Synthetix (SNX) is a decentralized finance (DeFi) platform with a market cap of about $651 million, ranking it 18th on the list of DeFi tokens. Synthetix is both a decentralized exchange and a platform for synthetic asset issuance. Users can use the platform to create and trade synthetic digital assets that describe other real assets, such as stocks, fiat currencies, commodities, or cryptocurrencies. It also has a staking mechanism that rewards users with liquidity while keeping the platform running.

Synthetix is built on the Ethereum network, the world’s second-largest cryptocurrency program by market capitalization. This makes SNX compatible with all ERC-20 tokens and frameworks. Investors are confident SNX could revisit its previous all-time high of over $25.

How to Buy Synthetic

- Choose an exchange offering Synthetix – Binance is highly recommended and one of the most popular crypto exchanges in the world.

- Create a trading account at Binance and verify it.

- Add funds to your account through various payment options.

- Search for ‘Synthetix” to open the chart and trades.

- Click ‘Trade’ and enter an amount to buy SNX.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Where to Buy Synthetix – Best Platforms

Synthetix is a software that enables users to create new crypto assets that mix real-world assets (such as the US dollar) and crypto assets (like Bitcoin). Synthetix, a growing number of decentralized finance (DeFi) cryptocurrencies, provides this service entirely through code, eliminating the need for a financial intermediary. Synthetix is merely a collection of smart contracts that run on the Ethereum blockchain.

This means that Synthetix users do not have to rely on a specific institution or person to manage the crypto assets they generate. Instead, they only need to trust that the code will run as intended. Synthetix can create these new assets through a process known as collateralization. To collateralize an asset on Synthetix, users must first purchase its SNX cryptocurrency, which can be used to generate these new assets once locked in a special contract (called synths).

We’ve narrowed down the best platforms for purchasing SNX after extensive research. Our list of sites to buy SNX in 2024 includes their features, fees, and the reasons for their exclusivity.

Best Brokers to Buy Synthetix

1 – Binance

Binance holds a significant name in the crypto world as it is the largest cryptocurrency market globally regarding daily transaction volume. It is a top platform to buy SNX as it deals only in cryptocurrencies. It was launched in 2017 by a Chinese entrepreneur, Changpeng Zhao.

Binance offers buying and selling of over 500 digital assets. However, it does not offer a wide range of products, as its main focus is cryptocurrency.

The most notable features of Binance are the lowest trading fees, secured funds, extensive charting options, zero-fee purchases, and efficient customer support. In addition, Binance provides complex security functions to its clients through the Secure Asset Fund for Users (SAFU), which allocates 10% of all trading fees received into the SAFU for user protection to its users.

Fees: The trading fees at Binance are only 0.10%, which can be further slashed to 0.025% by holding the native token BNB in their wallets. Another unique feature of Binance is its Earn program, which enables its users to grow their crypto funds by locking them for a period of time.

In June 2020, Binance listed Synthetix (SNX) and opened trade for multiple crypto pairs, including SNX/BTC, SNX/BNB, SNX/BUSD, and SNX/USDT.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Low trading fees

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

2 – Coinbase

Coinbase is a San Francisco-based cryptocurrency exchange that is considered the world’s largest crypto trading platform in terms of user numbers. Coinbase was the first major cryptocurrency exchange to go public in the United States, listing on the Nasdaq in April at $381, valuing the exchange at $99.6 billion fully diluted.

Coinbase accepts clients from 100+ countries and has more than 73 million users. The paramount feature of Coinbase is security, with 98% of customer funds being stored in secure offline storage.

Coinbase is a very simple and the most user-friendly platform for cryptocurrency trading. It is available on Android, iOS and offers more than 140 cryptocurrencies for trading. Its fee structure is not similar to that of other exchanges. All fees that Coinbase charges are disclosed at the time of the transaction.

Cryptocurrency transaction fees are determined by a combination of factors, including the payment method, size of the order, and market conditions like volatility and liquidity. Credit transactions are subject to a flat fee of 2% of the total transaction. The transaction fee on all purchases, including ATM withdrawals, is 2.49%.

Coinbase listed SNX on December 14, 2020, with open trade for trading pairs like SNX/USD, SNX/BTC, SNX/EUR, and SNX/GBP.

Pros & Cons of the Coinbase platform:

- Ideal for newcomers

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- Less customer support

- The Coinbase Pro website is slow and lacks chart indicators

3 – Bitfinex

Bitfinex was founded in 2012 and is based in Hong Kong. It is a digital asset trading platform that provides margin trading to its customers. Bitfinex is unique in allowing qualified users to trade with up to 10X leverage via Margin Funding.

Bitfinex also offers a variety of order types to provide its clients with the tools for every scenario. For instance, the scaled orders tool automatically enables traders to create multiple limit orders across a determined price range. It also provides a “paper trading” feature to test trading strategies. Bitfinex also facilitates a graphical trading experience with advanced charting functionality.

Bitfinex accepts deposits in the form of fiat and cryptocurrencies. Unlike other exchanges, Bitfinex supports fewer payment methods, as it only accepts Master Card, Visa, and Union Pay.

Founders – Bitfinex launched in December 2012 as a peer-to-peer Bitcoin exchange, providing consumers with digital asset trading services globally.

Bitfinex charges 0.1% maker fees and 0.2% taker fees, whereas there’s no deposit fee. However, withdrawal fees vary according to the coin. The withdrawal fee for SNX is 1.5674 SNX. An additional fee of 1% is charged for emergency withdrawals of funds within 24 hours.

On September 25, 2020, Bitfinex listed Synthetix (SNX) and enabled trading in SNX/USD and SNX/USDT.

Pros & Cons of the Bitfinex platform:

- High leverage for experienced traders.

- Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- Support team only available via email

4 – KuCoin

KuCoin was founded by Johnny Lyu in 2017 and is a global cryptocurrency exchange with 10 million global investors from more than 200 countries worldwide. Kucoin allows easy trading with its website and the Kucoin app, which can be accessed on iOS and Android.

Co-Founder & Chief Executive Officer

Johnny Lyu is the Co-Founder and Chief Executive Officer of KuCoin, one of the world’s most prominent cryptocurrency exchanges. KuCoin has developed to become one of the most popular cryptocurrency exchanges. It has over 8 million registered users from 207 countries and territories worldwide.

KuCoin was funded with $20 million in round A funding in November 2018 by IDG Capital and Matrix Partners. Forbes Advisor named it one of the Best Crypto Exchanges of 2021 in 2021.

The unique feature of Kucoin is that it keeps its clients up-to-date with the latest news in the crypto sector. Kucoin claims to be one of the world’s most sophisticated security technologies and provides 24/7 customer service to its clients.

Like Binance, Kucoin also requires a KYC verification process before opening an account to comply with the regulations. However, Kucoin is not listed to operate in the US, which means US citizens cannot directly deposit dollars or fiat currencies.

The fee structure of Kucoin is straightforward as it charges 0.1% on the maker and taker for less than 1000 KCS in balance. The fees depend on how many trades have been made over the past 30 days. The 30-day trading volume is measured in BTC rather than USD.

Withdrawal & Deposit

KuCoin allows buying bitcoin using fiat currency, but only via a third-party application. Investors may make payments using a credit or debit card, Apple Pay, or Google Pay, but not via bank transfer. Whereas, the fees might be astronomical.

Kucoin is one of the few exchanges that offer a margin trading feature. It also allows its users to lend their cryptocurrency holdings to others. Kucoin trading bots are also available on the Kucoin platform for nominal fees.

Kucoin listed SNX on its exchange on April 14, 2021, with the trading pair SNX/BTC.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Trading bots

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

5 – Bybit

Bybit is a new peer-to-peer (P2P) cryptocurrency derivatives exchange attempting to establish itself in the emerging cryptocurrency margin/leverage trading market. Despite its March 2018 launch, Bybit quickly gained traction in the Bitcoin trading community and began enrolling customers.

The exchange allows traders worldwide to engage in leveraged margin trading on a select set of cryptocurrency assets, with BTC, ETH, EOS, and XRP trading at up to 100x leverage.

Bybit, based in Singapore, is a cryptocurrency-to-cryptocurrency exchange that does not require customers to go through onerous KYC verification and currently has a daily trading volume of up to $1 billion.

Founders: Ben Zhou founded the company in March 2018. Before becoming the exchange’s CEO, he was the general manager of XM, a forex brokerage firm.

Leveraged trading: The primary product offering of Bybit exchange is perpetual futures with a leverage ratio of 100:1. This suggests that they intend to compete with existing exchanges like Binance and Phemex, which offer comparable non-expiry futures contracts.

Fee – Market takers pay a fee of 0.075 percent, while market makers pay a fee of -0.025 percent. As a result, market makers will be compensated when they initiate a transaction. Because of the low fee, market makers are likelier to be active and fill the order book.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Crypto derivatives are extremely risky

- Not suited to spot trading

- May share your data with third parties for marketing

What is Synthetix?

Synthetix is software that allows users to create new crypto assets that mimic real-world assets such as the US dollar and crypto assets such as Bitcoin. In a world with a plethora of emerging decentralized financial cryptocurrencies, Synthetix enables the service solely through code, eliminating the need for a financial intermediary.

Synthetix is a smart contract collection that runs on the Ethereum blockchain. It means that users of this platform do not have to rely on a third party or institution to manage the crypto assets they generate. Instead, they must simply trust that their code will run as intended. On Synthetix, new assets are created through a process known as collateralization.

To collateralize an asset on Synthetix, a user must buy its SNX token, which can generate new assets called synths once locked into a special contract. The synths created can then track the value of other assets using special data feeds known as oracles, which allow users to gain exposure to market movements.

According to DeFi Pulse, as of January 2022, the total value locked (TVL) in the DeFi projects in Synthetix is about $487.7. Kain Warwick founded M. Havven in 2018 with the name “Havven,” which raised about $30 million by selling 60 million HAV tokens through an ICO.

At that time, the goal of Havven was to create cryptocurrencies that mimicked the performance of cash, like the US dollar or the Euro, on multiple blockchains, including Ethereum and EOS. However, at the end of 2018, it was rebranded to Synthetix, and the goal of the protocol was expanded to include the creation of synthetic assets for cryptocurrencies and commodities. 2019 Synthetix raised approximately $3.9 million by selling SNX tokens to Framework Ventures.

Synthetix was governed initially by a non-profit foundation, which was dissolved in June 2020 and replaced by three decentralized autonomous organizations (DAOs). Holders of SNX tokens use these DAOs to vote on protocol changes and make decisions about the protocol’s future.

Initially, the Synthetix Protocol was known as Havven in 2018, when Kain Warwick established it. Warwick has experience building cryptocurrency payment platforms in Australia; the biggest platform he created was Blueshyft; before that, he was also an Advisory Council Member at Blockchain Australia and an Advisory Board Member at the Burger Collective.

How does Synthetix operate?

The operation of Synthetix includes the creation of different tokens that represent the synths within the platform. Guarantees, participation, inflation control, fees, and governance support each synth.

The user must acquire SNX and deposit it into the Synthetix platform to create a synth. In return, the platform creates a new synth token of the users’ choice. According to the software rules, the value of SNX locked would need to be maintained at or above 750% of the synth value created.

For example, if a user wants to create a synth representing the gold market, the synth will create a new token called gold. For example, if the user has $1000 worth of SNX deposited in his account, he will receive about $133 worth of gold using the 750% collateralization ratio.

Synthetix fundamentals

- What it does: The Synthetix Network Token (SNX) is an Ethereum token that powers the Synthetix protocol. SNX is staked to create Synths, which are also a form of an ERC-20 token. The holders of SNX are incentivized to actively participate in maintaining the system’s health.

- Kain Warwick founded Synthetix. The CTO is Justin Moses, a former Director of Engineering at MongoDB. Clint Ennis, a former Architect Lead at JPMorgan Chase, is a Senior Architect.

- Date launched: The Synthetix Protocol was formed in 2017, and Synthetix launched its token SNX in 2019.

- Availability: Most major cryptocurrency exchanges in the United States, like Binance, Coinbase, OKEx, Kucoin, Gate.io, Huobi Global, etc.

Is it Worth Buying Synthetix in 2024?

Looking back, the year 2022 proved to be quite tumultuous for the SNX token. It experienced a series of ups and downs in its value, leaving investors uncertain about what would happen next. Synthetix (SNX) holders were taken on a wild ride as significant events within the global cryptocurrency landscape caused dramatic shifts in their investment journey.

At the start of the year, there was a sense of optimism surrounding SNX as it began with a promising trajectory. On January 5th, its value reached impressive heights of $7.43. However, this bullish sentiment quickly faded due to Russia’s incursion into Ukraine, which sent shockwaves through financial markets. Consequently, on February 24th, 2022, SNX experienced a dramatic downfall and hit rock bottom at $3.36—a clear reflection of the prevailing geopolitical tensions.

In late March, a brief period of recovery occurred, marked by an optimistic surge that peaked at $8.11. However, subsequent months presented further challenges. In May, the UST stablecoin’s detachment had a seismic impact on the crypto world, leading to the downfall of the associated LUNA cryptocurrency and causing SNX to plummet to a mere $2.22 on May 12th.

June witnessed a setback in market sentiment when withdrawal cancellations on the Celsius (CEL) crypto platform affirmed the bearishness of the sector. This negative sentiment was further accentuated on June 18th, 2022, as SNX reached a record low of $1.45, its lowest value in nearly two years.

Glimpses of recovery emerged, with the token’s value reaching $4.33 on August 11th. However, subsequent months proved unable to maintain this positive trend. By November 7th, SNX had plummeted to a meager $2.77, reflecting the overall market turmoil exacerbated by the collapse of the FTX (FTT) exchange. This unfortunate event resulted in SNX hitting an alarming low of $1.55 on November 14th.

As the year neared its end, SNX struggled to regain stability, ultimately closing at $1.44 with a staggering year-on-year loss of nearly 75%. However, as 2023 began, there emerged a renewed sense of hope among SNX enthusiasts. On January 14th, the token surged past $2 and continued to rise, reaching $3 by February 8th—a significant valuation not seen since mid-September.

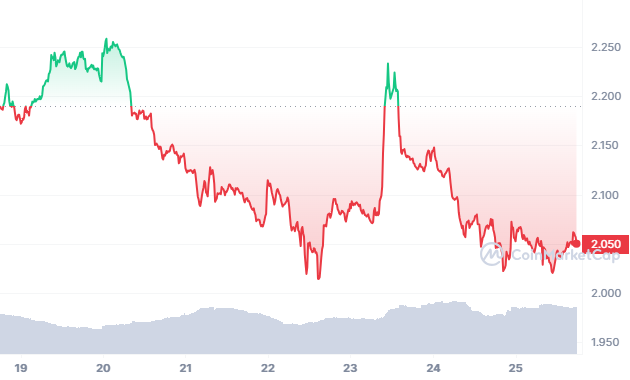

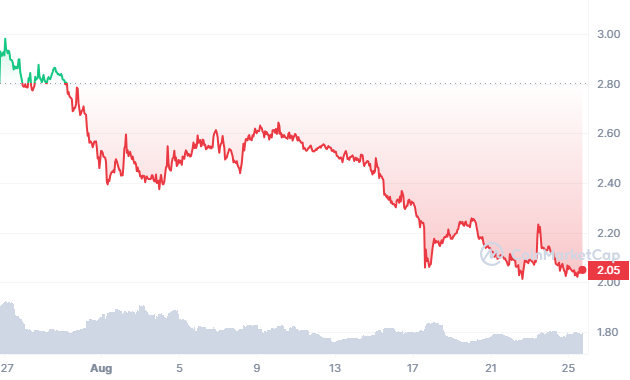

After reaching its peak, SNX experienced a slight setback but quickly surged back to $3.23 on March 5th, propelled by the news of an upcoming protocol upgrade. As of March 6th, 2023, SNX is valued at approximately $3.20. Presently, the price of Synthetix hovers around $2.51 and is accompanied by a 24-hour trading volume of $31,968,932. These figures indicate a recent decrease of 0.83% within the past day.

Synthetix currently holds the #59 position on CoinMarketCap, reflecting its standing in the broader market. With a live market capitalization of $553,157,290, Synthetix’s value continuously evolves in the dynamic cryptocurrency landscape. This has piqued the curiosity of investors and observers who ponder the future trajectory of this digital asset.

Will the Price of Synthetix Go Up in 2024?

Synthetix (SNX) has emerged as a frontrunner among decentralized finance (DeFi) projects for the year 2023, earning the endorsement of numerous market experts. The SNX token has staged an impressive resurgence over this year, bolstered by robust fundamentals and a versatile use case.

The second quarter of 2023 marked a significant turning point for Synthetix, demonstrating its promising progress. The ongoing enhancements to Synthetix Perps played a crucial role in driving this advancement, allowing seamless trading of synthetic assets. One remarkable achievement was the impressive 170% surge in trading volumes compared to the previous quarter, reaching an astonishing total trading volume of over 11 billion units.

In the second quarter, significant improvements were made, encompassing various key updates. These included streamlining execution processes, reducing trading fees, and expanding the range of available underliers for trading.

Most notably, the cost of trading on the platform experienced a significant reduction. Fees for ETH/BTC transactions were as low as 2 basis points (bp) for makers and 6 basis points (bp) for takers. This competitive fee structure aligns Synthetix with pricing models seen in centralized exchanges. Despite an increase in trading volumes, fees only rose by 7.3%, amounting to $7.3 million.

During that specific time frame, Synthetix allocated around $3.4 million as Optimistic Ethereum (OP) incentives for the participants. These incentives aim to gauge their long-term impact and effectiveness, with an expected duration until September 6th, 2023.

Furthermore, the introduction of snxETH, a novel synthetic representation of Ethereum on the V3 platform, marked a milestone for Synthetix in the second quarter. This move aligns with Synthetix’s strategy to roll out new features for the V3 platform while maintaining rigorous risk controls.

The Decentralized Autonomous Organization (DAO) is expanding continuously, with the introduction of new functionalities taking place simultaneously. During the second quarter, active trading on Synthetix Perps proved advantageous for both traders and stakers. This surge in trading volumes and associated fees contributed to a gradual reduction in inflation rates. As a result, SNX stakers were able to enjoy modest double-digit yields.

With the OP incentives program slated to run through most of the third quarter, opportunities for subsidized usage remain available to both stakers and users. The rollout of Synthetix V3 features aligns with the platform’s strategic vision of transforming into a more modular and adaptable ecosystem.

These strides in development and adoption set a promising stage for the potential price trajectory of Synthetix throughout the remainder of 2023. While keeping a close watch on the evolving market dynamics, current technical indicators suggest that Synthetix’s 200-day Simple Moving Average (SMA) will continue its ascent, reaching $2.46 by September 11th, 2023. Concurrently, the short-term 50-Day SMA is projected to attain $2.60 within the same timeframe.

The Relative Strength Index (RSI) serves as an additional market sentiment indicator, currently standing at 48.39. This value suggests a neutral stance regarding the SNX market. Traders frequently rely on this oscillator to assess whether a cryptocurrency is oversold (below 30) or overbought (above 70), thereby obtaining valuable insights into the prevailing market condition.

As the year progresses, all eyes will remain fixed on Synthetix, awaiting further developments and potential shifts in its price trajectory within the dynamic landscape of the cryptocurrency market.

When you’re considering an investment, follow these things:

This section is mainly for beginners who want to invest in the cryptocurrency market, as it goes through a step-by-step guide for investing. Investors must know about the following things before investing in the crypto market:

1. The Importance of Timing

Cryptocurrencies are extremely volatile, meaning their value changes dramatically over time, and investors, especially new ones, tend to lose all of their capital if they lack knowledge of the market. However, entering a market is a crucial thing to learn. In general, cryptocurrency traders try to “buy the dip,” which refers to buying more cryptocurrencies when their value is falling or at its lowest levels.

We can also say that SNX/USD was at its crucial level. Investors might be buying this dip in Synthetix coin, pushing its prices higher for the past few days.

2. Investing in Cryptocurrencies Using Traditional Methods

Cryptocurrency exchanges such as Binance and Coinbase make it simple for new traders to invest in cryptos using their credit cards, debit cards, or bank accounts. Other options like PayPal, Skrill, and Neteller are also available on different exchanges, which means entering the crypto market does not require complex paperwork.

3. Be wary of swindlers

Doing homework before selecting a cryptocurrency to invest in is the most important step to remember. It is because an investor might find a lot of buzz on social media about an investment strategy promising big returns on a specific crypto asset. Unfortunately, people in the cryptocurrency business have lost billions of dollars to Ponzi schemes, and an investor must try to avoid pretenders and false information. Again, this can only be done with much homework and research.

4. Develop a Business Plan

Devising a strategy for their portfolio is a quality only a successful investor possesses. It involves placing a limit order and automatically selling the asset or crypto when it reaches a certain level to minimize the loss. Some crypto platforms help their users mimic the moves of experienced traders. New investors are advised to find an experienced trader with a compatible risk tolerance to begin learning about crypto trading.

5. Choose a Trustworthy Crypto Exchange

The final step in making a cryptocurrency investment is to choose a cryptocurrency exchange and platform with a high level of liquidity, a vast range of cryptocurrencies, strong security measures, and dependability. In this article, we have mentioned a variety of cryptocurrency exchanges and the procedure to open an account with them. You can invest in cryptocurrencies through any of the above mentioned methods.

Buying Synthetix as a CFD Product

A Contract for Difference (CFD) is a financial derivative that pays the difference in settlement price between the opening and closing of a trade. If you belong to the UK, CFDs are considered a tax-efficient way of speculating on the financial markets. CFD trading lets one speculate on rising or falling prices of Forex, indices, commodities, stocks, and treasuries.

Before CFDs, crypto exposure was limited to holding and storing them in secured wallets; otherwise, funds were subject to possible theft by cybercriminals. However, CFDs enable a trader to trade on the price of the desired cryptocurrency despite worrying about the security of his assets. Another fascinating thing about crypto CFD trading is margin trading, which enables access to leverage mode, which unlocks greater opportunities to multiply gains.

We recommend using Binance or CryptoRocket to buy and sell altcoins with leverage. Binance now accepts a broader range of cryptocurrencies, including Synthetix. CryptoRocket currently supports approximately 40 other currencies. Cryptorocket does not currently support Synthetix, but they constantly add new coins. So keep an eye on CryptoRocket.

Similarly, we recommend Libertex for margin trading. Hopefully, Libertex will soon add the SNX/USDT pair to its trading platform.

Taxation on Synthetix Earnings

Cryptocurrencies are treated as property regarding taxation rules set by the IRS. It means that if all one did was buy cryptocurrency with US dollars and those crypto assets have been sitting untouched in an exchange or wallet, they are not subject to IRS reporting this year.

Crypto reporting to the IRS is required in certain events, including:

- Exchange of one cryptocurrency for another

- Selling cryptocurrencies for dollars

- Using cryptocurrency to buy goods or services

Crytpo earnings or SNX gains can be subject to taxation, just like capital gains. Anytime one sells an asset for a profit, the resulting gain or loss should be reported to the IRS. To determine the loss or gain related to crypto, the following things must be reported to the IRS: the date of acquiring the crypto, the date of selling, exchanging, or disposing of crypto, and the cost of acquiring the crypto plus the transaction fees.

After that, gains are taxed according to the time the cryptocurrency has been held, i.e., short-term or long-term. Less than one year is short-term, and more than one year is long-term. Short-term gains are taxed as ordinary income, while long-term gains are taxed at 0%, 15%, or 20%, depending on the taxable income and filing status.

The gains and losses are calculated on Form 8949 and then reported on Schedule D of Form 1040.

How to Get Ready for Tax Season if You Have Crypto?

Follow the following steps while filing for tax on crypto earnings:

Be Honest

Ensure that no information is left behind while filing for taxes on cryptocurrencies, as it could result in penalties, fees, and, in severe cases, even tax evasion charges. Form 1040 has been revised recently and now features a direct yes-or-no question regarding the receiving, selling, exchanging, and disposing of cryptocurrency. This feature signals that the IRS ensured nobody could pretend to be ignorant while reporting the gains.

Record Management

According to the new rules, cryptocurrency exchanges will not be required to send taxpayers 1099-B forms, aka tax-reporting summaries, until the 2023 tax year. It means the responsibility to keep accurate records of their transactions is solely on the traders.

Many exchanges, like Coinbase, allow their traders to download their trading history, which makes it easy for tax filers to calculate gains and losses. However, if one person is making trades off the exchange, then he should keep a record of it.

Tracking Tools

A taxpayer with 3 to 4 wallets and exchanges might have to reconcile their cost basis across varying platforms. For such people, investing in software that can help track transactions is suggested. Because reporting a single trade on one exchange will not be difficult, tracking more than one wallet and exchange will only complicate the procedure. It can be simplified by using tracking tools.

Hire a Professional

A taxpayer engaging in a complex situation might need help from a tax professional. They can guide you through various accounting strategies the IRS permits for reconciling the gains and losses of a taxpayer. A tax professional can also help determine the strategy for a specific client.

Make Your Losses Work for You

Those who did not take advantage of tax-minimization strategies last year, like tax-loss harvesting, donating, or gifting while realizing losses, still have a chance to lower their tax bill.

The rules suggest that if a person sells a cryptocurrency at a lower value than what he paid for it, then he might be able to deduct up to $3,000 of those losses on his taxes. The procedure is just like stockings.

Automated Trading With Robots

A crypto trading robot comes to buy and sell cryptocurrency at the right time to generate profits. Using algorithms, the bots analyze the crypto market independently and look for technical patterns that provide opportunities for profitable trades.

Robots use the information they analyze to determine the best trading entry and exit levels. They also alleviate the stress that comes with trading on one’s own.

How Cryptocurrency Robots Operate

Cryptocurrency robots monitor the markets continuously to recognize technical patterns. They are programmed to look for patterns like breakouts, reversals, and momentum in the cryptocurrency, which will provide trading opportunities. On identifying a pattern, crypto bots place the buying or selling position accordingly to open a trade.

The robots work automatically to exit the market and generate a profit once the movement is completed. When the market starts moving against the open position, the bots are programmed to exit the market automatically using a stop-loss feature to limit the consequences of the trade.

Crypto robots are very similar to the available forex signals in the market. The only difference is that they automatically trade on behalf of the trader. Unlike the general way, where a trader decides which trade to go with and which to ignore, cryptocurrency trading robots generally trade on every signal or pattern they find using their algorithm.

Synthetix Mining: Can You Mine SNX?

No, the Synthetix token (SNX) cannot be mined. It is because the Synthetix protocol uses proof-of-capacity consensus. Synthtetix users can get rewards by staking SNX tokens and issuing Synths. The stake rewards come from the Synthetix exchange fees, which currently stand at 0.3%.

To stake SNX, an ERC-20 compatible wallet must be connected to the Synthetix exchange. Then the SNX coins must be locked as collateral in the wallet to be able to mint Synth tokens. The collateral requirement is 750%. This is a simple way of generating rewards from trading fees on Synthetix. In addition to this, traders can also enjoy inflation rewards.

Decreasing Risk in Synthetix Investment:

Cryptocurrency investment is subject to risks of loss, and to protect yourself from big losses, the following steps can be taken by an investor.

Make use of a hard stop loss.

A hard stop loss enables the trader to keep his mind off the risk involved with crypto trading and limit the risk exposure. In this way, traders can keep their small losses from becoming big ones.

Leverage is your friend unless it’s too much.

High leverage can guarantee big gains quickly with a minimum amount of money. However, at the same time, they can also wipe out the entire capital if the market goes against the trade.

Market volatility

Looking for a volatile market while making trades is advised, as they tend to provide opportunities to make money from small price changes. Investors avoid a range-bound market as it can lead to a loss.

You must have heard that the cryptocurrency market is highly risky because it is highly volatile, but it is the very thing that has made the whole market so attractive. It is because a less volatile market is considered riskier as it offers fewer opportunities to make money. Additionally, less volatility gives fewer gains with higher transaction costs, so the situation becomes win-lose again, back to where it started.

Determine how much risk you can take.

The amount of money one can put at risk depends on the investor’s tolerance. Here it comes again, setting a stop-loss order. A trader must calculate the amount at risk while making a trade and set a stop-loss order according to his capacity to lose and the amount of capital. An investor must learn to do trade math before investing and calculating the risk.

Synthetix Price Predictions: Where Does SNX Go From Here?

On February 14th, 2021, Synthetix achieved its peak value by reaching an all-time high of $28.63 in trading. In contrast, its most minimal price was documented on January 5th, 2019, when it dropped to its historical low of $0.032478. Notably, the price rebounded from its all-time low to reach a value of $1.400150 at the lowest point following its peak.

Conversely, the price surged to $3.35 during the most recent cycle. Presently, the sentiment regarding Synthetix’s price prediction leans towards a bearish outlook, coinciding with a Fear & Greed Index value of 38, indicating a neutral stance.

Synthetix Price Prediction 2023

2023 is expected to be a promising year for Synthetix Network Token. Experts believe the token will surpass $3 by the second half of this year. It will have an average value of $2.35 throughout this year.

Synthetix Price Prediction 2024

The supply of SNX tokens is subject to increase every year from March till 2024. Given the above verdict, prices of SNX and USD are also expected to remain under pressure in 2024.

On the bullish side, the prices could hit $13 as the growth rate in the number of SNX tokens is expected to remain around 2%, and on the bearish side, the prices of SNX could hover around $10.

Synthetix Price Prediction 2025

Synthetix has come a long way, benefiting from the rapid growth of the DeFi space. As the whole DeFi ecosystem is getting stronger and stronger, the long-term chances of Synthetix achieving tremendous growth are very promising. Synthetix coin SNX might reach $20 in 2025 or above.

Summary

SNX is the native token of the Synthetix network. It is a derivative trading platform aiming to bring liquidity to the market through synthetic assets called “synths.” Synths represent the underlying asset’s price, and the users of platforms can earn rewards in the form of SNX tokens by providing collateral to the platform.

The launch of Synthetix on Ethereum Layer-2 Optimism has added great value in the past as this launch helped reduce the high gas fees of the Ethereum Network. Being an Ethereum fork, Synthetix holds great potential, which can be useful for Ethereum and Synthetix and other projects.

The growing market for the Synthetix network and the increased partnerships hold a promising future for this network. Its unique synths are also gaining popularity as many companies seek ways to improve their users’ capacity to access the loans associated with synths. The upcoming upgrades and releases for Synthetix will surely add to the growth in market share.

It means SNX has a somewhat promising investment opportunity as its prices are already at their lowest level, and in the crypto market, it is said to “buy the dip.” Therefore, if you want to buy SNX, you can start by opening an account at our suggested broker, Binance. It simply takes no more than 5 minutes to set up your account and begin purchasing Sythetix tokens securely.

Your Capital is at Risk

FAQs

Any risks in buying Synthetix now?

The whole crypto market has been facing selling pressure lately, but Synthetix token SNX has increased for the past ten days. The price recently declined to its all-time lowest level at below $4, and it seems like an excellent time to enter the market. SNX appears to have entered the oversold zone, and even if the price does not reverse momentum, it will undoubtedly correct, opening the door to opportunity. The price might reach $7.

Should I buy Synthetix?

There is no doubt that Synthetix is among the most complicated protocols in DeFi. However, at the same time, it is one of the most innovative DeFi protocols as it brings real-world assets into the blockchain world. While many projects claim to connect the traditional financial industry with DeFI, Synthetix has done it for real by creating Synths. So the future seems bright for Synthetix.

Is it safe to buy Synthetix?

Synthetix is an Ethereum-based project, which means it has the same security as the world’s second-largest cryptocurrency.

Where can I spend my Synthetix?

Users have the option to stake their SNX tokens on Synthetix, which in return is paid with a part of the fees generated on the network in proportion to their contribution. In simple terms, users can earn a share of Synthetix's fees through its exchange. SNX holders can also receive a right to participate in the Synthetix network.

Will Synthetix ever hit $100?

The long-term forecast for SNX supports a bullish trend, yet hitting $100 is a very challenging target. However, given the optimism surrounding Synthetix, the market may witness an excellent bullish run in Synthetix in the coming years, with its price crossing above $15.