The crypto industry has also undergone structural change in recent years. It takes you from a small market for tech designers and technology enthusiasts to a hub for millions of global investors. Many countries, fund managers, and major corporations have accepted cryptocurrencies and begun to invest a portion of their capital in digital currencies.

Many cryptocurrencies use blockchain technology to record their trading activities. It enables cryptocurrencies to function without a central authority by distributing their operations across a network of computers. Decentralized applications are among the blockchain network’s most well-known and influential aspects. However, there is a significant problem in this industry. Developers faced numerous challenges while creating decentralized solutions, including limited tools.

CTSI is the native token of the Cartesi ecosystem and is used in many essential aspects of the company’s operations. Businesses can accept CTSI payments and donations through NOWPayments in various ways. The network is becoming increasingly popular quickly, and the fact that it can be used in the real world makes it even more appealing to investors.

If you’re interested in CTSI and want to study it more, in this guide, we cover what CTSI is, who created it, how CTSI works, the CTSI token use case, and where you can buy CTSI on the dip. Is it worth buying in 2024? What will its price reach in the future?

How to Buy Cartesi Crypto

- Firstly you need to select a platform that lists Cartesi – we recommend eToro as its FCA, ASIC, and CySEC regulated.

- Create an account with eToro and validate your free trading account.

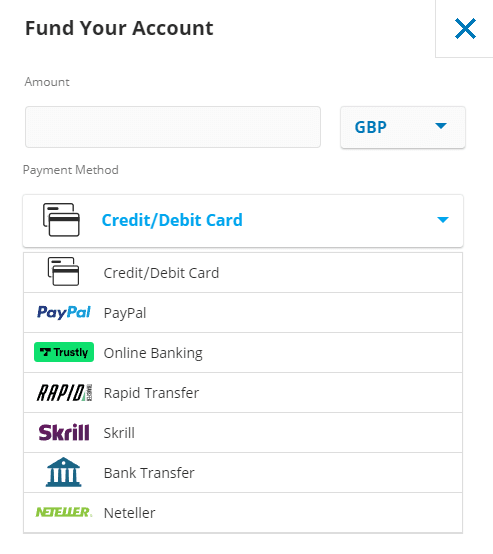

- One account is created, and making a deposit uses a bank transfer, a credit card, PayPal, or another supported method.

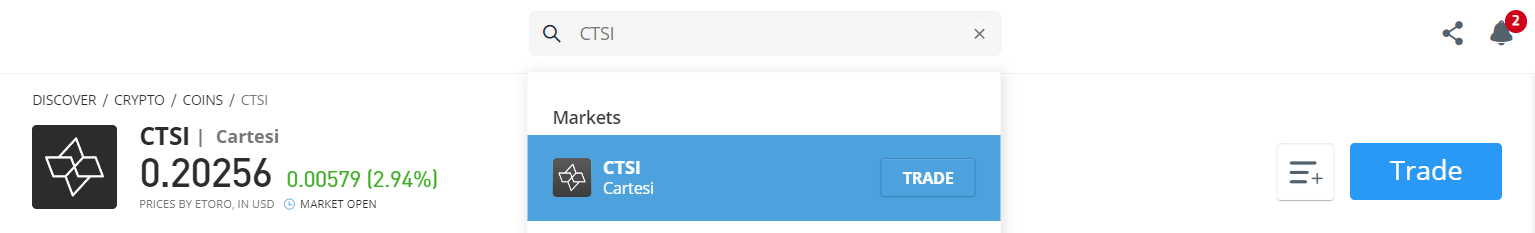

- Open the Cartesi price chart and trading platform by searching ‘CTSI’ in the drop-down menu.

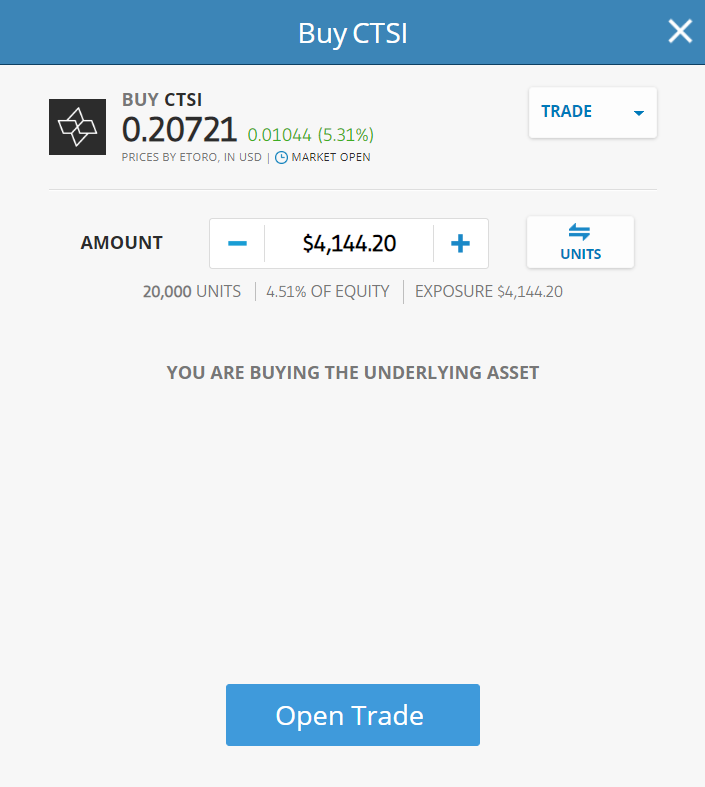

- Select the ‘Trade’ button and enter the CTSI amount you want to buy.

Best Exchange to Buy Cartesi in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

How to Sign Up at eToro

Creating a free eToro account is easy, and the site is particularly user-friendly for newbies.

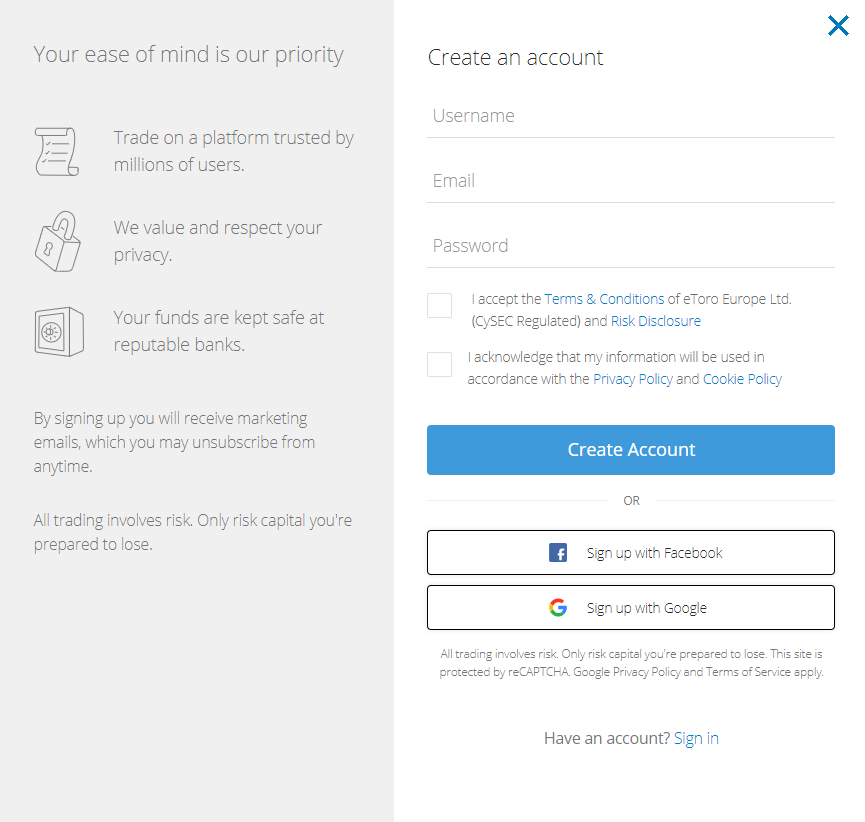

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, click on the signup option, which will lead to an account opening form.

