Bancor is a blockchain protocol designed to convert different virtual currency tokens directly and instantly instead of exchanging them on cryptocurrency exchanges. It is a cross-chain cryptocurrency conversion platform currently available on Ethereum and EOS, meaning people can swap tokens without intermediaries. Bancor is a non-custodial, decentralized exchange that enables the creation of liquidity pools to trade crypto assets.

It was founded in 2016 by Galia Benartzi, who designed it to be interoperable on multiple blockchains. Currently, the platform claims to be the only decentralized staking platform that allows you to make passive income via a single-sided deposit. Depositors can earn monthly rewards by staking their idle tokens like Wrapped Bitcoin (WBTC), Ether (ETH), Polygon token (MATIC), and Chainlink token (LINK). The protocol has a unique selling proposition that prevents impermanent loss when you stake your crypto tokens on its platform.

If you’re interested in Bancor and its token, keep reading because this article will walk you through the entire process of purchasing BNT. It will also assist you in comparing various cryptocurrency exchanges for trading BNT.

On this Page:

How to Buy BNT

- Choose an exchange offering BNT token; eToro is highly recommended as FCA, ASIC, and CySEC regulate it.

- Open and verify your trading account at eToro.

- Add funds to your account.

- Search for ‘BNT’ to open charts and trades.

- Enter the amount to trade BNT and push “Trade Now”.

Best Exchange to Buy BNT in July 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

Following is an overview of the investment process with FCA-regulated broker eToro for first-timers who want to purchase COP tokens.

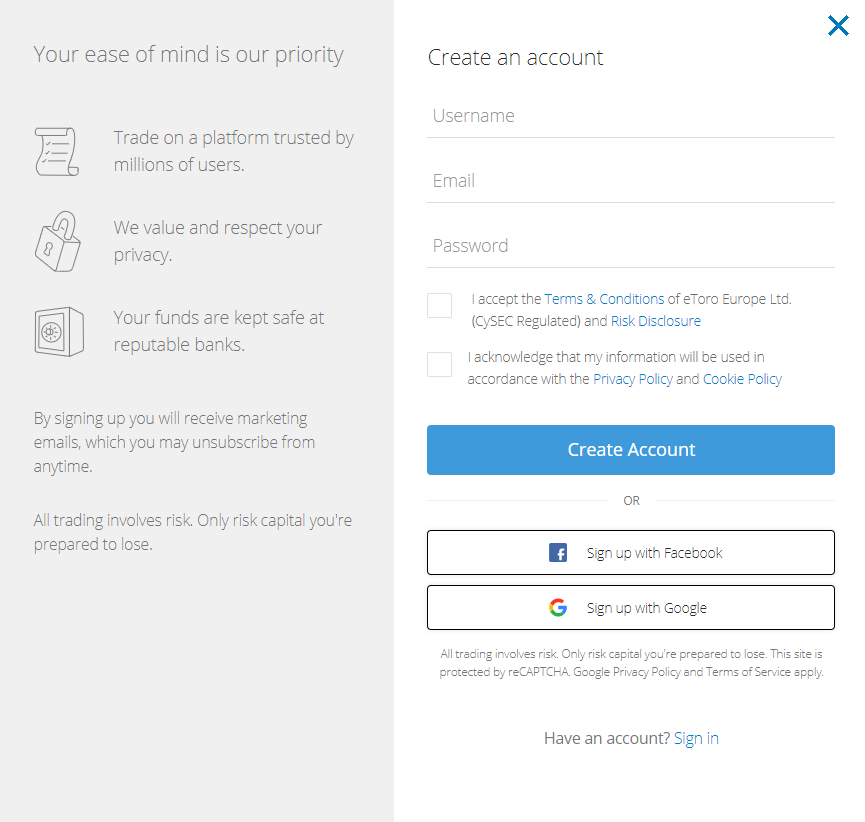

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- Click the “Join Now” or “Trade Now” button on the eToro website.

- You’ll find an electronic form on this page where you can enter all your personal information required to open a new trading account.

- Please complete this form with all the required information.

- eToro allows users to log in using Facebook or Gmail.

- Before submitting your information for consideration, please read eToro’s Terms & Conditions and privacy policy.

- After reviewing the terms, please indicate your agreement by checking the appropriate box.

- Click the “sign-up” button to submit your information.

eToro website homepage

Your capital is at risk.

Step 2: Upload ID

eToro will request a copy of your driver’s license or passport and present identity to ensure compliance with regulatory standards. A copy of the most recent utility bill or bank statement will be required to validate the address. The verification process will begin automatically once the documents are uploaded.

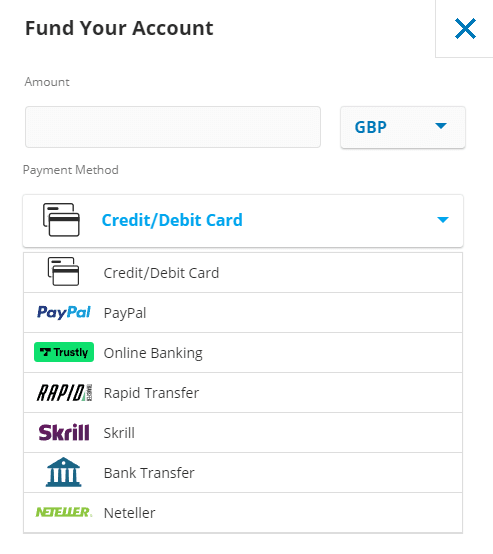

Step 3: Make a Deposit

After submitting supporting documents, the next step is to add deposit funds to your eToro account by connecting a payment method. eToro offers bank transfers, debit/credit cards, e-wallet, or PayPal.

eToro does not charge any fees for deposits. Once you’ve selected a payment method, click the ‘Deposit’ button to complete the transaction.

Deposit methods on eToro

On February 7, 2022, eToro listed the BNT token. There is no need to search for coins on other exchanges because the desired coin is available on eToro.

Step 4: Buy Bancor

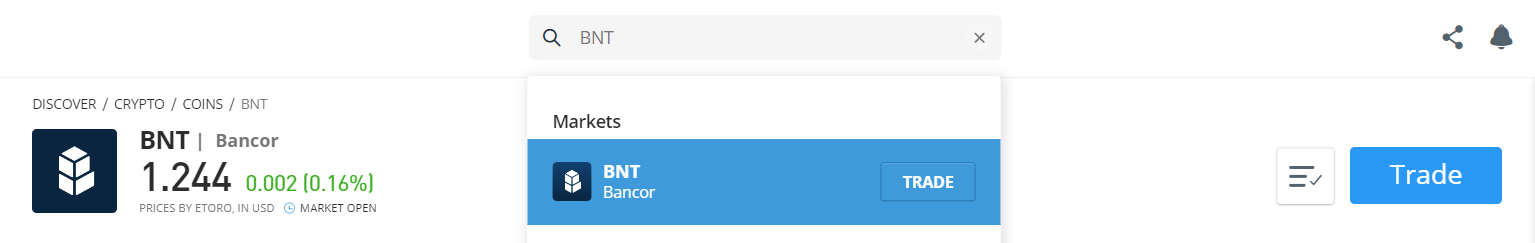

To buy BNT, type Bancor or BNT in the search box and enter the first result that appears.

Searching BNT on eToro

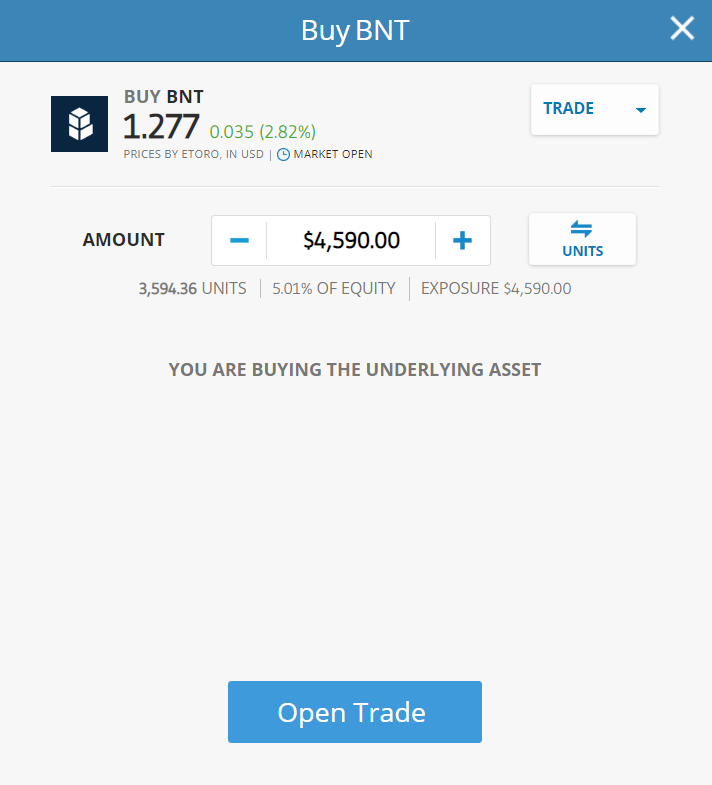

Step 5: Review Bancor Price

This step will take you to an order page to enter the number of BNT coins you want. Then, click ‘Open Trade’ to include the BNT in your portfolio.

Apart from the trading platform, we support storing your digital assets in a third-party wallet. For instance, the eToro Crypto Wallet, which now supports over 120 cryptocurrencies in addition to BNT, is one viable option.

BNT Price Chart on eToro

The good thing is, there’s no maker/taker fee on eToro as they solely charge buy/sell spread.

Step 6: Buy Bancor

Once you click the ‘Trade Now’ button, the order box will add the amount you want to allocate to the Bancor token. Once the order is confirmed, eToro will proceed to execute the purchase, and then you can find the BNT token in your portfolio.

Buy BNT on eToro.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Bancor – Best Platforms

You can purchase BNT tokens on various cryptocurrency platforms; however, this does not imply that you should go with the first provider you come across. Instead, you must carefully evaluate metrics such as fees, security, and features before deciding which broker is best for you. The following are detailed reviews of the top 5 cryptocurrency platforms to buy BNT.

Best Brokers to Buy Bancor

1 – eToro

When selecting a cryptocurrency platform, any trader’s top priority should be the safety of their funds. In this regard, eToro is one of the best brokers because four reputable financial authorities regulate it. In contrast, other well-known platforms operate in the market without a license from any regulatory body. eToro is licensed by the FCA in the United Kingdom, the SEC in the United States, ASIC in Australia, and CySEC in Cyprus.

eToro’s user interface is simple to use and ideal for new traders. In addition, a vast library of tutorials and other educational materials is available to traders who want to learn more about cryptocurrencies and other investment assets. Additionally, it enables you to stake prizes for purchasing Ethereum and storing it in your wallet and Cardano and Tron.

Read more about how to stake crypto.

Trading and transaction fees – eToro’s trading fees are the same as those other companies charge, such as 0.75 percent when buying or selling bitcoin. On eToro, converting between cryptocurrencies costs only 0.1 percent on top of the existing margins. As a result, in 2022, eToro will be the market leader in cryptocurrency trading, with a strong preference for crypto-assets and CFDs.

Customer service options – eToro’s customer service options are limited to email and a support ticket. “Club Members” can access customer service via live chat for a fee.

Deposit Fee – eToro charges a reasonable fee structure to its customers. Depositing eToro is free of charge. Deposit methods include bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller. The minimum deposit amount varies depending on the user region. Before trading, individuals in the United Kingdom and the rest of Europe, for example, must make a minimum deposit of $200. Users in the United States must make a $10 deposit.

eToro accepts Bitcoin, the leading digital asset, and popular altcoins like Ethereum, Aave, XRP, and Graph.

eToro Minimum Deposit

Buying and selling on eToro can be done online and on mobile devices via their mobile app. Opening an eToro account is simple and takes only a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp, founded in 2011, is a well-established cryptocurrency exchange platform that currently supports over 56 different cryptocurrencies. While this is a smaller selection than some exchanges, it is more than sufficient for most beginners, and the simplified fee structure makes it an easier (though slightly more expensive) entry point for newcomers; however, advanced users may prefer access to more coins or lower trading fees.

With its simple fee structure and the ability to purchase cryptocurrency directly from a bank account, credit card, or debit card, Bitstamp may be an excellent option for those new to cryptocurrency who want to stick to the major coins or even more popular altcoins.

The Benefits of Bitstamp

Instant orders: In the United States, you can deposit funds from your bank account into Bitstamp and immediately begin trading; in most states, you can also use a credit or debit card, though this may incur additional fees from Bitstamp and your card issuer.

Limit Orders: Spot the price you wish to buy or sell cryptocurrency.

Stop orders: Spot an entry or exit price for your transactions to mitigate potential losses caused by price volatility.

Trailing stop orders: Set an entry or exit price for your trades based on a predefined bottom, which can be adjusted upward if the price rises above its current value. This ensures that the spread between your stop and current prices is always the same, allowing you to profit from potential gains that would not have been possible with a standard stop order.

Market orders: Buy or sell cryptocurrencies at the best available market price, frequently higher than the price available via an instant order.

Security: All investors performing critical account operations must use two-factor authentication, and Bitstamp claims to store 98 percent of its digital assets in cold storage, with all assets insured. However, as determined by crypto exchange security evaluator CER, it came near the bottom of our study of crypto exchanges regarding security, indicating that it may still have room to improve to become a leader in this category.

Fees for Bitstamp: Bitstamp offers 24-hour customer support, including an emergency phone line. This level of support is uncommon in the cryptocurrency exchange industry, so if speaking with a live support agent over the phone is critical, you should give Bitstamp another look.

Bitstamp charges a flat fee percentage regardless of whether your order is a maker (creates liquidity on the exchange), a taker (reduces liquidity), or made via the trading or quick buy platforms.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Around-the-clock phone support.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Huobi Global was founded in 2013 and is headquartered in Singapore. Founded in China, the company relocated to Singapore after China’s cryptocurrency ban. The exchange prefers “digital asset exchange” over “cryptocurrency exchange.” It supports initial coin offerings (ICOs) and trading over 350 cryptocurrencies.

According to the company, as the blockchain economy evolves, new categories of digital assets will emerge. Huobi Global operates three platforms: a global platform, a Huobi Japan platform, and a Huobi Korea platform. US traders are not permitted to use this exchange’s services. It offers an advanced trading experience that includes margin and futures trading, interactive charts, and limit and stop orders.

Leverage of up to 5% is available for margin trading on the platform. Huobi Global’s fee structure is highly reasonable and competitive compared to other firms.

Deposit – The minimum deposit amount is $100 USD, and additional fees such as deposit, transaction, and withdrawal fees vary by currency.

Fee – Huobi charges a higher fee to those who wish to purchase cryptocurrency using a credit or debit card. Fees are charged at a flat rate of 0.2 percent for both makers and takers. Depending on the scale volume, it can also be as low as 0.1 percent.

Huobi Global provides customer support via email, phone, online chat, ticket system, and social media platforms. It includes several security features, including two-factor authentication, cold storage, account freezing, and Bitcoin reserves.

On August 28, 2020, Huobi listed BNT (Bancor). BNT/USDT, BNT/BTC, and BNT/ETH are the trading pairs that have been made available.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

Crypto.com was founded in 2016 as a global cryptocurrency exchange. It is headquartered in Hong Kong and serves over ten million traders in over 90 countries. It enables you to trade over 250 cryptocurrencies at a low trading fee. The unique selling point of the Crypto.com platform is that it allows users to stake their cryptocurrency. By staking or holding them in a crypto.com wallet, users can earn up to 14.5 percent p.a. interest.

Apart from trading, the exchange provides additional services, including staking rewards, Visa card benefits, NFT trading, and DeFi products. Additionally, the exchange offers access to various educational guides via its university portal. This platform suits users who wish to do more than simply hold their cryptocurrencies.

Crypto.com utilizes a variety of security measures, including MFA or multi-factor authentication. Additionally, it uses whitelisting to safeguard customer accounts. To guard against hacks and losses, the platform maintains compliance monitoring and stores customer funds in cold storage. Crypto.com exchange provides $250,000 in FDIC insurance on dollar balances. Customer service is available via email, live chat, and a help page at Crypto.com.

Cashback – Crypto.com offers five prepaid Visa cards in addition to the Obsidian Card, Midnight Blue Card, Ruby Steel Card, and others. These cards are accepted worldwide, where Visa offers a fixed percentage of cashback on purchases. The Obsidian card, under certain circumstances, offers the highest cashback rate of 8%. The Midnight Blue card earns 1% cashback, while the Ruby Steel card earns 2%. There is no annual fee for using the card, and ATM withdrawals are also free, depending on the card.

Deposit – This platform’s minimum account balance is set at $1. Maker/Taker commissions range from 0.04 to 0.40 percent. Purchases with a credit/debit card are charged at 0% or no fee for 30 days after account opening. Additionally, users can earn up to $2000 per referral.

Cryptot.com listed BNT on 13 August 2020.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a new peer-to-peer (P2P) cryptocurrency derivatives exchange looking to establish itself in the burgeoning crypto margin/leverage trading market. Even though it was founded in March 2018, Bybit quickly became popular among the cryptocurrency trading community and onboarded customers rapidly.

The exchange allows traders worldwide to participate in leveraged margin trading in a select range of crypto products, with digital assets such as BTC, ETH, EOS, and XRP traded with up to 10 Bancor leverage.

Bybit, whose headquarters are in Singapore, is a strictly crypto-to-crypto exchange that does not require its users to undergo stringent KYC verification. It currently generates close to $1 billion in daily trading.

Founders-Ben Zhou founded the BNTany in March 2018. Before becoming the exchange’s CEO, he was the general manager of a forex brokerage business called XM.

Leveraged trading: Bybit Exchange primarily provides perpetual futures products with 100:1 leverage. This suggests they’re attempting to bridge with established exchanges like Binance and Phemex, which offer similar non-expiry futures contracts.

Key Features

Other essential features include:

- 1 Click Coin Swaps: Users can easily swap between supported cryptocurrencies within their accounts.

- 100,000 TPS per contract: 10 times the industry average, resulting in no overloads.

- Leverage up to 10Bancor: Bybit’s generous leverage system allows for increased profit potential.

- Cold Wallet Storage/Manual Withdrawals: Bybit uses cold storage and three daily manual withdrawals to improve security.

- Unlimited Withdrawals: Platform users can make virtually unlimited trades and withdrawals.

- There is no KYC: Accounts can be created and managed using only an email address and a username.

Fee – 0.075 percent is charged to market takers, whereas -0.025 percent is charged to market makers. As a result, market makers will be rewarded when they initiate a deal. This low fee encourages market makers to be active and fill the order book.

Bybit listed Bancor on December 8, 2021. The available trading pair was BNT/USDT.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the top cryptocurrency exchanges globally, designed for experienced traders. It offers relatively low trading fees, and many popular cryptocurrencies can be traded on an intuitive platform.

Binance’s biggest distinguishing features include minimal fees, a robust charting interface, and support for hundreds of coins. Unlike eToro, Binance is a cryptocurrency-focused exchange that does not offer copy trading, FX, commodities, or other financial services.

Binance utilizes two-factor authentication (2FA) and FDIC-insured US dollar (USD) deposits. Additionally, Binance employs device management in the United States and addresses whitelisting and cold storage to safeguard its customers.

Fees: The trading fee Binance charges is only 0.10%, which can be reduced to 0.025% by holding its native token BNB in its wallets. Moreover, Binance charges 3.5 % or $10 for debit card purchases, whichever is bigger, or $15 for US wire transfers.

Binance is one of the largest cryptocurrency platforms, which gives access to over 370 cryptos and thousands of crypto pairs. Binance added BNT/BTC trading pair on 17th October 2017.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is limited.

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase has over 73 million users and is one of the best cryptocurrency platforms. It is a well-known name in the cryptocurrency arena and is suitable for both new and experienced traders. For beginners, it has a separate platform named Coinbase, and for professional traders, it has a more advanced Coinbase Pro platform.

Coinbase was created in San Francisco and is widely regarded as one of the most popular Bitcoin trading platforms in terms of the user base. Coinbase was the first major cryptocurrency exchange to go public in the United States, listing on the Nasdaq in April at $381, valuing the exchange at $99.6 billion fully diluted.

Coinbase offers the purchase and sale of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more than 130 types of different cryptocurrencies for trading. It has a user-friendly and highly functional mobile app allows users to buy/sell, and manage their cryptos. Coinbase also offers a way to earn free crypto to learn about newer digital assets through the Coinbase Earn program. In addition to the earn, while you learn feature, it maintains an impressive library of educational resources.

Fee Structure – Coinbase charges higher fees for smaller transactions than other competitors. However, Coinbase Pro, on the other hand, charges more competitive fees, which is why it is considered a better option for trading. The fee structure of Coinbase is not only expensive but complex as well. The maker/taker charge is 0.5 percent up to $10,000 in volume traded in 30 days, which decreases to 0.35 percent. If your 30-day volume surpasses $300 million, you can trade cryptocurrency for free without paying a maker fee.

Bancor has been available on Coinbase.com and in the Coinbase Android and iOS apps since June 2020. Customers of Coinbase can now trade, send, receive, or store BNT in most Coinbase-supported regions. Moreover, traders can trade these pairs in Coinbase BNT/USD, BNT/BTC, BNT/GBP, and BNT/EUR.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin is a well-known name in the crypto sector as it has established itself as a prominent one-stop shop for all crypto operations. It was launched in 2017, and now it offers more than 200 cryptocurrencies in more than 400 markets worldwide.

Kucoin’s trading fees are among the lowest in the market as it does not charge monthly counts or withdrawal fees. The deposit fee depends on the method of transfer you select. It claims that 1 in 4 crypto holders worldwide use its services because of its solid customer base.

Kucoin offers a broad wide range of cryptocurrencies with about 750 currency pairs. It can get you the experience of less popular coins, which will not be easy to find on popular cryptocurrency exchanges. This platform offers the KuCoin Earn service, which pays interest on cryptocurrencies by staking or lending. Its mobile app also provides its customers with margin trading and trading bots.

The Kucoin fee can be reduced by holding at least 1000 KCS. The maker/taker fee starts at 0.1% and lowers as you level up. Withdrawal fees vary by cryptocurrency.

For US citizens who cannot directly deposit into the Kucoin account, the fees range from 3.5% to 5%. The withdrawal/transfer fees depend on the specific coin.

Kucoin is one of the few exchanges that offer a margin trading feature. It also allows its users to lend their cryptocurrency holdings to others. Users can also hire trading bots for a nominal fee on this platform.

Kucoin listed BNT on its exchange on September 1st, 2020, and supported trading pairs, including BT/USDT, BNT/BTC, and BNT/ETH.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange that enables users to purchase, sell, and trade diverse digital coins. The Hong Kong-based portal was founded in 2012.

Intermediate and professional traders are more likely to use Bitfinex’s trading area, as it features a robust set of chart analysis tools.

Apart from cryptocurrency, a wire transfer is the only option for depositing and withdrawing monies. As with Coinbase, Bitfinex is one of the few platforms that allows you to short cryptocurrencies and use leveraged trading tactics.

Founders – Bitfinex launched in December 2012 as a peer-to-peer Bitcoin exchange, providing consumers with digital asset trading services globally.

Giancarlo Devasini has been Bitfinex’s Chief Financial Officer since 2013 and has played a critical role in the company’s success. Giancarlo Devasini began his career as a physician in 1990, earning a Doctor of Medicine degree from Milan University.

Is Bitfinex a regulated exchange?

Bitfinex Securities Ltd., a provider of blockchain-based investment products, has created a regulated investment exchange (Bitfinex Securities) in the AIFC to improve members’ access to various financial products. As a result, Bitfinex is entirely unregulated. While the corporation is headquartered in Hong Kong and registered in the British Virgin Islands, it is registered in the British Virgin Islands.

Fees and deposit limits – For bank transfer deposits, Bitfinex charges a 0.1 percent fee. For example, if you deposit $10,000, you will be charged a fee of $10. If you fund your account with cryptocurrency, you will be charged a small fee depending on your selected coin.

Fees for withdrawals – Bitfinex imposes a 0.1 percent fee for withdrawals made by bank transfer. If you require funds within 24 hours, you can pay a 1% expedited fee. Alternatively, the fees associated with Bitcoin withdrawals differ according to the coin.

Bitfinex listed Bancor (BNT) on July 26th, 2018, and opened trading for BNT/BTC.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- Support team only available via email

What is Bancor (BNT)?

Bancor is a decentralized exchange built on the Ethereum and EOS blockchains. The protocol employs an automated market maker smart contract to facilitate token trades against token liquidity pools without matching buyers and sellers. The native token of this protocol, BNT, is used to make trades among other smart contract tokens.

It is currently built on the Ethereum and EOS blockchains but is designed to be interoperable with additional blockchains. While initiating the exchange of tokens, the Bancor network token BNT is used by the protocol, which helps keep exchange costs down. Usually, it takes multiple exchanges to move investments around, which makes the process expensive. Of course, decentralized exchanges have reduced costs, but the Bancor network reduces costs and time.

The protocol offers Instant Impermanent Loss Insurance, which brings back the original value of deposited tokens to liquidity providers (LP). Previously, if an LP withdrew tokens after 100 days or more, the insurance was subject to compensating 100% of any impermanent loss. With the upgrade of Bancor3, this can now be achieved right from day one.

The launch of Bancor 3 has also offered dual-sided rewards. Now, third-party protocols are allowed to provide rewards in their pools. As a result, depositors are eligible for dual-sided rewards in the form of BNT and the token in which they choose to stake. Again, both rewards are protected from impermanent loss.

The new upgrade also allowed users to stake BNT in a single pool and earn rewards from the entire Bancor network. In addition, it eliminates the need to move BNT across different pools, reducing the cost of trading and staking tokens on the network and simplifying the incentive process. Anyone can contribute their preferred amount to Bancor liquidity pools without waiting for slots to open because there is no deposit limit.

How does Bancor work?

Although it is a decentralized exchange where users can swap one crypto for the other, there are significant differences between Bancor and other DEXs. For instance, Bancor is powered by its depositors. The funds deposited are used to facilitate trades placed across the world. Anyone can deposit crypto tokens on the Bancor platform and swap their tokens.

In the case of ordinary decentralized exchanges, there is no option to deposit your crypto holdings solely. DEXs are designed so that each trading pair is part of a pool of two crypto assets, and any deposit into that pool must include equal amounts of both assets. In addition, each trading pair gets half of the deposit. In this way, there is a chance that deposits will lose value when vested in a liquidity pool, which is known as an “impermanent loss.”

However, Bancor obviates this issue as it offers single-sided deposits. For example, a user can deposit his crypto, and the second asset in the trading pair will be deposited by the Bancor platform with its native token BNT. This process allows the depositor and Bancor DEX to earn money from users paying exchange fees. The earnings made by the Bancor protocol are used to reimburse the depositor for any impermanent loss.

BNT fundamentals

- What it does: Bancor enables the swap of one crypto to another without an intermediary. It also reduces cost and time while doing so. It is based on the Ethereum and EOS blockchains and provides tokens on smart contract blockchains with built-in price discovery and liquidity.

- Guy Benartzi is the co-founder and CEO, and Yudi Levi is the CTO.

- Date launched: The Bancor was launched in June 2017.

Is it Worth Buying Bancor (BNT) in 2024?

Bancor (BNT) has witnessed significant fluctuations and price swings since its establishment, creating a dynamic market environment. According to data obtained from Coinmarketcap, BNT made its debut in June 2017 at an initial offering price of $4.18.

Within days, the coin’s value plummeted to $1.70, leaving early investors dismayed. However, it later regained some of its losses and reached approximately $3.23 in early September of the same year.

Throughout the year, BNT’s performance showcased a blend of highs and lows. Despite encountering inevitable fluctuations, the coin exhibited resilience by reaching $5 by year-end. The optimism carried over into 2018 as BNT opened strongly at $5.37, generating optimism among traders and investors.

On January 10th, a significant event unfolded when the BNT token surged to an all-time high of $10.4. This remarkable rise was attributed to the token’s listing on various exchanges, enhancing its visibility and appeal to potential buyers. However, this upward momentum proved fleeting as the token encountered an unexpected downturn in early April, plummeting to $2.15.

The subsequent months proved quite turbulent for BNT as its value experienced significant fluctuations. In May, the coin surged to an impressive $5.25 only to gradually decline throughout the rest of the year, ultimately settling at a modest $0.60 by the end of the year.

