With the rise of mobile applications, the investment process has been made much easier than it once was. Now, investors like you or I can simply create an account with little to no effort, log in without a minimum payment, and get to the process.

Back in the day, one had to call up a stock broker, speak about the trade, and pay a large fee. Now, most of the process is instantaneous. It doesn’t require any third-party communication, and fees are much smaller or even nonexistent.

Of course, even with the ease of stock trading applications, there are still some that are much better than others. Some focus on real estate, others micro-investing, and others more just on stocks. With so many options out there, we took it upon ourselves to try and find the best ones for your needs.

So, without further ado, we present to you this guide of the best investment apps for 2019 and beyond.

Top Investment Apps of 2019

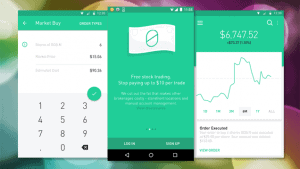

1. Robinhood – Free Stock Trading for US

Robinhood is named after the character himself, Mr. Robin Hood, who steals from the rich and gives to the needy. The reasoning here is similar: for anyone to get involved in the stock market. Since this application is commission free and streamlines the investment process, it ensures those who aren’t rich have a chance at being so. Robinhood makes it so stock trading isn’t only for the rich.

Robinhood provides news for each stock, related ones to invest in, price history, and overall information about every stock option. The app is also looking into cryptocurrency trading, as are many other stock trading applications. In fact, users can invest in Bitcoin, Ethereum, Ethereum Classic, Dogecoin, Litecoin, and Bitcoin Cash via Robinhood right now!

One of the Robinhood’s offerings is its “Instant” feature. Essentially, the app gives you access to profits immediately. This is unlike many of the traditional platforms. Both of these features cater to day-traders, but they aren’t exactly ideal for long-term traders. If you’re in that realm, you may want to look into other applications instead of this one.

Also, Robinhood has a paid “Gold” membership, which users like you or I can pay for to gain access to higher instant deposits, margin investments, more detailed research, and much more. While this isn’t a replacement for more advanced features, those happy with the Robinhood application who are looking to get a little more series do have this avenue.

Pros:

- Great for beginner investors

- Zero minimum deposit

- Fantastic information regarding stocks

- All commission fees are included with the spread – nothing extra for you!

- Participates in cryptocurrency

- Absolutely no withdrawal fees

Cons:

- Doesn’t help with retirement or some other important investment accounts

- Despite being streamlined, it is missing a lot of advanced features like dividends

2. Acorns – Easy to Use Personal Investment App for Beginners

Acorns isn’t free, but it has a very low monthly fee of $1. That and it streamlines the investment process so you don’t have to do much at all. You see, Acorns links to your debit or credit card, takes the spare change from your everyday purchases, and places it into a variety of stocks. To do so, the application takes your purchases and rounds them up to the nearest dollar, which is where it pulls the spare change from.

This process can be customized to happen daily, monthly, or just weekly. It all depends on what you’d prefer. That said, while Acorns is a great entry-level application, this form of investment doesn’t cater itself to advanced, long-term trading. For example, while the app is an ideal space to learn the basics of investments, it’s not the best way to keep a portfolio going due to its lack of advanced features.

A nice touch, however, is something called the Modern Portfolio Theory. With this, Acorns chooses model portfolios and models yours after them. So you can pick and choose which you’d prefer and go from there. Also, the platform is partnered with different brands such as Airbnb, Apple, and Macy’s that bring you even more rewards while shopping there.

Pros:

- Makes it easier to start investing

- Model portfolios for you to go after

- Teams up with brands for extra cash

- While not free, is incredibly cheap

- Doesn’t require a minimum

Cons:

- Not the best space for long-term investing

- Charges a monthly fee, even if cheap

3. TD Ameritrade – US Stock Trading Alternative

While it doesn’t have the cheapest commissions in the world, TD Ameritrade doesn’t require a minimum investment and has some fantastic features for you to take advantage of.

To start, similar to Robinhood, TD Ameritrade offers in-depth research on different stocks. Though on top of this, the application gives advice on how to build your portfolio, a ton of different exchange-traded funds to search through, and fantastic customer support. While there are so many benefits here, keep in mind that TD Ameritrade does have a $6.95 fee for each trade.

Thanks to all of these useful features, TD Ameritrade is great for beginners… aside from its high commission fees, that is. All education is done via the application’s “Ask Ted” specialty, which provides information based on your chosen knowledge level. And, the portfolio planning tool is great for those saving for investment and other sorts of plans.

Otherwise, there isn’t much bad to say about TD Ameritrade. It’s been around for a while, so the company has had time to work out any kinks and provide quality services to investors. As long as you can afford it, this application is a great choice for anyone looking to trade.

