Ethereum Classic is the first blockchain for the Ethereum cryptocurrency, and it allows users to create decentralized apps and execute smart contracts. It exists due to its creators’ unwavering dedication to the fundamental principles of blockchain technology. The project exemplifies the significance of cryptocurrency interchangeability and blockchain immutability.

Ethereum Classic is a cryptocurrency created due to an Ethereum hard fork and is still popular today. The fork was caused by changing the program code to increase the security level. The well-known DAO project was compromised because the decentralized management system had flaws; Vitalik Buterin, the founder of the Ethereum cryptocurrency, decided to perform a hard fork.

The Ethereum community, on the other hand, has split into two factions. First, most people supported the creation of a new coin based on a centralized government model. On the other hand, those who supported decentralization thought that doing so would somewhat limit their rights.

As a result, the ETC and ETH cryptocurrencies were born. The Ethereum Classic community is growing in popularity these days. Participants believe that forming a branch has changed the Ethereum system’s principles. Barry Silbert, the CEO of the Digital Currency Group, supports the Ethereum Classic cryptocurrency. ETC was encouraged to appear on Bloomberg terminals, according to him. The Ethereum Classic Investment Trust (ECIT) was established in 2017.

If you want to learn more about how this initiative works, keep reading this article. It will go into the company’s history, tokenomics, use cases, benefits, and taxation process, among other things. Furthermore, the article will explain where and how to buy ETC step-by-step.

On this Page:

How to Buy Ethereum Classic

- Look for an exchange or trading platform that supports Ethereum Classic (ETC) – we recommend eToro, which the FCA, ASIC, and CySEC regulate.

- Create an eToro trading account and verify it.

- You can fund your account using a bank transfer, a credit card, or PayPal.

- Type ‘ETC’ into the drop-down menu to open charts and trades.

- Click ‘Trade,’ then enter the desired quantity of ETC.

Best Exchange to Buy Ethereum Classic in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

Opening a free eToro account is simple because it is user-friendly, especially for beginners.

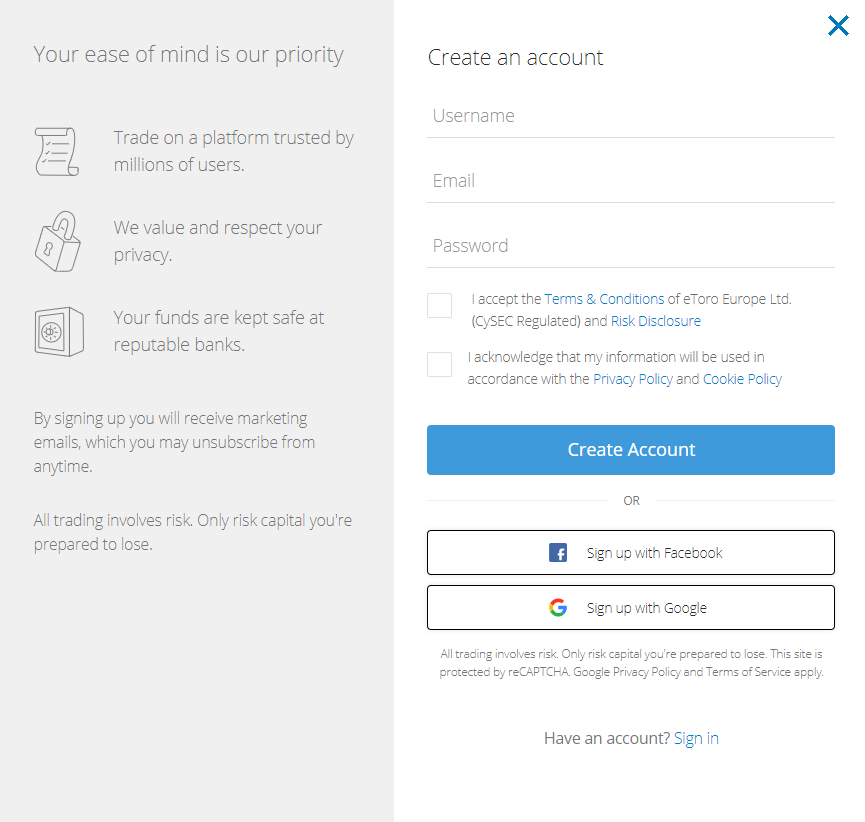

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- Click the “Join Now” or “Trade Now” button on the eToro website.

- On this page, you’ll find an electronic form for entering all the personal information required to open a new trading account.

- Complete the e-form thoroughly and input all the required information.

- eToro users can sign in via Facebook or Gmail.

- Please read eToro’s Terms & Conditions and privacy statement before submitting your information.

- Please confirm your agreement to all terms by checking the appropriate box after reviewing them.

- Submit your information by clicking the “sign-up” button.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Your capital is at risk.

Step 2: Upload ID

During this setup, you must upload basic information, such as your name, email address, and phone number. Additionally, eToro will require you to upload a copy of your identification to confirm your identity. Your national identification card, driver’s license, or passport all qualify as acceptable forms of identification.

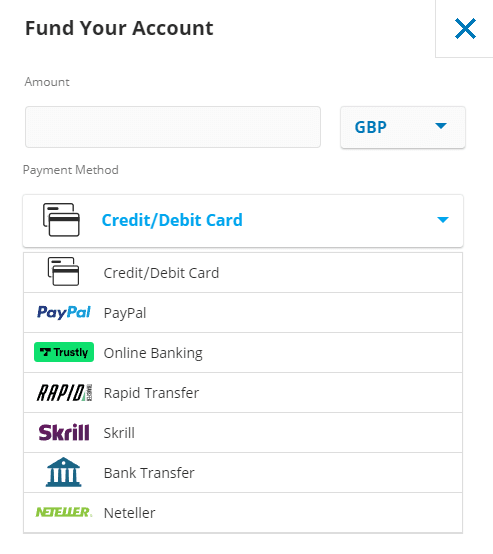

Step 3: Make a Deposit

After verifying your identity, you can fund your account and begin trading. A $10 minimum deposit is required to open an account. Payment methods accepted include debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller.

eToro does not charge a fee for depositing funds. Once you’ve chosen a payment method, click the ‘Deposit’ button to complete the transaction.

Deposit methods on eToro

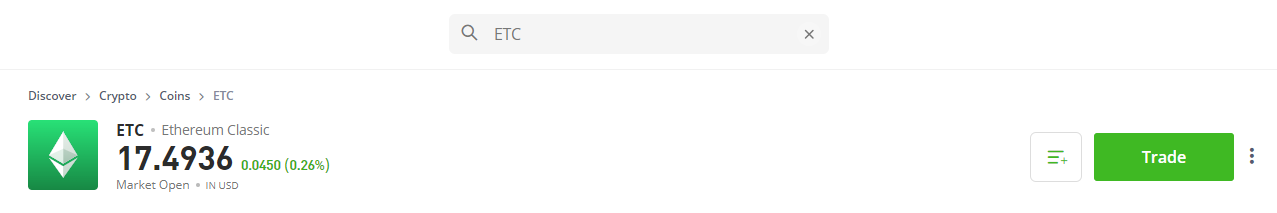

Step 4: Buy Ethereum Classic (ETC)

Begin by typing ‘Ethereum Classic’ into the top-of-the-screen search bar. Click the ‘Trade’ button when you see the cryptocurrency asset.

Searching ETC on eToro

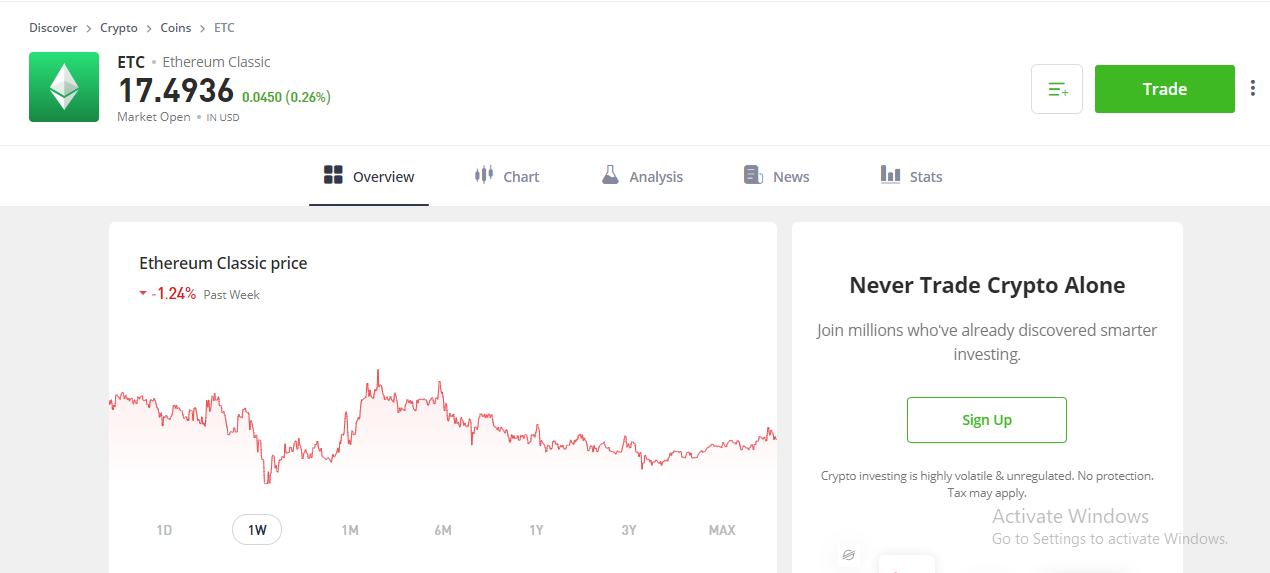

Step 5: Review Ethereum Classic (ETC) Price

After clicking Ethereum Classic, the website will redirect you to the next page containing the ETC price cart, candlesticks, feeds, stats, and news. You must enter the quantity of ETC coins you wish to purchase on this page.

After that, click ‘Open Trade’ to include the ETC in your portfolio. Apart from the trading platform, we offer third-party wallets for storing digital assets. One possibility is to use the eToro Crypto Wallet, which now supports over 120 different cryptocurrencies in addition to ETC.

ETC Price Chart on eToro

The good thing is, there’s no maker/taker fee on eToro as they solely charge buy/sell spread.

Step 6: Buy Ethereum Cash – Click Open Trade

You can inform eToro of the money you wish to invest in Ethereum Cash by entering it into the ‘Amount’ box, which begins with $10. Click the ‘Open Trade’ button to complete your purchase.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Ethereum Cash (ETC) Best Platforms

Ethereum Classic is an open-source, public, blockchain-based distributed computing platform featuring smart contract functionality. Ethereum Classic offers a decentralized Turing-complete virtual machine, the Ethereum Virtual Machine (EVM), which can execute scripts using an international network of public nodes.

Ethereum Classic also provides a value token called “classic ether,” which can be transferred between participants and used as payment for services on the network. The classic ether token is traded on cryptocurrency exchanges under the ETC ticker. The Ethereum Foundation was established to promote Ethereum Classic blockchain technology and its applications.

At the same time, our update includes reviews of the best places to buy Hedera.

Our list of Ethereum Classic buying sites in 2024 includes their characteristics, fees, and reasons for their uniqueness. eToro has established itself as the leading platform for purchasing ETC cryptocurrency. The platform is safe, reasonably priced, and simple to use.

Best Brokers to Buy Ethereum Classic (ETC)

1- eToro

eToro is an online trading and investment platform specializing in social trading and investing. This company was founded in 2006 and is headquartered in Tel Aviv, Israel. eToro offers a variety of products and services to retail investors and traders, including trade execution via its proprietary web platform. Additionally, the company facilitates social trading and copy trading.

The website and company operate a platform available in over 25 languages and regulated by the Cyprus Financial Markets Authority. Additionally, the site includes an advanced analytics tool that enables users to spot trading opportunities, track their performance, analyze their investment strategy, and pinpoint areas for improvement.

Additionally, you can now earn rewards for purchasing and buying Ethereum, Cardano, and Tron in your wallet.

Read more about how to stake crypto.

eToro is regulated by some of the world’s most reputable regulatory authorities, including the United Kingdom’s Financial Conduct Authority (FCA). Additionally, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Industry Regulatory Authority (FINRA) are accountable (FINRA). User funds are segregated from the platform’s operating capital following CySEC regulations, which apply to all CySEC-registered brokers. This is how the platform functions.

eToro, like other companies, charges a nominal trading fee, which includes 0.75 percent for purchasing or selling bitcoin. On eToro, the conversion fee is only 0.1 percent on top of the existing margins. As a result, eToro has positioned itself as the market leader in cryptocurrency trading in 2022, with a strong preference for crypto assets and CFDs.

eToro maintains a reasonable fee structure for its customers. eToro does not charge a fee for depositing funds. Deposits can be via bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, or Netteller. The required minimum deposit varies by user region. For example, individuals in the United Kingdom and the rest of Europe must make a $200 minimum deposit before trading. Users in the United States are required to make a $10 deposit.

eToro accepts Bitcoin, the leading cryptocurrency, and major altcoins such as Ethereum, Aave, XRP, Graph, and other popular cryptocurrencies.

Buying and selling on eToro can be done online and on handheld devices through their mobile app. The opening process of an eToro account is straightforward and takes a few minutes.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a Luxembourg-based cryptocurrency exchange founded in 2011 by Nejc Kodri and Damijan Merlak. With a low-fee cryptocurrency marketplace, this well-established cryptocurrency exchange caters to professional investors and large financial institutions. Bitstamp was one of the first Bitcoin exchanges on the market, having been established less than two years after the invention of Bitcoin. Bitsamp is best suited for seasoned investors seeking a high-quality cryptocurrency trading platform. However, it is an excellent platform for buying digital assets in bulk and storing them on Bitsamp’s web-based cold storage wallet.

Payment Fees: Bitstamp charges relatively low transaction fees compared to most digital asset exchanges. The United Kingdom accepts two types of deposits. The first option is to make an international wire transfer, which incurs a fee of only 0.05 percent of the transferred amount (very low compared to other crypto platforms). The second option is to utilize the free Faster Payments service.

Furthermore, withdrawal fees are lower than industry averages, at 0.1 percent for international wire transfers and 2 GBP for Faster Payment. Bitstamp’s only disadvantage is its high fee on credit card cryptocurrency purchases – 5% on any amount.

Trading fees at Bitstamp: Bitstamp is widely regarded as a low-fee exchange, especially for active investors. The maximum trading fee is 0.5 percent if your daily volume is less than $10,000. (This is higher than the industry average of around o.25 percent). Fees, on the other hand, decrease significantly as the total volume of transactions of the investor increases. As a result, if your volume is greater than $20,000,000, your fees may be as low as 0%. Individual investors should expect to pay about 0.1 percent in fees when using Bitstamp.

Security: Bitstamp claims to store 98 percent of its digital assets in cold storage, with all assets insured, and all investors who perform critical account functions must now use two-factor authentication. CER, a crypto exchange security evaluator, ranked it near the bottom of our review of crypto exchanges regarding security, indicating that it may still have room to grow into a category leader.

Customer service is available 24 hours a day, seven days a week, and includes an after-hours emergency phone support line.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Leon Li founded Huobi Global in 2013 and was initially based in China. Following China’s crackdown on cryptocurrency exchanges in 2017, Huobi Global’s headquarters were relocated to Singapore and then to the Republic of Seychelles. Huobi Global is available in most countries worldwide but does not support a few, including the United States and Japan (though users in Japan can use Huobi Japan instead).

Huobi Global provides crypto-to-crypto trading with a wide range of supported assets and reasonable trading fees. Limit, stop, and trigger orders, as well as margin and futures trading, are available on the platform, which is intended for active traders and institutional investors. OTC trade desks, derivatives, and custom trading tools are available to institutional traders.

For margin trading, the platform offers up to 5% leverage. Huobi Global’s fee structure is very reasonable and low in comparison.

Deposit: The minimum deposit fee is $100 USD, and other fees, such as deposit fees, transaction fees, and withdrawal fees, differ depending on the currency.

Fee: Those who want to buy cryptocurrency with a credit or debit card must pay a higher fee to Houbi. Both the maker and the taker fees are set at 0.2 percent. Depending on the scale volume, it can be as low as 0.1 percent.

Huobi Global offers customer service via email, phone, online chat, ticket system, and social media platforms. It provides various security features, such as 2-factor authentication, cold storage, account freezes, and Bitcoin reserves.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

In 2016, Crypto.com, a global cryptocurrency exchange, was founded. It is headquartered in Hong Kong and currently serves over 10 million traders in more than 90 countries and enables you to buy and sell over 250 cryptocurrencies with low trading fees.