The year 2021 marked a bullish phase for Bancor as its value saw a significant rally. Starting at $1.26, the coin surged impressively to reach $9.34 within two months.

February and March of that year proved to be highly successful periods for cryptocurrency. However, the momentum was not sustained, as the token underwent a correction over the subsequent three months, resulting in a decline to $2.66 by June.

After a period of correction, BNT entered into a sideways movement phase. It maintained a relatively stable range for several months and eventually reached $3.21 by the end of December. However, as the beginning of 2022 arrived, a bearish trend emerged and pushed the token’s value down to $2.087 by the end of January.

In the subsequent months, various challenges and setbacks arose, with one notable event being a significant drop to $1.26 in May. This decline occurred within a broader market downturn triggered by events like the Terra LUNA price drop.

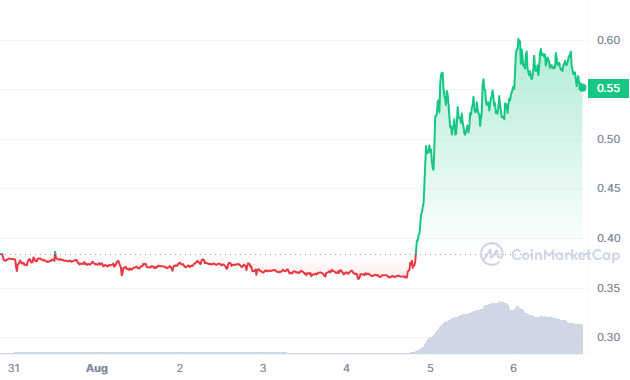

The latter half of 2022 was marked by a struggle for BNT to maintain its price range, hovering between $0.30 and $0.50. Despite sporadic attempts at recovery, the token’s value remained within this challenging range. In mid-2022, the token regained momentum, exhibiting a range-bound trading pattern fluctuating between $0.33 and $0.61.

As of the beginning of 2023, Bancor embarked on a modest recovery, although it struggled to break past the crucial resistance level of $0.61. Despite this, the coin encountered bearish pressure that led to a decline to $0.40. Presently, BNT has managed to maintain a position above $0.35, hinting at a potential for recovery in the near future.

According to the latest data, the current price of the Bancor Network Token is approximately $0.54. It has a 24-hour trading volume of $111.78 million and a market cap of $81.28 million. Within the past 24 hours, this price surged by an impressive 50.45%.

The price history of Bancor Network Token illustrates its fluctuations. On January 11th, 2018, it reached a peak value of $12.00, while on March 13th, 2020, it recorded its lowest point at $0.116162. Currently, the sentiment appears to lean towards bullishness with a Fear & Greed Index reading of 54 (Neutral).

The Bancor Token has a circulating supply of 149.80 million BNT out of its maximum supply of 198.86 million BNT. The token experiences a yearly supply inflation rate of -28.78%. In terms of market cap rankings, it holds the 37th position in the DeFi Coins sector, the 16th position in the Exchange Tokens sector, and the 100th position in the Ethereum (ERC20) Tokens sector.

The token’s journey has resembled a thrilling roller coaster ride, marked by unexpected ups and downs and significant milestones along the way. Investors are cautiously attentive, searching for promising signs of a brighter future amidst the constantly evolving landscape of the crypto market.

Cryptocurrency experts cautiously maintain a sense of optimism amidst the recent developments surrounding Bancor. The journey of this particular coin, marked by moments of growth, challenges, and stabilization, vividly demonstrates the volatile and ever-evolving nature of the cryptocurrency market.

Will the Price of Bancor (BNT) Go Up in 2024?

The cryptocurrency market in 2023 is experiencing a strong comeback, filling investors with renewed optimism. The early months of this year have shown significant recovery across various crypto assets, raising hopes for consistent growth.

Amidst this backdrop, industry observers and experts eagerly speculate on the potential fate of Bancor (BNT), a digital token poised to reclaim its lost momentum. It holds promising prospects for significant price surges throughout the year.

Industry insiders, including experts from coincodex, have shared their insights on the Bancor Network Token, projecting a promising outlook. Projections indicate that BNT is expected to trade between $0.492971 and $0.727531. Of particular interest is the upper threshold of this price range—a potential increase of 34.77%—which could lead to BNT reaching a price point of $0.727531.

The feasibility of this optimistic price target is grounded in several factors that are actively shaping the dynamics of the cryptocurrency landscape. Investors display heightened interest in Bancor, allocating their resources and capital to this digital asset. This trend is rooted in a series of pivotal developments within the Bancor network’s ecosystem, which have transpired recently.