Pros:

- Great for beginners and experts

- Built-in portfolio helper

- “Ask Ted” assistant

- Educational content

- No investment minimum

- Great customer support

Cons:

- High trading fees

4. Stockpile – Buy Stocks and ETFs with Very Low Fees

Stockpile is an interesting investment application that tackles the process a little differently than other stock trading apps. To start, the app provides you with all sorts of different stocks to buy small fractions of. It charges $0.99 per trade, but also allows you to gift stocks.

This is done in a similar process to gift cards, in that you can buy fractions of stocks like Facebook, Google, Netflix, and more to give to your loved ones. Also, there’s no minimum balance which makes trading on Stockpile even easier than some other applications.

However, one should note that Stockpile only offers Stocks and ETFs. There aren’t any Options choices, bonds, futures, or anything else. This is a bit odd since bonds are often a great gift. On top of this, smaller gifts charge you extra fees – more than the $0.99 transaction fees for most activity on here.

But, it’s easy to appreciate the simplified stock gifting process here. This isn’t really possible otherwise without knowing the social security number of the recipient. Also, the recipient doesn’t have to pay any fees upon receiving the stock.

Pros:

- Provides fractional stocks

- No fees for the recipient

- $0.99 transaction fees

- No minimum balance

Cons:

- Charges extra for smaller gifts

- Limited stock options

5. Clink – Build an Automatic Monthly Savings Portfolio

Clink is an investment application with a focus on savings. Essentially, it takes your money and places it into Exchange-Traded Funds (ETFs) at your discretion. The app does so via a process called micro saving. Basically, you set an amount for the application to save on a regular basis. For example, you may want Clink to take $20 a week or 15% of the price of your gas tank fill up each time.

From there, it takes that money and places it into stocks without you needing to get involved. It’s that simple, and similar to Acorns, helps you invest with a hands-off approach. The automation is what’s key here, as it can be difficult to start putting your money towards investments by yourself.

One should note, however, that Clink costs $1 a month up to your first $5,000. From there, the monthly charge is 0.25% of your entire portfolio. Unfortunately, this application doesn’t have an IRA or Roth IRA as of this writing. That, and Clink doesn’t automatically adjust your portfolio if an investment position moves around. Some other applications do so by themselves, meaning you will have to do some micromanaging here.

Pros:

- Focus on savings

- Automated process

- Micro-investing is a great introduction to the industry

- Supports ETFs

Cons:

- Monthly fee

- Doesn’t have IRA or Roth IRA

What is an investment app?

An investment application is a replacement for old-time stock trading. In the earlier days of the stock market, an investor would have to call a stockbroker, ask for a trade to be made under their name, and have to pay a hefty fee. We’ve since evolved past that thanks to investment apps.

These applications allow you to buy into investments almost instantly. No longer does one have to call up a company and deal with waiting and extra fees. Additionally, investment apps tend to be great resources for information on different stocks, as well as a space for you to manage your portfolio and make the best of your investments.

How do investment applications make money?

Stock trading applications charge commission fees so they can make a profit. This means that every single time you make a trade, you’re charged extra for it. Of course, this is only one way these applications profit.

Another is with managed accounts. Here, the app offers an account that is managed by a stockbroker for a fee. That way, you don’t have to pay attention to your stocks, and you can still make money from them. That is, if you can afford to do this.

These firms also charge for extra services like live trading over the phone, or Options and futures contracts. Moreover, some applications charge account fees which come to if you decide to switch accounts from one space to another, or inactivity fees if you don’t use your account for a while. All of these things add up to a large cost for you, and a lot of money for the application.

Tips for choosing an investment trading app

In order to assist you in your search for an investment application that best suits your individual needs, check out the following tips.

➡️Investment Types

There are all sorts of different investment types for the average trader. These include but are not limited to traditional stocks, exchange-traded funds (ETFs), cryptocurrencies, and Options. Depending on what you’re looking for you may want an app that provides one or all of these. It’s also not a bad idea to start with one and move onto a more advanced application later on.

➡️Ease of Use

Of course, while a trading application makes the actual investment process easier, this doesn’t help you if the user interface barely works. When looking at the different applications, examine how you flow through the process. Pay attention to what works and what doesn’t and make sure you’re not wasting time trying to figure out the menu process.

➡️Reputation

As with any application you’re putting money into, pay attention to its background. Is the userbase generally happy with the provided services? Was the group ever involved in shady business practices or legality issues? See what the world has to say on a service before investing your time and money into it.

