Join Our Telegram channel to stay up to date on breaking news coverage

Tron (TRX) Price Analysis – September 21

Both the technical indicators for Tron (TRX) are still holding at the positive side after the recent price drop in the market.

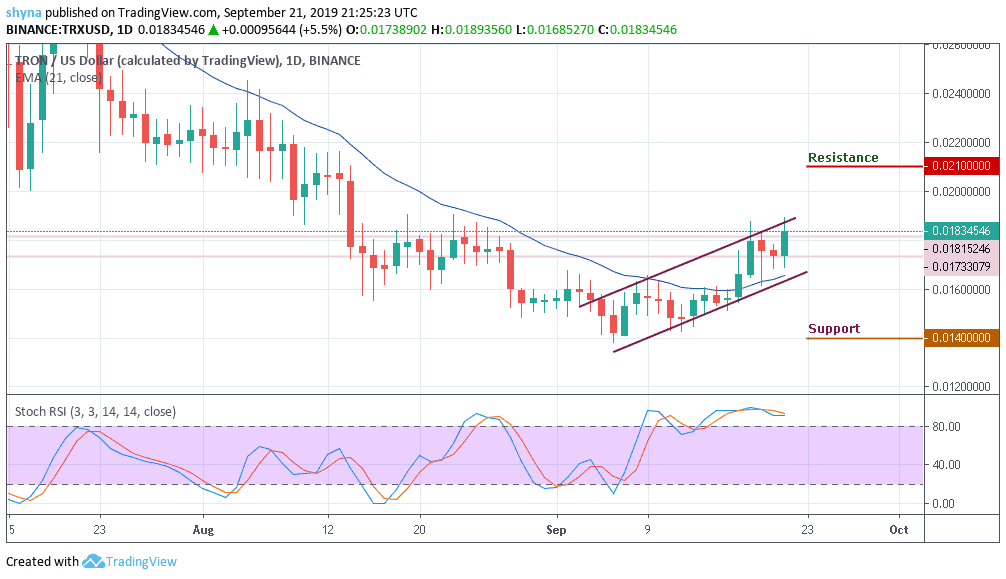

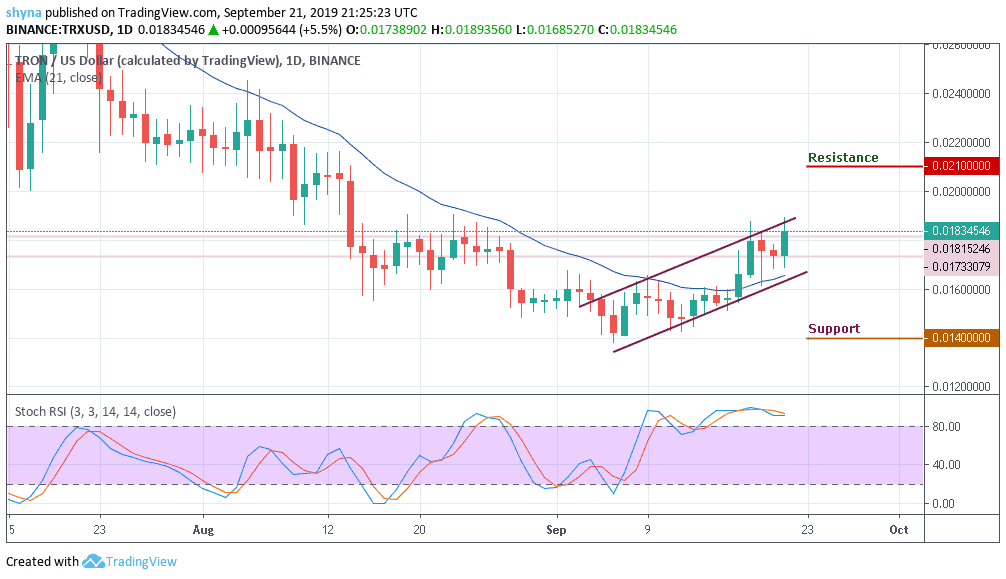

TRX/USD Market

Key Levels:

Resistance levels: $0.021, $0.023, 0.025

Support levels: $0.014, $0.012, $0.010

Tron’s price is steadily maintaining a higher high and higher low over the past few days, making the market to touch $0.0185 on September 18. Yesterday, the price of TRX dropped to $0.0173 after a slight pullback in the market. Despite the drop, today, the TRX market is currently up by +6.78% while the price is still moving above the 21-day EMA, bringing the market under the bull radar.

However, in as much the TRX/USD pair continues to shape in an ascending channel pattern, we can expect the market to keep maintaining a bullish moment before the price could hit the target resistance level. But if the price actions drive beneath the channel formation, the token may fall to $0.014, $0.012 and $0.010 support levels.

Moreover, a further sell may cause the market to retest the $0.0160 support, testing the channel’s lower boundary. Should the market bounce back, we may see the next buying pressure towards the $.014, $0.012 and $0.010 resistance. Nevertheless, TRX is still maintaining a bullish trend on the daily chart as the stochastic RSI is extremely at the overbought zone.

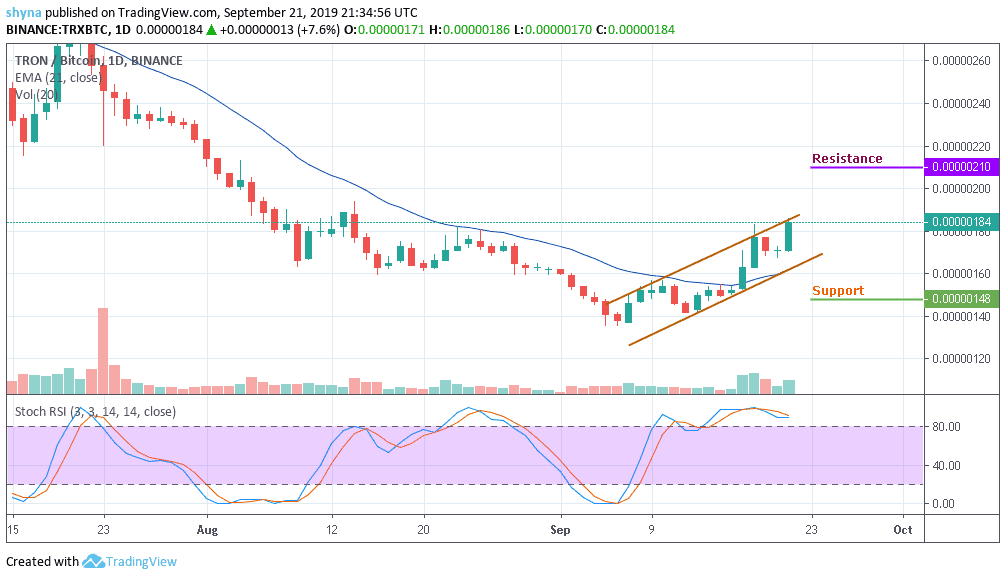

TRX/BTC Market

Comparing with Bitcoin, Tron (TRX) is trading on the upside, although the price action has remained intact above the moving averages. As the trading volume coming up slowly, if the selling pressure resumes, the TRX price variation may likely begin the downtrend. For now, the stochastic RSI moves at the overbought which makes the market to be strong at the uptrend movement.

Nevertheless, as the price move to break out of the channel at 188 SAT. We can expect close resistance at the 200 SAT before breaking to 210 SAT and potentially 220 SAT levels. Moreover, if the bearish steps-in and validate a break below the 21-day EMA; we can then confirm a downtrend for the market and the closest support levels lie at 148 SAT, 138 SAT, and 128 SAT.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage