Join Our Telegram channel to stay up to date on breaking news coverage

ETC Price Analysis – September 20

Ethereum Classic has managed to maintain momentum even in the downtrend movement.

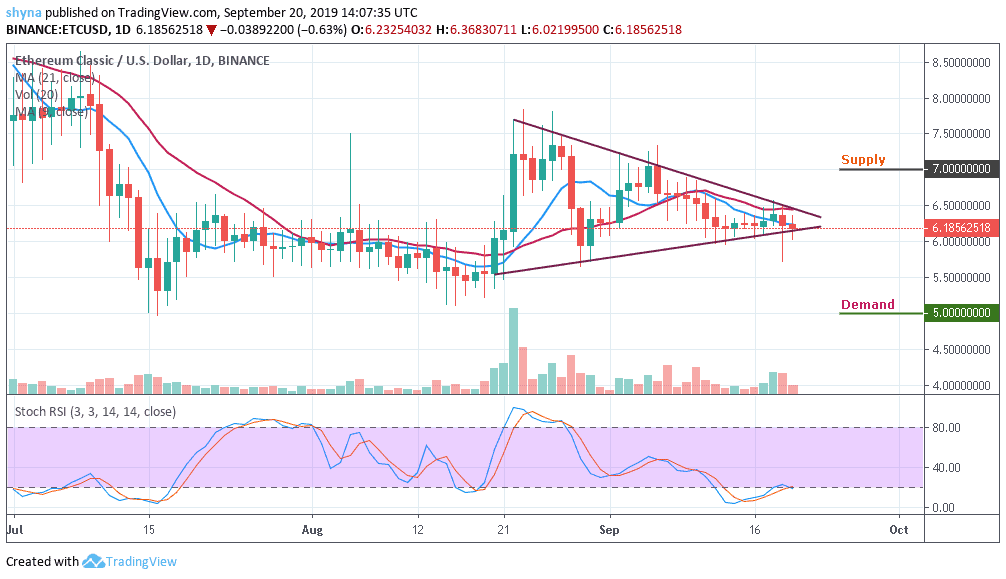

ETC/USD Market

Key Levels:

Supply levels: $7.0, $7.5, $8.0

Demand levels: $5.0, $4.5, $4.0

Ethereum Classic (ETC) has managed to stand ground in the on-going bearish trend in the crypto market, though the price has been showing variations for over three months. More so, the past one-day price trend has seen the coin moving in a flattish range within the baseline price of $6.0-$6.5.

Furthermore, following yesterday’s bearish surge which has significantly pull the trade to the lower channel. Presently, the price is about to cross below the 9-day and 21-day moving averages as the stochastic RSI is at the oversold zone. If this occurs; we can expect immediate support at $5.0, $4.5 and $4.0 levels. On the other hand, a bounce-back could regroup buyers for the key resistance levels around $7.0, $7.5 and $8.0.

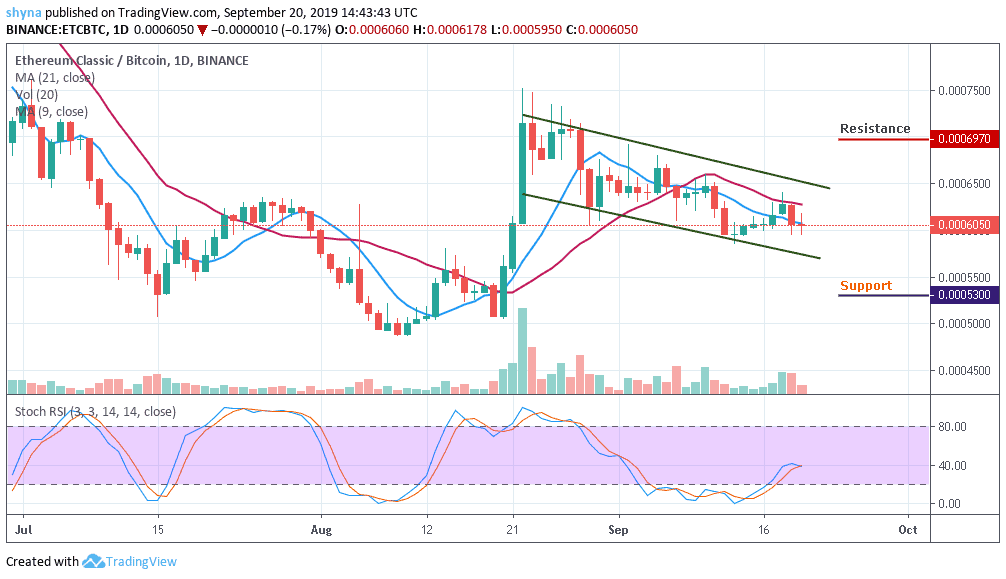

ETC/BTC Market

Comparing with Bitcoin, after some few days uptrend, ETC price dropped below the moving averages yesterday, the coin has continued the bearish run at the moment. The next level of support may surface at 5600SAT and then locate further key support at 5300SAT and 5000SAT levels if the sell-off later becomes huge.

However, on the upside, if the bulls can gather enough momentum to push the price above the descending channel, Ethereum Classic could face the 6600SAT resistance. Above the mentioned resistance lies the major 6970SAT level and above. The stochastic RSI indicator moves around level 40 and if the signal line travels above the level, we can expect bullish pressure above the channel.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage