Join Our Telegram channel to stay up to date on breaking news coverage

The Solana price has dropped 2% in the last 24 hours to trade for $98.85 as of 9:00 a.m. EST time, with trading volume rising 7%.

It comes at a time when Solana-based meme coins are trending, taking the baton from Bonk Inu (BONK). Now, MYRO and SILLY are the meme coin sensations on the SOL blockchain.

With Myro price rallying up to 775% on the month, Silly price is up 40% on the week. SILLY recently secured a listing on the HTX exchange, ranking among the exchange’s top gainers on Wednesday.

🚀 #HTX Listing Gains Recap:

— HTX (@HTX_Global) January 17, 2024

🔹 $MYRO +1383%

🔹 $RATS +1100%

🔹 $SATS +791%

🔹 $SILLY +300%

🔹 $TROLL +223%

🔹 $ZKF +163%

Which one did you trade?

Trade the hottest altcoins on https://t.co/K7SVDpBTiU and ride the crypto wave! 🌊 pic.twitter.com/LpZRpbOmDr

Elsewhere, American multinational asset management firm Franklin Templeton hailed Solana in a January 17 post on X.

On Solana, we see Anatoly’s vision of a single atomic state machine as a powerful use case of decentralized blockchains, lowering information asymmetry. And we are impressed by all the activity seen on Solana in Q4 2023

— Franklin Templeton (@FTI_US) January 17, 2024

-DePIN

-DeFi

-Meme coins

-NFT innovation

-Firedancer

While the post did not allude to the current spot exchange-traded funds (ETFs) frenzy, one analyst pointed the community to this investment product, saying, “The year of altcoin ETFs.” This triggered hope for SOL ETFs on social media platform X among its crypto community.

Solana Price Outlook With Emerging Hope For SOL ETFs

The Solana price remains within the confines of an ascending parallel channel. Nevertheless, it faces overhead pressure due to the midline of the bullish governing pattern and the supply zone that extends from $107.92 to $121.19. It comes after SOL flipped the descending trendline into a support.

Based on the outlook of the technical indicators, the odds favor the downside. For starters, the Relative Strength Index (RSI) is nose-diving, a sign that momentum is falling. If this trajectory sustains, the RSI could soon cross below the signal line (yellow band). Such a crossover is deemed a sell signal and is therefore bearish.

Also, the Moving Average Convergence Divergence (MACD) indicator is still moving below its signal line (orange band), suggesting the odds for a slump are higher than they are for a move north.

The Average Directional Index (ADX) indicator, which quantifies trend strength, shows that the predominant trend (uptrend) is losing steam. This adds credence to the postulation that a move south is likely for the Solana price.

If the bears have their way, the Solana price could lose the immediate support due to the descending trendline. An extended fall could see SOL market value tag the 89.02 support level, with the potential to collect the buy-side liquidity (BSL) that resides underneath.

In the dire case, the Solana price could dwindle all the way to the $80.00 psychological level, with the potential to roll over to the $68.03 support. Such a move would constitute a 30% drop below current levels.

TradingView: SOL/USDT 1-day chart

Converse Case

On the other hand, considering the RSI remains above 50, the price strength is still in the hands of the bulls. The position of the MACD in the positive territory reinforces this position.

If sidelined investors or late buyers increase their buying pressure, the Solana price could push north, potentially overcoming the resistance due to the midline of the channel.

In a highly bullish case, the Solana price could venture into the supply zone. A break and close above the midline (mean threshold) of this order block at $114.76 would confirm the continuation of the uptrend. This could see the SOL price flip this order block into a bullish breaker and use it as the jumping-off point to hit the $126.36 resistance level, marking the Christmas high. This would denote a 27% climb above current levels.

On-chain Metrics Supporting Solana Price Bearish Outlook

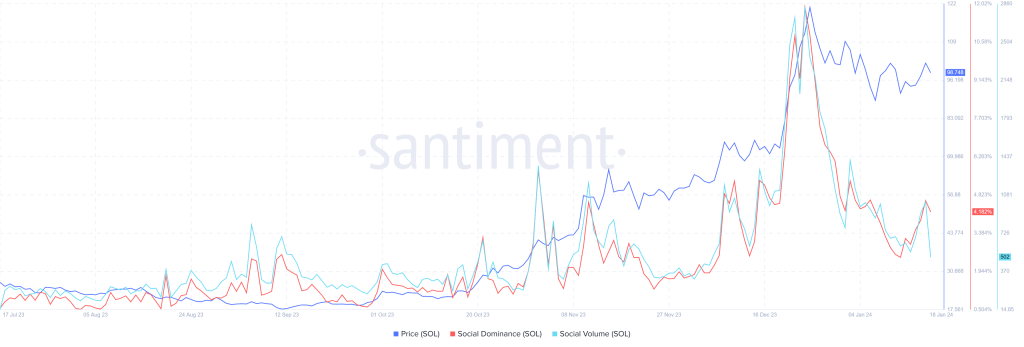

Santiment data shows falling social volume and social dominance, pointing to reduced mentions of the SOL coin across crypto-related social media. This is relative to over 50 other projects.

