Avalanche is a smart contract platform for launching decentralized applications and financial assets and creating custom blockchain networks. Avalanche aims to be a global asset exchange that allows anyone to launch, trade, or make any asset and control it decentralized using smart contracts and other cutting-edge technologies. Hence, most market investors are considering how to buy Avalanche (AVAX).

The developers at Ava Labs claim that Avalanche is the first smart contract network that offers transaction finalization in under one second as standard. The mainnet of Avalanche was launched in September 2020, and the platform’s native token is AVAX, which performs various tasks within Avalanche and also can be used as a reward and payment system. The native token of Avalanche, AVAX, has a limited supply of 720 million coins. The coin is used not only as part of the consensus mechanism but also for paying network transaction fees.

On this Page:

How to Buy Avalanche (AVAX)

- Choose an Avalanche (AVAX) exchange – we recommend Binance.

- Create an account

- Deposit funds into your account

- Search ‘Avalanche (AVAX)’ in the drop-down menu

- Click ‘Open Trade’ and select an amount of Avalanche (AVAX) to buy

Best Places to Buy Avalanche (AVAX) in December 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

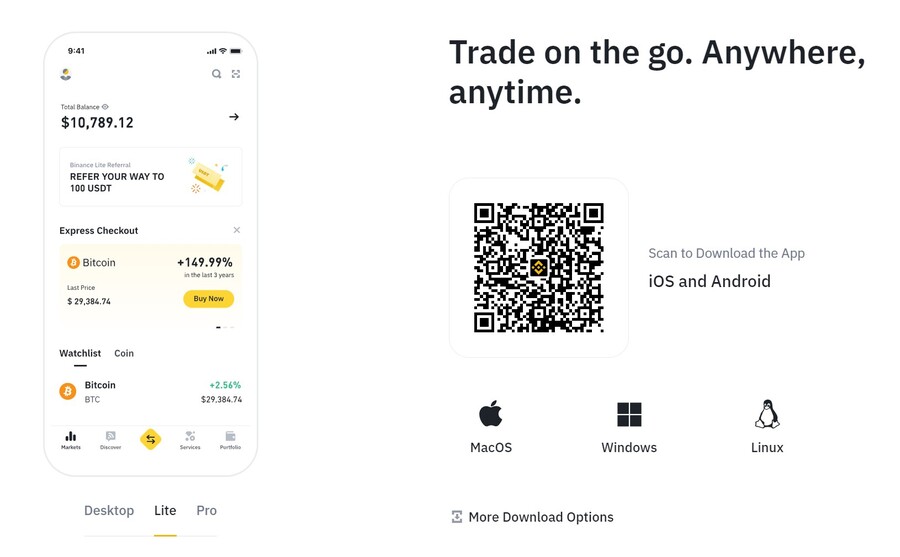

How to Buy Avalanche (AVAX) with Binance – Full Step-by-Step Guide

If you want to learn more about buying Avalanche (AVAX), the first step is to register an account with an exchange. We recommend Binance since it is the simplest way to purchase AVAX.

Step 1: Open an Account

The first step is to open the Binance website and register for a trading account by clicking on the “Register” button at the center of the screen. Enter your:

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

How to Buy AVAX on Binance

Step 2: Upload ID

To comply with regulatory rules, Binance will request you to give a copy of your driver’s license or passport to verify the provided identity. A copy of the utility bill or bank account statement will be required to validate the address. Once the documents are uploaded, the verification will take place automatically.

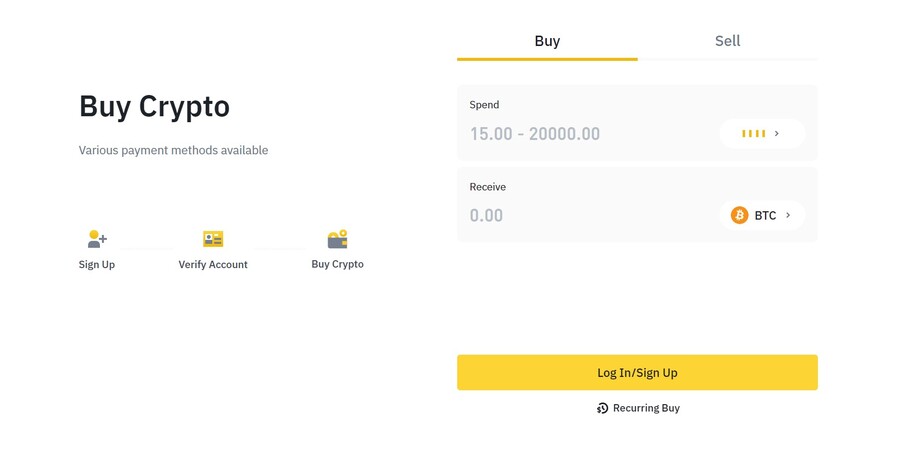

Step 3: Make a Deposit

The minimum requirement for opening an account with Binance is $15, which can be deposited through various methods, including:

- Debit cards

- Credit cards

- Bank transfers

How to Buy Avalanche (AVAX) on Binance

Step 4: Buy AVAX

Binance offers direct Avalanche (AVAX) purchases, meaning you don’t have to deposit funds right away if you don’t want to. You can buy it directly with a card or Apple Pay with a minimum purchase of $15. Note, this comes with fees of around 4%. If you first deposit funds via bank transfer and then make a spot AVAX purchase, it will be slightly cheaper regarding fees.

Compare Cryptocurrency Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

What is AVAX?

Avalanche is a smart contract platform that allows you to develop decentralized applications, financial assets, and custom blockchain networks. Avalanche’s goal is to be a global asset exchange that allows anybody to launch, trade, or develop an asset and control it decentralized utilizing smart contracts and other cutting-edge technologies.

According to Ava Labs, Avalanche is the first smart contract network that delivers transaction finalization in less than one second as standard. Avalanche’s mainnet began in September 2020, and the platform’s primary token is AVAX, which performs numerous jobs within Avalanche and may also be utilized as a reward and payment system.

Erim Gun Sirer, Kevin Sekiniqi, and Maofan Ted Yin are the three co-founders of Ava Labs. Sirer is a seasoned computer scientist well-known for his work on Bitcoin and decentralized networks. Yin and Sekiniqi are Cornell University graduates with a Ph.D. in computer science.

Avalanche’s major goal is to compete with Ethereum by creating its decentralized finance ecosystem. Several Ethereum-based DeFi projects have merged with the platform, including bZx, SushiSwap, Reef, Securitize, and TrueUSD. Avalanche is also developing a bridge to the Ethereum network, allowing users to transfer assets between the two chains seamlessly.

AVAX, Avalanche’s native token, has a finite amount of 720 million coins. Not only is the coin utilized as a part of the consensus method, but it is also used to pay network transaction fees.

Avalanche claims to achieve higher scalability than Ethereum through a high transaction throughput of 4500 TPS. In short, Avalanche is an Ethereum competitor to beat Ethereum and take its position as the most widely utilized platform for smart contract creation.

Since its launch, the AVAX coin has seen a massive appreciation in its value. The coin has surged by about 2028% in its lifetime span, not more than 9 months. The coin was initially launched at $2.95 in late December 2020, and in September 2021, it reached its all-time high level of $79.57. Currently, the coin is moving around $66. AVAX has hit a new high of over $100 since this post.

Decentralized asset trading on Avalanche

The rise in Avalanche’s native token price could be attributed to the unique features the platform offers. Avalanche provides decentralized asset trading that anyone can access, and the network is also unique in giving subsecond transaction confirmations.

The rapid use of this platform as an alternative to the Ethereum blockchain pushed the prices of AVAX higher in such a short time. Being a new coin and having this exposure to growth was not easy, but the platform’s unique features and rapid use as a substitute for Ethereum made it possible for AVAX to achieve this growth rate.

The continued migration of liquidity to the Avalanche network, new integrations, protocol upgrades, and the collection of large capital funds helped AVAX gather strength in the market. The market capitalization of Avalanche is $14.4 billion.

Best Broker to Buy Avalanche (AVAX)

1 – Binance

Binance is the world’s largest cryptocurrency exchange by daily transaction volume, with over $20 billion in deals per day. It gives you access to hundreds of assets and a smooth trading service that makes it simple to make money.

The benefits of Binance are quite remarkable. The trading commission is a one-time fee of 0.1 percent, which is relatively minimal. Expert traders can employ complex tools such as futures and margin trading, and the exchange provides several deposit and withdrawal options. Combined with Binance’s high liquidity, it is easy to see why it is so popular.

Binance, on the other hand, is a crypto-only exchange. The exchange also has significant credit card transaction fees, and the primary portal isn’t user-friendly. Furthermore, the Binance interface is not particularly user-friendly for newcomers. For first-time Avalanche (AVAX) consumers, the charts and menu selections may be perplexing. The most convenient cryptocurrencies to deposit are Bitcoin, BTC, and Ethereum ETH.

Binance debuted Avalanche (AVAX) and opened trading for AVAX/BTC, AVAX/BNB, AVAX/BUSD, and AVAX/USDT trading pairs at 6:30 AM on September 22, 2020. (UTC). Users can now begin depositing AVAX to trade.

