Stellar is among the fastest-growing Blockchain platforms that we have today. With increased speed, more scalability and less cost, this cryptocurrency platform has gained relevance in the blockchain industry with one more added advantage – simplicity.

Now among the top 10 blockchain platforms globally, Stellar sports its own cryptocurrency, Stellar Lumens (XLM).

But can it become one of the few cryptocurrencies you can invest in?

If you want the added advantage of affordability and simplicity, then yes.

However, there are several essential aspects to keep in mind. Here, you will learn how to buy stellar lumens (XLM) and where to buy them, but you’ll also know whether it is a wise choice for your blockchain portfolio.

On this Page:

How to buy Stellar (XLM): A Quick Guide

It is 2023, and blockchain has become more affordable, or at least, that’s what most people expect it to be. If you are the same and seek to purchase a cryptocurrency at a low cost, you’ll be happy to learn that the eToro platform provides the perfect way to purchase lumens coins – at just $10. It is fee-free if you’re using USD to buy your cryptocurrency; this benefit extends to debit or credit card payments in USD.

Here is a thorough way to get your hands on some Stellar Lumens:

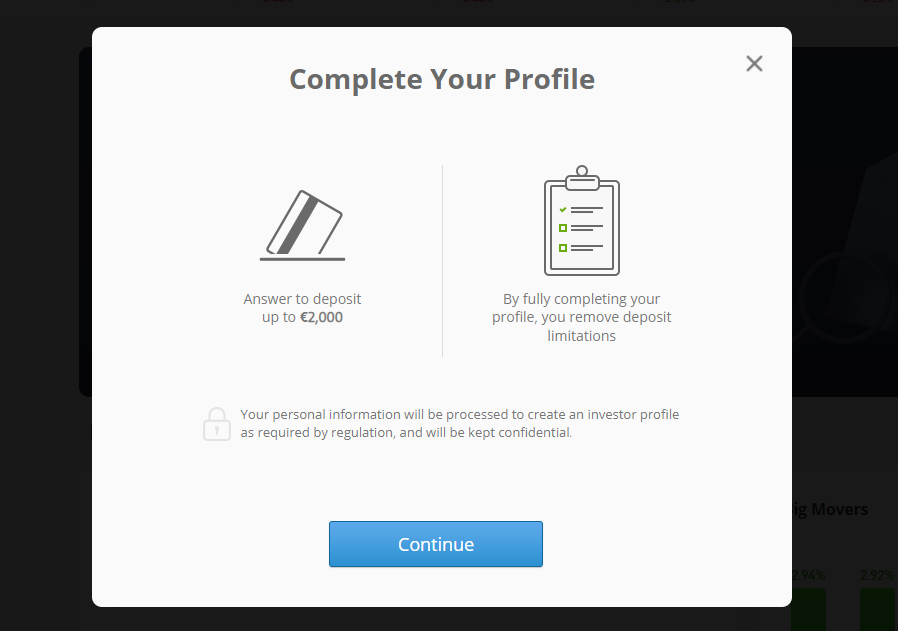

- To get started, you must create your eToro account. The procedure is quite simple. All you require is to input your details, provide a verification ID, and you will receive your credentials once the platform accepts your credentials.

