Investous is among the most active online brokers available and has been having more and more users signing up on it every day. We decided to test it and found the service to be legit. This broker is regulated by CySEC and is allowed to operate in most of Europe.

It offers over 270 assets to choose from and uses well-reputed trading platforms like MT4 and WebTrader to support its trades. Read our full review to find out everything you need to know about Investous.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

On this Page:

What is Investous?

Investous is a CFD broker created in 2018. It is currently owned and operated by FI Markets Limited and is registered at Kolonakiou Avenue 43, Shop No: 2B, Agios Athanasios, 4103 Limassol, Cyprus. It was voted best execution broker in 2018 thanks to the efficacy and sophistication of its software. We have tested the broke to find out whether it actually is a legit broker. It is safe to say that it is and making money on it is definitely possible. It is also a platform that clearly strives to protect customers by providing a risk disclaimer on all of the pages of its website.

As well as this, it provides an education section, detailed information on fees, deposits and withdrawals and a legal section to give you access to any information you might need before deciding whether you want to trade on it or not.

Regulation and Trust

Investous is licensed and regulated by the Cyprus Securities and Exchange Commission, better known as CySEC. The Commission is among the most trusted and well-reputed regulatory agencies together with the Financial Conduct Authority and the Australian Securities and Investments Commission. Brokers found within a CySEC regulatory framework are allowed to operate in most European countries and some non-European ones.

The fact that the broker is regulated certainly adds to its reputation because it means that it has to meet certain standards regarding capital support and user protection in order to maintain its regulatory status. For example, CySEC-regulated brokers are required to possess an operational capital of at least 730,000 EUR, to file reports on a regular basis and have insurance on part of the trading capital.

Markets/Instruments

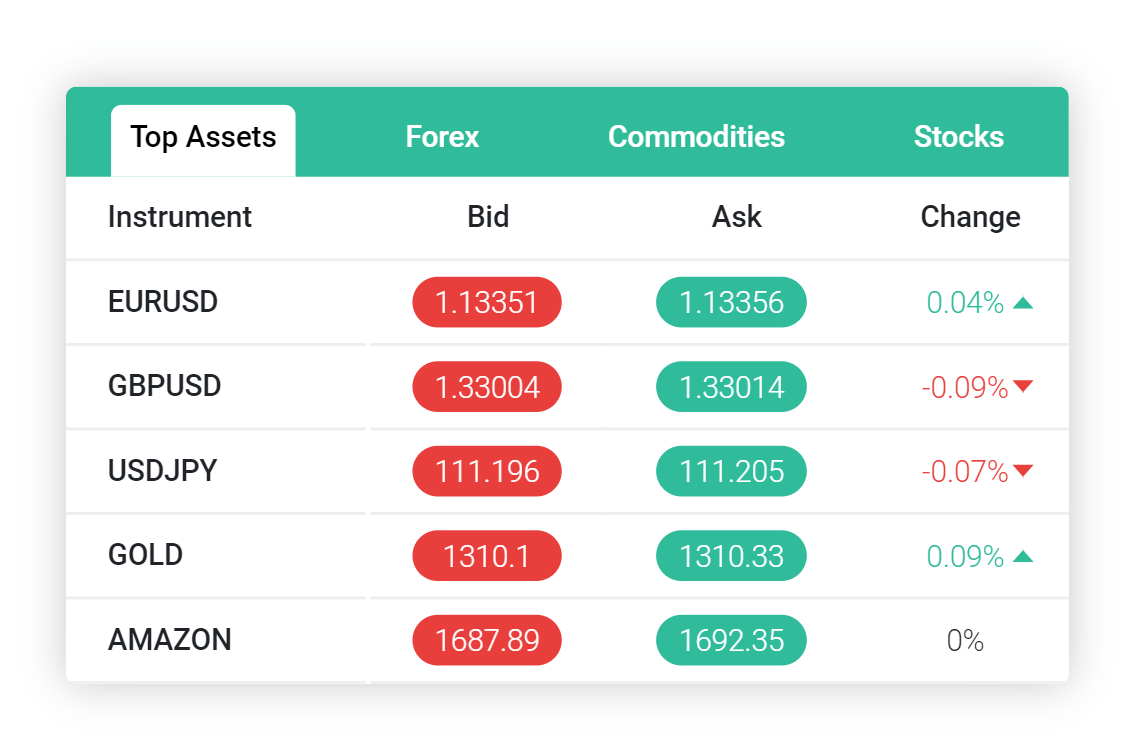

Investous boasts a huge variety of markets and instruments for you to choose from. There are over 270 assets you can choose from, including stocks, indices, commodities and forex.

Amongst the main forex assets you will find EUR/USD, USD/JPY, USD/CAD, GBP/USD, GBP/JPY and much more. The main commodities include Gold, Silver, Aluminum and Zinc. As for the stocks, the biggest names are Amazon, Apple, Facebook, Adidas, Nike and so on.

