Cryptocurrency has become an essential in the investment industry. The wide variety of tokens keeps growing day by day with a countless array of ambitious projects being released on a variety of blockchain networks throughout the market.

Granted that the market is volatile and not every coin out there is as legitimate or promising as the famous Bitcoin, however we’re certain that there are some projects out there that have a big future ahead of them, which is why we’re going to suggest them to you in this article on the best long term crypto investments one could possibly make in November 2024. So let’s strap in and get ready to HODL!

Best Long-Term Coins – Top List

- Pepe Unchained – Pepe-Themed Memecoin Ideal as a Long-Term Investment

- Flockerz – Long-Term Meme Coin With Focus on Community

- FreeDum Fighters – Politifi Token With a Long-Term Goal

- Best Wallet Token – Long-Term Utility Token Supporting a Strong Ecosystem

- Crypto All-Stars – Long-Term Meme Coin with Multiple Benefits

- Shiba Shootout – Cowboy-Themed Meme Coin with Long-Term Growth Potential

- totEra – A Metaverse Crypto with Massive Long-term Potential

- Tamadoge – A Play to Earn Dogecoin rival

- Manta Network – Web3 Crypto with Long-Term Potential

- Celestia – A Modular Blockchain Network With Long-Term Potential

- Bitcoin – Oldest Long-Term Cryptocurrency

- Ethereum – Second Biggest Long-Term Crypto

- Cardano – Massive Long-term Project

- Litecoin – Known as Bitcoin’s Little Sibling

- Solana – Ambitious Coin Powering the Solana Blockchain

- Binance Coin – Solid Altcoin Powering the Binance Smart Chain

- Polkadot – Popular token Powering Polygon Blockchain

- Tether – Best Long-Term Stablecoin

- Sandbox – Best Long-Term Metaverse Coin

Best Long-Term Crypto Investments – Full Analysis

Pepe Unchained – Pepe-Themed Memecoin Ideal as a Long-Term Investment

Unlike many other memecoins, Pepe Unchained aims to be more than just a trend. It introduces an innovative storyline where the Pepe mascot, initially constrained by the limitations of its original blockchain, breaks free by adopting Layer 2 solutions. This transition allows Pepe Unchained to offer faster transaction speeds, lower costs, and its own blockchain explorer, setting it apart as a more efficient and scalable cryptocurrency ecosystem.

The project is still in its early stages but has already gained considerable attention. Its presale has raised over $400k in less than two weeks, demonstrating strong investor interest and confidence. This initial success indicates a high potential for future growth, especially as the project continues to develop and gain more visibility within the crypto community.

Investing in Pepe Unchained now, while it is still priced at just $0.008 per token, could be a strategic move for those looking to capitalize on the memecoin hype. Early investors not only benefit from a lower entry price but also have the opportunity to participate in staking, which offers impressively high APY rates. The project’s commitment to building a robust ecosystem for Pepe enthusiasts, along with its innovative use of Layer 2 technology, suggests that Pepe Unchained could see substantial appreciation in value over time, making it a great token to consider investing in for the long term.

Flockerz – Long-Term Meme Coin With Focus on Community

Multiple meme coins have emerged this year, all claiming to redefine the norm and provide users with something more. However, their visions often only exist within the roadmap. Flockerz, on the other hand, does something different. It embraces its meme nature while providing a utility that could yield long-term benefits.

At the center of this unique cryptocurrency project is a distinct lore about a king meme—a blue hen with a crown, and a leading meme coin trader. He decided to distribute his powers among his subjects, creating democracy and generating wealth across his new FlockTopia.

This lore is used to communicate Flockerz’s focus on decentralization and democratization. The project’s roadmap is simple: create a decentralized autonomous organization and reward those who vote on its future. This could establish a symbiotic relationship between the trader and the meme coin, leading to long-term implications.

Like any meme coin, it doesn’t take itself too seriously when it comes to humor. A bunch of blue degenerate hens with lazy eyes cracking jokes and trying to create a community. This could give Flockerz the viral factor needed to increase in value. For further details about this ecosystem, we recommend visiting flockerz.com.