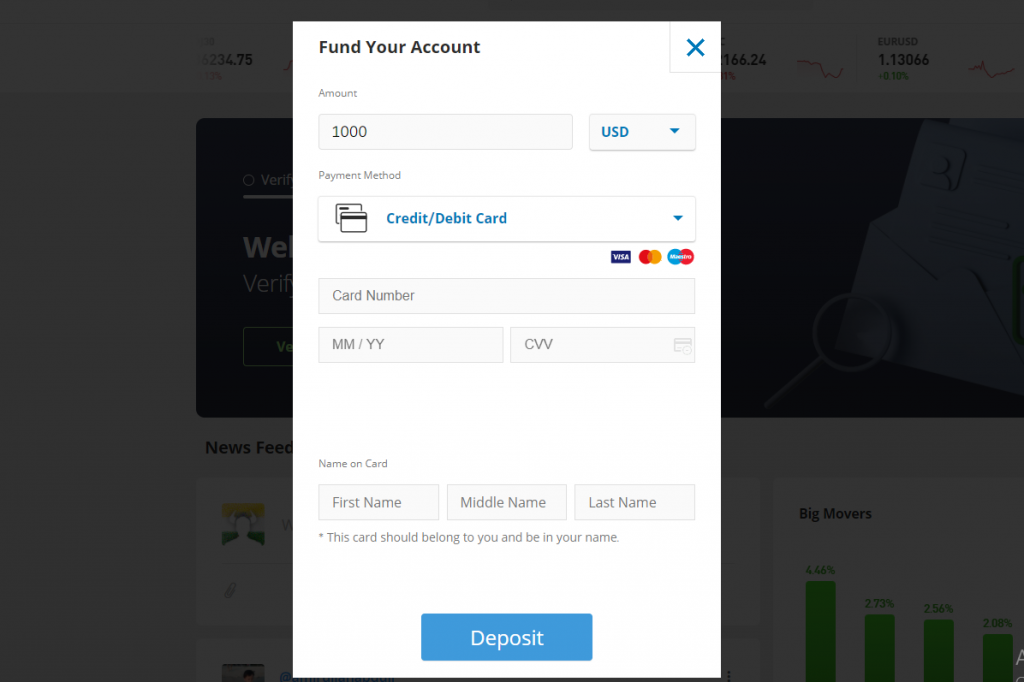

- Enter the funds: You need to deposit a minimum amount to start trading on the platform: USD 10. Thus, make the required deposit and open the account. If you are using USD deposits, they are chargeless or fee-free. After that, choose the debit or credit card payment method you’re comfortable with.

- Search for the Stellar coin: Once you have entered the dashboard and into the domain of eToro, it is time to search for the Stellar Lumens coin. Thus, enter the term “Stellar Lumen” in the search box, click on the options that appear before you, and end on the relevant page. Afterward, click on the “Trade” button to proceed.

- Make your purchase: After being directed to the relevant page, you must choose how many coins you wish to purchase. Enter the desired about and click on the “Open Trade” option to finish.

The process is quick but is bare-bones. Read on if you want to look at a more comprehensive procedure of the same, and then want to take all the decisions after weighing all the pros and cons of the Stellar (XLM).

Best Places to Buy Stellar in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Where to buy Stellar (XLM)?

Before purchasing the coin, you must decide where you want to buy your cryptocurrency. It is a critical decision that sets the foundation of your trading capabilities in the blockchain domain.

Stellar is not just “any other” cryptocurrency; it is counted among the top 10 blockchain investments. Therefore, it has the attention of many crypto exchanges, all providing an array of lucrative deals and functionalities.

Because we understand the gravity of this situation and want you to make the right choice, we are presenting a list detailing the top four ways you can buy Stellar (XLM).

1. eToro – the best way to buy Stellar because of the attributes

Among all the crypto trading platforms we have come across, eToro is the best. It has an intuitive interface, provides a wide array of functionality, and has the most incentives for purchasing cryptocurrencies.

Launched in 2007, eToro quickly established itself among the biggest crypto platforms. Contributing to that rise is its unique approach to the fee structure.

It takes a spread-only approach when you purchase a coin. What is that? It is a fee equivalent to the difference between buying and selling price of coins.

This spread on cryptocurrency starts at the lowest level and continues until the highest. Other exciting aspects of this platform include no deposit fee for US dollars and the acceptability of all payment methods. So, whether you have a debit card, credit card, ACH, online banking, or domestic wires, eToro will provide you with a way to invest in Stellar (XLM).

Furthermore, for the more tech-savvy among you, eToro also accepts payments via E-wallets such as PayPal and Neteller.

The minimum deposit requirement for all clients is $10. This amount is enough, especially if you wish to buy multiple Stellar Lumens from the start. However, if you are eying more exclusive coins such as Solana and ETH, eToro also allows you to invest in a fraction of those tokens.

Besides Stellar Lumens (XLM), eToro supports more than 40 digital assets. These include Dogecoin, Litecoin, EOS, Cardano, XRP, to name a few. If you are up for investing in multiple asset classes, eToro has systems to facilitate you.

Furthermore, if your interest is not only in Star Lumens (XLM) but also in other digital assets, creating an eToro CopyPortfolio allows you to take a simple but effective approach towards that.

What is CopyPortfolio? It is a passive financial product to invest in multiple cryptocurrencies of diverse values to discerning eyes. Being on the flagship features of the platform, CopyPortfolio gets all the maintenance it requires from eToro’s internal systems.

But the perks of eToro do not stop there. It is also one of the best crypto staking platforms on the platform – making it an ideal tool if staking your Stellar Lumens is something you’re up for.

2. Crypto.com: A convenient place to buy Stellar lumens with a debit card

Akin to eToro, Crypto.com has also gained immense popularity among

In fact, word on the grapevine is that Crypto.com is one of those rare platforms that opened the doors to crypto to those whose bank balances were too humble to enter the blockchain ecosystem.

The procedure to buy Stellar (XLM) from crypto.com is similar to other platforms. It consists of account creation, verification, and coin purchase.

Because Crypto.com puts the accessibility aspect at the forefront, it accepts most conventional forms of payment, including debit and credit cards. Due to that, this popular trading portal provides novice and veteran users with an efficient way to invest in crypto assets.

Let us now talk about the charges. Crypto.com will charge you 2.99% for buying Stellar (XLM). However, you won’t need to pay any costs if you invest in Stellar Lumens, or any coin for that matter, during the first month of opening the account. By giving new account holders a free trial for one month, it has been able to increase its investor count.

Crypto.com hosts 250+ crypto assets other than stellar lumens. These assets allow this platform to diversify its portfolio and render facilities beyond traditional exchange and brokerage.

But the variety of services it renders doesn’t stop there. Crypto.com also offers a visa-backed prepaid debit card – allowing interested users to engage with non-digital, cash-infused monetary transactions.

Other than that, the platform also has an Earn Tool. By sporting analytics of the latest trends of the blockchain ecosystem, the earn tool helps the newcomers find better crypto-investment opportunities.

3. Coinbase: The most user-friendly way to purchase Stellar

For those looking for a DEX with simplicity, Coinbase provides a wide array

Its reputation is well-known within the crypto space – allowing it to gather hundreds of millions of customers since its inception. Because of its simplistic approach, Stellar is suitable for starters seeking a platform that they can trust without conducting a lot of assessment.

Here is how to invest in Stellar coin via Coinbase:

Download the app, sign-up, provide your IDs to receive verification. Once you’ve created an account on the platform, you’re free to engage with its systems to add a payment method and start investing in Stellar Lumens.

As far as the charges go, Coinbase charges a 4% fee to purchase lumens via debit or credit card. Yes, it is pricey. However, since Coinbase follows along the lines of eToro, it has a fee-free model for US customers. Just use ACH to transfer USD, and after the funds arrive, at 1.49% to buy lumens.

4. Binance – For those worried about the price

Do you consider yourself of humble means but still don’t want to miss out

For payment options, you are free to choose between crypto or dollars to invest via Binance.

However, it is advisable to invest via cryptocurrency because while the dollar is convenient, using crypto is the cheapest, costing a mere 0.10% per slide.

The platform follows a location-dependent fee model for debit/credit card payments but charges a 4.5% transaction amount. If that sounds steep, you can choose among banking options such as ACG, and they are chargeless but time-consuming.

Once you have purchased stellar lumens using your desired method, the tokens will be transferred into your Binance web wallet. Another factor that makes Binance a cut above the rest of its competitors is its wide range of security tools. It does not shy away from robust security measures, including two-factor authentication, cold storage and device whitelisting.

Furthermore, to facilitate financial security to the customers, it provides Safe Asset Funds. Currently valued at 1 billion US dollars, SAF is a Binance-designed tool to protect user funds. 10% trading fees of every transaction is allocated to this fund to facilitate insurance against security issues.

What is Stellar Lumen (XLM)?

Stellar is an open-source platform for payments and currencies. It is used for creating and sending digital representations of all currencies, including crypto. A truly publicly accessed network with no owner, it aims to unite the world’s financial systems.

Supported by a decentralized network, Stellar handles millions of transactions every day.

Developers came up with it to address the most prominent issues in the current ecosystem. It has grown in worth as a result. Other reasons are that it is a cheaper, faster, and energy-efficient blockchain.

Launched in 2014 to enhance the existing financial system, Stellar has solved more than 2 billion operations.

As a multi-currency platform, it has done away with restrictions and thus allows all types of cryptocurrencies to exist amidst its blockchain systems.

To facilitate the transactions, Stellar uses Stellar Lumens (XLM), a native digital currency. It accelerates the speed at which the blockchain performs the transaction. Thus, interacting with Stellar requires a minimum balance of 1 Lumen. 100,000 transactions can be achieved by this amount of XLM, considering each transaction costs 0.00001 Lumen.

The native currency acts as a bridge to make cross-border asset transactions less pricey and more reliable. Since it was founded by one of the co-founders of Ripple Labs, it has the same foundation as the XRP coins.

This token eases the movement of money between the users.

However, unlike other crypto coins, these aren’t rewarded over time. Instead, Stellar gave Lumen’s production a 1% annual increase during the first five years since its launch. Thus, after 2019, the production was reduced. Currently, 50 billion lumens are in circulation, 20 billion of which are in the open market and 30 billion coins are used for Stellar’s development.

Stellar is now planning to put the remaining coins to the public.

Is Stellar Lumens (XLM) a good investment?

Although launched to enhance the capabilities of Stellar blockchain, Lumens has now gained ground in the outside market as well. It has seen a modest increase in value. However, the Blockchain market is inherently volatile. Thus, we won’t advise you to invest in XLM (Stellar Lumens) right away.

That being said, the current market trends are shouting that stellar might be a good investment.

And here are the reasons:

Faster and cheaper transactions speeds

One Lumen costs less than a penny, a groundbreaking aspect of the cryptocurrency ecosystem. For those who wish to invest in the blockchain’s future, XLM provides a good entry point.

Furthermore, the currency uses anchors to create a faster exchange network.

Anchors are referred to as financial institutions, acting as ramps to facilitate the exchange of different cryptocurrencies.

The offering of a Smart contract

Stellar has started offering smart contracts in 2022. It has done to push for affordable transactions by removing exorbitant network fees. For instance, one transaction only costs 0.00001 Lumen.

Thus, for those of whom cross-border payment fees are a pain point, Stellar lumens’ smart contract-infused approach has resolved that.

Can handle fiat-based cryptocurrencies

Conventional currencies constantly butt heads with crypto because of the concept of legality. However, Stellar supports all fiat-based currencies. By bridging real and virtual money, it is merging crypto with conventional assets – inching blockchain towards getting full recognition across the globe.

Allows Chain Transactions

Stellar Lumens allows complex chain reactions on the platform. For instance, in the absence of a direct currency pair, stellar lumens can act as the bridge between the two currencies and ease the transaction process.

Stellar exchange

The stellar exchange allows for exchanging orders within the platform. The instant interactions of the order in the public ledger ensure no ambiguity exists in the transactions.

Price Predictions

Amidst a year marked by remarkable growth and a turnaround from the challenges faced in 2022, the network under scrutiny has experienced significant advancements. Notably, Arf, a Swiss-regulated global settlement banking platform, has teamed up with the Stellar Development Foundation to unveil an unprecedented offering: the world’s inaugural unsecured, short-term working capital financing solutions based on USDC for licensed financial institutions.

Coinme®, a well-known cryptocurrency cash exchange in the United States, has partnered with the Stellar Development Foundation to introduce Circle’s USDC on the Stellar network. This collaboration is a significant step forward in their joint effort to integrate USDC into Coinme’s extensive global cash onramp and offramp ecosystem.

The incorporation of USDC on Stellar has the potential to transcend borders as it facilitates the seamless conversion of physical cash into digital currency. This integration spans a vast network of locations, making digital cash easily accessible. By strategically integrating this technology, financial inclusion is enhanced, and cash transactions, transfers, and receipts operations are streamlined.

The Stellar Development Foundation has extended its involvement by investing a substantial amount of $5 million into Abra. This strategic move achieves dual objectives: integrating the Stellar network into Abra’s infrastructure and expanding the platform’s financial services portfolio.

Abra, known for its wide accessibility across hundreds of countries, initially entered the market by offering a variety of crypto assets. It briefly included equities but had to withdraw due to regulatory considerations.

This investment in Abra carries greater significance than just a capital infusion. It signifies a strategic partnership between Abra and Stellar, where the former has already secured almost $50 million in traditional venture capital. This collaboration solidifies Stellar’s position as a prominent player in the evolving financial technology landscape.

The Stellar Development Foundation’s investment ventures are not a novel occurrence. In fact, the foundation initially invested capital in DSTOQ Group Ag, a platform that facilitates global stock market investments. These series of investments manifest a deliberate endeavor to incorporate Stellar technology into various financial ecosystems.

These significant developments have sparked speculation about the future path of Stellar Lumens (XML), the native cryptocurrency of the network. Market observers and investors are closely monitoring these revolutionary collaborations and investments to gauge their potential impact on the cryptocurrency’s value in the coming days.

Analysts’ predictions are nuanced, with technical indicators signaling a bearish sentiment. This sentiment is further echoed in the Fear & Greed Index, which registers a neutral stance with a reading of 54.

The fate of Stellar Lumens in the ever-changing world of cryptocurrencies is yet to be determined. People eagerly watch as partnerships, investments, and technological integrations shape its future. All attention is focused on the price charts, revealing the ongoing dynamics of the market.

Performance of Stellar XLM

Looking retrospectively at the trajectory of XLM’s price, 2021 was nothing short of remarkable. Stellar witnessed a meteoric rise of 108% in its price, capturing the attention of both seasoned and novice investors. In this period, the Stellar Foundation’s quarterly report for 2021 demonstrated impressive year-over-year growth figures, highlighting the robustness of its network.

An outstanding achievement was the considerable expansion of the network itself. Its numbers grew remarkably by 35.57%. Additionally, the Stellar network experienced an astounding surge in total payments processed, with an impressive increase of 372.19%. Moreover, the network’s decentralized exchange (DEX) witnessed significant growth as the average daily trading volume soared by a staggering 962.94%.

During the given period, Stellar Lumens (XLM) displayed a significant upward trend in value. It commenced the year at a modest 0.13 and nearly doubled to reach 0.27 by the end of the year. The peak of this surge was observed in May 2021 when XLM briefly touched an impressive value of 0.70.

The crypto landscape is seldom a smooth journey, and Stellar Lumens experienced fluctuations as it entered 2022. Beginning the year at 0.2763, the currency encountered various ups and downs, reaching peaks of 0.2713 and 0.2627 in January.

Global events caused XLM’s decline, reaching its lowest point at 0.192 on January 22. The latter half of 2022 portrayed a subdued outlook for XLM, with its price dwindling to around $0.10 by September and further dropping to $0.07 by December.

In 2023, the year presented mixed results for XLM. Although there were modest gains in the price trajectory, with it holding steady at $0.08 and experiencing a growth of 1.35% during the initial months, it became evident that the crypto was still influenced by broader market fluctuations, as observed in other prominent cryptocurrencies.

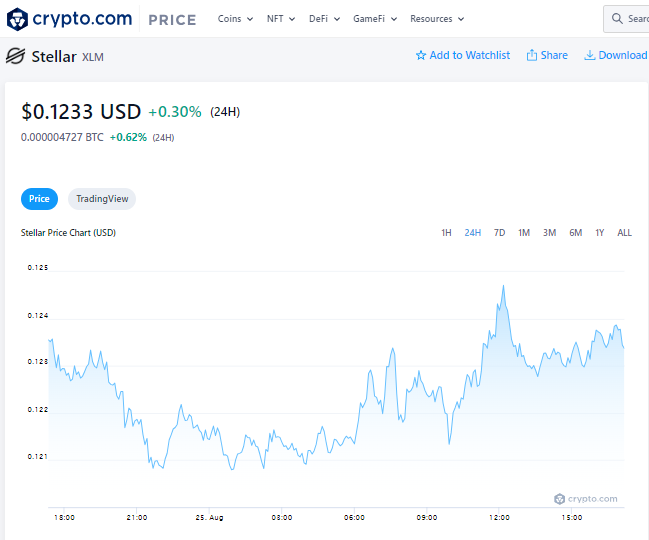

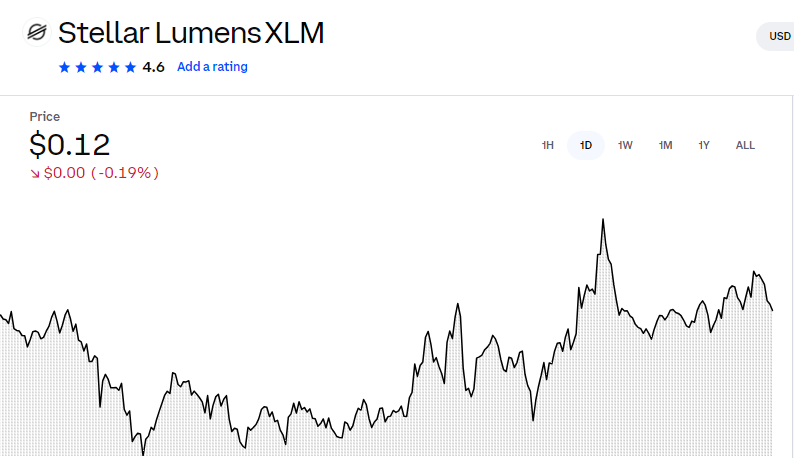

Presently, Stellar is valued at $0.123883, with a 24-hour trading volume of $146.38M and a market capitalization of $3.37B, maintaining a market dominance of 0.32%. Over the past 24 hours, XLM’s price dipped by -0.92%.

XLM’s historical data reveals interesting milestones. On January 4, 2018, it reached its all-time high of $0.930121, whereas its all-time low of $0.001227 was recorded on November 18, 2014. Following its ATH, XLM’s lowest price reached $0.027660, while its highest post-cycle low reached $0.796465.

With a circulating supply of 27.31 billion XLM out of a maximum supply of 50 billion XLM, Stellar maintains a yearly supply inflation rate of 8.17%, creating 2.06 billion XLM in the past year. Regarding market capitalization, Stellar secures the top spot in the Stellar Network sector and holds the 14th position in the Layer 1 sector.

Over the past 30 days, Stellar witnessed 14 out of 30 green days, with price volatility of 7.04%. As Stellar continues its journey through the cryptocurrency landscape, market participants are reminded of the inherent risks of investing in such dynamic assets.

What are the risks of buying Stellar (XLM)?

Before you invest in Stellar, you should understand the risks involved. A blockchain is a diversified place where things can change quickly. And while Stellar has done all it can to make the market more conducive and welcoming, there are certain aspects that you cannot ignore.

Volatile market

Even though stellar maintains a good position in the graph, that can change rapidly with time. We have witnessed the downward trend in Jan, picking back up.

Afterward, the crypto market was in shock after lumens went to the lowest, closing at 0.17 at the start of March. One can say that because stellar is so intertwined with other crypto-currencies, acting as a facilitator of cross-border transactions, it is susceptible to changes in the market.

Tokens have ended

No more tokens are being produced by the platform anymore. There are 50 billion tokens in total, out of which 20 billion are available on the secondary market, and 30 billion tokens are utilized for Stellar’s development.

But that development is slow. And even though a plan exists to release the remaining 30 billion coins to the public, the progress has been slow. And that sluggishness leaves them susceptible to market volatility.

People are dogmatic about leaving competitors.

Stellar has many competitors, including goliaths like ETHEREUM, RIPPLE and others. They bear a bigger and better portfolio than Lumens. Thus, although people are interested in Lumens, their choice is driven by cheapness.

The critical reason behind this is the lack of communication. Stellar is trying to evolve, but it is not communicating its intentions clearly.

As a result, people are apprehensive about seeing Stellar Lumens as an alternative.

Ways to buy Stellar (XLM)

What is your preferred method to enter the crypto ecosystem? Whatever your approach is, the top-rated brokers in the market are ready to help you.

As the blockchain ecosystem grows accustomed to creating a conducive environment for newcomers, most trading platforms welcome standard payment methods.

Thus, you can choose between the following ways to get your hands on Stellar XLM.

Purchase Stellar using conventional credit and debit cards

It is an option for you if you have an account with eToro or Coinbase –regulated online brokers with a good history. Debit and credit cards are viable on those platforms, allowing you to directly invest your money in stellar.

However, the charges are higher, with Coinbase charging 3.99% and Crypto.com charging 3%.

However, both those platforms, including eToro, take the fee-free approach for USD-backed credit or debit cards.

Buy stellar with PayPal.

Seeking to invest in Stellar using wallets? Yes, there are options available to you, and all it requires is a verified account on Coinbase. However, charges are high. Thus, eToro is a more prudent option if you want to leverage your wallet to invest in Stellar Lumens.

Choosing the best Stellar XLM wallet

If you genuinely want to feel like you belong to the blockchain atmosphere, you need to take an approach traditional to the ecosystem – crypto wallets.

However, before choosing the best wallet to store your lumens, keep the following points in mind:

- Maintain a minimum Balance: Your wallet should have had 20 XLM at all times to remain active. However, since Stellar has become more open and is on the path to making blockchain more welcoming to outsiders, you only need 1 XLM in your wallet.

- Look at the security features: You can watch your real wallet, but digital wallets need robust digital security. Therefore, don’t shy away from looking for wallets with security features such as encryption, two-factor authentication, PIN and password.

- Find out about restoring during a crisis: Wallets must offer you a way to salvage your coins. Without a back- up feature that should be present, investing in blockchain becomes a risky prospect. Therefore, choose a wallet that provides you with the Recovery option.

- Support from the developers: Crypto wallets can act out sometimes; they are digital tools, after all. Thus, when features mess up your wallets, good customer support is what you need.

Thankfully, Binance, Crypto.com, and eToro encompass these aspects.

eToro wallet – Many traders and investors prefer it for storing NFTs and Crypto

Now that you know the different ways you can take to invest in XLM let us expand upon the previous process.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

How to buy stellar – The Complete tutorial

Now it is time for you to know how to buy XLM more comprehensively than we discussed earlier.

Step 1: Create a crypto account on eToro

Your first task is to open a Crypto account on the platform we consider the best one yet, eToro.

Account creation is a hassle-free process requiring you to only provide rudimentary information, including full name, home address, telephone number, and email. Then, proceed to choose a solid password to complete the process.

Step 2: Upload your Identification documents

Not just anyone can be allowed to be a part of the elusive crypto ecosystem; it is a tech-intensive platform hosting human members. Thus, as per the anti-money laundering regulations, you must provide a copy of your government-issued identification document to eToro.

You’ll also need to upload proof to verify the authenticity of your residence. Thus, keep an electricity bill handy by your side.

Step 3: Deposit funds

Verification leads to access to your account. And once you have access to your dashboard, start by depositing funds in your eToro wallet. You have to put a minimum $10 deposit on the platform, and you can opt for either a debit card, credit card, or bank transfer.

Step 4: Search for Stellar Lumens

Enter “Stellar Lumens” in the search bar. You will land on the relevant page. Once there, load up the order form by clicking on the “Trade” button.

Step 5: Purchase XLM

Choose how much investment you want to put in and click on the “Open Trade” to finalize your transaction.

How to sell stellar?

Once you have purchased the Stellar Lumens (XLM) tokens, eToro will store them in your wallet. Whenever you desire to sell your coins, just go to your dashboard, select the lumens and “execute sell order”. After-sale, the USD equivalent value of the tokens will be added to your account.

Conclusion

Stellar (XLM), due to its affordability, fast processing and conducive approach toward crypto, can prove to be a game-changer.

By providing highly scalable transactions combined with simplicity, effortless cross-border transactions and ease of use, it has genuinely become desirable for crypto enthusiasts.

So, if Stellar XLM matches your requirements, buy it using eToro.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

What is XLM?

XLM is Stellar Lumens, the Native token of Stellar, and it is considered one of the best performing altcoins in the market today.

Where to buy XLM?

XLM is among the top 10 cryptocurrencies in the market, and thus, you have a wide array of trading platforms. But, eToro is the best platform to purchase XLM.

How many XLM coins remain?

There are 20 billion XLM coins in circulation, and stellar is planning to release the remaining 30 billion tokens in future.

Bitcoin

Bitcoin

Comments are closed.