With the growth of the cryptocurrency market, new coins are emerging with different use cases. Ankr is also one of the new crypto projects that have entered into the potential of decentralized finance. A blockchain-based DeFi infrastructure and Web3 platform called Web3 was launched in 2017 as part of this project. It allows people to stake on other blockchains.

The main purpose of Ankr is to enable easy access to Web3 and enhance the efficiency of blockchain infrastructures. An Ethereum-based token, ANKR, powers the platform that can be used for staking, governance, payments, and decentralized app creation. The platform supports more than 40 blockchain protocols for development and staking.

If you are interested in ANKR, this guide will provide you with all the necessary information and will prepare you to enter the most user-friendly trading experience on the market to purchase ANKR.

On this Page:

How to Buy Ankr (ANKR)

- Choose an exchange offering ANKR token; eToro is highly recommended.

- Open and verify your trading account at eToro.

- Add funds into your account.

- Search for ‘ANKR’ to open charts and trades.

- Enter the amount to trade ANKR and push “Trade Now”.

Best Exchange to Buy ANKR in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

Opening a free eToro account is simple, as the platform is extremely user-friendly, especially for beginners.

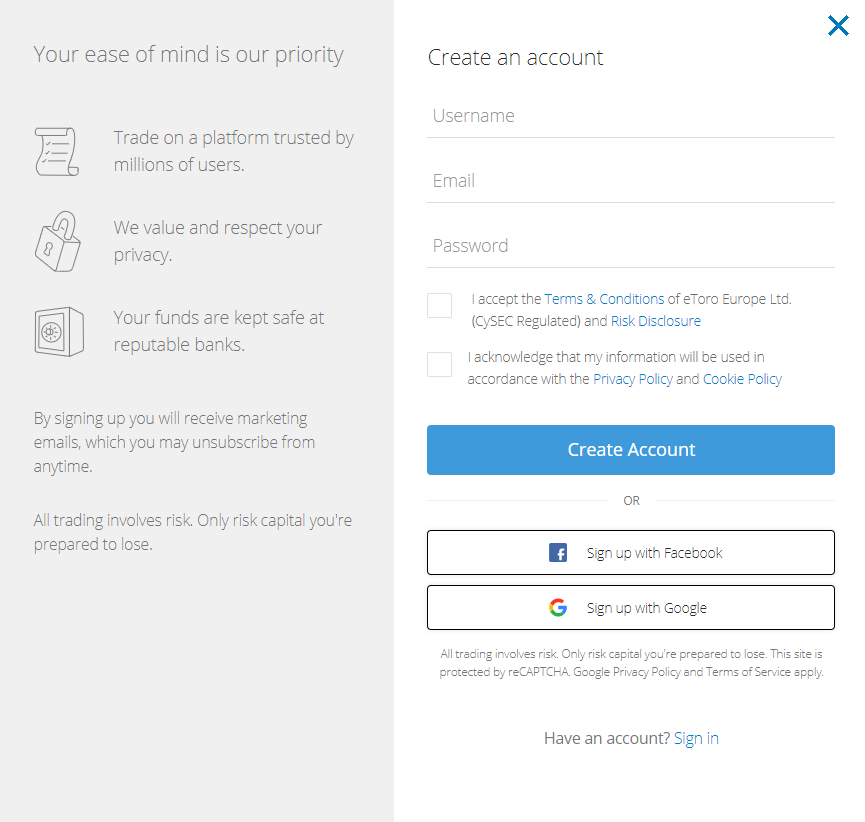

Step 1: Open an Account

To open a new trading account, please follow the steps outlined below.

- On the eToro website, click the “Join Now” or “Trade Now” button.

- It has a form on this page where you can put in all of the personal information you need to open a new trading account.

- Please complete this form completely.

- You can log in with either Facebook or Gmail.

- Before submitting your information for consideration, please review eToro’s terms and conditions and privacy statement.

- Please check the box if you agree with all of the terms after you read them.

- Submit your information by clicking the “sign-up” button.

eToro website homepage

If you’re interested in using the eToro mobile app on iOS or Android, check out our guide to the eToro app. It includes screenshots demonstrating the app’s appearance and functionality.

Your capital is at risk.

Step 2: Upload ID

During this stage of the process, the eToro website will request that you scan and upload your proof of identity.This can be a passport, an ID card, or a bank statement; exact requirements vary depending on the broker. In addition, some online brokers will request that you send physical copies of your documents to them. This has the potential to slow down the account opening process significantly. Fortunately, in the case of eToro, this can be done electronically.

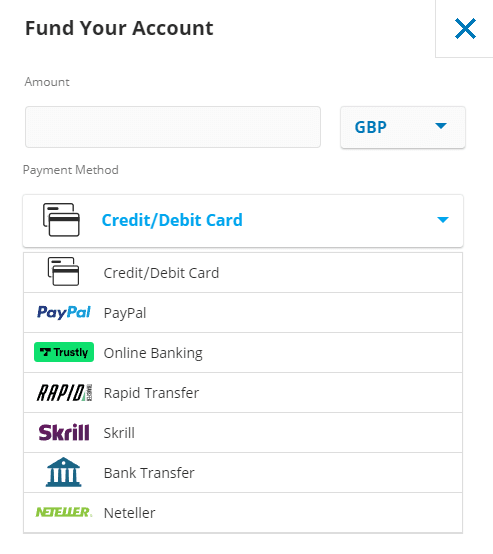

Step 3: Make a Deposit

Following the submission of supporting documents, the next step is to deposit funds into your eToro account by linking a payment method. eToro accepts bank transfers, debit/credit cards, e-wallet, and PayPal as payment methods.

Deposit methods on eToro

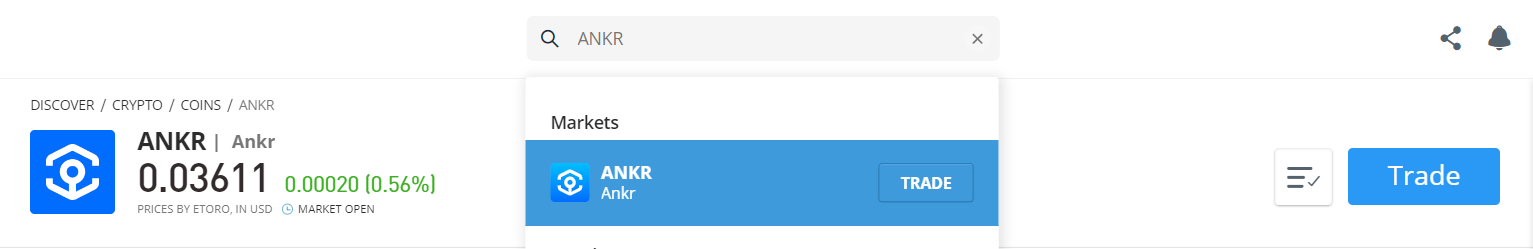

Step 4: Buy Ankr (ANKR)

Using the search bar, find ANKR on an eToro account that has been funded recently. Click on the “Trade” button as the result appears and it will lead to the chart page.

Searching ANKR on eToro

Step 5: Review Ankr Price

On this page, we can check out the price chart, news feeds, stats related to Ankr, and the latest research data. After performing technical and fundamental analysis, click on the “Trade” button to enter details related to your entry, exit, and trading volume.

ANKR Price Chart on eToro

The good news is that eToro does not charge a maker/taker fee because they only charge for the buy/sell spread.

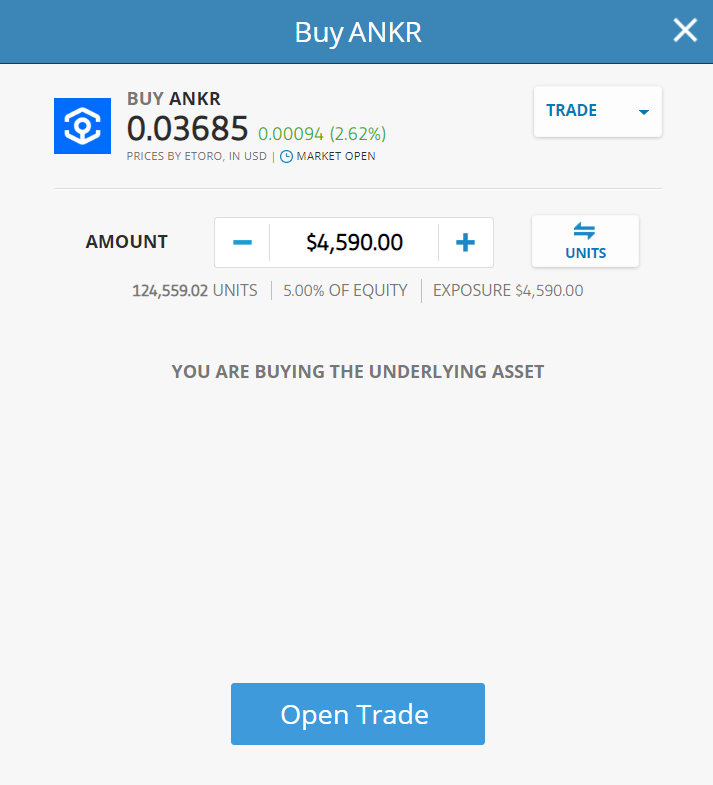

Step 6: Buy Ankr

Once you click on the “Trade Now” button, the order box will appear where you can add the amount you want to allocate to the Ankr token. Once the order is confirmed, eToro will proceed to execute the purchase, and then you can find the ANKR token in your portfolio.

Buy ANKR on eToro

eToro listed the ANKR token on February 3, 2022. As the desired coin is available on eToro, there is no need to search for it on other exchanges.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Ankr – Best Platforms

You can buy the ANKR token on many cryptocurrency platforms, but it does not mean that you choose the first provider that comes across. Instead, you must carefully assess metrics like fees, safety, and features, and then you should decide which broker suits you best.

The following are in-depth reviews of the top cryptocurrency platforms to buy ANKR.

Best Brokers to Buy Ankr

eToro rose to prominence due to its groundbreaking social investing platform, which allows users to mimic the transactions of other investors. The number one priority of any trader should be the safety of their funds while choosing a cryptocurrency platform.

In this regard, eToro is one of the best brokers as it is regulated by four reputable financial authorities, while there are more famous platforms working in the market without having a license from any regulatory body. eToro is licensed by the FCA in the United Kingdom, the SEC in the United States, ASIC in Australia, and CySEC in Cyprus.

The user interface of eToro is straightforward to use and is best for new traders. In addition, an extensive library of tutorials and other educational materials allows traders to learn about cryptocurrencies and other investment assets.

Additionally, it now enables you to stake prizes for purchasing Ethereum and storing it in your wallet, as well as Cardano and Tron.

Read more about how to stake crypto.

The platform offers to buy ANKR on a spread-only basis.

Deposit Methods – Payment options accepted by eToro include debit and credit cards, e-wallets, Paypal, Skrill, and bank transfers. The bank transfer might take a waiting period of 1-3 days.

Trading and transaction fees – eToro prices for cryptocurrencies are equal to those on other platforms, such as 0.75 percent for buying or selling bitcoin. Converting from one cryptocurrency to another on eToro costs only 0.1 percent more than the current spreads.

As a result, by 2022, eToro have established itself as a top crypto trading broker, with a strong preference for crypto-assets and CFDs.

Deposit Fee – Users of eToro can take advantage of a reasonable pricing structure. There are no deposit fees at eToro.

Depending on the user’s region, the minimum deposit varies. For those in the United Kingdom and the majority of Europe, a minimum deposit of $200 is required before trading can commence. A $10 deposit is required for users in the United States.

eToro offers Bitcoin, the most prominent cryptocurrency, and famous altcoins like Ethereum, Aave, XRP, Graph, and others.

eToro Minimum Deposit

On eToro, you can buy and sell both online and using their mobile app on your smartphone or tablet. The registration process for an eToro account is simple and takes only a few minutes.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Supports Apple ID, Google, and Facebook login

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy / sell spread large on altcoins

Your capital is at risk.

2 – Huobi

Huobi is one of the largest global crypto exchanges as it ranks in the top three by trading volume. Leon Li established it in 2013, which makes it one of the oldest online exchanges around. It was first in China, but after China banned cryptocurrencies, the platform moved to the Seychelles and Singapore.

It offers trading in about 380 cryptocurrencies. Apart from cryptocurrencies, it also offers ICO tokens, which has helped make it one of the biggest and most prominent crypto exchange platforms. It has more than 3 million registered accounts and has expanded its infrastructure to the USA, South Korea, and Japan; and has its token named the Houbi Token (HT), which was originally issued in January 2018.

The Republic of Seychelles regulates the platform. Furthermore, it is also regulated by the FCA in the UK. It complies with the KYC policies as well. Huobi also offers margin trading for BTC, LTC, and ETH with 5X leverage. The exchange offers the latest technological advancements like 2-factor authentication in terms of security. It also keeps 98% of clients’ assets in cold storage to prevent hacks.

Deposit – Huobi accepts more than 90 deposit and withdrawal methods, including Faster Payments, US ABA transfer, SWIFT International Transfer, Visa/Mastercard, USD Balance, SEN, and more. Instead of cash, the platform also accepts deposits in cryptocurrencies like XRP, BTC, LTC, and their token, HT.

Fee – The minimum deposit fee is $100. The withdrawal fee on international wire transfers is 1%. For cryptocurrency withdrawals, it is 0.0001BTC and 0.001 LTC. The trading fee is flat and charged at 0.2%, which can go down to 0.1% for customers dealing in larger trading volumes. The maker fee is usually 0.02%, and the taker fee is 0.04%.

Huobi Global has many ways for customers to get help, like email, phone, online chat, ticket system, and social media. This platform’s additional unique features include Huobi Wallet, Huobi Mall, Huobi Prime, Huobi, Eco Chain, and Mobile App. Users can also earn rewards by completing tasks and inviting friends.

Huobi listed ANKR on April 1, 2021. Trading was available with ANKR/USDT.

Pros & Cons of the Huobi platform:

- Impressive trading platform

- More than 350 cryptocurrencies

- High level cyber security

- Strong customer support

- Low trading fees

- Professional trading tools

- Mobile app

- 24/7 customer support

- No fiat deposits or withdrawals

- Not available in the US.

- Complex account registration process

3 – Crypto.com

The cryptocurrency exchange, Crypto.com, was founded in 2016. It stands out as a one-stop shop for all your cryptocurrency transactions, which makes it a good fit for investors of any experience level. However, the trading interface of this exchange might be too much for newbies. This cryptocurrency exchange offers its own native cryptocurrency called Cronos (CRO). According to the founders of this exchange, the vision of crypto.com is a future where cryptocurrencies will be a standard investment class rather than just a curiosity. The unique features of this platform are Cashback Visa Cards and High-Interest Rates.

The platform offers five prepaid Visa Cards, each available with five different reward tiers, including the Obsidian Card, Midnight Blue Card, Ruby Steel Card, Royal Indigo of Jade Green, and Frosted Rose Gold/Ice White. Each reward tier has a different reward amount based on the amount of CRO staked on the card. These cards can also be received on popular subscriptions like Spotify, Netflix, and Amazon Prime. The highest reward is 8% on a stake of 5 million CRO and can be cashed out through the Obsidian card.

Other cards like Midnight Blue can give up to 1% cash back, Ruby Steel Card up to 2%, Royal Indigo of Jade Green offers 3% cashback, and Ice White/Frosted Rose Gold offers 5% cash back rewards.

Crypto.com also offers earnings with an interest rate by choosing to loan your cryptocurrency to others. The Earn Program can let you earn as much as 14.5% on your deposits. It is one of the highest percentages of interest rates offered by cryptocurrency exchanges. Another unique feature of Crypto.com is that it allows you to use cryptocurrency in the real world. You can use your cryptocurrency to make purchases of goods and services through the exchange. It is made possible via the Crypto Visa Cards offered by the platform.

Fee – The fee structure of crypto.com is somewhat complex. The minimum account balance is set at $1 on this platform. The maker/taker fee varies according to the 30-day trading volume. The maker fee ranges from 0.036% to 0.40%, and the taker fee ranges from 0.090% to 0.40%. Furthermore, no fee is charged for transferring money from a bank account.

Deposit Methods – Payment methods include credit/debit cards, which charge only 3%. Paypal is a payment method available in addition to an ACH transfer and a wire transfer. It is also used as a form of promotion and offers a $10 sign-up bonus and up to $2000 for referring to the platform.

Crypto.com provides a vast set of services to its customers, including trading, buying, and selling services and goods with crypto, staking rewards, cashback rewards, Visa cards, DeFi products, a separate NFT platform, and much more. It is one platform with a massive number of services. The exchange also offers educational guides through its University Portal. It also has a mobile app available on the Apple Store and Google Playstore. The platform is best suited for those who want to do extra with their cryptocurrency holdings.

Deposit – The minimum account balance on this platform is set at $1. The Maker/Taker fees range between 0.04 and 0.40 percent. Credit/debit card purchases are charged at 0% or no fee during the first 30 days of account opening. In addition, users can earn up to $2000 for each friend they refer.

Security – In terms of security, Crypto.com uses security measures like multi-factor authentication and whitelisting to keep customer accounts safe. In addition, the platform stores the deposits made by customers offline in cold storage to prevent hacks. The exchange also delivers $250,000 in FDIC insurance on dollar balances.

Customer support at Crypto.com can be reached through email, live chat, and a help page. Cryptot.com listed ANKR on 13th October 2020.

Pros & Cons of the Crypto.com platform:

- 250+ cryptocurrencies

- Separate NFT platform

- No fees to send crypto to others via mobile app

- Upto 8% cash back via its own Visa card

- Price alerts

- Upto 14.5% p.a. interest earnings

- Competitive fee

- Tax support available

- Pay more for lower balances

- Not available for New York residents

- Limited services for US platform

- No customer service via phone

- No crypto to crypto trading

4 – Bybit

Bybit is a peer-to-peer (P2P) cryptocurrency derivatives exchange that aims to break into the rapidly growing cryptocurrency margin and leverage the trading market. When Bybit went public in March of this year, it quickly became a major player in the cryptocurrency trading industry and began accepting customers.

Only a few types of cryptocurrencies can be traded on the exchange, but they can be leveraged up to 100 times. This means that people from all over the world can trade these goods in exchange.

Bybit, based in Singapore, is a crypto-to-crypto exchange that does not require customers to go through onerous KYC verification and presently generates up to $1 billion in daily trading.

Founders: The company was started in March 2018 by Ben Zhou. Before becoming the exchange’s CEO, he was the general manager of a forex brokerage firm called XM.

Leveraged trading: Bybit Exchange specializes in perpetual futures with 100:1 leverage. This indicates that they seek to compete with existing exchanges such as Binance and Phemex, which provide non-expiry futures contracts.

Key Features

Other essential features include:

- 1 Click Coin Swaps – Within their accounts, users can quickly switch between supported coins.

- 100,000 TPS per contract – 10 times the industry average, resulting in no overloads.

- Leverage up to 100x – Bybit’s generous leverage system allows for increased profit potential.

- Cold Wallet Storage/Manual Withdrawals – Bybit uses cold storage and three daily manual withdrawals to improve security.

- Unlimited Withdrawals – Platform users can make virtually unlimited trades and withdrawals.

- There is no KYC– Accounts can be created and managed using only an email address and a username.

Fee – Market takers pay 0.075 percent, while market makers pay -0.025 percent. Thus, when a market maker opens a trade, they will be compensated. This low fee encourages market makers to be active and fill the order book.

Bybit listed Ankr on November 25, 2021. The available trading pair was ANKR/USDT.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

5 – Binance

Binance is one of the top 100 cryptocurrency exchanges globally, and it is basically designed for experienced traders. It offers relatively low trading fees, and a wide range of popular cryptocurrencies are available to trade on an intuitive platform.

Binance’s main focus is only on cryptocurrencies as it does not offer other investment assets like eToro, which offers a wide variety of tradeable assets. It has become one of the top platforms because of its features like secured funds, extensive charting options, zero-fee purchases, and efficient customer support. Binance uses the ANKR security function named SAFU to allocate 10% of the trading fees to protect its users.

Fees: The trading fees charged by Binance are only 0.10%, which can further be reduced to 0.025% by holding its native token BNB in their wallets. It also enables its customers to earn rewards by participating in a staking program that allows 30% APR on specific cryptos.

Binance is one of the largest cryptocurrency platforms, which gives access to over 500 cryptos and thousands of crypto pairs. Binance added the ANKR/BTC trading pair on December 11th, 2021.

Pros & Cons of the Binance platform:

- Approximately 500 cryptocurrencies can be traded.

- Broader selection of altcoins

- Additional staking options—Binance Earn feature

- Professional traders have access to all of the chart indicators they require.

- Trading leveraged margins-long or short

- Numerous transaction types are available.

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

- Limited US version

6 – Coinbase

Coinbase is a cryptocurrency trading platform launched in San Francisco and is one of the most popular in terms of user counts. Coinbase was the first major cryptocurrency exchange to go public in the United States, debuting on the Nasdaq in April at $381 per share, valuing the company at $99.6 billion when all of its shares were sold.

Coinbase is a platform that allows you to purchase and trade cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and over 50 others. It can also be used to transmit and receive cryptocurrency and convert one cryptocurrency to another. Coinbase, like stock trading apps, shows current cryptocurrency prices and trends, as well as a snapshot of your portfolio and industry news. Use the Coinbase Pro exchange for trading; it’s cheaper than the regular Coinbase site, which functions more like a broker.

On the Coinbase Pro exchange, you can create your limits or market orders for REN. The maker/taker cost is 0.5 percent until you trade $10,000 in volume in 30 days, after which it is 0.35 percent. If your 30-day trading volume is more than $300 million, you can trade for free in crypto. Maker costs for limited orders aren’t charged.

ANKR was listed on March 23rd, 2021, with open trade for trading pairs like ANKR/USD, ANKR/BTC, ANKR/GBP, and ANKR/EUR.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to / from bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker / taker fee than Binance unless your trading volume is very high

- Coinbase Pro website is slow and lacks chart indicators

- Less customer support

7 – KuCoin

KuCoin, a global cryptocurrency exchange founded in 2017, provides its eight million customers with a wide range of trading options. Examples include staking and lending and spot, futures, margin, and peer-to-peer (P2P) trading.

The cryptocurrency platform KuCoin claims to offer the highest level of security and a cryptocurrency selection of almost 400. It is a user-friendly exchange with a simple layout despite its extensive features. KuCoin has some of the lowest fees in the cryptocurrency industry.

Co-Founder & Chief Executive Officer

Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the world’s most well-known cryptocurrency exchanges. KuCoin has grown to become one of the most popular cryptocurrency exchanges, with over 8 million registered users from 207 countries and territories around the world. In November 2018, IDG Capital and Matrix Partners invested $20 million in KuCoin, and Forbes Advisor named it one of the Best Crypto Exchanges of 2021 in 2021.

Deposit & Withdrawal

KuCoin can be used to purchase cryptocurrencies with fiat money, but only through a third-party app. For instance, investors may pay with a credit or debit card, Apple Pay, or Google Pay, but not with a bank transfer. You will also be required to purchase a certain amount of one currency right away.

You could, for example, spend $200 on Tether (USDT), a stable coin tied to the US dollar. Tether can then be used to purchase additional currencies. You couldn’t just deposit $200 and wait for the right time to invest it. Other exchanges allow you to deposit money and decide how and when to spend it.

Trading Fees for KuCoin

Kucoin’s trading fee structure is quite simple. The platform charges both makers and takers 0.1 percent, making it one of the most affordable bitcoin exchanges online. You can further reduce your fees if you hold the platform’s native Kucoin tokens.

Kucoin listed ANKR on its exchange on March 14th, 2019, and supported trading pairs including ANKR/BTC and ANKR/ETH.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

8 – Bitfinex

Bitfinex is a popular cryptocurrency exchange where users can buy, sell, and trade a wide range of digital coins. The platform was founded in 2012 and is headquartered in Hong Kong. Because it has a plethora of charting tools, intermediate and professional traders are the most likely to use Bitfinex’s trading area.

Apart from cryptocurrency, wire transfers are the sole accepted payment option for depositing and withdrawing funds. Like Coinbase, Bitfinex is one of the only platforms that allows you to short cryptocurrencies and leverage trading tactics.

Founders: Bitfinex launched as a peer-to-peer Bitcoin exchange in December 2012, offering digital asset trading services to customers worldwide. Since 2013, Giancarlo Devasini has been Bitfinex’s CFO and has played a key role in the company’s success. Giancarlo Devasini began his career as a doctor in 1990 when he earned a Doctor of Medicine degree from Milan University.

Bitfinex – Is it regulated?

Bitfinex Securities Ltd., a provider of blockchain-based investment products, has created a regulated investment exchange (Bitfinex Securities) in the AIFC to improve members’ access to a diverse variety of financial products. As a result, Bitfinex is completely unregulated. The firm’s headquarters are in Hong Kong, and the company is registered in the British Virgin Islands.

Fees and deposit limits – Bitfinex charge a 0.1 percent fee for bank transfer deposits. For example, if you deposit $10,000, you will be charged a fee of $10. You will be charged a small fee if you deposit with cryptocurrency, determined by the coin you use to fund your account.

Withdrawal fees – Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. If you need money in less than 24 hours, you can pay a 1% expedited fee. On the other hand, Bitcoin withdrawal costs differ based on the coin.

Bitfinex listed Ankr (ANKR) on July 26th, 2018, and opened trading for ANKR/BTC.

Pros & Cons of the Bitfinex platform:

- Established since 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- Support team only available via email

What is Ankr (ANKR)?

Ankr was created by its CEO and co-founder, Chandler Song, to establish an easily accessible platform for the development of Web 3. Ankr is a blockchain-based cross-chain infrastructure with a DeFi platform that enables staking and dApp development. The main idea behind this protocol is to remove the need for central authorities and give ownership and control over data and applications to users and network participants.

In simple words, Ankr aims to make the adoption of Web3 easier by offering a platform where users can deploy nodes on Proof-of-Stake blockchains, stake their PoS tokens, and access DeFi apps. Ankr is unique because it simplifies the node creation process to just a few clicks for dozens of blockchains. Generally, running a node for a PoS blockchain requires significant hardware investments and technical proficiency. However, the node operators only pay a monthly fee to Ankr for using the platform’s various services. This way, ANKR offers cost-efficient solutions for developers and enterprises.

Stkr – The Staking Protocol

After releasing the Ankr mainnet in 2019, the developer’s team behind the project launched a staking protocol named Stkr. Stkr allows users to stake Ethereum in return for a small amount of ETH, which represents the future gains on the deposited staking balance. This way, network participants get rewards for staking through the Stkr protocol. To build dApps on the network, users set up development nodes and set up staking nodes. Users can also become stakers on the ANKR Web3 platform by setting up these nodes.

Ankr was first hosted on the Ethereum blockchain, and ANKR was launched as an ERC-20 token, though BEP-2 and native versions of the token now exist. Ankr released its mainnet in 2019, and the next year, the team launched a staking protocol, Stkr. Ankr offers ETH 2.0 staking through the Stkr protocol, which gives profit to users based on staked balances.

Ankr platform can be used in three different ways by the users: by running their nodes and staking, developing and deploying applications, or accessing enterprise solutions. For instance, the network participants can easily earn a passive income by powering the network and enabling smooth operations for developers and enterprise users who can gain easy and cost-effective access to Web 3.

How does Ankr work?

Ankr is the native token of the network and can be used for multiple purposes, including payments and access to applications deployed on the network, staking, and voting on governance proposals. In addition, Ankr provides decentralized applications, staking nodes, and support for the Web3 infrastructure.

Ankr recognizes that not every user has the resources or technical capacity to launch a node from scratch or participate in the validation process on the Proof-of-Stake blockchain. So, Ankr simplifies the process for individuals or developers across dozens of blockchains, including Ethereum, Bifrost, Tron, Kusama, Polygon, and Polkadot.

It also simplifies the onboarding process for individuals looking to stake tokens on various blockchains and helps validate transactions. Usually, staking 32 ETH is required to become a validator for the Ethereum 2.0 blockchain, whereas, by using Ankr’s Stake Fi, users can stake as little as 0.5 ETH, and in return, they can receive an ETH and additional rewards, which can be used to access decentralized finance applications and protocols.

