Despite the significant crypto dip, the popular crypto platform eToro has released some new cryptocurrencies on its platform to give investors some respite. One of three new cryptocurrencies added to eToro this week is Serum (SRM).

Serum is a decentralized exchange (DEX) ecosystem that delivers decentralized finance at exceptional speed and cheap transaction fees (DeFi). It is the only high-performance DEX built on a central limit order book and matching engine that is fully on-chain. Serum’s on-chain order book allows ecosystem partners to share liquidity and fuel their trading services for institutional and retail consumers.

If SRM is one of the latest digital assets that you want to add to your portfolio, this guide will share details on how to buy SRM in minutes via an SEC-regulated broker.

How to Buy SRM Coin – Quick Steps

- Step 1: Open an eToro Account

To get started, create an eToro account. Fill out the relevant details after clicking the ‘Join Now’ button. After that, upload a copy of your ID to confirm your account.

- Step 2: Deposit Funds

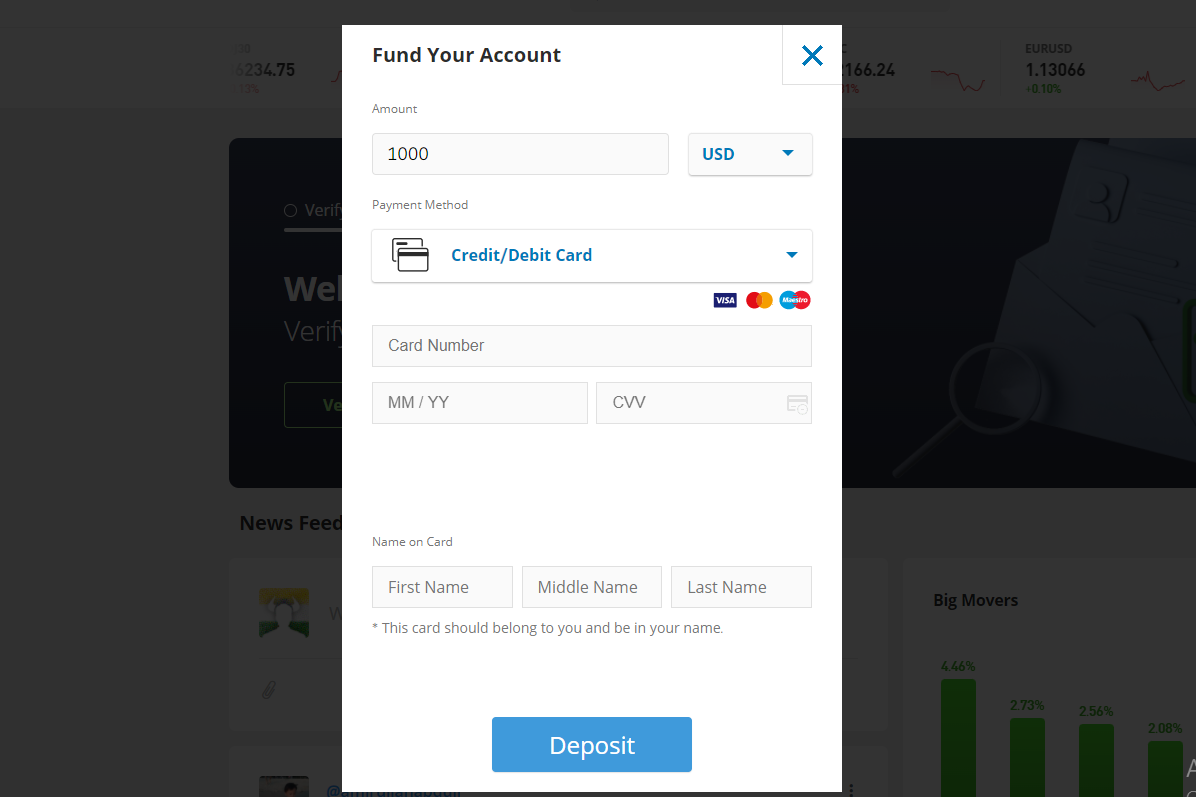

eToro offers free fiat currency deposits, and US customers only need to invest $10. You can use a debit or credit card, PayPal, a bank wire, or any other method that is supported to make a payment.

- Step 3: Search for SRM Coin

To get right to the relevant investment page, search for ‘SRM’ and click ‘Trade.’

- Step 4: Buy SRM Coin

Finally, start with $10 and tell eToro how much you want to put into SRM. Click ‘Open Trade’ to confirm.

Your capital is at risk

Where to Buy SRM Coin?

1. eToro: Overall Best Place to Buy SRM Coin in 2024

At the top of our list of the best places to buy SRM coins is eToro, a certified online platform founded in 2007.

With eToro, you can buy SRM on a spread-only basis, which means that you will only be charged the difference between the buy and sell price at the moment of the order rather than the usual charges.

According to eToro, spreads on cryptocurrency transactions start at just 0.75 percent when buying Bitcoin.

When you fill your eToro account in US dollars, there are no deposit fees. All accepted deposit and withdrawal methods, including debit/credit cards, ACH, online banking, and domestic wire transfers, are subject to this rule.

On eToro, the minimum deposit for US customers is only $10. You may obtain SRM for as little as $10 with eToro’s fractional crypto purchases.

In addition to SRM, eToro covers around 60+ more digital assets. On eToro, the most popular coins are Bitcoin, EOS, Cardano, Litecoin, Dogecoin, Ethereum, and XRP. Binance Coin (BNB) is also available with a 2.45 percent average spread.

eToro also offers traditional asset classes such as the US and foreign equities, ETFs, FX, indices, and more. The eToro Crypto Portfolio is a beautiful solution if you want to buy SRM while also having exposure to other digital assets.

The eToro Crypto Portfolio is a passive financial product that allows you to invest in a variety of cryptocurrencies at various weights with a single investment. Because eToro manages the portfolio, you won’t have to worry about research or upkeep. You can buy SRM money on eToro’s main website or through its iOS/Android app, depending on the available platforms.

The Securities and Exchange Commission (SEC) regulates eToro, and it is also registered with the Financial Industry Regulatory Authority (FINRA). As one of the most prominent crypto staking platforms, eToro is also an excellent choice for SRM staking.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

- It has a larger pool of popular coins than other well-known exchanges

- The commission rate is 0%.

- Competitive spreads are available depending on the type of cryptocurrency

- Copy trading tool for investors to mimic the transactions of other traders

- Virtual Portfolios and a variety of teaching tools for first-time investors

- Social connectivity platform available

- Both desktop and mobile devices are supported

- Mobile application that is simple to use

- Transparency in fees

- The demo account has a $100,000 virtual balance

- Offered only in a few states in the US

- The number of investment options is restricted

- It may not be relevant to traders looking for advanced technical analysis

- Withdrawal charges

- Inactivity penalties

Your capital is at risk

2. Crypto.com – Simplest Place to Buy SRM Coin using Debit Card

Crypto.com is one of the most well-known cryptocurrency exchanges today. The platform aims to provide users with a straightforward, low-cost option to invest in digital assets.

Once you’ve completed the process of opening a Crypto.com account and proving your identity, you can purchase SRM currency with a debit card. A 2.99 percent commission is applied when purchasing SRM through Crypto.com. Conversely, the platform waives the fee for the first 30 days after signing up. In addition to SRM, Crypto.com has over 250 distinct digital currencies.

- Impressive variety of cryptocurrencies for trading

- Lower fees on cash transfers compared to other exchanges

- Transparency in fee structure, several reductions available

- Mobile-friendly

- Clean and simple interface

- DeFi tokens are also available on the platform

- Transparent communication of relevant information like investment premiums, supported assets, and account-related directions

- Visa cards can be used to earn incentives on crypto spending

- Higher interest rates than even the highest-yielding savings accounts

- Tax assistance

- High fees for debit and credit card transactions

- Some services are still out of bounds in the US

- Crypto-to-crypto trading is not currently possible

- Customer service can be improved

- Trading fee savings are difficult to navigate

- Educational resources not extensive

Your capital is at risk

3. Binance: Buy SRM at Just 0.10% per Trade

If you are looking for the cheapest way to buy Serum crypto, Binance is a good option. Because of its low expenses, over 100 million traders currently use this top-tier exchange.

Binance will only charge you 0.1 percent when you swap SRM for supported digital currencies like Bitcoin, Ethereum, BNB, or USDT.

You must, however, be able to deposit payments in Bitcoin to take advantage of the minimal charge structure. This is because depositing cash with a debit or credit card costs 4.5 percent, while buying SRM with USD costs an additional 0.5 percent.

Using the Binance US website, you can access over 60 more digital currencies. Both large-cap blockchain assets like Bitcoin, Ethereum, and Cardano, as well as less liquid ERC-20 tokens, are included in the list.

Regardless of how you choose to pay for your SRM investment, Binance offers a range of storage options. This includes its Trust Wallet program, which gives users access to the popular decentralized exchange PancakeSwap.

- Fast account creation process

- Low fees

- Several cryptocurrency pairs are available

- Safe and secure multi-currency wallet

- Abundant liquidity

- Plenty of educational resources

- Multiple deposit options

- It is not ideal for beginners due to its complexity

- Has run into regulatory issues in the past in several countries

Your capital is at risk

What is Serum (SRM)?

Today, users and developers feel limited by high gas costs and delayed transactions due to the popularity of DeFi and the expansion of DEXes on Ethereum. Serum intends to address these common DeFi difficulties, along with those of centralization, inadequate capital efficiency, and liquidity segmentation.

Project Serum is a collaborative effort by FTX, Alameda Research, and the Solana Foundation that is open source.

The Serum Foundation, which is sponsored by a group of specialists in cryptocurrencies, trade, and decentralized finance, is now funding its development. Many of the project’s design and thought leadership come from companies in the cryptocurrency and finance industries.

Traders and composing projects benefit from Serum DEX’s on-chain central limit order book and matching engine, which enables liquidity and price-time-priority matching.

The flexibility to determine the price, size, and direction of their trades is a feature of this exchange model for users. Serum’s existing architecture, bootstrapped liquidity, and matching service assist composing projects.

Serum is based on Solana and requires no permissions. The web-scale blockchain Solana is capable of 50,000 transactions per second with block durations of 400 milliseconds.

This is accomplished using the SHA 256 hash chain, which is a verified delay function. The design of Serum is intended to ensure that DeFi can compete with centralized services.

Visit eToro to Buy SRM Token Now

Your capital is at risk

Is SRM a Good Investment?

The crypto industry is evolving unpredictably, with new projects popping up now and then. New project interest has continued to rise as they provide investors with higher returns on investment. Serum is an example of a crypto project with both current and future revenue potential and major use applications.

Unlike most Ethereum-based decentralized exchanges, Serum takes advantage of Solana‘s strong performance to provide users with a regular order book. Users, however, do not trade directly on Serum; it is simply a contract on the Solana blockchain.

Unlike decentralized exchanges like Uniswap and Curve, which use the automated market-making methodology (AMM), Serum provides traders with a small order book and matching engine.

Traders are not limited to putting market orders; they can also place orders at other prices, giving them a similar experience to a centralized exchange. Serum can be used by any crypto project with a token to boost liquidity and provide a trading matching service.

Here are some of its key features and services elaborated:

Order Books

Customers benefit from Serum’s online central limit order since it matches price-time priority for transactions and composing projects. Buyers can pick the price of Serum, the size of trades, and the direction of trades in this exchange mechanism.

Projects benefit from the Serums’ established infrastructure, matching service, and bootstrapped liquidity. Serum can match derivatives orders and spot market orders (psyOptions, Offpiste, HXRO).

Serum Core

Serum’s asset-agnostic order book and backend matching engine help match any Solana-based products, including options, futures, and other financial instruments. The asset-agnostic order book can also be used as a backend matching engine for other applications.

True Composability

Serum strives to preserve consistency in design and composability. Serum-based programs will be more adaptable. It offers various uses and allows purchasers to share middleware in one location. The Serum order book is designed to complement Serum’s architecture and increase its versatility.

Solana Speed and Cost

The serum is an SPL-token asset specialist. Minimal transaction latency, low costs, great throughput, and security are some benefits of using Solana.

With a block time of 400ms and a transaction rate of approximately 50k per second, the Solana blockchain does not require sharding. Solana has an Ethereum bridge and follows a policy of doubling capacity and improvements every two years.

Cross-Chain Swaps

Tokens existing on another platform can be easily traded on Serum. The cross-chain method operates when both parties submit ETH to smart chain contracts, like in the case of the cross-chain exchange between ERC-20 tokens.

Serum enables users to create their own cutting-edge DEX, integrate the Serum swap functionality, and use Serum as a liquidity layer and matching engine for protocol features.

Other Services

Serum’s decentralized on-chain order matching service gives developers freedom and control when dealing with apps.

Compared to power-based trading features, Serum’s decentralized exchange provides more pooled liquidity and shared resources. Validator nodes on Serum can get entrenched in one of two ways: through voting or delegation.

