Join Our Telegram channel to stay up to date on breaking news coverage

EURCHF Price Analysis – July 24

Today’s daily candle is also bearish which penetrated the $1.098 level down side, exposed $1.092 demand level. The price may decline to test the demand level of $1.092 in case the Bears exert more pressure on the currency pair.

EUR/CHF Market

Key levels:

Resistance levels: $1.098, $1.104, $1.110

Support levels: $1.092, $1.084, $1.077

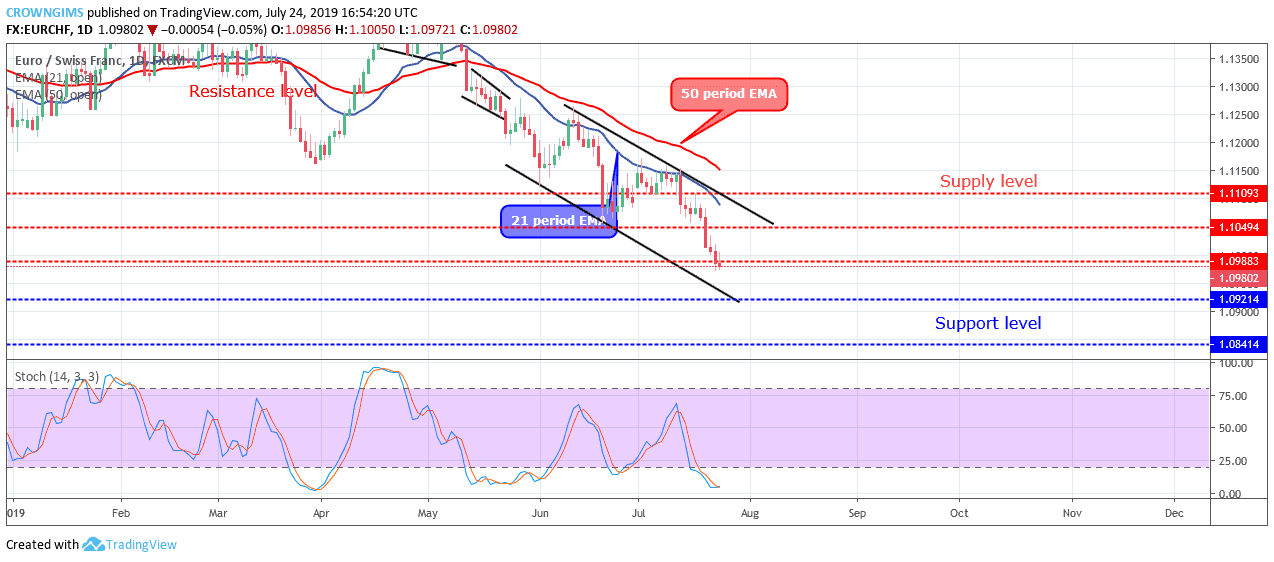

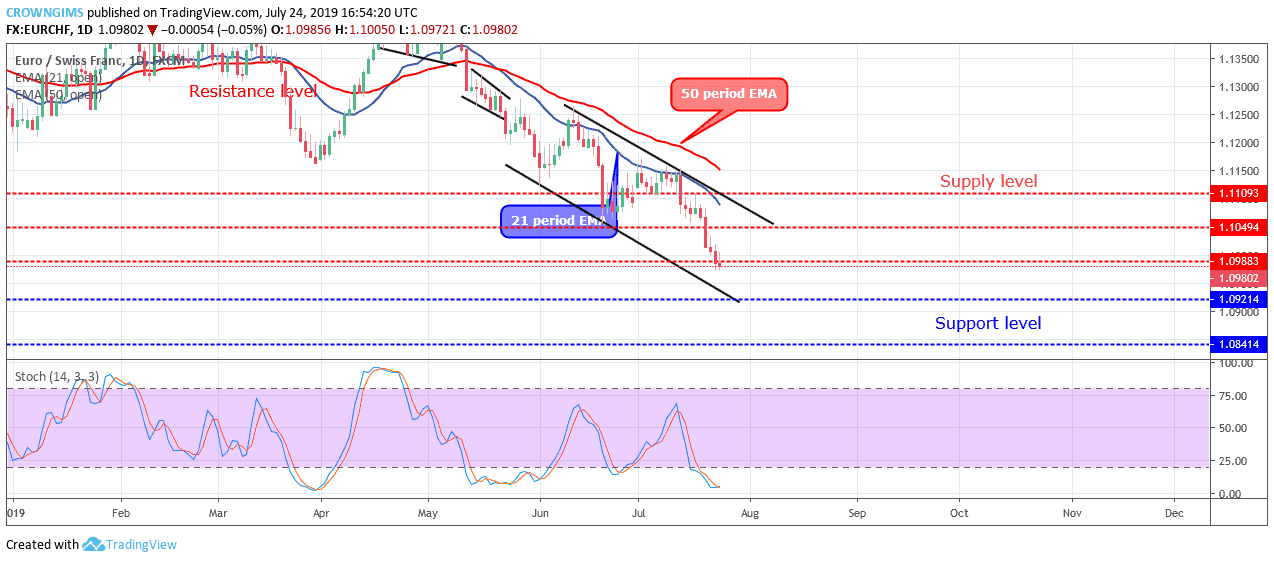

EURCHF Long-term trend: Bearish

EURCHF is bearish on the long-term outlook. The currency pair is under strong bearish pressure. After the bearish breakout that occurred on July 12, the Bears have been in control of the EURCHF market. More strong bearish candles were produced after the breakout and this led to the breakdown of the former support levels of $1.104 and $1.1098. Today’s daily candle is also bearish which penetrated the $1.098 level down side, exposed $1.092 demand level.

