Among the world’s most in-demand commodities, crude oil is hugely popular among traders, mainly due to the liquidity and volatility of the ‘Balck Gold’. As an economic driver whose price changes affects virtually every other commodity and financial instrument in the world, oil is the base on which the most economically viable countries stand on.

It accounts for more than a third of the world’s energy source for more than 15% of the global GDP. Regional and international blocs have even been established to control its production, supply, demand and global prices, but the existence of numerous global players and an insatiable demand ensures that these prices are always fluctuating.

As the price of oil fluctuates, it presents traders with an opportunity to invest and make tangible returns off trades when this value goes up or down.

Are you interested in investing in oil? In this article, we take you everything you need to know, including oil trading strategies, the best brokers for oil trading, and a step-by-step guide to how to trade oil.

On this Page:

How to Trade Oil in 3 Quick Steps:

In a rush? You should follow three easy steps in order to open an account and start trading oil.

1. Open a Trading Account

Create a free trading account with our recommended broker. You'll just need to provide a few basic details to sign up.

2. Deposit Funds

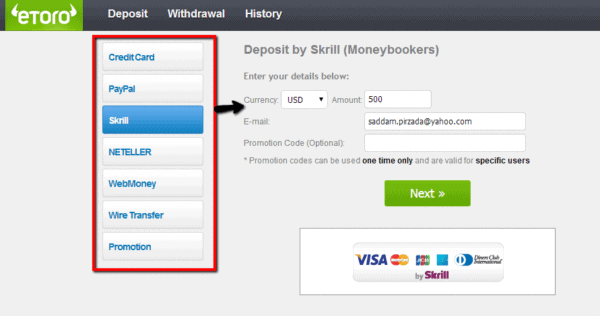

Once you're signed up, you can deposit funds into your account. Our recommend broker offers a range of deposit options, including PayPal.

3. Trade Oil

Now you've got a funded account you can begin trading oil. If you're a beginner, you can use the eToro demo account to learn the ropes before investing real money.

75% of retail investors lose money when trading CFDs with this provider.

Step 1: Sign Up to an Oil Trading Platform

Before you begin trading oil, you need to find a suitable online trading platform. We’ve reviewed many stockbrokers and have found that the following the are best oil trading platforms.

1. eToro – Market Leading Broker Built on Social Trading Innovation

eToro is a leading trading platform famous for its social trading tools, such as CopyTrader. This tool allows users to follow and mimic the trades of top investors, which makes eToro a great option for both beginners and experienced traders alike.

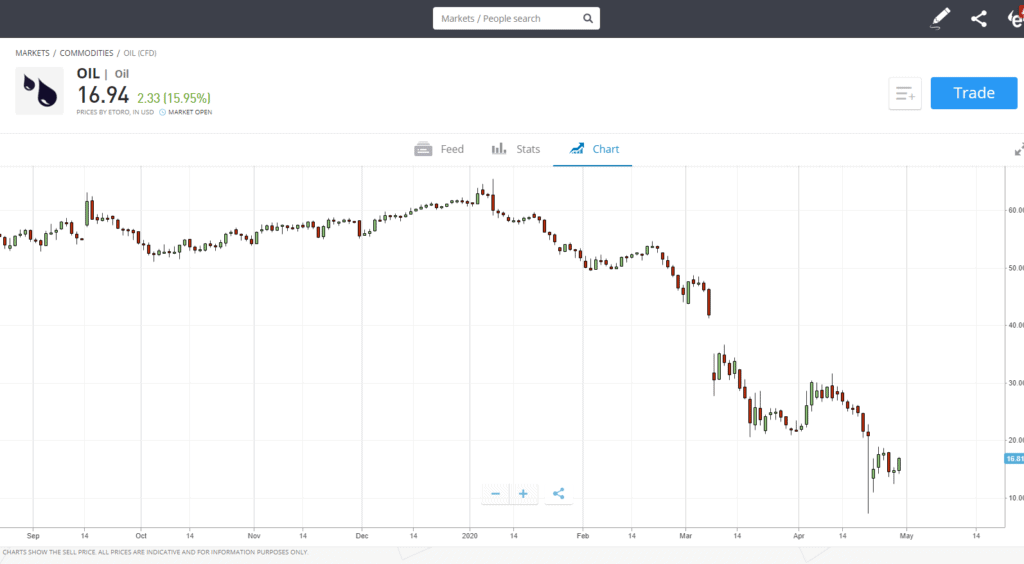

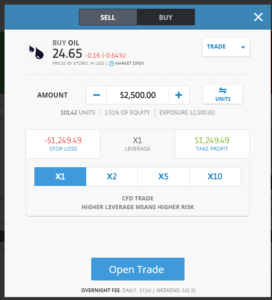

eToro users can trade oil CFDs at a spread of 5 pips. There is no commission, but there are weekend/overnight fees for CFD positions, such as leveraged positions and short (SELL) orders. The market hours for oil trading Sunday 23:00 to Friday 21:30 Western European Time.