Pros & Cons of the Binance platform:

- Excellent liquidity

- Exceptional security features

- Professional traders have access to sophisticated products.

- High fees for credit card deposits

2 – Coinbase

Coinbase is one of the most well-known cryptocurrency exchanges in the United States, as well as one of the largest in the world. However, keep in mind the hazards associated with trading these speculative currencies. Coinbase, the largest cryptocurrency trading platform in the US, was created in San Francisco in 2012.

In April, Coinbase became the first crypto trading company in the United States to be listed on a US market, with an IPO valued at over $86 billion. While bitcoin brokerages are not protected by the Securities Investor Protection Corporation or SIPC, Coinbase compensates for any losses incurred due to theft or hacking.

Avalanche (AVAX) has been available on Coinbase.com and in the Coinbase Android and iOS apps since October 1, 2021. Customers of Coinbase can now trade, transmit, receive, or store AVAX in the majority of Coinbase-supported regions, with certain restrictions noted on each asset page here. Coinbase Pro also supports trading in these assets.

Pros & Cons of the Coinbase platform:

- It gives you access to more than 50 cryptocurrencies

- A low minimum is required to fund an account

- Cryptocurrency is safe if a website is hacked

- Higher fees than other cryptocurrency exchanges

3 – Bitfinex

Bitfinex, Bitfinex, launched in 2012, is one of the older cryptocurrency exchanges. Since its inception, the exchange has remained a market leader in cryptocurrency trading, ranking eighth among the world’s largest cryptocurrency exchanges by volume.

Bitfinex has relatively cheap trading costs, with most trades costing less than 0.20 percent. This exchange appears suitable for many users but has a shady history, including several fines and accusations of cryptocurrency market manipulation.

The New York Attorney General concluded that Bitfinex and Tether deceived clients and markets by overstating Tether reserves and concealing losses. Bitfinex has also been fined for running an unregistered exchange and enabling illegal off-exchange trades. This raises serious concerns about the integrity of this cryptocurrency exchange.

Bitfinex’s active trading platform offers 150 cryptocurrencies, including Bitcoin, Ethereum, Terra, Tether, Solana, Litecoin, Ripple, etc. There are far too many to mention here, but Bitfinex does an excellent job supporting popular currencies on its platform.

As previously stated, Bitfinex is closely associated with Tether, a stablecoin worth $1. However, previous instances of reserve dishonesty may cause you to reconsider holding too much Tether in your account, assuming you’re willing to have it. Tether maintains that the currency is wholly backed, but it is up to you to determine whether or not you believe them.

Fees – Another notable feature of Bitfinex is the absence of trading fees. The majority trades either a 0.10 percent maker fee or a 0.20 percent taker fee. This rate applies to crypto, stablecoin, and fiat transactions.

Bitfinex listed Avalanche (AVAX) back on September 22, 2020. AVAX can be traded with US Dollar (AVAX/USD) and Tether (AVAX/USDt). Trading will be allowed only in select jurisdictions and restricted to verified individuals.

Pros & Cons of the Bitfinex platform:

- Established since 2012

- Suited for advanced traders

- Low trading fees

- Over 100 supported coins

- Margin trading, derivatives, and advanced order types supported

- Accepts bank wire deposits and withdrawals

- U.S. citizens not accepted

- Not regulated

- Hacked on more than one occasion

4 – Bybit

Bybit, founded in 2018, is a forward-thinking, rapidly expanding cryptocurrency derivatives exchange. A team of individuals with experience in investment banking and the forex sector formed the organization. Bybit’s headquarters are in Singapore, and the company is registered in the British Virgin Islands. It promises a worldwide economy and offers a trading system that appears to be fast, secure, and transparent. It has set out on a quest to create the next-generation financial ecosystem powered by innovative and powerful blockchain technology. With over 1.6 million Bybit users worldwide, whether retail or professional clients, Bybit stays customer-focused and strives to give the most incredible user experience possible.

Bybit exchange, a crypto derivatives exchange, offers a fair trading environment to trade futures contracts with good leverage in BTC/USD, ETH/USD, XRP/USD, EOS/USD, and BTC/USDT everlasting contracts. According to our Bybit review, this cryptocurrency exchange operates and delivers a safe, secure, fair, transparent, and efficient futures trading platform. Market takers pay 0.075 percent, while market makers pay -0.025 percent. As a result, they will be compensated when a market maker opens a transaction. This low cost encourages market makers to stay active and fill the order book.

Where is Bybit regulated?

Bybit Fintech Limited operates a regulated cryptocurrency trading platform called Bybit. The corporation is based in Singapore and is registered in the British Virgin Islands. Users need not obtain KYC to trade on Bybit because the Bitcoin exchange is not yet regulated in any country.

- USDT everlasting BTC, ETH, EOS, and LTC pairs

- Trading costs range from 0.025 to 0.075 percent for leverage up to 100 times.

- Order books with high liquidity and low spreads

- Bybit is a mobile trading app.

- 4.9 out of 5 stars based on over 50,000 reviews

- Affiliate and referral programme (30% commission)

Pros & Cons of the Bybit platform:

- Trustworthy and reputable trading platform

- 4th largest derivatives exchange in the world by volume

- Variety of markets, including spot, perpetual, and Futures

- Advanced and feature-rich trading platform

- Intuitive and responsive mobile app

- Difficult for beginners to navigate

- A limited number of spot trading pairs against BTC

5 – KuCoin

KuCoin is a secure and simple-to-use cryptocurrency exchange platform where users worldwide may trade crypto assets. Furthermore, the platform is situated in Seychelles, and the founding members have previous expertise running businesses like Ant Financial and iBox PAY.

Kucoin is often referred to as “The People’s Exchange.” The platform includes a trading bot, margin trading, futures trading, loans, and other services. Furthermore, according to the platform, one of every four HODLers uses KuCoin.

Kucoin has its cryptocurrency, known as Kucoin Shares (KSC). If you hold KSC coins, you will save trading costs and gain more cryptocurrency. KuCoin is also one of the top ten cryptocurrency exchanges in the world, according to CoinMarketCap.

Trading Fees – Kucoin’s trading fee structure is pretty straightforward. The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. If you own the platform’s native Kucoin Shares tokens, you can further minimize your fees.

KuCoin listed Avalanche (AVAX) back on March 05, 2021, and supported trading pairs include AVAX/USDT and AVAX/BTC.

Pros & Cons of the KuCoin platform:

- Users can trade using Arwen without transferring funds into a third-party wallet

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- User-friendly exchange

- Due to KuCoin’s commitment to rapidly launching new, innovative crypto assets, customers can access various trading pairs

- Low trading and withdrawal fees

- KuCoin Shares allow users to invest in the success of KuCoin

- Users can choose from a vast number of trade pairs

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilize

- Lacks the trading volumes found on some of the more established platforms

- No fiat trading pairs

Is it Worth Buying AVAX in 2022?

The price of the AVAX coin reached highest level near $100. In the total lifetime of AVAX, approximately 9 months, the coin has seen only 2 months of decline. The growth rate of AVAX was promising as the adoption of the Avalanche platform was rising rapidly. Toward the end of November 2022, AVAX reached its new all-time high of $134.53. The coin has seen its up and downs since then, but the price has been on a steep decline since the beginning of April 2022. AVAX is currently trading at $30.30

Nonetheless, being an Ethereum competitor, Avalanche has an advantage over Ethereum. ETH is struggling to reduce its gas fees and is working on the latest upgrade to Ethereum 2.0, which has no definitive release date yet. In contrast, Avalanche claims to provide 4500 TPS with minimum fees and has an excellent opportunity to increase its market share.

The network of Avalanche is a cross-chain compatible with Ethereum, which means that any project or token operating on Ethereum can fully migrate to the Avalanche ecosystem and take advantage of higher throughput capabilities and lower transaction costs. This is why AVAX might have a bright future despite the downtrend.

What triggered buying in AVAX in September 2021?

The sudden rise in AVAX prices in September was due to the announcement from Avalanche that they had a handful of significant funds of around $230 million for a project. The participants of the substantial funds included Polychain Capital, Three Arrows Capital, and Dragonfly Capital. This showed that more prominent institutional players were keenly interested in the Ethereum competitor, Avalanche.

Additionally, many assets and projects have started migrating from networks like Ethereum to Avalanche to participate in its growing DeFi ecosystem, which has also added to the increased value of AVAX. The evidence of this can be provided with the accelerated total value locked in its platform, which has climbed to $2.17 billion.

Furthermore, a series of partnerships and integration announcements from Avalanche has also played an essential role in advancing the prices of AVAX in such a short period. The project came under the limelight after announcing a partnership with sports card and memorabilia company Topps, which launched its Inception NFT digital collectibles series on the network.

Aave, one of the top Defi protocols, is also looking to launch Aave on the Avalanche network as a vote of approval is in progress to see if investors want to deploy Aave on Avalanche. If this happens, the TVL on Avalanche will increase further and push AVAX higher.

Similarly, new partnerships, migrations of assets, and projects to Avalanche, along with upgrades, are definitely on their way and will continue to support the prices of AVAX in the future, which makes investment in AVAX worthwhile in 2021.

Will the Price of Avalanche (AVAX) Go Up in 2024?

Avalanche (AVAX), like many other cryptocurrencies, experienced a bear phase and a drop in value due to the LUNA-led crash and the FTX-led market downturn. However, it remains an innovative cryptocurrency with the potential for significant growth if its ecosystem sees major development.

In January 2023, Avalanche experienced signs of recovery as its value started to rebound. By Q2 2023, the cryptocurrency demonstrated substantial growth in both average daily active addresses (up by 132.1%) and transactions on the C-Chain (up by 162.2%).

This impressive progress could be attributed to increased stablecoin liquidity and enhanced activity from LayerZero. Consequently, AVAX’s revenue skyrocketed, boasting a remarkable increase of 173.1% when comparing Quarter-over-Quarter (QoQ) data in AVAX or a staggering surge of 150.3% when measured in USD terms.

Ava Labs, the team behind Avalanche, has been actively working on enhancing the ecosystem. They introduced Avalanche Arcad3 to accelerate gaming development and partnered with companies like GREE, Loco, and TSM. Additionally, they launched Evergreen Subnets and Spruce, welcoming partners such as T. Rowe Price, WisdomTree, Wellington Management, and Cumberland.

Moreover, Alibaba Cloud launched Cloudverse, enabling businesses to deploy metaverses on the Avalanche platform, while SK, one of South Korea’s largest conglomerates, launched its dedicated Avalanche Subnet, UPTN. Furthermore, the Cortina network upgrade brought three key optimizations to the Avalanche mainnet.

As of August 1, 2023, the current price of AVAX stands at $12.65, with a 24-hour trading volume of $282.71 million, a market cap of $4.38 billion, and a market dominance of 0.37%. The token experienced a decrease of -2.28% in the last 24 hours. Avalanche reached its all-time high price of $146.18 on November 21, 2021, and its all-time low of $2.79 on December 23, 2020. Since the last all-time high, the lowest price recorded was $9.99 (cycle low), and the highest price was $15.94 (cycle high).

The circulating supply of AVAX currently stands at 346.02 million out of a maximum supply of 720.00 million. Over the past year, approximately 61.67 million AVAX were created, resulting in a yearly supply inflation rate of 21.69%. In the Proof-of-Stake Coins sector, Avalanche holds the seventh position while ranking first in the Avalanche Network sector and twelfth in the Layer 1 sector.

Last week, Avalanche’s popularity surged, with social metrics increasing by over 100%. Despite no major events in the ecosystem, social mentions rose by over 150% to reach 1.44k, and social engagement soared by more than 200% to reach 60.4 million. Social dominance and social contributors also increased by 157% and 28%, respectively. However, the fundamentals of the network declined, with daily active users and daily transactions decreasing.

🔺Avalanche Weekly Social Signals🔺

Most Influential Projects@MoonbeamNetwork@ActaFi@AvaxArrogant@DeFiKingdoms

Influencers of the Week@AltCryptoGems@cryptojack@kyle_chasse@TeddyCleps

Source: @LunarCrush#AVAX $AVAX #Avalanche pic.twitter.com/8QvPQxGI4c

— AVAX Daily 🔺 (@AVAXDaily) July 30, 2023

The popularity of Uniswap (UNI) on Avalanche experienced a significant boost due to the integration of the two platforms. This integration enables users to easily exchange Avalanche tokens on Uniswap, thereby enhancing the token’s utility and paving the way for potential growth.

Despite the positive developments, current predictions for Avalanche’s price indicate a relatively modest increase of 0.17%. By August 5, 2023, it is projected to reach $12.75. Technical indicators reveal a bearish sentiment, and the Fear & Greed Index stands at 53, suggesting a neutral market atmosphere. Over the past 30 days, Avalanche has experienced 14 out of 30 (47%) green days with a price volatility of 4.27%.

How to Choose the Right Crypto Broker for Buying AVAX

Given the abundance of brokers from which to purchase AVAX, you must make the best decision possible. As you look for the best broker for you, consider the following factors:

1. Fees

When trading cryptocurrencies like AVAX, finding a low-cost broker is crucial; what’s the significance? Because fees can quickly accumulate. Get a breakdown of the broker’s fee structure before deciding on a trading platform. Fees for withdrawals, deposits, transactions, and trading should be included.

2 – Safety

The correct broker should have appropriate safety and security standards to avoid illegal access to your assets.

3. Support

A reputable broker will also have a strong customer service department to assist you with your every requirement.

4. Deposit Options

You want to be able to make as many deposits as feasible. There are always a lot of choices, from bank transfers to credit cards to payment processors. Just keep in mind that each one comes with its own set of expenses.

When you’re considering an investment, follow these things:

Every cryptocurrency carries dangers, and this is especially true for AVAX. So, when you invest, ensure you don’t get caught up in FOMO. Apart from following others, you must research before investing in any digital asset.

1 – Research, research: Before investing your money, excellent and comprehensive research about the product must be done to avoid associated risks.

Here are the different methods we looked into:

- Investigating social media channels.

- Examining future events

- Investigate the principles.

- Discover popular subjects.

- Make use of the potential of specialist forums.

- Attend crypto meetups.

- Take note of the transaction volume.

Monitor the market – Monitoring the market is the next stage in learning more about your chosen product or digital asset. The market may move in a different direction than you expected, and staying calm when the market moves in a new direction is equally important. The most accessible approach to keeping up with the market is to read through review sites and recommendations.

Buying Avalanche (AVAX) as a CFD Product

Contracts for differences (CFDs) are financial derivatives that allow you to speculate on different financial markets while not owning the underlying asset. It is commonly utilized in established markets such as foreign exchange currency pairs, equities, bonds, indices, and commodities.

Trading CFDs requires more than just buying and selling; it also involves agreeing to exchange the difference in an asset’s price between the time the contract is opened and the time it expires.

CFD trading has entered the cryptocurrency industry, and AVAX is now available as a CFD product. If you have problems understanding bitcoin trading or storing crypto funds, you can benefit from AVAX using CFDs. We encourage trading AVAX CFDs on the Binance or Coinbase platforms because they are regulated and include various analytical tools.

Taxation on AVAX Earnings:

As the cryptocurrency market is still in its infancy and establishing itself, regulatory authorities, including the SEC, are attempting to control it. The Internal Revenue Service has also been trying to develop a cryptocurrency tax framework. Cryptocurrencies and digital assets are treated as real estate and subject to capital gains taxation. However, cryptocurrency earnings are considered income in certain circumstances and fall into the income tax category. The following taxable events trigger capital gains and income taxes when exchanging digital assets.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21 and IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals with bitcoin as a capital asset but not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Taxable events that are considered property gains tax in the US:

- Exchanging your cryptocurrency for fiat money

- Making purchases with crypto.

- Swapping one cryptocurrency for another – through an exchange or a peer-to-peer (P2P) channel – is common.

Taxable events that are considered income taxes:

- Block rewards accrued as a result of Bitcoin mining.

- Cryptocurrency assets are acquired through liquidity pools (LPs) or by staking.

- Receiving cryptocurrency in exchange for services rendered.

- Obtaining cryptocurrency via an airdrop.

- Earning interest by lending to systems that provide decentralized finance (DeFi).

Be aware that you can write off your capital gains tax through losses incurred from trading. You can also save up to $3,000 of your income taxes, depending on how long you have held on to an asset.

Calculating Your Capital Gains Tax

The crypto market has seen exponential growth in the past year, and government agencies are trying to take knowledge of it. Given the recent spike in the non-fungible token (NFT) sub-sector, the IRS is also looking to get a piece of the crypto pie. Two things essentially decide the number of capital gains tax rates for cryptocurrencies: your income tax bracket and how long you have held on to your crypto asset. This will help you calculate your:

a.) Capital Gains on Short-Term Investments

The short-term capital gains tax is determined mainly by the time you have traded or held cryptocurrency. You will be taxed at your standard marginal rate if you have earned or lost money trading or keeping crypto for less than a year. Losses incurred during that trading year may prove beneficial. Using a tax-loss harvesting plan, you can deduct up to $3,000 from your taxes. Additionally, you can backdate your taxes to the following year.

b.) Capital Gains on Long-Term Investments

If you have been trading cryptocurrencies for over a year, you qualify for long-term capital gains. You will pay taxes ranging from 0% to 20%, depending on your income. On this page, we’ve detailed the income tax brackets.

AVAX Mining: Can You Mine AVAX?

No, AVAX has a proof-of-stake mechanism and not a proof-of-work mechanism, which means it cannot be mined; instead, it can be staked.

Decreasing Risk in AVAX Investment:

Every investor must devise strategies to guard against massive losses. If you wish to minimize your risks, follow these guidelines:

- Hedging your risks requires maintaining a well-balanced portfolio of investments. Use financial instruments to limit the risk of adverse price changes. By contrast, investors can hedge one investment by exchanging it for another.

- Utilize a stop-loss order: A stop-loss order is used to limit an investor’s loss in the event of an adverse change in the value of a security position. If you utilize a stop-loss order, you are not required to check your holdings daily. A stop loss is an investor’s ally. Therefore, the place stops loss and adheres to it. When an investment does not go as planned, you’ll want to know when to withdraw your money.

- Define a target: Short-term traders seeking risk management should utilize take-profit orders. This is because they can leave a trade immediately after achieving their predetermined profit target, avoiding the risk of a market collapse. Long-term traders despise such orders since they reduce their profits.

- To mitigate risk in cryptocurrency trading, I utilize many exchanges and hardware wallets and invest in a range of narratives (Oracles, Defi, or insurance). To minimize risk while trading, only trades when compelling patterns form or a coin reaches its bottom.

- When investing, I prefer to concentrate on coins with excellent fundamentals. I invest only on rare occasions in response to breaking news or other significant events. If I choose to invest, I will also conduct a technical analysis. I evaluate factors such as the stage of the currency’s life cycle.

Is there any pattern to the trading? There is support and resistance for the coin and recent price history, news, and upcoming events. If I invest in fundamentally good coins, I can maintain my composure even if the price fluctuates significantly, as I am confident that the price will eventually grow.

AVAX vs. Other Cryptocurrencies

Avalanche (AVAX) vs. Ethereum (ETH)

AVAX is similar to Ethereum and is also known as Ethereum-Killer. The platform aims to unseat Ethereum and take its position as the most widely used platform for smart contracts. The higher transaction throughput of 4500 TPS has made Avalanche’s platform claim higher scalability than Ethereum. Furthermore, the platform’s transaction fee is also lower than Ethereum’s, attracting developers and existing projects on Ethereum to migrate to Avalanche’s network. Unlike Ethereum, Avalanche provides a penalty less staking environment.

The Ethereum network’s programs and services all require computational power to function (and that computing power is not free). Besides, Ether is a payment method network users use to pay for the services they want from the network.

Avalanche (AVAX) vs. Bitcoin (BTC)

Avalanche is a platform for building decentralized applications and custom blockchain networks (dApps). The Avalanche crypto platform, developed by Ava Labs, is one of many initiatives vying to dethrone Ethereum as the most frequently used innovative contract platform in the blockchain ecosystem.

Conversely, Bitcoin uses peer-to-peer technology to manage transactions and issue new bitcoins without a central authority or banks. The network as a whole is in charge of these tasks. Anyone can participate in Bitcoin because it’s open-source, and nobody owns or controls it. Several of Bitcoin’s unique qualities enable it to be used in ways no other payment system has been able to.

AVAX Price Predictions: Where Does AVAX Go From Here?

Avalanche is one of the world’s leading DeFi cryptocurrencies aiming to make decentralized finance a usual topic in daily conversation about economics. In light of that, its price movements rely on a combination of market sentiments and developments in the ecosystem. The third factor that acts as a catalyst is Avalanche’s influence on other cryptocurrencies. Note that many of its attributes are being seen as something to improve upon by new cryptocurrency projects, meaning Avalanche has to keep up in technology if it seeks to match up with the latest crypto assets.

After the 2022 downturn, tides have started to turn in a positive direction in 2023, and thanks to Bitcoin’s recent resurgence, Avalanche has gotten some benefits. The recent resurgence has led bulls to rally, struggling to maintain support at $16. If Avalanche can persist above this level for at least a month, it can increase this year.

Moreover, the potential for growth in AVAX price is strong due to the active development of the Avalanche network. The future looks promising, with several upcoming developments. In the coming months, a series of subnets are scheduled to transition onto the Avalanche mainnet.

According to the brains behind the project at Ava Labs, they are currently working on over 100 subnets. The plan is for many of these subnets to become live by 2023. With each migration, the Primary Network validator set is expected to expand, consequently increasing the demand for enhanced network security.

Following the successful partnership between the Spruce network and esteemed institutions like T.Rowe Price and Wellington Management, the Avalanche Evergreen Subnets are now actively seeking to onboard Web2 companies. This strategic move holds immense potential for widespread enterprise adoption, fueled by the platform’s comprehensive suite of institutional solutions.

In its pursuit of further development and expansion, Avalanche is actively exploring custom VM solutions for its subnets. This initiative builds on previous achievements, including introducing the Rust SDK in Q4’22, progress on HyperVM in Q1’23, and the Move Virtual Machine in Q2’23.

RephraseKevin Sekniqi, the Co-founder and COO of Ava Labs, has announced a series of optimizations for AvalancheGo throughout 2023. Notably, the platform saw significant enhancements with the introduction of the Cortina upgrade in Q2.

With firm plans set for 2023, portions of the vision are already being implemented, affirming Avalanche’s dedication to maintaining competitiveness throughout the remaining year. Investors and enthusiasts eagerly watch AVAX’s future prospects as the network’s advancements indicate potential substantial growth in the upcoming months.

Avalanche Price Prediction for 2023

If the market turns even more positive than it is at this time of the month, Avalanche can witness a bullish flipping that will push Avalanche’s price to $23 by the end of this year. While this is not a significant surge, remember that the market has changed, and witnessing parabolic gains is impossible in old cryptos unless you count presale cryptocurrency assets.

Avalanche Price Prediction for 2024

We expect that the last embers of the crypto winter will die by the beginning of 2024, marking the end of the longest crypto winter in the market. People will again start to trade in cryptos, and Avalanche, a DeFi asset, and crypto with immense utility, will see a new influx of buyers. That renewed interest will push the Avalanche price to $51 by the end of 2024.

Avalanche Price Prediction for 2025

2025 will see mass adoption of DeFi and other cryptocurrencies. To support these new concepts, governments will introduce new regulations in the crypto space, giving OG cryptos like Avalanche a safe space to grow. That interest may push Avalanche’s price close to $73 by the end of 2025.

Avalanche Price Prediction for 2026 and Beyond

The crypto space is changing fast. So, it is likely that three years from now, Avalanche will consolidate as one of the biggest cryptocurrencies in the market. That fact alone, coupled with new developments and more legacy technologies accepting this crypto, will increase the AVAX price pump.

Experts at Changelly say that Avalanche might grow beyond $100 in 2026, 5x its all-time high. And if the token does consolidate itself in the market as an asset necessary for other cryptocurrencies to prosper, we might see more upswings.

Summary

Avalanche is a platform for building decentralized applications and custom blockchain networks (dApps). The Avalanche crypto platform, developed by Ava Labs, is one of many initiatives vying to dethrone Ethereum as the most frequently used innovative contract platform in the blockchain ecosystem.

As mentioned earlier, if all markets turn positive, the Avalanche price is poised to smash through all boundaries and perform spectacularly, climbing the top. It would undoubtedly show indicators of fortune for its investors if it exceeded all limitations over the next year.

If you’re ready to invest in AVAX, you can complete your crypto journey using our recommended exchange, Binance.

You should also remember the following:

- Investing in and trading AVAX necessitates extensive research and effort.

- AVAX is a high-risk investment.

- Invest just what you can afford to lose.

- Only use registered brokers and exchanges when trading or investing.

- You should consult review sites and online specialists for their thoughts on Bitcoin.

FAQs

Any risks in buying AVAX now?

In addition to the positive fundamentals, the technical outlook also supports a bullish bias in AVAX/USD. Currently, AVAX is supported at the 50.75 level, and the closing of candles above this level can drive the bullish trend in AVAX. Moreover, the Avalanche crypto platform is home to over 270 projects, including DeFi initiatives such as Tether (USDT), SushiSwap (SUSHI), Chainlink (LINK), and The Graph (GRT). More than 1,000 validator nodes are staking AVAX tokens. Thus, it's safe to AVAX now, but we recommend you do your research before investing.

Should I buy AVAX?

Avalanche has had a rough 2022, but the market doesn't suggest the end of the world. The token still maintains a respectable position in the crypto space - early 2023 has seen it go up, partly because of the support Bitcoin could obtain in early January. While Avalanche may not smash any records over the next couple of years, it might do so beyond that. So yes, you must think about diversifying your crypto portfolio using Avalanche.

Where can I spend my AVAX?

AVAX is still not as popular as Bitcoin. However, a rising number of retailers are now accepting it. In any event, you may always exchange AVAX for other cryptocurrencies such as Bitcoin, Ethereum, or Tether to make online payments.

Is it safe to buy AVAX?

Avalanche is a platform for building decentralized applications and custom blockchain networks (dApps). The Avalanche crypto platform, developed by Ava Labs, is one of many initiatives vying to dethrone Ethereum as the most frequently used innovative contract platform in the blockchain ecosystem. Thus, it's safe to invest in it. However, we recommend not to put all your investment in one basket.

Will AVAX ever hit $1000?

While Avalanche is involved with multiple community projects across the web, its ubiquity has fallen thanks to the mega retrace of 2022. The token currently struggles to reach $14 at the time of writing. A jump to $1000 would require it to parabolically increase by 50x, which might not be possible within the next 4 or five years. After that, however, when cryptocurrencies grow more common, the Avalanche price may see major action in the market - and if bulls rally, it might make major headways to $1000.

Bitcoin

Bitcoin