How to trade on Investous

Registration

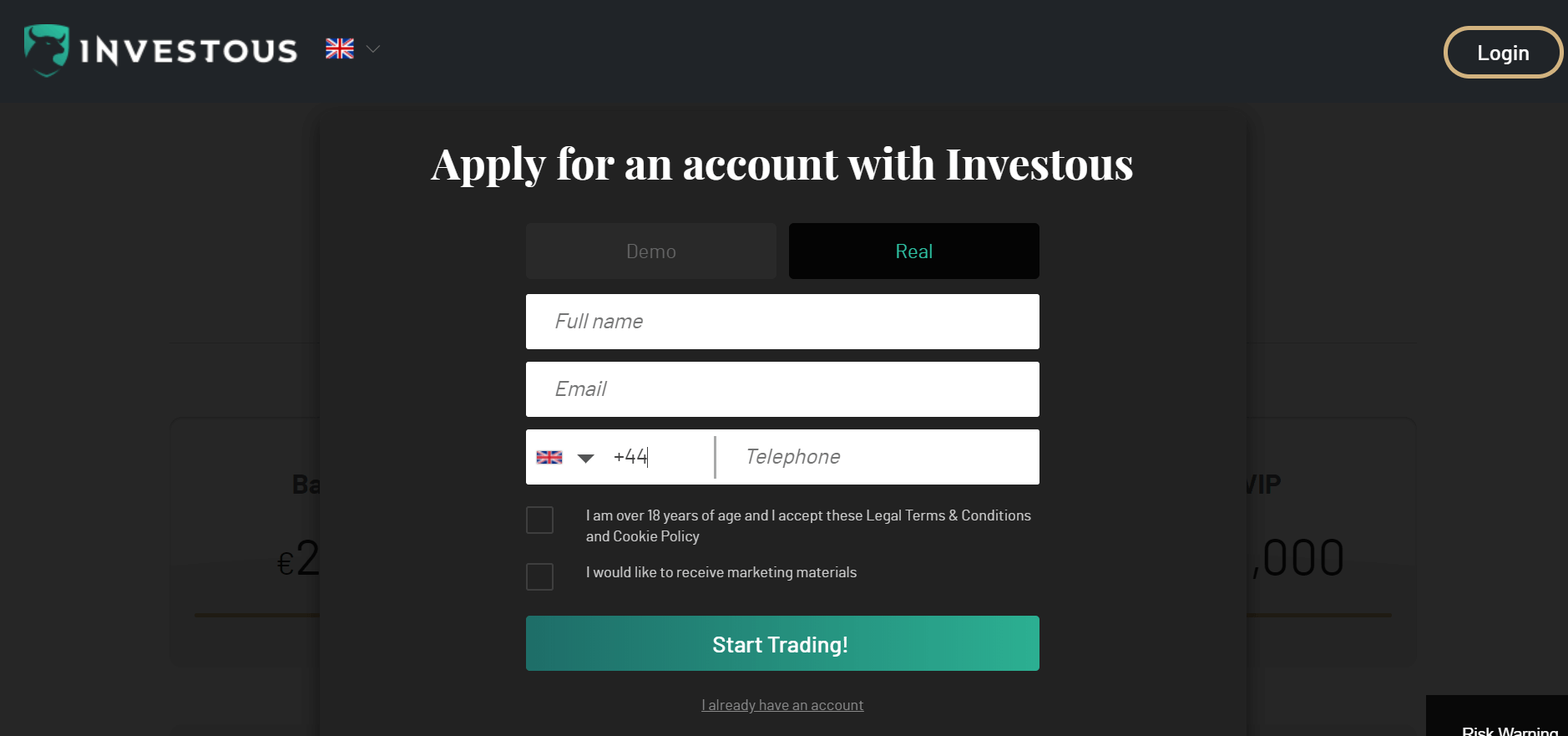

Signing up on Investous is pretty straight forward. Just click here to get started. You will then be asked to fill in a few details such as your full name, email address and phone number. You will also have to confirm that you are over 18 and that you have read the terms and conditions. Before clicking on the “start trading” button, make sure you decide whether you want to sign up on the demo account or on the real account.

In the first case, you will be redirected to the trading platform with a demo balance of 100,000 EUR. We definitely suggest to trade in demo mode first to get familiar with all of the platform’s proceedings. In case you decide to sign up for a real account, beware that before being directed to the deposit page, you will first have to complete a questionnaire in accordance with CySEC regulations. Other than questions about your financial circumstances, you will also be asked about trading knowledge. Once you have completed the questionnaire, which will take around 10 minutes, you will be able to deposit your funds into your new account.

Deposit

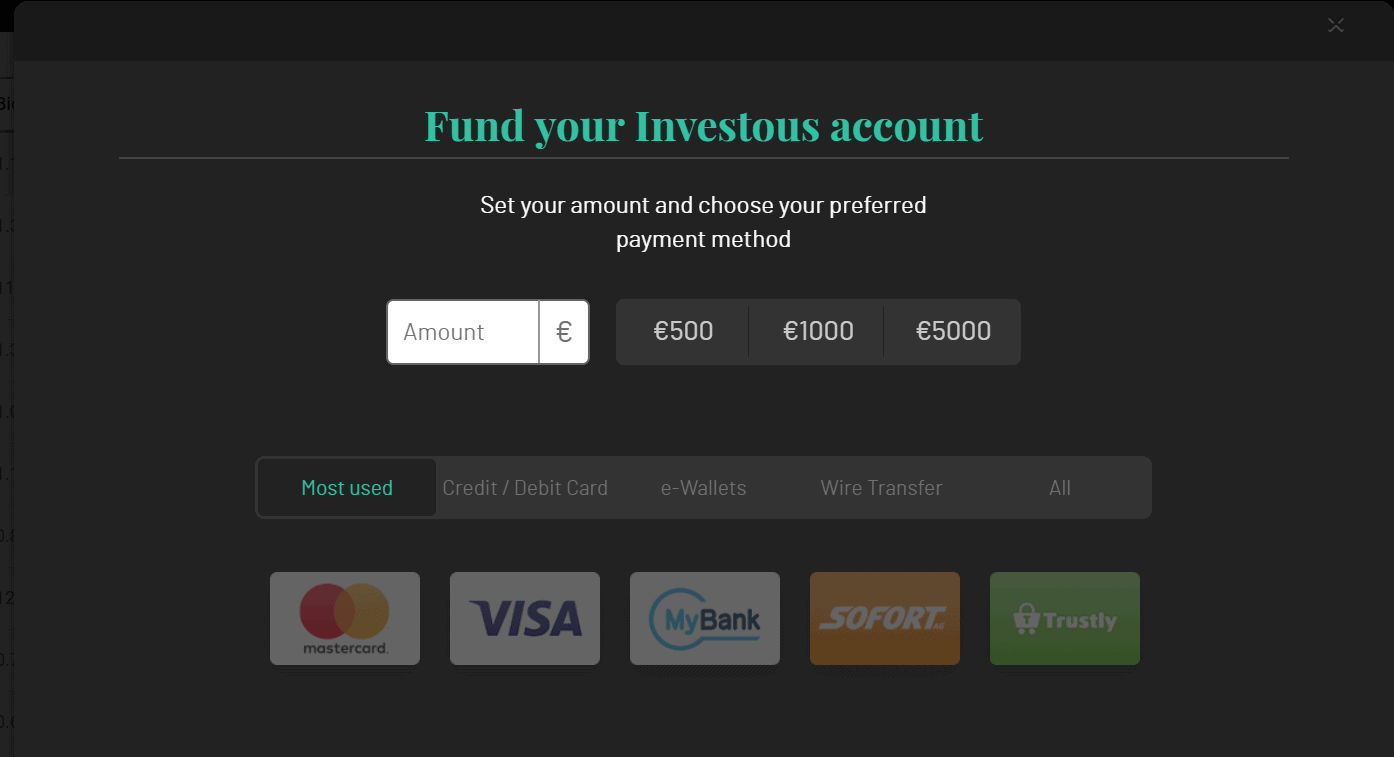

You will then be required to deposit a minimum of 250EUR in your account in order to start live trading. You will not be charged any fees for the deposit. Before depositing any funds, we recommend to try trading in demo mode first. Once you have seen how the platform works, you can move on to depositing real funds into your account. If you are depositing money via credit card your maximum daily deposit will be 10,000 EUR and the maximum monthly deposit will be 40,000 EUR. The same rules apply for electronic payments and bank transfers.

Payment Methods

Investous offers a great variety of payment methods you can choose from. You can pay via MasterCard or VISA credit and debit cards and by bank transfer. As well as this, you can choose to pay with e-wallets such as MyBank, Sofort and Trustly.

Trading

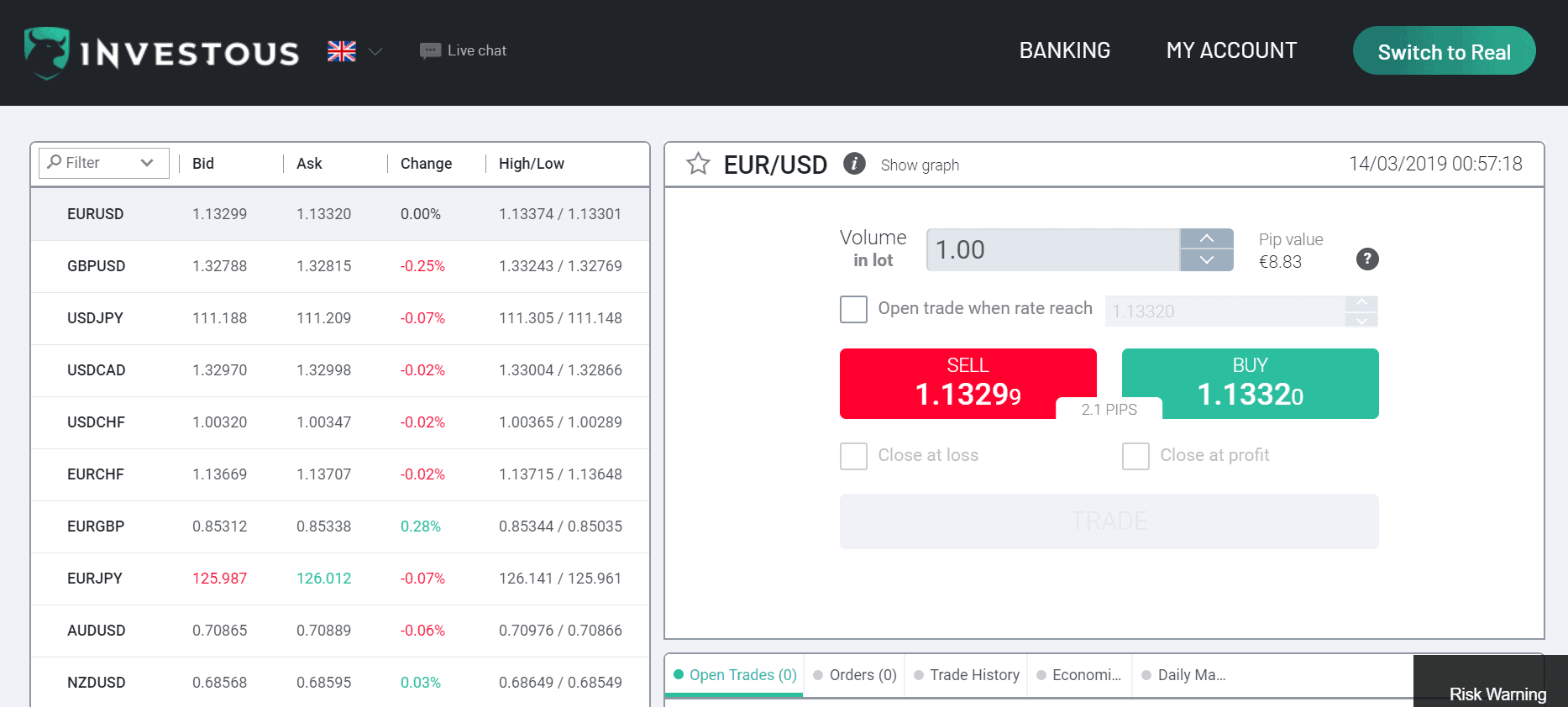

Once you have deposited funds into your account, you will be redirected to the trading platform. If you have traded on online CFD platforms before then it should be very easy for you to find your way around it. If you have it do not worry about it because it is very simple. On the left side of the screen you will see the asset list. If you are searching for an asset in particular you use a filter, where you can select the type of asset you are looking for. Once you have found it, you can select on it and on the right side you will find all the information you need on that asset, including buying and selling value, lot value, spread, margin, leverage and so on. At the bottom of the trading platform you will have access to your trading history, economic calendar and your open trades.

