On this Page:

Sam Bankman-Fried Net Worth: From FTX Billionaire to Inmate

Samuel Benjamin Bankman-Fried, commonly known as SBF, is a former billionaire and the founder of the cryptocurrency exchange FTX. In 2023, the wealthy entrepreneur was convicted of fraud and related crimes following the bankruptcy of FTX. The former ‘poster boy’ for crypto is now far from wealthy. As of 2025, Sam Bankman-Fried’s net worth is $0 – and he is most likely in debt.

Bankman-Fried, formerly considered the friendly genius of the crypto world, faced significant financial problems at FTX and its sister company, Alameda Research. As the evidence of fraud began to surface, FTX depositors raced to withdraw their assets, forcing FTX to pause withdrawals as it simply didn’t have the funds to payout its users. SBF filed for bankruptcy soon after.

Since March 28, 2024, Bankman-Fried has been serving his 25-year prison sentence. In this post, we will tell you all about his success and his fall from glory.

Breaking Down Sam Bankman-Fried’s Net Worth in 2025

After the FTX collapse and his trial, Sam Bankman-Fried’s net worth plummeted to $0. In an interview with the New York Magazine, SBF shared that he had made $10 billion, mostly through crypto investments, in 2021. His wealth reportedly peaked at around $26.5 billion before the scandal in 2022, according to Forbes (though Bloomberg Billionaires Index estimated his net worth at $16 billion in November of the same year).

Sam Bankman-Fried’s net worth in 2021 was mainly tied up in ownership of half of FTX and a share of its FTT tokens, but the details haven’t been publicly disclosed.

The disgraced crypto millionaire once ranked the 25th richest person in America. Today, his fortune has crashed to nothing, and, judged by how much he has to pay, he is likely to remain in debt for the rest of his life – especially since he’s been sentenced to 25 years in prison.

Back in 2022, Sam Bankman-Fried shared that he only had $100,000 in his bank account. Today, after the forfeiture order and other losses, this number is $0. Seeing how FTX’s value dropped and he owes $11 billion in forfeiture, Bankman-Fried most likely owes money, too.

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| Confiscated Robinhood investment | $648 million |

| 2022 net worth | $26.5 billion |

| FTX ownership | ~50% |

| Forfeiture sum | $11.02 billion |

| Total Net Worth | $0 |

Sam Bankman-Fried Net Worth: Early Life, Education, and Family

Samuel Bankman-Fried was born on March 5, 1992, in Stanford, California. He studied at Crystal Springs Uplands School in Hillsborough and attended the Canada/ USA Mathcamp summer program for high-school students who are talented in math.

After his high school graduation, Bankman-Friend enrolled and graduated from the Massachusetts Institute of Technology (2014), earning a bachelor’s degree in physics with a minor in mathematics. While at MIT, he lived in a coeducational group house, Epsilon Theta.

Samuel’s troubles have been following his family members around, as well. Bankman-Fried’s parents, Barbara and Joseph, are highly esteemed professors at Stanford Law School. FTX’s new owners are suing both of them to return assets that their son gave them over the years, both in the form of cash and real estate. The value of the assets in question amounts to a whopping $32 million, so it’s no wonder that FTX’s new owners want them back. While the parents confirm Sam gave these to them as a gift, they deny any wrongdoing.

The parents recently met with people close to the Donald Trump administration to find out whether a presidential pardon for their son is an option.

SBF’s father, Joseph Bankman, was very involved with FTX, providing legal and tax advice to his son’s company. He reportedly assisted in recruiting staff and received millions in gifts from FTX funds. While he hasn’t been charged with a crime, his level of involvement has raised serious questions in legal proceedings.

Samuel also has a younger brother, Gabriel, who used to work as director of the nonprofit Guarding Against Pandemic. Gabriel’s organization and its political action committee (PAC) faced federal scrutiny after it was revealed that Sam Bankman-Fried was using tens of millions of dollars in stolen customer funds on research projects and campaign donations.

Following the scandal, Gabriel Bankman-Fried stepped down as director of the organization in November 2022, around the same time FTX collapsed. He hasn’t been charged with any crimes but has largely disappeared from public life.

SMF Net Worth: Rising the Ranks in Crypto to Losing His Freedom and Fortune

Sam Bankman-Fried’s career was a resounding success for many years, helping him build a fortune in the billions of dollars. Let’s see what made him rich and famous and how he lost his wealth, freedom, and reputation.

Early Career Days

In 2013, while he was still studying for his BA, Sam Bankman-Fried started interning at Jane Street Capital, one of the top proprietary trading firms in the US, where he traded international ETFs. This marked his beginnings in the NFT and blockchain industry. After graduation, he returned to Jane Street Capital to work there full-time – and remained with the company until September 2017, when he moved to Berkeley, California.

In Berkeley, Bankman-Fried worked at the Centre for Effective Altruism (CEA) as the company’s director of development. He wasn’t there for long, though – he worked from October to November 2017.

Hitting Milestones with Alameda Research

In November 2017, Bankman-Fried and Tara Mac Aulay established Alameda Research, a quantitative trading firm with an initial capital of $55 million. The main investors in the venture were computer programmer Jaan Tallinn and investor Luke Ding. The name “Alameda Research” was selected to represent a more traditional image and offer smooth interactions with banks without the stigma associated with crypto ventures.

By 2021, Bankman-Fried had acquired approximately 90% ownership of Alameda Research. In January 2018, he orchestrated an arbitrage strategy by capitalizing on the higher Bitcoin prices in Japan compared to the United States. All he had to do was buy as much Bitcoin in the US as possible and then sell it all on the Japanese market for essentially free profit. He reportedly moved up to $25 million a day during this period.

As the Alameda Research founder, Bankman-Fried attended a cryptocurrency conference in Macau, which prompted him to relocate to Hong Kong to expand his trading activities.

Alameda Research would actually be the base for Bankman-Fried’s FTX. The company played a significant role as its primary market maker and is one of the main contributors to FTX’s support.

Alameda Research is now defunct. In November 2022, following the liquidity crisis at its sister company, FTX, both Alameda Research and FTX filed for bankruptcy. Investigations revealed that FTX had lent over half of its customer funds to Alameda, even though it was expressly forbidden by FTX’s terms of service. This led not only to legal scrutiny but also criminal charges against key executives.

Before the bankruptcy, Alameda Research was thriving with $13 billion in assets (September 2022). In December 2022, Caroline Ellison, the former Alameda Research CEO, pleaded guilty to multiple charges, including wire fraud and conspiracy to commit money laundering. She admitted to conspiring with others to misuse billions of dollars from FTX customers and, as a result, was sentenced to two years in prison.

At the trial, Ellison testified against her former boss, SBF, in exchange for leniency. Prosecutors used her private notes as evidence in his trial. It has also been disclosed that she dated SBF for a period of time.

The Founding and Success of FTX

In May 2019, Sam Bankman-Fried and Gary Wang co-founded FTX, a cryptocurrency derivatives exchange platform. The platform started operations the following month and gained traction in the crypto market at a whirlwind pace. By July 2021, FTX had raised $900 million in a single founding round and was valued at an impressive $18 billion!

In September 2021, FTX signed a sponsorship deal with Mercedes’ Formula 1 team. By October of the same year, it raised additional capital from investors such as Tiger Global and Singapore’s Temasek, pushing the valuation to $25 billion.

In early 2022, FTX’s U.S. arm was valued at $8 billion after it raised $400 million from investors like Temasek and SoftBank Group. A few weeks later, on January 31, 2022, FTX raised yet another $400 million – which boosted its overall valuation to $32 billion!

FTX’s ambition continued to expand throughout the years, securing a $135 million naming rights deal for the home court of the Miami Heat in June. The Heat played their home games at FTX Arena in downtown Miami.

In July 2022, FTX signed a deal with an option to purchase the struggling crypto lender BlockFi for up to $240 million. The company also offered a partial bailout of the bankrupt crypto lender Voyager Digital, but Voyager referred to FTX’s bid as a “low-ball offer.”

After the FTX scandal, BlockFi also filed for bankruptcy, facing financial ruin due to exposure to the collapse. The company has since been liquidating its assets, including selling claims against FTX. BlockFi is also working to repay its customers based on the value of their claims at the time of the bankruptcy filing.

Earlier in July, the Plan Administrator successfully sold BlockFi’s outstanding claims against FTX for an amount in excess of the face value of the claims. As a result, the BlockFi Estate will be distributing 100% of the dollarized petition date value on all allowed customer…

— BlockFi (@BlockFi) July 25, 2024

FTX Loses Its Power and Reputation

Amidst all these high-profile moves and the obvious wealth of Sam Bankman-Fried, FTX’s credibility began to take a hit. On August 19, a U.S. bank regulator ordered the cryptocurrency exchange FTX to stop making “false and misleading” claims about whether customer funds were insured by the government.

Trouble continued to spread until it escalated in November 2022 when a leaked balance sheet from crypto news site CoinDesk revealed that Alameda Research, Sam Bankman-Fried’s trading firm, was heavily reliant on FTX’s native token, FTT. This disclosure raised even more concerns about FTX’s liquidity and stability.

On November 6, Changpeng Zhao, the CEO of Binance, announced that his exchange would liquidate its holdings of FTT due to the recent revelations. This move would turn out to be the beginning of the end for SBF, FTX, and Alameda Research.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 BNB (@cz_binance) November 6, 2022

As FTT cratered and FTX users spammed the site with withdrawal requests, FTX quickly paused withdrawals. By November 11, 2022, Bankman-Fried filed for bankruptcy after the major liquidity crisis. This also marked the beginning of a legal and financial ruin that tarnished FTX’s once-glowing reputation.

Sam Bankman-Fried’s Legal Trouble and Incarceration

In December 2022, Sam Bankman-Fried was arrested in the Bahamas and later extradited to the United States to face charges of fraud and conspiracy related to the misappropriation of funds. SBF faced a high-profile trial starting on October 3, 2023.

Bankman-Fried was charged with seven counts:

- 2 counts of wire fraud

- 2 counts of conspiracy to commit wire fraud

- Conspiracy to commit securities fraud

- Conspiracy to commit commodities fraud

- Conspiracy to commit money laundering

The prosecutors presented evidence that SBF orchestrated a scheme to divert customer funds from FTX to Alameda Research, which led to major financial losses for investors and customers.

In his defense, the 31-year-old crypto mogul pleaded not guilty to deceiving investors and cited the presence of lawyers as a justification for his decision. He argued that it was legal counsel who led him to believe he was acting within the bounds of the law.

[US v SBF without jury present]Judge Kaplan: One question is, Where is this policy? But let's move on.

Cohen: Tell me about North Dimension.

SBF: Alameda set it up in 2020.

Cohen: How?

SBF: Dan Friedberg gave me papers to sign and I did— Inner City Press (@innercitypress) October 26, 2023

The recommendation from the prosecution was for over 100 years in prison. Bankman-Fried asked for a 6.5-year prison sentence instead, saying that the prosecution’s request was ‘grotesque.’

“The money was there—not lost,” -his lawyers said. “The harm to customers, lenders, and investors is zero. Sam is a 31-year-old, first-time, non-violent offender who was joined in the conduct at issue by at least four other culpable individuals, in a matter where victims are poised to recover—was always poised to recover—a hundred cents on the dollar.”

After a five-week trial, the jury deliberated for around five hours before finding the defendant guilty on all counts on November 2, 2023. The prosecution described the fraud as one of the largest in U.S. history, with billions of dollars being misappropriated.

A second trial on five charges, including bribery and bank fraud, was also scheduled for early March 2024. The charges were brought by federal prosecutors after Bankman-Fried was extradited in December 2022. On December 30, 2023, prosecutors dropped these charges and announced that they wouldn’t proceed, stating that this would only prolong the case resolution.

Before August 11, 2023, Bankman-Fried lived with his parents under court-ordered restriction and was out on bail. However, prosecutors alleged witness tampering after SBF gave a reporter the personal writings of Former Alameda research CEO Ellison, his ex-girlfriend. On August 11, Judge Kaplan concluded that witness tampering had occurred and therefore revoked Sam Bankman-Fried’s bail.

On March 28, 2024, Judge Lewis A. Kaplan sentenced Sam Bankman-Fried to 25 years in prison. Additionally, he was ordered to forfeit $11.02 billion.

“It’s most of what I think about each day,” SBF said in an email interview. “I never thought that what I was doing was illegal.”

As of September 2024, he has been serving his sentence at the Brooklyn Jail, the Metropolitan Detention Center. In the meantime, Bankman-Fried’s lawyers have appealed his conviction and the prison sentence, but this process is still ongoing.

Crazy that SBF actually dresses better in jail pic.twitter.com/pVgi1EoIsX

— Inverse Cramer (@CramerTracker) February 20, 2024

Following his conviction, Bankman-Fried settled with a group of FTX investors. In exchange for their agreement to drop claims against him, he has agreed to assist in legal actions against celebrity promoters and venture capital firms that endorsed FTX. This includes providing documents and testimony to aid in victim recovery.

As of now, the settlement awaits court approval.

Gary Wang, the co-founder and former CTO of FTX, pleaded guilty to fraud charges and cooperated with the authorities. He is one of the several witnesses who provided critical information that facilitated Sam Bankman Fried’s prosecution. In exchange for his cooperation, Wang was sentenced to no prison time at all.

The SEC today charged Caroline Ellison and Gary Wang for their roles in a multiyear scheme to defraud equity investors in the crypto trading platform FTX. Ellison and Wang are cooperating with the ongoing investigation.

— U.S. Securities and Exchange Commission (@SECGov) December 22, 2022

In August 2024, a U.S. court ordered FTX to pay $12.7 billion to customers and fraud victims, which marks one of the largest recoveries in the history of the Commodity Futures Trading Commission.

A month later, Stanford University said it would return the $5.5 million in “gifts” it received from the crypto exchange.

We have been in discussions with attorneys for the FTX debtors to recover these gifts, and we will be returning the funds in their entirety,” a spokesperson told Bloomberg News.

Sam Bankman Fried’s Investments: High-Risk, High-Reward Portfolio

Sam Bankman-Fried is not only famous as the founder of the cryptocurrency exchange FTX but also for his aggressive investment strategies. His portfolio before the downfall of FTX was diverse and included major investments in public companies and high-risk ventures.

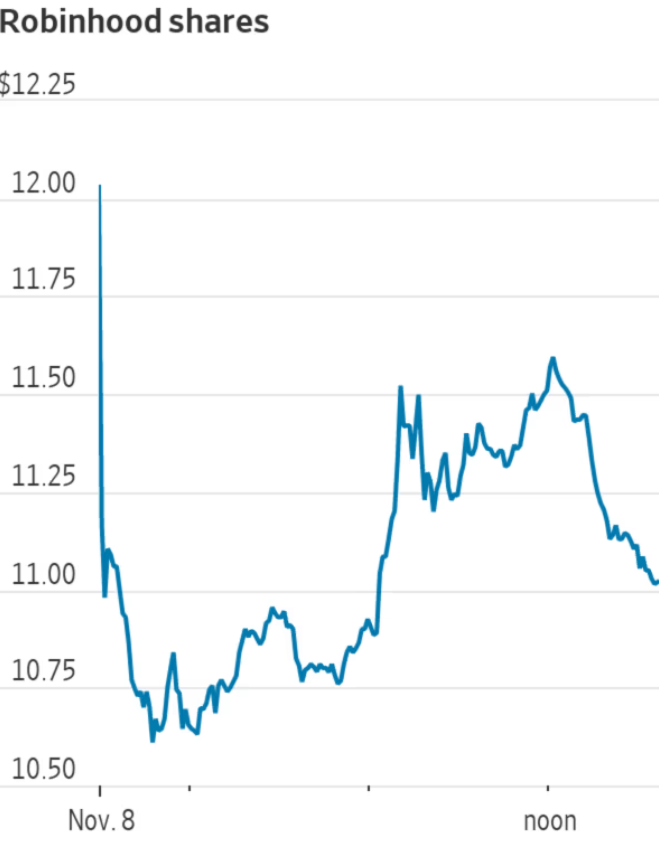

One of his most notable investments came in May 2022 when it was revealed that Sam Bankman Fried’s majority-owned Emergent Fidelity Technology Ltd. had purchased 7.6% of Robinhood Markets’ stocks for $648 million. Robinhood shares tumbled in FTX’s fallout.

The Robinhood investment was reportedly funded through a $546 million loan from Alameda Research. This once again highlights Sam Bankman Fried’s suspect business dealings. The U.S. government confiscated his Robinhood shares in January 2022.

In 2022, SBF also offered to assist Elon Musk in financing his $44 billion acquisition of Twitter, with an offer of up to $5 billion. Still, despite the discussions, he wasn’t able to get a piece of the deal.

Bankman-Fried was also a prolific venture capitalist. He invested $500 million in the AI firm Anthropic and another $500 million in various venture capital firms. One of his investments was a $200 million stake in Sequoia Capital, a top backer of FTX.

In a somewhat bizarre twist, as his empire began to unravel, Bankman-Fried revealed that he wanted to purchase the island nation of Nauru to use as a “bunker” in the event of an apocalyptic scenario.

As a major entrepreneur in the crypto industry, Bankman-Fried most likely had a fortune invested in cryptocurrencies. However, the details of his crypto portfolio have never been publicly disclosed.

Vitalik Buterin, the founder of Ethereum, strongly criticized SBF by pointing out that he failed to articulate why cryptocurrency was valuable beyond being a business opportunity. According to Buterin, SBF’s recklessness and crimes led to a lack of trust in the crypto community as a whole.

Political Donations and Philanthropy

Before it all crumbled down, Bankman-Fried was notably active in philanthropy and political donations, challenging millions into both arenas.

Political Donations

Bankman-Fried was a significant political donor, particularly during the 2022 U.S. midterm elections (when his net worth was at its peak). He contributed over $40 million to various political campaigns, favoring Democratic causes. He was the second-largest individual donor to the Democratic Party in the 2022 election cycle, right behind George Soros.

Even though he was predominantly supporting the Democratic Party, he also directed funds to Republican candidates. However, his Republican donations were often funneled through less transparent channels, which led to allegations of campaign finance violations.

In August 2023, federal prosecutors charged Bankman-Fried with using over $100 million in stolen customer funds for political donations, which further complicated his legal situation.

FTX FOUNDER, SBF’S FAMILY FACES $100M POLITICAL DONATION SCANDAL

– Sam “SBF” Bankman-Fried ‘s family faces scrutiny following revelations of a $100 million financial scandal linked to misuse of company assets for political contributions.

– According to The Wall Street Journal… https://t.co/hhdZDtU2Zx pic.twitter.com/h0t2fuzCPf

— BSCN (@BSCNews) July 5, 2024

Philanthropy

Beyond political donations, Bankman-Fried has been involved in philanthropic efforts, calling himself an “effective altruist.” He founded the FTX Future Fund with the aim of supporting different charitable initiatives. In 2022, the Future Fund committed around $160 million to 110 nonprofits.

The FTX collapse in late 2022 cast a dark shadow over his philanthropy, and the Future Fund ceased operations.

Lessons from Sam Bankman-Fried’s Rise and Fall

Sam Bankman-Fried’s rise and fall offer vital lessons that everyone in the world of business and finance must learn. His story teaches us the importance of transparency, strict ethics, and the undeniable need for solid risk management.

The collapse of FTX and the following legal battle are evidence of the perils of unchecked ambition, as well as the consequence of prioritizing one’s growth and personal wealth over ethical and regulatory requirements. He could have simply refused to take funds from FTX users to bailout Alameda Research and he would likely still be a free man with billions of dollars in the bank.

Bankman-Fried’s career was extremely successful, so much so that people used to consider him a financial savant. However, his carelessness, aggressive investment strategies, and misuse of customer funds ultimately exposed the illusion of his financial genius.

Trust is essential in any business, and even more so in emerging financial industries like cryptocurrencies. Bankman-Fried’s fall from grace shows the devastating impact of violating your customers’ trust (and the law).

The lack of proper regulatory oversight for crypto exchanges was another major factor in FTX’s collapse. This story is a reminder of the need for clear rules and regulations across industries, especially ones as volatile and unregulated as cryptocurrency. As former White House communications director Anthony Scaramucci said, “Sam Bankman-Fried really hurt the industry”.

FAQs

What is Sam Bankman-Fried's net worth?

At his peak, Bankman-Fried's net worth was estimated at over $26 billion. Today, his net worth is $0.

What happened with FTX and Bankman-Fried?

Sam Bankman-Fried is the founder of FTX, a company that filed for bankruptcy after it was revealed that the company had been using customer funds to cover risky bets.

What is Bankman-Fried's current legal situation?

Bankman-Fried was arrested in December 2022 and charged with several offenses, including wire fraud, securities fraud conspiracy, and money laundering. He was sentenced to 25 years in prison and is currently incarcerated.

What is the 'FTX scandal'?

The FTX scandal refers to the financial crisis that led to the collapse of the cryptocurrency exchange FTX in 2022. The scandal led to billions of dollars in losses for investors and customers.

Was Bankman-Fried the only person responsible for FTX's collapse?

Bankman-Fried is the central figure in the collapse, but several other key executives, including Caroline Ellison and Gary Wang, are also included in the scandal.