Solana Santiment: Social Volume, Social Dominance

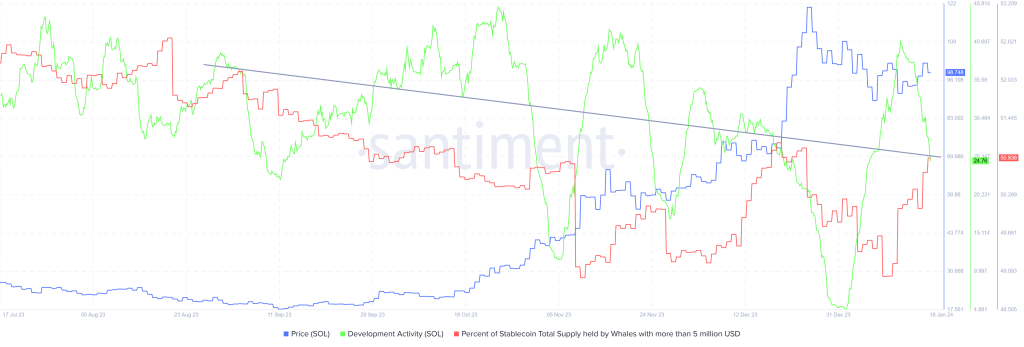

Development activity has also dropped from 41.64 to 24.76 between January 12 and January 18, representing a 40% drop in less than a week. Also, the buying power of the whales is low at 50.836 relative to the 51.087 recorded on December 19. This is seen in the drop in the percentage of stablecoin total supply held by whales with more than $5 million.

Solana Santiment: Development Activity, Percentage of stablecoin total supply held by whales

Meanwhile, many traders are turning to LPX, which analysts say is among the best AI crypto coins to buy in 2024. The project’s presale is ending soon, which is a call to action for interested investors to buy now.

Promising Alternative To Solana

LPX is the ticker for the Launchpad XYZ ecosystem, a consumer-focused project providing insights and analytics on all Web3 sectors. These are delivered through a well-crafted interface that brings Web3 to everyone.

#LaunchpadXYZ makes #Web3 human by simplifying a complex world into one familiar home. 🏠

— Launchpad.xyz (@launchpadlpx) January 11, 2024

Discover how things work, what the risks are, and how to operate safely.#Presale #Blockchain #Crypto #Alts pic.twitter.com/EmADe2eBce

Committed to meeting users at the heart of the next wave of Web3, Launchpad focuses on two core values – independence and decentralization. With this, it fosters safe usage of web3 while at the same time ensuring that users maximize their potential yield.

🔍 Ready to outperform in the #Crypto market? #LaunchpadXYZ gives you that competitive edge with real-time data analysis, market insights, and advanced trading tools. 🛠

— Launchpad.xyz (@launchpadlpx) January 14, 2024

Step up your trading strategy and stay ahead of the curve. 📊 #TradingEdge #Presale #BullMarket pic.twitter.com/iXKGRjoGqr

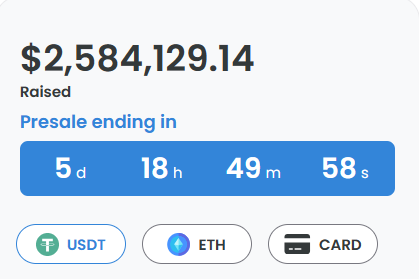

The Launchpad XYZ presale has raised more than $2.584 million. Investors can buy LPX now on the website, where each token sells for $0.0445. The presale ends in less than six days so do not miss out on this opportunity for affordable entry.

Join the many traders who are already reeling in profits of as much as 30x ROI from the free calls provided on Launchpad XYZ

Visit Launchpad XYZ to buy LPX in the presale here.

Also Read:

- How to Buy Launchpad XYZ – LPX Token Presale

- Last Call for Launchpad XYZ? Alessandro De Crypto Offers Last-Minute Insights

- ETH Beta Profits At Launchpad XYZ As Investors Migrate From OP And MATIC To Bag 2,917% ROI, ICO May Sellout

Smog (SMOG) - Meme Coin With Rewards

- Airdrop Season One Live Now

- Earn XP To Qualify For A Share Of $1 Million

- Featured On Cointelegraph

- Staking Rewards - 42% APY

- 10% OTC Discount - smogtoken.com

Join Our Telegram channel to stay up to date on breaking news coverage