A centralized exchange is an organization that facilitates the exchange of assets between two entities. In financial terms, it refers to a body that enables monetary transactions between parties.

While the current regulatory issues have prompted questions about the viability of such entities within the cryptocurrency space, there are still merits to centralized exchanges. In this guide, we provide a clear definition of what a centralized exchange is, as well as its benefits and drawbacks. Additionally, we conclude this review by offering a step-by-step guide on how to start trading on a centralized exchange.

What is a Centralized Exchange (CEX)?

Investors can trade crypto cryptocurrencies on a centralized exchange, which is a centralized body that facilitates transactions between two parties. These bodies work in the same way as banks and traditional stock exchanges, acting as intermediaries where users can deposit their funds and buy or sell different digital assets.

In a centralized exchange, all the operations are handled by a central authority. Thus, in addition to facilitating the exchange of digital assets, centralized exchanges also act as custodians of digital assets – providing a place for users to store their cryptocurrencies.

Here are the listed key characteristics of a centralized exchange:

- They are centrally controlled – A single authority oversees the complete operation of a CEX, including infrastructure, security, and transactions.

- They offer order books – Centralized exchanges offer order books that match buyers and sellers to create a liquid market. It also allows users to place a limit on their buy/sell order and provide them with additional features, such as insurance.

- They are regulated – Since most cryptocurrency exchanges deal with real money, they have to be regulated according to the Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. That means users need to provide their KYC details to the CEX before using its services.

- They offer custodial wallets – Since the onus of securing an investor’s assets falls on a centralized exchange, it also offers custodial wallets. Crypto brokers such as eToro, for instance, provide mobile wallets that secure an investor’s assets and help them buy and sell crypto.

- Trading Fee – A Centralized Exchange charges a transaction fee. The transaction fee is charged per trade, but it varies depending on factors like order type and trading volume.

What Are The Pros and Cons of a CEX – At A Glance

Listed below are the pros and cons of a centralized exchange at a glance:

- Offers a user-friendly interface

- Higher liquidity when compared to decentralized exchanges (DEX)

- Suitable for risk-averse investors looking for legit intermediaries

- Offers custodian services

- Many exchanges offer insurance services

- Offers a wide array of investing tools

- Isn’t subject to the risks of Automated Market Makers (AMMs)

- Users have no control over their wallet keys

- Security issues

- Subject to intense regulatory scrutiny

- Prone to unethical business practices

Benefits of Trading on a Centralized Exchange

Here is a more comprehensive look into the benefits of trading on a centralized exchange.