You can set short (SELL) positions, leverage trades and trade with fractional ownership when trading commodities at eToro. Fractional trading means that if a single unit of oil costs $1,000, you can invest as little as $100, for example.

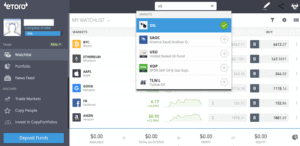

You can benefit from the community of oil traders at eToro. When you click on the oil trading section, you’ll see a feed of posts from fellow traders offering advice and insights. You’ll also be able to review the stats price chart provided by eToro.

With a simple and intuitive platform, eToro is easy to use, and the customer support is also helpful. It's also a highly regulated platform with licenses from CySEC, FCA and ASIC. All of this combined makes eToro the best online broker for oil trading.

- 0% commission

- Fractional ownership trading

- Social trading tools

- $5,000 account minimum for CopyPortfolios

Step 2: Understand the Oil Trading Market Works

We always recommend doing your research and making sure you’re clued in before you invest in any financial instrument. Let’s take a look at what you need to know about the market before you begin oil trading.

WTI oil vs. Brent oil

Oil is traded as both Western Texas Intermediate (TWI) crude oil and Brent crude oil, which are two different grades of the physical commodity.

These two oils differ in terms of prices and the exchanges on which they’re traded. WTI oil is traded on the New York Mercantile Exchange (NYMEX) and is the benchmark for oil prices in the US, while Brent oil is traded on the Intercontinental Exchange (ICE) In London and is the benchmark in Europe and most other parts of the world.

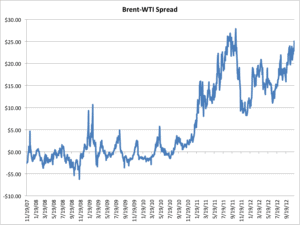

WTI generally trades at a discount to Brent. The price difference between the two is known as the WTI vs. Brent spread, and the spread can change as the supply and demand of each oil increases or decreases.

Ways to trade oil

Wondering just how oil is traded? There are several different ways, one of the main ways being the trading of oil futures contracts. Oil futures are contracts in which two parties agree to exchange a specific quantity of oil at a set price on a predetermined date. They are of interest to traders who look to sell contracts at a profit as the price of oil fluctuates.

Another way to trade oil is through CFDs (contracts for difference). CFD trading allows you to speculate on futures without actually purchasing the contracts themselves. Instead, you’re simply trading price changes in crude oil. Whereas trading futures takes place on a commodities exchange, CFD trading is offered by brokers and is more suitable for beginner traders. The upside to trading oil CFDs is that you can invest smaller amounts that you can expand tenfold using leverage, and you also have access to innovative analytical tools and expert advice at online stockbrokers.

An alternative to trading individual markets is investing in oil ETFs (exchange traded funds) and the shares of oil companies. The prices of these instruments are influenced by the price of oil and can sometimes offer good value.

Factors affecting the price of oil

If you want to trade oil successfully, it’s important to have a sound understanding of the different factors acting on oil and the impact they have on its price. As well as supply and demand, the price of oil is affected by a number of other notable factors, including geopolitical events, crude oil inventories, economic growth and recession, global trade decisions, weather and natural disasters, and OPEC (the Organization of the Petroleum Exporting Countries), the body that regulates oil production and supply, to name just a few.

Step 3: Learn an Oil Trading Strategy

There are many different trading strategies out there, so you need to find the one that best suits you. Here’s a run-down of the best oil trading strategies.

Day trading

Day trading is the buying and selling of financial instruments within a single trading day, in which all positions are closed before the market closes. As the price of oil is constantly fluctuating, due to both fundamental supply and demand factors and the actions of traders, oil commodity trading is popular among day traders looking to profit from fast movements.

There are a range of day trading strategies. For example, swing trading is a strategy that looks to make money on both the up and down movements by focusing on short-term price patterns, while scalping is based on taking small but frequent profits and maintaining a strict exit strategy. Other day trading strategies include trend trading, mean reversion and money flows.

