When it comes to loans and lending in the current world, the lender that you choose can in many cases determine whether your lending process is successful, or if it’s a headache. When it comes to cryptocurrency loans and lending platforms, this is emphasized even more; as a result, it’s important as a prospective borrower, that you know the ins and outs of platforms like BlockFi, one of the more mainstream crypto lenders. As a result, this guide will review BlockFi from a high-level perspective and provide you with the pros, cons, limits, account types, and factors that compose BlockFi in our attempt to uncover whether BlockFi is recommended, and if so, for which types of users?

Is BlockFi recommended?

✅BlockFi is a mainstream level, registered and regulated firm in the cryptocurrency lending and interest-bearing account sector that runs on a multi-tiered structure for its users (Which is subsequently one of the more alternative structure types that incentivize larger, institutional-scale users). BlockFi supports cryptocurrency lending as well as cryptocurrency interest-bearing accounts; if you’re unfamiliar with either of these concepts, visit our guide on Bitcoin loans, which goes into detail on these processes. Fundamentally, BlockFi is one of the leaders in both of these divisions, however, it’s particularly skewed towards certain types of users.

As a result of the information, statistics, and testing reports we’ve compiled on our side, we believe the notion that BlockFi is one of the top-level cryptocurrency lenders, with multiple account types and very advanced regulatory status/registration, however, it is more tailored for larger-sized investors. As a whole, we generally recommend BlockFi if you are an institutional-level investor or a cryptocurrency-focused firm, however, if you are a retail-level user with a smaller account, we’d recommend other platforms like Nexo.

What is BlockFi?

BlockFi is primarily a cryptocurrency lending platform, however, it’s also a crypto interest-bearing account outlet as well. We’ll overview both of them: To understand BlockFi as a loan platform, you first need to understand the concept of cryptocurrency/Bitcoin loans that are formed upon collateralization.

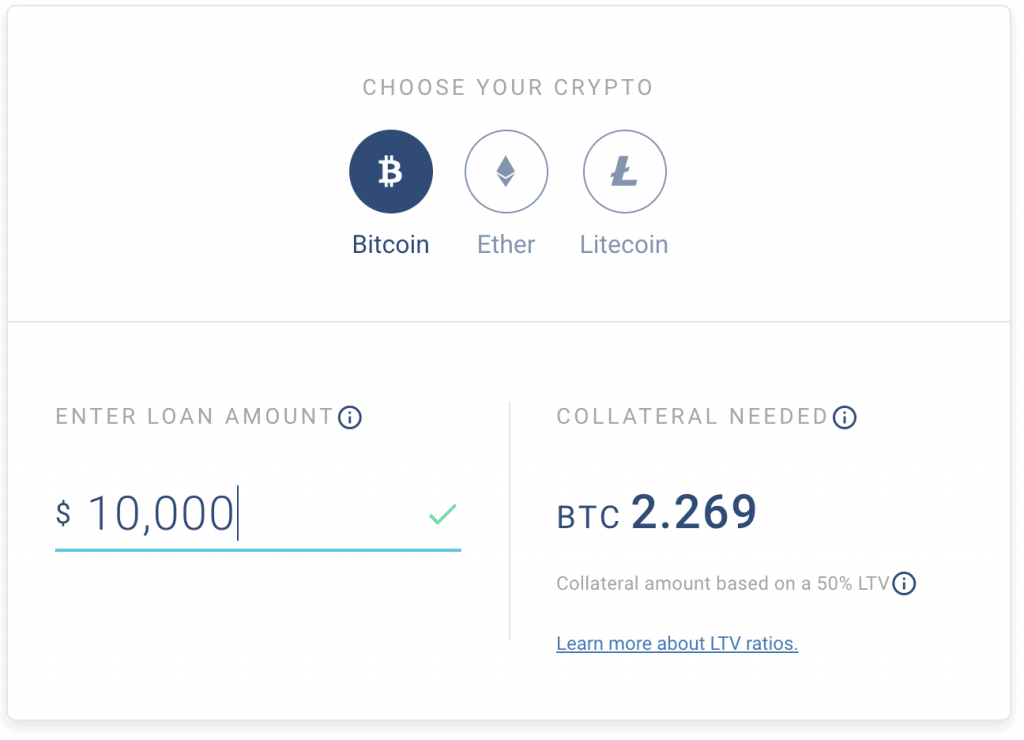

BlockFi offers what is called ‘LTV-based cryptocurrency loans’, which is a loan where you deposit a base amount of cryptocurrency, and you have issued an immediate loan in either cash (Direct to your bank account) or stable coin which is entirely based upon an LTV ratio. LTV ratios can be translated as amounts of cryptocurrency that need to be held in custody to avoid liquidation of the loan in question. For example, BlockFi may offer you a 50% LTV ratio loan, which means that you need to deposit twice as much cryptocurrency relative to the loan you want to take out. If I wanted a $100,000 loan on BlockFi with a 50% LTV ratio, I’d need to deposit $200,000 in cryptocurrency that’s supported on BlockFi. Because crypto is so volatile, BlockFi is able to issue this loan and say that unless the value of the $200k in crypto declines to below $100k, my loan won’t liquidate.

BlockFi additionally offers an interest-bearing account for a variety of assets.

Pros and Cons

Pros

- One of the highest levels of regulation and security when it comes to cryptocurrency lending platforms.

- No late fees, customized minimum payment amounts. Be in control of your repayment process.

- Highly individualized lending platform, each user gets their own specialist to communicate with.

- Quick, easy to get started process

Cons

- Since there’s a high emphasis on regulation and compliance, only 4 total cryptocurrencies are supported

- BlockFi is highly regulated and has a high emphasis on U.S. regulatory stature, however, global borrowers may find trouble in looking for clarity.

- Retail-level customer service is fairly limited/weak.

Markets / Products

Score: 8.5/10

BlockFi is established in a variety of markets, and also enables multiple products, placing it a step above other similar crypto lenders. BlockFi is engaged in not only the lending/cryptocurrency loan issuance market but is also engaged in safety and interest accumulation of held assets, making it a multi-product platform. To get started on either of BlockFi’s products, simply buy Bitcoin, speak with a BlockFi representative to make sure your account is established correctly, and open an account.

To overview, here are BlockFi’s offered products:

- Cryptocurrency lending/loan platform: LTV-based cryptocurrency loans based upon collateral

- Ineterst rates on loans as low as 4.5%

- Interest-bearing cryptocurrency accounts at a 6.2% annual interest minimum

- Compounding interest-bearing cryptocurrency accounts – Only provider of this product at the moment

- Institutional custody (Fund security)

Exclusive Features

Score: 9/10

One of the most admirable traits about BlockFi is its exclusive features that other cryptocurrency lenders do not have/possess. Of those unique features, are:

➡️Compound Interest Cryptocurrency Savings Accounts

Different platforms have previously been able to provide interest-bearing cryptocurrency accounts on major spectrums, however, BlockFi is the only regulated, institutionally-backed compound interest offering cryptocurrency account. Cryptocurrency stored in BlockFi’s institutionally insured savings account are not only federally insured, but also compounded immediately upon interest payments.

➡️Institutionally-backed Cryptocurrency Loans

Many platforms are offering cryptocurrency lending, and the concept is not something new amongst the industry, however, BlockFi is the first to offer these cryptocurrency loans while being institutionally-backed and 100% federally insured. (As according to their documents)

➡️Tax Assistance

One of the cooler and more unique features of BlockFi is that it offers a dedicated tax assistance portal, which helps facilitate using BlockFi to understand how using BlockFi products can offer additional tax benefits, which no other crypto lending platform has enabled.

Supported Countries

Score: 8/10

BlockFi does a fairly good job when it comes to offering its products from a jurisdictional standpoint. Although the institutionally-backed interest-bearing account is prohibited from use in select U.S. states including New York and Washington, the crypto lending portion of BlockFi is enabled almost entirely internationally.

Languages

Score: 3.5/10

At the moment, BlockFi is fairly limited in terms of language, as it only offers English support.

Lending Platform Review

Score: 8/10

BlockFi is a favored cryptocurrency lending platform with a sleek and easy to use interface. As a platform, it’s amongst one of the more better designed and layered lending opportunities, however, it garners this benefactor through its simplicity. BlockFi offers an easy to use interface where users can seamlessly apply for loans, set up repayment loan terms, and monitor the value of their loan, the LTV ratio of their loan, as well as multiple other factors. Paying off loans are as easy as finite clicks of buttons, all of which are guided by the intuitive functionality of BlockFi.

As far as getting started with a loan and getting preliminary approval for a loan, you do not need identity verification, and you can apply for a loan immediately without restrictions.

Fees and Limits

Fee structure, as well as account limitations and restrictions, are amongst the deciding factors when it comes to deciding which cryptocurrency lending platform or site that you want to use. BlockFi’s fee structure is fairly low compared to other similar sites like Nexo or SALT. Additionally, BlockFi is the only major cryptocurrency lender in its bracket that doesn’t impose an additional discount or tiered system in combination with inclusive company crypto, making it rather attractive.

- Minimum: No Minimum for interest account (However, you need $2,500 equivalent to compound interest) – $4,000 collateral min crypto required for loan.

- Maximum: $100M

Score: 7.5/10

Limits

Loan Limits

BlockFi imposes a minimum starting value of $4,000 in cryptocurrency collateral to get started, which equates to a $2,000 loan in fiat value (Its minimum). As this isn’t traditionally the amount that retail users want to get started with (This is usually in the hundreds of dollars amount), BlockFi then becomes more of an asset for institutional level clients as opposed to retail users.

For interest-bearing accounts on BlockFi, there is additionally no minimum that is required to get started, however, in order to acquire compound interest, you’re required to have a deposit of $2,500 or so.

Lending and Credit Fees

BlockFi imposes a traditional minimum APR that starts at approximately 4.5%. This is then flexible dependent on multiple factors, including the type of cryptocurrency you use as collateral, the amount of information you enter, etc. This APR is then applied to the LTV ratio which you can then choose to pay off in certain increments from the locked-up amount.

BlockFi also offers a starting rate for interest-bearing accounts at 6.2% annually.

Withdrawal Fees

BlockFi does not have any major withdrawal fees, other than the minimum network requirement amount in the case of certain cryptocurrency withdrawals. The detailed list can be viewed here.

Account types

Score: 8.5/10

We commend BlockFi on its ability to offer multiple account types, which are all fairly impressing in terms of features and abilities.

Compound Interest-bearing Accounts: These account types are unique in comparison to other platforms mainly because of the function of compounding the interest gained on these cryptocurrency accounts.

Loan Accounts: BlockFi offers loans to cryptocurrency users based upon LTV ratios; these types of accounts can be opened nearly immediately as long as you have the amount of collateral that is required.

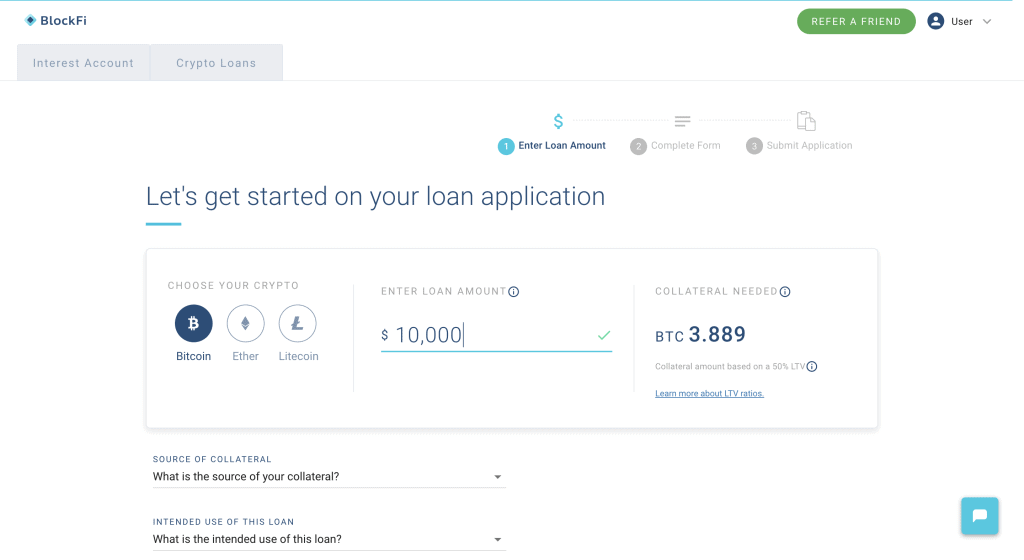

How to get a loan on BlockFi

-

Create an account

To get started with a loan on BlockFi, you firstly need to create an account which will be used mainly to access all of the details and specs of your particular loan.

For an initial account, you don’t need any type of credentials, however, if you’d like the lowest possible fees and APRs, we recommend validating information and account specs. Also, if you’re an institutional account level, we also recommend fully verifying and validating your account as larger amounts in account types are just generally more secure when full credentials are provided.

Dependent on your account type, you’ll then be asked to enter in the proper credentials (This won’t be more than your email, account type, specification, and basic credentials – full verification is what will require your ID, and additional info).

-

Apply for Loan

After you’ve created your account, the next step here is to get started with your loan. This requires multiple levels of questions and specifications that are best tailored to indicate the best specs for your loan. This includes the loan amount, the collateral you need to deposit to maintain the loan, the type of collateral, sources, uses of the loan, and more.

Once you’ve completed these steps, you’ll be asked to finalize the details of the loan and the specifications of it overall. Once you’ve done this, you can finalize and submit the application for the loan. The application will be reviewed, and you’ll be given access to the loan as well as all of the surrounding details (Time, rates, length, and more).

-

Use Your Loan and Set Payments

The final step is to then withdraw your loan and set up the payments based on your input. You can specify payments and indicate various inputs including how much you want to liquidate for the repayment per month, and more.

However, in any case, if the value of your collateral surpasses an LTV rate, your collateral will immediately liquidate regardless of the system you’ve set up.

Security and Regulation

Score: 9.5/10

Regulation

One of the main reasons why BlockFi is among one of the more recommended platforms in comparison to others is the transparency and main regulation that is made so vividly apparent on BlockFi. BlockFi is partnered with Gemini, the New York Trust, and utilizes Gemini Dollars, which is Gemini’s internal cryptocurrency that is regulated and federally insured.

Security

BlockFi offers insurance on collateralized cryptocurrency, and additionally is now managing over $53M in cryptocurrency, putting it amongst some of the largest wealth managers in cryptocurrency.

Deposit and Withdrawal Process

Score: 7/10

Payment Options

BlockFi can be operated using cryptocurrency, and also exclusive Gemini Dollars.

Deposit: Deposits on BlockFi can be done in either Bitcoin, Ethereum or Litecoin. It is fairly limited, however, this is mainly because these are amongst the assets that BlockFi has received a level of regulatory approval for. For interest-bearing accounts, Gemini Dollars (GUSD) can be used.

Withdrawal: Withdrawals on BlockFi can be made via Gemini Dollars or fiat value via bank account.

Education and Resources

Score: 9/10

Overall, we commend BlockFi for its ability to offer a variety of different educational resources that make the picture fairly clear when it comes to what the platform is, what they offer, and essentially how everything works at its core. In fact, while other cryptocurrency and lending platforms have maintained strictly either a resource center or a blog where they try to explain how the platform works and some of its other quirks through blog posts, BlockFi actually offers access to both of these. BlockFi has a frequently updated blog section, as well as an educational resource center.

BlockFi does a great job with offering its clients and prospective users the ability to learn about the service as well as the functionality of the platform in their spare time.

LTV-based loans and cryptocurrency lending platforms and services as a whole are both very complex and new forms of technology and financial services. BlockFi, in our opinion, does an excellent job of providing these types of services and translating the hard to decipher nature of cryptocurrencies and cryptocurrency lending.

Customer service

Score: 7/10

Since BlockFi’s business model is more tailored to institutionally-sized clients, on the platform you’re many times often given individual account managers and operators. These are dedicated mediators and assistants who are assigned to your account types that are tasked with ensuring you know how to maneuver the platform, use it for its main benefits, etc.

However, if you’re looking for more instant, retail-level customer service options, BlockFi isn’t the best option. As it’s more entirely tailored for the institutional-level of clientele and users, it appears as if customer service isn’t one of their focuses.

BlockFi vs Nexo

Both Nexo and BlockFi let you earn interest and take loans against your cryptocurrency holdings. Nexo’s interest rates on crypto holdings yield 20% yearly interest, which is way higher than BlockFi’s 6.2%. BlockFi supports fewer currencies and cryptos as compared to Nexo. Also, BlockFi being a highly regulated entity and having a high emphasis on U.S. regulatory stature, global borrowers may find trouble in looking for clarity.

Conclusion

BlockFi is one of the better, more regulated cryptocurrency lenders with competitive fees, however, when it comes to the general landscape, we overall believe that BlockFi is better for institutional/larger-sized loans and accounts. As a whole, BlockFi is reputable and fairly efficient, and we strongly recommend looking into BlockFi as a cryptocurrency lending platform or interest-bearing account if you’re talking about larger sums of capital, however, for retail-level purposes, there are fairly better alternatives.

To get started with cryptocurrency lending, or interest-bearing crypto accounts like BlockFi, you’ll need to get access to cryptocurrency; to easily get started with crypto, you can buy Bitcoin immediately and easily using PayPal.

Read more:

FAQs

How do I know what my rates will be on BlockFi?

You can check preliminary rates on BlockFi using their inclusive built calculator.

Which assets can I deposit to get started on BlockFi?

You can deposit Bitcoin, Ethereum, or Litecoin to get started on BlockFi, and also Gemini Dollars for interest-bearing accounts.

What is the maximum loan term that I can get on BlockFi?

The maximum offered loan term on BlockFi is 12 months.

Is BlockFi legal?

Yes, BlockFi is legal in its operating districts; it is also one of the more fully-compliant platforms when compared to others.

What rates does BlockFi offer for loans?

BlockFi offers up to 50% LTV-value and loan issuance, and its APR starts at a competitive 4.5%. Both of these percentages vary and are not set in stone.

How do I get a loan on BlockFi?

To get a loan on BlockFi you need to first create an account and then apply for a loan, which is reviewed by BlockFi's core team.

What is an LTV ratio?

An LTV ratio is a 'loan-to-value' ratio which is a certain number that indicates the value of your collateral in comparison to the loan you've acquired/are looking to acquire.

How much do I need to earn compound interest?

On BlockFi, you need a minimum of $2,500 in cryptocurrency or stable coin equivalent in order to start earning compound interest on these products. There is no minimum for getting started on the platform, only a minimum for compounding interest that is earned.