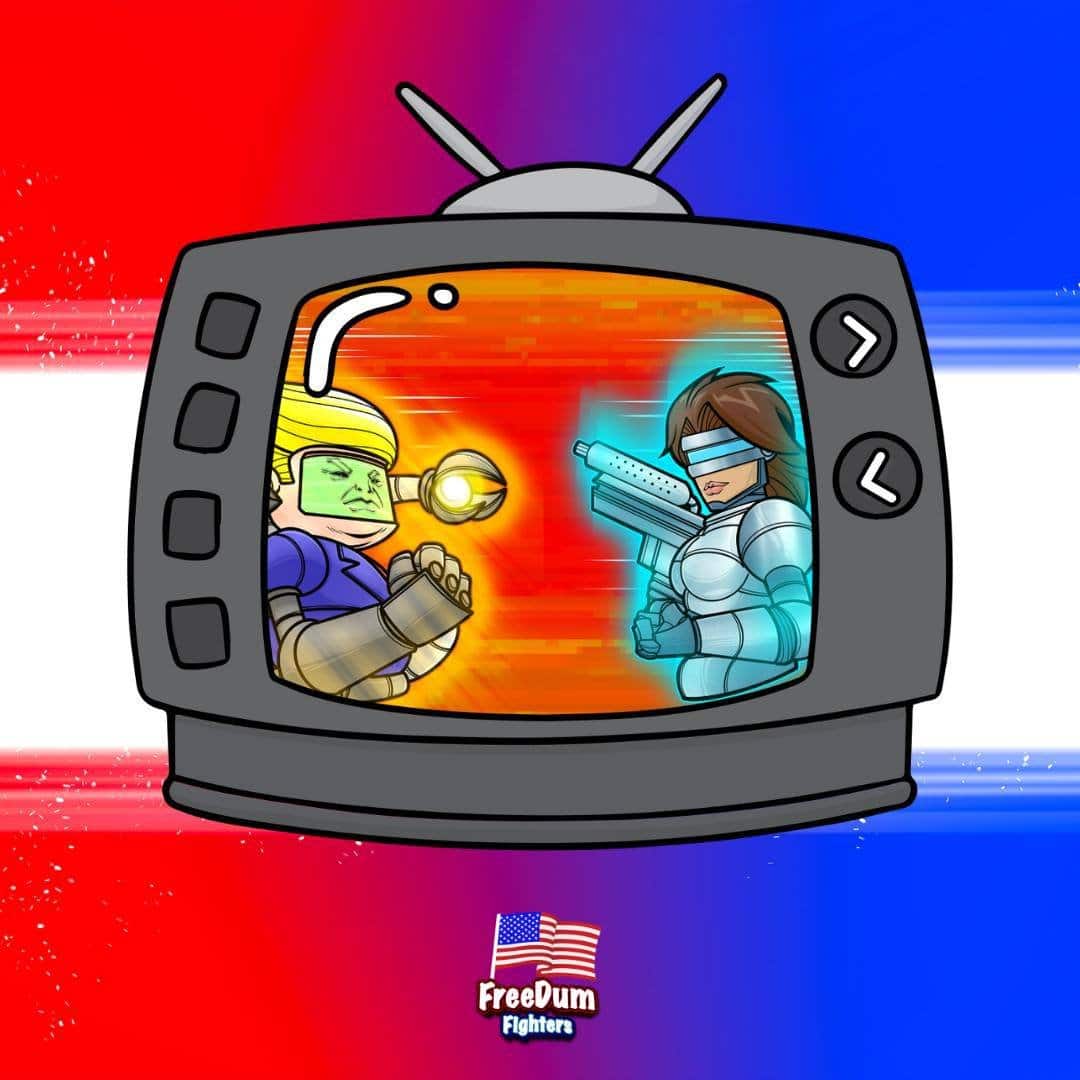

FreeDum Fighters – Politifi Token With a Long-Term Goal

If one is on the lookout for high-potential crypto projects with a long-term view, then FreeDum Fighters could be a strong candidate. Unlike many projects driven purely by market trends or speculative interest, this token is deeply connected to real-life events, specifically U.S. politics. This integration with real-world happenings gives the project a unique edge, making it more than just another memecoin—it evolves with ongoing political landscapes, which can help maintain interest and relevance over time.

One of the reasons FreeDum Fighters is appealing to long-term holders is its timely concept. The project revolves around satirical characters based on well-known political figures like Donald Trump and Kamala Harris, offering an engaging and dynamic storyline. As real-world political events unfold, FreeDum Fighters has the potential to stay relevant, especially during key political periods like elections. This strong tie to reality means that the token isn’t reliant solely on hype but can benefit from real-life developments, keeping its community engaged for years to come.

Beyond its concept, FreeDum Fighters offers multiple opportunities for participation and earning. The staking system introduces strategic elements where investors can vote for Magatron or Kamacop, with rewards shifting based on the popularity of each character. This mechanism encourages continuous involvement and keeps the staking process exciting, offering long-term investors the chance to earn consistently while staying engaged with the project.

There is also a debate-driven rewards system that brings an interactive dimension to the project. Participants are encouraged to discuss various social and political topics, earning tokens through their involvement. This not only strengthens the community but also ensures that token holders are constantly part of the project’s growth, further solidifying FreeDum Fighters as a long-term option for those who want more than just financial returns from their investment.

Visit FreeDum Fighters Presale

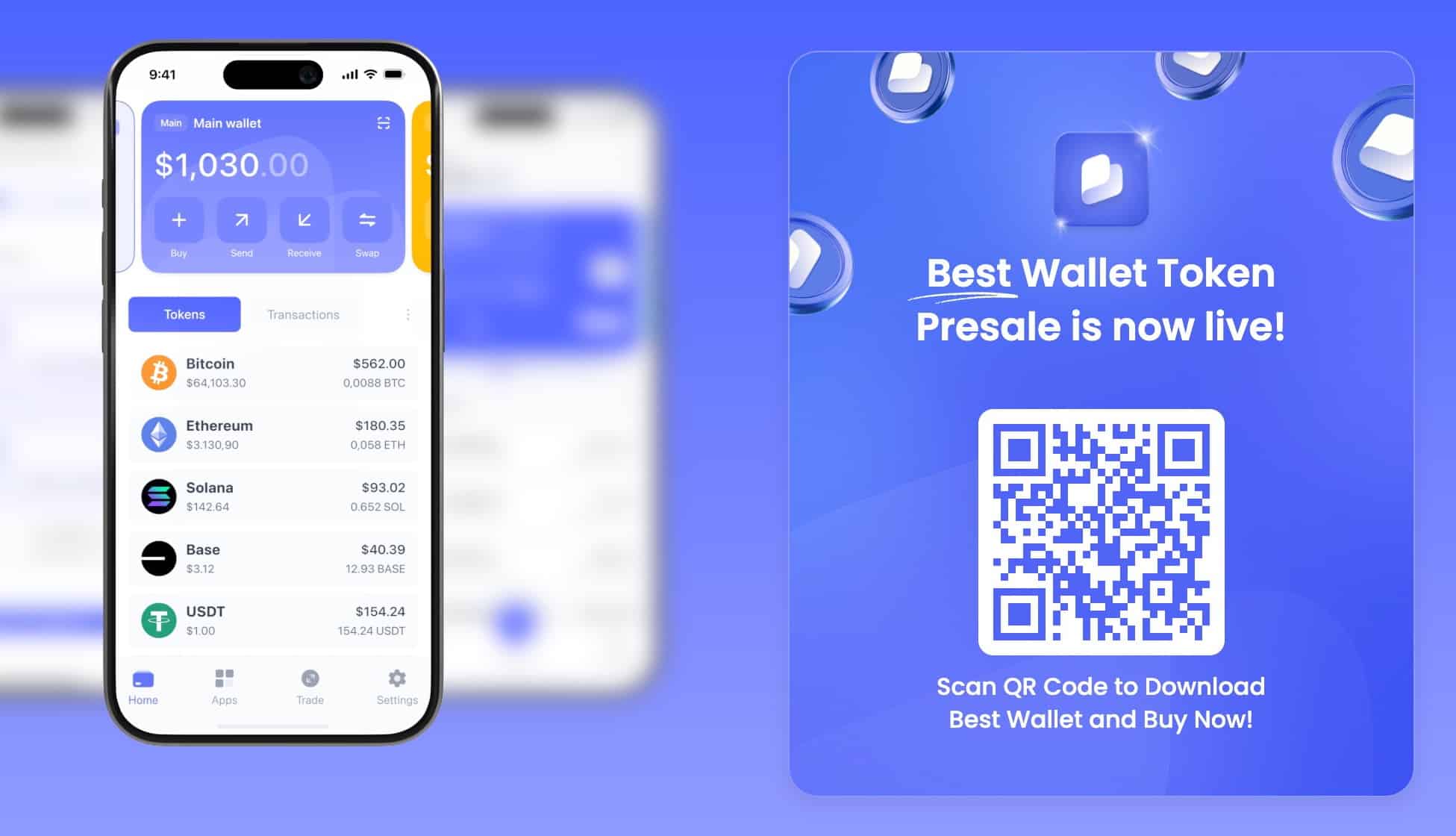

Best Wallet Token – Long-Term Utility Token Supporting a Strong Ecosystem

Best Wallet Token offers an array of practical features that improve the user experience within the Best Wallet platform, making it a long term project worth considering. Designed to deliver value beyond speculative purposes, BEST provides tangible benefits across various DeFi functions, making it a useful asset for digital asset management. As the primary token of Best Wallet, BEST allows users to access unique features within a platform known for its compatibility with over 60 blockchains.

A major function of BEST is its ability to reduce transaction fees on the Best Wallet app. By holding BEST, users can experience lower costs on trades and transfers—an advantage for those managing a diversified portfolio. This cost efficiency makes regular crypto transactions more affordable, which can be especially beneficial for users frequently engaging with DeFi tools or conducting trades.

BEST holders also gain early access to presales on Best Wallet’s aggregator, giving them the opportunity to explore and invest in new projects ahead of general availability. This exclusive access aligns well with users interested in early-stage investments and emerging projects.

Staking BEST within the platform offers additional utility, providing holders with competitive APY rewards. This staking function creates a source of passive income, encouraging users to stay connected with the platform and benefit from long-term holdings.

Further enhancing its role, BEST functions as a governance token, granting holders a say in decisions about platform updates and new features. This community-driven model strengthens user involvement, ensuring that feedback and preferences contribute to the platform’s future direction.

With a fixed supply of 10 billion tokens and built on the Ethereum blockchain as an ERC-20 token, BEST combines ease of access with security. Essentially, the token is designed for users seeking a long-term crypto asset that supports active participation and delivers real functionality within any growing Web3 ecosystem.

Visit Best Wallet Token Presale

Crypto All-Stars – Long-Term Meme Coin with Multiple Benefits

Even though it’s not always at the top of the list for those looking for long-term gains, Crypto All-Stars has what it takes to offer long-term upsides. Even though the token’s entire motif is to bring the community together by sporting the pixelated look of most top meme coin mascots, its main utility does more than just that.

Essentially, investors of top meme coins can stake their meme coins, be it Dogecoin, Shiba Inu, Dogwifhat, Pepe, Turbo, Coq Coin, or Based Brett, and earn rewards in terms of STARS tokens. This aspect of uniting the community through profit is one of the reasons Crypto All-Stars’ buzz has spread across social media.

The likes of 99Bitcoins, one of the leading crypto educators on YouTube, have said positive things about this project, stating that it could have 10x potential both in the short and long term.

Available on presale, Crypto All-Stars has raised upwards of $300k within a short span of time. It shows that investors are interested in what Crypto All-Stars has to bring to the long-term table.

Visit Crypto All-Stars Presale

Shiba Shootout – Cowboy-Themed Meme Coin with Long-Term Growth Potential

Meme coins are not often equated with assets that have long-term potential, but Shiba Shootout aims to change that with a suite of features that could entice both short-term degen investors and long-term gain seekers.

The token’s short-term potential can be gleaned from its imagery, which portrays Shiba Inus as cowboys riding across the frontier to prove they are the best.

The project’s long-term potential, however, comes from a blend of perks that focus on community engagement, referral rewards, governance, staking, and interactive games that could change the way people view meme coins.

The referral rewards are called Posse Rewards, the governance is designed to give the meme coin community the power to decide the fate of the project, and for community engagement, Shiba Shootout has devised Lucky Lasso Lotteries and Campfire Stories.

Campfire Stories will form a backdrop for investors to share their meme and investment stories and earn points for rewards. With Lucky Lasso Lotteries, the goal is to buy tickets for the giveaways and make significant gains.

A standout feature of this project is that none of these are mere visions; some of them have already started to come true. Shiba Shootout has already developed a P2E game that is about to debut on Google and Apple stores. Furthermore, presale investors will also be able to earn upwards of 2000% APY through staking.

These factors can boost Shiba Shootout’s momentum to stay relevant in the market for the long term. Interested parties can visit shibashootout.com to assess the other intricacies of this particular project. Following this token’s social media channels is also advised since it posts regular updates to engage with the community.

Tamadoge (TAMA)

Tamadoge is not your regular meme coin. It’s way better than that. Like a meme coin, it has the potential to go viral. At the same time, it does not face the usual drawbacks that these meme coins face.

Unlike other meme coins, Tamadoge is backed by a well-structured system that houses the Tamaverse. One of the top cryptocurrency exchanges in the industry, OKX, has listed Tamadoge.

Tamadoge, listed as TAMA, allows its owners to play a Play to Earn (P2E) game where players are required to train and raise their pets and fight them in a battle to earn rewards. The pets can be exchanged or sold in Tamaverse as NFTs.

This provides investors with more returns on their investment in the long run. Tamadoge has been able to raise 1.7 million USDT within a few days of its beta sale and plans to raise $2 million in the beta sale. In total the entire presale’s hard cap is $19 million.

Given the kind of reception it has received during its beta sales, it is very much likely that it’ll achieve its targets before the set deadline.

Update – the Tamadoge presale sold out early and is now listed on OKX, see our updated guide on how to buy Tamadoge.

Your capital is at risk.

Manta Network – Web3 Crypto with Long-Term Potential

Manta Network is revolutionizing the Web3 space by introducing a modular ecosystem that simplifies the development of solidity-based applications. With its distinctive and efficient technology stack, the platform is accessible to a wide range of developers. Its modular approach grants it a speed advantage over L1 and reduces gas fees compared to L2.

Positioned as one of the initial EVM-equivalent Zk application platforms, Manta Network prioritizes both scalability and security. The platform is underpinned by four technological stacks: Celestia, Polygon, OP Stack, and Polkadot.

This multi-chain approach gives developers a bigger leeway to create projects, giving Mandata Network a massive long-term potential.

The platform has been described on its official whitepaper as app-agnostic. With Manta SDK, the Manta Network can be utilized across various pools. The platform has been noted for its growing potential thanks to the recent partnerships and its commitment to non-invasive compliance.

Although Manta Network has exhibited some volatility in its performance on the price charts, experiencing modest growth of 28% throughout its existence, the project is slowly evolving. It is likely that more developers and the ecosystem will come to leverage Manta Network’s unique modular approach, which would make it a good crypto to invest in for long-term traders.

Celestia – A Modular Blockchain Network With Long-Term Potential

One of the reasons that Manta has been able to create a modular ecosystem with the added benefit of scalability is Celestia.

Celestia is a new cryptocurrency project, which established itself as a unique Data Availability network that allows it to be scalable as well as modular at the same time.

To achieve its modular framework, Celestia uniquely designates the data availability layer as its consensus layer, assigning distinct attributes to each layer. Two key elements, Data Availability sampling, and Namespace Merkle trees, constitute the foundation of Celestia’s approach.

Data Availability sampling involves selectively verifying specific data nodes within the tree, while Namespace Merkle trees partition data into multiple namespaces. Despite the complexities involved, this methodology enables developers to easily construct their decentralized applications or blockchains using Celestia’s blockchain.

With Data Availability Sampling, the need to verify all the data is reduced, and with Merkle trees, developers get access to a simple way to construct complex dapps.

Among the myriad new cryptocurrencies entering the crypto space in Q3 of 2023, Celestia emerged and experienced a notable surge in price. This Web3 crypto has slowly been climbing the price charts. While its performance has now stagnated in response to the recent Bitcoin pullback, it is likely that a bit of good sentiment to pull up the value of this token.

