known as MCO and was built on the Ethereum blockchain, whereas Crypto.com was known as Monaco; however, they rebranded and renamed the token CRO, as it is now known.

Crypto.com is a cryptocurrency exchange that provides trading, investing, stakes, wallets, NFTs, and various other services. This platform supports over 250 different currencies and offers low fees and benefits to customers who own a significant amount of Crypto.com Coin (CRO). The network of cryptocurrency-related items will make it an appealing option for people who want to do a lot with their coins.

The Founders of Crypto.com

In 2016, Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo established a company named Monaco. 2018 the company changed its name to Crypto.com after buying a cryptography expert and professor Matt Blaze-owned domain.

Crypto.com is a Hong Kong-based corporation with approximately 3,000 employees. Its offerings and services include staking, a crypto exchange, crypto Visa debit cards, NFT auction, crypto financing, etc. Customers can use crypto.com to stake CRO, Bitcoin, Ethereum, and various other cryptocurrencies, turning into a decentralized financial (DeFi) market, and the goal is to make cryptocurrency more affordable and flexible for the common people.

CRO Advantages

The Cronos blockchain and its token, CRO, promise to resolve numerous issues typically linked with mainstream blockchain adoption. The primary goal of CRO is to support a faster payment network by implementing scalability solutions that enhance performance as transaction load increases. In addition, Crypto.com’s developers have also taken measures to simplify CRO blockchain integration and improve merchant support.

Visa cards

The Visa Card, previously known as the MCO Visa Card, is the world’s first reusable, metallic, and crypto-linked prepaid card. The top-tier Obsidian card earns 8% cashback and offers many other extra benefits. Crypto.com offers five prepaid Visa cards that can be used wherever Visa is accepted. However, consumers must fill them up before spending money.

The Crypto.com Visa Card is a reloadable prepaid card. Prepaid cards are, in general, the same as debit cards. In contrast, debit cards are tied to your bank account, whereas prepaid cards must be filled. In this situation, customers may fill up their cards using bank account transactions, credit or debit cards from other companies, or cryptocurrencies.

Nodes

The Crypto.com Chain employs two types of nodes to ensure user security and safety. Council nodes, also known as validator nodes, can be used for network data access, settlement, and confirmation. The council nodes are typically in charge of platform governance. Any chain member can use community nodes, also known as full nodes. Community nodes are also used to settle transactions, obtain network information, and confirm that send and receive exchanges have occurred.

Security

Crypto.com employs several security protocols, including multi-factor authentication (MFA) and whitelisting, to ensure the security of user accounts. To help secure the account, it is also necessary to use a strong password and other internet security practices. For example, because cryptocurrency transactions cannot be reversed, it is unlikely that customers will be able to recover any lost crypto if their account is hacked.

Crypto.com employs strict supervision and secures customer deposits offline using cold storage to help avoid breaches and losses. It also collaborates with local banks in the United States to ensure that the FDIC protects US currency accounts.

Is it Worth Buying Cronos (CRO) in 2023?

The journey of Cronos CRO has been characterized by various fluctuations. It debuted in December 2018, starting at $0.0153 per coin. The value of the CRO token quickly gained momentum and peaked at $0.103 in March 2019. However, progress seemed to level off until the spring of 2020.

Between March and August 2020, the token experienced a significant growth of over fivefold, reaching a value of $0.1785. This remarkable surge can be attributed to the launch of the Crypto.com wallet during that period.

The early months of 2021 saw an impressive increase in the value of Cronos CRO, with a surge of 285%. By April, its price reached $0.2452. The token’s peak performance occurred in November 2021, when it achieved an all-time high value of $0.9005. However, as the year drew to a close, the price dropped to $0.5575.

Cronos CRO gained attention for its venture into the realm of non-fungible tokens (NFTs) and received significant endorsement from acclaimed actor Matt Damon. However, 2022 posed challenges for the token as it briefly reached a value exceeding $0.50 before encountering a decline, despite its rebranding attempts to Cronos.