Account types

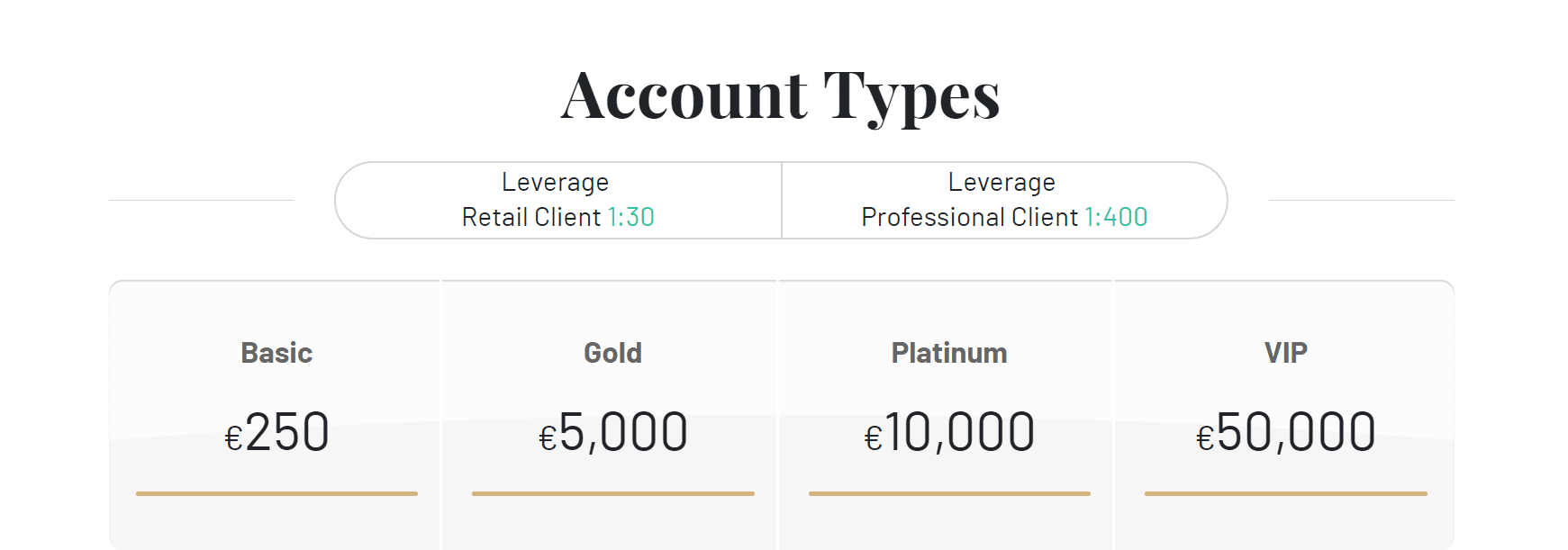

Investous offers four different account types: Basic, Gold, Platinum and VIP. For every upgrade of your account you will receive some great advantages although you are requested a higher minimum deposit amount for each account upgrade. For the basic you are required to deposit at least 250 EUR, 5,000 EUR for Gold, 10,000 EUR for Platinum and 50,000 EUR for VIP. Basic and Gold account holders are offered a leverage of up to 1:30 whilst Platinum and VIP account holders have a leverage of up to 1:400.

