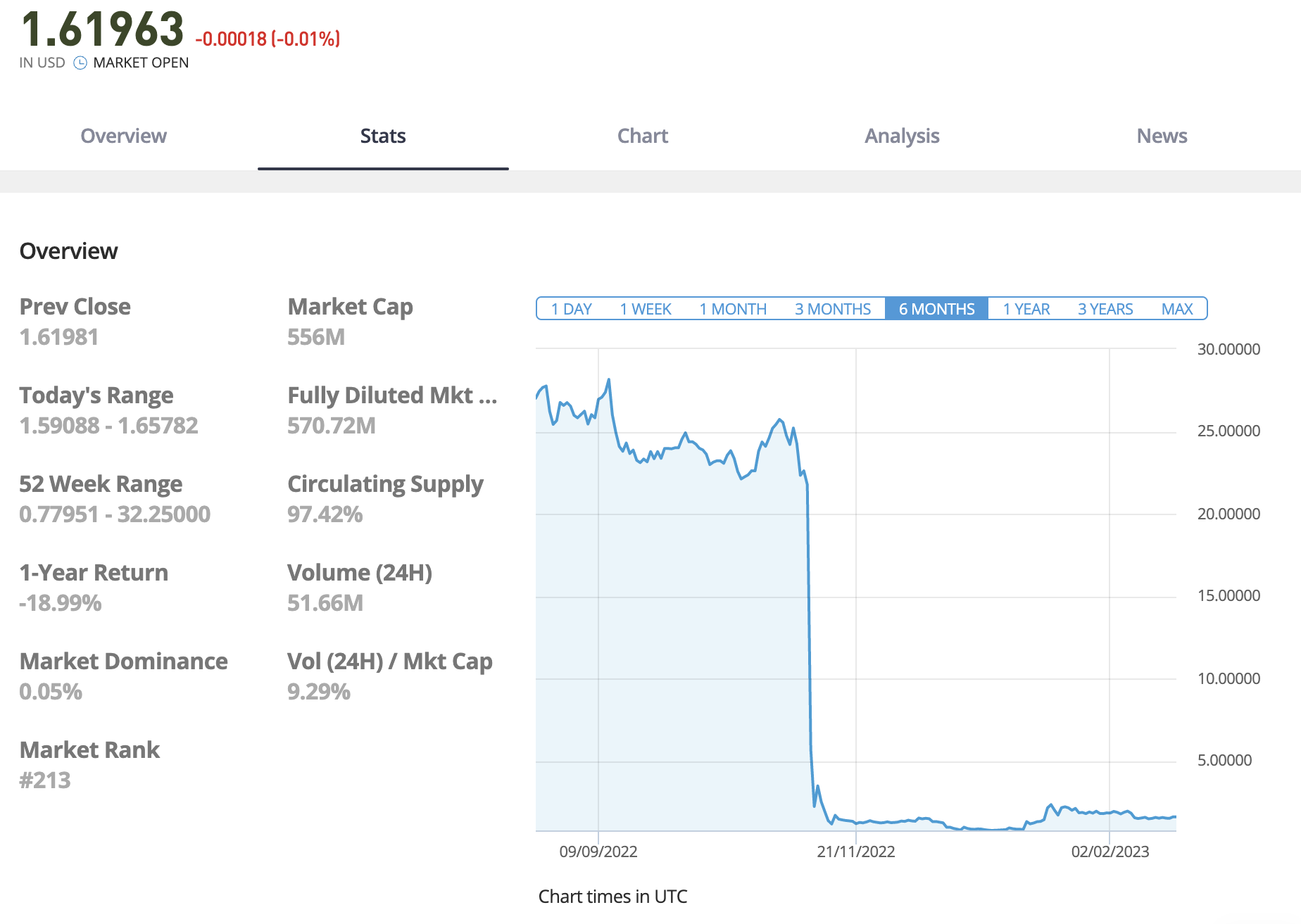

Update – the FTT price collapsed when it emerged FTX exchange was insolvent and had misused customer funds. See our best cryptos to buy now guide for some FTT alternatives.

FTX token is the native cryptocurrency of the now-defunct FTX derivatives exchange. Based Ethereum blockchain, the token was used to reduce trading fees on the exchange or serve as collateral against future positions. The token is available under the ticker FTT, which, when the FTX exchange was active, could be used for earning interest or buying NFTs.

The FTX collapse led to the FTT price collapsing. And now that the legal proceedings against FTX founders are underway and FTX entities of other countries, like FTX Japan, have announced crypto withdrawals to resume, there has been some upwards momentum in FTT’s price.

Do these developments make FTT a good investment in 2024? Answers to this question and more are given in this guide that teaches how to buy FTX tokens this year.

How to Buy FTT – Quick Guide

- Step 1 – Create an Account on a suitable trading platform – Choose a crypto trading platform – we recommend eToro to buy FTT. Create an account by furnishing your details and completing the KYX process

- Step 2 – Deposit funds into your account – Deposit funds into your account using the standard fiat methods – as eToro provides many options like Neteller. ACH, Visa debit, or credit cards.

- Step 3 – Search for FTT – Enter ‘FTT’ in the search box of eToro.

- Step 4 – Buy FTT – Searching for FTT will lead you to its price chart. Analyze it, click on the open trade button, and then buy FTT using fiat.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk

Best Places to Buy Bitcoin in 2024

1. eToro – Best Broker to Buy Bitcoin

eToro listed FTT along with other tokens to its list on May 31st 2022.

eToro is situated in the United Kingdom and was founded in 2007. Since then, it has grown its company across the UK, and now has over 13 million active traders. eToro is licensed by the FCA, ASIC, and CySEC and is partnered with the FSCS. This platform provides a traditional way of buying shares and offers CFDs that provide leveraged trading with low margin requirements.

It means that by utilizing eToro, investors can avoid not only commission-free trading but also monthly/annual fees. The broker offers trading on 17 different stock exchanges, including NASDAQ, with over 1700 securities. Furthermore, eToro accepts roughly 79 different cryptocurrencies for a very modest charge. It offers a simple social trading platform that allows traders to communicate with one another.

Unlike traditional brokers, eToro does not charge a high commission, and there are no account management fees, rollover fees, or ticket fees. However, the only fee charged by eToro is a minimum buy-and-sell spread fee. The best feature provided by eToro is its social trading platform and tools, which are very useful for beginner investors. The interactive platform enables traders to copy the trade positions of experienced traders, giving rewards to professional traders.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros & Cons of the eToro platform:

- Copy and social trading are available on eToro.

- Regulated by ASIC, FCA, and CySEC.

- Offers to buy CFDs in addition to stocks.

- Trading of stocks with no commissions.

- User-friendly graphical user interface (graphical user interface) stockbroker.

- App for mobile trading that is well-known.

- Skrill, VISA, Neteller, and PayPal are all accepted by eToro.

- Pro traders may find it difficult to perform advanced technical analysis.

2 – Binance

Binance is without a doubt the greatest eToro alternative. Binance is the world’s largest cryptocurrency exchange by daily transaction volume, with over $20 billion in deals per day. It gives you access to hundreds of assets and a smooth trading service that makes it simple to make money.

The advantages of Binance are pretty astounding. The trading commission is 0.075%, which is extremely low. Expert traders can use sophisticated tools, including futures and margin trading, and the exchange offers a variety of deposit and withdrawal methods. When you combine this with Binance’s high liquidity, it’s easy to see why it’s so popular.

Pros & Cons of the Binance platform:

- Excellent liquidity.

- Security features that are second to none.

- Professional merchants have access to high-end merchandise.

- Not suitable for beginners..

4 – Bitfinex

Bitfinex, launched in 2012, is one of the older cryptocurrency exchanges. Since its inception, the exchange has remained a market leader in cryptocurrency trading, now ranking eighth among the world’s major cryptocurrency exchanges by volume, according to CoinMarketCap.

Bitfinex has relatively cheap trading costs, with most trades costing less than 0.20 percent.

Bitfinex’s active trading platform offers 150 cryptocurrencies, including Bitcoin, Ethereum, Terra, Tether, Solana, Litecoin, Ripple, and many others. There are too many to list here, but Bitfinex performs a fantastic job of supporting popular currencies on its platform in general.

Fees

Another notable aspect of Bitfinex is the absence of trading fees. The majority trades either a 0.10 percent maker fee or a 0.20 percent taker fee. This rate applies to crypto, stablecoin, and fiat transactions.

However, Fees can be avoided if you keep the LEO currency in your account. For example, you can save 15% on taker costs for crypto-to-crypto and crypto-to-stablecoin trades if you have the equivalent of $1 in LEO in your account.

With at least $5,000 in LEO, you’ll receive a 25% discount on taker costs for crypto and stablecoin trades, as well as a 10% discount on fiat trades. And, if you have $10,000 or more in LEO, you may be eligible for a bigger percentage discount, depending on your amount.

Bitfinex listed FTT back on August 19, 2019. FTT can be traded with USD (FTT/USD) and USDt (FTT/USDt). Trading will only be available in certain jurisdictions, and is exclusive to verified users.

Pros & Cons of the Coinbase platform:

- Established since 2012

- Suited for advanced traders

- Over 100 supported coins.

- Accepts bank wire deposits and withdrawals

- U.S. citizens not accepted

- Not regulated

- High trading fees

- Hacked on more than one occasion

5 – KuCoin

KuCoin is a Singapore-based exchange founded in Hong Kong in 2017. It’s a genuinely global corporation, having offices in Hong Kong, Singapore, and Seychelles, which is why it bills itself as “The People’s Exchange.” Their goal was to provide consumers worldwide with an easy and secure platform for buying and selling a variety of digital currencies. They have undoubtedly made an impression on the global crypto community, increasing their user base to over 8 million in just four years and serving one in every four crypto holders globally.

KuCoin is a relatively new cryptocurrency exchange that has swiftly gained a devoted following due to its user-friendly design and a high degree of security. The exchange is well-known for having many various cryptocurrency pairs, which allows customers to buy a wide range of cryptocurrencies. On the negative, Kucoin is a crypto-only exchange, so if you want to buy coins with fiat currency like HKD, USD, or CAD, you’ll need to use another exchange.

It provides bank-level security, a slick interface, a user-friendly UX, and a wide range of crypto services, including Margin and futures trading, built-in P2P exchange, ability to buy crypto with a credit or debit card, Instant-exchange services, ability to earn crypto by lending or staking via its Pool-X and opportunity to participate in new initial exchange offerings (IEOs) via KuCoin Spotlight.

Besides, KuCoin has some of the lowest fees because it lists small-cap cryptocurrencies with significant upside potential, has a vast range of coins, lesser-known cryptos, and strong profit-sharing incentives – up to 90% of trading fees are returned to the KuCoin community via its KuCoin Shares (KCS) tokens.

Trading Fees – Kucoin’s trading fee structure is pretty straightforward. The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. If you own the platform’s native Kucoin Shares tokens, you can further minimize your fees.

KuCoin listed FTX Token (FTT) back on September 24, 2021, and supported trading pairs include FTT/USDT, FTT/BTC.

Pros & Cons of the Coinbase platform:

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- User-friendly exchange

- Low trading and withdrawal fees

- KuCoin Shares allow users to invest in the success of KuCoin.

- Users can trade using Arwen without having to transfer funds into a third-party wallet.

- Due to KuCoin’s commitment to rapidly launching new, innovative crypto assets, customers have access to a huge variety of trading pairs.

- Users can choose from a vast number of trade pairs.

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilise.

- Lacks the trading volumes found on some of the more established platforms.

- No fiat trading pairs

6 – Bybit

Bybit is a cryptocurrency derivatives platform founded in March 2018 and has since grown to become one of the world’s most popular exchanges, with over 3 million users worldwide. The program focuses on leverage trading

Bybit allows you to trade a number of markets, including spot, inverse perpetual, USDT perpetual, and inverse Futures.

Market takers pay 0.075 percent, while market makers pay -0.025 percent. As a result, they will be compensated when a market maker opens a transaction. This low cost encourages market makers to stay active and fill the order book.

Where is Bybit regulated?

Bybit is a legal cryptocurrency trading platform run by Bybit Fintech Limited. The corporation is registered in the British Virgin Islands and has its headquarters in Singapore. Because the cryptocurrency exchange is not yet regulated in any nation, users do not need to provide KYC to trade on Bybit.

- USDT everlasting BTC, ETH, EOS, and LTC pairs

- Trading costs range from 0.025 to 0.075 percent for leverage of up to 100 times.

- Order book with high liquidity and low spreads

- Bybit is a mobile trading app.

- 4.9 out of 5 stars based on over 50,000 reviews

- Affiliate and referral programme (30% commission)

Pros & Cons of the Coinbase platform:

- Trustworthy and reputable trading platform

- 4th largest derivatives exchange in the world by volume

- Variety of markets including spot, perpetuals and Futures

- Advanced and feature-rich trading platform

- Intuitive and responsive mobile app

- Difficult for beginners to navigate

- Limited number of spot trading pairs against BTC

3 – Capital.com – Trade FTT Commission-Free

Capital.com is a global CFD brokerage with offices in the UK, Cyprus, and Belarus. It is home to over 2 million traders and has handled over $18 billion in transactions. Capital.com offers a UK-based trading platform for investors who want more flexibility in their investments.

It is a CFD specialist platform that offers leveraged trading as well as short-selling. FTT can be traded through Capital.com by putting up 50% of the margin.

It offers over 3,000 of the most liquid assets split across five sectors, making it appealing to a wide range of traders.

Initial Deposit

To start an account with Capital.com, you must make a minimum deposit of $20. RBS and Raiffeisen keep client funds completely separate; accounting monstrosity Deloitte audits the finances of two of Europe’s top financial institutions. This broker also serves to institutional clients through its Prime Capital division, implying a significant liquidity pool. Only a proprietary trading platform is available on Capital.com.

Another intriguing feature of Capital.com is that, in comparison to other brokers, it provides services at a low cost. Capital.com offers commission-free trading as well as low spread fees. CFD stock trading is only recommended for experienced investors, but Capital.com provides training materials, including a trade learning mobile app, to assist newcomers. It accepts payments using debit/credit cards, bank transfers, and e-wallets, just as other brokers. It also provides risk-free trade learning through demo-account trading. It is also governed by the FCA.

Pros & Cons of the Capital.com platform:

- Hundreds of UK and US-listed shares are available for trading.

- App for learning how to trade.

- The use of artificial intelligence (AI) to uncover trading flaws.

- Provides daily trading suggestions.

- Advanced trading using charts and an interface for analysis.

- There are no commissions to pay.

- Custom trading strategies are not supported.

What is FTX Token (FTT)?

The FTX exchange started out as a powerful trading platform offering a variety of trading facilities, including spot, over-the-counter, futures and predictions market. It became the second biggest cryptocurrency exchange at one point for its ability to address the shortcomings of existing cryptocurrency exchanges and building on them.

One of the biggest features of the FTX exchange is the FTT. FTT is an exchange token that allowed users to reduce the transaction fee they would pay for trading on FTX exchange. FTT also users to earn more interst on assets available on the FTX exchange.

However, since the downfall of FTX, FTT has become little more than a tradable asset. Those who didn’t board the sell-of train when it came to light just how overleveraged FTT was thanks to it being fed into Alameda Research, continue to hope the new FTX founders revive this asset.

FTX Founded by Sam Bankmen & Gary Wang

Sam Bankmen and Gary Wang founded FTX. Sam Bankmen is an MIT graduate who used to work at Jane Street Capital and Gary Wang is a former Google software engineer. FTX has a market capitalization of $6.46 billion, and the coin FTT is not available on any significant US cryptocurrency exchanges.

FTX does not use traditional margin trading but instead uses leveraged tokens, which let the customers take a leveraged position without dealing with the complexities of full margin trading. Moreover, the restrictions on retail derivatives trading limit the selection of services offered by FTX in the United States.

The FTT token with the supply of 345 million., once was instrumentals in dealign with many issues of derivatives exchanges, be it poor liquidity, clawbacks and tedious trading processes. However, the clawback issue, which basically is when an exchange takes money from investors to cover for another person’s bankruptcy – was something FTX did with FTT tokens. People’s FTT tokens, that were not supposed to be used by anyone, even FTX itself, were used without people’s consent to keep Alameda research afloat.

Is it Worth Buying FTT in 2024?

FTX’s value has collapsed in 2022 and as the FTX exchange is now closed down, there is no utility for the FTT token anymore.

Also FTT is among those assets that couldn’t capitalize on Bitcoin’re resurgence in 2023. While there was some uptick and FTT was able to breakout above its $1 resistance, the token has entered the accumulation with no discernible use case in sight.

All the news is not bad for FTT holders, however, as FTX Japan has recently announced that it would resume withdrawals. That reaction did recover the FTT price by 28%. However, that was largely due to a large of of FTX customers who want to get out their assts and not interact with of FTX’s offerings.

However, there are some developments happening.But the news about them is so vague and so bias is that we won’t recommend someone who hasn’t gotten their money stuck in FTX exchange to invest in this cryptocurrency.

And from the technical perspective too, all the indicators of this assets are showing bearish signs. That said, those who want to capitalize on short-term gains and be quick about dropping in and out of their investments, can try investing in FTX as the current market is quite volatile.

Will the Price of FTT Go Up in 2024?

It is hard to say since most of the signs are pointing to bearish sentiments. The recent uptick of 28% was caused by FTX Japan’s announcement to open withdrawals on the exchange. That is not a long-term utility, it merely gives hope FTT holders that they will recover their funds from the exchange.

That said, FTX’s new CEO John Ray has said the FTT is thinking about reviving tits business. Ray started a task force to explore options available to restart the exchange. The CEO has decided to go this route since he believes that that this, FTX’s customers may get more value than simply liquidating the assets.

But the broken trust caused due to FTX’s debacle have long-term implications. Even if the FTX exchange returns, it is highly unlikely that the now wiser cryptocurrency traders will opt for it.

That said, like the FTX Japan development, other positive news regarding FTX may be able to shortly push the price of this asset. But investors must always expect retrace. With that said, it is highly unlikely for FTT to go much higher in 2024.

How to Choose the Right Crypto Broker

Given the large number of brokers from whom to buy FTT, it’s vital that you pick the finest choice available. Consider the following aspects when you search for the best broker for you:

1. Fees

What is the relevance of selecting a low-cost broker when trading cryptocurrencies like FTX token? Because costs can add up rapidly. Before choosing a trading platform, get a breakdown of the broker’s fee structure. Withdrawal and deposit fees, as well as transaction and trading fees, should all be included.

2 – Safety

The right broker should have suitable safety and security measures in place to prevent unauthorised access to your money.

3. Support

A reputable broker will also have a strong customer service department to assist you with your every requirement.

4. Deposit Options

You want to be able to deposit as much money as possible. There are numerous options available, ranging from bank transfers to credit cards to payment processors. Just bear in mind that each one has its own set of costs.

When you’re considering an investment, follow these things:

Every cryptocurrency comes with risks, and this is especially true in the case of FTT. So, whenever you invest, you mustn’t get drawn into FOMO. Apart from following others, you must conduct your research before investing in any digital asset.

1 – Research, research, research: Before investing your money, excellent and comprehensive research about the product must be done to avoid risks associated with them.

Here are the different methods we looked into:

- Exploring Social Media platforms.

- Analyzing upcoming events.

- Research the fundamentals.

- Discover trending topics.

- Utilize the power of niche forums.

- Go to crypto meetups.

- Observe transaction volume.

2 – Monitor the market:

Monitoring the market is a second step in knowing more about your selected product/ digital asset. The market could move in a different direction from your expectations, and keeping your calm when the market is moving in another direction is also an essential factor. The best way to monitor the market is to go through the review sites and recommendations on them.

Buying FTT as a CFD Product

Contracts for differences (CFDs) are derivatives that allow you to speculate on multiple financial markets without owning the underlying asset. It is widely used in established markets such as foreign exchange currency pairings, stocks, bonds, indices, and commodities.

Trading CFDs entails more than simply buying and selling; it also entails agreeing to swap the difference in an asset’s price when the contract is opened and expires.

CFD trading has made its way into the cryptocurrency industry, and FTT is now available as a CFD product. If you’re having trouble understanding bitcoin trading and where to keep your crypto funds, you may use CFDs to profit from FTT. We recommend trading FTT CFDs on the Binance or coinbase platforms since these are regulated and allow you to choose from various analytical tools.

Taxation on FTT Earnings:

Regulators, notably the Securities and Exchange Commission (SEC), are attempting to control the cryptocurrency market because it is still young and developing. Furthermore, the Internal Revenue Service has been attempting to establish a cryptocurrency tax structure. Cryptocurrencies and digital assets are currently treated as properties and are subject to capital gains tax. However, under some circumstances, some cryptocurrency earnings are considered income and fall into the income tax category. When exchanging digital assets, the following taxable events qualify for capital gains and income taxes.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21, IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals who have bitcoin as a capital asset but are not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Taxable events that are considered property gains tax in the US:

- Exchanging your cryptocurrency for fiat money

- Making purchases with crypto.

- Swapping one cryptocurrency for another – whether through an exchange or a peer-to-peer (P2P) channel – is common.

Taxable events that are considered income taxes:

- Block rewards from cryptocurrency mining

- Crypto assets are earned from liquidity pools (LPs) or staking.

- Receiving crypto for services rendered

- Getting crypto from an airdrop

- Earning interest from lending to decentralized finance (DeFi) platforms

Be aware that you can write off your capital gains tax through losses incurred from trading. You can also save up to $3,000 of your income taxes, depending on how long you have held on to an asset.

Taxation on buying FTT

Calculating Your Capital Gains Tax

In the last year, the crypto market has grown at an exponential rate, and government agencies are attempting to gain information about it. The IRS is also aiming to obtain a piece of the crypto pie, given the recent surge in the non-fungible token (NFT) sub-sector. The number of capital gains tax rates for cryptocurrencies is generally determined by two factors: first, your income tax bracket, and second, how long you have held on to your crypto asset. This will assist you in calculating:

a.) Capital Gains on Short-Term Investments

The amount of short-term capital gains tax you must pay is primarily determined by how long you’ve been trading or owning cryptocurrencies. You will be taxed under your normal tax bracket if you have made gains or losses from trading or owning crypto for less than a year. Losses incurred during that trading year may be valuable. You can write off up to $3,000 in taxes if you use a tax-loss harvesting plan. You also have the option of deferring your taxes to the next year.

b.) Capital Gains on Long-Term Investments

Long-term capital gains apply if you have been trading cryptocurrencies for upwards of a year. You will pay taxes between the range of 0 to 20% depending on your income. We have itemized the income tax brackets on this link.

Automated Trading With Robots

A trading robots is a computer programme that, on a computerised basis, executes all of the activities of a professional trader on an exchange. The computer software is a fully automated version of tried-and-true trading techniques. Regardless of the direction in which asset values are moving, robots tend to outperform humans during periods of substantial market volatility. This is because they rely on trading strategies that are meant to generate profits even when the market is down.

In addition, the most successful bitcoin bots in the world are known for their lightning-fast research and execution. As a result, they can complete a huge number of transactions every day and thereby take advantage of any trading opportunities that arise.

Trading FTT can be a difficult profession for anyone, and there is no assurance that your market analysis will result in a profit. There are other sure ways to grow your capital with little to no effort to get around this problem. Ideally, the bots make a profit, and that profit is bigger in risk-adjusted terms than if you had just bought and held the same coins throughout.

Trading bot software is unregulated, so you should only deposit funds into bots that you can afford to lose. Our review team has a vetting system to help filter out genuine trading software from the rest. Some of the notable trading robots that we’ve reviewed include:

FTT Mining: Can You Mine FTT?

No, FTT is a Proof-of-Stake token and thus cannot be mined. However, when. FTX exchange was active, FTT could be staked on it in return for APY (Annual Percentage Yields.)

Decreasing Risk in FTT Investment:

Every investor needs to find ways to protect themselves from any big loss. If you want to cap your risks, then follow these rules:

Use multiple exchanges: To reduce risk in crypto trading, I use a variety of exchanges, employ hardware wallets, and invest in a variety of narratives (Oracles, Defi, or insurance). To reduce risk when trading, trade only when truly strong patterns form or when a coin has reached its bottom.

Hedge your risks: You should always have a well-balanced portfolio of investments. Use financial instruments strategically to mitigate the risk of adverse price movements. On the other hand, the investors hedge one investment by making a trade-in another.

Use a stop loss: A stop-loss order is used to restrict an investor’s loss on an adverse move in a security position. You don’t have to monitor your holdings on a daily basis if you use a stop-loss order. An investor’s ally is a stop loss. Be a note of it and make sure you stick to it. When things don’t go as planned when investing, you’ll want to know when to take your money out.

Set a target: Short-term traders who want to manage their risk should employ take-profit orders. This is because they can exit a transaction as soon as their predetermined profit target is met, avoiding the risk of a market decline. Traders that follow a long-term strategy dislike such orders since they reduce their profits.

Fundamental & Technical analysis: When it comes to investing, I prefer to focus on coins with strong fundamentals. I only invest on rare occasions in response to news or other events. If I decide to invest, I will also do a technical analysis. I consider things like where the currency is in its life cycle. Are there any trading patterns? For the coin, there is support and resistance, recent price history, news, and forthcoming events. If I invest in fundamentally sound coins, I can stay calm even if the price changes a lot because I know the price will eventually rise.

FTT vs. Other Cryptocurrencies

FTT vs. Ether

There was once a time when staking ETH was considered better than Ethereum as it prevented the high gas fees. However, FTT currently has no use case. It had limited utility to begin with – it is an exchange cryptocurrency. And since the exchange is no more, FTT is not a better investment option than Ethereum. On the flip side, Ethereum’s transactional token, Ether, is used to streamline network operations.

All of the Ethereum network’s programmes and services require computational power to run (and that computational power is not free). Furthermore, Ether is a payment method that network users use to pay for the services they want from the network.

FTT vs. Bitcoin

FTT is an exchange token that once powered the FTX exchange – which has been now closed. It is an ERC-20 token that once helped in reducing the transaction fee on the FTX exchange. However, post FTX-crash, FTT has no discernible use case other than being a tradable asset that has no fundamental value at the current time. Bitcoin, on the other hand, works without a central authority or banks, relying on peer-to-peer technology to manage transactions and issue new bitcoins. These tasks are delegated to the network as a whole. Bitcoin is open-source and nobody owns or controls it, so everyone can participate. Several unique characteristics of Bitcoin allow it to be used in ways that no other payment system has been able to.

FTT Price Predictions: Where Does FTT Go From Here?

The FTT price in early 2022 was above the $20 mark. But as soon as Coindesk’s report highlighting FTX’s finances came to light, Binance liquidated its holdings that destroyed the value of FTT tokens.

As a result of that, FTT’s vaue dropped from $22 to barely above $1 and then below it. However, as news above Sam Bankman-Fried’s punishment came to light the FTT community did come together to briefly rally this asset. But it was in vain since FTT has no utility anymore thanks to FTX exchange being inactive.

Bitcoin’s recent uptick, however, has fuelled some support for FTX. The token moved briefly above its 20-day Simple Moving Average (SMA) before accumulating around $1.7. And the current price charts is flat, with equal green and red candles. Furthemore, the token’s curren RSI is 47, which puts it inside the nuetral zone.

Now whether it will make a comeback this year is the question of how the community responds to FTX re-opening (if it does). So far, there are no use cases pushing this cryptocurrency forward other than people’s hope to retain their assets. Many FTT holders believe that the new team might make FTX as valuable as the old days, but we don’t recommend relying on this blind faith, since it was partly responsible for last year’s downtrend.

But to test 2023’s latest high, FTT must move up to $2.5, which requires it to have a 60% increase. So far, the token is not showing any sign of growth – but it can change soon if more positive news about the exchange hits the market.

How to Buy FTT – Full Guide

Below is a more detailed overview of how to purchase FTT online, using screenshots.

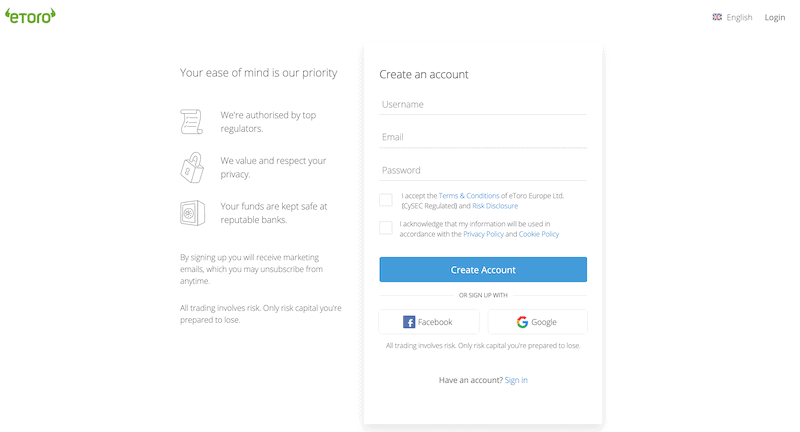

Step 1: Open an Account

The first step is to open the eToro website and then register for a trading account by clicking on the “Join Now” button at the center of the screen.

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

How to signup at eToro

Step 2: Upload ID

eToro will then require you to verify the provided identity with a copy of your driver’s license or passport to comply with government regulations. A copy of the utility bill or bank account statement will also be required to verify the provided address. The verification will then automatically happen once the documents are uploaded.

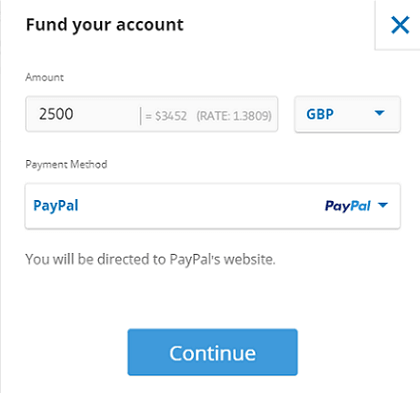

Step 3: Make a Deposit

The minimum requirement for opening an account with eToro is $200, which can be deposited through various methods, including:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

eToro doesn’t charge any deposit fees. This is less expensive than some of its key competitors, such as Coinbase, which charges 3.99 percent to buy Bitcoin with a debit card.

How to Buy Cryptos on eToro

Furthermore, there is no transaction cost if you are a US resident depositing funds through a USD-backed payment method. The minimum deposit is $10 for residents of the United States and $200 for most other countries.

Step 4: Search and Buy FTT

Type “FTT” in the search bar and you will see that the token is listed on the platform. Once you are the on the page, analyze the price charts and click on the “Trade” button. Enter the amount of tokens that you want to buy and click on the “Open Trade” button to finalize.

How to Buy FTX (FTT) on eToro

eToro- Best Place to Buy FTT

The FTX token is the native cryptocurrency of the now-defunct FTX derivatives exchange. As such, while the token was once used to earn more interest on the platform and reducing the transaction fees, it doesn’t have any utility anymore.

That said, the price chart shows that FTT still has value as a tradable asset, which is why its value has seen some upticks. However, these upticks are choppy and have no real cause other than Bitcoin’s price movements. Furthermore, positive news about FTX is the only thing that’s positively contributing to FTX’s sudden ups in the price charts. But these might not be enough to assist this token for long.

On a positive note, however, FTX is under new leadership. The new CEO is trying to revive the cryptocurrency exchange. What shape it will take and how the past misgivings will impact its structure are somethings that we have to wait and see. But FTT holders are banking on good news to come out of the recent bankruptcy, which is why the token hasn’t completely collapsed yet.

You should also remember the following:

- It is important to know the utility of FTT and its value as an tradable asset before investing in it

- FTT is an extremely high-risk investment currently and no long-term value can be seen in this asset currently.

- Invest just what you can afford to lose.

- Only use registered brokers and exchanges when trading or investing.

- You should also consult review sites and online specialists for their thoughts on Bitcoin.

FAQs

Any risks in buying FTT now?

There's always risks in buying digital assets. Only invest what you can afford to lose. The FTT price may retrace to test support around the $40 area. However in the long-term, the trend is bullish and $100 looks highly likely as a target.

Should I buy FTT?

With a look at the daily chart, the FTT price might hit $80 if it manages to overcome resistance.

Where can I spend my FTT?

FTT is still not as widely used as Bitcoin. However, there are an increasing number of stores that are now accepting it. In any case, you can always convert FTT into other cryptocurrencies like Bitcoin, Ethereum, or Tether to make payments online.

Is it safe to buy FTT?

The FTX exchange is a powerful trading platform for spot, over-the-counter, futures, and prediction markets. The FTT token has a total supply of 345 million FTT coins, of which approximately 95 million are in circulation. Considering such popularity and security, it's safe to buy FTT. However, make sure to research the fundamentals before making a decision.

Will FTT ever hit $1000?

If the FTX exchange continues to grow and dominate the cryptocurrency space, FTT will grow with it. Binance exchange's similar native token BNB has increased in price from under $1 to a high of almost $700. FTT could make similar moves.