SALT, which is an acronym for Secure Automated Lending Technology is one of the larger, well-known Bitcoin/cryptocurrency loan platforms. On this platform, you can receive what is called ‘LTV-based’ cryptocurrency loans, where your loans are collateralized by cryptocurrency that you deposit. In these cases, like with SALT, you deposit a certain amount of cryptocurrency and are given a loan based on the volatility of that asset. SALT joins just the very few numbers of legal cryptocurrency lenders that enable Bitcoin loans. SALT has its pros and cons, and as a result, we’ve gone through them all to deduct a final conclusion on whether or not SALT should be your lender of choice when it comes to Bitcoin loans.

Is SALT recommended?

SALT is a Bitcoin and cryptocurrency lending platform that proposes lending that is facilitated entirely through its SALT token. SALT maintains fairly high minimum loans, and although it is regulated and maintains compliance, we’re a bit uneasy about SALT. We will explore exact reasoning as to why we aren’t entirely thrilled with SALT, however, as a whole, does it function as it’s supposed? Well, we’re not entirely sure.

SALT has come under a lot of scrutinies for not only faking and overexaggerating fees, claims, and processes, but also for not solving unanswered user claims and complaints. As a result, based upon previous misconduct, unanswered user claims, and higher fees/limits, we believe that SALT may be a decent lending platform and could be an alternative if you’re not able to access other platforms such as Nexo, however, we generally do not recommend it. Due to the incremental mishaps in company conduct and a few unanswered questions as far as user complaints, we are personally not convinced entirely to use SALT.

In any case, we always advise you to do your own due diligence and simply use this as a reference.

What is SALT?

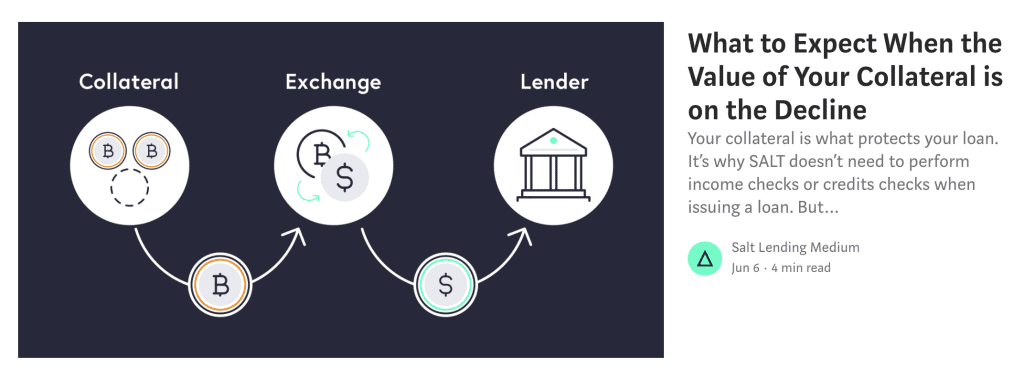

SALT is a single-purpose cryptocurrency platform focused on lending funds in exchange for cryptocurrency collateral. In order to get started on the platform, and even derive the smallest level of optimization from it, you need to first buy cryptocurrency that you will then deposit to use as collateral on the platform. Then, once you deposit the cryptocurrency, you will be given a loan issue amount. This loan amount is relative to the cryptocurrency collateral you’ve deposited; depending on your LTV ratio, the lower the price of the cryptocurrency falls, the more of your collateral is sold to pay off the loan. However, this comes with multiple abilities in your practice:

- SALT issued loans have pre-determined interest rates as well as minimum payments that you can establish beforehand which essentially eliminates any minimum payment worries, and also no late fees.

- SALT issued loans can additionally be collateralized using SALT’s main cryptocurrency, which offers reduced interest rates and higher limits.

SALT works by using a collateralized cryptocurrency that you can buy on brokers like Coinbase and then simply holding that cryptocurrency securely in the SALT lending platform.

