Pfizer Inc. is an American multinational pharmaceutical and biotechnology company headquartered on 42nd Street in Manhattan, New York City. It has a market capitalization of $213.662 billion. In 1849, two German immigrants, Charles Pfizer and his relative Charles F. Erhart founded the corporation in New York. The company was ranked in the 64th position on the Fortune 500 list of the biggest US corporations by total revenue in 2020. Thus, the shares of this pharmaceutical giant are very appealing to many investors.

Investors who want to buy Pfizer stocks online or intend to add them to their portfolio can find this guide very helpful as it covers everything. The article consists of every detail that one should need to buy Pfizer stocks online in the UK. Moreover, this article infers top brokers and a step-by-step guideline through the process.

On this Page:

Step 1: Find the Best Brokers to Buy Pfizer Stocks in 2024

The fact is that Pfizer is one of the top listed global corporations in terms of revenue generation. Whereas, the market capitalization shows that many UK brokers will allow the service of buying their shares.

Throughout the globe, Pfizer Inc. is listed on four stock exchanges, including the New York Stock Exchange (NYSE), Paris Euronext, the London Stock Exchange (LSE), and the SIX Swiss Exchange. The company’s primary listing is on the New York Stock Exchange. However, traders need an online trading platform to access the New York Stock Exchange (NYSE).

To buy Pfizer stocks online, one must find a broker regulated within the country, offering a minimum trading fee. For the convenience of investors, we have two of the most trusted and well-regulated stockbrokers based in the UK that will allow them to buy Pfizer shares.

1. eToro – Buy Pfizer Stocks Online without Commission

One of the most trusted stockbrokers offering more than 800 shares of companies in the United Kingdom is eToro. This platform provides a traditional way of buying shares and offers CFDs that provide leveraged trading with low margin requirements.

eToro is an online brokerage company that a group of fintech entrepreneurs initially originated in 2007 in Israel. The platform provides a range of asset classes and lets eToro users buy traditional assets and trade contracts for difference (CFDs).

One of the things that distinguishes eToro from other brokers is that it is one of the few that provides cryptocurrency trading. eToro is a complete trading platform where traders can interact with each other and copy their trading activities.

Major Features of eToro

One of the most intriguing features of eToro is its industry-leading price structure, as it is one of the only platforms in the sector that offers commission-free stock purchases. Traditional brokers charge a fixed fee of around £3-£8 per trade, but on the eToro platform, investors do not have to pay any trading fees except for the buy-and-sell spread.

Apart from this spread, the only financing fee that eToro charges is the 0.5% currency conversion fee at the time of deposit and a $5 withdrawal fee.

Initial Deposit – The minimum deposit starts for a UK investor at around £160.

Various Payment Methods – Traders can use various methods of payment through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, VISA, or Neteller. Another exciting service offered by eToro is that investors can also buy and sell a fraction of stocks. For all newbies, it means traders can buy a fraction of stocks and have no need to buy a single share of a company with their share trading account eToro.

Regulation – eToro is regulated in the United Kingdom (UK) and worldwide, holding licenses from the ASIC, FCA, and CySEC. In addition to this, eToro is a member of the Financial Services Compensation Scheme (FSCS) that protects the first £85,000 of investors’ funds in case of the broker’s bankruptcy.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros & Cons of the eToro platform:

- eToro offers copy & social trading

- ASIC, FCA, and CySEC regulated

- Offers to buy CFDs along with the shares.

- Commissionless shares trading.

- User-friendly GUI (graphical user interface) stockbroker.

- Renowned mobile trading app.

- eToro accepts Skrill, VISA, Neteller, and PayPal.

- Performing advanced technical analysis can be challenging for pro-traders.

67% of retail CFD accounts lose money when trading with this provider.

2. Plus500 – Buy Pfizer Stocks Online with Low Fees CFD Platform

Another well-known CFD brokerage firm working in the UK is Plus500, which offers to buy Pfizer stocks online along with thousands of other stocks. This broker also offers leveraged trading like eToro with a ratio of 5:1. Thus, traders can take a large position in the market and buy shares of a company with relatively little money in their accounts.

Plus500 is considered one of the most cost-effective stockbrokers in the United Kingdom as it provides 100% commission-free services. The spread fee on this platform is also relatively low as compared to other platforms. Plus500 offers shares of the best companies listed in the US, the UK, and Germany.

The broker provides clients with one of the most popular and user-friendly stock-trading platforms with various unique features. These features include price alerts, risk management tools, an economic calendar, and, most importantly, a built-in charting package. The risk management is provided with the feature of a stop-loss order that, if added to the trade, protects the investor from maximum loss and manages their risk.

Initial Deposit – Plus500 requires a minimum deposit of £100 to get an account open.

Payment Methods – Traders can use a debit card, credit card, PayPal, Skrill, or a UK bank account as a payment method.

Regulation – Like eToro, the FCA regulates the Plus500 broker. Therefore, one must not have any concerns related to the safety of his funds and regulations.

Pros & Cons of the Plus500 platform:

- A user-friendly platform for share trading.

- 100% Commissionless share trading

- A great mobile trading app.

- It offers a demo account feature.

- Highly competitive spread fees.

- Leverage of up to 5:1 for share trading.

- The Financial Conduct Authority (FCA) regulates it.

- Charts are limited, which isn’t appropriate for advanced stock traders.

72% of retail CFD accounts lose money when trading with this provider.

Step 2: Research about Pfizer Shares

Although Pfizer is among the world’s greatest corporations and is classified as a blue-chip stock, investors should still do research before investing in any company.

Conducting your analysis and researching Pfizer’s share performance, history, and forecasts about the company before investing in its shares is highly recommended.

Let us take a look at the history of Pfizer’s share price.

History of Pfizer Stock Prices:

In 1849, two cousins, Charles Pfizer and Charles F. Erhart, founded Pfizer in New York City. The capital was collected from the father of Pfizer, and the two men successfully produced a palatable anti-parasitic drug called Santonin. The company’s revenue doubled during the time of the American Civil War as the demand for disinfectants, painkillers, and preservatives increased.

The company skyrocketed during WW2 because it was the only company that was able to develop and market mass production of penicillin. A large number of wounded citizens and soldiers worldwide raised the demand for penicillin, and the company started generating heavy amounts of revenue.

Pfizer share price chart on eToro

During the following decades, Pfizer continued to expand its business. The company signed a partnership with a Japanese company, Taito, in 1955 to produce and distribute antibiotics. In the 1970s, Pfizer acquired several pharmaceutical companies, like Mack Illertissen. Recently, some of the most popular drugs made by Pfizer include Bextra, Celebrex, Advil, Diflucan, Robitussin, Viagra, and Lyrica.

Pfizer has had an annualized growth rate of 14.4%

The shares of Pfizer have had an annualized growth rate of 14.4% since they first went public in 1942. Pfizer joined the Dow Jones Index in 2014, and the price of its shares underperformed the index during this period. Over the past three decades, the share price of Pfizer has been trading like other major blue-chip companies. The excellent performance of its share price was attributed to the company’s strong dividend and the steady and moderate growth in the healthcare sector.

Lately, Pfizer has been in the news due to the COVID-19 vaccine that it has manufactured with the collaboration of BioNTech, which is a German-based biotechnology company. The vaccine created by Pfizer and BioNTech is 95% effective in an ongoing large-scale clinical trial. Compared to other coronavirus vaccines, the Pfizer & BioNTech vaccine has the highest efficacy rate, making it the most prevalent vaccine throughout the world.

Recently, the US FDA has fully approved the Pfizer & BioNTech vaccine. Thus, anyone aged 16 and above in the US can be injected with the vaccine. This approval was the first one to be granted to any coronavirus vaccine in the world.

The effective performance of vaccines created by Pfizer has triggered an upward momentum in its share prices lately. Therefore, it has lifted the YTD return of the company to 31.43% in August 2021 from a negative-0.59% YTD return during last year at the same time.

Pfizer (NYSE: PFE) Dividend Information

Pfizer (NYSE: PFE) is a popular dividend-paying stock among investors looking for a higher return on their funds. With a dividend yield of 4.02 percent, this corporation pays an annual dividend of $1.56 per share along with a dividend yield ratio of 3.22%.

Furthermore, Pfizer pays a quarterly dividend of $0.39, which is much higher compared to the companies listed on the S&P500. Thus, investors tend to hold their savings in Pfizer shares.

Should I Buy Pfizer Stocks Online?

Considering Pfizer’s position in terms of growth, there are plenty of reasons behind considering its shares for investment. Most importantly, Pfizer is one of the world’s largest drug companies, and it has recently successfully developed a coronavirus vaccine with the highest efficacy rate in the world.

Furthermore, most analysts are very optimistic about the future of Pfizer’s share price, which also makes it a better investment option.

Why do analysts believe that Pfizer shares could prove profitable? Let’s find out below…

Pfizer’s Stock is Reasonably Priced

According to analyst expectations, Pfizer’s stock is currently undervalued, especially when considering the growth potential, earnings ratio, and initiatives to produce the Covid-19 vaccination.

We can’t deny the efforts Pfizer has put into developing the coronavirus vaccine in collaboration with BioNTech. Thus, the company’s share price does not match the standards and position of the company in the market.

Currently, one share of Pfizer is trading at $47.51, and its price-earnings ratio is 20.39. At the same time, the average PE ratio for healthcare services stands at 21.47 as of August 25th, 2021. Therefore, Pfizer’s shares were trading at a discount recently.

The Pfizer annual free cash flow for 2020 was 12.15B. That demonstrates its profitable operations generated a large amount of cash. It can be used to expand the business and maintain its position as the world’s leading biopharmaceutical producer.

Pfizer Earnings and Growth Potential

The second-quarter earnings of Pfizer in 2021 totaled $19.0 billion, an increase of 92% or $9.1 billion compared to the previous year’s quarter. This reflected about 86% operational growth of $8.5 billion. During the first half of 2021, Pfizer paid about $4.4 billion in cash dividends of $0.78 per share, which represented a 3% increase in dividend per share compared to the same period last year.

The company changed its outlook for growth and earnings in its quarterly report and raised its full-year revenue expectations for 2021 to $78-$80 billion. Moreover, the company expanded its expectations for EPS to a range of $3.95 to $4.0. The company’s increased expected earnings and growth potential were due to its successful development of the coronavirus vaccine with the highest efficacy rate in the world.

Step 3: Opening an Account and Funds Deposit

Once all the research about Pfizer shares has been conducted, the next step is to open an account with a selected broker. The process of opening an account with a broker for buying and selling Pfizer shares is not that difficult. Well, we have already mentioned some well-known and trusted brokers above. For investors’ convenience, the process of opening an account with eToro has been shared below.

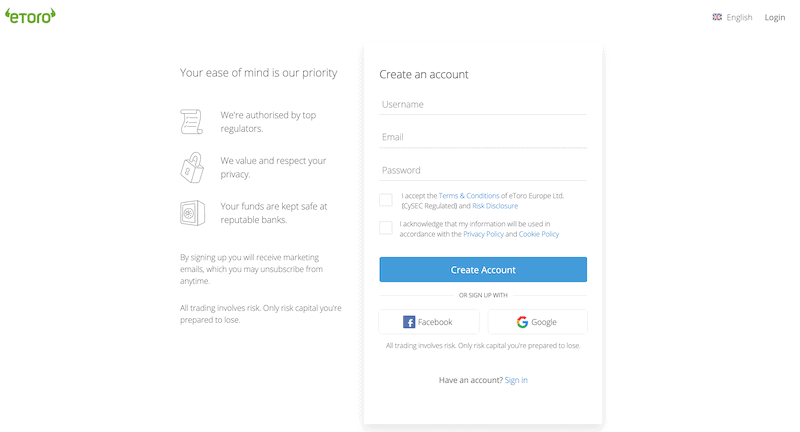

The first step is to open the website of eToro and then register for a trading account by clicking on the “Join Now” button at the center of the screen.

Opening an account to buy Pfizer stocks

A registration form will appear that will require some personal details, and then, upon submission, it will generate a password. Since the FCA authority regulates eToro, it will ask you to verify your identity. For verification, investors can upload a copy of their passport, driver’s license, bank account statement, or a utility bill to show the investor’s address.

After getting approval from eToro, investors can add funds to their accounts with a minimum amount of $200. The payment can be made via various debit cards, credit cards, PayPal, and bank wire transfer facilities.

Step 4: Buy Pfizer Stocks Online via the eToro Platform.

Once the account has been funded, investors can now begin the process of purchasing Pfizer shares. The method of buying stocks via eToro is straightforward to follow.

- The process starts with logging into the account by entering the username and password.

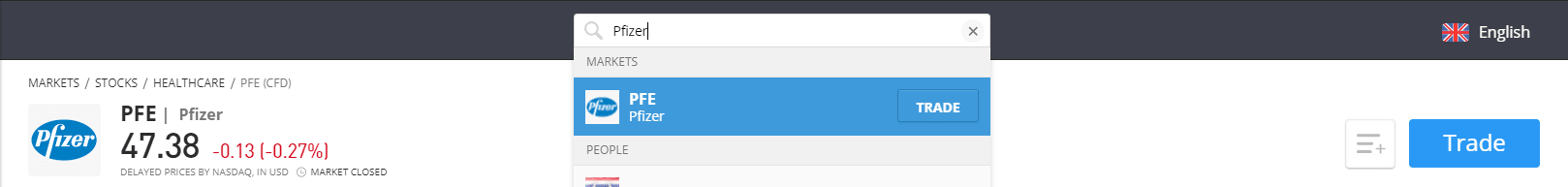

- Type Pfizer or PFE in the search box.

- The popped-up search results will bring forward a list, and investors will have to click on the desired stock.

Pfizer stock ticker

On the Pfizer stock page, a trader needs to click on the “Trade” button to open an order form. Furthermore, you will need to enter the desired amount of investment in the stock of Pfizer. Alongside, it’s crucial to enter a stop-loss order to minimize the loss.

Lastly, press the “Open Trade” button to send an order to the market. That’s all. Congratulations; the process of buying Pfizer shares has been completed.

Conclusion

The coronavirus pandemic has made it clear that healthcare companies have the potential to improve the treatment of dangerous diseases. Being a blue-chip biopharma company, Pfizer has enormous potential. Besides, the company hasn’t only successfully developed a coronavirus vaccine with the collaboration of BioNTech. Additionally, it also provided the highest efficacy rate in its vaccine around the globe.

Given this fact, pharmaceutical giant Pfizer could provide a considerable return in share price or dividend distribution. The accelerated expectations related to earnings and growth make Pfizer’s position stronger within the healthcare sector community. Besides, the high profitability ratio is also adding strength to Pfizer’s bullish forecast.

In the era of the coronavirus pandemic, it would be an ideal investment to buy shares of the Pfizer company. Considering the fact that it has successfully developed the top-ranked vaccine. Lastly, the boosted demand for the covid-19 vaccine gives an excellent reason to invest in Pfizer. For this reason, the odds of a surge in Pfizer’s stock prices remain high.

Click the link below to get started!

FAQs

The rise in the valuation of Pfizer stocks shows no sign of slowing down and the trend still appears to be a bull market. News of booster jabs and new vaccines to fight different coronavirus variants keeps coming out, driving the share price higher.

Our top broker recommendation is eToro as they are regulated in multiple countries, the easiest to make a deposit onto and simplest to use for beginner investors and traders. Is it a good time to buy Pfizer stocks?

Where can I safely buy Pfizer stocks online?