➡️Research

Does the investment application provide in-app research for investors? What sort of information does it give that can help users make a quality trade? Robinhood, for example, includes expert analysis on if the stock is worth buying, selling, or holding. That and users can view stock-related news without having to leave the application.

➡️Automation

If you’re just getting into stock trading, an automated process might be your best bet. Applications like Acorns put money in investments without you thinking about it. That’s’ right, just by buying things during your everyday activities, Acorns puts your spare change from each one into different stocks. If you struggle with giving away your hard-earned cash, this investment app would be a good one to get started with.

➡️Deposit Minimums

While some applications don’t require a deposit minimum to get started, those that do could charge a lot of money. This upfront fee is usually worth the investment, but only if you can afford it in the first place. That and if the application is even worth an upfront fee in the first place.

How much money do investment apps cost?

As always, it depends entirely on what you’re trying to get out of investing. Some applications require a minimum to get involved while others don’t. On top of this, there are applications that charge high fees, like TD Ameritrade’s $6.25 fee for every single trade. If you can find an investment app with no minimum and cheap trade fees, then you’ll be set for a while.

Are there any other costs in trading?

Yes, there actually are other costs in trading. That said, commissions are the most common ones. But it’s good to know the other types.

For example, there’s a such thing as “margin interest”. This is when an app charges an investor who trades with borrowed money, otherwise known as “on margin”. Depending on the application, you’ll have to pay a variety of different annual percentage rates based on how much you borrow.

Then there are taxes. Don’t forget that you must pay taxes on all of your different investments, and short term investments are taxed higher than other capital gains. Moreover, some of these applications charge “fund expenses,” which is taken from your profits automatically.

Also, some of these applications charge inactivity fees, transfer fees, brokerage fees, and more. These can add up over time, so it’s important to know which applications charge which fees for your financial well-being.

How we rated these free investment trading apps

When looking at different investment applications, we considered a few different key aspects.

✅Quality of service: What’s most important, of course, is that these applications bring in quality services for you and your investments. There is no excuse for lackluster features.

✅Investment types: We also paid attention to the investment types such as stocks, exchange-traded funds, or cryptocurrencies.

✅Ease of use: We also paid attention to ease of use. Are these apps useful for beginners or only experts? Fortunately, there’s a good variety of both. Some services automate the investment process, while others require the user’s attention. Others more stuck with only easy features while some include some advanced options for long-term investors.

✅Trading features: Overall, the investment applications we paid most attention to were those that gave the investor options. Each one on this list has a variety of approaches one could take, alongside some features for every time of investor.

Conclusion

If you’ve read our guide from start to finish, you now have a solid understanding of what works in an investment app. Each of these applications provides a different experience a little unlike the rest of them on the list.

Take a chance and try out each one to see what you prefer. Hopefully, our guide helped you in your decision-making process, and you’ll find one that gets you started and staying in the world of investments. Happy profiting!

FAQs

The best investment app for your buying needs is based entirely on your preference. Read through this list and pick the one that caters best to you.

This is interesting because each app is different. Some applications, like Robinhood, are entirely free to both use and trade on. Others, like TD Ameritrade, don't require a minimum but charge high rates on each trade. Each has its own way of working, so make sure you're aware of it ahead of time.

Stock trading applications provide all sorts of different assets to buy. Some offer just traditional stocks while others, like Robinhood, provide access to cryptocurrencies as well. Others support ETF's, Options, and more.

Very much so! And some more than others. For example, TD Ameritrade has a portfolio helper that puts helps diversify your investments between the different options. Some might have you jump into cryptocurrencies, while others will help you pick and choose between traditional stocks. As long as you have the money, you can diversify between as many different investments as you'd like.

While not exactly hidden, there are extra fees inside your investment apps, some of which will come later than others. For example, taxes. All of your trades and investments are taxed, and this is something you must cater for ahead of time. Also, there are brokerage fees, transfer fees, and some applications even have inactivity fees. As always, it all depends on the application. Well, aside from taxes. Taxes always hit.

In some ways, yes. For example, a lot of these applications are fairly basic and only provide an elementary look at stock trading. That said, they're also a great way to start stock trading, as they save you money and only focus on the essentials. However, if you're looking to become an advanced trader later on, you'll want to move over to more traditional applications once you get the hang of things. Just make sure to find one with low commission fees!Also, few of these applications have any sort of reliable risk tolerance. Essentially, an app will decide on what you can risk based on only a little bit of information. This could lead to inaccurate data and, as a result, poor investments. Which investment app is best for buying stocks?

What do investment apps charge?

What assets can investment apps be used to purchase?

Do investment apps help me diversify??

Are there any hidden fees in investment apps?

Are there any disadvantages to using investment apps?