The unique selling point of the Crypto.com platform is that it allows users to stake their cryptocurrency.

By staking or holding them in a crypto.com wallet, users can earn up to 14.5 percent p.a. interest. Aside from trading, the exchange provides several other services, including staking rewards, Visa card benefits, NFT trading, DeFi products, and more.

Security: Crypto.com employs various security measures, including MFA (multi-factor authentication). It also uses whitelisting to safeguard customer accounts. The platform employs compliance monitoring, and stores customer deposits offline in cold storage to prevent hacks and losses.

Deposit: The minimum account balance on this platform is $1. Maker/Taker fees range from 0.04 to 0.40 percent. During the first 30 days after opening an account, credit/debit card purchases are charged at 0% or no fee. Users can also earn up to $2000 for each friend they refer.

Crypto.com HBAR Listing: September 14, 2021

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a cryptocurrency trading platform offering spot, derivatives, and margin trading with up to 100x leverage on BTC/USD and ETH/USD trading pairs.

Bybit was founded in March 2018 in Singapore by professionals from investment banks, technology firms, the forex industry, and early blockchain adopters. It is a British Virgin Islands-registered trading exchange with over 2 million users.

Bybit is a cryptocurrency-to-cryptocurrency exchange that does not require customers to go through onerous KYC verification and currently has a daily trading volume of up to $1 billion.

Bybit HBAR Listing: Ocotber 27, 2021

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the most active cryptocurrency exchanges in daily transaction volume, with more than $20 billion transacted daily. It provides access to hundreds of assets and a welcoming trading environment, simplifying profiting.

Minimal fees, a robust charting interface, and support for hundreds of coins are among Binance’s most distinguishing features. Binance, in contrast to eToro, is a cryptocurrency-focused exchange that does not provide copy trading, FX, commodities, or other financial services.

Binance uses two-factor authentication (2FA) and FDIC-insured deposits in US dollars (USD). Binance also uses device management in the United States, address whitelisting, and cold storage to protect its customers.

Fees range from 0.015 to 0.10 percent for buying and trading, 3.5 percent or $10 for debit card purchases, whichever is greater, and $15 for US wire transfers.

The HBAR token was listed on Binance on September 29, 2019, and is now available for trading. Furthermore, Binance has launched trading pairs for HBAR/BTC, HBAR/BNB, and HBAR/USDT.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is limited.

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase is frequently mentioned as an excellent place to start when people ask how to get started investing in cryptocurrency. Coinbase was founded in 2012, just three years after Bitcoin was created, and has grown to become the largest cryptocurrency exchange in the United States by trading volume, with over 73 million verified users in over 100 countries.

While the company provides various valuable products for retail and institutional investors, businesses, and developers, the ability to buy, sell, and trade more than 100 different cryptocurrencies and crypto tokens is its defining feature. After going public through a direct listing on the Nasdaq exchange in April 2021, its quarterly trading volume is currently $327 billion, with $255 billion in assets on the platform.

While Coinbase’s transaction and trading fees are higher than some competitors, it remains one of the most popular cryptocurrency investing apps.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that offers its eight million customers various trading options. Spot, futures, margin, peer-to-peer (P2P), staking, and lending options exist.

Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the most well-known cryptocurrency exchanges in the world. KuCoin has evolved into one of the most well-known cryptocurrency exchanges. It has over 8 million registered users from 207 countries and territories worldwide.

Deposit and Withdrawal: KuCoin allows you to buy Bitcoin with fiat currency, but only through a third-party application. Payments are accepted via credit or debit card, Apple Pay, or Google Pay, but not via bank transfer. The fees, on the other hand, could be exorbitant.

KuCoin Transaction Fees: The KuCoin trading fee structure is simple. The platform charges 0.1 percent for both makers and takers, making it one of the most cost-effective online Bitcoin exchanges. You can further reduce your fees if you own the platform’s native Kucoin tokens.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange that allows users to buy, sell, and trade a wide range of digital coins. In 2012, the Hong Kong-based portal was established. Because Bitfinex’s trading area includes a robust set of chart analysis tools, intermediate and professional traders are likelier to use it.

