Join Our Telegram channel to stay up to date on breaking news coverage

As the market gradually recovers, investors are eager to seize opportunities presented by the impending bullish trends by investing in low-cost tokens. However, choosing these tokens priced under 1 cent demands thorough research. Hence, this article curates affordable tokens with potential returns in the crypto market.

7 Best Cheap Crypto to Buy Now Under 1 Cent

Investors are drawn to the excitement of discovering the next big thing in the crypto market, particularly with a price tag under 1 cent. Hence, tokens like ALGO, ASTR, and FET have recently gained traction, as their affordable prices and potential market performance have captured traders’ attention. In other news, Bitcoin has experienced a 3% increase over a week, with analysts foreseeing a longer-term upward trend.

1. Algorand (ALGO)

AlgoKit 2.0 will integrate pure, native Python into its platform, which is welcome news for developers in the Algorand ecosystem. This move aims to empower millions of developers worldwide, including students and AI/ML professionals. With AlgoKit, builders can begin their journey in 10 minutes. Hence, it offers users easy development, testing, and deployment on the Algorand blockchain.

Moreover, Algorand is transitioning from a relay structure to a peer-to-peer (P2P) gossip network. Notably, this is similar to the operational model adopted by Bitcoin and various other crypto networks.

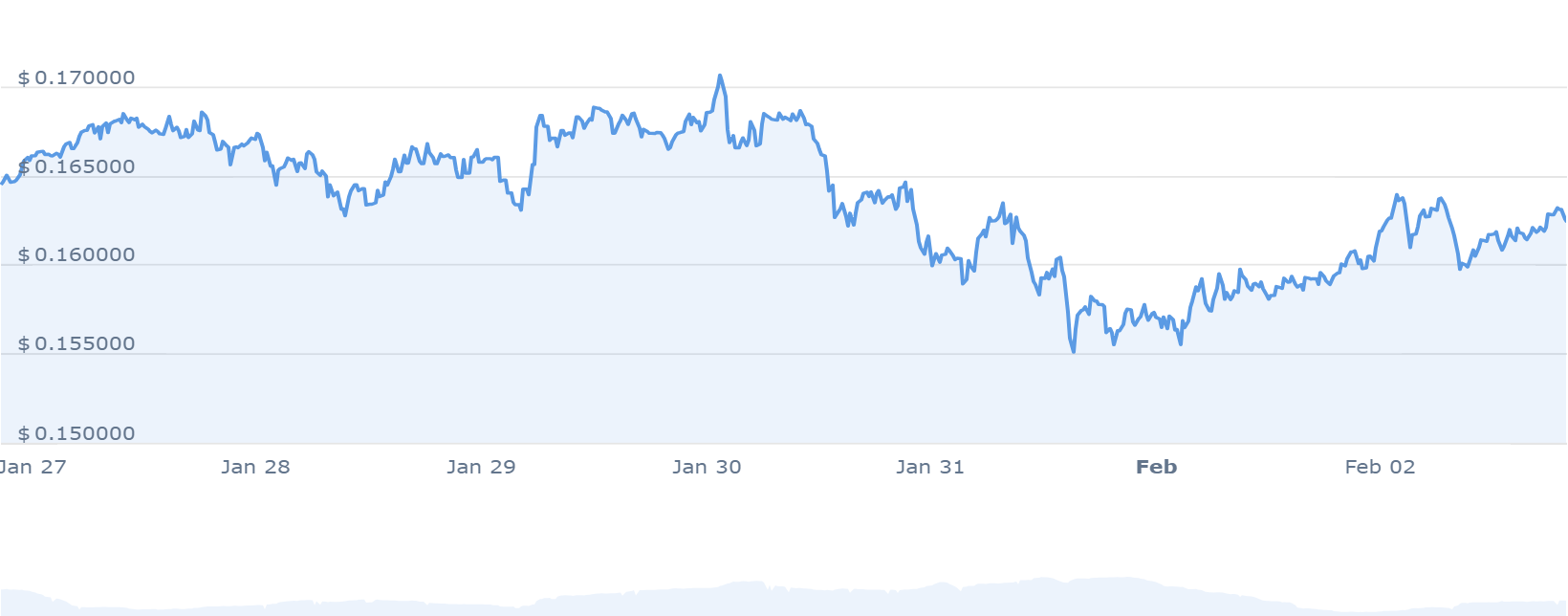

Furthermore, Algo’s shift toward a P2P network is crucial for the Algorand network as it strengthens its resilience and autonomy. Therefore, this positions it for sustained operation independently of potential disruptions. In the market scene, ALGO is currently bearish; however, a greed score of 60 suggests active trade by investors.