Markets and Products

Score: 7/10

SALT, unfortunately, underwhelms from markets and products point of view. Unlike competitors like BlockFi and Nexo, SALT doesn’t offer an interest-bearing account. While SALT does offer the internal SALT token, putting it in competition with NEXO tokens, the benefits of NEXO far outweigh those of SALT.

To make matters worse, when it comes to the assets that are accepted on the platform for deposit and collateralization, the supported assets don’t match up against competitors. SALT enables the inclusive SALT token which is used for discounts on interest which seem interesting at first glance, however, in comparison with products offered on Nexo or BlockFi, SALT seems to sink towards third place.

SALT’s products itself are very intuitive and use technology in a way that many other firms cannot, however, compared to alternatives, we’re a bit underwhelmed by its capability.

Special Features

Score: 6/10

Exclusivity is extremely important when dealing with these relative lending platforms: SALT underperforms in this regard by not offering unique or features on its platform that would compete with the market. In fact, we can only really finalize one unique feature on SALT, which is its mobile application, however, when it comes to analyzing it, there’s nothing entirely special that we can tell about the mobile application, and in fact, it only seems to have basic deposit, withdraw, and historical access functions.

➡️Semi-Exclusive SALT Tokens

SALT maintains mild exclusivity in that it processes internal SALT tokens. However, they do not function in any exclusive way that we’ve seen demonstrated in the case of NEXO. SALT tokens simply serve as a utility, used for discounts on the platform if you choose.

➡️Mobile Application

SALT additionally has a mobile app, something other platforms don’t have, but the application is fairly underwhelming in its functionality.

Supported Countries

Score: 8.5/10

We do give SALT kudos for actively expanding and trying to provide services amongst a variety of different countries. According to public sources, SALT worked with regulatory entities to provide SALT lending in the remainder of the states within the U.S. that it was previously barred from. SALT, because of its track record, is available in an impressive amount of jurisdictions.

Lending Platform

Score: 7/10

As a whole, we have generally mixed feelings when it comes to the SALT lending platform, and while it serves its purpose and has factually been a successful option for cryptocurrency or Bitcoin lending, we’re not 100% satisfied with SALT, for a few reasons.

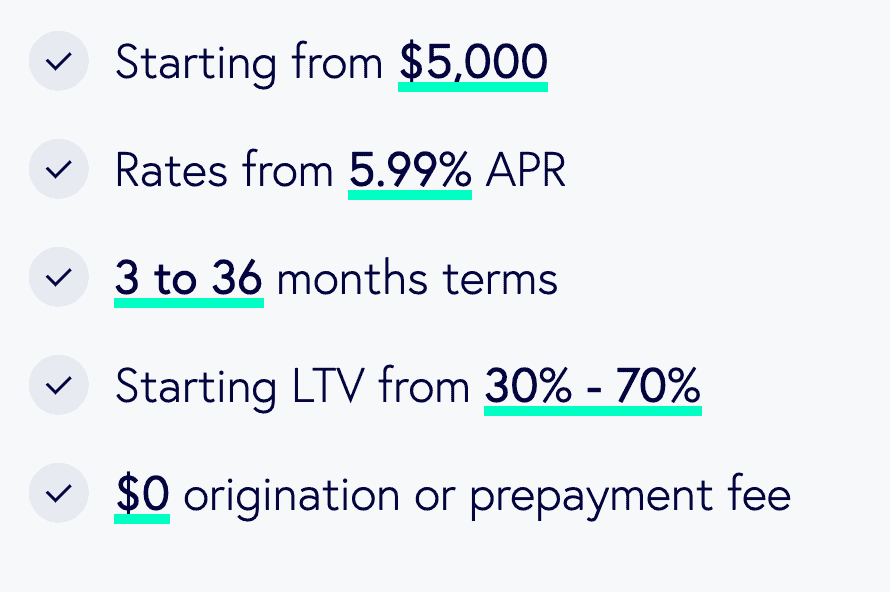

To start, SALT we’ve found that the platform is partially a hassle to get started with. For example, on the homepage, the platform indicates that APR’s begin at 6% and 30-70% LTV rates, which is true, however, only if the proper registration process is completed. SALT lending has had a history and user-submitted track record of waiting sometimes extremely long amounts of time prior to finally issuing loans. Some users have reported it took them as long as multiple weeks to be approved for a loan, at which point a non-favorable lending term was placed. This depends on multiple factors, which makes us a bit uneasy; if a platform is looking to be revolutionary and disruptive, then it 1.) Should outpace the competition in terms of timing (Multiple weeks is equivalent to a legacy loan issuer), and it should 2.) Not have the uncertainty that it’s placed amongst users so far.

Additionally, the number of assets that are offered on SALT’s lending platform is fairly limited in comparison to competing platforms, and even if they were to provide a Bitcoin-focused or singular asset emphasized platform, the services should be all around groundbreaking, which, unfortunately, they aren’t.

Fees and Limits

Immediately, SALT gets a bonus for offering competitive fees and limits in regards to the legacy financial industry, however, the next set of comparisons and review would have to be placed amongst the remainder of cryptocurrency lenders out there. While we can give credits to SALT when comparing it to traditional finance, we need to take a separate look and see it for what it is when comparing it to the remainder of the industries available.

Score: 7.5/10

Limits

Loan Limits and Minimums

SALT is a bit of a let down when it comes to loan minimums as the very smallest amount that you can start with is $5,000. This takes SALT out of the game when it comes to retail investors and users as this traditionally means with an appropriate LTV ratio, you’ll have to deposit a minimum of about $10,000 or so. As most retail users aren’t looking to process this relative amount, it cuts off the opportunity for many users.

As far as loan maximums, SALT offers a max loan issuance of $25M to select users, which makes it clear that the platform is more of an institutional-focused entity than a provider of retail loans. Nonetheless, this separates it from NEXO, for example, who has a $500 loan minimum, much less than SALT’s min.

Lending and Credit Fees

SALT doesn’t impose any late monthly fees or equivalent because the entirety of the loan process is determined and published at its initial creation. As a result, however, you do have to pay an APR or equivalent on the collateral that you put up on the platform. This can sometimes be a rather larger negative considering you’ll have to pay a volatile amount on an even more volatile asset. However, in any case, the APR that is added to your loan and reduced from your collateral is fairly autonomous, making it super easy for you to not forget payments, and even pay off your loan faster than you initially wanted to.

????APRs on SALT begin at 6%.

????LTV ratios on SALT can range normally from 30-70%.

Withdrawal Fees

In the case of withdrawing cryptocurrency, there are no additional fees imposed, equivalent to NEXO which makes it fairly efficient as a place of storage. Additionally, the only fees added to transactions are those to pay the network facilitation.

Account types

Score: 6.5/10

Unlike most other lending platforms of this type, SALT really only enables 1 main type of loan account. Although this account type allows you to use multiple types of assets as your main form of collateral, the underlying account types don’t change. Using the inclusive SALT token can additionally help to leverage price discounts and what not, however, it doesn’t offer you any separate account types or equivalent.

Loan Accounts: These are the only types of accounts that can be opened with SALT. In this case, you place collateral in the form of cryptocurrency which establishes your LTV ratio. Then, depending on the fluctuation of the collateral, your LTV ratio follows; assuming you do not hit a liquidation point, you can pay back the loan on your own terms.

