Balancer is an automated market maker (AMM) developed on the Ethereum blockchain that seeks to incentivize a distributed network of computers to operate an exchange where users can buy and sell any cryptocurrency. Balancer enables the trading of crypto assets without needing a financial intermediary like an exchange.

BAL is a prominent emerging decentralized finance protocol built on the Ethereum blockchain. It is an open and accessible alternative to centralized exchanges that allows the trade of ETH and ERC-20 tokens in a permissionless environment. Users can trade supported tokens on this platform against one another, which creates liquidity pools on the platform. These trades of financial assets provide liquidity to the protocol, which rewards the liquidity providers and users.

The article includes a step-by-step guide to purchasing the BAL token. It compares well-known exchanges that allow BAL trading, and everything needed to buy BAL is listed below.

On this Page:

How to Buy BAL

- Choose an exchange offering BAL token; eToro is highly recommended as FCA, ASIC, and CySEC regulate it.

- Open and verify your trading account at eToro.

- Add funds to your account.

- Search for ‘BAL’ to open charts and trades.

- Enter the amount to trade BAL and push “Trade Now.”

Best Exchange to Buy BAL in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

Following is an overview of the investment process with FCA-regulated broker eToro for first-timers who want to purchase BAL tokens.

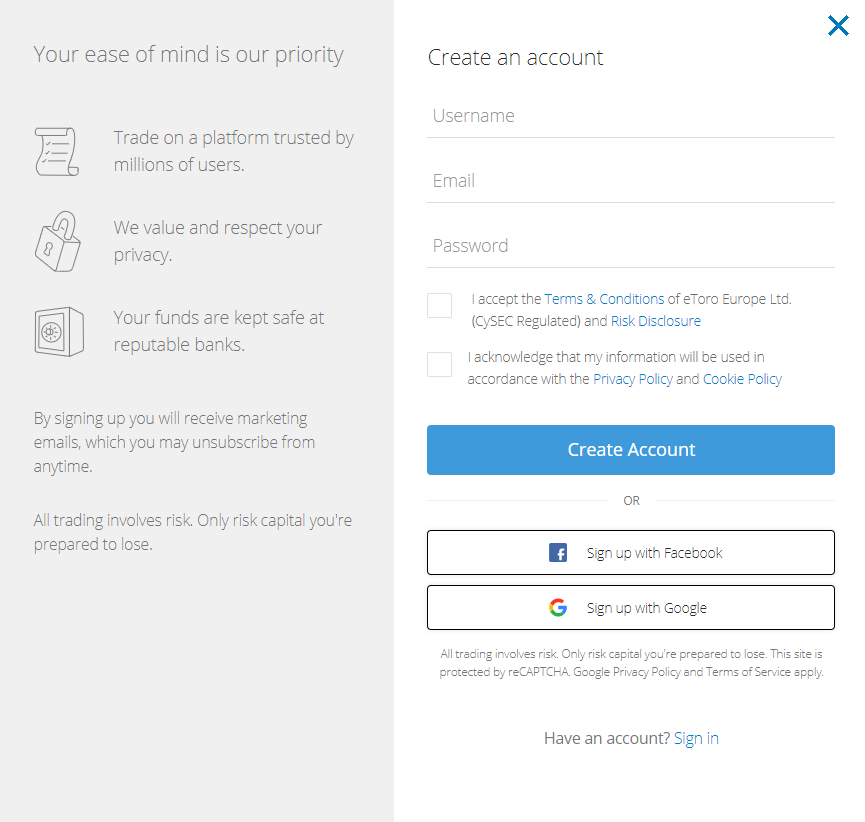

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, click the “Join Now” or “Trade Now” button.

- You’ll find an electronic form on this page where you can enter all your personal information required to open a new trading account.

- Please fill out this form with all of the necessary information.

- Users can log in to eToro using Facebook or Gmail.

- Before submitting your information for consideration, please read eToro’s Terms & Conditions and privacy policy.

- Please indicate your agreement by checking the appropriate box after reviewing all the terms.

- To submit your information, click the “sign-up” button.

eToro website homepage

Your capital is at risk.

Step 2: Upload ID

eToro will require supporting documents to verify your identity, including your passport copy or driver’s license. Moreover, a copy of the most recent utility bill or bank statement will also be needed as proof of address. Once the documents are uploaded, the verification process will begin automatically.

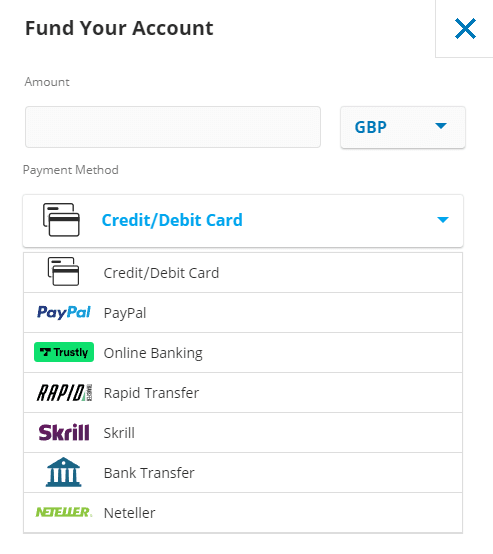

Step 3: Make a Deposit

After submitting supporting documents, the next step is to add deposit funds to your eToro account by connecting a payment method. eToro accepts bank transfers, debit or credit cards, e-wallets, and PayPal as payment methods.

Deposit methods on eToro

On February 7, 2022, eToro listed the BAL token. There is no need to search for coins on other exchanges because the desired coin is available on eToro.

Step 4: Buy Bancor

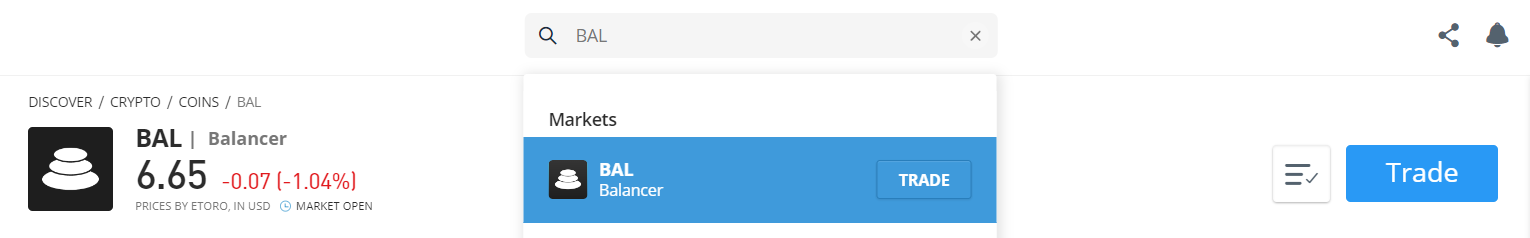

To purchase BAL, enter Balancer or BAL into the search box and click on the first result.

Searching BAL on eToro

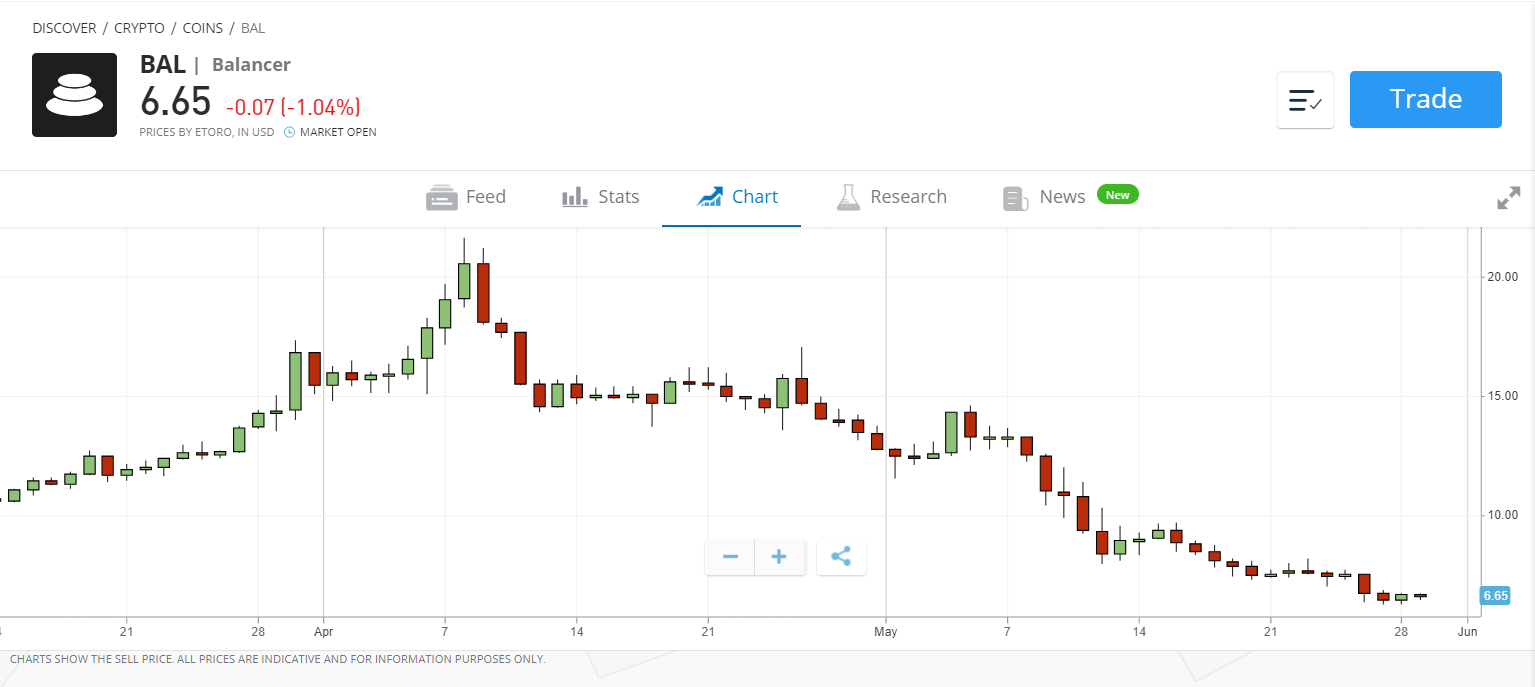

Step 5: Review Balancer Price

This step will take you to an order page where you can enter the quantity of BAL coins you wish to purchase. After that, click ‘Open Trade’ to add the BAL to your portfolio.

Besides the trading platform, we recommend using third-party wallets for storing your digital assets. For instance, one viable option is the eToro Crypto Wallet, which now supports over 120 cryptocurrencies in addition to BAL.

BAL Price Chart on eToro

The good news is that eToro does not charge a maker/taker fee; instead, they charge a buy/sell spread.

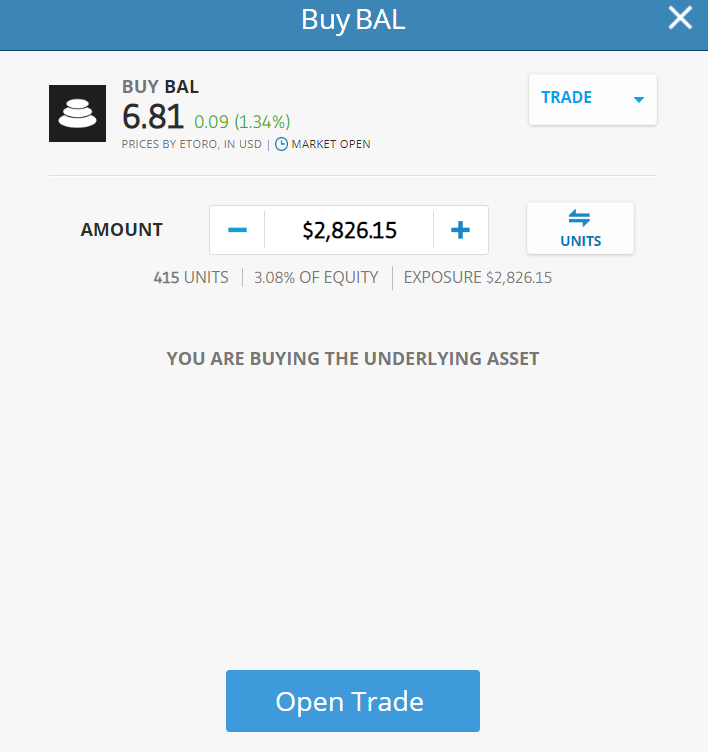

Step 6: Buy Balancer

When you click the ‘Trade Now’ button, an order box will appear in which you can enter the amount you want to allocate to the Balancer token. Once the order is confirmed, eToro will complete the transaction, and the BAL token will be added to your portfolio.

Buy BAL on eToro.

On February 7, 2022, eToro listed the BAL token. There is no need to search for the desired coin on other exchanges because it is available on eToro.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Balancer – Best Platforms

You can buy BAL tokens on various cryptocurrency platforms; however, this does not imply that you should go with the first provider you come across. Instead, you must carefully evaluate metrics such as fees, security, and features before deciding which broker is best for you.

The following are detailed reviews of the top 5 cryptocurrency platforms where you can buy BAL.

Best Brokers to Buy Balancer

1 – eToro

eToro made its name with its social investing platform, an innovative tool allowing users to mimic other investors’ trades. Established in 2007, eToro has over 20 million users in 140 countries, including the United States.

In 2022, the company began offering stocks and ETFs to customers in the United States. Previously, while eToro operated multi-asset brokerages in other countries (offering stocks, commodities, and forex trading), customers in the United States could only trade cryptocurrencies on the platform.

Virtual trading: Each eToro account has a $100,000 virtual trading account, allowing you to practice trading with simulated money.

Additionally, it enables you to stake prizes for purchasing Ethereum and storing it in your wallet and Cardano and Tron.

Read more about how to stake crypto.

Trading and transaction fees – EToro charges a 1% fee to buy or sell crypto assets on its platforms. There is no commission on stock and ETF trades, and when you sell a stock, the broker pays the regulatory transaction fees. In addition, there is a $75 account transfer fee for partial and complete transfers.

Trading pairs for cryptocurrencies: Direct crypto-to-crypto trading is not available to users in the United States. However, a crypto-to-crypto conversion option is available for Bitcoin, Litecoin, Bitcoin Cash, Ethereum, and Stellar, similar to Coinbase’s offering.

Customer service options – eToro’s customer service options are limited to email and a support ticket. “Club Members” can access customer service via live chat for a fee.

eToro Social trading

EToro’s CopyTrader allows you to automatically copy and trade based on the movements of other traders. This is how it works: You select an investor to mimic, and with the click of a button, you can begin automatically mirroring their positions (with the option of a stop-loss level to limit potential losses). The service is currently only available for cryptocurrency, but eToro says it plans to add copy trading for stocks and ETFs.

The bare minimum for copying a user is $200. Users can copy up to 100 traders at the same time. Users can view millions of other traders’ portfolios, statistics, and risk scores even if they do not use CopyTrader. (While they can access all public profiles worldwide, US clients can only copy other US users.)

eToro accepts Bitcoin, the leading digital asset, and popular altcoins like Ethereum, Aave, XRP, and Graph.

Deposit Fee – eToro charges a reasonable fee structure to its customers. Depositing eToro is free of charge. Deposit methods include bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller. The minimum deposit amount varies depending on the user region.

Minimum Deposit: EToro’s minimum deposit amount is $10 if you use a debit card or connect a bank account. In addition, the company allows you to invest in fractional shares of stock, which means you can buy a small portion of a share for any amount greater than $10.

eToro Minimum Deposit

On eToro, you can buy and sell online and via their mobile app. Whereas opening an eToro account is simple and takes only a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA, or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp, launched in 2011, is a well-established cryptocurrency exchange site offering over 56 cryptocurrencies. While this is a smaller selection than some exchanges, it is more than enough to satisfy most beginners, and its simplified fee structure makes it an easier (though slightly more expensive) point of entry for newcomers; however, more advanced users may prefer access to more coins or lower trading fees.

Bitstamp, with its straightforward fee structure and the ability to buy crypto using fiat cash directly from a bank account, credit card, or debit card, can be an excellent alternative for individuals new to cryptocurrency who want to stick to leading coins or even more popular altcoins.