Technical analysis

Technical analysis involves looking at indicators and price patterns to understand oil price movements. It is less of monitoring the oil markets and more about keeping tabs on the price action. Technical analysts, who mostly comprise of day and intraday traders, will often use a combination of such tools as the 50-day and 100-day moving averages indicator, the Fibonacci retracement, Pivot point and oscillator tools to monitor both the price movement and volume of trades.

Ideally, technical analysts operate on the hypothesis that the price of oil is predictable. They are therefore constantly monitoring oil prices and volumes of trades and interpreting them as different patterns, like the double top and double bottom, flag, triangle or head and shoulders, and using this to predict the price of the commodity.

Fundamental analysis

Fundamental analyses of oil trades involve understanding the intrinsic value of the commodity and how different factors acting on its price now and in the recent past affect its future prices. It involves taking into account all economic, financial, and political factors acting on oil’s supply or demand and assessing their impact on its immediate future and longer-term prices.

In most cases, the fundamental analysis approach to oil trading is applied by position traders. For instance, if you hoped to trade oil long term today, your analysis would have to take into account such factors as the recent OPEC decision to cut down on production, the Trump Administration’s calls on oil-producing nations to increase production, and impacts of US Sanctions on Iranian and Venezuelan oil, as well as the exploration of massive oil deposits in such parts of the world as South Africa.

How will all these affect the price of oil that has already assumed an uptrend after the US sanction on Iran’s oil? Additionally, what impact will leading oil producers’ reneging on the OPEC’s decision to cap daily production have on the short term and long term prices of oil? Having analyzed all these factors, you then decide whether to long or short on the commodity and for how long.

Risk management

Risk management applies to both strategies. While the volatility and a high number of oil industry players create an attractive trading environment, they also mean there is significant risk when it comes to oil trading. While potentially lucrative, the oil trading market can also be unstable.

Some of the risk management practices that every oil trader, both technical traders, and fundamentalist must embrace include proper money management, proper usage of leverage as well as hedging. Most traders go with a risk/reward ratio of 1:2 or 1:3 to help manage risk.

Step 4: Begin Trading Oil

Once you feel confident in your knowledge of the market and have chosen an oil trading strategy, you’re ready to sign up to a broker and open your first oil trade. Our pick for the best platform for oil trading is eToro, due to its low spread, useful social trading tools and licenses from regulatory bodies like CySEC and FCA.

After you’ve created an eToro account, trading oil CFDs is straightforward. First up, you simply need to log in to your broker account and search for oil.

Once you select oil, you will be taken to the oil market page where you can place an order or trade. Set the trade amount, stop loss, leverage and take profit, then simply click ‘Open Trade’ and your order will be set.

Conclusion

Oil trading is an art that takes time to master. This explains the emphasis most online oil CFDs trading brokers put on educating and training their oil traders through the provision of trading tools, insights, guides, daily market reports and demo accounts. You also need to master the different factors acting on oil and the impact they have on its price action.

More importantly, you need to decide on your trading strategy and master it. But long gone are the days when the day trader would only stick to analytical tools – if you hope to maximize your returns and increase your percentage win rates, you need to keep following the fundamentals of the oil market.

If you want to begin trading oil, there’s no better place to start than eToro, our recommended online broker for oil trading.

FAQs

Is oil traded 24 hours a day?

Online brokers have different opening times for oil CFDs markets. However, you can usually trade oil most hours of the day for four to five days a week, depending on your chosen broker.

What is the best oil trading strategy?

This depends on your own strengths and weaknesses as a trader, as well as whether you opt for day trading or longer-term positions. When trading the highly volatile oil market, however, you should make use of the insights and risk management tools available at top brokers like eToro.

Is oil CFDs trading profitable?

It's possible to make money trading oil CFDs, but you should remember that most traders end up losing money. It takes a lot of time, research and skill to trade oil successfully.

How long will it take to learn how to trade oil successfully?

The answer to this is relative to how much time you allocate to training, your previous level of exposure to the oil trading, and more importantly, the speed at which you grasp new concepts. Ideally, the more time you allocate to training and simulated trading in a demo environment, the faster you will learn to trade.

Can I use targets and stop-loss orders when oil trading?

Yes, most brokers understand the volatility these markets expose their clients to and have, therefore, decided to come up with several risk management measures meant to help protect your investments. This includes the use of stop loss and negative balance protection features.

How much money do I need to invest to start trading oil?

This depends on the minimum deposit of your chosen broker, which is usually $200 or $100.