EURCHF price is trading within the falling channel below the 21 periods EMA and 50 periods EMA. The Stochastic Oscillator period 14 is below 20 levels with the signal lines pointing down to indicate a further decrease in the price of EURCHF and sell signal. The price may decline to test the demand level of $1.092 in case the Bears exert more pressure on the currency pair.

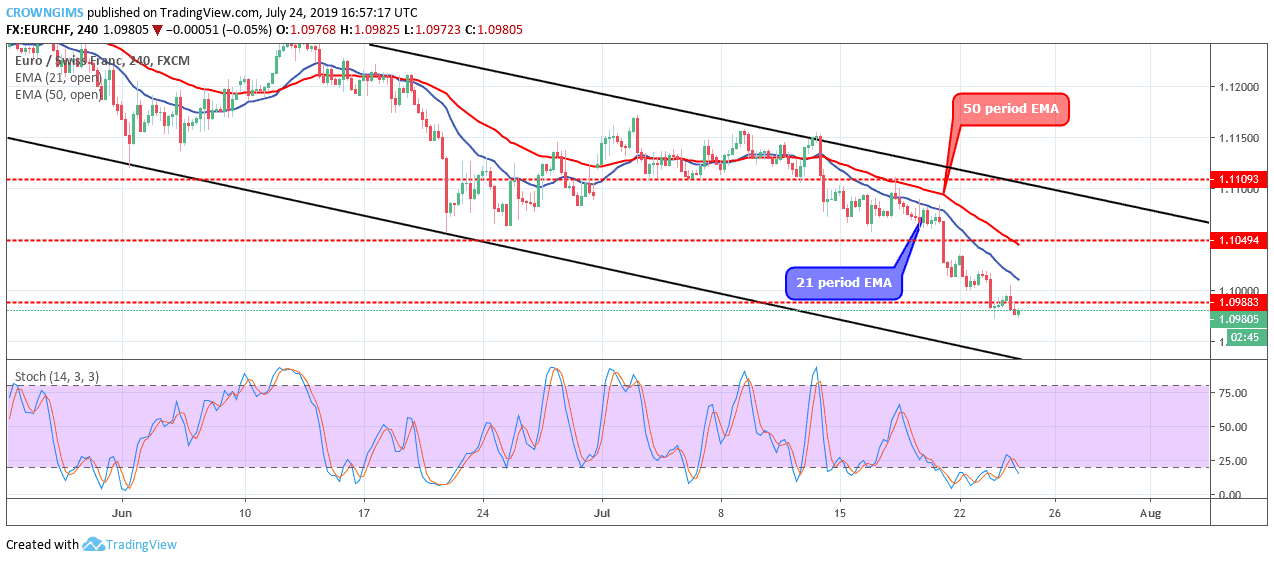

EURCHF medium-term Trend: Bearish

EURCHF is bearish on the medium-term outlook. The bearish momentum further increased in the 4-hour chart and the price made lower lows movement down towards the $1.104 on July 19. The level could not hold the price and it was penetrated downside. The bearish momentum extended to $1.098 demand level today and it was broke down. The price is targeting the demand level of $1.092.

The Stochastic Oscillator period 14 is below 20 levels and the signal lines bending down to indicate that the price may fall to the demand level of $1.092.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage