Security token offerings (STOs) function similarly to stock offerings (IPOs), except that they are represented on the blockchain by digital tokens rather than paper certificates. It’s like looking for a needle in a haystack, but there is a way through the muck as government officials try to figure out what blockchain technology is.

Blockchain engineers cross their fingers that governments won’t stifle creativity with overzealous regulation. Bringing conventional financial instruments onto the blockchain may be a major potential application of STO technology.

Top Crypto STOs to Invest in 2024 – List

- Pepe Unchained – Best Crypto STO Featuring the Pepe Meme Narrative

- Flockerz – Meme Coin STO with High Growth Potential

- FreeDum Fighters – Trending STO With a Politifi Concept

- Best Wallet Token – Popular STO With a Strong Utility and Ecosystem

- Crypto All-Stars – Leading Crypto STO with Multiple Meme Coin Mascots

- Shiba Shootout – Cowboy-Themed STO with Many Perks

Reviewing the Best Crypto STOs Worth Investing In

Do you want more information about the most successful launches of security tokens in 2024? The following are examples of some of the best security token offerings now available. These tokens have the potential to generate returns that are 10 times their initial investment and are currently being sold at a discount.

Pepe Unchained – Best Crypto STO Featuring the Pepe Meme Narrative

One of the best crypto STOs to have arrived this year is Pepe Unchained. Blending the PEPE theme while providing the world’s first meme-based blockchain, Pepe Unchained represents Pepe’s true potential unleashed.

The project’s background story describes how Pepe, tired of being locked inside an Ethereum chain, enlarged his brain and unlocked himself to create his own layer 2 blockchain.

As a layer 2 blockchain, Pepe Unchained offers numerous benefits, including the ability to generate double the staking rewards, facilitate faster transactions, and pave the way for unique projects to emerge.

Pepe Unchained has raised more than $6 million in its STO, and it will likely raise even more before the presale concludes. Therefore, investors looking for a high-potential STO should consider investing in this project.

Flockerz – Meme Coin STO with High Growth Potential

Another one of the leading crypto STOs to have graced the market this year is Flockerz. With its simple premise, community-centric perks, and comedic themes, it could also become one of the best cryptos on the market.

The premise of this project can be gleaned from its lore. It tells the story of a king—a hen who wore the crown and became the best trader in the kingdom. However, because much of the power was centralized, the rest of the kingdom burned. This led the king to make a final call, becoming a degen trader himself and distributing his power among his subjects, which resulted in the creation of FlockTopia.

FlockTopia is not just a simple virtual realm—it’s where Flockerz’s utility comes from. It functions as a Decentralized Autonomous Organization (DAO) that will determine how the project develops in the future. Those who stake tokens can vote within this DAO, earning rewards in the process. This is where the project’s Vote-to-Earn mechanic reveals its core utility.

The act of distributing power among the community aligns with the project’s tokenomics, and the comedic memes make it an attractive short-term investment as well.

FreeDum Fighters – Trending STO With a Politifi Concept

FreeDum Fighters brings a fresh and creative spin to the table, with its foundation built around political satire and community-driven engagement. What makes this STO particularly interesting is how it leans into both entertainment and investment, making it a rare gem in the crowded crypto market.

The project is based on a bold and satirical concept where two fictional political figures—Magatron and Kamacop—go head-to-head in a staged political battle. Investors get the opportunity to engage with the project not only as token holders but as active participants, thanks to features like staking. What makes FreeDum Fighters unique is its dynamic staking system, where rewards aren’t fixed. Instead, they shift depending on which character has less support, adding a strategic twist for investors looking to maximize their returns in a fun and interactive way.

As an STO, FreeDum Fighters goes beyond the typical model of simply offering tokens for sale. It integrates multiple engagement avenues, such as its debate-based reward system, where community members can join in on weekly discussions and earn DUM tokens for their contributions. This not only keeps the project lively but also creates a sense of ownership and involvement for the community.

While many STOs focus purely on financial returns, FreeDum Fighters offers much more by blending strategy, community participation, and humor into its structure. Investors who enter the space early through this STO will not only gain exposure to a project with growth potential but also find themselves part of an ecosystem that is evolving with real-world political themes and events.

For anyone looking at STOs as a gateway into more than just profit margins, FreeDum Fighters delivers an experience where investment, entertainment, and strategy collide, making it a project worth considering for those who want to be involved in something truly distinct.

Best Wallet Token – Popular STO With a Strong Utility and Ecosystem

Designed to offer both investment potential and practical functionality, BEST is the native token of the Best Wallet platform—a comprehensive crypto management app supporting over 60 blockchains and a wide range of DeFi activities. Its ongoing STO offers investors a unique opportunity to gain exposure to a token that powers an already operational platform with a growing user base.

As an STO, BEST provides added security and structure compared to many traditional token offerings. Investors in BEST can expect transparency and accountability, as the token is structured to offer a clear utility within the Best Wallet ecosystem. BEST holders benefit from exclusive features like reduced transaction fees on the platform, making day-to-day crypto activities more cost-effective. Investors of BEST will also gain early access to new presales on Best Wallet’s aggregator, allowing investors to explore and enter emerging projects before they reach the broader market.

BEST also provides staking opportunities with competitive APY rewards, adding a layer of passive income that strengthens its appeal as a long-term holding. By staking BEST, users can generate returns on their holdings while supporting the ecosystem’s growth, making it more than just a transactional token.

With a total supply capped at 10 billion tokens, BEST is built on the secure and widely supported Ethereum blockchain as an ERC-20 token. This fixed supply structure is crafted to balance market demand with the sustainability of the token, aiming to support long-term growth.

For those seeking an STO with a blend of utility and future potential, BEST stands out as a carefully structured investment within a well-established platform, aligning strong functionality with a promising outlook.

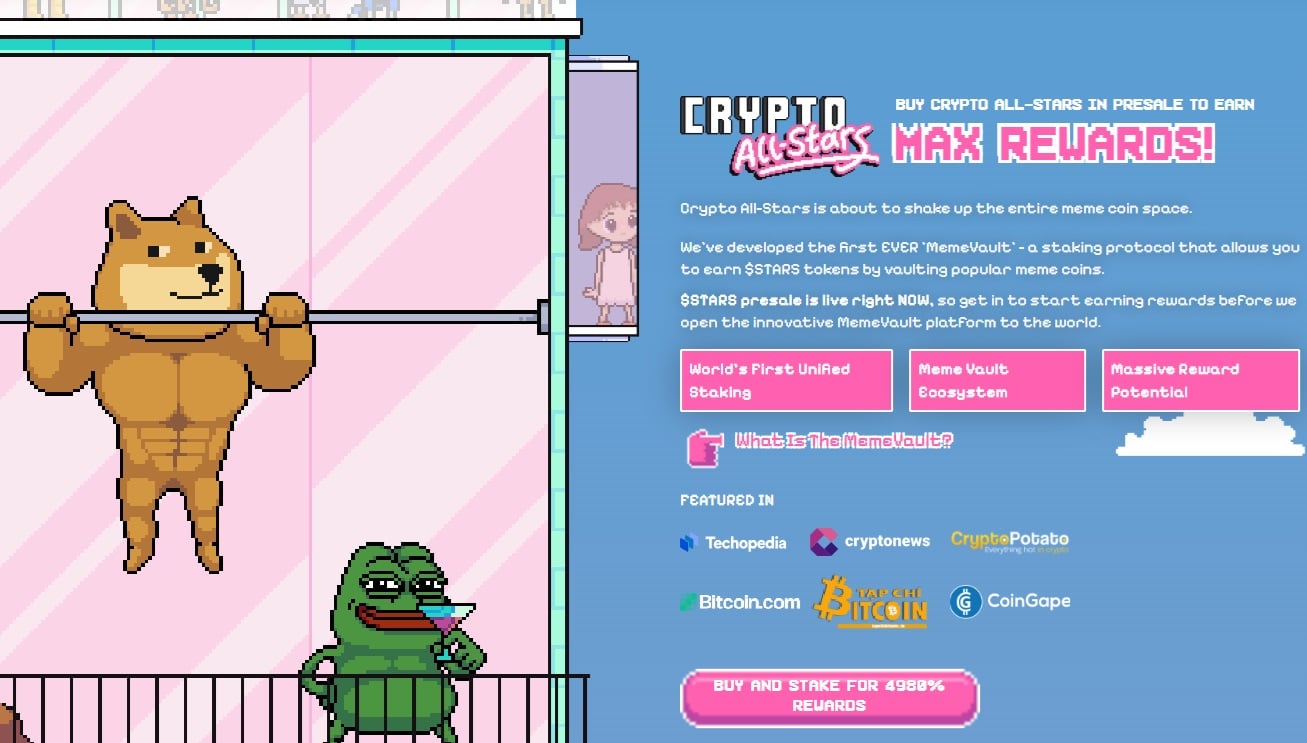

Crypto All-Stars – Leading Crypto STO with Multiple Meme Coin Mascots

Those looking for one of the best crypto STOs to support this year would find Crypto All-Stars a perfect asset for multiple reasons. For one, it has the viral factor coming since this crypto’s ecosystem “stars” the main mascots of all the major meme coins.

This imagery has been created to communicate the unique utility of the project that involves staking. Major meme coins can be staked in return for earning APY rewards in terms of STARS tokens.

This factor could allow Crypto All-Stars to generate interest from multiple meme coin communities, even NFT ones, which could help it generate gains not only for degen traders but also those who seek long-term profits.

With a tiered presale structure, this project essentially ensures that investors can generate profit even before the token lands on cryptocurrency exchanges.

Shiba Shootout – Cowboy-Themed STO with Many Perks

For those looking for a crypto STO that becomes a bigger asset with time, few come close to what Shiba Shootout offers. With its combination of cowboy themes blended perfectly with Shiba Inu memes, Shiba Shootout is creating its own Shiba Inu community that can outperform the original Shiba Inu by a long mile.

The reason behind many investors’ bullish view of this project is not only its imagery but also the long-term perks that cover every single aspect of blockchain technology. Multiple earning mechanics have been created, from Campfire Stores that power “engage to earn” to digital wallets that offer “store to earn” benefits.

The project has also implemented play-to-earn through its unique perks, and there is a unique stake-to-earn model that transforms the act of merely holding the token into a visible phenomenon, allowing investors to see their tokens in action.

This STO has hit the ground running with its cowboy themes. Interested parties can visit shibashootout.com to participate.

More on Crypto STOs & How They Work

The most important thing to realize is that an STO actually reflects ownership in some underlying security. Depending on the token, the security may be in the form of profits, bonds, shares, or income.

After the initial coin offering (ICO) mania died down, the STO emerged. In both cases, money is being raised for a project or business, but the ICO has much fewer restrictions than the traditional route. Despite the fact that there are companies operating inside SEC guidelines, this shouldn’t dissuade other businesses from considering the unregulated road.

Investors may profit from this since they will have a better idea of what they are buying, especially considering the prevalence of fraud and shady dealings in the initial coin offering (ICO). This has the potential to purge the cryptocurrency industry of con artists and other shady types that prey on unsuspecting investors.

What Are The Different Types of Security Tokens?

Debt tokens, equity tokens, and asset-backed tokens are the three distinct varieties of security tokens that are now available.

Debt Tokens

The use of debt tokens is akin to investors providing a corporation with a short-term loan. The blockchain network will host the smart contract that was generated for this loan, which will serve as a kind of debt collateral. The value of a debt token is going to be heavily determined by the payout model as well as the level of risk associated with the loan.

Equity Tokens

Both an initial public offering (IPO) and a security token offering (STO) are essentially the same things because they both symbolize equity in a corporation. The holders of equity tokens are likewise allocated a portion of a company’s profits and are given the chance to vote in the same manner as shareholders. The manner in which the ownership data is recorded is the primary distinction that can be drawn between a conventional stock and an equity token. In contrast to traditional equities, which are often issued as certificates and may also be kept in a database, equity tokens will be permanently recorded on the blockchain.

Asset Backed Tokens

Asset Backed Tokens stand in as digital substitutes for assets in the real world. These tokens employ the distributed ledger technology, or blockchain, to reliably record the transfer of ownership of these assets. Such tokens provide a trustworthy audit trail of the transaction as well as they have the potential to maintain their value. This suggests they may be used as a substitute for traditional property.

What Are Security Tokens Used For?

A corporation that wants to issue equities to shareholders might do so with the use of a security token. This type of token provides the same advantages that one would anticipate receiving from traditional securities, such as voting rights and dividends. Because blockchain is the underlying technology, security tokens come with a plethora of use cases in real life. Some of them are:

Immediate Payout

Investors who are interested in transferring assets have a primary issue with clearance and settlements. Although deals are completed in a short amount of time, changing ownership might take many days. The procedure is both automated and expedited when carried out on a public ledger.

Round The Clock Availability

At present, the financial markets function in accordance with their timetables, which means that they are often only open during regular business hours, only last for a predetermined amount of time, and need physical labor. On the other hand, a marketplace that operates on a blockchain platform is operational at all hours of day and night.

Open To Everyone

Everything is open to scrutiny on a blockchain platform, including, in some cases, the identities of the people taking part in the system. Everyone is able to examine the ledger, which makes it possible to monitor the ownership of certain fungible and non-fungible tokens and to view when they were issued.

Can Be Broken Down To Smaller Values

The tokenization of assets paves the way for an abundance of new investment options for investors of all stripes, from institutional hedge funds supported by Wall Street to ordinary investors selling or buying on Robinhood. As an illustration, a Picasso painting that is now valued at $10 million may be tokenized into 10,000 parts, with each piece having a value of $1,000. Tokenization will lead to greater degrees of accessibility and granularity, and it will also democratize the process of gaining access to assets.

What Is The Difference Between An STO and An ICO?

The fundamental security that is related to STO technology is the primary distinction between it and other technologies. In contrast to an ICO, which is a utility token that may be used to access a variety of different technologies, this is not the case. It is anticipated that governments continue to increase their knowledge of blockchain technology enabling them to regulate and understand these 2 systems better.

At the moment, authorities continue to have a rather limited understanding of blockchain technology. In order for government personnel to effectively control the area, there is a significant amount of work being put into teaching these individuals.

However, the absence of regulation is not particularly favorable for cryptocurrencies, despite the fact that the United States has adopted a somewhat hands-off stance as they try to navigate it. When regulations are in place, a significant increase in the amount of capital that may be invested in cryptocurrencies will be possible.

There have been nations that have taken an uncompromising stance against blockchain technology. One such nation is China, which has taken the extraordinary step of outlawing Bitcoin. Considering the rapid pace at which technology is advancing and shifting all across the world, this might have devastating consequences.

In the same way that governments did not know how to control automobiles in the 1800s, modern governments were clueless as to how to regulate the technology behind blockchains. The developers shouldn’t let this deter them from moving forward with the project.

It is destructive to try to fit technology into the realm of regulation; instead, legislation needs to adapt to technological advancements. In the end, security token offerings (STOs) are an attempt to do this, which involves fitting new technologies within the old regulation of securities.

How Will Investing In An STO Benefit You?

Traditional securities are superior in many respects to the more recent innovation known as security tokens, which are a new type of asset based on the blockchain. The following is a list of some of the advantages:

Better Safety

The most advantageous aspects of traditional securities and cryptocurrencies have been combined into a new digital asset known as security tokens. Because they can be exchanged on exchanges and are backed by real-world assets, they provide businesses with a practical and effective method for raising capital.

Traditional securities are the basis for security tokens; nevertheless, there are a few fundamental distinctions between the two types of investments. They provide increased safety, liquidity, and accessibility to investors all around the world.

Better liquidity

Since security tokens are created on the blockchain and follow all applicable SEC guidelines, they may be exchanged on decentralized markets. Security tokens can be traded between holders in a secondary market that operates similarly to the over-the-counter market for equities.

With security tokenization, investors have a greater chance of realizing a return on their investment and may more easily sell their shares should they so choose.

No Regulation Issues Will Crop Up

Authorities are wary about cryptocurrency project funding due to the potential for money laundering and fraud. However, Security Token Offerings provide a viable alternative. While initial coin offerings (ICOs) might be hard to monitor as an investor, security token offerings (STOs) are more transparent.

That makes it far simpler for authorities to keep an eye on the money produced in an STO as opposed to an ICO or IDO (initial DEX offering). In addition, STOs may be utilized as a more lawful option for firms seeking to obtain funds because they are backed by physical securities like stocks or bonds.