The token’s performance in 2022 suffered due to reduced staking rewards and the termination of certain partnerships. However, there has been an improvement in the landscape in 2023 compared to the previous year. While the token’s current value is nowhere near the impressive heights of 2021, the situation appears less dire.

The current price of Cronos stands at $0.057105, along with a 24-hour trading volume reaching $4.45 million. Estimated at approximately $1.47 billion, its market capitalization accounts for a market dominance of 0.12%. Within the past day, the price of CRO has experienced a modest uptick of 0.73%.

The current circulating supply of Cronos CRO amounts to 25.26 billion out of a maximum supply of 30.26 billion CRO tokens. Regarding market capitalization rankings, Cronos holds the fifth position within the Exchange Tokens sector and eleventh among Ethereum (ERC20) Tokens.

Will the Price of Cronos (CRO) Go Up in 2023?

Crypto.com has swiftly gained an impressive user base, surpassing 80 million individuals. This accomplishment solidifies its standing as a prominent player in the cryptocurrency market. With millions of unique wallet addresses, the platform has diligently enhanced its offerings, introducing innovative features like Yield Farming and Price Walkthroughs.

This concerted effort has successfully transformed Crypto.com into a robust hub in the crypto space. A crucial part of Crypto.com’s strategy involves forming strategic partnerships, especially with prominent sports organizations, to reach new user segments.

The platform’s visibility and reach have significantly increased through noteworthy collaborations with global entities like the FIFA World Cup, International Red Cross, and Red Crescent Movement. Furthermore, Crypto.com has successfully developed its own NFT marketplace and expanded operations into the previously untapped US market.

By joining the Blockchain Association of Singapore (BAS), Crypto.com has demonstrated its dedication to advancing blockchain technology. The platform’s consistent achievements, innovative features, and strengthened partnerships with established and emerging allies make it an appealing investment opportunity for 2023.

In the latest development, Crypto.com has secured registration approval from De Nederlandsche Bank (DNB) to offer crypto services. This endorsement comes after a comprehensive evaluation of the platform’s business operations and compliance, aligning with the Netherlands’ Money Laundering and Terrorist Financing (Prevention) Act (Wwft).

Adding to its streak of accomplishments, Crypto.com has unveiled a partnership with global video game commerce company Xsolla. This collaboration integrates Crypto.com’s checkout solution into Xsolla’s Pay Station platform.

The integration of Crypto.com Pay is set to revolutionize the gaming industry, creating exciting new opportunities for game developers and players alike. This symbiotic merger opens up innovative pathways, enabling secure and user-friendly cryptocurrency payments while streamlining transactions seamlessly.

This collaboration is set to revolutionize digital payment methods, offering players a more comprehensive range of transaction options in both digital and metaverse environments. Moreover, this partnership signifies a significant milestone for Crypto.com as it strengthens its presence within the gaming sector.

While the future holds promising milestones for the platform, the trajectory of Cronos (CRO) largely hinges on market responses to these significant announcements. Based on current predictions, experts anticipate a 4.84% price upswing, projecting the value of CRO to reach $0.060906 by August 12, 2023.

When analyzing technical indicators, it becomes evident that the prevailing market sentiment is Bearish. This is supported by the Fear & Greed Index, which stands at 54 (Neutral). Over the past 30 days, Cronos has demonstrated volatility of 2.14%. During this period, there were 10 out of 30 (33%) green days.

Cronos (CRO) Price Prediction: Where does Cronos (CRO) go from here?

Our analysts have made a price prediction for Cronos coin (CRO) based on thorough fundamental and technical analysis. This forecast considers various factors, including the platform’s growth potential, popularity, functions, utility, and demand.

Cronos Price Prediction 2023

Technical analysis suggests the CRO coin has a bullish trend potential for the rest of 2023. In the short term, the CRO coin is expected to reach a maximum of $0.67. The average price of a CRO coin for 2023 is expected to be $0.3, with a minimum price of $0.075 expected by the end of 2023. However, investors must note that these figures are solely derived from historical price action by the token. Major events within the market could act as catalysts for price movement for the CRO token, positively or negatively.

Cronos Price Prediction 2024

Given the increased demand and popularity of Crypto.com, our analysts believe that CRO may even try to surpass the $1 level in 2024. The following year will be very important, pushing the coin towards previously unexplored price levels. The coin is currently more than 98% below its all-time-high level of $0.9698, which it touched in 2021. The average price of a CRO token in 2024 is anticipated at $0.88, and the minimum level is forecasted at $0.76, depending on the growth of the Crypto.com exchange.

Cronos Price Prediction 2025

The CRO coin may reach new heights in 2025 as the platform may look for more partnerships and focus on expanding. At the moment, the major competition for Crypto.com is Binance and Coinbase. The exchange will likely look to beat its contenders by providing its users with more incentives, fee rebates, and features.

Furthermore, our analysts believe the platform will continue to expand its range of services, which will automatically add up to the value of its native token, Cronos CRO. In 2025, CRO is anticipated to reach as high as $1.5. The average price for CRO in 2025 is expected to be $1, and the minimum the coin will remain is projected at $0.96.

Cronos Price Prediction 2026

2026 could act as a period of consolidation for CRO or a year of complete parabolic movement. The price of CRO will depend heavily on how Crypto.com aims to position its exchange and surrounding ecosystem. Under the right market conditions, it may not be unlikely to see CRO at around $2. However, the growth of such a global crypto entity may also invite government interference. Any kind of negative press may have a major adverse effect on the price of CRO, which could potentially end up in the token losing a lot of its value gained within the past 2-3 years.

Summary

Cronos (CRO) is an Ethereum token that powers the Crypto.com Chain platform, which allows users to pay for goods and services with cryptocurrency while earning cashback. Crypto.com could be an excellent choice for a low-cost, exclusive cryptocurrency platform. Its value has increased due to the confirmation of a 20-year agreement for the name rights to Los Angeles’ Staples Center, which includes the various features and services it provides. It also works with Formula One and the Montreal Canadians of the National Hockey League. This collaboration aims to increase brand awareness and network activity.

This appears to be a genuine power play, as these agreements will link Crypto.com to some of the sport’s most influential clubs. As a result, it will serve as a point of contact for anyone interested in using cryptocurrency. When a cryptocurrency becomes well-known and works with a large corporation, its value rises. Even though the effort appeared to be potent catnip for investors, the advertisements are not entirely responsible for the CRO’s ever-increasing value. Although Crypto.com is the world’s economic leader in cryptocurrency marketing, there is much more to it.

If you are interested in the CRO token, you should use the eToro platform to buy it. It is a well-established and highly regulated platform. However, cryptocurrency investments are dangerous, so do your homework before diving in. Opening an account with eToro is simple and takes only 2 minutes.

Furthermore, automated trading bots can help you with your trading. You should also remember that any cryptocurrency trading profits will be taxed, so plan accordingly. CRO Token has a bright future, and you should consider investing in it immediately.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risk in buying CRO now?

Given the CRO Cronos coin's price history, our analysts believe the token is at a good level for investment. The coin hovers near the support level, indicating that it could reverse its upward trend quickly. Furthermore, users of crypto.com can benefit greatly simply by holding CRO tokens. However, purchasing any cryptocurrency entails risk, and one should always take calculated risks and follow a trading strategy that is appropriate for the market situation.

Is it safe to buy CRO?

CRO coin is based on the ERC-20 standard and was built on the Ethereum blockchain. Crypto.com's security measures are above the industry average. Crypto.com has the same level of security as Coinbase.

How much will CRO be worth in 2030?

The high growth potential of CRO coin as a result of the variety of features provided by the crypto.com ecosystem suggests that CRO could reach $15 in 2030. However, if any unfavorable market conditions emerge, the CRO token could be worth $9 by the end of 2030.

Wil CRO ever hit $5?

Yes! CRO may reach $5 shortly. Analysts predict that the CRO token will reach $5 in the next 5-7 years.

Bitcoin

Bitcoin