ANKR fundamentals

- What it does: Ankr is a Web3 infrastructure and cross-chain staking DeFi platform that aims to make it easy and affordable for anyone to participate in the blockchain ecosystem by building dapps, hosting nodes, or staking.

- Management team: Chandler Song is CEO, Ryan Fang is COO, and Stanley Wu is CTO of Ankr Protocol. All three people co-created the project.

- Date launched: The Ankr was launched in 2017.

Is it Worth Buying Ankr (ANKR) in 2022?

The ANKR token started as an ERC-20 token on the Ethereum blockchain in September 2018, with a maximum supply of 10 billion ANKR. The project raised about $14.5 million in just the first month by distributing the coin at $0.0055 per ANKR, or 5% of the total token supply. Before this public launch, about 30% of the ANKR token supply was distributed in a private presale. 20% of the tokens were attributed to the team behind Ankr and 5% to advisers. 40% of the tokens were left for mining rewards, and the rest was kept for marketing.

Ankr Post-pandemic Price Review 2020

The ANKR token experienced its all-time low level at $0.0007111 during the broader market sell-off amid the COVID-19 pandemic in 2020, but the start of 2021 favors this token as a bullish comeback was seen in February 2021 when the coin reached as high as $0.036. In March, the coin reached its first all-time high level at $0.208 after the token was listed on the Coinbase cryptocurrency exchange and recognized as the top validator on the Binance Smart Chain.

Ankr Price Review 2021

In the same month, Ankr was also featured on HitBTC, which increased the ways for investors to access this token. The effect of the Coinbase listing lasted for another month, and then Ankr started declining in May 2021. May and June were not in favor of Ankr, but the next two months were somewhat supportive. Another big jump in the ANKR token was seen in October 2021, when it announced $10 million in grants for multi-chain DeFi development. When it did this, it also came out with the Ankr Protocol, which is a web service portal for Web3 development.

In November 2021, the ANKR token reached its new all-time high level at $0.212 due to more partnerships. However, the coin started declining after that and ended up in 2021 at the $0.10 level.

Ankr Price Review 2022

The start of 2022 was also on bearish terms, as in January, the coin declined to $0.079. May 2022 also started on a bearish note, and the token has been declining continuously, currently moving at $0.036.

Since the coin is already near a low and is in an oversold zone, it appears to be a good time to go long because the fundamentals are strong.

Will the Price of Ankr (ANKR) Go Up in 2022?

Ankr’s price is influenced by various factors, including the limited supply of 10 billion ANKR tokens. This acts as an anti-inflation mechanism. The performance of Ankr is correlated to that of major cryptocurrencies, so conditions in the wider economy can also influence Ankr prices. Apart from this, there are other factors included in the price fluctuation of the ANKR token, including developments, updates, and upgrades, like the release of the Stkr staking protocol and the ANKR mainnet. The intrinsic value of the ANKR token is mostly defined by its technology, use cases, and technical capacity.

Gregory Gopman Joins ANKR

Recently, in February 2022, Ankr named Gregory Gopman its Chief Marketing and Business Development Officer. Gopman is a prominent figure in the decentralized internet movement. He has spent over 10 years working with startups, five years on Web2 and five on Web3. He was the brains behind Akash Network ($AKT) and Mewn. Mewn is a cryptocurrency consultancy that has helped cryptocurrencies like Kadena go from an $80M market cap to $4B in just 5 months. It is expected that hiring Greg Gopman was a very smart move by Ankr as it will help the protocol become more decentralized.

Ankr wants to assist numerous blockchains that have different apps, NFTs, and DeFi to work together and provide multi-chain solutions. Using Ankr, they can find solutions to multiply their capabilities. On their website, they say their platform is the only one of its kind because it has node infrastructure, staking, and DeFi. This makes it easy for people to build things and make money.

In November 2021, Ankr announced a partnership with Portal as it had plans to run a facilitation node to provide ongoing liquidity for atomic swaps between ANKR and other assets on Portal DEX. whereas Portal had plans to make ANKR’s token available on its DEX.

Ankr Line Chart – CoinMarketCap

In October 2021, Ankr announced that it would distribute more than $10 million in grants over the next 2 years to increase the growth of a distributed supercomputer and reward the creation of tutorials and education around Web3 development. In the same month, Ankr also launched support for Nervos Laye1 and Layer2 nodes. Users are enabled to easily run a Nervos validator node via Ankr’s blockchain infrastructure platform and developer API.

During the past few months, Ankr partnerships have declined in numbers as compared to previous months. However, still, there is a nice growth potential for this platform as recently the company has announced a new CMBD officer who has a very strong background. In our opinion, the ANKR token has a huge potential for growth for 2022.

Ankr Price Predictions: Where Does ANKR Go from Here?

The following are the ANKR price predictions made using different analytical websites’ algorithms.