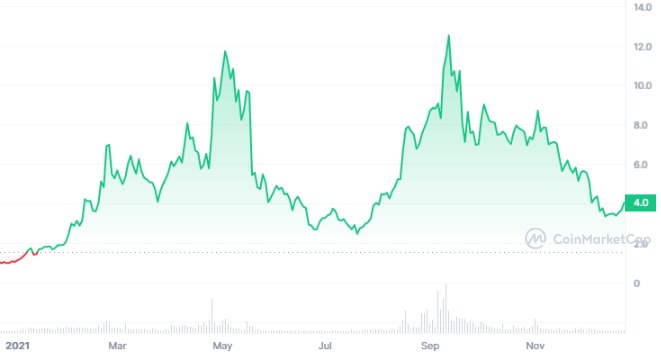

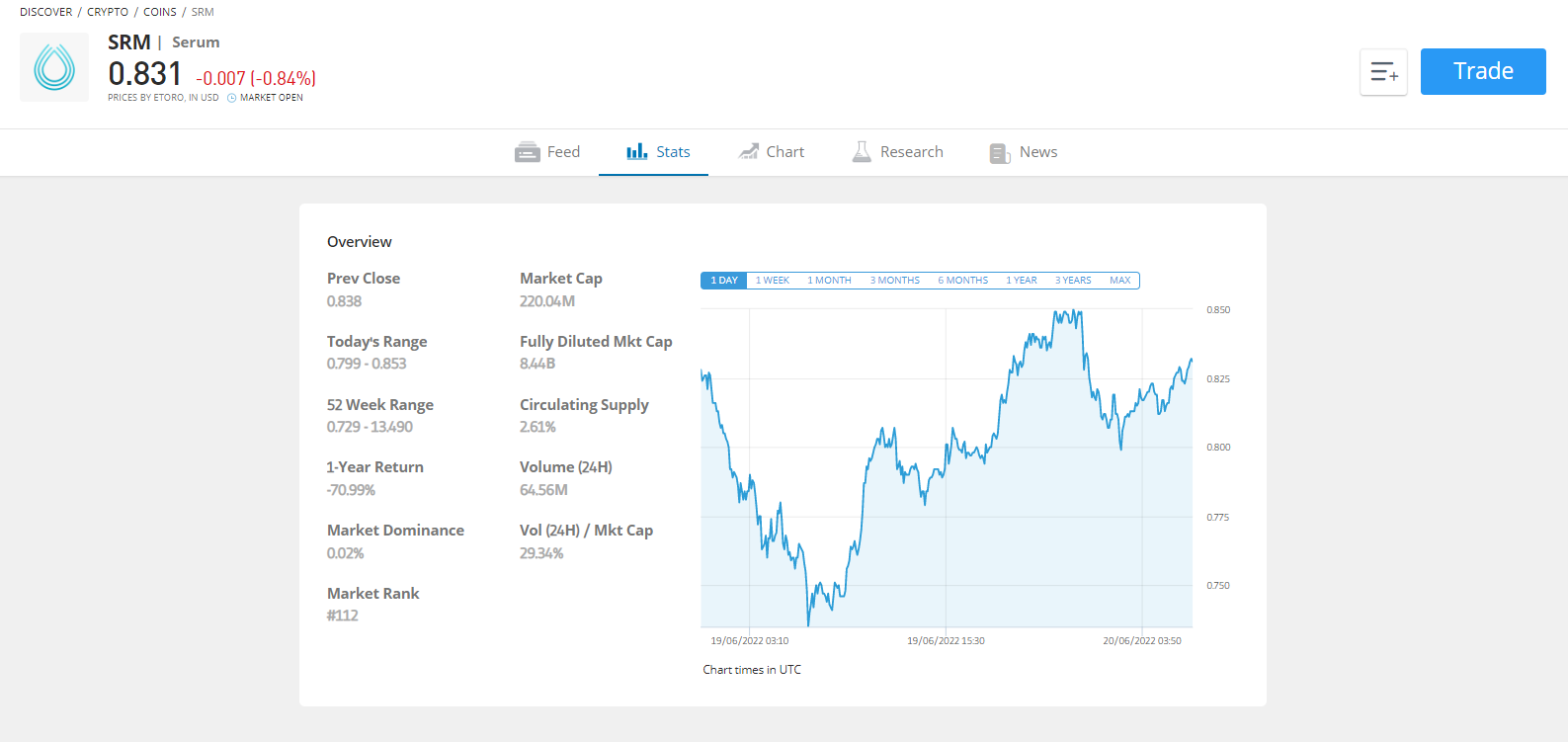

Serum Price

The question of whether it’s worthwhile to invest in Serum (SRM) during 2023 becomes a subject of scrutiny. To make an informed assessment, understanding the trajectory of SRM’s price history is crucial for interpreting ongoing trends and predicting potential future outcomes.

Serum, an entrant to the market in 2020, made a striking debut at $0.11 on August 11. Rapidly surging to $1.69 the following day, its early journey reflected the dynamic nature of the cryptocurrency market. The year 2021 witnessed a bullish phase for SRM, propelled by a robust crypto market. On May 3, SRM reached an impressive peak of $12.89.

A significant milestone came on September 11, 2021, coinciding with the announcement of the burning of 131,000 SRM tokens in a single week. This event propelled SRM to an all-time high of $13.72. However, the subsequent trajectory saw a decline, with SRM concluding the year at $3.42.

The year 2022 proved challenging for SRM, mirroring the broader crypto market trends. Despite initial fluctuations, the token experienced a sharp decline to $0.9794 on May 12, 2022, triggered in part by the de-pegging of the UST stablecoin and the subsequent collapse of the associated LUNA cryptocurrency. The situation worsened in June when SRM dropped to $0.7517 following the suspension of withdrawals by the Celsius Network (CEL) crypto lending platform.

While there were intermittent recoveries, SRM faced headwinds. An encouraging spike to $0.869 on November 5 was followed by a stark plunge to $0.1707 on November 14 due to the collapse of FTX. By the end of the year, SRM stood at $0.1428.

Stepping into 2023, SRM displayed renewed promise, trading at approximately $0.1555 in January. The early months of 2023 witnessed steady growth, hinting at a potential turnaround.

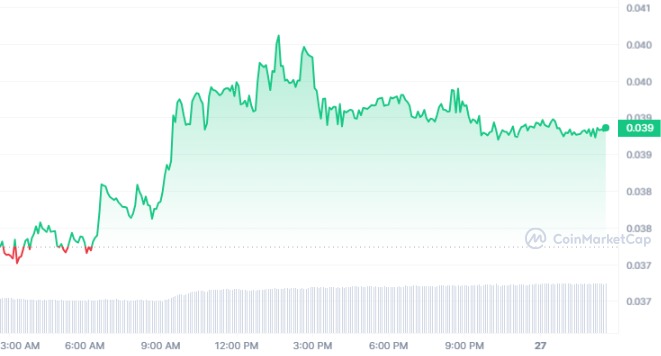

As of the latest update, the live Serum price stands at $0.039070, with a 24-hour trading volume amounting to $1,783,788. Impressively, SRM has surged by 4.70% within the last 24 hours, a testament to its volatile yet potentially rewarding nature. Presently occupying the #742 rank on CoinMarketCap, SRM boasts a live market capitalization of $10,284,863.

The circulating supply of SRM coins amounts to 263,244,669 out of a maximum supply of 10,161,000,000 SRM coins. These figures underscore the token’s potential for growth and its overall market positioning.

However, Serum’s price history paints a picture of volatility and resilience. While past performance doesn’t guarantee future results, the ongoing positive momentum in 2023 raises intriguing prospects for potential investors considering the token’s journey so far. The dynamic nature of the cryptocurrency market, however, calls for cautious assessment and an understanding of the underlying factors influencing SRM’s value.

SRM Price Prediction

Serum is poised for significant adoption. Its native token, SRM, stands to benefit from this surge in popularity. As Serum expands its services across different blockchains, it aims to safeguard its platform’s future and attract a larger user base. Despite optimistic price forecasts, achieving a new all-time high for SRM may require a patient approach.

As of August 27, 2023, the prevailing sentiment in the Serum price prediction landscape leans toward bearish. Out of the analyzed technical indicators, 12 indicators suggest bullish signals, while 18 indicators point to bearish signals. This divergence in technical analysis indicators underscores the uncertainty surrounding SRM’s price trajectory.

According to our technical assessment, Serum’s 200-day Simple Moving Average (SMA) is projected to experience a decline in the coming month, potentially reaching a value of $0.130397 by September 25, 2023. In the short term, the 50-day SMA is anticipated to reach approximately $0.042704 by the same date.

The Relative Strength Index (RSI), a widely followed momentum oscillator, offers insights into whether a cryptocurrency is oversold (below 30) or overbought (above 70). Presently, the RSI value for SRM is calculated at 23.89, indicating an oversold market condition. As per RSI analysis, this suggests that the price of SRM is likely to experience a decrease in the near future.

However, the current dynamics surrounding Serum’s price prediction indicate a bearish sentiment among technical indicators, compounded by the oversold position signaled by the RSI. While the platform’s expanding utility and adoption potential remain promising, investors and observers should be prepared for a potential decline in SRM’s price in the coming weeks based on the present analysis.

Your capital is at risk

Ways of Buying SRM

The payment method you choose determines the best way to purchase SRM. When you choose one of the top-rated brokers listed above, you have the option of making the following deposits:

Buy SRM using a Debit or Credit Card

After you’ve opened an account with an authorized online platform like eToro, you can buy SRM with a credit or debit card.

This payment method lets you invest in SRM tokens immediately because your chosen broker will debit your card and then add the digital assets to your portfolio.

On the other hand, some brokers charge high fees for credit and debit card transactions. Coinbase has a 3.99 percent fee, while Crypto.com has a 2.99 percent fee. EToro accepts fee-free USD-backed credit and debit card deposits.

Buy SRM using PayPal

You have a few options to buy SRM coins using PayPal.

For example, after validating your Coinbase account, you can complete the transaction. Like credit/debit card payments, fees are 3.99 percent of the transaction amount. Using eToro, you can buy SRM with PayPal and avoid paying any deposit fees.

Buy SRM without KYC Verification

You can buy SRM before the KYC process only if you have a Bitcoin wallet.

You can use an illegal exchange to deposit Bitcoin and then swap the tokens for SRM. As part of the anti-money laundering process, you will always be asked to upload some identity when purchasing SRM with fiat money via credit/debit card or PayPal.

Best SRM Wallet

Now that you know how to invest in SRM coins, you must consider how you want to hold your digital assets. This is the circumstance since SRM tokens are typically saved in private wallets that may be downloaded as a mobile app or a desktop program.

Some of the leading businesses in this sector are Phantom Wallet, Sollet, and Solflare Wallet. These wallets provide complete control over your SRM cash; only you can access your private keys.

Afterward, you must take a few security precautions to protect your SRM tokens from being remotely hacked. If you want a more beginner-friendly solution, you might want to look into the eToro Money Crypto Wallet.

Your capital is at risk

How to Buy SRM Crypto – A Tutorial

The methods below will take you through the process of buying SRM coins safely and cheaply, whether to invest in them or use them to buy the best NFTs via the top-rated platform eToro.

This SEC-regulated platform, as previously indicated, not only allows you to trade SRM on a spread-only basis, but it also has a $10 minimum trade.

Step 1: Open an eToro Account

Create an account on the eToro website to begin the SRM investment process. When you click the ‘Join Now’ button, a form will appear. Fill out the form with your full name and contact details.

When you select the ‘Create Account’ option, you will be asked for additional information such as your home address, date of birth, and social security number.

Step 2: Upload ID

You must authenticate your identification before buying SRM cryptocurrency with US dollars on eToro. This fully automated process takes no more than 1-2 minutes to complete.

To establish your identity, upload a copy of your state ID card, passport, driver’s license, bank account statement, or utility bill to verify your address.

Step 3: Deposit Funds

To buy SRM, make a minimum deposit of $10 into your eToro account. eToro takes some different payment methods, including Visa, MasterCard, and ACH, to mention a few.

PayPal and Neteller, to mention a few, are accepted e-wallets. You will not be charged any fees if you use a payment type denominated in US dollars.

Step 4: Search for SRM

At the top of the eToro dashboard is a search bar. You can now start typing the word ‘SRM’. Then, from a drop-down choice of eligible markets, eToro will choose SRM. When you see SRM, click ‘Trade.’

Step 5: Buy SRM

All you have to do now is tell eToro how much money you want to invest in SRM coins. This can be any amount of money in US dollars, ranging from $10 to $10,000. To confirm your investment, click ‘Open Trade.’

Your capital is at risk

Conclusion

Given Serum’s predictions, features, and immense potential holding the Serum token (SRM) for an extended period of time could be a wise investment. These projections, however, aren’t necessarily the most critical factor to consider when making a purchase.

Fundamental analysis, technical analysis, and other market characteristics all impact investment decisions. Finally, doing your study rather than relying on price estimates to form a judgment is a great alternative.

SRM’s price will eventually fluctuate with market swings, so investors should watch it. Invest just what you can afford to lose, as always.

If you want to add SRM money to your portfolio right now, you can do so in around five minutes using the SEC-regulated provider eToro. You may buy SRM tokens instantaneously and without fees using a debit/credit card or an e-wallet, and eToro only asks for a $10 minimum initial investment.

Read More:

FAQs

Where can I find SRM for the best price?

After examining several leading cryptocurrency brokers and exchanges, we discovered that eToro is the best place to buy SRM. It just takes a few minutes to set up a verified trading account, and you may buy SRM tokens with a debit/credit card, e-wallet, or bank transfer.

Is it a good idea to invest in SRM?

It seems like a good idea to invest in SRM right now. Once phase 3 is completed, Serum might get a lot of traction, and its native token could earn a lot of value. Serum is working to future-proof its platform and expand its user base as it expands into cross-chain services. SRM price expectations are bullish, but it may take some time to reach a new all-time high.

Is it possible to buy SRM using PayPal?

SRM is not on PayPal's list of approved crypto marketplaces. eToro, an SEC-regulated broker, does, however, accept PayPal for SRM purchases.