- Fill in the required information on the eToro electronic account opening form.

- You can also signup eToro account using Facebook or Gmail.

- Before confirming signup, read and understand eToro’s Terms & Conditions and privacy policy.

- Lastly, click on the “signup” option to apply.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Your capital is at risk.

Step 2: Upload ID

eToro will require you to submit verification documents such as proof of ID and proof of address once your account has been created. You can upload your National ID Card, Passport, or Driving License as proof of identification. On the other hand, a utility bill, credit card bill, or bank statement can be uploaded to verify your address.

Once the eToro team has verified and approved your documents, the account will be activated for trading.

Step 3: Make a Deposit

Once the account is approved, you can make your initial deposit. Login to the eToro website and navigate the “Deposit Funds” options. The “Fund Your Account” menu will pop up, where you can enter the amount you want to deposit, your currency, and a deposit mode.

Opening an eToro account requires a $10 minimum deposit, which can be made in various ways. Debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller are accepted payment methods. eToro doesn’t charge any fees on deposits. Once everything is selected, complete the transactions and click the ‘Deposit’ button.

Deposit methods on eToro

Step 4: Buy Cartesi (CTSI)

Once the account is funded, navigate to the search option and type CTSI or Cartesi into the top-of-the-screen search bar. Click the ‘Trade’ button when you see the cryptocurrency asset.

Searching Cartesi on eToro

Step 5: Review Cartesi (CTSI) Price

This action will take you to a page where you can enter the quantity of Terra coins you wish to purchase. Click ‘Open Trade’ to include Cartesi in your portfolio. Lastly, we recommend storing your digital assets in a wallet provided by a third party in addition to the trading platform. One viable option is the eToro Crypto Wallet, which now supports over 120 cryptocurrencies and Cartesi.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Cartesi price chart on eToro – before the Terra crash

The good thing is, there’s no maker/taker fee on eToro as they solely charge buy/sell spread.

Step 6: Buy Cartesi

You can tell eToro how much money you want to invest in CTSI by entering it into the ‘Amount’ box, which starts at $10. To complete your purchase, click the ‘Open Trade’ button.

How to buy Cartesi on eToro

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Cartesi Tokens – Best Platforms

Many digital currencies have recently emerged in the crypto world, and meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB) have seen massive price increases since their launch. Because of the success of these coins, several new cryptocurrencies, including Cartesia, have been launched (CTSI).

Cartesi’s creator aimed to create a solution that would assist the crypto industry in addressing issues related to computing, scalability, and the architecture of blockchain applications. This versatile project aims to remove unnecessary barriers by providing developers with a user-friendly Linux execution environment.

The best place to buy Cartesi right now is discussed further below. Our list of sites to buy CTSI in 2024 includes fees, features, and other details. eToro has established itself as the best place to buy CTSI cryptocurrency, and by momentarily delisting it, it has protected investors from a significant portion of the CTSI drop.

Best Brokers to Buy Cartesi

1- eToro

eToro is a social trading and investment platform that offers online trading and investment. Established in 2006, this company is based in Tel Aviv, Israel; eToro provides various services to retail investors and traders, including trade execution through its proprietary web platform. Furthermore, the company offers social trading and copy trading.

The site and company provide a platform in over 25 languages approved by the Cyprus Financial Markets Authority. The website also includes a sophisticated analytics tool that allows users to identify trading opportunities, monitor performance, analyze their investment strategy, and identify areas for improvement.

You can also earn rewards by trading Ethereum, Cardano, and Tron in your wallet.

Learn more about how to stake cryptocurrency.

eToro is regulated by some of the world’s most reputable regulatory bodies, including the Financial Conduct Authority of the United Kingdom (FCA). Also in charge are the Australian Securities and Investment Commission, the Cyprus Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA) (FINRA). User funds are kept separate from the platform’s operating capital by CySEC regulations for all CySEC-registered brokers. This is how the platform functions.

Like other companies, eToro charges a small trading fee, which includes 0.75 percent when buying or selling bitcoin. On eToro, the cost of converting bitcoins is only 0.1 percent on top of the existing margins. As a result, by 2022, eToro will have established itself as the market leader in cryptocurrency trading, with a strong preference for crypto-assets and CFDs.

eToro accepts Bitcoin, the world’s most popular cryptocurrency, and altcoins like Ethereum, Aave, XRP, and Graph. Buying and selling on eToro can be done online and through their mobile app. Opening an eToro account is simple and only takes a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a cryptocurrency exchange based in Luxembourg founded in 2011 by Nejc Kodri and Damijan Merlak. This well-known cryptocurrency exchange provides a free marketplace for professional investors and large financial institutions.

Bitstamp was founded less than two years after the invention of Bitcoin and was one of the first Bitcoin exchanges in the cryptocurrency market.

Bitsamp is best suited for experienced investors looking for a top-tier cryptocurrency trading platform. However, it is an excellent platform for buying digital assets in bulk and storing them on Bitsamp’s web-based cold storage wallet.

Payment Fees: Bitstamp charges relatively low transaction fees compared to most digital asset exchanges. The United Kingdom provides two deposit options. The first option is to use an international wire transfer, which costs only 0.05 percent of the transferred amount (very low compared to other crypto platforms). The second option is to take advantage of the free Faster Payments service.

Furthermore, the withdrawal fee is less than the industry standard – 0.1 percent for international wire transfers and 2 GBP for Faster Payment. The only drawback to Bitstamp is the high fee they charge on credit card cryptocurrency purchases – 5% on any amount.

Bitstamp trading fees: Bitstamp is widely regarded as a low-fee exchange, particularly for highly active investors. If your daily volume is less than $10,000, the maximum trading fee you can pay is 0.5 percent. (This is higher than the industry average of around o.25 percent). However, as the investor’s total volume of transactions increases, so do the fees. As a result, if your volume exceeds $20,000,000, you may pay no fees at all. Individual investors should expect to pay a fee of about 0.1 percent at Bitstamp.

Security: Two-factor authentication is now required for all investors performing critical account functions. Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured. However, according to crypto exchange security evaluator CER, it ranked near the bottom of our review of crypto exchanges in terms of security, indicating that it may still have room to grow into a category leader.

Customer service is available 24 hours a day, seven days a week, and an emergency phone support line is available.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Leon Li founded Huobi Huobi Global in 2013 while still living in China. Following China’s crackdown on cryptocurrency businesses in 2017, Huobi Global migrated its headquarters to Singapore and then to the Republic of Seychelles. Except for the United States and Japan, Huobi Global is available in most of the world’s countries (though users in Japan can use Huobi Japan instead).

Huobi Global provides crypto-to-crypto trading with a wide range of supported assets and low trading fees. Limit, stop, trigger orders and margin and futures trading are available on the platform, which is intended for active traders and institutional investors. In addition, OTC trade desks, derivatives, and customized trading instruments are available to institutional traders.

For margin trading, the platform provides up to 5% leverage. As a result, Huobi Global’s fee structure is quite affordable and competitively low. Other fees, such as deposit, transaction, and withdrawal, differ depending on the currency. The initial deposit is $100.

Those who want to buy cryptocurrencies with a credit or debit card must pay a higher fee to Huobi. Both the maker and taker fees are set at 0.2 percent. It can be as low as 0.1 percent, depending on the volume of the scale.

Huobi Global offers email, phone, online chat, a ticketing system, and social media platforms for customer support. It provides various security features, such as two-factor authentication, cold storage, account freezes, and Bitcoin reserves.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

Crypto.com was founded in 2016 as a global cryptocurrency exchange headquartered in Hong Kong. It currently serves over 10 million traders in over 90 countries and allows you to buy and sell over 250 cryptocurrencies with low trading fees.

The ability to stake cryptocurrencies is the platform’s primary selling point. Customers can earn up to 14.5 percent annual interest rates by staking or storing them in a crypto.com wallet. Aside from trading, the exchange provides additional services such as staking incentives, Visa card benefits, NFT trading, DeFi products, and more.

Crypto.com employs various security measures, including multi-factor authentication (multi-factor authentication). Whitelisting is occasionally used to safeguard consumer accounts. The platform employs compliance monitoring and saves customer deposits offline in cold storage to prevent hackers and losses.

Deposits on this platform require a $1 minimum account balance. The maker/taker fees range from 0.04 percent to 0.40 percent. Purchases with a credit or debit card incur no or a zero percent fee during the first 30 days after account opening. Users can also earn up to $2,000 for each referral.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

With over 6 million registered users, it is the fastest-growing cryptocurrency exchange. Purchase, sell, and trade popular coins and NFTs across various contract types. Bybit is a cryptocurrency trading platform offering spot, derivatives, and margin trading with up to 100x leverage on BTC/USD and ETH/USD trading pairs.

Bybit was founded in March 2018 in Singapore by experts from investment banks, technological organizations, the forex sector, and early adopters of blockchain technology. It is a registered trading exchange in the British Virgin Islands with approximately 2 million customers.

Bybit is a cryptocurrency-to-cryptocurrency exchange that does not require customers to go through time-consuming KYC verification and has a daily trading volume of up to $1 billion.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the most active cryptocurrency exchanges in daily transaction volume, with over $20 billion daily transactions. It provides access to hundreds of assets and a trading environment facilitating easy earning.

Low costs, a comprehensive charting interface, and support for hundreds of cryptocurrencies distinguish Binance. Unlike eToro, Binance is a cryptocurrency-centric exchange that does not offer copy trading, FX, commodities, or other financial services.

Binance utilizes two-factor authentication (2FA) and FDIC-insured US dollar (USD) deposits. Additionally, Binance protects its customers with device control in the United States, address whitelisting, and cold storage.

Fees range from 0.015 to 0.10 percent for purchasing and selling, 3.5 percent or $10, whichever is greater, for debit card purchases, and $15 for US wire transfers.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited.

- High fees for credit card deposits

- No copy trading

7 – Coinbase

When people ask how to get started investing in cryptocurrencies, Coinbase is frequently recommended. Coinbase was founded in 2012, just three years after Bitcoin was created, and has grown to become the largest cryptocurrency exchange in the United States by trading volume, with over 73 million verified users from over 100 countries.

While the company provides various valuable products for individual and institutional investors, corporations, and developers, the ability to buy, sell, and trade over 100 different cryptocurrencies and crypto tokens is its defining feature. The company went public in April 2021 through a direct listing on the Nasdaq exchange. Its quarterly trading volume has increased to $327 billion, and the platform’s assets have increased to $255 billion.

Despite having higher transaction and trading fees than its competitors, Coinbase remains one of the most popular apps for investing in cryptocurrencies. The Coinbase Pro exchange accepts Terra limit and market orders. The maker/taker fee is 0.5 percent of the first $10,000 in volume traded in a 30-day period and 0.35 percent after that. You can trade cryptocurrencies without incurring maker fees if your 30-day volume exceeds $300 million.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that provides various trading options to its eight million customers. Spot, futures, margin, peer-to-peer (P2P), staking, and lending are all options.

Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the world’s most well-known cryptocurrency exchanges. KuCoin has grown to become one of the most well-known cryptocurrency exchanges. It has over 8 million registered users from 207 countries and territories.

KuCoin lets you buy bitcoins with fiat currency, but only through a third-party application. Payment can be made with a credit or debit card, Apple Pay, or Google Pay, but not by bank transfer. However, the fees may be prohibitively expensive.

KuCoin Transaction Fees: The KuCoin trading fees have a simple structure. The platform charges 0.1 percent for both makers and takers, making it one of the most affordable Bitcoin exchanges on the internet. You can further reduce your fees if you own the platform’s native Kucoin tokens.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a popular cryptocurrency exchange where users can buy, sell, and trade different digital coins. In 2012, the Hong Kong-based portal was established. Intermediate and expert traders are more likely to use Bitfinex’s trading area because it contains a robust set of chart analysis tools.

Apart from cryptocurrencies, wire transfers are the only way to deposit and withdraw funds. Bitfinex, like Coinbase, is one of the few platforms allowing cryptocurrency shorting and leveraged trading. Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange, providing clients worldwide with digital asset trading services.

Bitfinex Securities Ltd., a provider of blockchain-based investment products, has established a regulated investment exchange (Bitfinex Securities) in the AIFC to provide members with greater access to a wide range of financial products. Consequently, Bitfinex is entirely unregulated. Despite its Hong Kong headquarters, the corporation is registered in the British Virgin Islands.

Fees and deposit limits: For bank transfer deposits, Bitfinex charges a 0.1% fee. For example, if you deposit $10,000, you will be charged $10.

Bitfinex imposes a 0.1 percent withdrawal fee for bank wire withdrawals. If you require funds within 24 hours, you can pay a 1 percent expedited fee.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- US citizens are not accepted.

-

Expensive trading fees

- Support team only available via email

What is Cartesi (CTSI)?

Cartesi is a self-contained decentralized platform. It is the first Blockchain operating system and a layer-2 system. It enables developers to create decentralized logic using Linux and traditional programming frameworks while maintaining the decentralization and security inherent in blockchains. The procedure entails providing developers with various tools, information centers, and apps to assist them in designing Smart contracts independent of the various available blockchain systems.

The Cartesi network is powered by the CTSI utility token, which uses Optimistic Rollups technology to overcome blockchain scalability and excessive fees. CTSI could be used for staking as well as network fees.

Cartesi enables millions of new businesses and developers to adopt The Blockchain OS and connect Linux apps. With a revolutionary virtual machine, the enthusiastic result of various factors, and side chains, the network paves the way for creators of all types to develop the next generation of blockchain apps.

Cartesi Ecosystem: The main products of the Cartesi ecosystem are:

Noether: Noether is the transient data of Cartesi’s side-chain. It helps DApps to achieve faster bandwidth while demanding lower fees. However, Noether also features a proof-of-stake system that allows users to risk their CTSI to gain mining rewards.

Cartesi Machine: The Cartesi Machine is a virtual server based on Linux operated by Cartesi nodes. It is designed to perform DApp calculations before publishing the information to the blockchain. Standard programming languages can be used to build DApps that work in a Linux framework.

Rollups: Cartesi Rollups are a collection of on-chain and off-chain features that provide an Enthusiastic Rollups solution and are the basic foundation for developing DApps. The Cartesi Machine is a virtual machine (VM) that operates a whole Linux OS and executes the back end of each DApp.

Descartes SDK: The Descartes SDK is the most basic framework that DApps can employ to do calculations that would be difficult or unreasonably costly to execute on-chain because of their complexity or the volume of data to be handled.

Carti: Carti is a decentralized product organizer for Cartesi Machines. It gives developers control over when, how, and where their package data is saved, so they can make the experience fit the needs of their customers.

Fundamentals of Cartesi

When was it originated: Cartesi was established in the year 2018

Management Team: Cartesi was established by Erick de Moura, Augusto Teixeira, Diego Nehab, and Colin Steil. Erick de Moura is the current CEO of Cartesi.

Native token: CTSI

What it does: The Cartesi project intends to make decentralized apps more efficient, scalable, and easy to create. CTSI coin delivers scalability to decentralized apps via network nodes in the internet ecosystem.

How does it work: Cartesi uses a unique side chain and other reducing blockchain technology to improve Dapp’s development in different ways. The platform provides a Linux operating system for developing scalable blockchain Decentralized applications. The CTSI token is a cryptocurrency created primarily to reward Cartesi network node operators. Because of the incentive, this guarantees that the network runs smoothly and productively.

CTSI Use Case: CTSI tokens are utilized on the network for staking and network processing fees.

Is it worth Buying Cartesi (CTSI) in 2024?

Since its inception, Cartesi (CTSI), a cryptocurrency project gaining traction among investors, has undergone significant developments. It went public in April 2020 with an initial price of $0.0571. Throughout its journey, CTSI has experienced notable price fluctuations and witnessed substantial growth.

Initially, CTSI experienced a consistent rise in prices, reaching its peak in early January 2021. Despite occasional price fluctuations that suggested a potential collapse, the value of the token persistently ascended, ultimately surging in April 2021.

Currently, Cartesi’s price is approximately $0.1473, indicating its potential for further growth. Experts project that the value of CTSI will continue to rise in 2023 due to increasing scarcity and resulting price appreciation. Investors seeking long-term strategies may find the current pricing point of CTSI appealing, offering the promise of enhancing the token’s value over time. The token’s market capitalization amounts to $108.48 million, with a market dominance of 0.01%. Over the past 24 hours, CTSI’s price has experienced a 4.37% increase.

Cartesi’s historical price data unveils significant milestones. On May 8, 2021, the token reached its all-time high of $1.744300—a remarkable achievement. Conversely, on May 10, 2020, it hit its all-time low at $0.026770—an unexpected slump. Following its peak, CTSI’s price experienced a dip to $0.094652, symbolizing a cycle low. However, it rebounded thereafter to reach a cycle high of $0.353583.

In terms of supply metrics, Cartesi currently has 742.55 million CTSI tokens in circulation out of a total maximum supply of 1.00 billion CTSI tokens. The yearly supply inflation rate amounts to 22.89%, resulting in the production of approximately 138.30 million CTSI tokens last year. Within the cryptocurrency landscape, Cartesi holds the 86th position among Ethereum (ERC20) Tokens and ranks as the 12th player in the Layer 2 sector.

However, Cartesi (CTSI) presents an intriguing investment opportunity in 2023. This is due to its impressive growth history, the potential for further appreciation, and strong position within the market. Although the current sentiment may lean towards bearishness, investors seeking diversification in the cryptocurrency sector may find Cartesi’s long-term prospects and unique features appealing.

Your capital is at risk.

Will the Price of Cartesi (CTSI) Go Up in 2024?

In March 2021, Cartesi partnered with Travala to expand its reach in the travel industry, offering over three million travel products. This collaboration further grew with Gather Network, enabling the utilization of CTSI within their ecosystem.

Cartesi actively sought collaborations to drive growth, joining forces with Avalanche, Elrond, Polygon, and other partners. These strategic alliances significantly bolstered the value of CTSI throughout the year. According to the 2023 price prediction, steady progress is expected, with an average price of $0.3 supported by continuous partnerships and advancements.

In recent developments, Rollups Reference has made significant updates to its on-chain project README, reflecting the latest state of the project. Notably, adding NxN on-chain to the public repository, previously confined to a private NxN repository, is expected to foster increased transparency and collaboration.

Enjoying reading bi-weekly development updates from the Cartesi ecosystem on Discord?

Or just wanting the quick scoop? 🗞️ If you’re the latter, here's your cheat-sheet for the freshest Cartesi tech developments: 🧵/9 pic.twitter.com/jKnDAKRdP0

— Cartesi (@cartesiproject) July 28, 2023

Another key achievement in the crypto space is successfully implementing the Merkle builder data structure. This new feature enables repetitions inside the tree, enhancing the efficiency and robustness of blockchain operations.

In addition, the Prototype & Support team actively contributes to the advancement of blockchain applications. They have introduced a Commit-Reveal Example and an exciting DApp known as the “odd and evens” game. These developments are expected to further drive the adoption and expand the use cases of decentralized applications.

In the realm of Research & Development Meetings, there has been a notable focus on metering solutions. One project that is attracting attention is the zkLinux project. Moreover, during the recent R&D meeting, a wide range of topics related to metering were covered. Experts have been diligently exploring innovative methods to ensure trust and efficiency in the crypto ecosystem. This includes securing untrusted code and considering adversarial and cooperative approaches to metering.

However, with these advancements and collaborative efforts, the crypto market is poised for growth and resilience in 2023, attracting the attention of investors and enthusiasts alike.

Cartesi (CTSI) Price Prediction: Where does Cartesi (CTSI) go from here?

The value of a cryptocurrency hinges on ecosystem growth and community support. CTSI, a versatile project, holds potential as a leading crypto in the coming months. Price prediction is tricky due to its volatility, though historical technical indicators offer insights. External market events can swiftly alter its trajectory; technical indicators only apply under ideal conditions.

CTSI Price Prediction 2023

According to technical analysis, CTSI is one of the most amazing cryptocurrencies to have risen this year. The CTSI price prediction for 2023 forecasts a significant climb in the first half of the year, perhaps reaching $0.23. As with other cryptos, the increase will be gradual, but there will be no sharp drops. With expected partnerships and breakthroughs, the minimum trading price of the Cartesi coin this year could be $0.11, with an average price of $0.18 and a maximum price of $0.27.

CTSI Price Prediction 2024

CTSI has plenty of potential to grow in 2023. It may announce many new partnerships and projects, and we predict the stock will shortly increase above $0.39. However, due to market volatility, CTSI will have an average trading value of $0.34 and a minimum trading fee of $0.33. This is because while the token may be utility-driven, factors may affect the growth of all cryptocurrencies to some extent.

CTSI Price Prediction 2025

With the right kind of market developments, project updates, and community growth, it may be possible to see CTSI trading in the $0.55 range by 2025. We speculate such a figure since CTSI is still a midcap token and has much more room to grow.

Summary

Cartesi is a distributed platform. It is a layer-2 system and the first Blockchain operating system. It enables developers to use Linux and standard programming frameworks to create decentralized logic. Its developers are attempting to address the same issues that other cryptocurrency developers face, such as poor performance, high prices, and difficulty scaling blockchain applications. However, their approach is distinct and effective.

With a few minor variations in value, Cartesi price estimates closely match predictions of a long-term rising trend. Some pricing forecasts are optimistic, while others are pessimistic. For instance, CTSI has grown significantly due to massive investor interest and the incorporation of mainstream developers into the Cartesi ecosystem.

Cartesi may be a worthwhile long-term investment if you are an investor looking for a coin to add to your portfolio. However, before relying on any cryptocurrency prediction market, you must conduct research, understand fundamental analysis, and examine various points of view.

If you’re wondering where to buy Cartesi in 2024, it’s listed on eToro. The platform is licensed and regulated by the FCA. It has one of the best reputations in the industry, providing a wealth of educational resources to help those new to the market learn the ropes.

Other Undervalued DeFi Projects

We recently updated our best altcoins list to include DeFi coin, an undervalued DeFi project (DEFC). Despite the May crypto crash, it rose in price by 350-400 percent that month after completing portions of its roadmap.

It has also already retraced 98.75 percent of its all-time high, as has Terra LUNA, albeit over a year. It’s now at a low price but still higher than presale. It has more upside potential than downside risk and has room to grow in 2024 as the DeFi market cap recovers.

FAQs

Any risk in buying CTSI now?

According to our technical analysts, buying CTSI now carries a high level of risk; it is a poor long-term (1-year) investment. If you want to invest in cryptocurrencies with high returns, CTSI may be the wrong choice. However, your current investment's value may decline in the future.

Is Cartesi a secure network?

Cartesi's features provide high security, which is one of the reasons this technology outperforms competitors' solutions. Its layer two blockchain architecture makes it ideal for developing highly scalable smart contracts using Linux VMs.

Where to buy CTSI

According to the official website, the Cartesi token can be purchased on exchanges such as Binance, Coinbase, Kraken, and Huobi. CTSI could also be converted into fiat currency.

How much will CTSI be worth in 2030?

In terms of pricing, the minimum, maximum, and average prices in 2030 are expected to be around $2.07, $2.20, and $2.14, respectively.

Will CTSI ever hit $1?

According to our technical analysis and Cartesi's price prediction, the CTSI price may reach $1 in 2027.

Bitcoin

Bitcoin