It has since undergone numerous stages of modernization with the most recent being the adoption of online futures contracts, also known as Contracts For Difference (CFDs) as one of their primary trading instrument.

Commodities trading does not refer to Bitcoin trading or the buying and selling of any other kinds of cryptocurrencies. But one thing remains steadfast though, the commodities basket hasn’t changed, and has only served to expand and feature more commodities.

The commodities market is quite expansive and caters for virtually every tradeable physical good. From agricultural produces, to precious metals, and natural oils and gases. Some of the most popular commodities in either of these industries include Gold, Silver, Platinum, coffee, Wheat, Sorghum, Soybeans, Corn, Crude oil, and natural gas.

On this Page:

Why trade commodities?

- CFDs can act as hedge against price of actual commodities: The fact that you can long or short with commodities makes it possible to use the futures to offset any unprecedented losses with your physical products. For instance, if you expect the price of gold or crude oil to fall, you can short its value in the CFDs thus eliminating the incidence or reducing the impact of loss.

- Less volatile compared to stocks: Futures markets are not as susceptible to volatile markets conditions as the stock and equities thereby minimizing the incidences of huge drawdowns.

- More profitable compared to stocks and equities: CFDs markets allow for the use of leverage in trading implying that you only need to fill up a margin to buy trade large volumes of commodities making it possible to reap maximally from small investments. The same cannot be said of stocks or physical commodity markets.

- Prices can never go below zero: The price of online futures contracts is always hedged against the price of the physical commodity. And while the actual value of the physical commodity may fall, it can never go near or below zero. The same cannot be said of stocks or currencies.

- Fewer markets to focus on: While there exist close to thousands of stocks and an equally countless number of currency pairs to choose from, there are only about 50 major commodities. The limited choice gives traders a chance to gain near-complete mastery of their preferred commodity.

Pros and cons of commodity trading

Pros

- Requires minimal investments and has low overheads – mostly internet charges

- Guarantee independence as markets remain open 24/5

- Commodity trades are not affected by such economic factors as inflation

- Long and short order calls make it possible to profit from both up-trending and down-trending markets

- CFDs are more liquid than the physical commodities and equities

Cons

- Subject to margin calls should markets move against your direction

- Uncontrolled use of leverage exposes you to excessive risks

- You risk losing more than your invested amounts when dealing with a broker who implements ineffective risk management tools

Which Commodities can I Trade?

Gold (XAU) and Crude oil are to the commodities markets what the EURUSD pair is to Forex trading. They are by far the most traded commodities. You, however, have unlimited options on the types of commodities to engage in, drawn from the different industries. It is important to note early on that the price of online commodities has a direct relation to the price and availability of physical commodities.

When choosing the right commodity to trade therefore, you are better off starting with one from your field of expertise. For instance, if you specialize in the energy industry and have first-hand access to information on the industry operations, consider trading the energy-related commodities like crude oil.

Popular commodities to trade

Best Commodity Brokers for 2019

There are a few factors that you have to put into consideration when choosing an online commodities broker, starting with the complexity of opening a commodity trading account with them. In most cases, opening a commodity trading account is quite effortless, some brokers, however, will demand such information as your net worth and creditworthiness in consideration of the high leveraged nature and equally high risks involved.

Other key factors to consider when choosing an online broker include the number of commodities offered for trade on their platform. The different analytics tools included and the level of emphasis given to research about the market and news. More importantly, the broker should provide a training ground, a demo trading environment, on which you can simulate and perfect the effectiveness of the different trading strategies and even gain more knowledge about the different commodities being traded.

Our top pick for the online commodities brokers for the year is CryptoRocket, best known for its versatility and provision of numerous commodity CFDs.

How to trade different commodities

As mentioned earlier, trading commodities CFDs involves buying and selling contracts for the future price of these commodities. You enter into a contract with your online commodity broker and agree to settle the differences in the price of the contract at the end of a given period of time. If the markets perform as you expect, the broker fills your account with the excess funds by the time of closing the trade and vice versa.

The key to successful commodities CFDs trading, therefore, lays in the mastery of the price movements. And learning how to use different tools to interpret current conditions and forecast possible price directions. The two most popular types of price movements are: the trending prices, where the price is following a specific upward or downward trend and the ranging price that involves the price bouncing up and down around a specific price point.

Trading a commodity on a trending market

A trending market refers to a situation where the price of a given commodity, gold or corn, assumes an upward (with rising prices) or a downward rally (with falling prices). It is, however, important to note that the price of commodities never follows a straight line but is characterized by uneven periods of bullish and bearish price trends.

While the monthly or quarterly charts may be indicative of a rising trend, it makes it practically impossible for a trader to determine the next course of market action. Several technical analytic tools have nonetheless been designed to help you decipher a particular commodity’s price action movement and include Moving Averages and Fibonacci tools.

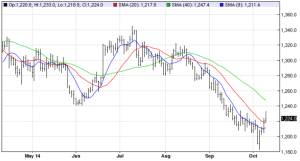

Using the moving averages

When examining the price action using the Moving Averages analyses tool, you will be looking out for the point at which the price of a commodity bounces off the moving average line. In most cases, this occurs when a shorter-term moving average line (50-day MA) crosses over the longer term moving averages trend line (100-day MA). If the line crosses above, that is an indication of a buy signal while crossing below indicates a sell signal.

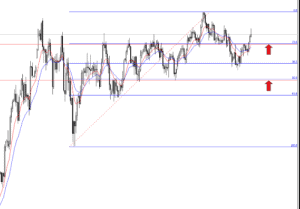

Using the Fibonacci retracement tool

You can also use the Fibonacci retracement tool to determine the best buying and selling points in a trending market. You then are supposed to buy the commodity when the tool points to a possible price dip in an upward trending market and sell if it indicates a price rally in a downward trending market.

How to trade commodities in stagnant market using Oscillator tool

The price of commodities won’t always assume an upward or downward trend, it will at times stagnate around a given price position. It will be characterized by numerous short price bursts and recessions, often referred to as ranges, which dance around a particular price point.

You can use oscillators to determine the best entry and exit points here. In such a case, the tool will help you identify the price dips when a commodity is oversold- the best buying point- and highest points where the commodity is overbought –representing the best selling point.

Should you use fundamental and technical analysis tools?

The decision on whether to use the fundamental or technical analysis tools to a large extent depends on your preferred trading style. If you hope to scalp such popular and high-liquidity commodity markets as gold or oil, you are better off employing technical analysis tools. If you intend to hold onto a commodity for a longer period of time by swing or position trading, you are better off considering the fundamental analysis techniques. The fundamental analysis here involves vetting the causes of long term price movements and reacting accordingly.

Sources of information for different commodities

The nature of most commodities makes them impossible or unprofitable to scalp and day trade. Most commodities investors are fundamentalists and this, therefore, demands a different approach to price analysis. Importantly, the fact that the price action of the online traded commodities CFDs has a direct relation with the price of the actual commodity brings the need to understand the underlying industry and how different changes and operations impact on the price of the commodity,

American Petroleum Institute and Energy Information Administration maintain some of the most comprehensive databases for the different markets and industries. The U.S Department of Agriculture also issues weekly and monthly reports on the state of the industry. Similarly, the precious metal and energy sectors are also releasing regular reports that have a direct impact on not just the price of the physical commodities but that of their CFDs counterparts as well. You can as well access the commodities calendar to review upcoming events that may impact your trading.

Bottom line

Trading commodities is no longer a preserve of mercantile exchanges and deep-pocketed investors. It has since moved online in the form of contracts for differences provided by such online commodity brokers as AvaTrade where margin and leveraged trades make it possible for virtually every enthusiast to trade commodities.

In a bid to make commodity trading accessible to as many traders as possible, these brokers have also come up with expansive training courses that teach everything there is to know about commodity trading. The top brokers have also embraced the social trading platforms and copy trading features that give novice traders a chance to make profits by duplicating the trade settings of the more experienced traders. You will, however, need to master the different analytic tools and how to interpret them if you too hope to reach the pro trader status.

FAQs

What are commodities?

These are defined as the basic goods or raw materials traded by individuals or institutions and often used in the production of more complex goods. These include such precious metals as Gold and silver, agricultural produce like corn and soybeans, and energy sector commodities like oils and natural gas.

How else can I trade commodities?

Popular ways of buying different commodities safe for the CFDs offered by the online commodity brokers include futures contracts that can be traded on Chicago (CMEX) and New York (NYMX) Mercantile Exchanges, Commodity-based ETFs that can be exchanged in the stock market, or buying and selling the physical commodity.

Do these CFDs contracts have an expiry date?

No commodity CFDs don’t have an expiry trade and function like any other financial instruments. The trades will, therefore, remain open until a time when the account holder decides to close them.

Can you trade commodity CFDs in the United States?

No. CFD trading is prohibited in the United States for both the country’s citizens and residents. Online traders here seeking to diversify their portfolios through commodities trading may consider such viable options as Futures contracts or the exchange-traded funds (ETFs).

Do online commodity brokers support automated trading?

Online commodity brokers have the right to exercise their discretion in deciding whether to allow the integration of automated trading algorithms into their MT4 platforms or not. Nevertheless, most brokers, support the use of expert advisors implying that you can trade your favorite commodity automatically, especially when using the scalping strategy.

How much do I need to start trading commodities?

Most online commodity brokers, including AvaTrade, have the minimum trade entry price for all their commodities set at $100.

Can I use stop loss and take profit orders when commodity trading?

Yes. Most online commodity brokers have committed to helping you safeguard your initial investments by way of introducing several risk management tools such as the stop loss and guaranteed stop loss features.

What is the most traded commodity in the world?

Crude oil, Coffee, Natural gas, gold, and Brent oil make up the five most traded commodities in the world, with the USD coming off as the most preferred pairing option for all these commodities.