AlgoKit 2.0

Pure, native Python is coming to AlgoKit 2.0.

Millions of developers worldwide, from students to today’s leading AI/ML professionals, will soon have the ability to build decentralized applications on Algorand, using a language familiar to them.

This is our… pic.twitter.com/BwYySBovKg

— Algorand Foundation (@AlgoFoundation) January 17, 2024

By extension, this trading activity indicates that an upward trend is forthcoming. Similarly, Algorand’s performance remains robust, with its position above its 200-day SMA. In addition, it is boasting high liquidity based on its market capitalization.

2. 1inch Network (1INCH)

1-inch Network’s price rebounded from a dip below the 200-day EMA on Friday, recovering from losses incurred the day before. The price trended downwards over the past two sessions, testing the 200-day EMA.

Moreover, 1INCH’s recent movement has oscillated back and forth due to uncertainty in the short term. Despite this, today’s nearly 3% gain contributed to a weekly growth of 3.79%. Furthermore, 1INCH has performed well recently, rallying from October 2023 until mid-January 2024.

1/ 🔥💼 Exciting update for #1inchPortfolio users!

We’re adding new chains & protocols to supercharge your experience.

Ready for an upgrade?

➡️ https://t.co/irUe2sbYz3#DeFi #1inch pic.twitter.com/1gdrZ5lLNw

— 1inch Network (@1inch) February 2, 2024

However, it experienced a sharp decline in the last couple of weeks, losing over 15% of its value. Nonetheless, it maintains a 27% gain over the previous three months. Also, the long-term outlook remains positive as 1INCH trades above the 200-day EMA. However, breaking below this indicator could signal a trend reversal. Overall, 1INCH’s current trends make it a compelling option to consider.

3. Aleph Zero (AZERO)

Aleph Zero has garnered significant attention since its listing on major platforms. Currently trading on KuCoin, AZERO’s price sentiment leans bearish—however, a greed index of 60 indicates reception from investors. Furthermore, AZERO trades above its 200-day moving average, a sign experts believe signals an impending bull market.

Meanwhile, AZERO’s price is $1.100998, marking a 6.26% intraday rally, with a trading volume of $2.82 million. Also, its market cap and dominance are $293.72 million and 0.02%, respectively.

🌟 Aleph Zero joins Oxford's @HomeDAO_live incubator to pursue innovative ZK use cases. We've already found the first one!

🤔 HomeDAO is a pioneering startup society in Oxford dedicated to Web3 founders, enabled by the NEAR Foundation, ConsenSys, Aleph Zero, and others.

🏙️… pic.twitter.com/W7SXIDvy2U

— Aleph Zero (@Aleph__Zero) January 25, 2024

Analysts anticipate a potential price surge for AZERO if it collaborates with other networks. On this note, the projection is a maximum price level surpassing $4.42 by 2024. Furthermore, in a bullish crypto market scenario, the average price of Aleph Zero is expected to stabilize at around $4.00 by the same year.

4. Astar (ASTR)

Astar Network, a big multi-chain smart contracts and Web3 infrastructure platform, launched Astar zkEVM on its mainnet. This new Layer 2 scaling solution for Ethereum is set to shake up the crypto world. Astar zKEVM is a zero-knowledge Ethereum Virtual Machine-compatible L2 powered by Polygon’s Chain Development Kit (CDK).

At the same time, Astar is doing well, inching closer to the $0.2200 mark. This positive trend suggests that Astar could go up to $0.2200. Therefore, traders who want to invest in crypto long-term might stick with it. Also, Astar is trading higher than key moving averages, which is a good sign for the market.

📢 Are you ready? 🙌

The Astar zkEVM mainnet is coming soon! 🔗

Prepare for a journey with us to celebrate the mainnet launch and our Japanese roots in a way that's uniquely Astar! 🎉

Come and discover our original character "Yoki", and explore our zkEVM ecosystem! pic.twitter.com/77clcNKnmA

— Astar Network (@AstarNetwork) February 1, 2024

Moreover, recent trading sessions show that bulls are in control. Astar has gained momentum and seems ready to go higher. This activity and momentum support the optimistic view of buyers in the market.

5. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix has unveiled an innovative initiative, allowing users to stake BTCMTX tokens in exchange for cloud mining credits. The primary aim is decentralizing control and providing token holders with a secure mining environment.

Moreover, the platform’s staking pool has attracted significant attention, accumulating an impressive stake of over 640,000,000 BTCMTX tokens. This accumulation has resulted in an advertised annual percentage yield (APY) of 65%. Thus, it indicates strong interest among participants.