Offers a user-friendly interface

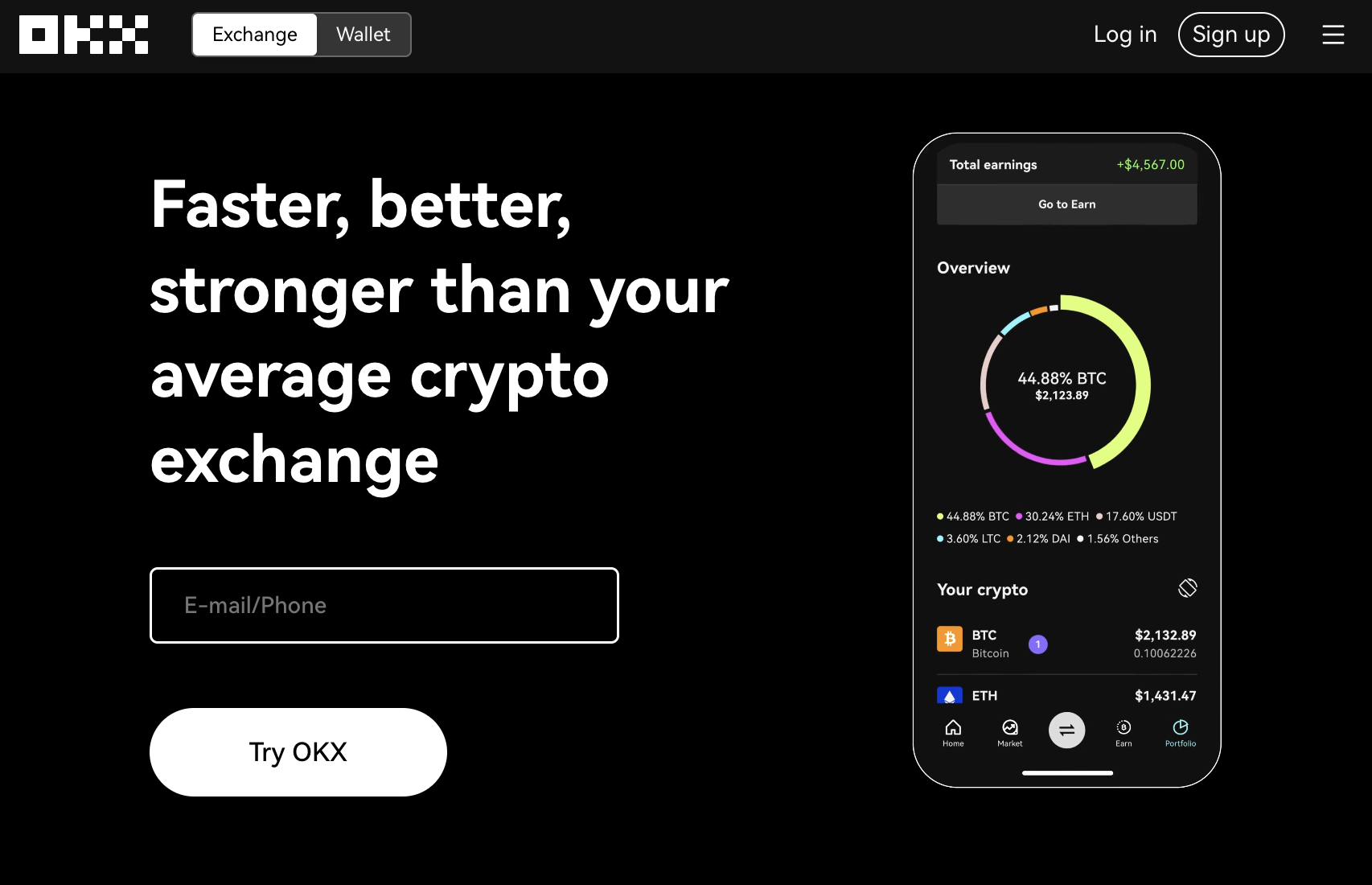

Most centralized exchanges are user-friendly. Since they are private organizations, they focus on providing good services, which include providing a UI that is suitable for beginners. For instance, trading on eToro has multiple perks. Not only is the signup process easy, but buying and selling crypto assets, too, is a matter of some clicks. The same goes for platforms like OKX. The world’s second-biggest cryptocurrency exchange by market capitalization provides a host of tools and tutorials to make its interface more user-friendly.

This factor makes people more receptive to adopting the crypto economy. sa

Higher liquidity when compared to decentralized exchanges (DEX)

Liquidity refers to how easily one can buy and sell a crypto asset without impacting the wider value of the prevailing asset. For instance, if a customer makes a whale move through a cryptocurrency exchange, selling many crypto assets of the same kind at the same time, it can adversely impact that asset’s value. With centralized exchanges, however, the liquidity is higher, which means users can easily trade an asset without impinging on its value.

That makes centralized exchanges a good option for those looking to invest in major altcoins.

Suitable for Risk-Averse Investors looking for Legit Intermediaries

Most entrants to the crypto space look for the best cryptocurrency exchanges when start trading crypto. And the reason they pursue it is because they want to avert some of the risks of crypto trading by holding an exchange accountable to a degree – at least when securing the assets is concerned.

Offers custodian services

While holding cryptocurrencies in your own hard wallet is more secure, it may not be an optimal option for the entrants of the space. This is why centralized exchanges offer custodian services, allowing one to store their digital assets securely. Furthermore, some cryptocurrency exchanges, such as OKX, put a certain portion of the assets inside cold storage, preventing them from being vulnerable to digital threats.

Many Exchanges offer Insurance Services

While cryptocurrency exchanges have robust security systems built in place, they are still vulnerable. Even Binance, the largest cryptocurrency exchange by market capitalization, was hacked in 2022, losing $500 million in the process. That is why these exchanges have insurance funds to secure users’ assets.

Other platforms, like OKX, have used measures like these to prevent losing users’ assets.

Offers a Wide Array of Investing Tools

Along with facilitating the buying and selling of cryptocurrencies, centralized exchanges also help people trade perpetual contracts, derivatives, spot and margin trading, and other services. Additionally, to help traders make informed investment decisions, these bodies offer market analysis reports and charting tools.