Easily Accessible To Everyone

The STO model’s last advantage is that it simplifies token distribution. Token presales in the ICO arena are restricted to a select few who have fulfilled rigorous standards. While this may be the case without an STO model, it is not true with one. Any investor who meets the necessary criteria and is ready to pay a fair fee may instead take part.

If tokens are widely accessible, investors may freely trade them amongst themselves without having to wait for a resale market to form. In addition, they are not required to employ the services of a middleman, like a broker or any other regulated organization. Also, when an issuer becomes public, there are more prospective buyers for its securities.

As a result, more favorable initial share price quotations. There is a significant development possibility for security tokens, and they may one day help bridge the gap between conventional securities and cryptocurrencies.

How Do You Get updated About the Latest STOs?

Finding the finest crypto STOs to invest in is among the most difficult aspects of the entire investment process.

It can be difficult for investors, particularly those who aren’t regularly tuned in to the most recent occurrences in the cryptocurrency industry, to recognize whenever a fresh STO is starting.

There is good news in that there are ways and means to identify cryptocurrency security token offers. The greatest place to start looking is social media, as this is where the majority of new cryptocurrency projects initially announce their STOs.

Start by following Telegram among others and stay updated about when an STO comes out and how to become part of it since many projects open these channels way before the STO has launched.

Investors may also discover crypto STOs by using websites like as CoinMarketCap, which is geared toward highlighting new cryptocurrency ventures. Because this online resource conducts an impartial review of every new cryptocurrency initial coin offering (STO).

Another platform to discover STOs is CoinSniper which is an exceptionally useful platform for locating the most reputable STOs. As a result, investors are able to concentrate on the initiatives with the most potential and leave the cons behind.

Conclusion

The most successful crypto STOs and IEOs give investors the chance to participate in the earliest stages of developing new crypto initiatives in a variety of industries, including gaming, decentralized application development (dApp), and more.

One of the most promising STOs currently in its presale stage is Pepe Unchained, which is now available as a presale.

FAQs on Crypto STOs

What Is An STO In Crypto?

When it comes to investing in a new cryptocurrency project, a Security Token Offering (STO) is frequently the first option that investors have to purchase the project's token. STOs can be hosted by a trading platform or through an exchange.

How Does A STO Work?

A comparable structure to that of an ICO is that of an STO. A cryptocurrency project is one that offers tokens to the general public for purchase on a cryptocurrency marketplace or via the website of the platform itself. In most cases, in order for investors to participate in an STO and obtain tokens, they will be required to link a wallet and trade a frequently traded cryptocurrency.

What Are The Benefits Of Security Tokens?

They provide the holder with a partial ownership stake. If the price of an item is too high, only a select few people will be able to afford to purchase it as an investment. But if you break up this asset into multiple pieces, then even those with a limited amount of capital may buy a piece of it and invest in it. Because of this, businesses have access to a wider variety of investors from whom they might solicit financial backing.

How is An STO Different from An ICO?

Initial Coin Offerings, sometimes known simply as ICOs, are just the first sales of newly created utility tokens. Tokens distributed through an initial coin offering (ICO) do not qualify as commodities and are not supported by any underlying asset. This sale of a fresh investment token is what's known as an STO, which stands for security token offering. Tokens in a security token offering (STO) stand for investments in a particular asset.

Are Security Tokens The Future?

As public capital markets contract, security token offers (STOs) are taking place in the private capital markets, both of which are sizable and expanding.

Are NFTs Security Tokens?

Keeping in mind that an NFT cannot be split into smaller parts, originality, possession, genuineness, and uniqueness, NFTs cannot be traded like fungible tokens. However, they may be bought and sold on exchanges like OpenSea.

Are Security Tokens Legal?

Like traditional securities, security tokens are within the purview of the SEC. The CSA's approval is required though while the STO needs to be registered by the CVM before they may operate.

Can security tokens be hacked?

Lost or stolen security tokens are a major problem. Every one of the victim's information may be accessed by whoever takes the physical device. Tokens are difficult to decipher and hack, although it is not technically impossible to do so. It's an extra safeguard, but no security system can offer complete peace of mind.