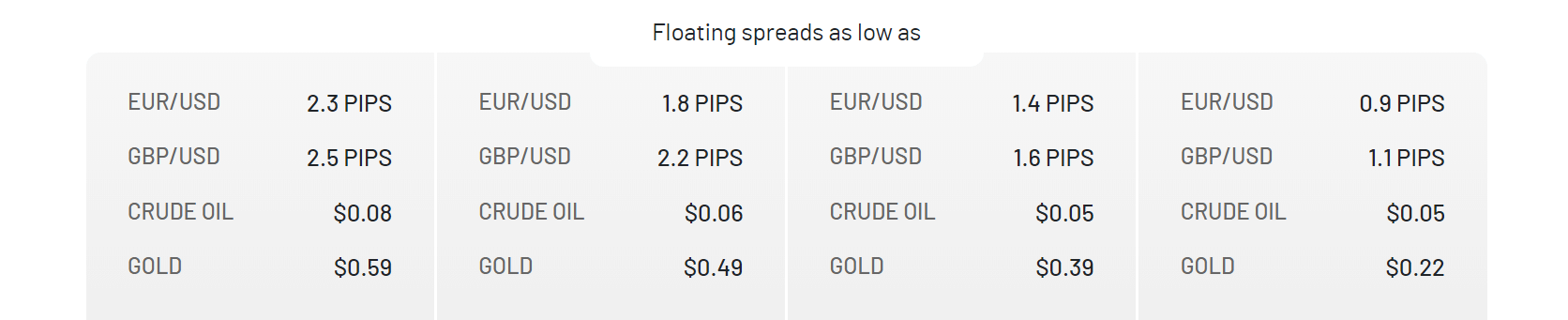

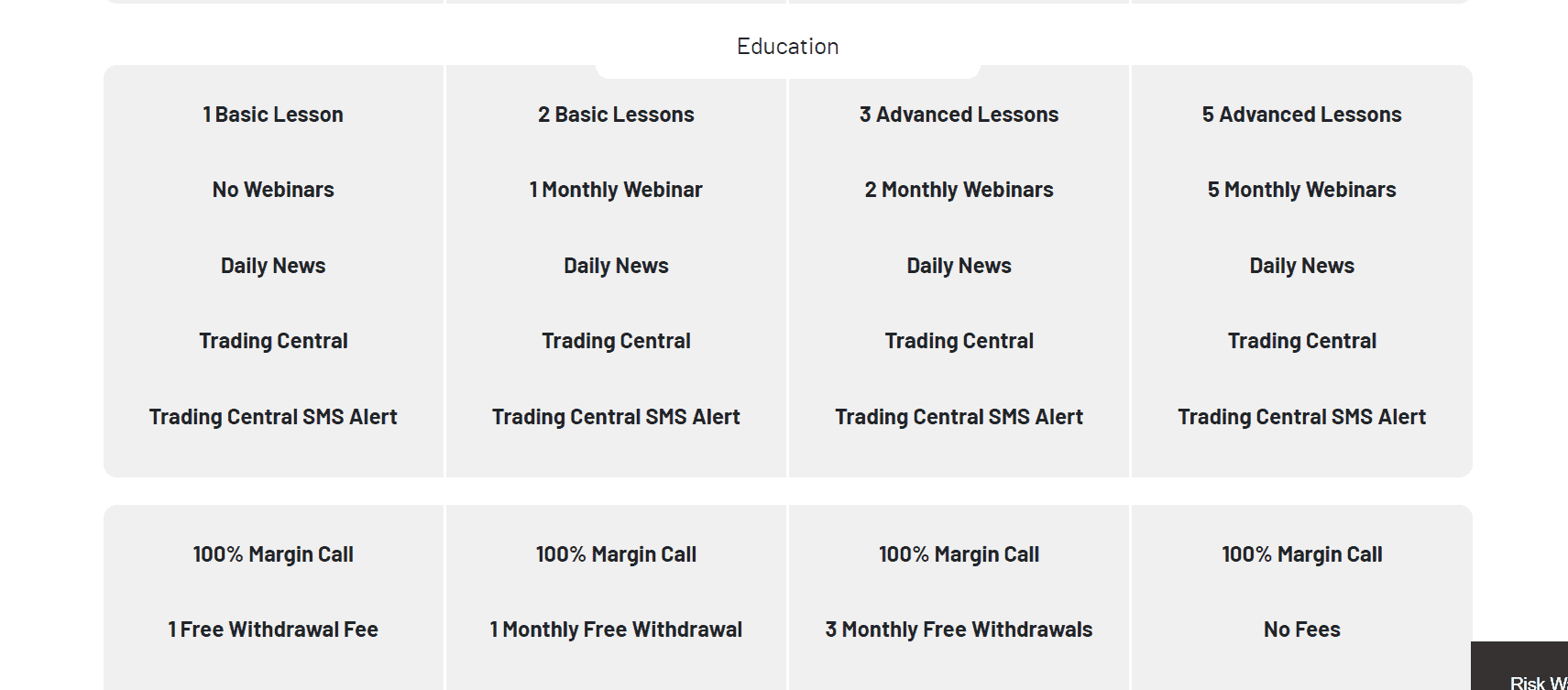

The higher your upgrade the lower your spreads will be. For the basic account, the spread on EUR/USD goes as low as 2.3 pips whilst with a VIP it can go down to 0.9 pips. The same goes for other assets: gold goes from $0.59 to $0.22. As well as this, account holders are entitled to a variety of educational advantages. If you have a basic account you can get one basic lesson, daily news, trading central and trading central SMS alert. While all account types are offered daily news, trading central and SMS alerts, the gold account offers two basic lessons instead of one and a monthly webinar. The Platinum account offers three advanced lessons and two monthly webinars while the VIP has five advanced classes and five monthly webinars. As for withdrawals, basic account holders can get only one free withdrawal, while gold accounts offer one free withdrawal a month, platinum three and VIP has no withdrawal fees at all.

Desktop platform

Investous uses a trading platform called MetaTrader4 to support its trades. It is one of the most popular platforms available and over 80% of the existing brokers use it. It is such a well-reputed platform thanks to its ease of use and suitability for beginners. At the same time however, all professional users can benefit from it because it has all the functions necessary for them to pursue their investment strategies, including trading history, asset list and trading charts. MT4 can be downloaded on your desktop in just a few minutes and it will be ready for use. Another platform that can be accessed through Investous is WebTrader, a popular and well-reputed web-based platform with similar functions to MT4.

Mobile platform

Both WebTrader and MT4 can be accessed from a mobile device as well. As already mentioned, WebTrader is online-based, meaning that as long as you have an Internet connection, you will be able to access it from any device, including smart phones and tablets. As for MT4, you can download the mobile app on App Store or Google Play. The app will give you access to the same trading functions available on the desktop version of the trading platform.

Commissions, spreads and fees

One of the biggest advantages of Investous is you are not required to pay commissions. There are however, other fees to be aware of.

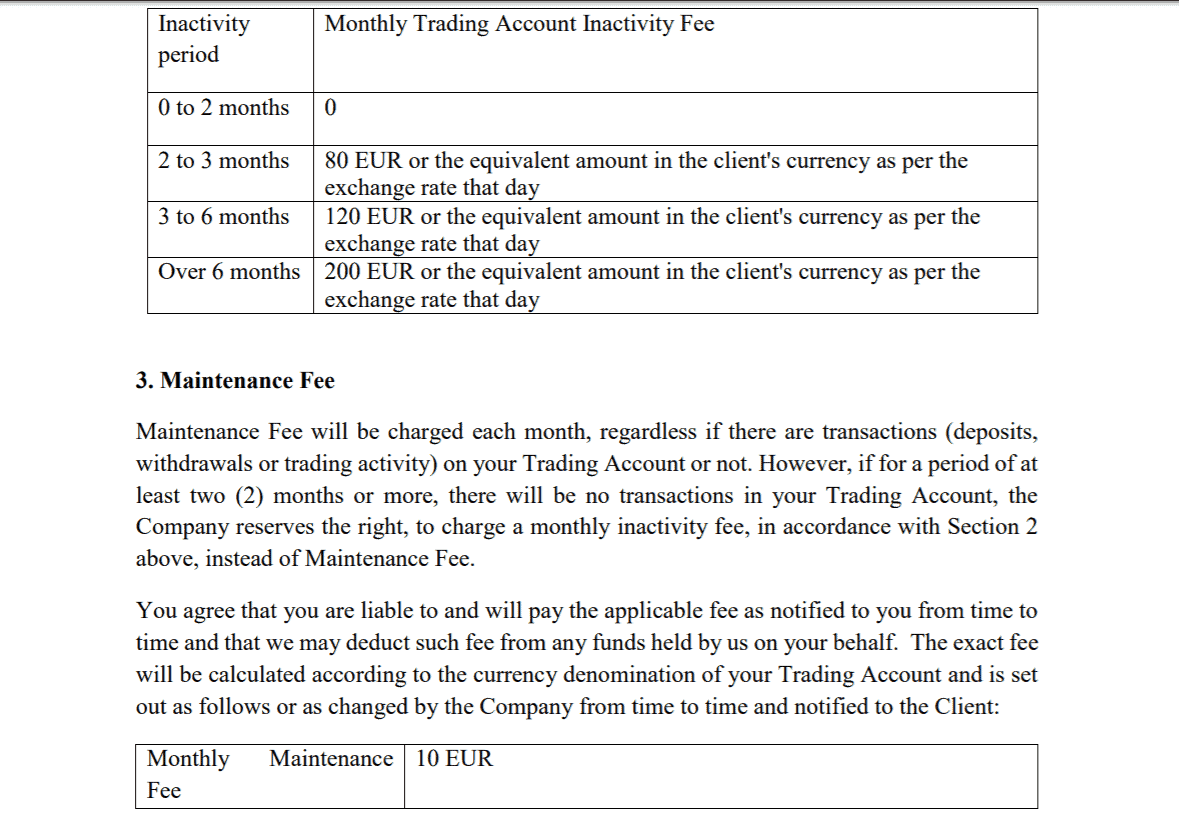

Although Investous does not charge registration, deposit or financing fees, maintenance, inactivity and withdrawal fees apply. The maintenance fee is 10 EUR, whilst the inactivity fee depends on the length of the inactivity period. If you have not used your account for a period of 0 to 2 months, there will be no fee. If the inactivity period lasts between 2 and 3 months you will be charged 80 EUR, 120 EUR if you have not used your account for 3 to 6 months and 200 EUR for inactivity periods of over 6 months. As for the withdrawal fees, you will be charged the equivalent of 24 EUR if withdrawing via wire transfer. The fee for Neteller, OKpay, Qiwi, credit, debit or prepaid card withdrawals is of 3.5%. If you are withdrawing via Skrill or Perfect Money, the fee is 2% and it is 0.9% if you are withdrawing via Webmoney.

It is also important to know about the spreads on Investous. The spreads vary depending on the asset you are interested in and on the account type you have. To give you a general idea, the spread on EUR/USD is of 2.3 pips, 2.5 pips on GBP/USD, $0.08 on crude oil and $0.59 on gold.

Leverage

Leverage on Investous goes up to 1:30. The term “leverage” refers to the debt you can use to buy an asset. If Investous has a leverage of 1:30, it basically means that if an asset costs 100 EUR, then you need to have at least 0.30 EUR available in your trading account to be able to purchase that asset. Having a low leverage like in this case exposes you to reduced risks because it does not allow you to take on excessive debts to be able to buy an asset. A higher leverage, of up to 1:400 is only allowed to professional users.

Lot sizes

The maximum trade size in lots is 10 for stocks and 3 for indices. One lot is 100,000 units for EUR/USD currency pair. All currency pairs have a lot value of 100,000 units. Other assets have different lot values. Gold has a lot value of 100 oz while Amazon has 100 shares and so do stocks like Coca Cola and Disney.

Account currency

You can choose your account to be in a currency of your choice between EUR, GBP, USD and RUB.

Education

The Investous website provides a comprehensive education section designed to help you through your trading experience should you have any doubts or concerns while trading. The section includes a glossary providing detailed definitions of several key words you may encounter in the world of crypto trading. There are also a number of informative videos for beginners, intermediate and advanced users on the forex market, market analysis, trading psychology, capital management and so on. Information on leverage and margins is also provided. On top of this, depending on your account type, you will have access to between one and five online classes and between one and five webinars per month.

Research, analysis and tools

On top of the education section, the broker provides detailed information on technical and fundamental analysis, two techniques that can be used to enhance and improve your investment strategies. There are also some practical examples of how to apply technical analysis methods to CFDs, including the Fibonacci Retracements, Moving Averages and Relative Strength Index. You can further delve into this topic by looking through the informative videos contained in the education section. Additionally, you will be able to find some great to increase your chances of making profits.

Customer service

Customer Support is one of the first things we look at when we test trading platforms. There is nothing more frustrating than trying to get in touch with an unresponsive support team, especially when you have pressing issues you have to deal with. However, knowing that the broker is CySEC-regulated, we assumed that customer support services would not constitute a problem of this broker and we were right. You can contact a member of staff at any time via email, live chat or by filling in a short support form.

The form requires you to provide your full name, email address and the content of the message. Before you send your query you will also have to select a topic between Customer Service, Affiliation, Regulation or Introducing Broker. Alternatively, you can contact a member of staff by mobile phone. They usually respond within a few hours. If you try to call the office and do not receive a response, make sure you drop them a message, they will certainly give you an answer as soon as possible.

Pros

- Suitable for both beginners and advanced users.

- Uses MT4 and WebTrader to support trades.

- Comprehensive education section.

- Contained leverage.

- Efficient customer service.

Cons

- High withdrawal fees.

- Fairly high spreads.

- There are inactivity and maintenance fees to watch out for.

Best Cryptocurrency Exchange in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Investous vs Other Brokers

Etoro-BTC-6

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Huobi

Visit SiteAs prices of digital assets are highly volatile, users could lose all or a substantial portion of the value of any digital asset they purchase....

How We Review Brokers

In case you were wondering, our reviews of brokers are the result of our tests of the platforms. There are quite a few things we look at to establish whether a broker is reliable or not:

- Regulatory status.

- Presence of risk disclaimers, education and legal sections to evaluate transparency.

- Information on fees, account types and spreads.

- Create an account and try the demo account to see if it is as helpful and explicative as it is supposed to.

- Switch to a real account and deposit the minimum funds necessary to start trading.

- Assess based on trading experience, availability of support, profit potential and more.

Conclusion

Investous is certainly among the best online brokers we have reviewed. Even though you may be able to save a few extra euros on other platforms, very few brokers are as reliable and trustworthy as this one. It is a very sophisticated and complex software but also easy to use, versatile and comprehensive of all the information you need to make the most out of your trading experience.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

What percentage of Investous users make money?

You will make profits between 11 and 26% of the time. The crypto market is known for its high volatility and it is no secret that making actual profits on it is a challenge. While it is possible to increase your chances of winning by depositing higher amounts of money, that does not give you any guarantees and losing capital is still very much possible.

How much money should I deposit when I begin?

The minimum amount you are required to deposit in order to start trading is 250 EUR/GBP/USD. Even though there are a few platforms that require a slightly lower initial amount, what Investous asks is quite reasonable. We suggest to deposit 250 EUR at first. As we have mentioned already, crypto trading is always risky and starting off with 250 EUR will give you the chance to see whether you are actually making money on it. If you see that you are making profits, feel free to increase your deposit amounts to try and make more money.

Can I access the same account through the apps on my phone?

Yes, there is no need to create a different account on your phone if you already have one on your laptop. Investous has a mobile app that you can log into by providing your account details. That will give you access to all the features and functions you have access to when trading on your computer.

Is there a demo account?

Yes. Before creating a real account and depositing real funds, you will have the option to try a demo account. You can actually switch to demo at any time, even after you have deposited funds into your real account. When trading in demo mode, you will be given a demo balance of 100,000 EUR that you can use to test the trading platform by placing trades and trying different investment strategies as well as seeing how the platform operates in the more general sense.

How do I open an account on Investous?

Opening an account is fairly simple. The first thing you need to do is go on the official website and look for the sign up button. Once you have done that, you will be required to provide your full name, email address and phone number. If you are trying to create a demo account then that is all you need, but if you are trying to create a real one you will have to go through a questionnaire on your financial situation and general knowledge of crypto trading. The whole process should take up to 15 minutes.

Is Investous a regulated broker?

Yes, absolutely. Investous is regulated by the Cyprus Securities and Exchange Commission. It is one of the most trusted and well-reputed regulatory agencies together with the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

Are there any fees on Investous that I should know of?

to pay inactivity, maintenance and withdrawal fees. Withdrawal fees for bank transfers are 35EUR and they vary depending on the other types of payment methods you use. With payment cards there is a fee of 3.5% whereas if you pay with e-wallets it goes from 0.9 to 3.5% depending on what e-wallet you use. Inactivity fees go from 80 EUR, which you have to pay if your account has been inactive over 2 months, to 200 EUR, if your inactivity period is over 6 months. There are also maintenance fees of 10 EUR. No registration, deposit or financing fees apply.

Bitcoin

Bitcoin