Trading stocks may be one of the most exciting ways to earn a steady income and grow wealth, but it’s a lot of work. From finding the right broker to identifying the best trading opportunities and understanding the best strategies to use, getting underway in the volatile trading world can be an uphill task, especially for first-time investors.

That’s where stock tips services come in, offering real-time market insights, expert recommendations, accurate trade signals/tips, in-depth analyses, and much more to help streamline the investment process and boost your chances of making significant profits.

This comprehensive guide compiles, lists, and extensively reviews some top stock tips services to help you achieve your investment goals in 2024.

Best Stock Tips Services To Use In 2024 – Quick List

Here’s a quick list of our top picks for the best stock tips services to use in 2024:

- Benzinga Pro – Overall Best Stock Tips Service Suitable For Beginners & Experienced Investors Alike

- eToro – Reputable Trading Platform Offering Commission-Free Trading & In-Depth Stock Tips

- AltIndex – Al-Powered Tips Delivered To Users’ Email

- AvaTrade – Actionable Stock Trading Tips

- Danelfin – Comprehensive AI-backed Market Analyses

- Morningstar – A Broad Range of Investing Tips & Ideas

- Seeking Alpha – Expert-Recommended Trading Tips

- Mindful Trader – Real-Time Buy/Sell Tips

8 Best Stock Tips Services In 2024 – Fully Reviewed

In this section, we thoroughly assess each stock tips service mentioned in the quick list.

Benzinga Pro – Overall Best Stock Tips Service Suitable For Beginners & Experienced Investors Alike

With its advanced yet simple-to-use features, Benzinga Pro is the perfect pick for beginners who are passionate about making the right trading decision from the start and professional traders looking to take their investment experience to the next level. The platform delivers explicit and prompt stock tips backed by fundamental and technical analysis to help traders make accurate trades during the best market moments and leave positions when necessary.

The first attractive feature of Benzinga Pro is Alerts, which delivers real-time, data-driven tips on stocks and the entire financial market. This particular aspect of Benzinga Pro gives users an edge over their counterparts, allowing them to identify potential trading opportunities before they become public knowledge. For a more personalized experience, users can customize the alert feature to suit their investment goals.

From calendar to watchlist and specific stock events, Benzinga Pro ensures that users get the exact tips that will be beneficial to their trading. Users will also be able to choose how they want to receive the tips, with options ranging from background sound to screen notification, and email.

With users’ convenience in mind, Benzinga Pro has a sleek and simple-to-use interface, making it relatively easy for beginners to navigate its features. There is also a stock screener that filters stocks based on meaningful metrics and a sentimental analysis tool that assesses the likely impact of a news story on a specific stock.

Also, setting itself apart from competitors, Benzinga Pro has designed a pricing structure that caters to all categories of users, including casual traders. There is a Basic subscription package that offers exclusive stock tips and in-depth market insights at $37 monthly.

The second package – Essential – costs $197 per month and includes more robust tools like insider trade tips, an enhanced options trading newsletter, and sentiment analysis. The last package, Streamlined, covers every basic feature alongside audio squawk, high beta squawk, and an advanced newsfeed. That being said, there is a 14-day free trial for new users.

eToro – Reputable Trading Platform Offering Commission-Free Trading In-Depth Stock Tips

eToro has been active in the global financial market for over a decade. It provides a secure interface for traders looking to trade stocks, commodities, and even cryptocurrencies in one spot. However, beyond providing a powerful architecture for trading stocks, eToro also enriches users’ overall experience with its TipRanks-backed tips and signals.

The platform is enveloped with multiple analysis tools that offer trading tips based on important metrics such as expert ratings, price targets, market news, and financial forecasts to help investors make informed decisions.

For beginners seeking to improve their understanding of the market, eToro has an “Academy” department enriched with comprehensive educational resources, ranging from articles, webinars, tutorials, and much more.

Another key attraction is the “smart portfolios” segment, featuring an innovative long-term investment portfolio curated by established analysts. This aspect of eToro ensures that investors can diversify their investments without conducting extensive research.

Those who prioritize detailed insights can also check out eToro’s “Earnings reports calendar,” which contains a list of earnings reports released by publicly listed companies. This calendar provides detailed insights into those companies’ financial performance and growth potential before investing in them.

Adding to its appeal is its CopyTrader feature, a one-click tool that allows newbies to emulate the trading strategies of successful traders for free. This industry-standard tool also caters to professional traders with other vital commitments besides trading stocks.

There is also an investment tracker, which tracks the market performance of stocks in real-time so that investors can act almost immediately and make profits in today’s volatile market.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

AltIndex – Al-Powered Tips Delivered To Users’ Email

Known for its game-changing AI infrastructure, AltIndex is revolutionizing how investors can access timely and accurate tips for stocks and cryptocurrencies.

What seems to be the most attractive aspect of the platform is its free plan, providing casual investors with firsthand market insights without any cost. These real-time tips are sent directly to users’ email, guaranteeing easy access.

To provide users with stock recommendations and tips that reflect marker realities, AltIndex usually aggregates thousands of data points, including social media. It leverages machine learning to extract and analyze social data based on several metrics, especially mentions, trends, ratings, and comments across social media platforms like Reddit, Facebook, and Twitter.

Guided by the data gathered from these sources, the platform will rate an asset from 1 to 100. For instance, a stock that appears many times in Reddit community discussions will rank high among trending stocks, with a sentimental label showing if the mentions are bullish, bearish, or even neutral. With this innovative approach, AltIndex lets users know why a stock is trending, giving them a clue about the next investment decision to take.

Another standout aspect of AltIndex is its stock screener service, arming users with high-quality information on stocks that meet their criteria. With thousands of securities available on the market, AltIndex’s screener filters stocks using predetermined metrics, allowing users to identify the best picks and strengthen their portfolios.

While a free package offers two stock alerts, 1 AI stock pick, a newsletter, and email support, AltIndex has a paid version segmented into three tiers: Starter, Pro, and Enterprise.

AvaTrade – Actionable Stock Trading Tips

With multiple awards to its name, including the best stock CFD broker in Europe, AvaTrade has carved a strong niche for itself as one of the leading trading apps around. It offers access to various financial instruments, including stocks, commodities, indices, bonds, etc.

However, AvaTrade is more than just a trading app. It offers various fundamental and technical analysis tools to help investors make better trading decisions. While the fundamental analysis tools cover essential educational resources to equip investors with the basics of assets, the technical tools dwell primarily on their market performances, taking into account traditional indicators like the Relative Strength Index, Moving Averages, Bollinger Bands, and many more.

Moreover, AvaTrade’s fundamental resources evaluate industry trends, the company’s financial status, market news, and other valuable indicators to enlighten investors on possible events that could trigger an uptrend or otherwise for an asset.

The technical segment explains carefully why an asset is currently experiencing an upward or downward movement. Based on this information, the platform will teach investors how to optimize their profits and minimize risks.

An additional highlight is its support for MetaTrader 4 and 5, which also deliver more detailed analyses and reports that can put users ahead of the curve. The platform is also home to a host of articles written by leading experts.

Above all, by integrating tips service into its trading platform, AvaTrade streamlines its users’ overall experience, allowing them to execute recommended trades almost immediately without leaving the app.

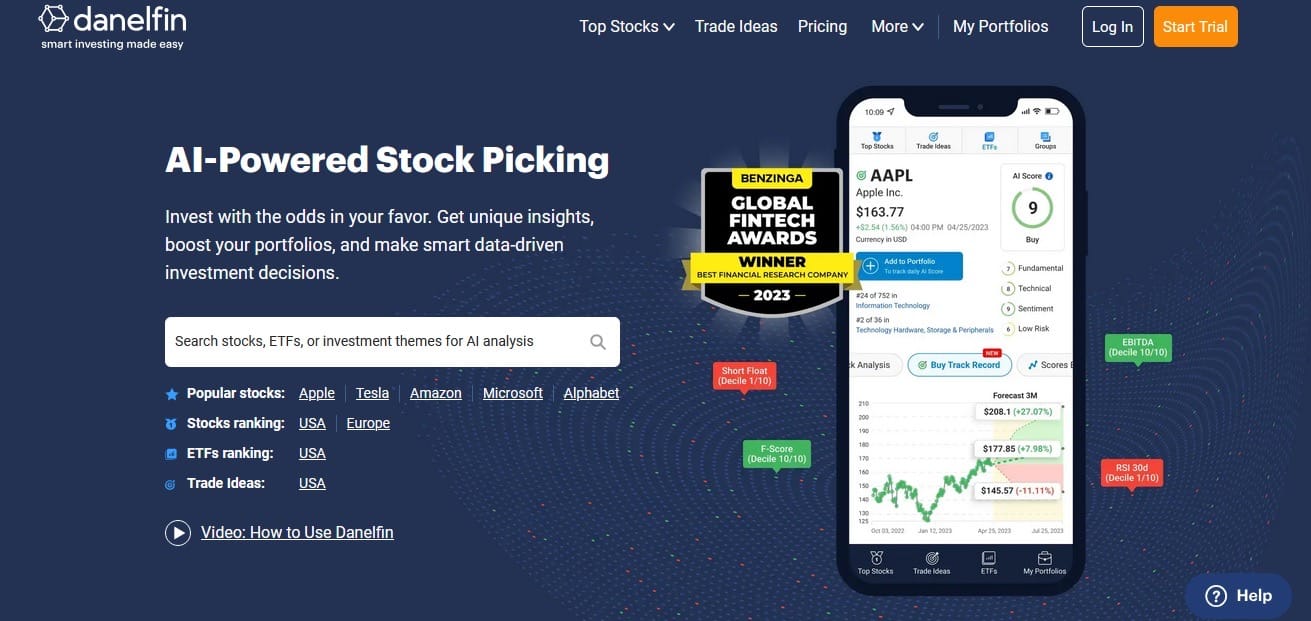

Danelfin – Comprehensive AI-Backed Market Analyses

Danelfin is yet another reliable stock tips service that leverages artificial intelligence to extract and analyze data and trends for the purpose of scouting the best market entry opportunity. The platform has an AI-powered predictive functionality that assesses all US stocks, European equities, and US-listed ETFs.

It uses more than 600 technical indicators, 150 sentiment indicators, and 150 daily fundamental indicators to come up with a price performance probability for a stock. After analyzing various data sources, the platform assigns an AI score to each stock.

Assets rated above 60 indicate a buying signal, while the ones rated below indicate a negative market sentiment, perhaps due to several factors like the company’s current financial performance, social media trends, and many more.

With this strategic approach, Danelfin helps investors stay updated about various factors that could influence the price of a stock in the next three months so that they can act as early as possible.

The Trade Ideas section is another attractive aspect of Danelfin, showcasing assets with high win rates across various industries and investment horizons. When it comes to U.S. stocks, Danelfin compares its signals with the S&P 500 TR index, which features the 500 leading US-traded companies. For Europe stocks, the platform aligns its predictions and analyses with the STOXX Euro 600.

Danielfin has a free package with limited analysis and equities for casual investors. Those who prefer more reports and monthly signals can subscribe to either its plus or pro plans.

Morningstar – A Broad Range of Investing Tips & Ideas

Founded as far back as 1985, Morningstar is one of the most reliable tips services around. It provides real-time signals, tips, and insights on multiple asset classes, including stocks and ETFs, helping investors to maximize their gains and minimize losses.

Integral to the platform is ESG Screener, a top-tier tool which supports investors in identifying assets and investment opportunities that meet regulatory standards and other predefined criteria. Morningstar has 150 in-house analysts who use various data and tools to evaluate more than 600,000 assets.

Morningstar rates stocks using the popular 5-star rating system most investors are familiar with, making it an ideal pick for those still finding their feet in the broad market. The ratings are primarily determined by the past performance of assets, serving as a guide to assess their growth potential.

Adding a feather to Morningstar’s cap is its X-ray feature which assesses investors’ portfolios from every angle, making it possible for them to constantly adjust their exposure and reduce investment risks. The platform also has a stock screener which filters assets based on investors’ trading goals and risk tolerance level.

Like most stock tips service providers, exclusive features on the platform are only available to premium members, with the subscription costing $29.95 monthly. Premium membership on Morningstar also guarantees unlimited access to the platform’s portfolio manager, ensuring that investors can keep up with the performance of their portfolio.

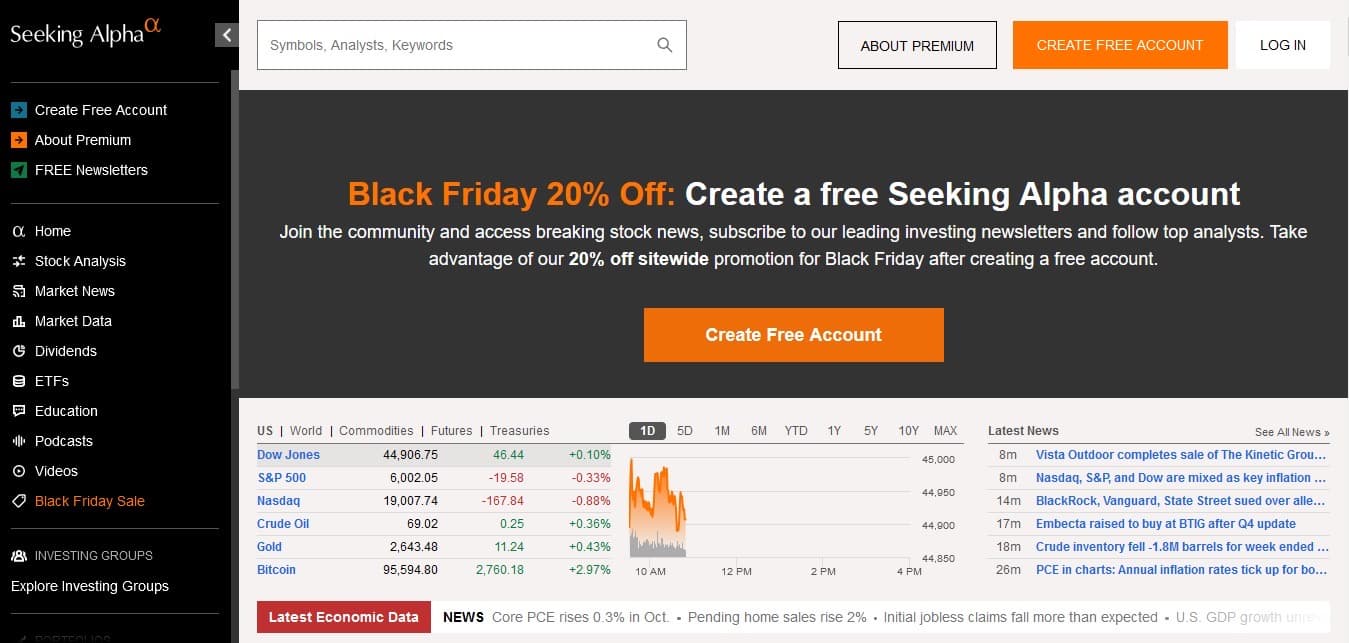

Seeking Alpha – Expert-Recommended Trading Tips

Seeking Alpha is another recommendable stock tips service provider for those seeking constant profits in today’s volatile market. Founded in 2004 by former Wall Street analyst David Jackson, Seeking Alpha provides premium financial commentaries and market analyses on nearly every stock that investors may be interested in.

The platform is home to hundreds of analysts who produce thousands of articles per month. Each article features broad insights into individual investment possibilities available to traders. Premium members will be able to see the long-term track record of each analyst producing investment ideas and their favorite stocks.

This approach makes it easy for them to discover and follow the strategies of proven performers whose trading goals align with theirs.

Complementing its appeal is its AI technology, which offers Quant ratings based on several metrics. In addition to this, Seeking Alpha provides Factor Scorecards, primarily designed to measure stock fundamentals and give ratings from “A+” to “F.”

Another major selling point for Seeking Alpha is its unique stock screener, accompanied by a proprietary rating system and expert analysis that are valuable to users’ trading journey. Also, thanks to its “Listen to Article” feature, users can stay updated with market trends and their portfolio holdings without losing focus on other daily activities.

Like most tips service providers, Seeking Alpha also offers a free account. However, those seeking unlimited access to cutting-edge content, rating systems, and stock screening tools will need to subscribe to the platform’s paid versions.

Mindful Trader – Real-Time Buy/Sell Tips

Mindful Trader is a well-known stock tipping service that uses a radical approach to guide investors on how to enter trades and maintain a healthy portfolio. Founded by Eric Ferguson, a renowned statistical analyst, Mindful Trader is built on decades of back-tested data to help traders find assets with a higher chance of success.

For those who want to avoid the noise of the market and take a more methodical approach to trading stocks, Mindful Trader’s is the right place to go. Eric usually sends out detailed stock picks every day, aimed at swing traders who want to capitalize on short and middle-term price movements.

When followed diligently, his backtested system could position investors for solid gains. Moreover, Eric, through the platform, also teaches risk management techniques, helping users to minimize their losses during bearish market conditions.

Another notable part of Mindful Trader’s services is its educational video content, detailing Eric’s strategies, general stock trading tips, market indicators, and more. This resource provides clients with basic information about specific assets and whether they are worth buying or not.

Users will also get first-hand trade alerts on their emails, containing stock pick updates, current positions, and possible changes. When it comes to pricing, Mindful Trader charges $47 per month.

What Is A Stock Tips Service?

In a trading world as volatile and complex as the stock market, the role of tips service providers can not be overestimated. These platforms have gained prominence as investors seek ways to navigate the ups and downs in the stock trading landscape.

Primarily, stock tip providers offer the expert-level guidance that users need to uncover high-potential stocks and build a profitable portfolio without spending countless hours researching.

Before furnishing users with relevant trading tips and recommendations on whether a stock is worth investing in, these platforms must have conducted extensive research, focusing on critical metrics like current market trends, investors’ sentiment, financial statements, sector evaluation, and technical indicators.

Most of them even go further to aggregate alternative data sources, especially social media engagement and online behavior, to predict market movement and deliver enhanced trading recommendations for users. Tips offered by these platforms, which mainly entail buy/sell signals, are usually accompanied by the rationale behind such trading suggestions.

These tips are delivered in a way that guarantees maximum accessibility. They are conveyed through various channels like newsletters, reports, alerts (email or SMS), and more. That being said, as the stock market continues to evolve, tips services have become indispensable, especially among those aiming to start their investment journey with full confidence.

How Do Stocks Tips Services Work?

Stock tipping services are research-oriented. In fact, research is the first and most important function of these platforms. With consistent research and analysis, they are able to stay on top of market trends and base their signals, analysis, and tips on facts rather than intuition.

Meanwhile, stock analysis is not a one-way thing. It involves evaluating various metrics and variables that could impact both the short and long-term performance of an asset so that traders can make informed trading decisions. To effectively analyze the growth potential of a stock, most stock tipping services consider the following metrics:

- Technical Analysis

This aspect of stock analysis dwells on market performance, identifying if the stock is in an uptrend or downtrend and establishing crucial entry and exit points to develop short-term trading tips for investors.

- Fundamental Analysis

Fundamental analysis focuses mainly on the fundamentals of an asset, like the financial status of the company it belongs to, earnings, assets, and liabilities to determine whether the asset is undervalued or overvalued.

- Sector Evaluation

The goal here is to identify the sectors that have gained significant traction and poised for rapid growth. The blockchain sector, for instance, is projected to reach the $1 trillion mark by 2032. AI is another fast-rising sector that has been generating buzz. With this in mind, sector analysis helps investors discover potential opportunities across industries before they go mainstream.

The final outcome of a robust research effort that captures all the aforementioned metrics will determine the kind of trading tips, recommendations, and suggestions given to subscribers. In most cases, these data-driven insights are delivered through alerts, reports, newsletters, and several other channels.

How We Select The Best Stock Tips Services

Here are some of the factors we considered before selecting the best stock tipping services:

Expertise & Track Record

For a tipping service to provide quality trading guidance, it must be operated by a team of experts who understand the nitty-gritty of the stock market. We checked the level of expertise demonstrated by these platforms, taking into account their historical success rate, risk management techniques, tips presentation/delivery methods, and many more.

Another important thing we checked is the reputation of each of the platforms, analyzing what the community feel about their service delivery. To gain more insights, we looked for on-site reviews and testimonials on top platforms like Trustpilot.

User Experience

How easy it is to navigate to navigate a platform is one crucial aspect we analyzed while compiling this list. An intuitive and easy-to-use interface ensures seamless experiences for users. Therefore, we explored each of the features embedded in each platform to evaluate their usability, ease of navigation, and performance.

Affordability

We also compare the quality of the tipping services offered by these platforms vis a vis the amount charged. To a reasonable extent, most of the platforms featured in this guide, especially Benzinga Pro and AltIndex, offer stocks trading tips that are more valuable than the amount charged.

This crucial advantage ensures that traders can make profits while spending less on subscription fees for tips.

Services Provided By Stock Tips Platforms

Here are some of the major services delivered by stock tips platforms:

- In-depth market insights

- Timely trading recommendations

- Expert-level buy/sell signals

- Detailed charting tools

- Fundamental resources, covering market-moving news, market trends, company’s balance sheet, and more

- Mentorship programs

- Real-time technical analysis

Our Verdict

Choosing the right stock tips service provider can be all that investors need to outperform the market and grow their wealth. In this guide, we fully reviewed some of the leading platforms that have been consistent in delivering quality stock tips for both short and long-term traders alike. We also highlighted the metrics used to rank these platforms.

Having tested the services of each of the platforms featured in this guide, we handpicked Benzinga Pro as the best among them, thanks to its valuable trading tips, advanced yet simple-to-use features, and affordable pricing structure.

FAQs

What are stock tips?

Stock tips are real-time trading suggestions, gotten through thorough research and analysis, to help investors make informed decisions.

Which is the best stock tips service to use?

Among a host of options available, Benzinga Pro stands out as the best stock tips provider to use, thanks to its excellent tools, timely and accurate trading ideas, simple UI, and inclusive pricing structure.