How to get a loan on SALT

-

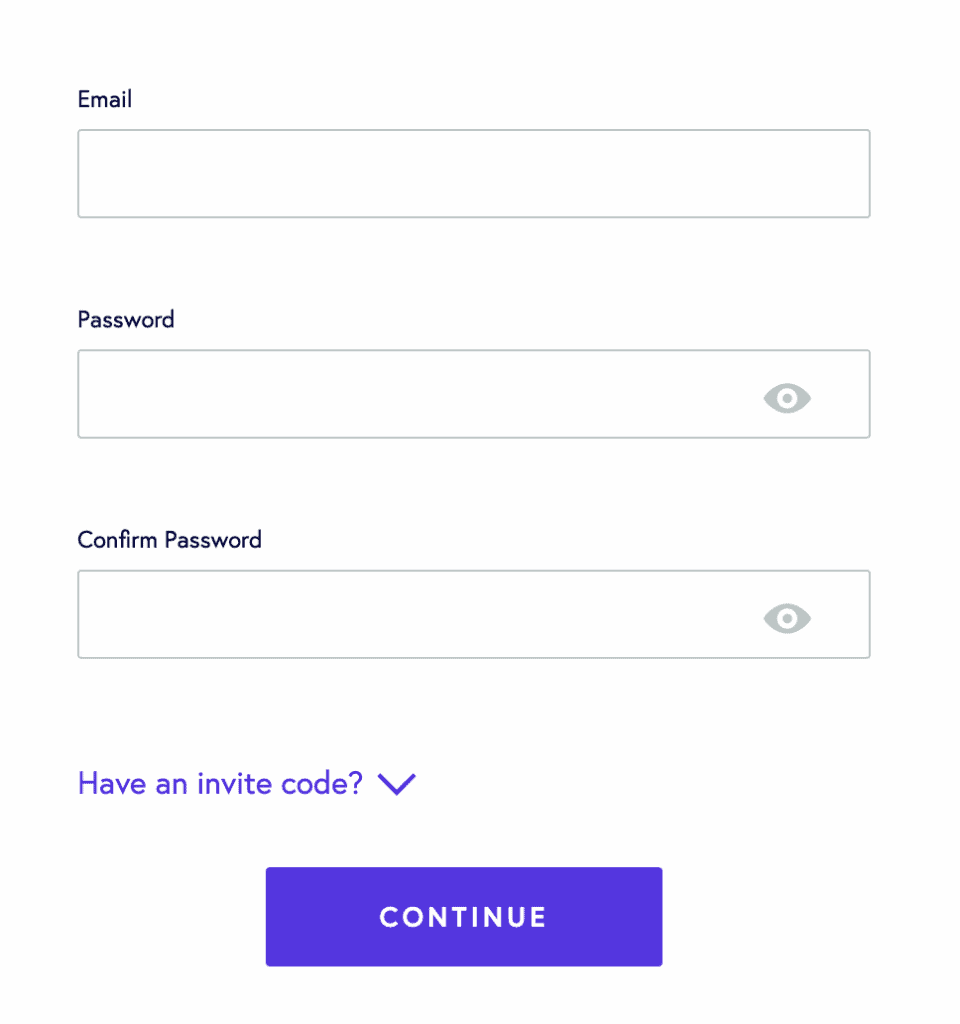

Create an account

To get started on SALT, the first step is to create an account; to do so, head to their main homepage platform and click the ‘Sign Up’ button. This will prompt you with a new page where you’ll be asked to enter in basic account information to move forward. The page will appear as follows:

Once completed, you’ll also, unfortunately, have to provide additional account information to verify/validate your overall account. You’ll see that you simply aren’t able to move forward until this step is completed. For account verification, you’ll need valid identification, proof of residence, and a form of second method authorization (Such as a phone number or secondary email). Once submitted, your account will be reviewed (Which can take a variable amount of time depending on your account).

-

Deposit Your Cryptocurrency Collateral

The second step here once you’ve submitted your account for review by the SALT lending team is to deposit your cryptocurrency as a form of collateral for your loan on the platform. As discussed, the SALT lending platform runs off of an LTV model, which means you are issued a fiat currency loan dependent on the amount of cryptocurrency you deposit.

Your LTV ratio, the loan terms, and more, are dependent on multiple factors that will be clarified for you upon finishing your account creation; nonetheless, decide which crypto you want to deposit and click the ‘Request a Loan’ button as is shown on the ‘Dashboard’ panel of your main account page.

Doing so will give you a list of cryptocurrencies to deposit; you can choose from the supported assets, or choose to deposit ‘SALT’ which is the proprietary cryptocurrency.

Depositing SALT will reduce the fees and give you a favorable redemption value, which is a step above utilizing other cryptocurrencies.

-

Withdraw Your New Loan

Upon entering your preferred type of redemption method for your SALT loan, you can then access your SALT loan. If your type of redemption was specified as a fiat withdrawal, then simply follow the onscreen instructions to enter your bank account details and begin the processing for your account. Otherwise, you can withdraw your new issued loan via stablecoins within certain parameters. In either case, the withdrawal process should be fairly similar.

Repayments

Since SALT lending runs on an LTV loan basis, funds are essentially locked based on your repayment terms, unless you specify to pay them back earlier. To repay parts of the loan earlier than you set beforehand, on your dashboard click on ‘Your Loans’ and press ‘Pay’.

Security and Regulation

Score: 8/10

Regulation

SALT is highly regulated; their insurance policy, platform, and token are all registered and maintained.

Security

All cyber-based aspects of SALT are insured 100%, you can read more about their cybersecurity policies here.

Deposit and Withdrawal Process

Score: 7.5/10

Payment Options

Deposit: With SALT, all deposits made need to be made via cryptocurrency or equivalent. The assets that are available for deposit on the platform are fairly limited, however, the process is streamlined and fast.

Withdrawal: Issued loans can be accessed directly via bank account or equivalent; in this case, the process is immediate and processing is standard based on your bank choice.

Education and Resources

Score: 6/10

One of the additional downfalls that SALT falls victim to is the lack of providing information and guidance for new users. While the platform does, in fact, offer a fairly intuitive blog with semi-active posts, it doesn’t compare to the other resource and educational sectors available on other cryptocurrency platforms.

Pros and Cons

Pros

- Entire loan is at all times insured

- Set pre-established loan terms and settlement options

- No monthly minimum payments, no late fees incurred, nothing similar

- No conversion to U.S. Dollar (A taxable event) required to use the service

- SALT provides individual account customer service-type support

Cons

- Fairly limited amount of assets that can be deposited as collateral in comparison to competing firms

- Educational content and resources are fairly limited in their nature.

- There has been a large amount of uncertainty about the exact parameters for the loans issued

Conclusion

Our due diligence, research, and experience with multiple crypto lending platforms point to an inevitable conclusion that SALT is not the ideal option for bitcoin and cryptocurrency loans. We don’t recommend SALT explicitly and believe there are better alternatives to cryptocurrency and Bitcoin loan platforms.

Bitcoin and cryptocurrency loans can be confusing at first glance; streamline the buying process by using platforms like PayPal.

In any case, ensure you stay up to date with all of InsideBitcoin’s news and updates by keeping up to date with InsideBitcoin’s developments!

FAQs

Which is better, SALT or Nexo?

We personally believe due to its wider availability for all types of clients and more transparent business processes, Nexo is the better crypto lending platform.

How much do I need to get started on SALT?

A minimum of $5,000 is required to get started on SALT lending.

Is SALT regulated?

Yes, SALT is regulated and all holdings on the platform are fully 100% insured.

Which cryptocurrencies can I use on SALT?

SALT supports a fairly limited amount of cryptocurrencies. This includes Bitcoin, Ethereum, Litecoin, Dogecoin, and DASH.

What happens if I get a SALT loan and my cryptocurrency value skyrockets?

Nothing - you still own the cash that was given to you through the loan as well as the cryptocurrency you store on SALT Minus the loan repayment that is owed.

Is SALT transparent?

One of SALT's biggest downfalls is that it isn't entirely transparent. Information is hard to acquire about the firm, it's registrations, and it's team, and that's, unfortunately, a red flag.

What verifications do I need to use SALT?

SALT is one of the only cryptocurrency lenders that requires extensive identity verification and registration in order to use the platform. For this, you need valid ID, valid proof of residence, and additional materials.

What determines my LTV ratio on SALT?

A combination of the amount of collateral invested, the type of collateral placed, your jurisdiction, and account validation will determine your LTV ratio.