Loopring (LRC) is an open protocol to develop decentralized crypto exchanges. Furthermore, the protocol enables users to construct a non-custodial, order book-based exchange on the Ethereum network by utilizing zero-knowledge proofs (ZKPs). Users have ownership over the private keys using the non-custodial exchange, allowing them to keep the crypto and assets secure. Loopring is purported to be a new DeFi system that employs a variety of virtual currencies, including LRC, its native utility coin.

The protocol aims to promote a global network of users to run a platform renowned for facilitating the development and production of new types of crypto-asset exchanges. Loopring claims that its exchanges can enable speedier settlement for traders by utilizing Zero-knowledge rollups or zk-rollups. Zk-rollups is a Layer 2 scaling technique that allows blockchains to validate transactions quickly while maintaining cheap gas prices. The Loopring platform, which uses cryptography (zk-rollups), allows exchanges to build on top of it to avoid the slow speeds and high costs associated with decentralized exchanges on Ethereum.

Do you still have questions concerning Loopring’s operation? Read on for our ‘What is Loopring?’ in-depth guide.

On this Page:

How to Buy Loopring

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Where to Buy Loopring- Best Platforms

Loopring is an Ethereum currency that self-describes as “an open-sourced, audited, and non-custodial trade protocol.” Its goal is to allow anyone to build non-custodial, order book-based exchanges on Ethereum using zero-knowledge proofs.

We have narrowed down the top platforms to buy Loopring after extensive study. Our list of platforms to buy Loopring in 2024 contains their features, fees, and why each is unique. These platforms are safe, reasonably priced, and easy to use.

1 – Huobi

Huobi Global, headquartered in Singapore, was founded in 2013. Initially based in China, the company relocated to Singapore following China’s cryptocurrency ban. The exchange calls itself a digital asset exchange rather than a cryptocurrency exchange. It supports ICO tokens and allows trading in over 350 cryptocurrencies. According to the company, the future development of the blockchain economy will result in the creation of new categories of digital assets.

Huobi Global has three platforms: one for the entire world, one for Huobi Japan, and one for Huobi Korea. This exchange’s services are not available to US traders. It provides a sophisticated trading experience, including margin and futures trading, interactive charts, and limit and stop orders. The platform provides up to 5% leverage for margin trading. HuobiGlobal’s fee structure is very reasonable and comparatively low.

Deposit – The minimum deposit fee is $100 USD, and additional fees, such as deposit, transaction, and withdrawal, vary by currency.

Fee – Huobi charges a higher fee for those purchasing cryptocurrency using a credit or debit card. Maker and taker fees are charged at a flat rate of 0.2%. It can also be as low as 0.1 percent, depending on the volume of the scale.

Huobi Global provides customer support via email, phone, online chat, ticket system, and social media. It protects users with multiple layers of security, including two-factor authentication, cold storage, account freezing, and Bitcoin reserves.

Huobi listed Loopring on September 15, 2022. The trading pairs available include LRC/USDT, LRC/BTC, and LRC/ETH.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- Complex account registration process

Your Capital is at Risk

2 – Crypto.com

Crypto.com, a global cryptocurrency exchange, was founded in 2016. It is based in Hong Kong and serves over 10 million traders in over 90 countries. It lets you buy and sell over 250 cryptocurrencies with relatively low trading fees. The Crypto.com platform’s unique selling point is that it allows users to stake their cryptocurrency. Users can earn up to 14.5 percent p.a. interest by staking or holding them in a crypto.com wallet.

Aside from trading, the exchange offers other services such as staking rewards, Visa card benefits, NFT trading, DeFi products, and more. The exchange provides access to various educational guides through its university portal. This platform is appropriate for users who want to do more with their cryptocurrencies than simply hold them.

Security – Crypto.com employs some security measures, including MFA, which stands for multi-factor authentication. It also employs whitelisting to protect customer accounts. The platform employs compliance monitoring to prevent hacks and losses and stores customer deposits offline in cold storage.

Cashback – Besides the Obsidian Card, Midnight Blue Card, Ruby Steel Card, and others, Crypto.com offers five prepaid Visa cards. These cards are accepted anywhere Visa is accepted and guarantees a certain percentage of cashback on purchases. The Obsidian card offers the highest cashback rate of 8% under certain conditions. The Midnight Blue card provides 1% cash back, while the Ruby Steel card provides 2% cash back. There is no annual fee for using the card, and ATM withdrawals are also free, depending on the card.

Deposit – This platform’s minimum account balance is $1. The Maker/Taker fees range between 0.04 and 0.40 percent. Credit/debit card purchases are charged at 0% or no fee during the first 30 days of account opening. In addition, users can earn up to $2000 for each friend they refer.

Crypto.com listed Loopring (LRC) on August 05, 2021. Users of the Crypto.com App can now purchase LRC at a true cost in USD, EUR, GBP, and 20+ fiat currencies and spend it at over 60M merchants worldwide via the Crypto.com Visa Card.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

Your Capital is at Risk

3 – Bybit

Bybit exchange primarily delivers endless futures products with a leverage of 100:1. This suggests they are striving to contest with established exchanges such as Binance and Phemex, which deliver comparable non-expiry futures contracts. While the exchanges have particular commonalities, Bybit presents some special benefits over its competitors. For instance, we’ll enclose these aspects when we speak about their trading technology. Most traders from around the globe can use the exchange, and the site has been translated into English, Chinese, Korean, Japanese, and Russian; however, Bybit does not serve in certain jurisdictions, including the United States, Syria, and the Canadian province of Quebec.

Ben Zhou founded the company in March 2018. He was the general manager of XM, a forex brokerage company before evolving the exchange’s CEO. Ben Zhou put together an A-team of investment banking and fintech professionals who had formerly worked for Alibaba, Tencent, Morgan Stanley, and other well-known companies. As a result, the Bybit exchange now contains blockchain experts and seasoned currency dealers. Bybit is one of the fastest-growing cryptocurrency exchanges, with over 3 million registered users.

Bybit supports five cryptocurrencies for trading: BTC, ETH, EOS, XRP, and USDT. Each asset will have its wallet by default, but Bybit will calculate your equity in BTC. If you have any of the coins listed above saved elsewhere, you can move them to your Bybit wallets and start trading with them. Bybit’s Fiat Gateway can be used to purchase cryptocurrency. The Fiat Gateway takes Bitcoin, Ethereum, USDT, and 45 fiat currencies such as the US dollar, Australian dollar, Euro, and pound sterling. Market takers pay 0.075 percent, while market makers pay -0.025 percent. As a result, they will be compensated when a market maker opens a transaction. This low cost encourages market makers to stay active and fill the order book.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Crypto derivatives are extremely risky

- Not suited to spot trading

- May share your data with third parties for marketing

Your Capital is at Risk

4 – Binance

Binance is one of the largest cryptocurrency exchanges in daily transaction volume, with over $20 billion in daily transactions. It allows you to access hundreds of assets and a smooth trading environment that makes it simple to generate money.

Binance’s most notable features include minimal fees, extensive charting choices, and hundreds of cryptocurrencies. Binance is a cryptocurrency-only exchange that does not provide copy trading, forex, commodities, or other services.

Binance uses two-factor authentication (2FA) verification and FDIC-insured US dollar (USD) deposits. Moreover, Binance also uses device management in the United States, address whitelisting, and cold storage to protect its customers. Speaking about the fee, Binance charges 0.015 percent to 0.10 percent for purchase and trading fees, 3.5 percent or $10 for debit card purchases, whichever is greater, or $15 per US wire transfer.

Binance listed the LRC token on October 30, 2017, and it offers to trade on Loopring (LRC). Moreover, Binance has opened trading for LRC/BTC and LRC/ETH trading pairs.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

Your Capital is at Risk

5 – Coinbase

Coinbase, the most extensive cryptocurrency trading service regarding user numbers, was created in San Francisco in 2012. Coinbase was the first major cryptocurrency business to go public in the United States, launching on the Nasdaq in April at $381, giving the cryptocurrency exchange a fully diluted market value of $99.6 billion.

Coinbase enables you to trade cryptocurrencies like Bitcoin, Litecoin, Ethereum, and more than 50 other altcoins. Traders can also use Coinbase to convert one cryptocurrency to another. Moreover, one can send and receive cryptocurrency. Coinbase, similar to a stock trading application, provides the current market price (CMP) and cryptocurrencies trend, a snapshot of the portfolio, and industry-related news. For trading, use the Coinbase Pro exchange, which has lower costs than the leading Coinbase site, which is more of a broker.

You can establish your limits or market orders for Algo on the Coinbase Pro exchange. The maker/taker charge is 0.5 percent unless you trade above $10,000 in volume in 30 days, reducing it to 0.35 percent. If your 30-day volume exceeds $300 million, maker costs (for limit orders) are waived for free crypto trading.

Coinbase listed Loopering(LRC) back on September 10, 2020. Except for New York State, support for LRC will be accessible in all Coinbase-supported jurisdictions. Transfers will be available during business hours, Pacific time, as in past launches.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT.

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

Your Capital is at Risk

6 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that offers its eight million members various trading options. Spot, margin, futures, and peer-to-peer trading, as well as lending and staking, are all examples.

KuCoin claims to provide the highest level of security and a cryptocurrency variety of around 400. It is a user-friendly exchange with a simple layout despite its extensive functionality.

In addition, the Kucoin exchange has some of the lowest costs in the cryptocurrency business.

Founders – Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the world’s most popular cryptocurrency exchanges. KuCoin has become one of the most popular cryptocurrency exchanges, with over 8 million registered users from 207 countries and territories worldwide.

KuCoin raised $20 million in round A funding from IDG Capital and Matrix Partners in November 2018 and was listed as one of the Best Crypto Exchanges of 2021 by Forbes Advisor in 2021.

KuCoin Deposit – There is only one option for depositing and withdrawing money from Kucoin. You must fund your cryptocurrency account because the network does not accept fiat currency.

- Only cryptocurrency deposits and withdrawals are accepted.

- Payments via debit/credit card, bank account, or e-wallet are not accepted.

Trading Fees – Kucoin’s trading fee structure is pretty straightforward. The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. If you own the platform’s native Kucoin Shares tokens, you can further minimize your fees.

KuCoin listed Loopring (LRC) on Feb 3, 2021, and supported trading pairs include LRC/USDT.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

Your Capital is at Risk

7 – Bitfinex

Bitfinex is a popular cryptocurrency exchange where users may buy, sell, and trade various digital coins. The platform, situated in Hong Kong, was first established in 2012.

Because the platform provides a good selection of chart analysis tools, intermediate and expert traders are the most likely to use Bitfinex’s trading area.

Besides cryptocurrencies, a bank transfer is the only payment option supported for depositing and withdrawing funds. Bitfinex, like Coinbase, is one of the few platforms that allows you to short cryptocurrencies and use leverage trading tactics.

Founders – Bitfinex began as a peer-to-peer Bitcoin exchange in December 2012, providing digital asset trading services to consumers worldwide.

Giancarlo Devasini has been Bitfinex’s CFO since 2013 and has played a vital role in the company’s growth. Giancarlo Devasini began his career as a physician, earning a Doctor of Medicine degree from Milan University in 1990.

Is Bitfinex regulated?

Bitfinex Securities Ltd., a provider of blockchain-based investment products, has opened its regulated investment exchange in the AIFC (Bitfinex Securities) to enhance members’ access to a broad range of financial products. Thus, Bitfinex isn’t regulated in any way. The corporation is based in Hong Kong and is registered in the British Virgin Islands.

Fees and deposit limits – Bitfinex charge a 0.1% fee on deposits via bank transfer. For example, if you deposit $10,000, you will be charged a fee of $10. If you deposit using cryptocurrency, you will be charged a modest fee, determined by the individual coin you use to fund your account.

Fees for withdrawals – Bitfinex charges a 0.1% fee on withdrawals via bank transfer. If you require funds within 24 hours, you can pay a 1% expedited fee. Alternatively, bitcoin withdrawal costs differ by coin.

Bitfinex listed Loopring (LRC) on September 15, 2020, and enabled trading against USD, BTC, and USDt, with margin and funding markets set to be enabled as sufficient liquidity develops.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- Support team only available via email

Your Capital is at Risk

What is Loopring?

Loopring is an Ethereum-based software platform that intends to reward a global network of users for managing a platform that facilitates the creation of new forms of crypto-asset exchanges. Loopring, one of a growing number of decentralized finance (DeFi) protocols, provides this platform by combining different cryptocurrencies, including its own LRC token. Most significantly, Loopring promises that their platform will enable exchanges built on it to avoid the poor speeds and high prices associated with decentralized exchanges on Ethereum by utilizing a newer type of cryptography known as zero-knowledge rollups, or zkRollups.

Loopring claims that with zkRollups, its exchanges can provide traders with speedier settlements. zkRollups allow Loopring exchanges to finish key computations elsewhere rather than directly settling trades on the Ethereum blockchain (as other decentralized exchanges do). The concept is that by lowering the number of transactions that a Loopring exchange must submit to the Ethereum network, traders will trade faster and at a lower cost. In contrast, other decentralized exchanges require transactions validated by the Ethereum network, which takes minutes rather than seconds or milliseconds.

The network can process 1,000 times more deals per second than Ethereum, with each transaction costing only a fraction of a cent. Loopring is one of a growing number of decentralized finance (DeFi) protocols that employ a combination of cryptocurrencies, including its own LRC token, to power its platform. Loopring believes that using a newer type of cryptography known as zero-knowledge rollups, or zkRollups, its platform will enable exchanges built on it to avoid the poor speeds and high prices associated with decentralized exchanges on Ethereum.

How Does Loopring Work?

The cutting-edge cryptography that Loopring implements on its platform is its primary value proposition. As a result, it’s crucial to note that zkRollups are the only suggested approach for making the Ethereum blockchain more suitable for DeFi applications. xvii, Matic, Optimistic Rollups, and Plasma compete for cryptography concepts. Some enthusiasts believe ZkRollups are promising because they use a well-known type of encryption known as zero-knowledge proofs, which allows a computer program to claim data without disclosing it.

A zero-knowledge proof, for example, could allow a government agency to verify that you are over the legal age to access a website without exposing your precise birthdate. zkRollups use the exact mechanism to combine hundreds of transfers into a single transaction, allowing quick and cheap exchanges outside the Ethereum network. These transactions are subsequently finalized on the blockchain, where zero-knowledge proofs are used to validate the accuracy of off-chain transactions.

Loopring zkRollups

Users must first deposit their funds to a smart contract governed by the Loopring protocol to trade on a Loopring exchange. Loopring exchanges offload the work required to complete trades off the main Ethereum blockchain. This information includes things like a user’s account balances and order histories. Loopring then validates transactions on the Ethereum blockchain to complete trades initiated off-chain. These trades are batch-processed to cut costs and boost speed. With this technology, loopring claims that it can perform over 2,000 trades per second. Each batch of transactions is then put into the Ethereum blockchain with zero-knowledge proofs, allowing anyone to recreate the off-chain transactions. This gives users confidence that the transactions are authentic and have not been tampered with by unauthorized parties.

Is it Worth Buying Loopring in 2024?

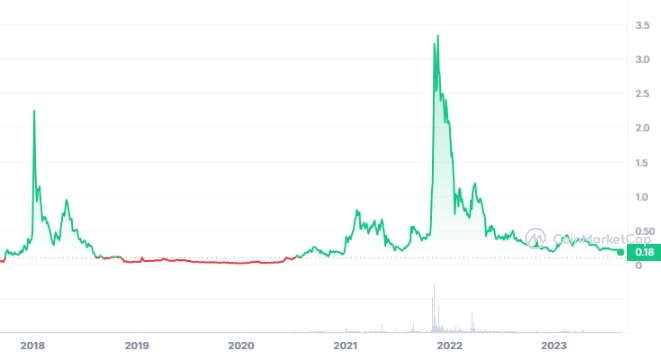

In retrospect, the Loopring (LRC) cryptocurrency had garnered considerable attention in 2021 with a substantial price surge. Notably, the token achieved an impressive all-time high of $3.2 in December of that year. Fast forward to 2022, Loopring encountered its first significant price spike marked by heightened volatility, sustaining an upward trajectory for two consecutive months until April.

However, the broader cryptocurrency market eventually adopted a sideways trend, and by mid-April 2022, Loopring’s price began its descent, primarily stuck in a downtrend for the remainder of the year.

The year 2023, however, has provided a modest glimmer of hope for Loopring enthusiasts. Recent market movements have showcased a slight recovery, albeit accompanied by fluctuating dynamics. In the last month alone, the value of LRC witnessed a sharp decline of approximately -50.570%, effectively erasing a substantial average worth of $0.22 from its prevailing valuation. Such a sudden downturn has positioned the coin in a dip, potentially presenting an opportune moment for astute investors seeking short-term gains.

Analyzing the price dynamics over the past 90 days unveils a notable decrease of around -30.03%. Within this timeframe, Loopring’s value oscillated between a minimum average of $0.28 and a maximum average of $0.31, showcasing the inherent volatility of the cryptocurrency market.

However, a closer examination of the most recent four months reveals an ascending trend in Loopring’s performance. It suggests that specific market segments may have experienced heightened interest during this period. The latest data indicates a discernible uptick in Loopring’s trading volume over the past four months. Notably, trading volume wields a pivotal influence over the token’s price trajectory.

As Loopring navigates the twists and turns of the cryptocurrency landscape, investors and enthusiasts alike remain watchful, anticipating whether the recent price dip is indeed a fleeting opportunity for wise investors or a sign of more profound underlying challenges. Only time will tell how Loopring’s journey unfolds in digital assets’ dynamic and ever-evolving realm.

Will the Price of Loopring Go Up in 2024?

With its foundation built upon the Ethereum Layer-2 protocol, the potential for Loopring’s price to surge in 2023 hinges on a series of key factors and recent advancements within the project.

Loopring’s connection to the Ethereum Layer-2 protocol serves as a cornerstone for its growth. Leveraging the benefits of this protocol can pave the way for stable and secure returns for its investors. One of the standout features is Loopring’s utilization of a decentralized protocol optimized to enhance order execution efficiency, contributing to a robust use case for the cryptocurrency.

Despite the ongoing challenges the crypto bear market poses, Loopring has made significant strides in the second quarter of 2023. The project’s Q2 progress report showcases remarkable achievements, instilling optimism for a potential bull market. Notable updates include the launch of NFT Red Packets and Block Trading and the highly anticipated Loopring L3 announcement.

Key achievements in the second quarter:

- The total trading volume on Layer 2 is nearing $6 billion.

- Over 205,000 Layer 2 accounts created.

- Loopring Gaming gaining traction, featuring the introduction of NFT Red Packets.

- Unveiling of Loopring L3 on Taiko, promising scalability enhancements and cost reduction.

Loopring’s Layer 3 (L3) introduces an optimized zkRollup on the zkEVM L2, aligned with Ethereum founder Vitalik Buterin’s vision for Layer 3. This strategic approach translates to substantial cost savings for Smart Wallet usage through transactions shifted to Taiko L2, driving cost-effectiveness and competitiveness.

The project’s expansion to Arbitrum Layer 2 extends its reach, introducing its features and decentralized exchange (DEX) capabilities to a broader audience. The Loopring Smart Wallet has undergone significant enhancements, incorporating features like Social Recovery and Whitelisted Addresses. With accessibility across multiple networks, the Smart Wallet aims to provide secure crypto and NFT storage solutions.

Moreover, the imminent completion of margin trading brings an additional layer of functionality, allowing separate Loopring wallet accounts for trading and leveraging, thereby expanding asset options. Exciting prospects also lie in the pipeline, with the introduction of ERC-20 Blind Boxes and Private NFT Red Packets. These innovations empower creators with tools to incentivize communities while streamlining distribution costs.

Loopring’s commitment to advanced trading tools and bots is evident through the introduction of Stop-loss orders and plans to amplify auto trading bot functionalities. These developments facilitate systematic trading strategies, grid trading, and more.

The community engagement front remains vibrant with the ongoing Loophead NFT challenges, rewarding active users with unique NFTs and wearables. Community Ambassadors and Builders are pivotal in recognizing contributions that fuel Loopring’s growth.

While Q2 has showcased remarkable progress on technology and community engagement, the implications for Loopring’s price movement are generating considerable interest. As of the latest data, Loopring’s current price is $0.183836, with a 24-hour trading volume of $17.32 million, a market cap of $244.79 million, and a market dominance of 0.02%. Over the past 24 hours, the LRC price has seen a 0.85% increase.

Loopring’s price history adds depth to the analysis. The cryptocurrency reached its all-time high of $3.77 on November 10, 2021, and hit its all-time low of $0.019725 on December 18, 2019. The most recent cycle low was $0.171269, while the cycle high reached $0.189175.

Regarding supply metrics, Loopring’s circulating supply currently stands at 1.33 billion LRC out of a maximum supply of 1.37 billion LRC. The yearly supply inflation rate is 0.11%, reflecting the creation of 1.43 million LRC in the last year. From a market ranking perspective, Loopring holds the 19th position in the DeFi Coins sector, 14th in the Exchange Tokens sector, 38th in the Ethereum (ERC20) Tokens sector, and 7th in the Layer 2 sector.

Despite these developments, it’s crucial to note that Loopring’s price prediction sentiment leans toward bearish, and the Fear & Greed Index currently registers at 38 (Fear). As the project continues to innovate and expand, market dynamics and investor sentiment will play pivotal roles in determining whether Loopring’s price will experience an upward trajectory in 2023.

When you’re considering an investment, follow these things:

Do you want to buy Bitcoin but don’t understand how cryptocurrencies work? Just stop right there!

Cryptocurrencies can be an exciting investment prospect, but novice investors risk losing money if they are duped by scammers or back a new cryptocurrency with no track record. It’s never easy to pick a cryptocurrency broker/platform.

This section will review things you should know before buying in the cryptocurrency industry.

1. Commissions and Spreads

Brokers typically make money by charging commissions, which will take a percentage of the total spread. Most brokers will not charge a commission; they will profit from wider spreads. Try to find out how brokers make money by shopping around.

2. Features of the account

When you first enter the cryptocurrency market, you’ll find that each broker has a different set of services to offer. When comparing the characteristics of different brokers, there are four things to remember. First, margin and leverage, spread and charges, initial deposit requirements, and deposit and withdrawal effort are essential to consider.

3. Deposit and withdrawal methods

Brokers have different policies for depositing and withdrawing money. Account users may deposit funds into their accounts online using a bank check, credit card, PayPal, or personal check. On the other hand, Withdrawals are usually done via wire transfer or checks. The broker will charge you a fee for this service. So it’s important to consider the deposit and withdrawal options before selecting an exchange or a crypto trading platform.

4. Customer Service

The forex and crypto market is open 24/7 a week. As a result, you’ll need a broker with 24-hour customer service. Failure to have a properly functioning customer care department might result in significant losses. You should test out a broker’s customer service system before signing by phoning, emailing, or talking with them online.

5. Compliance with regulations

You should always check the reputation of an exchange or a broker before investing with them, just like you would with any other business. Even if different countries have different laws, determine to whom these brokers are connected. For example, you should check the broker’s regulatory compliance and license rather than relying on a flashy website.

6. Trading Platform

A trading platform is an investor’s perspective and access to the market. As a crypto trader, you must verify that your chosen software and trading platform has all the necessary technical and analytical tools. You should also check whether trades can be entered and exited with ease. To summarise, once you have confidence in the broker you choose, you will devote more time and attention to developing the best crypto trading strategy.

Buying Loopring as a CFD Product

CFD stands for ‘contract for difference,’ referring to a short-term contract between an investor and an investment bank or spread betting organization. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specific financial item, including currencies, stocks, and commodities. Trading CFDs means winning or losing money depending on which direction your chosen asset moves. CFDs are financial derivatives that allow investors to speculate on short-term price swings. Some advantages of CFD trading include trading on margin and going short (sell) if you believe prices will drop or surge (buy) if you believe prices will soar.

CFDs provide several benefits and are tax-efficient in the United Kingdom, so there’s no stamp duty to pay. However, please remember that tax treatment differs depending on individual circumstances and may vary or differ in jurisdictions outside the United Kingdom. CFD trades can also be used to hedge an existing physical portfolio. Our clients can trade at home or on the go with a CFD trading account, as our platform is remarkably adaptable to traders of all skill levels.

The good news is that CFD trading has entered the cryptocurrency space. Loopring is now accessible as a contract for difference (CFD). If you have difficulty monitoring cryptocurrency with the exchange storing your crypto assets, you can profit from LRC using CFDs.

We recommend trading altcoins with leverage on Binance or CryptoRocket. Binance supports more altcoins, including LRC. CryptoRocket supports fewer altcoins, currently, about 40.

LRC isn’t available on Cryptorocket, but they are consistently adding new coins.

There is an LRC/USD trading pair on derivatives broker Libertex. We also recommend that platform, although if you are based in the UK, they no longer offer cryptocurrency instruments to retail clients in the UK as of Jan 2021.

Your Capital is at Risk

Taxation on Loopring Earnings

There are several myths surrounding the taxation of crypto assets. One is that crypto-assets are free from taxation since they are deemed ‘winning,’ similar to gambling or playing the lottery.

That is not truthful!

This section examines the notion of cryptocurrency assets and how they will be taxed.

What are crypto assets?

Cryptocurrencies are digital representations of wealth or contractual rights that are cryptographically secure and can Cryptocurrencies are digital representations of wealth or contractual rights that are cryptographically secure and can be:

- Electronically transferred

- Stored

- Electronically transferred

Cryptocurrencies are held in a virtual wallet, accessed via apps or websites. There is no reserve bank or authority to maintain the system or intervene if things go wrong. Every transaction is recorded on a public ledger, or ‘blockchain,’ which uses Distributed Ledger Technology (DLT), a digital network that simultaneously stores transaction details in numerous places.

What Are Cryptocurrency Taxes and How Do They Work?

Capital gains tax rules apply to cryptocurrencies such as Bitcoin and Ethereum, for better or worse. The Internal Revenue Service (IRS) considers all cryptocurrencies to be capital assets, and you must pay taxes when you sell them for a profit. This is precisely what happens when you sell more traditional investments, such as stocks or mutual funds, for a profit.

The amount you owe in capital gains taxes is settled by whether you’ve kept cryptocurrency for less or more than a year. In case you haven’t yet hit the 12-month mark, your cryptocurrency profits are taxed at short-term capital gains rates. These rates are the same as your ordinary income tax rate.

On the other hand, if you’ve had your coins for at least a year, you may be qualified for a long-term capital gains rate. These rates are lower than most income taxes, relying on your taxable income.

Just like with any other investment, if you sell your crypto investment at a loss, you may be able to claim a capital loss, which you can use to offset other income taxes.

However, bitcoin taxes come with a handful of extra snags.

You may be subject to cryptocurrency taxes if you use cryptocurrency to purchase.

If you use cryptocurrencies to buy products or services, your transaction counts as a sale of that cryptocurrency. This implies you’ll have to pay capital gains taxes if the value of your coins has increased over what you bought for them. You’ll also have to pay any relevant sales tax.

When Do You Pay Crypto Taxes When You Mine Crypto?

If you acquire Bitcoin by mining it or receive it as a promotion or payment for goods or services, it is taxable as regular income. At your ordinary income tax rate, you must pay tax on the entire fair market value of the cryptocurrency on the day you get it.

If you keep the same cryptocurrency you mined or earned from these activities, and its value rises, and you either use it or sell it later at a profit, you’ll have to pay capital gains taxes on the earnings, depending on how long you’ve had it.

In the United Kingdom, how are crypto-assets taxed?

If you live in the United Kingdom, you must pay tax on any profits you make from your crypto assets. For instance, a capital gains tax (CGT) is imposed on the difference between the price you paid for your bitcoin and the price you received when you sold your bitcoin.

Profits above your tax-free threshold are subject to capital gains tax (the Annual Exempt Amount). The tax-free allowance for capital gains for years 20 and 21 is £12,300.

As an illustration, assume you invested £12,000 in a Bitcoin asset. You purchased the coin for £8,000. A capital gains tax of 10% or 20% (depending on your income) must be paid on the £4,000 profit earned from the cryptocurrency unless it falls below your tax-free allowance of £12,300.

When a sale is made, and a profit is earned, CGT is required and must be reported on a self-assessment tax return.

Automated Trading With Robots

As the title suggests, a trading robot is an automated software capable of conducting market research and trading. The technology involved, which is frequently improved through machine learning and artificial intelligence, can outperform human capabilities.

For instance, while an experienced trader may focus on a few assets, artificial intelligence trading robots can simultaneously scan thousands of markets. It accomplishes this through the use of a ‘what-if’ algorithm and a variety of technical indicators. As an example, suppose the trading robot is assessing the Bitcoin cryptocurrency. The algorithm may be configured to place a sell order when the RSI (Relative Strength Index) value is more than 70.

Similarly, when a critical resistance line is anticipated to be breached, the algorithm may be set to purchase Bitcoin. In some instances, trading robots may focus exclusively on the research process. When the software identifies a possible trading opportunity, an alert is generated. This is referred to as a signal, and it typically includes the necessary entry and exit order values, which the user must manually enter.

In any event, auto trading robots like Bitcoin Evolution and Bitcoin Lifestyle have the potential to help you advance your trading career without requiring you to spend hours upon hours analyzing the market and developing techniques.

The primary issue is that most auto-trading robot platforms are sham. These providers will make bold claims about super-high monthly returns, but there is typically no way to verify their claims. This is why extreme caution must be exercised while selecting a trading robot platform.

When you’re considering a crypto investment, follow these things:

Keep these five other factors in mind as you begin to invest in cryptocurrencies.

Understand what you’re investing in

Understand exactly what you’re investing in, just like any other investment. When buying stocks, it’s critical to read the prospectus and extensively research the companies. Plan to do the same with every cryptocurrency, as thousands of them operate differently, and new ones are generated every day. So for each trade, you must comprehend the investment case.

Remember, the past is past.

Many new investors make the mistake of looking at the past and extrapolating to the future. Bitcoin was once worth pennies but is now worth a lot more. Investors are interested in what an asset will do in the future, not what it has done in the past. What factors will influence future returns? Traders who acquire a cryptocurrency today need tomorrow’s gains, not yesterday’s.

Watch out for volatility.

Cryptocurrency values are about as volatile as any asset can be. They could be thrown out in a matter of seconds based on nothing more than a rumor that turns out to be false. That can be advantageous for knowledgeable investors who can quickly execute trades or understand the market’s fundamentals, how it is trending, and where it might go. It’s a minefield for new investors who don’t have these abilities—or the high-powered algorithms that direct these trades.

Control your risk.

You must control your risk while trading any asset on a short-term basis, especially volatile assets like cryptocurrencies. As a new trader, you’ll need to learn how to manage risk and develop a strategy to help you avoid losing money. And this process differs from one person to the next:

Don’t invest more than you can afford to lose.

Finally, you should avoid investing money you don’t need in speculative assets. If you can’t afford to lose it all, you shouldn’t invest it in risky assets like bitcoin or other market-based assets like stocks or ETFs, for that matter.

Loopring Price Predictions: Where Does LRC Go From Here?

If you’re looking for Loopring price forecasts/predictions for 2022, 2023, 2024, 2025, and 2030 and want to know where Loopring (LRC) prices can go, go no further. Please remember that this prognosis, like all others, should be regarded as only a suggestion from some market experts/analysts. Not to mention the impossibility of accurately anticipating anything. So let’s get started.

Loopring (LRC) Price Prediction 2023

The price prediction for Loopring in 2023 looks quite optimistic, seeing its performance at the beginning of the year. The price of Loopring (LRC) is expected to reach a maximum of $1.54 in 2023 and maintain a minimum of $1.23. This would also make Loopring (LRC) average around $1.36 in 2023.

Loopring (LRC) Price Prediction 2024

According to a technical price analysis for Loopring (LRC) in 2024, the crypto is expected to reach a minimum price of $1.30 in the first half of the following year. The maximum price for Loopring in 2024 is expected to breach the $1.50 mark in 2024, while the average is around $1.34.

Loopring(LRC) Price Prediction 2025

Going through the Loopring forecasts and technical analysis, the price prediction for 2025 looks like a bullish one. The crypto will be able to reach a maximum of $2.08, breaching the $2 mark. However, keeping the conservative outlook intact, the crypto is expected to have a minimum price of $1.61.

Loopring (LRC) Price Prediction 2026

The forecast for Loopring (LRC) in 2026 shows that the crypto might have a minimum price of around $1.51 and a maximum price of $1.77, while the crypto might average around $1.62 in 2023.

Summary

LRC is the Ethereum-based cryptocurrency token of Loopring, an open protocol for developing decentralized cryptocurrency exchanges. On average, the daily trading volume of the whole cryptocurrency market ranged between $50 and $200 million in 2020. Most of that trading occurs on centralized cryptocurrency exchanges and online platforms operated by private organizations that hold users’ assets and allow the matching of buy and sell orders.

Such systems have several drawbacks, so a new decentralized exchange has evolved to minimize these imperfections. On the flip side, completely decentralized exchanges are not without flaws.

Loopring’s goal is to connect centralized order matching with decentralized on-blockchain order settlement to construct a hybridized offering that combines the best attributes of centralized and decentralized exchanges. LRC coins were made available to the public in August 2017 as part of an initial coin offering (ICO), and the Loopring protocol was initially deployed on the Ethereum mainnet in December 2019.

If you’re ready to invest, our suggested regulated broker, Huobi, can help you get started. It simply takes three minutes to set up your account and begin purchasing Loopring securely.

You should also remember the following:

-

Loopring is a cryptocurrency that has a high level of risk. Therefore, investing in and trading Loopring necessitates extensive research and effort.

-

When investing, you should only use registered brokers and exchanges. Moreover, you should only invest what you can afford to lose.

-

You should also seek advice from review sites and web specialists about Loopring.

Your Capital is at Risk

FAQs

Any risks in buying Loopring now?

For a long time, many experts and traders believe that Loopring has been a terrific investment. Surprisingly, the price is growing. As a result, the investment is certain to provide a fair return.

Should I buy Loopring?

Loopring's current price is about $0.1824, with a market capitalization of $242 million. There's a strong potential for an upward trend continuation. Considering the increased popularity and developments of LRC, you should consider adding the coin to your portfolio.

Where can I spend my Loopring?

The LRC can be used to buy and sell products and services via e-commerce or retail, but unlike credit or debit cards, the payment is instant. A cryptocurrency exchange or a broker can be used to convert it. A peer-to-peer platform can turn digital tokens into cash by simply selling them. This approach also has lower fees and assures a better exchange rate than a third-party brokerage.

Is it safe to buy Loopring?

It's impossible to say which cryptocurrency is a good investment and which is not. However, it appears to be a viable option if you're searching for a long-term investment in Loopring coin. Aside from the Loopring Price Prediction, we have no idea how cryptos will do. Loopring Coin and other Cryptocurrencies are similarly volatile and might change price direction at any time. As a result, before making any investment decision, it's best to conduct some personal study.