One notable advancement that has captured widespread attention is the introduction of Carbon, Bancor’s innovative on-chain trading protocol. The distinguishing feature of Carbon lies in its ability to facilitate customizable limit and range orders, revolutionizing traditional trading approaches. A particularly intriguing aspect of this disruptive protocol is its implementation of auto-rotating, one-directional liquidity. Not surprisingly, this visionary concept has generated immense interest and enthusiasm within the cryptocurrency community.

The Carbon protocol has been operating during a beta testing phase for several months. It has successfully allowed users to partake in automated decentralized exchange (DEX) trading strategies. Throughout this testing and refinement period, various automated trading strategies tailored specifically for the cryptocurrency market have emerged and proven effective.

Integral to the design of Carbon’s architecture is its seamless integration with Bancor’s Fast Lane arbitrage protocol. This innovative mechanism facilitates and executes arbitrage activities involving Carbon, Bancor, and external exchanges. By capitalizing on lucrative arbitrage opportunities and reinvesting the resulting profits back into the Bancor ecosystem, the Fast Lane protocol strengthens Bancor’s overall value proposition.

The developments happening in Bancor have a promising trajectory for 2023. As the wider crypto market recovers, Bancor is positioned to take advantage of renewed investor interest and technological innovation, which could lead to significant price gains. Throughout the year, market participants and enthusiasts will closely monitor Bancor’s performance with excitement to see its projected price potential come to fruition.

Bancor Mining: Can You Mine BNT?

Bancor’s native token, BNT, cannot be mined, so participants must use investment or trading strategies to increase their holdings. The market cap of BNT is determined by its price fluctuations on the open market.

Potential investors will calculate profitability based on valuation and trading measures, not mining tasks. Since BNT is a smart token, it functions differently than a normal cryptocurrency, so there is no way to mine BNT.

Bancor Price Predictions: Where Does BNT Go from Here?

Following are the BNT price predictions made using different analytical websites’ algorithms.

Gov.Capital: According to their projections, the price of Bancor after a year would be $3.02, thereby providing a return of more than 1000% to its investors.

UptoBrain: It has been forecasted that there will be a jump in the prices of BNT tokens in 2023. These tokens are predicted to surpass $3.37 by the end of this year.

Price Prediction: As per its projections, the average price of Bancor would be $0.61, while its maximum price would be $0.69.

Bancor Price Prediction 2023

If we look at the efforts put in by the development team and community of BNT, we can say that there is more to come from the Bancor protocol in the coming years, which will add up to the value of BNT.

The average price for BNT in 2023 has been predicted at $0.61, depending on the market conditions, while at the same time, the maximum level is anticipated at $0.69 for 2023.

Bancor Price Prediction 2024

For 2024, the analysts have been more bullish as they see a range of adoption and interest from investors. The token BNT could reach the value of $1.04 by the end of 2024 due to substantial cooperation with financial institutions. However, the average price for 2024 has been predicted to be $0.90.

Bancor Price Prediction 2025

In 2025, analysts believe that the Bancor token will touch new highs as they see impressive long-term growth in the price. The average price of BNT has been predicted for 2025 at $1.28, and the prices could surge as much as $1.53 in the near future.

Summary

Bancor is getting more and more attention from financial institutions lately due to its unique feature of eliminating the need for a third party to convert one coin into another. While helping users convert tokens, the platform reduces the process’s cost and gives them incentives. Depositors can also earn rewards for staking their idle tokens. This has increased the coin’s popularity and made it an attractive investment opportunity.

If you are interested in buying the native token of the Bancor project, BNT, many exchanges offer you trading and holding it. However, we recommend using the most popular brokerage platform, eToro. It is the only platform with the most licenses from regulatory bodies, including FCA, ASIC, CySEC, etc. The process of opening an account at eToro is straightforward.

As many upgrades are in the works, the future potential of BNT suggests bullish momentum. However, BNT comes with risks as the market is highly volatile. However, risks can be mitigated by adopting some techniques. One of them is using automated trading bots. Earnings from BNT are also taxable, and there is a long process for filing tax returns in the United States.

The prices of BNT/USD have reached their lowest levels, and it is suggested that this could be a good entry point. So, if you are interested, open an account with eToro and start trading BNT.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risks in buying Bancor now?

The BNT/USD price is trading at its level and is likely to gain support at $0.50. The odds of a bullish reversal remain high above the $1.00 mark; therefore, there's less risk of loss in buying Bancor now.

Is it safe to buy BNT?

The BNT token, as an ERC-20 token, has the same security as the second largest cryptocurrency. Therefore, one shouldn't be concerned about its safety.

Where can I spend my BNT?

BNT coins aren't generally accepted as a mode of payment. However, BNT tokens can help the pools get money. They can also be used on the Bancor platform to change one crypto into another.

Will Bancor ever hit $10?

Analysts predict that the Bancor token will reach new highs by 2025, citing the price's impressive long-term growth. The average price of BNT is expected to be $1.28 in 2025, with prices potentially rising to $1.53 in the near future.

Bitcoin

Bitcoin