Bitstamp Advantages

Instant orders: In the United States, you can use automated clearing house (ACH) transactions to deposit funds from your bank account into Bitstamp and begin trading immediately; in most states, you can also use a credit or debit card, though this may incur higher fees from Bitstamp and your card issuer.

Limit Orders: Determine the price at which you want to purchase or sell a specific cryptocurrency.

Stop orders: Set an entry or exit price for your transactions to limit potential losses due to price volatility.

Trailing stop orders: Set an entrance or exit price for your trades based on a predefined bottom, which can be modified upward if the price climbs over its present value. This ensures that the spread between your stop price and the current price is always the same, allowing you to capture possible gains that you would not have been able to collect with a basic stop order.

Market orders: Purchase or sell cryptocurrencies at the best available market price, sometimes higher than the price accessible through an instant order.

Security: All investors performing necessary account operations must now use two-factor authentication. Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured. However, as determined by crypto exchange security evaluator CER, it placed near the bottom of our study of crypto exchanges regarding security, indicating that it may have room to improve to become a leader in this category.

Bitstamp provides 24-hour customer service, including a phone support line for urgent inquiries. This type of assistance is difficult to find in the crypto exchange industry, so if speaking with a support agent over the phone is vital to you, you should give Bitstamp a second look.

Fees for Bitstamp: Unlike most cryptocurrency exchanges, Bitstamp charges a flat fee percentage whether your order is a maker (creates liquidity on the exchange), a taker (reduces liquidity), or made using the trading or quick buy platforms.

For traders with less than $10,000 in monthly transaction volume, trading costs will be 0.5 percent. Fees have been decreased to 0.25 percent for people trading more than $10,000 but less than $20,000, and they will continue to fall as trading volume grows.

Bitstamp listed Balancer (BAL) on September 03, 2020, and GALA/USD trading pairs are available on the exchange.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Around-the-clock phone support.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Leon Li founded Huobi Global in 2013 and was initially based in China. Following China’s crackdown on cryptocurrency exchanges in 2017, Huobi Global’s headquarters were relocated to Singapore and the Republic of Seychelles. Huobi Global is available in most countries worldwide but does not support a few, including the United States and Japan (though users in Japan can use Huobi Japan instead).

Huobi Global provides crypto-to-crypto trading with a wide range of supported assets and reasonable trading fees. Limit, stop, trigger orders and margin and futures trading are available on the platform, which is intended for active traders and institutional investors. In addition, OTC trade desks, derivatives, and custom trading tools are available to institutional traders.

Huobi Global Cryptocurrency Exchanges

Huobi Global provides users access to over 348 cryptocurrencies, making it one of the largest crypto selections on a centralized exchange. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Dogecoin (DOGE), and Polkadot (DOT). New cryptocurrencies are also added regularly, and you can view Huobi’s complete list of support assets here. Huobi also has its exchange token, Huobi Token (HT), and token holders are eligible for fee reductions.

Deposit: The minimum deposit amount is $100 USD, and additional fees such as deposit fees, transaction fees, and withdrawal fees vary by currency.

Fees: Huobi Global has reasonable fees for trading cryptocurrency but higher fees for purchasing cryptocurrency with a credit or debit card. Although fiat deposits (such as US dollars) are free, users must pay trading fees. Fees are charged at a flat rate of 0.2 percent for both makers and takers. Depending on the scale volume, it can also be as low as 0.1 percent.

Fees for Huobi Global Trading: Huobi Global charges fees on a maker-taker basis, with discounts available for high-volume traders who hold HT tokens. Whether you are a maker or a taker in the transaction, you will pay different fees. Professional accounts necessitate a high trading volume (more than 1,000 BTC every 30 days) and a larger HT holdings requirement (at least 2,000 total).

Houbi Global provides customer support via email, phone, online chat, ticket system, and social media platforms. It includes several security features, including two-factor authentication, cold storage, account freezing, and Bitcoin reserves.

August 8, 2020, Houbi listed Balancer (BAL). BAL/USDT, BAL/BTC, and BAL/ETH are the trading pairs that have been made available.

Pros & Cons of the Houbi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

Crypto.com, a global cryptocurrency exchange, was founded in 2016. It is based in Hong Kong serves over ten million traders in over 90 countries, and allows you to trade more than 250 cryptocurrencies for a low trading fee.

The Crypto.com platform distinguishes itself by allowing users to stake their cryptocurrency. Users can earn up to 14.5 percent p.a. interest by staking or holding them in a crypto.com wallet.

The exchange provides additional services, including staking rewards, Visa card benefits, NFT trading, and DeFi products. Additionally, the exchange offers access to various educational guides via its university portal. This platform suits users who wish to do more than simply hold their cryptocurrencies.

Crypto.com has a more extensive selection of cryptocurrencies on its exchange than any other service reviewed by NerdWallet, with approximately 180 cryptocurrencies available.

Low fees with cash: Crypto.com has no trading or transaction fees on Crypto.com if you pay with money transferred from your bank account via ACH or an automated clearinghouse.

High fees for credit or debit card transactions: Fees for credit or debit card purchases were charged 2.99 percent in late 2021. Even though these fees can be avoided with some effort, this has historically been the most convenient way to fund a Crypto.com account with cash.

Crypto.com announced in December 2021 that it would begin accepting instant ACH transactions. Previously, customers had to go through their banks to complete ACH or wire transfers, which could take days.

Deposit – This platform’s minimum account balance is $1. The maker/taker commission ranges from 0.04 percent to 0.40 percent. Credit/debit card purchases are charged at 0% or no fee for the first 30 days after opening the account. Furthermore, users can earn up to $2000 per referral.