Big Announcement! 🎉#BitcoinMinetrix has hit a phenomenal milestone, raising over $10,000,000! 🪙 pic.twitter.com/toEsT1NvWv

— Bitcoinminetrix (@bitcoinminetrix) January 31, 2024

During its initial presale phase, Bitcoin Minetrix has demonstrated notable market traction. Also, the ongoing presale of BTCMTX has successfully raised over $10 million by selling tokens at $0.0132 each.

6. Flow (FLOW)

Despite a bearish sentiment, Flow shows a greed level of 60 on the Fear & Greed Index. Notably, it maintains a stable position above its 200-day simple moving average. Recent performance indicates a positive trend, with 16 green days out of the last 30, reflecting a 53% increase. In addition, Flow boasts high liquidity, which is evident from its market capitalization.

Furthermore, Flow currently leads the NFT Tokens sector by market cap and holds the 34th position in the Layer 1 sector. With strong fundamentals and community support, Flow is poised for growth. Also, collaborations with other networks could propel the FLOW Coin’s price beyond $3.81 by 2024.

We are excited to announce the first ever Flow Hacker House at @EthereumDenver!

Register now to a secure a spot at the Flow State Hacker House or apply for a Flow Foundation Scholarship to go to Denver 💪

More details from @ElDumboTS below ⤵️ pic.twitter.com/c5MKu9vADe

— Flow 🌊 (@flow_blockchain) January 24, 2024

If the bullish trend in the crypto market persists, Flow’s average price may stabilize around $3.45 by 2024. Moreover, Flow’s current market trends and community backing positions it for future growth. Therefore, investors should monitor announcements of collaborations, as they could significantly impact the coin’s value.

7. Fetch.ai (FET)

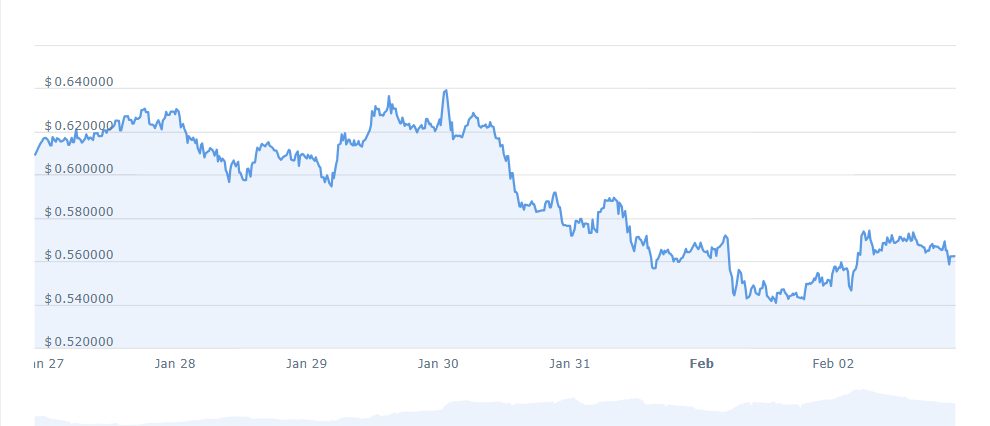

Fetch.ai is carving a path of resilience. Notably, it has bounced off the $0.55 support level, accompanied by a surge in trading volume and a favorable Relative Strength Index (RSI). These factors hint at a potential upward movement towards $1.5 soon.

Furthermore, the prevailing bearish sentiment temporal as the greed level of 60 suggests optimism among investors. Moreover, Fetch.ai’s displayed a 104% surge in the past year, bettering 77% of the top 100 tokens.

Building on our partnership with @ImperialX_AI, our Programme Director @sanawajid81 led a brainstorming session between Fetch and Prof. Alessio Lomuscio from @ConsultImperial! 📚

Collaborations with academic minds will guide the next generation of #AI development 🧠 pic.twitter.com/Vybk0NuBwY

— Fetch.ai (@Fetch_ai) February 1, 2024

Meanwhile, FET is currently ranked #38 in the Ethereum (ERC20) Tokens sector and #50 in the Layer 1 sector. In addition, it is placed #7 in the AI Crypto sector, holding a strong market presence. With high liquidity attributed to its market cap, Fetch.ai is a promising investment opportunity within the crypto landscape.

Read More

Smog (SMOG) - Meme Coin With Rewards

- Airdrop Season One Live Now

- Earn XP To Qualify For A Share Of $1 Million

- Featured On Cointelegraph

- Staking Rewards - 42% APY

- 10% OTC Discount - smogtoken.com

Join Our Telegram channel to stay up to date on breaking news coverage