For instance, with OKX, not only can investors get buy and sell crypto, but they can also discover markets and opportunities. The platform even goes so far as to provide copy trading facilities, as well as loan programs.

P2B also offers similar services. To learn more, read our P2B exchange review.

Isn’t subject to the risks of Automated Market Makers

Decentralized exchanges rely on Automated Market Makers to maintain their liquidity. But if an AMM doesn’t have an efficient liquidity pool, it can have a negative impact on an asset’s price, leading to capital inefficiency and impermanent loss.

Centralized exchanges, however, rely on an extensive pool of buyers and sellers to maintain their liquidity.

Also, check out our guide listing the best DEX cryptos to buy.

Drawbacks of Centralized Exchanges

Listed below are the drawbacks of trading on a centralized exchange:

Users have no control over their wallet keys

The most prominent issue that users face with centralized exchange is the lack of control they have over their wallet keys. With no direct access to their assets, investors can incur massive losses if the exchange abruptly shuts down.

During the FTX collapse, most users lost their stored assets. It was reported by the FTX Bankruptcy team that the exchange owes $8.7 billion to its customers.

Security issues

Even though most centralized exchanges have robust security measures in place, most of them have proven lacking in the past. There have been many high-profile hacks that have cost billions of dollars worth of losses to the crypto space. These incidences don’t seem to be slowing down.

In 2022 alone, multiple cryptocurrency exchanges, including Crypto.com and Binance, had to deal with their systems being compromised and loss of assets.

Subject to intense regulatory scrutiny

Centralized exchanges are controlled by centralized authorities that are subject to intense regulatory scrutiny. That means many of the actions that an exchange might need to take may be perceived as unfair to new users.

Most often, these regulations include restrictions that limit the assets exchanges can support. For instance, SEC marked over 68 cryptocurrencies as securities, leading many cryptocurrency exchanges to remove support for these assets.

Also, SEC recently filed a lawsuit against Coinbase for operating as an unregistered broker.

It means that investors need to be more careful when selecting the right CEX for their needs.

Prone to Unethical Practices

Since profit is the primary goal of centralized cryptocurrency exchanges, there is nothing stopping them from adopting unethical business practices. Misrepresenting information and market data manipulation can be common for these exchanges if that means extracting more profits from their user base.

In FTX’s case, it was revealed that even though the official terms stated that the exchange wouldn’t be using user funds to conduct any business, they were used to keep Alameda Research afloat.

How to Start Trading on a Centralized Exchange?

Here is the step-by-step guide to start trading on a centralized exchange. For reference, we are using the second biggest cryptocurrency exchange by market capitalization – OKX:

Step 1 – Go to OKX

Visit the official website of OKX and start creating the account. Enter your email or phone number and follow the on-screen instructions to create an account.

Step 2 – Verify Your Account

After creating an account, you will receive a prompt to verify your account to gain access to all Binance services. Go to the top left side and click on the “Identification” button. It will take you to the account verification page.

Step 3 – Deposit the Minimum Amount

After verifying your account, you can start trading, but only after depositing the minimum amount, which, at press time, is $10. Use any of the traditional methods to make that deposit.

Step 4 – Start Trading Crypto

If you are a beginner, you can select the “Buy Crypto” option and buy crypto assets directly using a credit or debit card. The same button also lets one access OKX’s P2P trading facilities.

More advanced users, however, would want to click on the trade button and engage with complex trading facilities like derivatives & margin trading, Trading bots, Copy Trading, and more.

Conclusion

Centralized exchanges are centralized organizations facilitating crypto trading. While they do prove ease of access being run by a centralized authority, investors do need to compromise some freedom when it comes to control of their assets.

In this guide, we have highlighted these factors and other pros and cons of using a CEX for trading crypto. In terms of the best ones available in the market, we recommend OKX, and eToro.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

What is a CEX?

CEX, or Centralized Exchange is an intermediary organization that facilitates crypto trading. It is run by a central authority who undertake all operations including storage of digital assets and providing other services.

Are centralized exchanges secure?

Centralized exchanges, being private organizations, implement security measures to keep the assets secure. However, hacking attempts have increased in the past. So, while exchanges have continually been upgrading their security features, they are not always secure.

What is the difference between a centralized and decentralized exchange?

A centralized exchange is run by a central authority while a decentralized exchange has a decentralized control. With the latter, the onus of keeping the assets secure fall on users. But for the former, users are provided with custodial wallets.