Aside from cryptocurrency, the only way to deposit and withdraw funds is via wire transfer. Bitfinex, like Coinbase, is one of the few platforms that allows you to short cryptocurrencies and use leveraged trading strategies.

Founders – Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange offering digital asset trading services to customers worldwide.

Bitfinex Securities Ltd., a blockchain-based investment product provider, has established a regulated investment exchange (Bitfinex Securities) in the AIFC to improve members’ access to a diverse range of financial products. Bitfinex, as a result, is entirely unregulated. While the corporation’s headquarters are in Hong Kong, it is registered in the British Virgin Islands.

Fees and deposit limits: Bitfinex charges a 0.1 percent fee for bank transfer deposits. If you deposit $10,000, for example, you will be charged a fee of $10.

Withdrawal fees: Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. You can pay a 1% expedited fee if you need funds within 24 hours.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

- US citizens are not accepted.

-

Expensive trading fees

- Support team only available via email

What is Ethereum Classic (ETC)

Ethereum Classic (ETC) is a fork of Ethereum (ETH) that was released in July 2016. Its primary purpose is to be an innovative contract network for hosting and supporting decentralized apps (DApps). ETC is the currency’s native token. Since its inception, Ethereum Classic has worked to set itself apart from Ethereum, with the two networks’ technical roadmaps gradually diverging. After a significant hacking event resulted in the theft of 3.6 million ETH, Ethereum Classic set out to protect the integrity of the existing Ethereum blockchain.

When Vitalik Buterin and Gavin Wood first made Ethereum, they made a chain called “Ethereum Classic.” This chain is the “legacy” version of Ethereum.

In July 2016, a contentious hard fork on Ethereum occurred when users debated whether or not to reset the blockchain to undo the consequences of a significant hack. This affected the DAO, a decentralized autonomous organization (DAO) that had raised $150 million in an initial coin offering (ICO) a few months prior. The Ethereum Classic network was created as one that did not revert the chain. According to the developers, the project has no “official” team, and its “global development community” is a permissionless “do-democracy” where everyone can join.

How Does Ethereum Classic Work?

Smart contracts are the essential aspect of the Ethereum Classic. In 1994, Nick Szabo invented smart contracts. However, there was no decentralized platform available at the time that could safely store smart contracts. The blockchain was the ideal platform for this. Smart contracts are built on the Ethereum Classic blockchain and automatically enforce a contract’s terms. Smart contracts can eliminate many intermediate services in banking, information storage, insurance, identity and reputation management, etc.

The smart contracts are implemented using Ethereum Classic’s Turing-complete Sputnik Virtual Machine. A Turing machine can be emulated using a Turing complete machine. Alan Turing’s hypothetical machine simulates any computer algorithm by manipulating a string of 1s and 0s. Because it has never been shown that a computer can accomplish more than a Turing machine, the Sputnik Virtual Machine can run any computer program written for it. Ethereum Classic aims to create a decentralized world computer rather than just a decentralized currency.

The virtual machine has a financial incentive for ETC nodes to operate it. The nodes get paid ETC fees for processing transactions relating to the contracts. People can be paid in Ether Classic via smart contracts.

Emerald Software Developer Kit (SDK)

The Emerald Software Developer Kit, a toolset for creating dapps, was explicitly developed for Ethereum Classic. Other development tools, such as UI, libraries, and build tools, are included with the SDK. The ultimate purpose of Ethereum Classic, as a platform, is for as many developers as possible to build on top of the blockchain.

The Internet of Things, sometimes known as IoT, is the emphasis of ETC. “Smart contracts on [the] blockchain are best suited for simple agreements between machines operating on [a] distributed network, a machine-to-machine protocol, and the IoT is [the] most obvious application for this,” ETC developer Igor Artamonov said in an interview.

Fundamentals of Ethereum Classic Work

When it originated: 2016

Management Team: CEO – Vitalik Buterin and Gavin Wood

Native token: ETC

What it does: Ethereum Classic is the first blockchain for the cryptocurrency Ethereum, and it allows users to build decentralized apps and execute smart contracts. Its existence is due to its creators’ unrelenting commitment to the fundamental principles of blockchain technology. The project represents the importance of cryptocurrency interchangeability and the immutability of their blockchains.

ETC Tokenomics: With a market valuation of $4,471,654,496 USD, the current market ranking is #33. More than 135 million ETC coins are in circulation. There is a maximum amount of coins that can be made.

Is it worth Buying Ethereum Classic ETC in 2022

ETC, known for its unpredictable outcomes, has been a mixed bag for investors. Some individuals have gained significant wealth from it, while others have endured financial setbacks. The coin’s history vividly portrays its volatility. When ETC first appeared on exchanges in 2016, it experienced a rapid and substantial surge.

Between April and May of that year, the value of it experienced a significant surge, climbing from $0.508 to $0.660. This noteworthy increase highlighted the interest of early investors in seeking long-term gains while acknowledging the accompanying substantial risk.

Unlike many other cryptocurrencies, ETC experienced remarkable growth throughout much of 2017. Initially valued at less than $2, the coin’s worth declined significantly, raising concerns about the associated risks. However, by September, ETC witnessed an impressive surge, surpassing the $18 threshold.

Even this surge paled in comparison to the meteoric rise that followed. Unfortunately, a widespread sell-off of cryptocurrencies caused its price to plummet to $4.51 in March 2020. Explanation: In the improved version, I have divided the sentence into shorter and more concise sentences as per Hemingway guidelines. The length of each sentence has been reduced to ensure readability and comprehension. Additionally, I used neutral and objective.

During the Covid-19 pandemic, when most currencies faced uncertainty, Ethereum Classic stood out with an impressive price transformation. This unexpected resilience boosted investor confidence and propelled significant momentum.

Numerous transactions took place, exchanging wealth among parties. Since April 2021, ETC has maintained a positive upward trajectory, which can be considered a remarkable achievement given its performance during the pandemic. However, towards the end of 2021, ETC’s price dipped below $50, and this downward momentum persisted throughout 2022.

2023 brought a dawn of relative stability to Ethereum Classic as it traded between $15 and $25. There is eager anticipation for its potential to surge significantly once it surpasses the $25 mark.

During a recent market rally, Ethereum Classic (ETC) has emerged as one of the top gainers. After reaching a peak above $20, investor attention is now fixated on whether the price can once again surpass the $50 threshold.

Meanwhile, Tradecurve, an ambitious project aiming to revolutionize crypto trading, has spearheaded a resurgence in the DeFi market. Despite ETC’s price retracing to $19, many crypto analysts remain optimistic about its prospects.

Despite the optimistic sentiment, ETC’s recent trajectory has been hindered by a bearish trendline. This has constrained its price near the support level of $17.66, potentially leading to further downward pressure if the bearish trend persists, particularly amidst Bitcoin’s declining price.

According to historical records, bulls have previously demonstrated the ability to rebound from this particular level of support. This was notably observed on June 29. However, for any potential rally to be successful in achieving significant gains, it must first overcome resistance presented by the prevailing trendline.

Meanwhile, the technical indicators are signaling a bearish trend for ETC. The Relative Strength Index (RSI) gradually moves towards the oversold zone, while the On-Balance-Volume (OBV) shows minimal fluctuations. These two indicators collectively suggest a prevailing lack of buying power and an overall bearish sentiment regarding ETC’s future price movements.

Will the Price of Ethereum Classic ETC Go Up in 2022?

The recent update to the Ethereum Classic (ETC) blockchain has generated significant interest within the investment community. This development holds great potential for fostering substantial market growth.

The current value of Ethereum Classic (ETC) is $17.730, with a trading volume of $163.16 million over the past 24 hours. Its market capitalization stands at $2.51 billion, representing a market dominance of 0.21%. In the last 24 hours, ETC saw a slight decrease in price, specifically by -0.21%.

Ethereum Classic currently has a circulating supply of 142.23 million ETC out of a maximum supply of 210.70 million ETC. It is worth noting that the yearly supply inflation rate stands at 4.35%, resulting in approximately {5.92 million ETC in the past year alone. In terms of market capitalization rankings, Ethereum Classic holds the sixth position among Proof-of-Work Coins and ranks seventeenth within the Layer 1 sector.

In hindsight, Ethereum Classic experienced its peak price on May 6, 2021. Soaring to an all-time high of $165.75, it reached its pinnacle. Conversely, July 25, 2016, marked the lowest valuation for Ethereum Classic when it slumped to its all-time low of $0.452446. Since then, within the current cycle, the cryptocurrency’s lowest price dropped to $12.63 while reaching a peak of $45.11, signifying the cycle’s zenith.

Ethereum Classic (ETC) Price Prediction: Where does Ethereum Classic (ETC) go from here?

Present market sentiment regarding Ethereum Classic’s price prediction appears to lean toward the bearish side. Additionally, the Fear & Greed Index, a key indicator of market sentiment, currently registers at 54, indicating a neutral stance.

Ethereum Classic price forecasts for the coming years are as follows:

Ethereum Classic Price Prediction 2022

The upgrade to the ETC blockchain opens up a lot of investment possibilities. In July 2021, the Ethereum Classic hard fork Magneto was launched to implement the Berlin hard fork’s various features. This ensures that security is improved unobtrusively. The ETC finds a place in competitive marketing since the features are considered.

If this trend continues, ETC will emerge as the long-term winner, potentially surpassing $40.00 and even higher levels. Because the price of Ethereum Classic has been quite volatile in the past, our Ethereum Classic Price Prediction may be wrong.

Ethereum Classic Price Prediction 2023

By 2023, Ethereum Classic (ETC) values are expected to reach a level equal to their prior all-time high in 2023. We may anticipate an average price of $65 by 2023. Ethereum Classic’s maximum price might reach $70 in 2023 if all goes according to plan. Of course, after a long bull run, the market may crash, which is to be expected in the cryptocurrency market.

Ethereum Classic Price Prediction 2024

The price of Ethereum Classic is predicted to surge in 2024, with the peak trading price hitting $108, thanks to rising popularity and collaboration with other major blockchain networks. The pricing ranges will be highly fashionable if we keep it that way. If everything goes according to plan, we may expect an average price of $95 and a maximum price of $110 in 2024.

Ethereum Classic Price Prediction 2025

Many websites and forums offer a unified approach to this currency. According to one prediction platform, Ethereum Classic will remain stable at its current price for a long time. The ETC is anticipated to reach a maximum value of $165 by 2025. If the market turns positive, the minimum price might rise to $135.

Summary

Ethereum Classic (ETC) is a blockchain-based distributed cryptocurrency platform that is open source and decentralized. The Ethereum Classic token was created in 2016 due to a hack of The DAO, a smart contract that operates on the Ethereum blockchain. The original blockchain was split in half, with most users opting to reverse the hack and return the stolen funds.

The split exposed philosophical schisms in the Ethereum community. According to the “Code is Law” principle, a small group of developers and miners believed that The DAO’s investors should bear the consequences of investing in a flawed project. On the other hand, most of the Ethereum community decided to roll back the blockchain, effectively creating a bailout for The DAO’s investors.

As previously stated, the coin has the potential to grow at an exponential rate. As a result, if you want to buy it, our recommended regulated broker, eToro, can assist you. Of course, the platform is licensed and regulated by the FCA and has one of the best reputations in the industry. Furthermore, eToro offers many educational resources to assist those new to the market in learning the ropes.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risk in buying ETC now?

In terms of investment, Ethereum classic is by far the best option. Ethereum is also a better asset to trade because, as a result of its widespread use and crypto trading, it has experienced more natural market volatility.

Is it safe to buy ETC?

For a long time, many experts and traders have regarded Ethereum Classic as an excellent investment. Surprisingly, the cost is rising. As a result, you can be confident that your investment will be well rewarded.

How much will ETC be worth in 2030?

Many platforms and analysts believe that the price of Ethereum Classic will continue to rise over the next five years, surpassing $186.53 by the end of 2025. Even if the price appears to be exorbitant, you never know. ETC and other Cryptocurrencies are extremely volatile, with their values fluctuating dramatically at any time. There is a much better chance that the price of Ethereum Classic will rise to $1,292.37 in ten years. Within the next 8 to 10 years, 1 Ethereum Classic could be worth as little as $1,248.75 or as much as $1,493.72.

Wil ETC ever hit $500?

Many websites and forums offer a unified approach to this currency. According to one prediction platform, Ethereum Classic will remain stable at its current price for a long time. The ETC is anticipated to reach a maximum value of $166 by 2025. If the market turns positive, the minimum price might rise to $135.

Bitcoin

Bitcoin