Bitcoin (BTC)

There has been a 1.88 percent drop in Bitcoin prices in the last few days, and the price is currently fluctuating between 42 and $43,000 US dollars. As of the most recent price movement in Bitcoin, the token’s market capitalization was at $827.3 US dollars. There are also indications that the next Bitcoin halving will play a huge role in its future price.

Bitcoin is a sort of digital asset that employs public-key cryptography to record, sign, and transfer transactions across the Bitcoin blockchain – all without the scrutiny of a central authority.

An unidentified software architect or collective of developers using the alias of “Satoshi Nakamoto” established the Bitcoin network in January 2009. An electronic payment system that employs a cryptocurrency called bitcoin (lowercase “b”) to transmit value over the internet or function as a store of values like gold and silver is termed the Bitcoin network (Bitcoin).

Bitcoins are divisible to eight decimal places since each one is composed of 100 million satoshis (the smallest unit of bitcoin). There is no limit to the number of bitcoins you may buy with only one dollar.

Your capital is at risk

Ethereum (ETH)

Even before Bitcoin, a programmer by the name of Nick Szabo laid the foundations for Ethereum. The basics of smart contracts, which he outlined in a paper written in 1994, were subsequently used as a building stone for Ethereum. Smart contracts would not have been conceivable without the 2009 development of the blockchain. While working as a computer programmer, Vitalik Buterin came up with the idea to create an open-source digital currency in 2013. More than $18.3 million was raised for Ethereum in a financing round put together by a group of prominent cryptocurrency experts, including Charles Hoskinson (Cardano) and Gavin Wood (Polkadot).

From the time of conception in 2014 to the time of debut in 2015, the project took around two years to complete. Eth had been pre-mined and dispersed to the team and crowd-sale participants when the blockchain went live on July 30th. Since then, Ethereum has been a popular platform for developers to experiment with and create decentralized apps (dApps).

The Ethereum leadership decided to roll back the blockchain in order to undo the breach. This ruling has been and continues to be contentious since some advocates of cryptocurrencies and blockchain believe that code is law. Ethereum Classic, a version of Ethereum that never had the assault reversed, is still in use today. Meanwhile, you can check out our guide to know if you should invest in Ethereum.

There has been a lot going on in Ethereum’s history since 2016, however this part will focus on its features. When it comes to understanding what makes Ethereum both successful and contentious, it is crucial to know where it originated from.

Your capital is at risk

Cardano (ADA)

In terms of market capitalization, Cardano is among the most popular cryptocurrencies. With a blockchain that’s adaptable, sustainable, and scalable, it’s intended to be the next generation of the Ethereum concept. Using smart contracts, Cardano intends to enable a broad variety of decentralized banking applications, new crypto coins, games, and more. “Ouroboros is the first provably safe proof-of-stake protocol,” said the Cardano developers. in terms of security, scalability and energy efficiency.”

There are two levels to the Cardano blockchain, which are the Cardano Settlement Layer (CSL) and the Cardano Computing Layer (CCL) (CCL). Accounting records are kept in the central ledger (CSL) (and is where the transactions are validated by the Ouroboros consensus mechanism). Apps operating on the blockchain rely on smart contracts to do all of their calculations on the CCL layer. The Cardano network will be able to execute up to a million transactions per second thanks to the blockchain being divided into two layers.

Cardano native tokens, in contrast to Ethereum-based tokens, are not produced by smart contract. To put it another way, they use the same software platform that powers the ADA crypto-currency in general. Cards native assets are now considered “first class citizens” on the blockchain, according to the nonprofit Cardano Foundation. The native design of these coins has the potential to improve security while also lowering transaction costs.

Your capital is at risk

Litecoin (LTC)

In 2011, a split in the Bitcoin blockchain resulted in the emergence of Litecoin (LTC), a cryptocurrency. As a result of developer worries about Bitcoin being too centralized, it was created to make it more difficult for large-scale mining corporations to acquire an upper hand. Litecoin has transformed itself into a mineable coin and a peer-to-peer payment system, while being unable to stop business miners from taking over Litecoin mining.

At its inception, Litecoin had a goal of thwarting large-scale mining operations by employing a separate encryption mechanism. However, miners soon modified their specialized machinery and proceeded to improve their mining capability.

Like Bitcoin, Litecoin can be mined using ASIC miners. Transaction data is stored in a block on a blockchain. It is validated and made available to any system member (referred as as a miner) who wishes to view it using mining software. Finally, Litecoin gets a new block on the chain and a payout for the miner.

Your capital is at risk

Solana (SOL)

The cryptocurrency used by Solana is called SOL. As the native and utility token of Solana, it offers a way of exchanging value and, by staking, ensures the security of the blockchain. As of March 2020, SOL was one of the top ten cryptocurrencies in terms of market valuation, and the team has worked hard to achieve this goal.

SOL tokens operate in a similar fashion as Ethereum tokens. Token holders of Solana use the PoS consensus method to validate transactions, despite the fact that their tokens perform identically. In addition, the SOL token allows users to engage in governance while simultaneously receiving incentives and paying transaction costs.

There will be more than 500 million Solana coins put in circulation with the current total quantity of Solana topping 511 million tokens — Solana’s circulating supply is little over half of this. Solana’s founders and the Solana Foundation own 60 percent of SOL tokens, while the community has only 38 percent.

To find out where to acquire Solana tokens, you can find them on the majority of markets. Binance, eToro, Coinbase, KuCoin, Huobi, and FTX are just a few of the main cryptocurrency exchanges in Solana.

Your capital is at risk

Binance Coin (BNB)

Originally based on Ethereum’s ERC-20 standard, Binance Currency has subsequently moved to its own blockchain and is now known as the Binance Chain native coin. An initial coin offering (ICO) for BNB tokens was announced in July 2017 and has a cap of 200 million tokens. Angel investors received 10% of the BNB tokens, 40% of the tokens were given to the founding team, and the remaining 50% of the tokens were distributed via the ICO process.

About two-thirds of the money received during the ICO process was supposed to be utilized to create the Binance platform and make the required updates to the Binance ecosystem.

Binance’s own blockchain, the Binance chain, is the native currency of BNB, which was originally built on the Ethereum network.

The entire amount of Binance tokens has decreased since the ICO, despite the fact that 100 million tokens were originally given. Binance burns its treasury’s Binance coins once every three months with a fifth of its quarterly income.

Your capital is at risk

Polkadot (DOT)

Polkadot is a piece of software that aims to encourage a worldwide network of computers to run a blockchain on top of which users may build and maintain their own chains.

Similarly, Polkadot is one of a number of rival blockchains that are attempting to build an ecosystem of cryptocurrencies, such as Ethereum (ETH), Cosmos (ATOM) and EOSIO (EOS).

A newcomer, Polkadot (released in 2020), has some of the most innovative technological aspects to help it achieve its lofty aim.

So, Polkadot is built to work with both Ethereum and Litecoin-based blockchains. User-created networks, known as parachains, and a primary network, known as a relay chain, where transactions are permanent.

Customizable parachains may feed into the main blockchain and benefit from the same security as the main chain’s transactions.

According to the Polkadot team, only the CPU resources needed to maintain a safe and accurate main chain may be used for transactions. For the advantage of the end user, parachains may be customized for a variety of purposes.

They think this approach will allow Polkadot users to complete transactions quietly and efficiently, building blockchains that do not divulge user data to the public network or that otherwise handle a higher number of transactions.

Your capital is at risk

Tether (USDT)

Tokens in circulation of Tether (USDT), a blockchain-based cryptocurrency with a price tied to $1.00, are backed by an equal number of U.S. dollars. In order for a stablecoin to function, it must be linked to a bank account that holds a regular fiat currency.

Tether tokens, produced by BitFinex, are the Tether network’s native tokens and trade under the USDT sign. USDT has a market valuation of around $68 billion as of October 2021, making it the fifth-largest cryptocurrency.

Stablecoins, like Tether, are a subset of cryptocurrencies that seek to avoid the wild price volatility seen by other popular cryptocurrencies such as Bitcoin and Ethereum. Instead of being utilized for speculative investments, it might be used for trade and as a kind of wealth storage.

Tether is a stablecoin that is backed by the value of the US dollar. All of the circulating cryptocoins are pegged to one or more of these fiat currencies. In addition to crypto-collateralized stablecoins, there are also non-collateralized and non-crypto stablecoins. A non-collateralized stablecoin is one that doesn’t have any assets to back it up, but instead functions like a reserve bank to make sure there is always an enough supply of tokens to meet demand.

Your capital is at risk

Sandbox (SAND)

When Pixowl first introduced The Sandbox in 2011, it was a blockchain-based virtual environment where people could play around with digital goods they had created. For a decentralized platform for a healthy gaming community, the Sandbox combines the power of decentralized autonomous organizations (DAO) with non-fungible tokens (NFTs).

Main goal: Introducing blockchain technology into mainstream gaming via effective implementation of Sandbox platform, according to official whitepaper Play-to-earn models are encouraged on the platform, allowing gamers and developers to work together. The SAND utility token, introduced by The Sandbox, makes use of blockchain technology to simplify transactions on the network.

Your capital is at risk

What Are Long Term Cryptocurrencies – Definition

The wide variety of cryptocurrency tokens being released might come off as a little bit intimidating at first glance, since there are many people who observe the market without any prior knowledge, and investing in projects you haven’t researched can create losses. The main problem with the crypto industry is that there are a lot of false projects on the market, so it’s very important to know what you’re putting your money into, since not every coin is made for long-term investment.

For a token to be a solid long term investment, it needs to be backed by a solid project with concrete plans on future expansion. These coins usually start off by growing extraordinarily fast in terms of price and market caps due to lengthy pre-launch planning and pre-sales that kick-start the trading project with a group of investors who decide they want to put money in the coin before it is officially launched to trade on main networks with the use of secondary platforms.

This also helps the coin start off at a more stable, less volatile rate due to being launched with a decent number of sales which are made prior to the moment when the coin can start being traded. The aforementioned coins have already gone through the stage of building a solid reputation and are now sitting amongst the most reliable cryptocurrencies on the market, and are on the way to growing bigger and bigger as their projects keep advancing into building the pediment for the future of the upcoming reign of blockchain technology.

What Is the Best Exchange for Investing in Cryptocurrencies

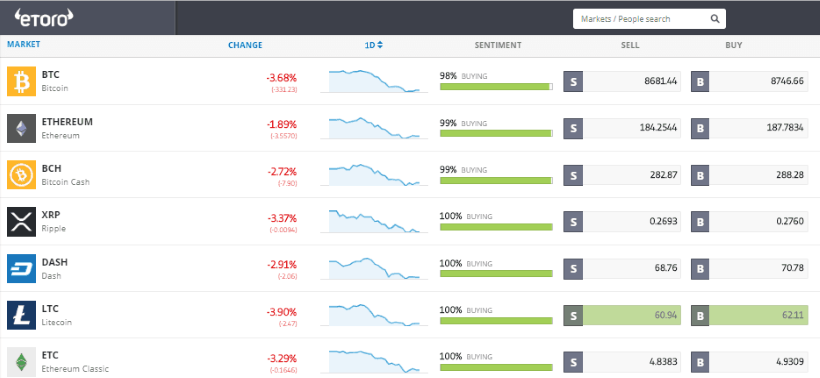

1. eToro

eToro is a well-known cryptocurrency and stock trading platform online. Adding support for Bitcoin (BTC) trading in 2014 made it one of the first online trading organizations to do so. Ethereum (ETH) and Ripple (XRP) were introduced shortly after (XRP).

eToro was founded by Ronen Assia, David Ring, and Yoni Assia in Tel Aviv in 2007. Assia continues to serve as CEO of the company to this day.

eToro was formerly known as RetailFX, but subsequently changed its name to eToro and added commodities, indices, and equities to its portfolio. When it released its social trading feature in 2010, it became the world’s largest social trading network because it allowed members to imitate the moves of successful traders.

In 2014, eToro launched BTC support, allowing users to buy and sell CFDs on the world’s most popular digital currency (to non-U.S. users). Since then, more digital assets have been added, including Ethereum (ETH), XRP (XRP), and Bitcoin (BTC). eToroX and a crypto wallet were launched by the company in 2018 as a way to enter the cryptocurrency market.

EToro is attempting to establish itself in the highly competitive crypto exchange market today by constantly improving its crypto trading services.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

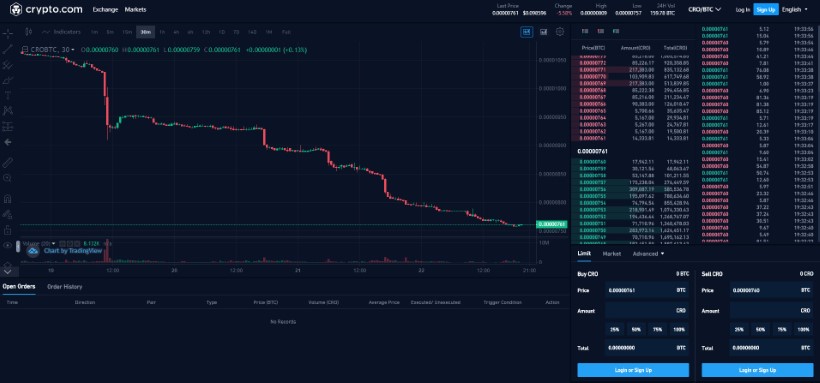

2. Crypto.com

In addition to a wide choice of cryptocurrencies and blockchain-related items, Crypto.com is a famous exchange. A wide variety of currencies are available for purchase, sale, and trading, and trading fees are kept to a minimum. There are also credit cards, a decentralized trading platform and an NFT marketplace offered by the firm. Users may also earn up to 14.5% interest by staking their crypto or keeping it in a Crypto.com wallet for a certain amount of time.

Crypto.com can be a suitable option for anyone who wants to acquire and keep cryptocurrencies like Bitcoin and Ethereum. With strong trading volume or considerable holdings of the CRO currency, fees drop to as low as 0.40 percent. It is possible to trade cryptocurrency futures on Crypto.com as well as trade in 250 different currencies.

In 2016, Hong Kong-based Crypto.com was created. More than 250 cryptocurrencies are presently available to more than 10 million clients throughout the globe. Crypto.com offers a wide range of cryptocurrency-related financial solutions to customers in more than 90 countries.

Beginner and expert cryptocurrency users alike may benefit from Crypto.com’s extensive currency selection, affordable prices, and more services. Beginners, on the other hand, may be put off by the sheer number of options.

Anyone looking to do more with their cryptocurrencies than merely purchase and keep will benefit most from using Crypto.com, in our opinion In other words, anybody who wants to use cryptocurrency as a medium of exchange rather than merely an investment vehicle will find a lot to like in this platform.

Your capital is at risk.

How to invest in Long Term Coins

On eToro, you may trade crypto assets in any of two main methods:

Contracts For Difference (CFD) allow you to trade in the price fluctuations of crypto assets without actually owning them. Investors and traders may benefit from a security’s price changes without actually holding the underlying asset using CFD instruments, while purchasing underlying assets means you get to hold your token anonymously under the care of a separate platform, not needing to use a place to store your token such as an e-wallet.

See how these two methods compare.

Investing in the underlying asset

Trading conventional money (US dollars) for crypto asset tokens like Bitcoin, XRP, or Litecoin is the only way to purchase the actual underlying asset.

A crypto asset is purchased on your behalf by eToro and registered under your name when you acquire it this way.

You’ll make money if the value of the crypto asset you possess grows in value. For example, if the price of gold declines, you’ll lose money.