WalletInvestor has predicted a somewhat bullish scenario for the ANKR coin throughout this year. According to them, the coin could reach $0.151 by the end of this year. However, for the upcoming five years, they have been more bullish as they expect the coin to reach $0.477.

Gov.Capital has provided extremely bullish expectations for the ANKR token. The website has suggested that this year, the coin could reach about $0.23, and for the next five years, the ANKR forecast has been set at $1.669.

DigitalCoinPrice is not as bullish as the above websites, but they have said that this year, the price of ANKR tokens could reach $0.0825. For the next two years, the coin is anticipated to hover around $0.094. In 2025, the token could reach the $0.12 level.

Price Prediction also expects a bullish scenario for the ANKR token as the average price for this year has been set at $0.064 by them. They have predicted a maximum level of $0.066 and a minimum level of $0.059 for ANKR tokens for the year 2022.

Let’s take a look at the ANKR price prediction from 2022 to 2025.

ANKR Price Chart – Daily Timeframe

Ankr Price Prediction 2022

Ankr has not had a good start to the year. Technical analysis suggests the coin still has room to grow. The coin fell from the start of the year until January 23rd when it experienced some buying. The bullish momentum lasted two weeks, until February 2nd. The coin has been steadily falling since then. If the coin fails to reverse its bearish momentum, it may fall as low as $0.032. If the coin regains its strength, it could reach $0.35 by the end of 2022.

Ankr Price Prediction 2023

According to our analysis, the network is on its way to bringing a revolution in Web3.0 and streamlined dApp creation, which means there is a lot of bullish potential in the future. They expect the coin to breach the $0.45 level by the end of 2023 if everything goes in its favor. However, if the network fails to launch upgrades and bears take the market, then the price could hover around $0.20.

ANKR Weekly Chart – Triple Bottom Pattern Breakout

Ankr Price Prediction 2024

Analysts believe that the coin could have an average price of about $0.305 in the year 2024. However, if the coin experiences bullish trends this year, then it could hit the $0.60 level. The bears’ dominance this year could keep the prices near the $0.35 level.

Ankr Price Prediction 2025

There is a good chance that a decentralized internet will disrupt this beneficial technology in the coming years. Ankr’s future appears to be very bright, as there are many exciting events on the horizon, as well as new upgrades. If all planned integrations go as planned, its prices could reach $0.90 by 2025. However, if the platform fails to gain traction among its user base, it could reach $0.55 by the end of 2025.

Summary

Ankr is a worthwhile project in DeFi and cloud storage that complements the staking of ETH 2.0 and ANKR tokens. The Ankr platform aims to decentralize the internet and offer easy access to Web 3.0. The project facilitates functional enterprise solutions, staking nodes, and developer APIs. It is considered one of the top projects of its kind, and the platform has been growing and developing continuously.

Although ANKR tokens have been experiencing price pressure recently, they have also experienced a rise in popularity in 2021, and the upcoming upgrades hold great potential for their future price sentiment. If you are interested in buying the ANKR token, then many exchanges and broker firms offer buying services.

We recommend the trusted and most popular broker firm, eToro. It is regulated by the FCA, CySEC, and ASIC. The sign-up process is straightforward and short as compared to its counterparts. Taxes are levied on all earnings generated by an ANKR token. Ankr can be traded as a CFD, and automated bots can also be used to save time and avoid fatigue. Ankr trading comes with its risks, and it is advised to research as much as you can before investing.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risks in buying ANKR now?

Ankr plays a key role in the internet's future, and it is affordable and available on several cryptocurrency exchanges. Ankr has been gaining much attention lately due to its services. It enhances the capabilities of blockchain, which shows that there is enormous potential for growth for this coin. However, every investment is risky as there are equal chances of gaining and losing, so complete and thorough research must be done before investing.

Should I buy ANKR?

ANKR is an essential addition to the DeFi market, which could make it a good investment in the long run. Staking ANKR tokens can also generate returns for network participants.

Is it safe to buy ANKR?

The ANKR token is an Ethereum token, or ERC-20 token, which means it enjoys the same security features that the second largest cryptocurrency has. In addition, Ankr is protected by distributing blocks across the network and building a structure that allows developers, businesses, and staking protocols to be used. This is done with the help of computational power.

Where can I spend my ANKR?

Ankr is a utility token that can be used for staking, voting on governance proposals, and as a payment method for gaining access to services on the Ankr network. Its leading utility is to power the protocol and main network, but it can also be traded in the crypto market.

Will Ankr ever hit $5?

Given its price history, it is highly unlikely or impossible for now to say that the ANKR token could reach $5 in the near-term or long-term future. If planned integrations are completed successfully, their prices could reach $0.90 in 2025. However, if the platform fails to gain traction with its user base, it might reach as high as $0.55 by 2025.

Bitcoin

Bitcoin