Cryptot.com listed (Balancer) BAL on February 1, 2021. A Balancer Pool is an automated market maker with specific key characteristics that allow it to function as a self-balancing weighted portfolio and price sensor. Balancer flips the index fund concept on its head. Instead of paying fees to portfolio managers to rebalance your portfolio, you pay fees to traders who rebalance your portfolio by looking for arbitrage opportunities.

Users of the Crypto.com App can now purchase BAL at actual cost using USD, EUR, GBP, and 20+ fiat currencies and spend it at over 60M merchants worldwide via the Crypto.com Visa Card.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a new peer-to-peer (P2P) cryptocurrency derivatives exchange looking to establish itself in the burgeoning crypto margin/leverage trading market. Although founded in March 2018, Bybit is quickly becoming popular among the cryptocurrency trading community and onboarding customers rapidly.

The exchange allows traders worldwide to engage in leveraged margin trading in a select range of crypto products, with digital assets such as BTC, ETH, EOS, and XRP trading with up to 100x leverage.

Bybit, which has its headquarters in Singapore, is a strictly crypto-to-crypto exchange that does not require its users to undergo stringent KYC verification. It currently generates close to $1 billion in daily trading.

Founders Behind ByBit

Ben Zhou founded Bybit in March 2018, and he previously established himself in Fintech as XM’s China District General Manager for seven years. XM is a leading brokering service provider, and Bybit’s core team has experience in investment banking and the Forex industry, as well as being early blockchain adopters.

The exchange is based in Singapore, with additional Hong Kong and Taiwan offices. It is registered in the British Virgin Islands.

Leveraged trading: Bybit Exchange primarily provides perpetual futures products with 100:1 leverage. This suggests they’re attempting to bridge with established exchanges like Binance and Phemex, which offer similar non-expiry futures contracts.

Key Features

Additional noteworthy characteristics include the following:

- Coin Swaps in a Single Click – Users can easily swap between supported cryptocurrencies from within their accounts.

- 100,000 TPS per contract – ten times the industry standard, ensuring no overloads.

- Leverage up to 100x – Bybit’s generous leverage system enables you to maximize your profits.

- Bybit utilizes cold wallet storage and three daily manual withdrawals to enhance security.

- Unlimited Withdrawals – Platform users have virtually unlimited trading and withdrawal capabilities.

- No, Know Your Customer (KYC) – Accounts can be created and managed with just an email address and a username.

Fee – 0.075 percent is charged to market takers, whereas -0.025 percent is charged to market makers. As a result, market makers will be rewarded when they initiate a deal. This low fee encourages market makers to be active and fill the order book.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the largest cryptocurrency exchanges in the world, offering low fees, access to hundreds of digital currencies, and enhanced tools for experienced investors. However, Binance is not accessible to customers in the United States; if you live there, you must use Binance.US, which has less functionality. Read our complete Binance review to see if it’s the right trading platform for you.

Binance is well-known for its lightning-fast trade execution. Before founding Binance in China in 2017, founder Changpeng Zhao devised a new system for corresponding orders for high-speed traders. While it does not have as many digital currencies and crypto-to-crypto trading pairs as its parent corporation, Binance does have a selection of nearly 60 cryptocurrencies and continues to outperform many other US exchanges.

Minimum Deposit: The minimum trade in the United States is $10.

Fees for trading and transactions: Binance.US charges a flat 0.1 percent spot trading fee, which is lower than the fees charged by many other US exchanges, such as eToro (about 0.75 percent for Bitcoin trades) and Coinbase (which charges 0.5 percent for trading fees plus a flat fee of up to $2.99 per trade, depending on trade amount). Binance.US also has a 0.5 percent Instant Buy/Sell fee for traders in a hurry.

Binance adds a 4.5 percent fee to debit card transfers (unlike its global brokerage, Binance.

Credit card purchases are not permitted in the United States). Cash deposits and withdrawals via ACH bank transfers are free of charge, whereas bank wire transfers cost $15 per transaction. The fees for cryptocurrency withdrawals vary depending on the cryptocurrency; Bitcoin withdrawals cost 0.0005 percent with a minimum withdrawal amount of 0.001 bitcoin.

Binance is one of the largest cryptocurrency platforms, which gives access to over 370 cryptos and thousands of crypto pairs. Binance added BAL/BNB, BAL/BTC, and BAL/BUSD trading pair on 6th August 2020.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is limited.

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase is the largest cryptocurrency exchange in the United States, trading nearly 100 cryptocurrencies. Coinbase fees, on the other hand, can be perplexing and higher than those of some competitors. While Coinbase provides appealing security features, cryptocurrency trading is highly volatile, so always consider the risks.

Trading platforms: Coinbase users can trade on the original Coinbase platform, allowing users to purchase cryptocurrency with US dollars and Coinbase Pro. Coinbase Pro, formerly GDAX, has advanced charting functions, allowing users to conduct crypto-to-crypto transactions and place market, limit, and stop orders.

Coinbase, Earn: An innovative way to “earn while you learn.” Coinbase offers video classes and exams to educate users about cryptocurrency trading and some available cryptocurrencies. Users can also earn specific cryptocurrencies by taking the classes.

Fees: Coinbase sometimes charges higher fees (and has a more complicated fee structure) than other cryptocurrency exchanges. Coinbase is ideal for Cryptocurrency traders who want convenience. Traders who want to convert one cryptocurrency to another quickly.

The minimum trade amount required to purchase cryptocurrency on Coinbase is $2.

Fees for trading and transactions: Coinbase’s fee structure is a perplexing jumble of elements that are determined by two factors:

- Coinbase charges a 0.5 percent spread on cryptocurrency sales and purchases; rates may vary depending on market fluctuations.

- Coinbase also charges a fee, either a flat fee or a variable fee, based on the amount purchased and the payment method used.

Since October 2021, Balancer (BAL) has been available on Coinbase.com and in the Coinbase Android and iOS apps. Coinbase customers can now trade, send, receive, and store BAL in most Coinbase-supported regions.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin is a well-known name in the cryptocurrency sector, having established itself as a prominent one-stop shop for all crypto operations. It was founded in 2017 and now offers over 200 cryptocurrencies in over 400 markets worldwide.

Crypto Products: Kucoin provides a diverse range of cryptocurrencies, with approximately 750 currency pairs. It can provide you with experience with less popular coins that are difficult to find on popular cryptocurrency exchanges. This platform offers the KuCoin Earn service, which pays interest on cryptocurrencies through staking or lending. Its mobile app also provides its customers with margin trading and trading bots.

Fee: Kucoin’s trading fees are among the lowest in the market because it does not charge monthly or withdrawal fees. The deposit fee is determined by the method of transfer you choose. Because of its large customer base, it claims that one in every four cryptocurrency holders uses its services.

By holding at least 1000 KCS, the Kucoin fee can be reduced. The maker/taker fee begins at 0.1 percent and decreases as you progress through the levels. Withdrawal fees differ depending on the cryptocurrency.

Fees range from 3.5 percent to 5 percent for US citizens who cannot deposit directly into their Kucoin account. The withdrawal/transfer fees vary depending on the coin.

Kucoin is one of the few exchanges that provide margin trading. It also allows its users to lend their cryptocurrency holdings to others. Users can also hire trading bots for a nominal fee on this platform.

On September 02, 2021, Kucoin listed Balancer (BAL) on its exchange, with supported trading pairs including BAL/USDT, BAL/BTC, and BAL/ETH.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex was established in 2012, making it one of the oldest cryptocurrency exchanges. This exchange, designed for professional and institutional traders, has some of the industry’s highest BTC/USDT volume, thanks partly to the 100x leverage it provides traders.

Bitfinex supports various order types, margin trading, and over-the-counter (OTC) trading, making it an excellent platform for experienced traders seeking advanced options and low fees. It is, however, not available in the United States.

Founders: Bitfinex, founded by Giancarlo Devasini and Raphael Nicolle, was one of the first cryptocurrency exchanges to provide peer-to-peer margin trading. Even though this feature helped Bitfinex stand out among an ever-expanding list of competitors, Bitfinex has been the victim of multiple hacks and was recently fined by US regulators.

Despite its long history, Bitfinex is still a popular exchange among professional traders and institutional investors. However, potential users should exercise caution, given the company’s history of security and regulatory issues.

Fees: Bitfinex charges reasonable fees, though not the lowest in the industry. While most traders will pay between 0.1 percent and 0.2 percent per trade, those with high trading volumes may see their fees drop to zero. Users who trade more than $7.5 million monthly can place free maker trades. Discounts are also available for those who hold USDt LEO in their accounts.

Security: Following several major breaches in the past, Bitfinex has increased its security. It supports two-factor authentication (2FA) and wallet address whitelisting, and it keeps 99.5 percent of user funds in multi-signature cold storage.

This exchange has also instituted ongoing account monitoring to aid in the detection of any suspicious activity. It tracks login information and IP addresses, and users can freeze their accounts if they believe their data has been compromised.

Bitfinex listed Balancer (BAL) on October 3rd, 2020, and opened trading with US Dollar (BAL/USD) and tether (BAL/USDt).

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

Lack of Regulation

-

US citizens are not accepted.

-

Expensive trading fees

What is Balancer (BAL)?

Balancer is a modern form of a decentralized exchange, also known as an automated market maker. It uses the ratio of assets shared in a liquidity pool to determine the asset’s value. The price of each asset changes when users make trades by adding or removing liquidity from one side of a pool. This changes the pooling ratio, so the cost of each asset also changes.

The Balancer Protocol operates different pools, including private, shared, and smart pools.

- Private pools make the owner the pool’s sole contributor to liquidity and give the owner control over the pool. It means all the parameters become mutable by the owner.

- Shared Pools are explicitly designed for liquidity providers. The LPs get Balancer Pool Tokens (BOTs) in earnings or rewards for providing liquidity.

- Smart contracts control smart pools and are similar to private pools. They also receive BPTs. This pool allows anyone to contribute liquidity to the pool.

The company behind the protocol, Balancer Labs, was founded in 2018 by Fernand Martinell and Mike McDonald. It was started as a research program at the software firm BlockScience; Martinelli and McDonald co-founded the project, where the first was an entrepreneur and the second was a security engineer. Balancer serves traders and investors who want to swap their assets or provide liquidity without relying on a centralized exchange. The platform’s functionality is similar to that of Uniswap and Sushi, but it also includes several unique features. The main difference between those famous platforms and Balancer is that the flexibility and control it provides to pool owners is much more attractive.

Balancer liquidity providers earn whenever swaps are conducted through pools. The unique feature of Balancer is that pool managers can set their fees ranging from 0.0001% to 10%. Another essential feature is allowing pool owners to include up to eight different assets in their pool. With the multi-asset pool, users can create flexible portfolios that traders can automatically rebalance. This feature eliminates the need to be routed through ETH, which also helps reduce traders’ slippage.

In May 2021, the Balancer development team released an enhanced version named Balancer V2. The improved gas efficiency, reduced trading costs, separated the AMM logic from token management, made it possible to change the AMM logic, added internal token balances, and optimized efficiency for high-frequency traders.

How does the Balancer (BAL) work?

The settlement of trades on the Balancer platform is not done by ordering books; instead, a new concept known as Balancer Pools was introduced. The pools are made up of two to eight different cryptocurrencies that provide the liquidity that traders need.

The ratio of the token is first set when the balancer pool is created. A user allocates the percentage of each asset to the pool, for example, 25% of ETH, 25% of BTC, and 50% of USDT. Once the user initiates the trade, the pool is rebalanced. Tokens are reduced from the pool, which rebalances the ratio of tokens within the pool. This ensures that each asset has the same value as the rest of the pool.

If a user provides half of his ETH tokens in the pool and doubles the amount of BTC, the relative value of Ether and Bitcoin in the pool will not change. That would still constitute 25% of the pool’s total value.

The Balancer system automatically figures out the best available price from the range of available pools while conducting the trade.

For instance, the Balancer uses a Smart Order Routing System, ensuring that trades achieve the highest yield. In addition, it considers the fees, gas costs, and the amount of money that was traded during the trade. Furthermore, the pool creators can also set the fee for extracting liquidity from their pool at 0.0001% to 10%. Finally, the fee is split between those that provide liquidity to the pool.

BAL Fundamentals

- What it does: BAL is an Ethereum token that powers the Balancer protocol. The network is an automated market maker that lets anyone create or add liquidity to the trading pools. In return, they earn customizable trading fees.

- Management team: Fernando Martinelli is co-founder and CEO, Mike McDonald is co-founder and CTO, Kristen Stone is COO, and Timur Badretdinov is a front-end developer.

- Date launched: The Balancer was launched in March 2020.

Is it Worth Buying Balancer (BAL) in 2024?

Despite the market downturn in 2022, Balancer remained a standout cryptocurrency. It offers a unique opportunity for traders, enabling them to pay for portfolio rebalancing and explore arbitrage. This platform assists investors in managing costs and earning fees while holding ERC 20 tokens allows users to profit from Balancer pools.

In the realm of cryptocurrency markets, the latest price analysis reveals a slight upswing for Balancer (BAL). As of today’s trading activity, the price of Balancer has reached $4.27, indicating a modest increase of 0.48% over the last 24 hours. Moreover, the trading volume during this period amounted to around $8.42 million, contributing to the coin’s market capitalization of $218.61 million.

Despite its relatively modest market cap, Balancer maintains a fractional market dominance of 0.02%. These metrics position Balancer as the 48th most prominent player in the Ethereum (ERC20) Tokens sector, showcasing its presence in the competitive crypto landscape.

This particular digital asset has experienced price fluctuations over time. On May 4, 2021, Balancer reached its peak, with a record-breaking trade at $74.83. In contrast, its lowest point of $3.65 was recorded on June 18, 2022.

This later observation indicated a significant decline from its highest point. The price dropped to its lowest after reaching an all-time high (ATH) of $3.65. Conversely, the price increased to $9.15 after hitting the lowest point in the previous cycle, emphasizing the volatility of the coin’s value.

The current sentiment surrounding Balancer’s price prediction is inclined toward a bearish outlook. In contrast, the Fear & Greed Index currently stands at 50, indicating a neutral sentiment prevailing among market participants.

Balancer’s circulating supply currently stands at 51.23 million BAL tokens, a portion of the coin’s overall maximum supply of 96.15 million BAL. In the past year, an annual supply inflation rate of 21.47% has resulted in the creation of 9.06 million BAL tokens. This increase in supply dynamics significantly affects the token’s market performance.

When it comes to technical analysis, the recent data from August 5, 2023, at 12:24 reveals a nuanced sentiment. Specifically, 10 technical indicators suggest bullish signals, while a greater number of 20 indicates bearish signals. This combination of conflicting indicators highlights the intricate of predicting a Balancer’s near-term trajectory.

However, the price developments of Balancer are still influenced by various factors. Market analysts and traders closely monitor the movements of this dynamic cryptocurrency, carefully interpreting both optimistic and cautious signals to understand how it navigates through the complex interplay of market forces.

Will the Price of Balancer (BAL) Go Up in 2024?

Balancer’s value lies in its ability to utilize assets effectively. Despite fluctuations in demand, its reliance on automated market makers (AMMs) presents a potential source of income. The enhancement of Balancer’s worth is achieved through the expansion of trading pools and partnerships with organizations such as Fjord Foundry, Fjord NFTs, and Prime DAO. The collaboration with PrimeDAO supports Balancer DAO, while Fjord

Recent developments show that Balancer is collaborating with Avalanche to strengthen the expansion of Liquid Staked Tokens and introduce an innovative suite of DeFi technologies previously inaccessible. Unlike Bitcoin’s energy-intensive Proof of Work (PoW) or Ethereum’s staking-based Proof of Stake (PoS), Avalanche implements the efficient “Snow Consensus” mechanism.

Knee deep in the powder. 🏂

Balancer is LIVE on @avax.

Dive into the details.🔻https://t.co/zVFVh7amQ0

— Balancer (@Balancer) August 4, 2023

In this model, nodes are chosen to construct blocks. These blocks are then compared using a random sub-sample method. If most validators concur on a transaction, the block is swiftly finalized, resulting in improved throughput and energy efficiency.

The scalability solution of the network resides in its “Subnets” – unique ecosystems with specific rules for clusters of blockchains that cater to a wide range of use cases, from decentralized finance (DeFi) to gaming. By deploying a Balancer on the Contract Chain (C-Chain) within Avalanche, innovative pools will stimulate liquidity growth. Furthermore, there are more integrations expected in the future. Considering its potential, Balancer appears to be a promising cryptocurrency investment for 2023.

According to a technical analysis projection, experts anticipate that Balancer’s 200-day Simple Moving Average (SMA) is expected to decline in the upcoming month. The estimated value of the SMA is approximately $5.53 by September 3, 2023. Concurrently, Balancer’s short-term 50-day SMA is projected to reach around $4.35 by the same date.

The Relative Strength Index (RSI), a popular momentum oscillator, is widely used to determine whether a cryptocurrency is being traded in an oversold state (below 30) or an overbought state (above 70). The RSI value for Balancer stands at 34.79, indicating a neutral position for the BAL market. This suggests that there is no significant bias towards either overbought or oversold conditions at this particular time.

Balancer Mining: Can You Mine BAL?

No, Balancer’s native token BAL cannot be mined in the same way that Bitcoin or Ethereum can. However, it is because it does not employ a proof-of-work mechanism. On the other hand, Balancer Protocol provides its users with additional ways to earn BAL tokens.

One of them is in the mining of liquids. Each week, approximately 145K BAL tokens are distributed to users in exchange for providing liquidity to the network. The goal is to provide a strong incentive for early adopters to increase their liquidity and become involved in governance.

Balancer Price Predictions: Where Does BAL Go from Here?

Balancer has witnessed a major increase in price since the beginning of 2023. But that has largely been due to Bitcoin’s increased market traction. Furthermore, last year’s bullish tendencies that Balancer built evaporated from the cryptocurrency market. Experts now have a realistic outlook on this token.

The short-term Balancer price prediction remains bullish, with its 200-day simple moving average and 50-day moving average showing a buy signal. Also, the BAL token is currently accumulating above $6, and the current RSI is 53. These factors show that bulls support this token that has not been under or oversold.

That points to the fact that people are looking at Balancer as a practical investment. They are not overly bullish, and the current price shows just that.

Balancer Price Prediction 2023

Balancer went on a bullish momentum at the start of the year, but that subsided in February. The token has finally hit an accumulation range between $4.2 and $7.4. But if more developments come along, the price of BAL can go up to $9 by the end of 2023. We aren’t going higher because we are not entirely out of the crypto winter. More updates and integrations, if they are well publicized, can further act as a catalyst and pump the BAL price.

Balancer Price Prediction 2024

The long-term forecast for Balancer still puts it inside the “Buy zone.” And by 2024, we believe that much of the effects of crypto winter will disappear. A new stabilized market will start to set in, which will push the BAL price to $12 by the end of 2024. Another significant impact on the BAL price will be Bitcoin halving which will arrive in 2024.

Balancer Price Prediction 2025

2025 will see most cryptocurrency markets regulated and more DeFi protocols arriving. Balancer will likely receive the impact of both. Provided the regulations that arrive are progressive, and the DeFi protocols that choose Balancer are worth an investor’s time, we can see the Balance price surpassing $18 in 2025.

Balancer Price Prediction 2026 and Beyond

More adoptions, more integration, and better knowledge of the crypto market will be the primary catalyst pushing the BAL price higher. If another major bearish scenario does not happen, we will likely see Balancer reaching $25 in 2026.

But will Balancer cross its all-time high? While it is always possible, the cryptocurrency market has grown more conscious. So, it would not be prudent to expect the price of Balancer to increase to a massive scale as it did in 2021.

Summary

After going through all the aspects concerning the Balancer protocol, we can say that it is an AMM that allows individuals to benefit or earn money from their idle digital assets. Of course, traders can swap assets without fulfilling the KYC verification processes.

Whether BAL is a good investment depends highly on an investor’s risk tolerance. The liquidity of Balancer is constantly improving, which makes the platform cheap and highly flexible. In addition, the platform offers eight different assets that can be included in a portfolio, which makes it attractive for those investors looking to diversify their portfolio, supply liquidity, and earn from the tokens that lie only in their wallets.

It is advised to be responsible while investing in cryptocurrencies and not invest more than you can afford to lose. The cryptocurrency market is highly volatile and is subject to risk. Traders are also advised to file their taxes on cryptocurrency earnings and use automated trading bots to increase their chances of winning.

There are many cryptocurrency exchanges offering trading in BAL tokens. We recommend using the eToro platform, which is highly regulated and a prominent name in the market.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risks in buying Balancer now?

Balancer has set a goal of completing more integrations this year, making it an excellent investment opportunity. Although the price is currently falling, which may cause some investors to be concerned, the future prospects indicate great growth potential, making it a less risky investment.

Should I buy BAL?

BAL can be a profitable investment because a variety of factors influences its price movements. The demand for BAL is expected to rise this year due to an increase in the number of users and partnerships. If you want to make money in the long run, you should invest in BAL.

Is it safe to buy BAL?

Balancer keeps security a top priority as it has been fully audited three times by Trail of Bits, ConsenSys, and OpenZeppelin. Balancer does not support tokens that do not conform to the ERC-20 standard.

Where can I spend my BAL?

Users can create various types of liquidity pools, as well as add liquidity to public pools to earn a portion of the fees. They can also cast ballots on governance protocols.

Will Balancer ever hit $100?

Given its price history, there is a slim chance that BAL will reach $100 in the near future. However, in the long run, it may reach $25 by the end of 2026.

Bitcoin

Bitcoin