The key benefit of this strategy is that you control the crypto assets. As a result, the tokens will be yours to retain and use as you see fit. Using the tokens is as simple as putting them in your wallet, exchanging them for other crypto assets, sending them to friends, or using them to make purchases.

A $1,000 purchase of Bitcoin will allow you to pay for items at merchants that accept Bitcoin as payment.

The eToro Wallet allows you to store your crypto assets when you purchase the underlying asset on the exchange. This digital wallet is simple to use, safe, and supports several cryptographic protocols. You may store your crypto assets in the eToro Wallet and send and receive crypto assets from other wallets, as well as convert one crypto asset to another.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Etoro-ETH

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Using CFDs to trade cryptocurrencies

Using a CFD, you are basically betting on the asset’s future price movement without really owning it.

Although you will benefit if the price of bitcoin increases by purchasing $1,000 worth of Bitcoin CFDs, you will not really own any BTC tokens.

Using CFDs to trade tokens has two key benefits.

CFDs allow you to trade in both directions, so you can make money both ways. As a result, you have the opportunity to benefit from both price increases and decreases.

If you think the price of a crypto asset will climb, you should buy a CFD contract (also known as “going long”). But if you think the price of a crypto asset will decline, you should sell a CFD contract (this is known as “going short”).

Second, you may increase your exposure by using leverage with CFDs. In other words, you can manage $1,000 with just $500 when using x2 leverage. As a result, bigger earnings are possible (but also the potential for higher losses).

The drawback of trading CFDs is that you don’t really own any crypto tokens. In other words, you can’t put them in your wallet or use them to make purchases.

Why invest in Long Term Coins

Long term cryptocurrency investments are the easiest way to get into the crypto industry. You don’t need to keep observing your holdings or the current price of a coin non-stop since the outcome that will affect you is the price change within a longer period of time. As opposed to day trading or margin trading, where investors make use of fluctuations in real time, keeping an eye on the market all the time to avoid losses with more volatile cryptocurrencies.

Day trading with more volatile currencies might be a bit more profitable at the end of the day if you do it right, however it is not as secure as long-term trading with more stable coins, as the high volatility can also easily put traders at a loss. With long term coins, you don’t have to worry about little fluctuations, as long as you keep an eye on the pattern of how a token is projected to move in the future and are well aware of the progress of the project backing the token. Overall, it is ideal to invest in long term cryptocurrencies if you want to have trustworthy assets that are projected to grow at a faster rate than any other investment possible, whether it’s stocks, commodities, property and more.

Risks of investing in Long Term Coins

When it comes to risk, just like any other cryptocurrency, every long term token has a chance of devaluing. When you invest in crypto for the long term, it’s easy to get carried away and forget to check your holdings, which is the main reason why some long term investments end up at losses. It is very important not to forget about your investment and to keep a close eye on it since the market is still at its infancy and this makes it quite difficult to accurately predict how a coin will perform in the far future.

Those who keep an eye on their investments wouldn’t have much to worry about, since you can sell your coin at any time if you feel like it is no longer trustworthy to keep as a financial asset. The most important thing is to not neglect your holdings too much in order to stay updated on their progress and avoid losing too much money off of unforeseen volatility. Every coin is capable of going down in price, so it is crucial to know exactly what you’re investing in, and to only invest money which you do not need as part of your essential day to day expenses.

Best Place to Buy Long Term Cryptos in November 2024

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

How much you should invest in Long Term Coins

When it comes to how much money you should put in the best cryptocurrency to invest in 2024 for the long term, the most important thing is to identify and differentiate between money you need and that which you don’t need. It is crucial not to break your bank when it comes to investing in cryptocurrency as you never know what’s going to happen to your money once it’s invested. Some tokens might look like they are projected to massive success and end up reaching zero a week later, so it is very important not to throw all your necessary money out the window thinking it’s going to make you rich the next day.

Nowadays it is becoming harder and harder to find fool-proof projects which are destined to undefiable success, and you need to be very lucky to hit a moonshot. Set aside all that you need plus a little extra to stay comfortable , and then when you have something above that, you can start investing in cryptocurrency. The best mentality to take towards such an industry is one where you assume that every penny you put in there you can lose and not let it affect you financially, that way, should things go wrong, you’ll always have a backup and never end up in a pickle because you invested everything you had in crypto and lost it. It is also ideal to split your holdings between numerous projects, so that the high volatility does not directly affect your whole wallet directly, and like this, losses will be at the minimum.

Conclusion

A massive selection of new choices are emerging as decentralized finance gains popularity are tokens like Pepe Unchained.

FAQs

Are long-term cryptocurrency investments a smart idea?

Long-term investors often keep their assets for many years or decades in order to maximize profits. To put it another way, if you feel that blockchain technology will take off in the future, long-term crypto investments might be a smart move.

Do you know which cryptocurrency has the best long-term prospects?

Since no other cryptocurrency has been around for as long as Bitcoin, its long-term potential is unmatched.

Is there a drawback to putting money into cryptocurrencies?

As a result, cryptocurrency investments might be exceedingly risky. The cryptocurrency market is mostly based on speculation, and its tiny scale makes it more susceptible to price changes. One of the primary drawbacks of cryptocurrencies is that it may have a disastrous effect on the value of individual coins.