BioNTech is a Germany-based biotechnology company with a focus on developing cancer therapeutics, including immunotherapy. That along with vaccines for infectious diseases, including the latest COVID-19. The company is famous for combining innovative technologies with ground-breaking research to develop and produce effective individualized therapeutics for the treatment of oncology and other rare and infectious diseases.

BioNTech seeks to become the world’s leading pharmaceutical company for individualized cancer treatment. Moreover, it will have treated more than 440 patients with 17 different types of tumors by 2020. The company has also been working to develop candidates for vaccines and immunotherapy for the prevention of severe diseases like HIV and tuberculosis.

In 2018, BioNTech partnered with the leading US-based pharmaceutical company Pfizer to develop mRNA-based vaccines for preventing influenza. The partnership went further and the two companies eventually led the COVID-19 vaccine rally after announcing that their vaccine candidate was more than 90% effective in phase 3 clinical trials.

The development of the COVID-19 vaccine and increased demand from all over the globe to prevent the infection drew the attention of traders to BioNTech shares along with Pfizer, Moderna, and AstraZeneca.

The following article is a complete and comprehensive step-by-step guide to help UK investors with the buying process of BioNTech shares online.

On this Page:

Step 1: Find the Best Brokers to Buy BioNTech Stocks in 2024

The easiest way to buy online shares of BioNTech companies in the UK is to register yourself with an online stockbroker. However, the right broker must be selected as it could impact the cost of offered stocks as well as the investment of the trader.

Before selecting a broker, one must ensure that he chooses a cost-efficient stockbroker with other unique features.

While doing so, some essential things should be considered, such as registration with Financial Conduct Authority (FCA). Some of the top UK-based stockbrokers are mentioned below for a better understanding of the procedure.

1. eToro –Buy BioNTech Stocks Online without Commission

eToro is a 100% commission-free broker based in the United Kingdom. It was first launched in 2007, and since then, it has expanded its business throughout the UK. With more than 13 million active traders, eToro is a well-known stockbroker in the UK.

Furthermore, it does not charge any commission fees to its investors. eToro is licensed by the FCA, ASIC, and CySEC and is partnered with the FSCS. This platform provides a traditional way of buying shares and offers CFDs that provide leveraged trading with low margin requirements.

It means investors do not only enjoy the benefits of commission-free trading, but they can also avoid monthly/annual charges by choosing eToro. The broker provides trading through 17 different stock exchanges with more than 1700 equities, including NASDAQ, which can enable the online buying of BioNTech shares in the UK.

Initial Deposit

Initial Deposit

The minimum investment of $50 means that investors can enjoy the leverage trading facility. In simple words, investors have a chance to own a fraction of a share if they want, and they can also buy shares worth more than the amount deposited through CFD.

Copy trading is also a feature provided by eToro to its customers, which can help beginner traders mirror an experienced investor’s portfolio.

Various Payment Methods

Traders can use various payment methods through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, VISA, or Neteller. Another exciting service offered by eToro is that investors can also buy and sell a fraction of stocks. For all newbies, it means traders can buy a fraction of stocks and have no need to buy a single share of a company with their share trading account eToro.

Regulation

eToro is regulated in the United Kingdom (UK) and worldwide, holding licenses from the ASIC, FCA, and CySEC. In addition to this, eToro is a member of the Financial Services Compensation Scheme (FSCS) that protects the first £85,000 of investors’ funds in case of the broker’s bankruptcy.

Buying and selling on eToro can be done online as well as on mobile through their application. The opening process of an eToro account is straightforward and takes about a couple of minutes. The payment can be deposited in various ways, including debit/credit cards, e-wallet, bank transfer, and Paypal.

Pros & Cons of the eToro platform:

- eToro offers copy & social trading

- ASIC, FCA, and CySEC regulated

- Offers to buy CFDs along with the shares.

- Commissionless shares trading.

- User-friendly GUI (graphical user interface) stockbroker.

- Renowned mobile trading app.

- eToro accepts Skrill, VISA, Neteller, and PayPal.

- Performing advanced technical analysis can be challenging for pro-traders.

67% of retail CFD accounts lose money when trading with this provider.

2. Capital.com – Trade BioNTech Share (CFDs) Commission-Free

Capital.com is a global CFD brokerage with subsidiaries in the United Kingdom, Cyprus, and Belarus.

Over 2 million traders call it home, and it has processed over $18 billion in transaction activity. Investors who seek more flexibility in their investments can choose a UK-based trading platform at Capital.com.

It is a CFD specialist platform that offers leveraged trading as well as short-selling. BioNTech share CFDs can be traded through Capital.com by putting only 20% of the margin.

Over 3,000 of the most liquid assets are spread across five sectors, making it an appealing option for all sorts of traders.

Initial Deposit

Captial.com requires a minimum deposit of $20 to get an account open. Client funds are fully separated at RBS and Raiffeisen; accounting behemoth Deloitte audits two of Europe’s largest financial institutions and accounts. Through its Prime Capital division, this broker also caters to institutional clients, implying a large liquidity pool. Captial.com offers only a proprietary trading platform.

Another interesting service offered by Capital.com is that it offers services at a meager cost compared to other brokers. Along with commission-less trading, Capital.com also charges meager spread fees. The spread charged on BioNTech stock CFDs currently stands at $0.17.

CFD stock trading is recommended only for experienced investors, but Capital.com offers to help newbies with educational materials, including a trade learning mobile app. Like other brokers, it also accepts payments through debit/credit cards, bank transfers, or e-wallets. It also offers demo-account trading for risk-free trade learning. It is also regulated by the FCA.

Pros & Cons of the Capital.com platform:

- Provides 100s of UK and US-listed shares trading

- Trade learning mobile app

- AI assistance to identify weak points in trading

- Provides daily trade ideas.

- Advance trading with charts and analysis interface

- 100% commission-free

- It does not support custom trading strategies.

72% of retail CFD accounts lose money when trading with this provider.

Step 2: Research BioNTech Shares

BioNTech was founded in 2008 with an investment of 150 million euros. It has headquarters in Mainz, Germany. The Company focuses on the development and production of technologies and treatments for individualized cancer immunotherapy.

Between 2014 and 2018, BioNTech published many research results on mRNA mechanisms. In 2018, the company entered into a multi-year research and development collaboration with the U.S.-based company Pfizer Inc. with an aim to develop mRNA-based vaccines for influenza prevention.

In 2020, the company developed a successful candidate COVID-19 vaccine with the collaboration of Pfizer, which is considered the leading shot against the coronavirus with a more than 90% efficacy rate.

You’ll discover some crucial considerations to make below to assist with clearing the mist.

History of BioNTech Share Price

In 2019, the BioNTech company listed its shares on the NASDAQ Global Select Market with the ticker symbol BNTX. From its Initial Public Offering, the company was able to generate total gross proceeds of $150 million. The IPO of BioNTech included the sale of 10 million American depositary shares (ADS) at $15 per share, valuing it at $3.39 billion.

The stock price of BioNTech saw a surge after the company got involved in the coronavirus vaccine race. In March 2020, when the coronavirus pandemic across the globe was at its full pace, the company began working on its vaccine candidate with its partner Pfizer.

BioNTech share price chart on eToro

In less than 1.5 years, the company experienced a surge of more than 760% in its stock value. The share price, which started at $15, reached $129 in December 2020. Since then, the prices of BNTX have been rising continuously and have reached an all-time high of $464 during August 2021. Since the start of 2021, the shares of BioNTech have surged over 230% and have lifted the market value of the company to close to $27 billion.

Recent Developments In BioNTech

1. The COVID-19 vaccine

The increased demand for vaccine shots by governments worldwide has brought an opportunity for vaccine makers like BioNTech to give their stock prices a surge. The US government leaders have announced plans to increase the availability of booster shots by the end of September, and it has given BioNTech, along with other vaccine makers, an opportunity to increase their sales and generate revenues.

According to the company, the estimated production capacity in 2021 is 3 billion doses, and in the next year, up to 4 billion doses. Furthermore, the chances of increased demand for the COVID-19 vaccine generated with the partnership of Pfizer are very high. That’s because the drug makers have announced that their shot was more than 90% effective in preventing COVID-19 among those without evidence of prior infection.

This recent news could prove beneficial to BioNTech as the White House coronavirus advisor, Dr. Anthony Fauci, had previously said that vaccines with 50% to 60% efficacy should be acceptable. However, the fact cannot be denied that the sale of the COVID-19 vaccine is not the only source of the company’s revenue.

2. Melanoma & Solid Tumor Treatments

The treatments of melanoma and other solid tumors by BioNTech have entered Phase 2 trials and are expected to be completed next year. The drug against these diseases was made in collaboration with Genentech.

The markets for drugs and treatments for melanoma and solid tumors are expected to reach $12 billion and $322 billion, respectively, by the end of 4 years from now. To enter a huge market with a successful treatment will only benefit BioNTech’s share price in the future.

3. Other Work-in-Progress Treatments

The company has 27 programs with a status of work-in-progress in its research and development centers. Out of these 27 projects, 12 programs are in clinical trials, and the drug established with the collaboration of Genentech is the only one entered in phase-2 trials.

Given the track record, the odds of other vaccines entering subsequent stage trials and entering the market are minimal. Even if the company manages to develop some, it will take years for revenues to materialize. It means a lot of a company’s success depends on its non-vaccine endeavors.

4. Headquarters in Singapore

The company has already announced this year that it will open its Asia headquarter in Singapore along with a vaccine manufacturing plant with the support of the Singapore Economic Development Board. The operations of that factory are expected to take effect from 2023. Moreover, it’s also expected that the project will help produce hundreds of millions of doses of mRNA vaccines per year.

Step 3: Opening an Account and Funds Deposit

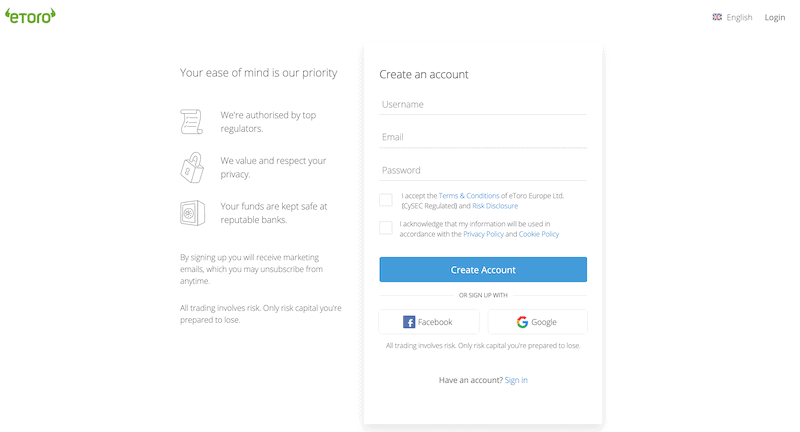

The next step in purchasing BioNTech shares in the United Kingdom is to open an account with a stockbroker who will give you access to the NASDAQ. The process of opening an account with a top broker in the United Kingdom, eToro, is mentioned below.

The first step is to open the website of eToro and then register for a trading account by clicking on the “Join Now” button at the center of the screen.

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

BioNTech share price chart on eToro

After providing the information, investors will be required to prove their identity through their driver’s license or copy of their passport. Another requirement will be to issue a recent copy of the utility bill or bank account statement. After uploading these documents, the next step will be to deposit funds into the account.

Minimum Deposit: $200 or £160

The minimum amount or the desired amount can be deposited through:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

Step 4: Buy BioNTech Stocks Online via the eToro Platform.

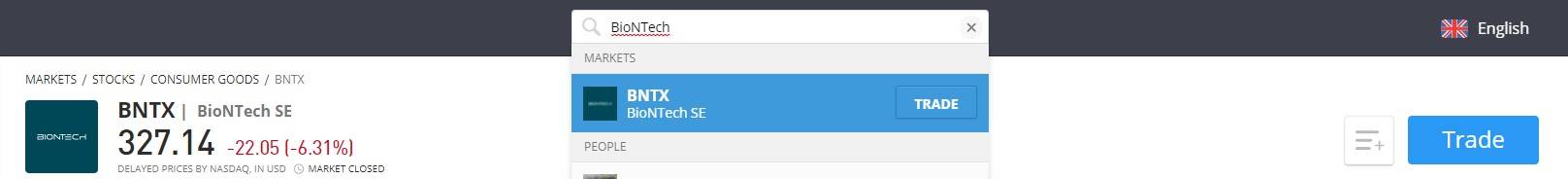

Once the account has been funded, investors can now begin the process of purchasing BioNTech shares. The method of buying stocks via eToro is straightforward to follow. Let’s take a look:

- The process starts with logging into the account by entering the username and password.

- Type BioNTech or BNTX in the search box.

- The popped-up search results will bring forward a list, and investors will have to click on the desired stock.

BioNTech share price chart on eToro

Then, click on the ‘Trade’ button and enter the desired amount of money you want to invest in the shares. Finally, clicking on ‘Open Trade’ will execute the function, and investment in BioNTech Shares will be made successfully.

The buy option is selected if a person thinks that the value of BioNTech share is going to increase in the future and the Sell option is selected if the person has a view that the share price of BioNTech is going to decrease.

Should I Buy or Sell BioNTech Shares?

According to BioNTech, based on its currency supply contracts, the estimated revenue from the vaccine could reach as high as 12 billion euros by the end of 2021. With a market cap of such size, it was a vast estimated revenue.

There are huge chances that the company might see a surge in its stock’s value in the coming months. Especially due to the increased demand for vaccines and the latest announcement by a company that it was more than 90% effective against coronavirus prevention.

Furthermore, there are 27 other projects still under preclinical or Phase 1 studies, which could also benefit the stock value of BioNTech if any of them is launched shortly. The success of the COVID-19 vaccine could also serve as proof of the effectiveness of mRNA technology that BioNTech widely uses in vaccine creation or the majority of its products.

As the vaccine produced by BioNTech in collaboration with Pfizer is leading the vaccine rally and helping governments tackle the coronavirus pandemic around the globe, the chances of BioNTech’s share value surge are very high at this time and for coming years as well.

Conclusion

Since its IPO, BioNTech shares have been rising in value; though the company does not pay any dividends to its shareholders, its popularity is still attracting investors. The vaccine made with the collaboration of Pfizer has not only helped the company generate a record revenue but also pushed its share prices higher.

The company’s rising demand for its COVID-19 vaccine and the prospects of upcoming vaccines and treatments for other diseases like melanoma and solid tumors shows excellent potential in the future. eToro platform is best for purchasing BioNTech shares as it provides 100% commission-free services.

FAQs

Is it a good time to buy BioNTech stocks?

Since its IPO, BioNTech shares have been rising in value; though the company does not pay any dividends to its shareholders, its popularity is still attracting investors. The company's rising demand for its COVID-19 vaccine and the prospects of upcoming vaccines and treatments for other diseases like melanoma and solid tumors shows excellent potential in the future.

Where can I safely buy BioNTech stocks online

Our top broker recommendation is eToro as they are regulated in multiple countries, the easiest to make a deposit onto and simplest to use for beginner investors and traders.