FTX Token (FTT), FTX exchange’s utility token, is one of the most controversial cryptocurrencies in the crypto market. The token has witnessed heated tides after FTX capsized with billions of dollars in customer funds. Its value nosedived by nearly 100% as its investor sentiment dwindled.

However, FTT has demonstrated remarkable resilience even when the odds turned against it. Despite the market’s roller-coaster rides since January, FTX Token saw only two major corrections in five months.

News of FTX relaunch and the bankruptcy claims portal slightly improved the token’s market sentiment. With its highly abrupt price movements, it’s hard to tell what will become of FTT in the coming months. However, a peek at its historical price actions, technical analysis, and market sentiments could give us heads-up on the token’s price outlook in the coming months.

Things You Need To Know About FTT

FTT is the native token of the defunct cryptocurrency exchange FTX, launched in May 2019. It provides access to all features and services on the FTX trading platform. FTX Token (FTT) creates utility in the FTX ecosystem by incentivizing users who hold and use the token.

The token claims it’s different from other exchange utility tokens with unique features, including clawback prevention. Clawback happens when investors lose money due to liquidation. FTT prevents this via a three-tiered liquidation model.

All was good with FTT until its parent platform, FTX exchange, experienced liquidity issues. FTX’s ordeal began when news of a massive deficit in its sister company Alameda Research’s balance sheet, circulated throughout the industry.

The crypto derivatives exchange could no longer meet up with the withdrawal requests of investors scramming to liquidate their funds to avoid losses.

Further investigations revealed that FTX and its former CEO, Sam Bankman-Fried transferred customers’ funds to Alameda Research. Just recently, he was found guilty of all the charges leveled against him. Meanwhile, the crypto exchange eventually filed for Chapter 11 bankruptcy protection in the United States on November 11, 2022, after it suspended withdrawals on its platforms.

The FTX fiasco escalated into a mayhem that claimed the lives of several crypto businesses, massive asset price crashes, including billions of dollar worth of investor funds.

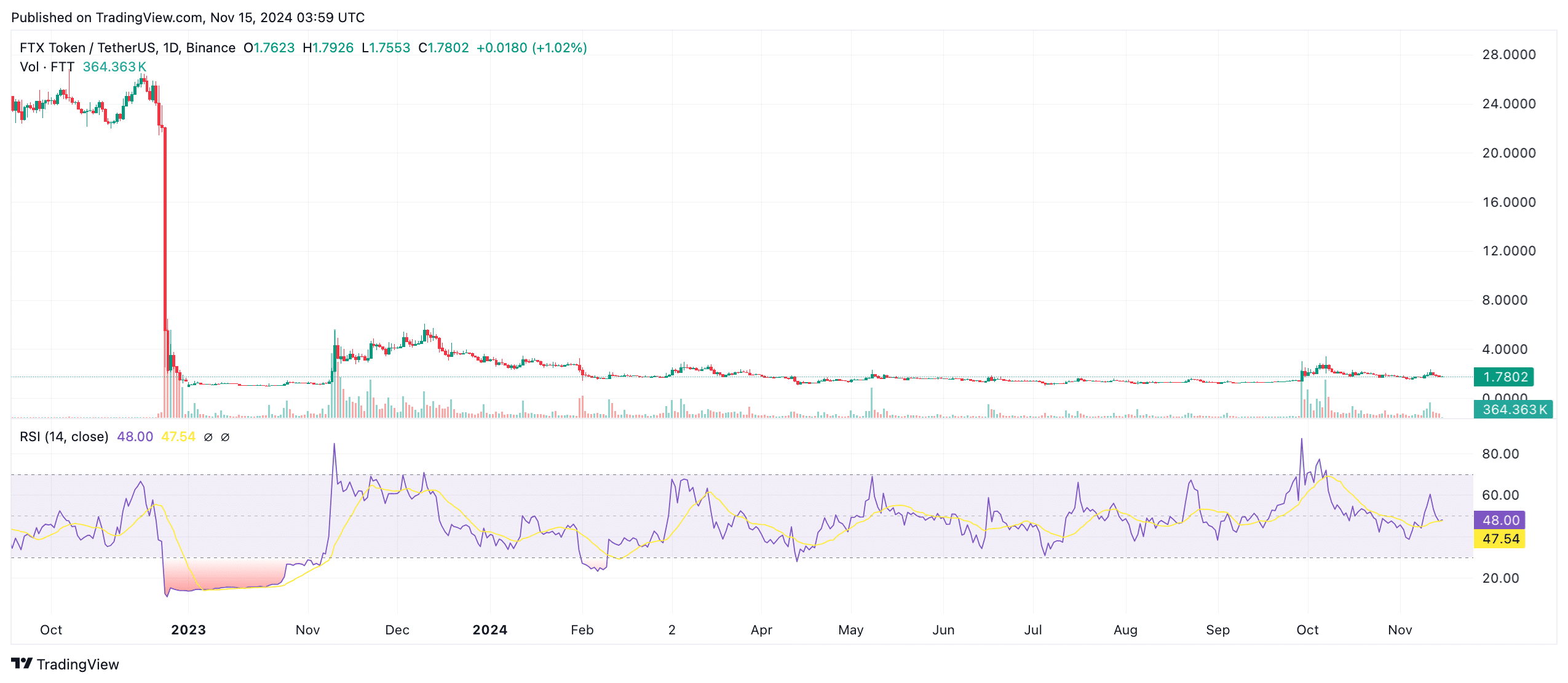

FTT price nosedived because of the FTX fiasco, with its values plummeting from an all-time high of $85.02 to an all-time low of $0.7763.

However, the tides quickly turned during the bankruptcy drama, pushing the token’s price to $1 in November and below $1 in December, 2022. Its trading volume skyrocketed to over $1 billion in early November and fell below $10 million.

The token has been struggling to recover since then. After a slight rebound above $1, FTT has been on a roller coaster ride. It managed to rise to the $5 range towards the end of 2023. However, since 2024, the token has been hovering in the $1 range, trading slightly above the $1.5 mark at the time of writing.

FTX Token (FTT) Price Movement

At the start of 2024, FTT opened with strong upward momentum, reaching a peak near the $5 mark in early January. This upward spike suggested initial optimism, likely due to speculative trading and a slight recovery in the broader market. However, this bullish momentum was short-lived as FTT quickly faced resistance at the $5 level, which proved difficult to break.

Following this peak, FTT began a gradual decline, moving downwards throughout the first quarter of 2024, with support levels forming around the $2 range. As the year progressed, FTT struggled to maintain any significant gains, trading mostly within the $1 to $2 range, showing a sideways trend with occasional minor spikes.

The chart indicates that FTT has faced persistent resistance around the $3 level in recent months, which has prevented sustained upward movement. Each time the token approached this resistance, it encountered selling pressure, pushing the price back down. On the support side, FTT appears to have found stability in the $1.5 range, with this level serving as a floor that buyers have defended to prevent further declines.

Factors Influencing FTX Token’s Price Action

Many investors may consider buying FTT at a discount price, following rekindled hope of restarting the defunct exchange. Hence, the token recorded a renewed funds inflow, evident in the increased trading volume witnessed in the past few days.

According to reports, the recent surge in the price of the token is not unconnected to the renewed interest in FTX by investors. After a trial that birthed a guilty verdict for SBF, scores of investors are now racing to acquire the embattled exchange. As the possibility of FTX’s reboot gathers momentum, FTT may soar beyond its current price.

Meanwhile, don’t forget that the current CEO of the exchange, John Ray 111 has earlier reiterated his plans to flip the coins and regain customers’ trust in the cryptocurrency exchange.

In addition to the reboot plans, the exchange has opened its portal since July with detailed steps on how FTX debtors can reclaim their funds following the recovery of $7.3 billion in liquid assets.

FTX debtors are to submit their account information authentication, account balance confirmation, review as of November 11, electronic proof of claim, noticing agent, and KYC authentication.

It bears mentioning that the noticing agent is Kroll Restructuring Administration. This development has improved investor sentiment on FTT, evident in its recent price movements.

FTX Token (FTT) Price Prediction

Q4 2024

The FTT token is trading in the $1.5 to $2 range, reflecting the limited utility and uncertain future of the project. With FTX remaining defunct and the token having no intrinsic value or functionality beyond community support and speculative hopes for a revival, it’s unlikely that FTT will see any significant upward movement.

The current price level is sustained by a mix of nostalgia and minimal market interest, with no substantial development or value being added to the token. Without a major announcement or tangible progress from the development side, FTT is expected to hover within the same range for the rest of the year, lacking any clear driver to push it past the $2 resistance.

2025

Looking into 2025, the outlook for FTT appears increasingly challenging. With FTX still defunct and no signs of a platform relaunch or significant value proposition, the token is likely to struggle with diminishing demand. In the absence of meaningful progress or developer action, the interest in holding FTT may wane as investors opt for more active and value-driven projects.

This could result in a gradual decline in FTT’s price, with the token potentially falling below the $1 range as more holders exit their positions. The lack of utility and ongoing uncertainty surrounding FTX’s future could lead to further depreciation, as the community’s speculative support may not be enough to sustain value. Unless a plan is introduced to rebuild the FTX platform or restructure the token’s utility, FTT’s appeal will likely erode, resulting in lower demand and a potential slide in price.

2026

By 2026, the probability of FTT maintaining relevance without substantial changes appears low. For FTT to experience any meaningful revival, there would need to be a significant development, such as a new entity taking control of FTX’s brand or a major initiative to rebuild the platform with added utility for FTT holders. Such a move could rekindle interest and possibly restore some of FTT’s value.

However, if no action is taken, the token will likely continue to stagnate, with a high chance of declining further as other projects capture investor attention. In the absence of a revitalized platform or new value proposition, FTT could be at risk of being relegated to a low-value, inactive asset with minimal trading activity, possibly leading to further depreciation or even market delisting.

The only path to recovery would be a concerted effort from developers or a takeover by a new organization to build upon the FTX legacy and provide FTT with a sustainable role in a rejuvenated ecosystem.

Factors That May Determine FTT Price In The Coming Months

Like every cryptocurrency, FTT’s price is subject to external and internal economic factors. Its price may move according to trending news around the FTX exchange, regulatory outlook, market/investor sentiment, and general economic conditions.

Market Sentiment

Improved or bullish market sentiment for a cryptocurrency means more people are willing to buy the token. It generates a high buying pressure or demand for the crypto asset, driving its price higher.

On the other hand, a bearish market sentiment increases the selling pressure on a coin, driving its price down since more holders are willing to sell at even the lowest price.

Check out our guide to discover when the next crypto bull run will unfold.

While several factors may affect FTT market sentiment, one of the main factors is ecosystem developments, news, and social media hype. Like the recent price boost due to the news of FTX’s relaunch, FTT’s price could rise in the coming months if positive developments that could improve investor sentiment reach the ecosystem.

Regulatory Outlook

Crypto market volatility has increased over the past few months due to regulatory uncertainty and enforcement actions against cryptocurrency exchanges. That generated a bearish momentum, which pushed most coin prices down, including FTT.

However, the market outlook would likely improve if the government should introduce a clear regulatory pathway for the crypto market. Comprehensive crypto legislation would boost investor trust in exchanges, attracting more buyers to crypto assets, including FTT.

For instance, the crypto market experienced a boost with the news of Ripple Lab’s win in its security lawsuit with the SEC. Most of the coins labeled as securities by the US SEC entered an uptrend when the news circulated. More so, indications of a possible crypto ETF approval have also heightened investors’ interest in the industry.

General/Macro Economic Conditions

Most of the time, bearish conditions in the broader real-world economy spill over to the crypto market. The reason is that crypto does not exist in isolation, as market participants interact with several external economic factors that may affect their buying strength.

Therefore, economic conditions like inflation, deflation, and currency devaluation, may affect investors’ interest in cryptocurrencies. In the case of inflation, central banks combat its effects by hiking interest rates, which affects crypto prices.

Also, currency devaluation may inflate crypto prices as more people resort to crypto to hedge against inflation. A win for the broader crypto market could also result in a profit for FTX Token.

For instance, the U.S. Federal Reserve maintained a hawkish stance on curbing inflation in the last few months. This led to persistent hikes in interest rates, reducing venture capitalist investments in crypto.

It also affected the traditional financial markets, pushing down stock prices, which share a close relationship with cryptocurrencies. The ripple effect spilled into the crypto market, leading to increased volatility and crashing asset prices, contributing to FTT’s downtrend.

However, FTT inherited a bullish momentum as the market rebounded slightly. But economists predicted a recession before the end of 2023, should the Fed continue its hawkish stance. A recession would likely affect the price of high-risk assets like FTT and other cryptocurrencies.

Notably, the U.S. harbors the world’s largest financial market and user base for cryptocurrencies, and the USD is the global reserve currency. Therefore, a bearish economic situation in the U.S. would affect the global financial market and cryptocurrencies, including FTX Token.

Ultimately, however, it must be noted that the token serves no purpose at the moment, which essentially makes it nothing more than a shitcoin with a huge community. So those who look to invest into the project must keep that in mind while considering it as an investment.

Developments Around FTX Exchange

FTT price could surge in the coming months if the FTX exchange reboot comes into fruition. This development, alongside its ongoing reimbursement efforts, could rejig the reputation of the exchange. Therefore, FTT’s price could see positive moves in the coming months if the touted FTX relaunch holds as expected.

Check out our guide to discover how you can buy FTX Token safely this year.

Investing In FTT

FTT has demonstrated incredible resilience despite the crazy tides roaring against it. After witnessing its fair share of volatility, its investors saw a ray of hope through the rebound moves.

Therefore, intending investors might wonder what lies ahead for them. The crucial question becomes: Is FTT a good buy? Where would it be in the next year? Will its price rise in the long term? What is the fate of short-term investors? Let’s look at a few of these.

Is FTT Worth Buying In 2023?

Based on the current forecast and expert price prediction, FTX Token price action seems bullish in the coming months. But this may be fueled by the bullish overall sentiment of the market rather than the virtue of FTT itself.

One must be very careful and invest only as much as they can risk losing.

Who Should Invest In FTT?

Although FTX went bankrupt, FTT still trades in some exchanges. The token currently trades on Binance, Bitget, Pionex, Nominex, and Gate.io. Therefore, risk-oriented investors who believe in FTT’s comeback potential have continued to trade the token on these platforms. Low-risk-tolerant investors should only invest the amount they can comfortably part with or desist from investing altogether.

For more information, read our guide on how to buy cryptocurrency safely this year.

Will FTX Token (FTT) Rebound And Reach $10?

FTT can hit $10, but that may not be possible again this year. In the coming years, we expect the token to rebound and reach $10 if all the strategic efforts to rebrand FTX yield good results. Hence, it might be a good buy for long-term holders.

Will FTT Reach $1,000?

Based on its current price, FTT’s value would have to increase by over 60,000% to reach $1,000. According to the token’s general price outlook and past movements, FTT may not rise to $1,000. Even if it does, that would be several years from the time of the report.

Where To Buy FTX Token

As mentioned earlier, a few centralized exchanges (CEX), such as Binance, Gate.io, Bitget, Nominex, and Pionex, still trade FTT/USD, FTT/USDT, and FTT/BUSD pairs.

Interested investors should create an account with their choice of crypto exchange and choose how they want to buy the asset and pay. As one of the best crypto exchanges around, Binance allows buyers to purchase FTT directly from their bank account via a fiat currency transfer or other third-party payment channels.

Your capital is at risk.

Steps To Buy FTX Token (FTT) On Binance

- Create a Binance account (or with any listed exchanges) via the mobile app or website and verify your identification.

- Choose how you want to buy the FTT tokens.

You have three options: credit or debit card (preferably Visa or MasterCard), Bank Deposit, and third-party payment channels.

- Check payment details and transaction fees and confirm the order.

- After purchasing the tokens, you can choose a secure crypto wallet (e.g., Trust Wallet) to store the assets. You can also stake the assets on Binance Earn to generate passive income.

Your capital is at risk.

FTT Alternatives – Trending Utility Tokens In 2024

If you are not sure about investing in FTX Token or are not risk-oriented, there are other relatively reliable cryptocurrencies to add to your portfolio. Since FTT is a utility token, you may consider buying Binance Coin (BNB), Uniswap (UNI), Bitcoin ETF Token (BTCETF), Bitcoin Minetrix (BTCMTX), Polygon (MATIC), Bitcoin (BTC), and Ethereum (ETH) amongst others.

FTT Versus Binance Coin (BNB)

BNB is the utility token created and issued by the crypto exchange, Binance. BNB was launched as an ERC-20 token on the Ethereum blockchain in July 2017. However, it later migrated to the BNB Smart Chain in February 2019 and became Binance’s native coin.

Binance users use BNB to pay trading fees and other services on the platform. Despite Binance’s ordeal with global regulators, the platform remains the world’s largest crypto exchange by trading volume. Also, its utility token, BNB, has witnessed an impressive price trajectory over the past 30 days. According to CoinMarketCap data, Binance trades at $246 as of press time.

Check out our guide to discover where you can buy BNB.

BNB’s market capitalization currently stands at $37.5 billion. There’s no doubt that BNB has a bigger future ahead of it, thereby positioning it as one of the best alternatives to FTT.

Your capital is at risk.

FTT Versus Uniswap (UNI)

Uniswap (UNI) is the governance coin for the Uniswap trading protocol, well-known for its role in facilitating automated trading of DeFi tokens. Uniswap allows for more efficient trading by solving liquidity issues plaguing decentralized exchanges through its automated solutions.

Uniswap launched its governance token, UNI, in September 2020. As of the time of writing, UNI’s price changes hands at $5.5 with a 24-hour price increase of 16%. For more details, read our guide on Uniswap Price Prediction.

Apart from serving as a medium through which users of Uniswap pay transaction fees, UNI also serves as a governance token. With the growing popularity and adoption of Uniswap, UNI has become one of the best coins to buy now.

Investors looking to escape issues associated with centralized exchanges might find UNI an attractive investment alternative.

Your capital is at risk.

The Best Low Cap Alternative To FTT – Best Wallet

FTT and other top coins have gained ground in the crypto market, increasing their market capitalizations. Like Bitcoin, early investors of these tokens gained massively, leveraging their low prices at the time.

However, it is not too late for investors looking for the next big utility project with high upside potential. If you are among these, Best Wallet Token could be your best bet.

Designed as the native token of Best Wallet, BEST provides users with numerous perks, including reduced transaction fees, staking opportunities with high APY, and exclusive access to advanced features within the wallet. These benefits make BEST more than just a utility token; it’s a powerful tool for enhancing the user experience on Best Wallet, a platform known for supporting over 60 blockchain networks and offering decentralized, non-custodial asset management.

Tokenomics play a crucial role in the appeal of Best Wallet Token. BEST has a limited supply, creating scarcity and potential for long-term appreciation as demand grows. The token’s distribution is structured to reward both early adopters and committed users, with staking rewards and loyalty bonuses available for those who hold and use BEST within the platform. This carefully planned tokenomics model fosters both community loyalty and active engagement.

🔥 The $BEST token presale is officially live! 🔥

For the next two weeks, this exclusive opportunity is only available to Best Wallet users, so take advantage while you can!

Join the presale now and secure your tokens at a discounted price. 🚀

Download the app! 📲… pic.twitter.com/VItxcDHAoE

— Best Wallet (@BestWalletHQ) November 11, 2024

Currently, BEST is exclusively available to Best Wallet users through a presale, offering early access at a discounted rate. This exclusivity allows early supporters to join the project at an attractive entry point, setting the stage for potential profitability as the platform expands.

Best Wallet has been proactive on its social media platforms, actively engaging its growing community and sharing updates on the presale and upcoming developments. For those who sign up now, this exclusive access offers a unique opportunity to get in on a high-potential project before it reaches broader markets.

Your capital is at risk.

Conclusion

While investing in FTT has drawbacks, it could also prove profitable following its price performances and expert analysis. Recent developments point towards the positive side of the coin, but as always, the tides can turn unexpectedly.

Therefore, investors must conduct extensive due diligence and implement relevant risk management strategies against potential losses. More so, investors can diversify their portfolios by investing in other promising alternatives like Best Wallet Token. Currently, the token is available on presale, meaning you can buy it at a discount price.

FAQs

Can I buy FTT on Binance?

Yes, Binance is one of the best exchanges where you can buy your FTT coins. Through its strong security mechanisms, users can buy their FTT coins without any issues.

Is Bitcoin ETF Token a good alternative to FTT?

Yes, we consider Bitcoin ETF Token as a good alternative to FTT because of its innovative features. It was launched amid the growing excitement greeting crypto ETFs.

Can I participate in the Best Wallet Token presale?

You can participate in the presale by using the affiliate link provided in our guide. The presale gives you a rare opportunity to buy the token at a discount price before it launches on centralized and decentralized exchanges.